Reports

Reports

Analysts’ Viewpoint on Market Scenario

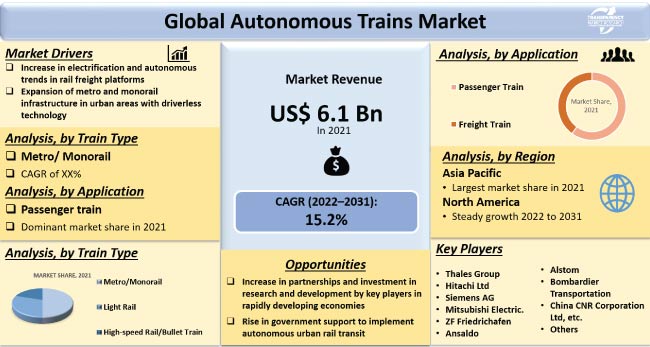

Adoption of new technology and improved infrastructure are expected to provide a much-needed boost to the rail transportation industry and consequently, augment autonomous trains market progress. Railroad firms must make modifications to their current operations in order to sustain profitability and successfully meet the demand for rail transportation. They also need to upgrade in order to cater to the rise in rail passenger and freight traffic as well as the ongoing expansion of the rail network.

The introduction of autonomous rail technology is anticipated to successfully solve several issues such as rising demand, safety concerns, extra expenses, environmental difficulties, human errors, and increased traffic congestion. Better accessibility, more mobility, and improved land use are a few of the key advantages of integration of autonomous rail technology in transportation. Electric trains and AV technology used in tandem are likely to greatly reduce pollution and safeguard the environment.

Autonomous trains facilitate the transport of more number of people and higher volume of cargo. This is advantageous for the environment, as railroad is one of the least polluting types of transportation. The combination of autonomous operation and moving block signaling has the potential to boost rail capacity by up to 50%, enabling greater low-carbon travel without the need to construct additional rail lines.

Autonomous trains also have the ability to collect information about their surroundings, including cuts, embankments, lineside infrastructure, structures, and vegetation, such as trees. This can be used to build a topographic database and establish a baseline of normality against which deviations can be monitored in real time. This can be improved any further by incorporating outside data, such as weather reports. This is extremely useful for applications such as predicting the risk of a slip-and-fall during the leaf-fall season and monitoring of tracks.

Increase in globalization and growing urbanization has led to greater need for transportation of goods and freight. It has also driven the demand for larger mobility solutions. A smaller more connected world has further reinforced the trend of preference for autonomous rail transport.

Consequently, a shortage of trained drivers is a foreseeable event predicted in the immediate future. This, in turn, is estimated to contribute to market demand for autonomous trains during the forecast period. Furthermore, rising tailpipe emission levels and growing trend of electrification are also likely to boost autonomous trains market development across the globe.

An increasing number of metro lines in cities all over the world have already adopted driverless train operation with Grade of Automation (GoA) Level 4. Higher levels of automation, starting with driver assistance systems and progressing to automatic obstacle detection, help mainline, regional, and tram operators to boost the capacity, flexibility, and energy efficiency of their rail operations. Automatic obstacle detection is a crucial building block in future train automation in various use cases

Municipal and government authorities are rapidly expanding metro and monorail infrastructure in major cities across the globe to tackle traffic congestion in urban areas. This, in turn, is estimated to boost the market demand for autonomous trains for the efficient and smooth operation of such mass transit rail networks.

For instance, Sydney Metro, in Australia, is a driverless rapid transit system that uses fully-automated metropolis trains assisted with the Urbalis 400 communication based train control (CBTC) signaling system. In November 2021, Delhi Metro started driverless train operations (DTO) on its 59 km Pink line to become the fourth largest DTO- mass rapid transit system across the globe.

Growing penetration of driverless or autonomous technology for urban transit rail, such as metro rails, monorails, and trams, is likely to drive the application of autonomous trains for passenger transit, as compared to freight transport, in the next few years.

According to the latest autonomous trains market trends, Asia Pacific is projected to witness rapid increase in demand for autonomous trains during the forecast period. Growth of the Asia Pacific market is primarily attributed to increase in industrialization and urbanization in expanding economies such as China, India, and South Korea.

In 2021, Europe held the second-largest market share for driverless trains worldwide. Additionally, North America accounted for the third-largest market share for autonomous trains in 2021. Fully automated and semi-autonomous (GoA 3) metro lines have been constructed in North America and are already in use commercially.

Leading players in the global autonomous trains business are adopting new technologies and emphasizing on mergers and acquisitions and product portfolio expansion. Some of the prominent players operating in the global autonomous trains market include ABB, Alstom, American Equipment Company, Beijing Traffic Control Technology, Belden, Bharat Forge, Bombardier, CAF, Calamp, CRRC, Deuta, Deutsche Bahn, General Electric, Hitachi, Hollysys, Ingeteam, Intesens, Kawasaki Heavy Industries, Mitsubishi Heavy Industries, Siemens, Tech Mahindra Ltd., Thales Group, Transmashholding, Tvema, and Wabtec Corporation.

Key players profiled in the autonomous trains market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 6.1 Bn |

|

Market Forecast Value in 2031 |

US$ 25.0 Bn |

|

Growth Rate (CAGR) |

15.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at Global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 6.1 Bn in 2021.

The market is expected to expand at a CAGR of 15.2% by 2031.

It is estimated to reach a value of US$ 25.0 Bn in 2031.

Increase in electrification and autonomous trend in rail freight platforms and low emission transport alternatives to mitigate pollution levels.

In terms of train type, the metro/monorail segment is likely to account for majority share by 2031.

Asia pacific is anticipated to be the highly lucrative region of the global market.

ABB, Alstom, American Equipment Company, Beijing Traffic Control Technology, Belden, Bharat Forge, Bombardier, CAF, Calamp, CRRC, Deuta, Deutsche Bahn, General Electric, Hitachi, Hollysys, Ingeteam, Intesens, Kawasaki Heavy Industries, Mitsubishi Heavy Industries, Siemens, Tech Mahindra Ltd., Thales Group, Transmashholding, Tvema, and Wabtec Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Volume (Units) & Value US$ Bn, 2017-2031

1.2. Demand & Supply Side Trends

1.3. TMR Analysis and Recommendations

1.4. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Macro-Economic Factors

2.2.1. FDI and Government Investments

2.2.2. Median Individual Income

2.2.3. Urbanization and Railway Infrastructure

2.3. Forecast Factors - Relevance & Impact

2.3.1. Edge Computing trends

2.3.2. Industry Trends and Emerging Technologies

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunity

2.5. Market Factor Analysis

2.5.1. Porter’s Five Force Analysis

2.5.2. SWOT Analysis

2.5.3. PESTEL Analysis

2.6. Regulatory Scenario by Country/ Region

2.7. Key Trend Analysis

2.8. Technology Roadmap

2.9. Manufacturer’s Perspective

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.1.1. Who Supplies Whom

3.2. Vendor Matrix

3.3. Gross Margin Analysis

4. Pricing Analysis

4.1. Cost Structure Analysis

4.2. Profit Margin Analysis

5. Impact Factors

5.1. Developments in the Artificial Intelligence Technology

5.2. Smart City Cluster – Connected Transportation Services

5.3. Railway Infrastructure

5.4. Cyber security Concerns

5.5. Edge Computing Trends

5.6. Trains Data Monetization

5.7. Service Benefits for Onboard Passengers

6. COVID-19 Impact Analysis –

6.1. Global Impact & Analysis

6.2. Regional Impact & Analysis

6.3. Government Countermeasures

7. Autonomous Trains Market – An Emerging Market for Freight Trains

8. Autonomous Trains Market Key Players -

8.1. SWOT Analysis

8.2. Profitability Analysis

9. Railway Budget Allocations by Country

10. Railway Production Statistics – Global/ by Geography

11. Autonomous Trains Market, by Track Length (Kilometers)

11.1. Market Snapshot

11.1.1. Introduction and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.2.3. Mexico

11.3. Europe

11.3.1. Germany

11.3.2. U. K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Nordic Countries

11.3.7. Russia & CIS

11.3.8. Rest of Europe

11.4. Asia Pacific

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. ASEAN Countries

11.4.5. South Korea

11.4.6. ANZ

11.4.7. Rest of Asia Pacific

11.5. Middle East & Africa

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

11.6. South America

11.6.1. Brazil

11.6.2. Argentina

11.6.3. Rest of South America

12. Global Autonomous Trains Market, by Grade of Automation

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Autonomous Trains Market Volume (Units) & Value (US$ Bn), Analysis & Forecast, 2017-2031, By Grade of Automation

12.2.1. GOA 1

12.2.2. GOA 2

12.2.3. GOA 3

12.2.4. GOA 4

13. Global Autonomous Trains Market, by Train Type

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Train Type

13.2.1. Metro/Monorail

13.2.2. Light Rail

13.2.3. High-speed Rail/Bullet Train

14. Global Autonomous Trains Market, by Technology

14.1. Market Snapshot

14.1.1. Introduction, Definition, and Key Findings

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Technology

14.2.1. CBTC

14.2.2. ERTMS

14.2.3. PTC

14.2.4. ATC

15. Global Autonomous Trains Market, by Component

15.1. Market Snapshot

15.1.1. Introduction, Definition, and Key Findings

15.1.2. Market Growth & Y-o-Y Projections

15.1.3. Base Point Share Analysis

15.2. Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Component

15.2.1. Tachometer

15.2.2. Doppler

15.2.3. Accelerometer

15.2.4. Camera

15.2.5. Antenna

15.2.6. Radio Set

16. Global Autonomous Trains Market, by Application

16.1. Market Snapshot

16.1.1. Introduction, Definition, and Key Findings

16.1.2. Market Growth & Y-o-Y Projections

16.1.3. Base Point Share Analysis

16.2. Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

16.2.1. Passenger Train

16.2.2. Freight Train

17. Global Autonomous Trains Market, by Track Length

17.1. Market Snapshot

17.1.1. Introduction, Definition, and Key Findings

17.1.2. Market Growth & Y-o-Y Projections

17.1.3. Base Point Share Analysis

18. Global Autonomous Trains Market, by Region

18.1. Market Snapshot

18.1.1. Introduction, Definition, and Key Findings

18.1.2. Market Growth & Y-o-Y Projections

18.1.3. Base Point Share Analysis

18.2. Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Region

18.2.1. North America

18.2.2. Europe

18.2.3. Asia Pacific

18.2.4. Middle East & Africa

18.2.5. South America

19. North America Autonomous Trains Market

19.1. Market Snapshot

19.2. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Grade of Automation

19.2.1. GOA 1

19.2.2. GOA 2

19.2.3. GOA 3

19.2.4. GOA 4

19.3. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Train Type

19.3.1. Metro/Monorail

19.3.2. Light Rail

19.3.3. High-speed Rail/Bullet Train

19.4. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Technology

19.4.1. CBTC

19.4.2. ERTMS

19.4.3. PTC

19.4.4. ATC

19.5. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Component

19.5.1. Tachometer

19.5.2. Doppler

19.5.3. Accelerometer

19.5.4. Camera

19.5.5. Antenna

19.5.6. Radio Set

19.6. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

19.6.1. Passenger Train

19.6.2. Freight Train

19.7. Key Country Analysis – North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

19.7.1. U.S.

19.7.2. Canada

19.7.3. Mexico

20. Europe Autonomous Trains Market

20.1. Market Snapshot

20.2. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Grade of Automation

20.2.1. GOA 1

20.2.2. GOA 2

20.2.3. GOA 3

20.2.4. GOA 4

20.3. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Train Type

20.3.1. Metro/Monorail

20.3.2. Light Rail

20.3.3. High-speed Rail/Bullet Train

20.4. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Technology

20.4.1. CBTC

20.4.2. ERTMS

20.4.3. PTC

20.4.4. ATC

20.5. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Component

20.5.1. Tachometer

20.5.2. Doppler

20.5.3. Accelerometer

20.5.4. Camera

20.5.5. Antenna

20.5.6. Radio Set

20.6. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

20.6.1. Passenger Train

20.6.2. Freight Train

20.7. Key Country Analysis – Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

20.7.1. Germany

20.7.2. U. K.

20.7.3. France

20.7.4. Italy

20.7.5. Spain

20.7.6. Nordic Countries

20.7.7. Russia & CIS

20.7.8. Rest of Europe

21. Asia Pacific Autonomous Trains Market

21.1. Market Snapshot

21.2. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Grade of Automation

21.2.1. GOA 1

21.2.2. GOA 2

21.2.3. GOA 3

21.2.4. GOA 4

21.3. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Train Type

21.3.1. Metro/Monorail

21.3.2. Light Rail

21.3.3. High-speed Rail/Bullet Train

21.4. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Technology

21.4.1. CBTC

21.4.2. ERTMS

21.4.3. PTC

21.4.4. ATC

21.5. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Component

21.5.1. Tachometer

21.5.2. Doppler

21.5.3. Accelerometer

21.5.4. Camera

21.5.5. Antenna

21.5.6. Radio Set

21.6. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

21.6.1. Passenger Train

21.6.2. Freight Train

21.7. Key Country Analysis – Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

21.7.1. China

21.7.2. India

21.7.3. Japan

21.7.4. ASEAN Countries

21.7.5. South Korea

21.7.6. ANZ

21.7.7. Rest of Asia Pacific

22. Middle East & Africa Autonomous Trains Market

22.1. Market Snapshot

22.2. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Grade of Automation

22.2.1. GOA 1

22.2.2. GOA 2

22.2.3. GOA 3

22.2.4. GOA 4

22.3. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Train Type

22.3.1. Metro/Monorail

22.3.2. Light Rail

22.3.3. High-speed Rail/Bullet Train

22.4. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Technology

22.4.1. CBTC

22.4.2. ERTMS

22.4.3. PTC

22.4.4. ATC

22.5. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Component

22.5.1. Tachometer

22.5.2. Doppler

22.5.3. Accelerometer

22.5.4. Camera

22.5.5. Antenna

22.5.6. Radio Set

22.6. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

22.6.1. Passenger Train

22.6.2. Freight Train

22.7. Key Country Analysis – Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

22.7.1. GCC

22.7.2. South Africa

22.7.3. Turkey

22.7.4. Rest of Middle East & Africa

23. South America Autonomous Trains Market

23.1. Market Snapshot

23.2. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Grade of Automation

23.2.1. GOA 1

23.2.2. GOA 2

23.2.3. GOA 3

23.2.4. GOA 4

23.3. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Train Type

23.3.1. Metro/Monorail

23.3.2. Light Rail

23.3.3. High-speed Rail/Bullet Train

23.4. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Technology

23.4.1. CBTC

23.4.2. ERTMS

23.4.3. PTC

23.4.4. ATC

23.5. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Component

23.5.1. Tachometer

23.5.2. Doppler

23.5.3. Accelerometer

23.5.4. Camera

23.5.5. Antenna

23.5.6. Radio Set

23.6. Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

23.6.1. Passenger Train

23.6.2. Freight Train

23.7. Key Country Analysis – South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

23.7.1. Brazil

23.7.2. Argentina

23.7.3. Rest of South America

24. Competitive Landscape

24.1. Company Share Analysis/ Brand Ranking, 2021

24.2. Key Player Strategy Analysis

24.2.1. Strategic Overview - Expansion, M&A, Partnership

24.2.2. Product & Marketing Strategy by Key Players

24.3. Autonomous Trains Market Key Player Pricing Analysis Based on –

24.3.1. Grade of Automation

24.3.2. Train Type

24.3.3. Application

24.4. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

24.5. Company Profile/ Key Players

24.5.1. ABB

24.5.1.1. Company Overview

24.5.1.2. Company Footprints

24.5.1.3. Production Locations

24.5.1.4. Product Portfolio

24.5.1.5. Competitors & Customers

24.5.1.6. Subsidiaries & Parent Organization

24.5.1.7. Recent Developments

24.5.1.8. Financial Analysis

24.5.1.9. Profitability

24.5.1.10. Revenue Share

24.5.2. Alstom

24.5.2.1. Company Overview

24.5.2.2. Company Footprints

24.5.2.3. Production Locations

24.5.2.4. Product Portfolio

24.5.2.5. Competitors & Customers

24.5.2.6. Subsidiaries & Parent Organization

24.5.2.7. Recent Developments

24.5.2.8. Financial Analysis

24.5.2.9. Profitability

24.5.2.10. Revenue Share

24.5.3. American Equipment Company

24.5.3.1. Company Overview

24.5.3.2. Company Footprints

24.5.3.3. Production Locations

24.5.3.4. Product Portfolio

24.5.3.5. Competitors & Customers

24.5.3.6. Subsidiaries & Parent Organization

24.5.3.7. Recent Developments

24.5.3.8. Financial Analysis

24.5.3.9. Profitability

24.5.3.10. Revenue Share

24.5.4. Beijing Traffic Control Technology

24.5.4.1. Company Overview

24.5.4.2. Company Footprints

24.5.4.3. Production Locations

24.5.4.4. Product Portfolio

24.5.4.5. Competitors & Customers

24.5.4.6. Subsidiaries & Parent Organization

24.5.4.7. Recent Developments

24.5.4.8. Financial Analysis

24.5.4.9. Profitability

24.5.4.10. Revenue Share

24.5.5. Belden

24.5.5.1. Company Overview

24.5.5.2. Company Footprints

24.5.5.3. Production Locations

24.5.5.4. Product Portfolio

24.5.5.5. Competitors & Customers

24.5.5.6. Subsidiaries & Parent Organization

24.5.5.7. Recent Developments

24.5.5.8. Financial Analysis

24.5.5.9. Profitability

24.5.5.10. Revenue Share

24.5.6. Bharat Forge

24.5.6.1. Company Overview

24.5.6.2. Company Footprints

24.5.6.3. Production Locations

24.5.6.4. Product Portfolio

24.5.6.5. Competitors & Customers

24.5.6.6. Subsidiaries & Parent Organization

24.5.6.7. Recent Developments

24.5.6.8. Financial Analysis

24.5.6.9. Profitability

24.5.6.10. Revenue Share

24.5.7. Bombardier

24.5.7.1. Company Overview

24.5.7.2. Company Footprints

24.5.7.3. Production Locations

24.5.7.4. Product Portfolio

24.5.7.5. Competitors & Customers

24.5.7.6. Subsidiaries & Parent Organization

24.5.7.7. Recent Developments

24.5.7.8. Financial Analysis

24.5.7.9. Profitability

24.5.7.10. Revenue Share

24.5.8. CAF

24.5.8.1. Company Overview

24.5.8.2. Company Footprints

24.5.8.3. Production Locations

24.5.8.4. Product Portfolio

24.5.8.5. Competitors & Customers

24.5.8.6. Subsidiaries & Parent Organization

24.5.8.7. Recent Developments

24.5.8.8. Financial Analysis

24.5.8.9. Profitability

24.5.8.10. Revenue Share

24.5.9. Calamp

24.5.9.1. Company Overview

24.5.9.2. Company Footprints

24.5.9.3. Production Locations

24.5.9.4. Product Portfolio

24.5.9.5. Competitors & Customers

24.5.9.6. Subsidiaries & Parent Organization

24.5.9.7. Recent Developments

24.5.9.8. Financial Analysis

24.5.9.9. Profitability

24.5.9.10. Revenue Share

24.5.10. CRRC

24.5.10.1. Company Overview

24.5.10.2. Company Footprints

24.5.10.3. Production Locations

24.5.10.4. Product Portfolio

24.5.10.5. Competitors & Customers

24.5.10.6. Subsidiaries & Parent Organization

24.5.10.7. Recent Developments

24.5.10.8. Financial Analysis

24.5.10.9. Profitability

24.5.10.10. Revenue Share

24.5.11. Deuta

24.5.11.1. Company Overview

24.5.11.2. Company Footprints

24.5.11.3. Production Locations

24.5.11.4. Product Portfolio

24.5.11.5. Competitors & Customers

24.5.11.6. Subsidiaries & Parent Organization

24.5.11.7. Recent Developments

24.5.11.8. Financial Analysis

24.5.11.9. Profitability

24.5.11.10. Revenue Share

24.5.12. Deutsche Bahn

24.5.12.1. Company Overview

24.5.12.2. Company Footprints

24.5.12.3. Production Locations

24.5.12.4. Product Portfolio

24.5.12.5. Competitors & Customers

24.5.12.6. Subsidiaries & Parent Organization

24.5.12.7. Recent Developments

24.5.12.8. Financial Analysis

24.5.12.9. Profitability

24.5.12.10. Revenue Share

24.5.13. General Electric

24.5.13.1. Company Overview

24.5.13.2. Company Footprints

24.5.13.3. Production Locations

24.5.13.4. Product Portfolio

24.5.13.5. Competitors & Customers

24.5.13.6. Subsidiaries & Parent Organization

24.5.13.7. Recent Developments

24.5.13.8. Financial Analysis

24.5.13.9. Profitability

24.5.13.10. Revenue Share

24.5.14. Hitachi

24.5.14.1. Company Overview

24.5.14.2. Company Footprints

24.5.14.3. Production Locations

24.5.14.4. Product Portfolio

24.5.14.5. Competitors & Customers

24.5.14.6. Subsidiaries & Parent Organization

24.5.14.7. Recent Developments

24.5.14.8. Financial Analysis

24.5.14.9. Profitability

24.5.14.10. Revenue Share

24.5.15. Hollysys

24.5.15.1. Company Overview

24.5.15.2. Company Footprints

24.5.15.3. Production Locations

24.5.15.4. Product Portfolio

24.5.15.5. Competitors & Customers

24.5.15.6. Subsidiaries & Parent Organization

24.5.15.7. Recent Developments

24.5.15.8. Financial Analysis

24.5.15.9. Profitability

24.5.15.10. Revenue Share

24.5.16. Ingeteam

24.5.16.1. Company Overview

24.5.16.2. Company Footprints

24.5.16.3. Production Locations

24.5.16.4. Product Portfolio

24.5.16.5. Competitors & Customers

24.5.16.6. Subsidiaries & Parent Organization

24.5.16.7. Recent Developments

24.5.16.8. Financial Analysis

24.5.16.9. Profitability

24.5.16.10. Revenue Share

24.5.17. Intesens

24.5.17.1. Company Overview

24.5.17.2. Company Footprints

24.5.17.3. Production Locations

24.5.17.4. Product Portfolio

24.5.17.5. Competitors & Customers

24.5.17.6. Subsidiaries & Parent Organization

24.5.17.7. Recent Developments

24.5.17.8. Financial Analysis

24.5.17.9. Profitability

24.5.17.10. Revenue Share

24.5.18. Kawasaki Heavy Industries

24.5.18.1. Company Overview

24.5.18.2. Company Footprints

24.5.18.3. Production Locations

24.5.18.4. Product Portfolio

24.5.18.5. Competitors & Customers

24.5.18.6. Subsidiaries & Parent Organization

24.5.18.7. Recent Developments

24.5.18.8. Financial Analysis

24.5.18.9. Profitability

24.5.18.10. Revenue Share

24.5.19. Mitsubishi Heavy Industries

24.5.19.1. Company Overview

24.5.19.2. Company Footprints

24.5.19.3. Production Locations

24.5.19.4. Product Portfolio

24.5.19.5. Competitors & Customers

24.5.19.6. Subsidiaries & Parent Organization

24.5.19.7. Recent Developments

24.5.19.8. Financial Analysis

24.5.19.9. Profitability

24.5.19.10. Revenue Share

24.5.20. Siemens

24.5.20.1. Company Overview

24.5.20.2. Company Footprints

24.5.20.3. Production Locations

24.5.20.4. Product Portfolio

24.5.20.5. Competitors & Customers

24.5.20.6. Subsidiaries & Parent Organization

24.5.20.7. Recent Developments

24.5.20.8. Financial Analysis

24.5.20.9. Profitability

24.5.20.10. Revenue Share

24.5.21. Tech Mahindra Ltd.

24.5.21.1. Company Overview

24.5.21.2. Company Footprints

24.5.21.3. Production Locations

24.5.21.4. Product Portfolio

24.5.21.5. Competitors & Customers

24.5.21.6. Subsidiaries & Parent Organization

24.5.21.7. Recent Developments

24.5.21.8. Financial Analysis

24.5.21.9. Profitability

24.5.21.10. Revenue Share

24.5.22. Thales Group

24.5.22.1. Company Overview

24.5.22.2. Company Footprints

24.5.22.3. Production Locations

24.5.22.4. Product Portfolio

24.5.22.5. Competitors & Customers

24.5.22.6. Subsidiaries & Parent Organization

24.5.22.7. Recent Developments

24.5.22.8. Financial Analysis

24.5.22.9. Profitability

24.5.22.10. Revenue Share

24.5.23. Transmashholding

24.5.23.1. Company Overview

24.5.23.2. Company Footprints

24.5.23.3. Production Locations

24.5.23.4. Product Portfolio

24.5.23.5. Competitors & Customers

24.5.23.6. Subsidiaries & Parent Organization

24.5.23.7. Recent Developments

24.5.23.8. Financial Analysis

24.5.23.9. Profitability

24.5.23.10. Revenue Share

24.5.24. Tvema

24.5.24.1. Company Overview

24.5.24.2. Company Footprints

24.5.24.3. Production Locations

24.5.24.4. Product Portfolio

24.5.24.5. Competitors & Customers

24.5.24.6. Subsidiaries & Parent Organization

24.5.24.7. Recent Developments

24.5.24.8. Financial Analysis

24.5.24.9. Profitability

24.5.24.10. Revenue Share

24.5.25. Wabtec Corporation

24.5.25.1. Company Overview

24.5.25.2. Company Footprints

24.5.25.3. Production Locations

24.5.25.4. Product Portfolio

24.5.25.5. Competitors & Customers

24.5.25.6. Subsidiaries & Parent Organization

24.5.25.7. Recent Developments

24.5.25.8. Financial Analysis

24.5.25.9. Profitability

24.5.25.10. Revenue Share

24.5.26. Other Key Players

24.5.26.1. Company Overview

24.5.26.2. Company Footprints

24.5.26.3. Production Locations

24.5.26.4. Product Portfolio

24.5.26.5. Competitors & Customers

24.5.26.6. Subsidiaries & Parent Organization

24.5.26.7. Recent Developments

24.5.26.8. Financial Analysis

24.5.26.9. Profitability

24.5.26.10. Revenue Share

25. Autonomous Trains Market – Primary Insights

List of Tables

Table 1: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Table 2: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Table 3: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 4: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Table 5: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Table 6: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Table 7: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Table 8: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Table 9: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Table 10: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 11: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Table 12: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Table 13: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Table 14: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Table 15: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Table 16: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Table 17: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 18: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Table 19: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Table 20: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Table 21: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Table 22: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Table 23: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Table 24: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 25: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Table 26: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Table 27: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Table 28: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Table 29: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Table 30: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Table 31: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 32: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Table 33: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Table 34: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Table 35: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Table 36: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Table 37: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Table 38: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 39: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Table 40: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Table 41: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Table 42: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

List of Figures

Figure 1: Global Autonomous Trains Market, Incremental Opportunity, by Application, (US$ Bn), 2022-2031

Figure 2: Global Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 3: Global Autonomous Trains Market, Incremental Opportunity, by Region, (US$ Bn), 2022-2031

Figure 4: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Figure 5: North America Autonomous Trains Market, Incremental Opportunity, by Grade of Automation, (US$ Bn), 2022-2031

Figure 6: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Figure 7: North America Autonomous Trains Market, Incremental Opportunity, by Train Type, (US$ Bn), 2022-2031

Figure 8: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 9: North America Autonomous Trains Market, Incremental Opportunity, by Technology, (US$ Bn), 2022-2031

Figure 10: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 11: North America Autonomous Trains Market, Incremental Opportunity, by Component, (US$ Bn), 2022-2031

Figure 12: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Figure 13: North America Autonomous Trains Market, Incremental Opportunity, by Track Length, (US$ Bn), 2022-2031

Figure 14: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 15: North America Autonomous Trains Market, Incremental Opportunity, by Application, (US$ Bn), 2022-2031

Figure 16: North America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 17: North America Autonomous Trains Market, Incremental Opportunity, by Region, (US$ Bn), 2022-2031

Figure 18: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Figure 19: Europe Autonomous Trains Market, Incremental Opportunity, by Grade of Automation, (US$ Bn), 2022-2031

Figure 20: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Figure 21: Europe Autonomous Trains Market, Incremental Opportunity, by Train Type, (US$ Bn), 2022-2031

Figure 22: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 23: Europe Autonomous Trains Market, Incremental Opportunity, by Technology, (US$ Bn), 2022-2031

Figure 24: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 25: Europe Autonomous Trains Market, Incremental Opportunity, by Component, (US$ Bn), 2022-2031

Figure 26: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Figure 27: Europe Autonomous Trains Market, Incremental Opportunity, by Track Length, (US$ Bn), 2022-2031

Figure 28: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 29: Europe Autonomous Trains Market, Incremental Opportunity, by Application, (US$ Bn), 2022-2031

Figure 30: Europe Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 31: Europe Autonomous Trains Market, Incremental Opportunity, by Region, (US$ Bn), 2022-2031

Figure 32: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Figure 33: Asia Pacific Autonomous Trains Market, Incremental Opportunity, by Grade of Automation, (US$ Bn), 2022-2031

Figure 34: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Figure 35: Asia Pacific Autonomous Trains Market, Incremental Opportunity, by Train Type, (US$ Bn), 2022-2031

Figure 36: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 37: Asia Pacific Autonomous Trains Market, Incremental Opportunity, by Technology, (US$ Bn), 2022-2031

Figure 38: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 39: Asia Pacific Autonomous Trains Market, Incremental Opportunity, by Component, (US$ Bn), 2022-2031

Figure 40: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Figure 41: Asia Pacific Autonomous Trains Market, Incremental Opportunity, by Track Length, (US$ Bn), 2022-2031

Figure 42: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 43: Asia Pacific Autonomous Trains Market, Incremental Opportunity, by Application, (US$ Bn), 2022-2031

Figure 44: Asia Pacific Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 45: Asia Pacific Autonomous Trains Market, Incremental Opportunity, by Region, (US$ Bn), 2022-2031

Figure 46: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Figure 47: Middle East & Africa Autonomous Trains Market, Incremental Opportunity, by Grade of Automation, (US$ Bn), 2022-2031

Figure 48: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Figure 49: Middle East & Africa Autonomous Trains Market, Incremental Opportunity, by Train Type, (US$ Bn), 2022-2031

Figure 50: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 51: Middle East & Africa Autonomous Trains Market, Incremental Opportunity, by Technology, (US$ Bn), 2022-2031

Figure 52: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 53: Middle East & Africa Autonomous Trains Market, Incremental Opportunity, by Component, (US$ Bn), 2022-2031

Figure 54: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Figure 55: Middle East & Africa Autonomous Trains Market, Incremental Opportunity, by Track Length, (US$ Bn), 2022-2031

Figure 56: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 57: Middle East & Africa Autonomous Trains Market, Incremental Opportunity, by Application, (US$ Bn), 2022-2031

Figure 58: Middle East & Africa Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 59: Middle East & Africa Autonomous Trains Market, Incremental Opportunity, by Region, (US$ Bn), 2022-2031

Figure 60: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Grade of Automation, 2017-2031

Figure 61: South America Autonomous Trains Market, Incremental Opportunity, by Grade of Automation, (US$ Bn), 2022-2031

Figure 62: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Train Type, 2017-2031

Figure 63: South America Autonomous Trains Market, Incremental Opportunity, by Train Type, (US$ Bn), 2022-2031

Figure 64: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 65: South America Autonomous Trains Market, Incremental Opportunity, by Technology, (US$ Bn), 2022-2031

Figure 66: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 67: South America Autonomous Trains Market, Incremental Opportunity, by Component, (US$ Bn), 2022-2031

Figure 68: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Track Length, 2017-2031

Figure 69: South America Autonomous Trains Market, Incremental Opportunity, by Track Length, (US$ Bn), 2022-2031

Figure 70: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 71: South America Autonomous Trains Market, Incremental Opportunity, by Application, (US$ Bn), 2022-2031

Figure 72: South America Autonomous Trains Market Volume (Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 73: South America Autonomous Trains Market, Incremental Opportunity, by Region, (US$ Bn), 2022-2031