Reports

Reports

Analysts’ Viewpoint

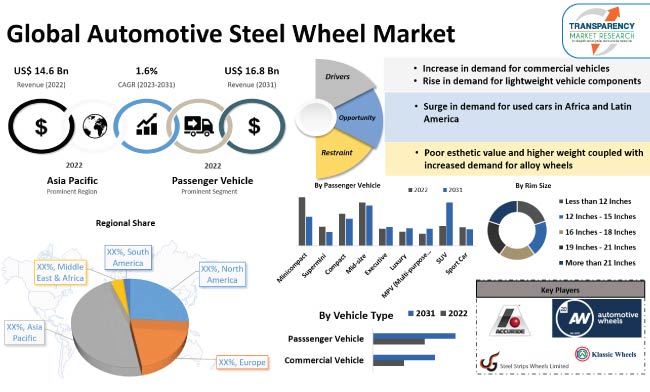

Increase in demand for commercial vehicles and rise in preference for lightweight vehicle components are driving the global automotive steel wheel market. Urbanization and rise in number of construction, road infrastructure development, and mining activities are fueling the production of vehicles across the world. This factor is bolstering the automotive steel wheel market growth.

Automotive steel wheel manufacturers are focusing on developing lightweight products based on new technologies, owing to increase in implementation of stringent emission norms regarding fuel efficiency in many regions. Manufacturers are exploiting lucrative automotive steel wheel market opportunities by developing new coatings and finishes for steel wheels to make them visually more appealing and resistant to corrosion. However, increase in competition from substitute materials such as aluminum and carbon fiber is expected to hamper market growth during the forecast period.

Steel wheel is a common type of wheel used on vehicles. It is typically made from steel or other metal alloys and used in various applications, including passenger cars, light trucks, heavy-duty trucks, and trailers. Steel wheels are often suitable for vehicles used in industries such as construction, mining, and agriculture, due to their strength and ability to function in harsh conditions. Increase in sales of commercial vehicles and low-budget cars is fueling market statistics.

Steel wheels, however, tend to be heavier than other types of wheels, which can affect fuel efficiency and handling. Hence, manufacturers are developing lightweight steel wheels to improve fuel efficiency and reduce emissions. Moreover, steel wheels are reliable and practical choice for drivers, particularly those who prioritize strength and durability over style and performance. Increase in demand for transport and mobility is boosting the sales of commercial and passenger vehicles, which is driving the global market.

Steel wheels are preferred for commercial vehicles due to their strength and durability. Growth of industries such as construction, logistics, and transportation is driving demand for commercial vehicles. Trucks, buses, and trailers need to carry heavy loads and travel through rough terrain. Hence, steel wheels are a popular choice for these commercial vehicles. Moreover, steel wheels are inexpensive, hence widely used in various commercial vehicles. These factors have increased demand for steel wheels in commercial vehicles.

Automotive steel wheels have been a popular choice for passenger vehicles for several years due to affordability, durability, and resistance to damage from potholes, curbs, and other road hazards. Presently, steel wheels with larger diameters are used in passenger vehicles. Moreover, steel wheels are compatible with modern safety systems in passenger vehicles.

Demand for more robust steel wheels for passenger vehicles is rising, owing to the desire for a more rugged and aggressive look for SUVs and pickup trucks. Passenger vehicles with steel wheels are also suitable for colder climates, as these wheels provide better traction and handling in snow and ice than other types of wheel. Furthermore, steel wheels are often less expensive than other types of wheels, which could help to reduce the cost of manufacturing and purchasing a passenger vehicle. This makes these steel wheels an attractive option for budget-conscious consumers.

As per the automotive steel wheel market forecast, Asia Pacific is expected to dominate the global industry during the forecast period, owing to the presence of major automobile manufacturers in the region. Moreover, growth of the e-commerce industry and rise in demand for automobiles, particularly in developing countries such as India and China contribute to market progress in the region. In China, demand for commercial and passenger vehicles is increasing due to rapid industrialization and urbanization, leading to rise in demand for automotive steel wheels. Rise in focus of the Government of India on boosting the manufacturing sector and increasing foreign investments in the automobile industry is expected to fuel automotive steel wheel market dynamics in the near future.

The automotive steel wheel market size in Middle East & Africa is anticipated to increase in the next few years. The region is likely to grow at a rapid pace during the forecast period. This can be ascribed to rise in demand for imported second-hand cars in the region, specifically in Kenya. Steel wheels require lower maintenance and are suitable for rougher terrain. Furthermore, replacement of steel wheels is inexpensive, which is contributing to the market growth in the region.

Increase in demand for used cars in Africa and Latin America is ascribed to factors such as limited public transportation, availability of affordable cars, and customization options.

The global market is consolidated, with the presence of small number of key players and new technological entrants. As per the automotive steel wheel market analysis, leading players are involved in strategic alliances with suppliers, agreements with government bodies, and active investment in R&D activities to gain market share.

Some of the manufacturers identified in the global market are Accuride Corporation, ALCAR Wheels GmbH, Automotive Wheels Ltd., Central Motor Wheel of America, Inc., CLN Coils Lamiere Nastri SpA, Klassic Wheels Limited, MAXION Wheels, Steel Strips Group, The Carlstar Group, LLC., Thyssenkrupp AG, Topy America, Inc., U.S. Wheel Corp., and Yantai Baosteel Wheel Co., Ltd.

Each of these players has been profiled in the automotive steel wheel market report based on parameters such as product portfolio, business segments, financial overview, latest developments, company overview, and business strategies.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 14.6 Bn |

|

Market Forecast Value in 2031 |

US$ 16.8 Bn |

|

Growth Rate (CAGR) |

1.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Volume in Units |

|

Market Analysis |

It includes cross segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 14.6 Bn in 2022

It is projected to grow at a CAGR of 1.6% by 2031

It expected to reach US$ 16.8 Bn in 2031

Increase in demand for commercial vehicles and rise in demand for lightweight vehicle components are driving the market

The passenger vehicle segment accounted for major share in 2022

Asia Pacific is anticipated to be a highly lucrative region in the near future

Accuride Corporation, ALCAR Wheels GmbH, Automotive Wheels Ltd., Central Motor Wheel of America, Inc., CLN Coils Lamiere Nastri SpA, Klassic Wheels Limited, MAXION Wheels, Steel Strips Group, The Carlstar Group, LLC., Thyssenkrupp AG, Topy America, Inc., U.S. Wheel Corp., and Yantai Baosteel Wheel Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Automotive Steel Wheel Market, by Rim Size

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Rim Size

3.2.1. Less than 12 Inches

3.2.2. 12 Inches - 15 Inches

3.2.3. 16 Inches - 18 Inches

3.2.4. 19 Inches - 21 Inches

3.2.5. More than 21 Inches

4. Global Automotive Steel Wheel Market, by OEM

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Steel Wheel Market Size & Forecast, 2017-2031, by OEM

4.2.1. Commercial Vehicle

4.2.2. Passenger Vehicle

4.2.2.1. Minicompact (A segment)

4.2.2.2. Supermini (B segment)

4.2.2.3. Compact (C segment)

4.2.2.4. Mid-size (D segment)

4.2.2.5. Executive (E segment)

4.2.2.6. Luxury (F segment)

4.2.2.7. MPV (Multi-purpose vehicle)

4.2.2.8. SUV

4.2.2.9. Sports Car

5. Global Automotive Steel Wheel Market, by Aftermarket

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Aftermarket

5.2.1. Commercial Vehicle

5.2.2. Passenger Vehicle

5.2.2.1. Minicompact (A segment)

5.2.2.2. Supermini (B segment)

5.2.2.3. Compact (C segment)

5.2.2.4. Mid-size (D segment)

5.2.2.5. Executive (E segment)

5.2.2.6. Luxury (F segment)

5.2.2.7. MPV (Multi-purpose vehicle)

5.2.2.8. SUV

5.2.2.9. Sports Car

6. Global Automotive Steel Wheel Market, by Region

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East & Africa

6.2.5. South America

7. North America Automotive Steel Wheel Market

7.1. Market Snapshot

7.2. North America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Rim Size

7.2.1. Less than 12 Inches

7.2.2. 12 Inches - 15 Inches

7.2.3. 16 Inches - 18 Inches

7.2.4. 19 Inches - 21 Inches

7.2.5. More than 21 Inches

7.3. North America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by OEM

7.3.1. Commercial Vehicle

7.3.2. Passenger Vehicle

7.3.2.1. Minicompact (A segment)

7.3.2.2. Supermini (B segment)

7.3.2.3. Compact (C segment)

7.3.2.4. Mid-size (D segment)

7.3.2.5. Executive (E segment)

7.3.2.6. Luxury (F segment)

7.3.2.7. MPV (Multi-purpose vehicle)

7.3.2.8. SUV

7.3.2.9. Sports Car

7.4. North America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Aftermarket

7.4.1. Commercial Vehicle

7.4.2. Passenger Vehicle

7.4.2.1. Minicompact (A segment)

7.4.2.2. Supermini (B segment)

7.4.2.3. Compact (C segment)

7.4.2.4. Mid-size (D segment)

7.4.2.5. Executive (E segment)

7.4.2.6. Luxury (F segment)

7.4.2.7. MPV (Multi-purpose vehicle)

7.4.2.8. SUV

7.4.2.9. Sports Car

7.5. North America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Country

7.5.1. U.S.

7.5.2. Canada

7.5.3. Mexico

8. Europe Automotive Steel Wheel Market

8.1. Market Snapshot

8.2. Europe Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Rim Size

8.2.1. Less than 12 Inches

8.2.2. 12 Inches - 15 Inches

8.2.3. 16 Inches - 18 Inches

8.2.4. 19 Inches - 21 Inches

8.2.5. More than 21 Inches

8.3. Europe Automotive Steel Wheel Market Size & Forecast, 2017-2031, by OEM

8.3.1. Commercial Vehicle

8.3.2. Passenger Vehicle

8.3.2.1. Minicompact (A segment)

8.3.2.2. Supermini (B segment)

8.3.2.3. Compact (C segment)

8.3.2.4. Mid-size (D segment)

8.3.2.5. Executive (E segment)

8.3.2.6. Luxury (F segment)

8.3.2.7. MPV (Multi-purpose vehicle)

8.3.2.8. SUV

8.3.2.9. Sports Car

8.4. Europe Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Aftermarket

8.4.1. Commercial Vehicle

8.4.2. Passenger Vehicle

8.4.2.1. Minicompact (A segment)

8.4.2.2. Supermini (B segment)

8.4.2.3. Compact (C segment)

8.4.2.4. Mid-size (D segment)

8.4.2.5. Executive (E segment)

8.4.2.6. Luxury (F segment)

8.4.2.7. MPV (Multi-purpose vehicle)

8.4.2.8. SUV

8.4.2.9. Sports Car

8.5. Europe Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Country

8.5.1. Germany

8.5.2. U. K.

8.5.3. France

8.5.4. Italy

8.5.5. Spain

8.5.6. Nordic Countries

8.5.7. Russia & CIS

8.5.8. Rest of Europe

9. Asia Pacific Automotive Steel Wheel Market

9.1. Market Snapshot

9.2. Asia Pacific Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Rim Size

9.2.1. Less than 12 Inches

9.2.2. 12 Inches - 15 Inches

9.2.3. 16 Inches - 18 Inches

9.2.4. 19 Inches - 21 Inches

9.2.5. More than 21 Inches

9.3. Asia Pacific Automotive Steel Wheel Market Size & Forecast, 2017-2031, by OEM

9.3.1. Commercial Vehicle

9.3.2. Passenger Vehicle

9.3.2.1. Minicompact (A segment)

9.3.2.2. Supermini (B segment)

9.3.2.3. Compact (C segment)

9.3.2.4. Mid-size (D segment)

9.3.2.5. Executive (E segment)

9.3.2.6. Luxury (F segment)

9.3.2.7. MPV (Multi-purpose vehicle)

9.3.2.8. SUV

9.3.2.9. Sports Car

9.4. Asia Pacific Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Aftermarket

9.4.1. Commercial Vehicle

9.4.2. Passenger Vehicle

9.4.2.1. Minicompact (A segment)

9.4.2.2. Supermini (B segment)

9.4.2.3. Compact (C segment)

9.4.2.4. Mid-size (D segment)

9.4.2.5. Executive (E segment)

9.4.2.6. Luxury (F segment)

9.4.2.7. MPV (Multi-purpose vehicle)

9.4.2.8. SUV

9.4.2.9. Sports Car

9.5. Asia Pacific Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Country

9.5.1. China

9.5.2. India

9.5.3. Japan

9.5.4. ASEAN Countries

9.5.5. South Korea

9.5.6. ANZ

9.5.7. Rest of Asia Pacific

10. Middle East & Africa Automotive Steel Wheel Market

10.1. Market Snapshot

10.2. Middle East & Africa Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Rim Size

10.2.1. Less than 12 Inches

10.2.2. 12 Inches - 15 Inches

10.2.3. 16 Inches - 18 Inches

10.2.4. 19 Inches - 21 Inches

10.2.5. More than 21 Inches

10.3. Middle East & Africa Automotive Steel Wheel Market Size & Forecast, 2017-2031, by OEM

10.3.1. Commercial Vehicle

10.3.2. Passenger Vehicle

10.3.2.1. Minicompact (A segment)

10.3.2.2. Supermini (B segment)

10.3.2.3. Compact (C segment)

10.3.2.4. Mid-size (D segment)

10.3.2.5. Executive (E segment)

10.3.2.6. Luxury (F segment)

10.3.2.7. MPV (Multi-purpose vehicle)

10.3.2.8. SUV

10.3.2.9. Sports Car

10.4. Middle East & Africa Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Aftermarket

10.4.1. Commercial Vehicle

10.4.2. Passenger Vehicle

10.4.2.1. Minicompact (A segment)

10.4.2.2. Supermini (B segment)

10.4.2.3. Compact (C segment)

10.4.2.4. Mid-size (D segment)

10.4.2.5. Executive (E segment)

10.4.2.6. Luxury (F segment)

10.4.2.7. MPV (Multi-purpose vehicle)

10.4.2.8. SUV

10.4.2.9. Sports Car

10.5. Middle East & Africa Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Country

10.5.1. GCC

10.5.2. South Africa

10.5.3. Turkey

10.5.4. Rest of Middle East & Africa

11. South America Automotive Steel Wheel Market

11.1. Market Snapshot

11.2. South America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Rim Size

11.2.1. Less than 12 Inches

11.2.2. 12 Inches - 15 Inches

11.2.3. 16 Inches - 18 Inches

11.2.4. 19 Inches - 21 Inches

11.2.5. More than 21 Inches

11.3. South America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by OEM

11.3.1. Commercial Vehicle

11.3.2. Passenger Vehicle

11.3.2.1. Minicompact (A segment)

11.3.2.2. Supermini (B segment)

11.3.2.3. Compact (C segment)

11.3.2.4. Mid-size (D segment)

11.3.2.5. Executive (E segment)

11.3.2.6. Luxury (F segment)

11.3.2.7. MPV (Multi-purpose vehicle)

11.3.2.8. SUV

11.3.2.9. Sports Car

11.4. South America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Aftermarket

11.4.1. Commercial Vehicle

11.4.2. Passenger Vehicle

11.4.2.1. Minicompact (A segment)

11.4.2.2. Supermini (B segment)

11.4.2.3. Compact (C segment)

11.4.2.4. Mid-size (D segment)

11.4.2.5. Executive (E segment)

11.4.2.6. Luxury (F segment)

11.4.2.7. MPV (Multi-purpose vehicle)

11.4.2.8. SUV

11.4.2.9. Sports Car

11.5. South America Automotive Steel Wheel Market Size & Forecast, 2017-2031, by Country

11.5.1. Brazil

11.5.2. Argentina

11.5.3. Rest of South America

12. Competitive Landscape

12.1. Company Share Analysis/ Brand Share Analysis, 2022

12.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

13. Company Profile/ Key Players

13.1. Accuride Corporation

13.1.1. Company Overview

13.1.2. Company Footprints

13.1.3. Production Locations

13.1.4. Product Portfolio

13.1.5. Competitors & Customers

13.1.6. Subsidiaries & Parent Organization

13.1.7. Recent Developments

13.1.8. Financial Analysis

13.1.9. Profitability

13.1.10. Revenue Share

13.2. ALCAR Wheels GmbH

13.2.1. Company Overview

13.2.2. Company Footprints

13.2.3. Production Locations

13.2.4. Product Portfolio

13.2.5. Competitors & Customers

13.2.6. Subsidiaries & Parent Organization

13.2.7. Recent Developments

13.2.8. Financial Analysis

13.2.9. Profitability

13.2.10. Revenue Share

13.3. Automotive Wheels Ltd

13.3.1. Company Overview

13.3.2. Company Footprints

13.3.3. Production Locations

13.3.4. Product Portfolio

13.3.5. Competitors & Customers

13.3.6. Subsidiaries & Parent Organization

13.3.7. Recent Developments

13.3.8. Financial Analysis

13.3.9. Profitability

13.3.10. Revenue Share

13.4. Central Motor Wheel of America, Inc.

13.4.1. Company Overview

13.4.2. Company Footprints

13.4.3. Production Locations

13.4.4. Product Portfolio

13.4.5. Competitors & Customers

13.4.6. Subsidiaries & Parent Organization

13.4.7. Recent Developments

13.4.8. Financial Analysis

13.4.9. Profitability

13.4.10. Revenue Share

13.5. CLN Coils Lamiere Nastri SpA

13.5.1. Company Overview

13.5.2. Company Footprints

13.5.3. Production Locations

13.5.4. Product Portfolio

13.5.5. Competitors & Customers

13.5.6. Subsidiaries & Parent Organization

13.5.7. Recent Developments

13.5.8. Financial Analysis

13.5.9. Profitability

13.5.10. Revenue Share

13.6. Klassic Wheels Limited

13.6.1. Company Overview

13.6.2. Company Footprints

13.6.3. Production Locations

13.6.4. Product Portfolio

13.6.5. Competitors & Customers

13.6.6. Subsidiaries & Parent Organization

13.6.7. Recent Developments

13.6.8. Financial Analysis

13.6.9. Profitability

13.6.10. Revenue Share

13.7. MAXION Wheels

13.7.1. Company Overview

13.7.2. Company Footprints

13.7.3. Production Locations

13.7.4. Product Portfolio

13.7.5. Competitors & Customers

13.7.6. Subsidiaries & Parent Organization

13.7.7. Recent Developments

13.7.8. Financial Analysis

13.7.9. Profitability

13.7.10. Revenue Share

13.8. Steel Strips Group

13.8.1. Company Overview

13.8.2. Company Footprints

13.8.3. Production Locations

13.8.4. Product Portfolio

13.8.5. Competitors & Customers

13.8.6. Subsidiaries & Parent Organization

13.8.7. Recent Developments

13.8.8. Financial Analysis

13.8.9. Profitability

13.8.10. Revenue Share

13.9. The Carlstar Group, LLC.

13.9.1. Company Overview

13.9.2. Company Footprints

13.9.3. Production Locations

13.9.4. Product Portfolio

13.9.5. Competitors & Customers

13.9.6. Subsidiaries & Parent Organization

13.9.7. Recent Developments

13.9.8. Financial Analysis

13.9.9. Profitability

13.9.10. Revenue Share

13.10. Thyssenkrupp AG

13.10.1. Company Overview

13.10.2. Company Footprints

13.10.3. Production Locations

13.10.4. Product Portfolio

13.10.5. Competitors & Customers

13.10.6. Subsidiaries & Parent Organization

13.10.7. Recent Developments

13.10.8. Financial Analysis

13.10.9. Profitability

13.10.10. Revenue Share

13.11. Topy America, Inc.

13.11.1. Company Overview

13.11.2. Company Footprints

13.11.3. Production Locations

13.11.4. Product Portfolio

13.11.5. Competitors & Customers

13.11.6. Subsidiaries & Parent Organization

13.11.7. Recent Developments

13.11.8. Financial Analysis

13.11.9. Profitability

13.11.10. Revenue Share

13.12. U.S. Wheel Corp

13.12.1. Company Overview

13.12.2. Company Footprints

13.12.3. Production Locations

13.12.4. Product Portfolio

13.12.5. Competitors & Customers

13.12.6. Subsidiaries & Parent Organization

13.12.7. Recent Developments

13.12.8. Financial Analysis

13.12.9. Profitability

13.12.10. Revenue Share

13.13. Yantai Baosteel Wheel Co., Ltd.

13.13.1. Company Overview

13.13.2. Company Footprints

13.13.3. Production Locations

13.13.4. Product Portfolio

13.13.5. Competitors & Customers

13.13.6. Subsidiaries & Parent Organization

13.13.7. Recent Developments

13.13.8. Financial Analysis

13.13.9. Profitability

13.13.10. Revenue Share

List of Tables

Table 1: Global Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Table 2: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 3: Global Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Table 4: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Table 5: Global Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Table 6: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Table 7: Global Automotive Steel Wheel Market Volume (Units) Forecast, by Region, 2017-2031

Table 8: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 9: North America Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Table 10: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 11: North America Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Table 12: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Table 13: North America Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Table 14: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Table 15: North America Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Table 16: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 17: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Table 18: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 19: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Table 20: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Table 21: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Table 22: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Table 23: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Table 26: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 27: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Table 28: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Table 29: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Table 30: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Table 31: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 33: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Table 34: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 35: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Table 36: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Table 37: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Table 38: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Table 39: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 41: South America Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Table 42: South America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 43: South America Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Table 44: South America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Table 45: South America Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Table 46: South America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Table 47: South America Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Table 48: South America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Figure 2: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 3: Global Automotive Steel Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Figure 5: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Figure 6: Global Automotive Steel Wheel Market, Incremental Opportunity, by OEM, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Figure 8: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Figure 9: Global Automotive Steel Wheel Market, Incremental Opportunity, by Aftermarket, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Steel Wheel Market Volume (Units) Forecast, by Region, 2017-2031

Figure 11: Global Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Automotive Steel Wheel Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Figure 14: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 15: North America Automotive Steel Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Figure 17: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Figure 18: North America Automotive Steel Wheel Market, Incremental Opportunity, by OEM, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Figure 20: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Figure 21: North America Automotive Steel Wheel Market, Incremental Opportunity, by Aftermarket, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Figure 23: North America Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Automotive Steel Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Figure 26: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 27: Europe Automotive Steel Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 28: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Figure 29: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Figure 30: Europe Automotive Steel Wheel Market, Incremental Opportunity, by OEM, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Figure 32: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Figure 33: Europe Automotive Steel Wheel Market, Incremental Opportunity, by Aftermarket, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: Europe Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Automotive Steel Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Figure 38: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 39: Asia Pacific Automotive Steel Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 40: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Figure 41: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Figure 42: Asia Pacific Automotive Steel Wheel Market, Incremental Opportunity, by OEM, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Figure 44: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Figure 45: Asia Pacific Automotive Steel Wheel Market, Incremental Opportunity, by Aftermarket, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Automotive Steel Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Figure 50: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 51: Middle East & Africa Automotive Steel Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 52: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Figure 53: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Figure 54: Middle East & Africa Automotive Steel Wheel Market, Incremental Opportunity, by OEM, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Figure 56: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Figure 57: Middle East & Africa Automotive Steel Wheel Market, Incremental Opportunity, by Aftermarket, Value (US$ Bn), 2023-2031

Figure 58: Middle East & Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Automotive Steel Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Rim Size, 2017-2031

Figure 62: South Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 63: South Africa Automotive Steel Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 64: South Africa Automotive Steel Wheel Market Volume (Units) Forecast, by OEM, 2017-2031

Figure 65: South Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by OEM, 2017-2031

Figure 66: South Africa Automotive Steel Wheel Market, Incremental Opportunity, by OEM, Value (US$ Bn), 2023-2031

Figure 67: South Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Aftermarket, 2017-2031

Figure 68: South Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Aftermarket, 2017-2031

Figure 69: South Africa Automotive Steel Wheel Market, Incremental Opportunity, by Aftermarket, Value (US$ Bn), 2023-2031

Figure 70: South Africa Automotive Steel Wheel Market Volume (Units) Forecast, by Country, 2017-2031

Figure 71: South Africa Automotive Steel Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South Africa Automotive Steel Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031