Reports

Reports

Analysts’ Viewpoint on Market Scenario

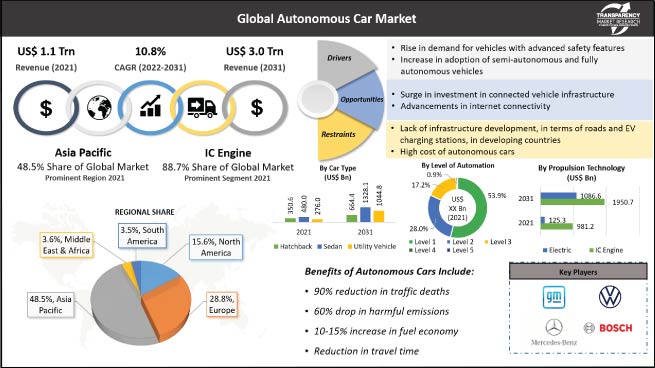

Adoption of autonomous cars has been rising significantly across the globe. Autonomous cars are ideal for various types of roads and terrains. They ensure driver safety and reduce the chances of any failure or accidents in harsh weather. Autonomous cars are also eco-friendly and fuel efficient. Increase in investment in smart cities is expected to augment the future of self-driving cars in the next few years. Rise in urban population has led to congested road conditions in several cities across the globe. This is fueling the demand for autonomous cars featuring park assist, traffic sign recognition, traffic jam assist, and other systems. Key players in the market are investing significantly in R&D of novel autonomous driving systems to broaden their revenue streams.

Autonomous car is a vehicle capable of sensing its environment and operating with or without human involvement according to its level of autonomy. In a fully self-driving car, a user is neither required to take control of the vehicle at any time nor is he/she required to be present in the vehicle. Advanced Artificial Intelligence (AI) and Machine Learning (ML) systems are integrated into automated cars to understand surroundings and respond to commands. Sophisticated sensors and actuators are used in conjunction with cutting-edge computer vision functions to continuously update maps, detect the presence of nearby vehicles and pedestrians, measure distances, and detect uneven surfaces in roads and sidewalks. Some of the best autonomous cars in 2022 are Genesis GV80, Tesla Model S, Cadillac Escalade, and BMW X7.

Rise in adoption of vehicles with advanced safety features is expected to fuel the global market size during the forecast period. Autonomous vehicles are equipped with various safety features such as adaptive cruise control, adaptive headlamp control, traffic sign recognition, forward collision warning, pedestrian detection, and automated braking. Car manufacturers are developing AI-based cameras to boost driver safety. LiDAR, radar, and sensors in autonomous vehicles aid in the rapid analysis of traffic data and lower machine-to-machine latency. Autonomous cars also offer reduced fuel consumption and CO2 emissions.

Increase in urban population has led to a surge in the daily average of traffic on roads. Rise in number of vehicles and lack of proper road infrastructure also cause traffic issues in cities.

Adoption of semi-automated and driverless cars helps minimize traffic congestion and effectively manage traffic flow. Studies suggest that even a small number of autonomous vehicles (5.0%) might make a big difference in eliminating waves, cutting overall fuel usage by up to 40%, and lowering breakdowns by up to 99%.

In terms of ADAS feature, the autonomous car industry has been segmented into adaptive cruise control, lane departure warning, tire-pressure monitoring, blind spot detection, adaptive front lighting, night vision, park assist, automatic emergency braking, forward collision, pedestrian detection, traffic sign recognition, traffic jam assist, and driver monitoring. The adaptive front lighting segment held major share of the global market in 2021. Adaptive front lighting system helps to dynamically adjust car headlights, thereby providing the driver optimum nighttime vision without compromising the safety of other road users.

The automatic emergency braking segment accounted for the second-largest share of the global market in 2021. Automatic emergency braking system aids in preventing possible collisions and reduces the speed of the moving vehicle, prior to a collision. The system aims to lessen the impact or prevent accidents altogether.

Based on level of autonomy, the global autonomous car market has been classified into level 1, level 2, level 3, level 4, and level 5. The level 1 segment held dominant share of the global market in 2021. It is expected to maintain its dominance during the forecast period. Level 1 autonomous cars offer at least one driver support system that provides steering assistance or braking and acceleration assistance. They are more affordable than vehicles in other levels. Level 1 autonomous cars are easy to operate in most countries with developing infrastructure.

The level 2 segment accounted for the second-largest share of the global market in 2021. Prominent car manufacturers are adopting level 2 autonomy to provide customers with advanced features such as directional, throttle, and braking control, and adaptive cruise control to ensure and enhance driver safety.

According to the autonomous vehicle market forecast, the level 4 segment is likely to grow significantly in the next few years. Level 4 autonomous driving technology is gaining traction in several regions. Currently, level 5 autonomous cars have no specific market. However, the level 5 segment is estimated to grow at a rapid pace during the forecast period, with significant technological development in autopilot cars.

In terms of volume, Asia Pacific dominated the global autonomous car market in 2021. Rise in investment in infrastructure development and expansion in the automotive sector are driving the market in the region. China is one of the leading producers of autonomous cars in Asia Pacific. Automakers in the region are investing significantly in R&D of Advanced Driver Assistance Systems (ADAS).

Europe is anticipated to record the second-largest autonomous vehicle market share during the forecast period, followed by North America. Surge in integration of adaptive front lighting systems in autonomous cars and the presence of key manufacturers are augmenting the market in Europe. Future of the autonomous vehicle market in North America appears promising, with rise in launch of several autonomous cars in the region.

The global autonomous car market is fairly consolidated, with a large number of players controlling majority of the share. Market players are investing significantly in comprehensive R&D activities to introduce innovative autonomous driving systems. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by top self-driving car companies. General Motors Company, Ford Motor Company, Mercedes-Benz Group AG, Volkswagen AG, Toyota Motor Corporation, Waymo LLC, Autoliv Inc., Robert Bosch GmbH, Volvo Group, Ficosa International SA, Gentex Corporation, Harman International Industries, Aisin Corporation, Valeo, Hyundai Mobis, ZF Friedrichshafen AG, Hella KGaA Hueck & Co., Texas Instruments Inc., Mobileye Global Inc., and Visteon Corporation are prominent entities operating in this market.

Each of these players has been profiled in the autonomous car market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 1.1 Trn |

|

Market Forecast Value in 2031 |

US$ 3.0 Trn |

|

Growth Rate (CAGR) |

10.8% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

Thousand Units for Volume and US$ Trn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, autonomous car industry analysis, autonomous car market size, autonomous car market growth etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The market was valued at US$ 1.1 Trn in 2021.

The market is expected to advance at a CAGR of 10.8% by 2031.

The market is likely to reach US$ 3.0 Trn by 2031.

China held prominent share of 55.7% of the autonomous car industry in 2021.

The adaptive front lighting segment accounted for the largest share of 22.7% of the global market in 2021.

Increase in demand for vehicles with advanced safety features and rise in urban traffic congestion.

Asia Pacific is the most lucrative region with 48.5% share of the global market in 2021.

General Motors Company, Ford Motor Company, Mercedes-Benz Group AG, Volkswagen AG, Toyota Motor Corporation, Waymo LLC, Autoliv Inc., Robert Bosch GmbH, Volvo Group, Ficosa International SA, Gentex Corporation, Harman International Industries, Aisin Corporation, Valeo, Hyundai Mobis, ZF Friedrichshafen AG, Hella KGaA Hueck & Co., Texas Instruments Inc., Mobileye Global Inc., and Visteon Corporation.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Thousand Units, US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Market Definition / Scope / Limitations

3.2. Macroeconomic Factors

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunity

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Regulatory Scenario

3.6. Key Trend Analysis

4. Industry Ecosystem Analysis

4.1. Value Chain Analysis

4.2. Vendor Matrix

5. Pricing Analysis

5.1. Regional Autonomous Car Sales Pricing (US$), 2017-2031

6. COVID-19 Impact Analysis – Autonomous Car Market

7. Impact Factors

7.1. On-going developments in connectivity technologies

7.2. Government emission norms

8. Global Autonomous Car Market, by ADAS Feature

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By ADAS Feature

8.2.1. Adaptive Cruise Control

8.2.2. Lane Departure Warning

8.2.3. Tire-pressure Monitoring

8.2.4. Blind Spot Detection

8.2.5. Adaptive Front Lighting

8.2.6. Night Vision

8.2.7. Park Assist

8.2.8. Automatic Emergency Braking

8.2.9. Forward Collision

8.2.10. Pedestrian Detection

8.2.11. Traffic Sign Recognition

8.2.12. Traffic Jam Assist

8.2.13. Driver Monitoring

9. Global Autonomous Car Market, by Component

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, Component

9.2.1. LiDAR

9.2.2. Radar

9.2.3. Camera

9.2.4. Sensor

10. Global Autonomous Car Market, by Car Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Car Type

10.2.1. Hatchback

10.2.2. Sedan

10.2.3. Utility Vehicle

11. Global Autonomous Car Market, by Level of Autonomy

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Level of Autonomy

11.2.1. Level 1

11.2.2. Level 2

11.2.3. Level 3

11.2.4. Level 4

11.2.5. Level 5

12. Global Autonomous Car Market, by Propulsion Technology

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion Technology

12.2.1. IC Engine

12.2.1.1. Gasoline

12.2.1.2. Diesel

12.2.2. Electric

12.2.2.1. Battery Electric

12.2.2.2. Hybrid Electric

12.2.2.3. Plug-in Hybrid Electric

13. Global Autonomous Car Market, by Region

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

13.2.1. North America

13.2.2. Europe

13.2.3. Asia Pacific

13.2.4. Middle East & Africa

13.2.5. South America

14. North America Autonomous Car Market

14.1. Market Snapshot

14.2. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By ADAS Feature

14.2.1. Adaptive Cruise Control

14.2.2. Lane Departure Warning

14.2.3. Tire-pressure Monitoring

14.2.4. Blind Spot Detection

14.2.5. Adaptive Front Lighting

14.2.6. Night Vision

14.2.7. Park Assist

14.2.8. Automatic Emergency Braking

14.2.9. Forward Collision

14.2.10. Pedestrian Detection

14.2.11. Traffic Sign Recognition

14.2.12. Traffic Jam Assist

14.2.13. Driver Monitoring

14.3. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, Component

14.3.1. LiDAR

14.3.2. Radar

14.3.3. Camera

14.3.4. Sensor

14.4. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Car Type

14.4.1. Hatchback

14.4.2. Sedan

14.4.3. Utility Vehicle

14.5. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Level of Autonomy

14.5.1. Level 1

14.5.2. Level 2

14.5.3. Level 3

14.5.4. Level 4

14.5.5. Level 5

14.6. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion Technology

14.6.1. IC Engine

14.6.1.1. Gasoline

14.6.1.2. Diesel

14.6.2. Electric

14.6.2.1. Battery Electric

14.6.2.2. Hybrid Electric

14.6.2.3. Plug-in Hybrid Electric

14.7. Key Country Analysis – North America Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

14.7.1. The U. S.

14.7.2. Canada

14.7.3. Mexico

15. Europe Autonomous Car Market

15.1. Market Snapshot

15.2. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By ADAS Feature

15.2.1. Adaptive Cruise Control

15.2.2. Lane Departure Warning

15.2.3. Tire-pressure Monitoring

15.2.4. Blind Spot Detection

15.2.5. Adaptive Front Lighting

15.2.6. Night Vision

15.2.7. Park Assist

15.2.8. Automatic Emergency Braking

15.2.9. Forward Collision

15.2.10. Pedestrian Detection

15.2.11. Traffic Sign Recognition

15.2.12. Traffic Jam Assist

15.2.13. Driver Monitoring

15.3. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, Component

15.3.1. LiDAR

15.3.2. Radar

15.3.3. Camera

15.3.4. Sensor

15.4. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Car Type

15.4.1. Hatchback

15.4.2. Sedan

15.4.3. Utility Vehicle

15.5. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Level of Autonomy

15.5.1. Level 1

15.5.2. Level 2

15.5.3. Level 3

15.5.4. Level 4

15.5.5. Level 5

15.6. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion Technology

15.6.1. IC Engine

15.6.1.1. Gasoline

15.6.1.2. Diesel

15.6.2. Electric

15.6.2.1. Battery Electric

15.6.2.2. Hybrid Electric

15.6.2.3. Plug-in Hybrid Electric

15.7. Key Country Analysis – Europe Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

15.7.1. Germany

15.7.2. U. K.

15.7.3. France

15.7.4. Italy

15.7.5. Spain

15.7.6. Nordic Countries

15.7.7. Russia & CIS

15.7.8. Rest of Europe

16. Asia Pacific Autonomous Car Market

16.1. Market Snapshot

16.2. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By ADAS Feature

16.2.1. Adaptive Cruise Control

16.2.2. Lane Departure Warning

16.2.3. Tire-pressure Monitoring

16.2.4. Blind Spot Detection

16.2.5. Adaptive Front Lighting

16.2.6. Night Vision

16.2.7. Park Assist

16.2.8. Automatic Emergency Braking

16.2.9. Forward Collision

16.2.10. Pedestrian Detection

16.2.11. Traffic Sign Recognition

16.2.12. Traffic Jam Assist

16.2.13. Driver Monitoring

16.3. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, Component

16.3.1. LiDAR

16.3.2. Radar

16.3.3. Camera

16.3.4. Sensor

16.4. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Car Type

16.4.1. Hatchback

16.4.2. Sedan

16.4.3. Utility Vehicle

16.5. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Level of Autonomy

16.5.1. Level 1

16.5.2. Level 2

16.5.3. Level 3

16.5.4. Level 4

16.5.5. Level 5

16.6. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion Technology

16.6.1. IC Engine

16.6.1.1. Gasoline

16.6.1.2. Diesel

16.6.2. Electric

16.6.2.1. Battery Electric

16.6.2.2. Hybrid Electric

16.6.2.3. Plug-in Hybrid Electric

16.7. Key Country Analysis – Asia Pacific Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

16.7.1. China

16.7.2. India

16.7.3. Japan

16.7.4. ASEAN Countries

16.7.5. South Korea

16.7.6. ANZ

16.7.7. Rest of Asia Pacific

17. Middle East & Africa Autonomous Car Market

17.1. Market Snapshot

17.2. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By ADAS Feature

17.2.1. Adaptive Cruise Control

17.2.2. Lane Departure Warning

17.2.3. Tire-pressure Monitoring

17.2.4. Blind Spot Detection

17.2.5. Adaptive Front Lighting

17.2.6. Night Vision

17.2.7. Park Assist

17.2.8. Automatic Emergency Braking

17.2.9. Forward Collision

17.2.10. Pedestrian Detection

17.2.11. Traffic Sign Recognition

17.2.12. Traffic Jam Assist

17.2.13. Driver Monitoring

17.3. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, Component

17.3.1. LiDAR

17.3.2. Radar

17.3.3. Camera

17.3.4. Sensor

17.4. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Car Type

17.4.1. Hatchback

17.4.2. Sedan

17.4.3. Utility Vehicle

17.5. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Level of Autonomy

17.5.1. Level 1

17.5.2. Level 2

17.5.3. Level 3

17.5.4. Level 4

17.5.5. Level 5

17.6. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion Technology

17.6.1. IC Engine

17.6.1.1. Gasoline

17.6.1.2. Diesel

17.6.2. Electric

17.6.2.1. Battery Electric

17.6.2.2. Hybrid Electric

17.6.2.3. Plug-in Hybrid Electric

17.7. Key Country Analysis – Middle East & Africa Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

17.7.1. GCC

17.7.2. South Africa

17.7.3. Turkey

17.7.4. Rest of Middle East & Africa

18. South America Autonomous Car Market

18.1. Market Snapshot

18.2. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By ADAS Feature

18.2.1. Adaptive Cruise Control

18.2.2. Lane Departure Warning

18.2.3. Tire-pressure Monitoring

18.2.4. Blind Spot Detection

18.2.5. Adaptive Front Lighting

18.2.6. Night Vision

18.2.7. Park Assist

18.2.8. Automatic Emergency Braking

18.2.9. Forward Collision

18.2.10. Pedestrian Detection

18.2.11. Traffic Sign Recognition

18.2.12. Traffic Jam Assist

18.2.13. Driver Monitoring

18.3. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, Component

18.3.1. LiDAR

18.3.2. Radar

18.3.3. Camera

18.3.4. Sensor

18.4. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Car Type

18.4.1. Hatchback

18.4.2. Sedan

18.4.3. Utility Vehicle

18.5. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Level of Autonomy

18.5.1. Level 1

18.5.2. Level 2

18.5.3. Level 3

18.5.4. Level 4

18.5.5. Level 5

18.6. Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion Technology

18.6.1. IC Engine

18.6.1.1. Gasoline

18.6.1.2. Diesel

18.6.2. Electric

18.6.2.1. Battery Electric

18.6.2.2. Hybrid Electric

18.6.2.3. Plug-in Hybrid Electric

18.7. Key Country Analysis – South America Autonomous Car Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

18.7.1. Brazil

18.7.2. Argentina

18.7.3. Rest of South America

19. Competitive Landscape

19.1. Company Share Analysis/ Brand Share Analysis, 2021

19.2. Key Strategy Analysis

19.2.1. Strategic Overview - Expansion, M&A, Partnership

19.2.2. Product & Marketing Strategy

19.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

20. Company Profile/ Key Players – Autonomous Car Market

20.1. General Motors Company

20.1.1. Company Overview

20.1.2. Company Footprints

20.1.3. Production Locations

20.1.4. Product Portfolio

20.1.5. Competitors & Customers

20.1.6. Subsidiaries & Parent Organization

20.1.7. Recent Developments

20.1.8. Financial Analysis

20.1.9. Profitability

20.1.10. Revenue Share

20.1.11. Executive Bios

20.2. Ford Motor Company

20.2.1. Company Overview

20.2.2. Company Footprints

20.2.3. Production Locations

20.2.4. Product Portfolio

20.2.5. Competitors & Customers

20.2.6. Subsidiaries & Parent Organization

20.2.7. Recent Developments

20.2.8. Financial Analysis

20.2.9. Profitability

20.2.10. Revenue Share

20.2.11. Executive Bios

20.3. Mercedes-Benz Group AG

20.3.1. Company Overview

20.3.2. Company Footprints

20.3.3. Production Locations

20.3.4. Product Portfolio

20.3.5. Competitors & Customers

20.3.6. Subsidiaries & Parent Organization

20.3.7. Recent Developments

20.3.8. Financial Analysis

20.3.9. Profitability

20.3.10. Revenue Share

20.3.11. Executive Bios

20.4. Volkswagen AG

20.4.1. Company Overview

20.4.2. Company Footprints

20.4.3. Production Locations

20.4.4. Product Portfolio

20.4.5. Competitors & Customers

20.4.6. Subsidiaries & Parent Organization

20.4.7. Recent Developments

20.4.8. Financial Analysis

20.4.9. Profitability

20.4.10. Revenue Share

20.4.11. Executive Bios

20.5. Toyota Motor Corporation

20.5.1. Company Overview

20.5.2. Company Footprints

20.5.3. Production Locations

20.5.4. Product Portfolio

20.5.5. Competitors & Customers

20.5.6. Subsidiaries & Parent Organization

20.5.7. Recent Developments

20.5.8. Financial Analysis

20.5.9. Profitability

20.5.10. Revenue Share

20.5.11. Executive Bios

20.6. Waymo LLC

20.6.1. Company Overview

20.6.2. Company Footprints

20.6.3. Production Locations

20.6.4. Product Portfolio

20.6.5. Competitors & Customers

20.6.6. Subsidiaries & Parent Organization

20.6.7. Recent Developments

20.6.8. Financial Analysis

20.6.9. Profitability

20.6.10. Revenue Share

20.6.11. Executive Bios

20.7. Autoliv Inc.

20.7.1. Company Overview

20.7.2. Company Footprints

20.7.3. Production Locations

20.7.4. Product Portfolio

20.7.5. Competitors & Customers

20.7.6. Subsidiaries & Parent Organization

20.7.7. Recent Developments

20.7.8. Financial Analysis

20.7.9. Profitability

20.7.10. Revenue Share

20.7.11. Executive Bios

20.8. Robert Bosch GmbH

20.8.1. Company Overview

20.8.2. Company Footprints

20.8.3. Production Locations

20.8.4. Product Portfolio

20.8.5. Competitors & Customers

20.8.6. Subsidiaries & Parent Organization

20.8.7. Recent Developments

20.8.8. Financial Analysis

20.8.9. Profitability

20.8.10. Revenue Share

20.8.11. Executive Bios

20.9. Volvo Group

20.9.1. Company Overview

20.9.2. Company Footprints

20.9.3. Production Locations

20.9.4. Product Portfolio

20.9.5. Competitors & Customers

20.9.6. Subsidiaries & Parent Organization

20.9.7. Recent Developments

20.9.8. Financial Analysis

20.9.9. Profitability

20.9.10. Revenue Share

20.9.11. Executive Bios

20.10. Ficosa International SA

20.10.1. Company Overview

20.10.2. Company Footprints

20.10.3. Production Locations

20.10.4. Product Portfolio

20.10.5. Competitors & Customers

20.10.6. Subsidiaries & Parent Organization

20.10.7. Recent Developments

20.10.8. Financial Analysis

20.10.9. Profitability

20.10.10. Revenue Share

20.10.11. Executive Bios

20.11. Gentex Corporation

20.11.1. Company Overview

20.11.2. Company Footprints

20.11.3. Production Locations

20.11.4. Product Portfolio

20.11.5. Competitors & Customers

20.11.6. Subsidiaries & Parent Organization

20.11.7. Recent Developments

20.11.8. Financial Analysis

20.11.9. Profitability

20.11.10. Revenue Share

20.11.11. Executive Bios

20.12. Harman International Industries

20.12.1. Company Overview

20.12.2. Company Footprints

20.12.3. Production Locations

20.12.4. Product Portfolio

20.12.5. Competitors & Customers

20.12.6. Subsidiaries & Parent Organization

20.12.7. Recent Developments

20.12.8. Financial Analysis

20.12.9. Profitability

20.12.10. Revenue Share

20.12.11. Executive Bios

20.13. Aisin Corporation

20.13.1. Company Overview

20.13.2. Company Footprints

20.13.3. Production Locations

20.13.4. Product Portfolio

20.13.5. Competitors & Customers

20.13.6. Subsidiaries & Parent Organization

20.13.7. Recent Developments

20.13.8. Financial Analysis

20.13.9. Profitability

20.13.10. Revenue Share

20.13.11. Executive Bios

20.14. Valeo

20.14.1. Company Overview

20.14.2. Company Footprints

20.14.3. Production Locations

20.14.4. Product Portfolio

20.14.5. Competitors & Customers

20.14.6. Subsidiaries & Parent Organization

20.14.7. Recent Developments

20.14.8. Financial Analysis

20.14.9. Profitability

20.14.10. Revenue Share

20.14.11. Executive Bios

20.15. Hyundai Mobis

20.15.1. Company Overview

20.15.2. Company Footprints

20.15.3. Production Locations

20.15.4. Product Portfolio

20.15.5. Competitors & Customers

20.15.6. Subsidiaries & Parent Organization

20.15.7. Recent Developments

20.15.8. Financial Analysis

20.15.9. Profitability

20.15.10. Revenue Share

20.15.11. Executive Bios

20.16. ZF Friedrichshafen AG

20.16.1. Company Overview

20.16.2. Company Footprints

20.16.3. Production Locations

20.16.4. Product Portfolio

20.16.5. Competitors & Customers

20.16.6. Subsidiaries & Parent Organization

20.16.7. Recent Developments

20.16.8. Financial Analysis

20.16.9. Profitability

20.16.10. Revenue Share

20.16.11. Executive Bios

20.17. Hella KGaA Hueck & Co.

20.17.1. Company Overview

20.17.2. Company Footprints

20.17.3. Production Locations

20.17.4. Product Portfolio

20.17.5. Competitors & Customers

20.17.6. Subsidiaries & Parent Organization

20.17.7. Recent Developments

20.17.8. Financial Analysis

20.17.9. Profitability

20.17.10. Revenue Share

20.17.11. Executive Bios

20.18. Texas Instruments Inc.

20.18.1. Company Overview

20.18.2. Company Footprints

20.18.3. Production Locations

20.18.4. Product Portfolio

20.18.5. Competitors & Customers

20.18.6. Subsidiaries & Parent Organization

20.18.7. Recent Developments

20.18.8. Financial Analysis

20.18.9. Profitability

20.18.10. Revenue Share

20.18.11. Executive Bios

20.19. Mobileye Global Inc.

20.19.1. Company Overview

20.19.2. Company Footprints

20.19.3. Production Locations

20.19.4. Product Portfolio

20.19.5. Competitors & Customers

20.19.6. Subsidiaries & Parent Organization

20.19.7. Recent Developments

20.19.8. Financial Analysis

20.19.9. Profitability

20.19.10. Revenue Share

20.19.11. Executive Bios

20.20. Visteon Corporation

20.20.1. Company Overview

20.20.2. Company Footprints

20.20.3. Production Locations

20.20.4. Product Portfolio

20.20.5. Competitors & Customers

20.20.6. Subsidiaries & Parent Organization

20.20.7. Recent Developments

20.20.8. Financial Analysis

20.20.9. Profitability

20.20.10. Revenue Share

20.20.11. Executive Bios

List of Tables

Table 1: Global Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Table 2: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 3: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Table 4: Global Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Table 5: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Table 6: Global Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 7: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Table 8: Global Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Table 9: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 10: Global Autonomous Car Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 11: North America Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Table 12: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 13: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Table 14: North America Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Table 15: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Table 16: North America Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 17: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Table 18: North America Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Table 19: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 20: North America Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: Europe Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Table 22: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 23: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Table 24: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Table 25: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Table 26: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 27: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Table 28: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Table 29: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 30: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Table 32: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 33: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Table 34: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Table 35: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Table 36: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 37: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Table 38: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Table 39: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 40: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Table 42: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 43: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Table 44: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Table 45: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Table 46: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 47: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Table 48: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Table 49: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 50: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 51: South America Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Table 52: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 53: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Table 54: South America Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Table 55: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Table 56: South America Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 57: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Table 58: South America Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Table 59: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 60: South America Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Figure 2: Global Autonomous Car Market, Incremental Opportunity, by ADAS Feature, Value (US$ Bn), 2022‒2031

Figure 3: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 4: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Figure 5: Global Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Figure 6: Global Autonomous Car Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2022‒2031

Figure 7: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Figure 8: Global Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Figure 9: Global Autonomous Car Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022‒2031

Figure 10: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 11: Global Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Figure 12: Global Autonomous Car Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Bn), 2022‒2031

Figure 13: Global Autonomous Car Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Figure 14: Global Autonomous Car Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 15: Global Autonomous Car Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 16: North America Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Figure 17: North America Autonomous Car Market, Incremental Opportunity, by ADAS Feature, Value (US$ Bn), 2022‒2031

Figure 18: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 19: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Figure 20: North America Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Figure 21: North America Autonomous Car Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2022‒2031

Figure 22: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Figure 23: North America Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Figure 24: North America Autonomous Car Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022‒2031

Figure 25: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 26: North America Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Figure 27: North America Autonomous Car Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Bn), 2022‒2031

Figure 28: North America Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 29: North America Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 30: North America Autonomous Car Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 31: Europe Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Figure 32: Europe Autonomous Car Market, Incremental Opportunity, by ADAS Feature, Value (US$ Bn), 2022‒2031

Figure 33: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 34: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Figure 35: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Figure 36: Europe Autonomous Car Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2022‒2031

Figure 37: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Figure 38: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Figure 39: Europe Autonomous Car Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022‒2031

Figure 40: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 41: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Figure 42: Europe Autonomous Car Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Bn), 2022‒2031

Figure 43: Europe Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 44: Europe Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 45: Europe Autonomous Car Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 46: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Figure 47: Asia Pacific Autonomous Car Market, Incremental Opportunity, by ADAS Feature, Value (US$ Bn), 2022‒2031

Figure 48: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 49: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Figure 50: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Figure 51: Asia Pacific Autonomous Car Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2022‒2031

Figure 52: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Figure 53: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Figure 54: Asia Pacific Autonomous Car Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022‒2031

Figure 55: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 56: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Figure 57: Asia Pacific Autonomous Car Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Bn), 2022‒2031

Figure 58: Asia Pacific Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 59: Asia Pacific Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 60: Asia Pacific Autonomous Car Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 61: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Figure 62: Middle East & Africa Autonomous Car Market, Incremental Opportunity, by ADAS Feature, Value (US$ Bn), 2022‒2031

Figure 63: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 64: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Figure 65: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Figure 66: Middle East & Africa Autonomous Car Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2022‒2031

Figure 67: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Figure 68: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Figure 69: Middle East & Africa Autonomous Car Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022‒2031

Figure 70: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 71: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Figure 72: Middle East & Africa Autonomous Car Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Bn), 2022‒2031

Figure 73: Middle East & Africa Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 74: Middle East & Africa Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 75: Middle East & Africa Autonomous Car Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 76: South America Autonomous Car Market Value (US$ Bn) Forecast, by ADAS Feature, 2017‒2031

Figure 77: South America Autonomous Car Market, Incremental Opportunity, by ADAS Feature, Value (US$ Bn), 2022‒2031

Figure 78: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 79: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Car Type, 2017‒2031

Figure 80: South America Autonomous Car Market Value (US$ Bn) Forecast, by Car Type, 2017‒2031

Figure 81: South America Autonomous Car Market, Incremental Opportunity, by Car Type, Value (US$ Bn), 2022‒2031

Figure 82: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017‒2031

Figure 83: South America Autonomous Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Figure 84: South America Autonomous Car Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022‒2031

Figure 85: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 86: South America Autonomous Car Market Value (US$ Bn) Forecast, by Propulsion Technology, 2017‒2031

Figure 87: South America Autonomous Car Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Bn), 2022‒2031

Figure 88: South America Autonomous Car Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 89: South America Autonomous Car Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 90: South America Autonomous Car Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031