Reports

Reports

Analysts’ Viewpoint

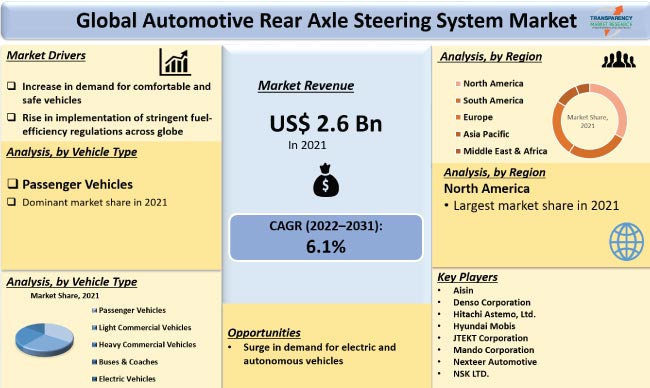

Automotive rear axle steering system helps improve vehicle comfort, agility, and stability. Increase in demand for safe and comfortable vehicles, rise in adoption of electric vehicles, and surge in demand for passenger vehicles and SUVs are the key factors that are expected to drive the global automotive rear axle steering system market during the forecast period.

Long-haul electric vehicles are becoming increasingly popular in major economies, as governments are striving to reduce carbon emissions in order to achieve their sustainability goals. Tax exemptions and government assistance are encouraging people to opt for electric vehicles with rear axle steering systems. Key players are grabbing optimum revenue opportunities by following the automotive rear axle steering system market trends.

Vehicles with rear-wheel steering help maintain vehicle stability at high speeds. They also improve the cornering stability at low to medium speeds. Electric actuators can be used to steer the rear wheels in one of two ways: left-right combined-type steering systems steer the left and right rear wheels with a single actuator, while left-right independent systems steer the left and right wheels independently.

Instead of using toe angle adjustment techniques such as toe-in and toe-out, left-right integrated systems drive the rear wheels either in the same direction as the front wheels or in the opposite direction.

The rear axle steering system increases vehicle safety rating and lessens the chances of an accident due to instability or rollover. New vehicles with rear axle steering systems can react more quickly while turning and changing lanes. Furthermore, the rear axle steering system makes it easy for the driver to smoothly transition into the next lane during lane changes. The driver no longer needs to press harder on the pedal while changing lanes. Thus, increase in adoption of the rear axle steering technology is estimated to fuel market progress in the near future.

Rise in demand for safe and comfortable vehicles around the world is one of the primary factors augmenting the automotive rear axle steering system market share. Improvement in stability of the rear axle steering system allows the driver to dodge potholes and strong gusts with less swaying of the vehicle.

Rear axle steering mechanism of the vehicle also enables the driver to execute smaller, slower-speed circular turns. These factors are expected to drive the popularity of rear axle steering systems in automobiles in the near future.

In December 2021, BMW patented the new rear wheel steering system. Rear-wheel steering, commonly referred to as integrated steering, has been a feature of BMW vehicles for a while. However, the amount of actual steering that the rear wheels can perform is somewhat constrained currently. The rear wheels may often only turn up to 5° due to certain restrictions, which result from the way the back axle is constructed.

The new method of steering back wheels entails the addition of a wheel carrier on each side, with an actuator on the bottom half that is kept in place by a grooved guide. This novel method might result in nearly 10° of steering without adding too much complexity to the rear axle.

Improvement in steering control decreases the likelihood of collisions and subsequently saves maintenance costs, thus extending the vehicle's lifespan. When using a rear axle steering system, a car's steering wheel reacts far faster than when using a conventional front wheel steering system. Driving is much more comfortable as a result of the improved ability to pinpoint the direction of travel.

A four-wheel steering system makes it easier to control and maintain stability when the vehicle is turning a corner or traveling through the rain. If the road is straight, the vehicle would continue to proceed straight even in the midst of strong gusts or potholes that could ordinarily force it to swerve off course.

As per the automotive rear axle steering system market segmentation, the passenger vehicles segment is anticipated to dominate the global market in terms of volume and value during the forecast period. Increase in demand for SUVs with comfort amenities is anticipated to fuel automotive rear axle steering system market value in the near future.

Installing rear-axle steering with a 4.5° steering angle adjustment carries several benefits such as improved maneuverability when parking, greater agility, and more secure road holding, particularly in the passenger car category. Thus, rise in demand for passenger vehicles across the globe is fueling market statistics, according to the automotive rear axle steering system market forecast report.

North America is anticipated to lead the global automotive rear axle steering system industry during the forecast period. Growth of the market in the region can be ascribed to expansion of the automotive sector and rapid adoption of electric vehicles.

Asia Pacific automotive rear axle steering system market size is likely to increase during the forecast period, owing to the implementation of stringent emission norms in countries such as India and China. The region is estimated to witness lucrative opportunities for the market during the forecast period, owing to the presence of key OEMs.

The global industry is consolidated, with the presence of large numbers of manufacturers that control significant share. According to the automotive rear axle steering system market research report, manufacturers are adopting advanced technologies to strengthen their market position. Key players are expanding their product portfolios through acquisitions and partnerships.

Some of the leading players in the global market are Aisin, Denso Corporation, Hitachi Astemo, Ltd., Hyundai Mobis, JTEKT Corporation, Mando Corporation, Nexteer Automotive, NSK LTD., NTN Corporation, Robert Bosch GmbH, Schaeffler Group, SHOWA CORPORATION, ThyssenKrupp AG, WABCO, and ZF Friedrichshafen AG.

Key players have been profiled in the automotive rear axle steering system market report based on parameters such as business strategies, product portfolio, recent developments, business segments, company overview, and financial overview.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.6 Bn |

|

Market Forecast Value in 2031 |

US$ 4.7 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.6 Bn in 2021.

It is expected to grow at a CAGR of 6.1% by 2031.

It is likely to be valued at US$ 4.7 Bn in 2031.

Increase in demand for comfortable and safe vehicles and rise in implementation of stringent fuel-efficiency regulations across globe.

Based on vehicle type, the passenger vehicle segment accounted for the largest share in 2021.

North America is the most lucrative region for vendors.

Aisin, Denso Corporation, Hitachi Astemo, Ltd., Hyundai Mobis, JTEKT Corporation, Mando Corporation, Nexteer Automotive, NSK LTD., NTN Corporation, Robert Bosch GmbH, Schaeffler Group, SHOWA CORPORATION, ThyssenKrupp AG, WABCO, and ZF Friedrichshafen AG.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units and US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. COVID-19 Impact Analysis

4. Ecosystem Analysis

4.1. Value Chain Analysis

4.2. Who Supplies Whom

4.2.1. Suppliers of RAS (Section 15.3)

4.2.2. Customers of RAS (Section 15.4)

5. Global Automotive Rear Axle Steering System Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031

6. Global Automotive Rear Axle Steering System Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

6.2.1. Passenger Vehicles

6.2.1.1. Hatchbacks

6.2.1.2. Sedans

6.2.1.3. Utility Vehicles

6.2.2. Light Commercial Vehicles

6.2.3. Heavy Commercial Vehicles

6.2.4. Buses & Coaches

6.2.5. Electric Vehicles

7. Global Automotive Rear Axle Steering System Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Automotive Rear Axle Steering System Market

8.1. North America Market Snapshot

8.2. North America Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

8.3. North America Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

8.3.1. Passenger Vehicles

8.3.1.1. Hatchbacks

8.3.1.2. Sedans

8.3.1.3. Utility Vehicles

8.3.2. Light Commercial Vehicles

8.3.3. Heavy Commercial Vehicles

8.3.4. Buses & Coaches

8.3.5. Electric Vehicles

8.4. Key Country Analysis – North America Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

8.4.1. The U. S.

8.4.2. Canada

8.4.3. Mexico

9. South America Automotive Rear Axle Steering System Market

9.1. South America Market Snapshot

9.2. South America Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

9.3. South America Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

9.3.1. Passenger Vehicles

9.3.1.1. Hatchbacks

9.3.1.2. Sedans

9.3.1.3. Utility Vehicles

9.3.2. Light Commercial Vehicles

9.3.3. Heavy Commercial Vehicles

9.3.4. Buses & Coaches

9.3.5. Electric Vehicles

9.4. Key Country Analysis – South America Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest of South America

10. Europe Automotive Rear Axle Steering System Market

10.1. Europe Market Snapshot

10.2. Europe Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

10.3. Europe Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

10.3.1. Passenger Vehicles

10.3.1.1. Hatchbacks

10.3.1.2. Sedans

10.3.1.3. Utility Vehicles

10.3.2. Light Commercial Vehicles

10.3.3. Heavy Commercial Vehicles

10.3.4. Buses & Coaches

10.3.5. Electric Vehicles

10.4. Key Country Analysis – Europe Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

10.4.1. Germany

10.4.2. U. K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Eastern Europe

10.4.7. Rest of Europe

11. Asia Pacific Automotive Rear Axle Steering System Market

11.1. Asia Pacific Market Snapshot

11.2. Asia Pacific Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

11.3. Asia Pacific Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

11.3.1. Passenger Vehicles

11.3.1.1. Hatchbacks

11.3.1.2. Sedans

11.3.1.3. Utility Vehicles

11.3.2. Light Commercial Vehicles

11.3.3. Heavy Commercial Vehicles

11.3.4. Buses & Coaches

11.3.5. Electric Vehicles

11.4. Key Country Analysis – Asia Pacific Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. ASEAN Countries

11.4.5. South Korea

11.4.6. ANZ

11.4.7. Rest of Asia Pacific

12. China Automotive Rear Axle Steering System Market

12.1. China Market Snapshot

12.2. China Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

12.2.1. Passenger Vehicles

12.2.1.1. Hatchbacks

12.2.1.2. Sedans

12.2.1.3. Utility Vehicles

12.2.2. Light Commercial Vehicles

12.2.3. Heavy Commercial Vehicles

12.2.4. Buses & Coaches

12.2.5. Electric Vehicles

13. India Automotive Rear Axle Steering System Market

13.1. India Market Snapshot

13.2. India Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

13.2.1. Passenger Vehicles

13.2.1.1. Hatchbacks

13.2.1.2. Sedans

13.2.1.3. Utility Vehicles

13.2.2. Light Commercial Vehicles

13.2.3. Heavy Commercial Vehicles

13.2.4. Buses & Coaches

13.2.5. Electric Vehicles

14. Middle East & Africa Automotive Rear Axle Steering System Market

14.1. Middle East & Africa Market Snapshot

14.2. Middle East & Africa Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

14.3. Middle East & Africa Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

14.3.1. Passenger Vehicles

14.3.1.1. Hatchbacks

14.3.1.2. Sedans

14.3.1.3. Utility Vehicles

14.3.2. Light Commercial Vehicles

14.3.3. Heavy Commercial Vehicles

14.3.4. Buses & Coaches

14.3.5. Electric Vehicles

14.4. Key Country Analysis – Middle East & Africa Automotive Rear Axle Steering System Market Size (Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

14.4.1. GCC

14.4.2. Turkey

14.4.3. South Africa

14.4.4. Nigeria

14.4.5. Rest of Middle East & Africa

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2021

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

15.3. Company Profile - Automotive Rear Axle Steering System Automakers

15.3.1. Toyota

15.3.1.1. Company Overview

15.3.1.2. Company Footprints

15.3.1.3. Production Locations

15.3.1.4. Product Portfolio

15.3.1.5. Competitors & Customers

15.3.1.6. Subsidiaries & Parent Organization

15.3.1.7. Recent Developments

15.3.1.8. Financial Analysis

15.3.1.9. Profitability

15.3.1.10. Revenue Share

15.3.1.11. Executive Bios

15.3.2. Volkswagen

15.3.2.1. Company Overview

15.3.2.2. Company Footprints

15.3.2.3. Production Locations

15.3.2.4. Product Portfolio

15.3.2.5. Competitors & Customers

15.3.2.6. Subsidiaries & Parent Organization

15.3.2.7. Recent Developments

15.3.2.8. Financial Analysis

15.3.2.9. Profitability

15.3.2.10. Revenue Share

15.3.2.11. Executive Bios

15.3.3. Mercedes-Benz Group

15.3.3.1. Company Overview

15.3.3.2. Company Footprints

15.3.3.3. Production Locations

15.3.3.4. Product Portfolio

15.3.3.5. Competitors & Customers

15.3.3.6. Subsidiaries & Parent Organization

15.3.3.7. Recent Developments

15.3.3.8. Financial Analysis

15.3.3.9. Profitability

15.3.3.10. Revenue Share

15.3.3.11. Executive Bios

15.3.4. Ford Motor Company

15.3.4.1. Company Overview

15.3.4.2. Company Footprints

15.3.4.3. Production Locations

15.3.4.4. Product Portfolio

15.3.4.5. Competitors & Customers

15.3.4.6. Subsidiaries & Parent Organization

15.3.4.7. Recent Developments

15.3.4.8. Financial Analysis

15.3.4.9. Profitability

15.3.4.10. Revenue Share

15.3.4.11. Executive Bios

15.3.5. Honda

15.3.5.1. Company Overview

15.3.5.2. Company Footprints

15.3.5.3. Production Locations

15.3.5.4. Product Portfolio

15.3.5.5. Competitors & Customers

15.3.5.6. Subsidiaries & Parent Organization

15.3.5.7. Recent Developments

15.3.5.8. Financial Analysis

15.3.5.9. Profitability

15.3.5.10. Revenue Share

15.3.5.11. Executive Bios

15.3.6. General Motors

15.3.6.1. Company Overview

15.3.6.2. Company Footprints

15.3.6.3. Production Locations

15.3.6.4. Product Portfolio

15.3.6.5. Competitors & Customers

15.3.6.6. Subsidiaries & Parent Organization

15.3.6.7. Recent Developments

15.3.6.8. Financial Analysis

15.3.6.9. Profitability

15.3.6.10. Revenue Share

15.3.6.11. Executive Bios

15.3.7. BMW

15.3.7.1. Company Overview

15.3.7.2. Company Footprints

15.3.7.3. Production Locations

15.3.7.4. Product Portfolio

15.3.7.5. Competitors & Customers

15.3.7.6. Subsidiaries & Parent Organization

15.3.7.7. Recent Developments

15.3.7.8. Financial Analysis

15.3.7.9. Profitability

15.3.7.10. Revenue Share

15.3.7.11. Executive Bios

15.3.8. SAIC Motor

15.3.8.1. Company Overview

15.3.8.2. Company Footprints

15.3.8.3. Production Locations

15.3.8.4. Product Portfolio

15.3.8.5. Competitors & Customers

15.3.8.6. Subsidiaries & Parent Organization

15.3.8.7. Recent Developments

15.3.8.8. Financial Analysis

15.3.8.9. Profitability

15.3.8.10. Revenue Share

15.3.8.11. Executive Bios

15.3.9. FAW Group

15.3.9.1. Company Overview

15.3.9.2. Company Footprints

15.3.9.3. Production Locations

15.3.9.4. Product Portfolio

15.3.9.5. Competitors & Customers

15.3.9.6. Subsidiaries & Parent Organization

15.3.9.7. Recent Developments

15.3.9.8. Financial Analysis

15.3.9.9. Profitability

15.3.9.10. Revenue Share

15.3.9.11. Executive Bios

15.3.10. Hyundai

15.3.10.1. Company Overview

15.3.10.2. Company Footprints

15.3.10.3. Production Locations

15.3.10.4. Product Portfolio

15.3.10.5. Competitors & Customers

15.3.10.6. Subsidiaries & Parent Organization

15.3.10.7. Recent Developments

15.3.10.8. Financial Analysis

15.3.10.9. Profitability

15.3.10.10. Revenue Share

15.3.10.11. Executive Bios

15.3.11. Dongfeng Motor Corporation Ltd.

15.3.11.1. Company Overview

15.3.11.2. Company Footprints

15.3.11.3. Production Locations

15.3.11.4. Product Portfolio

15.3.11.5. Competitors & Customers

15.3.11.6. Subsidiaries & Parent Organization

15.3.11.7. Recent Developments

15.3.11.8. Financial Analysis

15.3.11.9. Profitability

15.3.11.10. Revenue Share

15.3.11.11. Executive Bios

15.3.12. Others

15.3.12.1. Company Overview

15.3.12.2. Company Footprints

15.3.12.3. Production Locations

15.3.12.4. Product Portfolio

15.3.12.5. Competitors & Customers

15.3.12.6. Subsidiaries & Parent Organization

15.3.12.7. Recent Developments

15.3.12.8. Financial Analysis

15.3.12.9. Profitability

15.3.12.10. Revenue Share

15.3.12.11. Executive Bios

15.4. Company Profile - Automotive Rear Axle Steering System Manufacturers

15.4.1. Robert Bosch GmbH

15.4.1.1. Company Overview

15.4.1.2. Company Footprints

15.4.1.3. Production Locations

15.4.1.4. Product Portfolio

15.4.1.5. Competitors & Customers

15.4.1.6. Subsidiaries & Parent Organization

15.4.1.7. Recent Developments

15.4.1.8. Financial Analysis

15.4.1.9. Profitability

15.4.1.10. Revenue Share

15.4.1.11. Executive Bios

15.4.2. ThyssenKrupp AG

15.4.2.1. Company Overview

15.4.2.2. Company Footprints

15.4.2.3. Production Locations

15.4.2.4. Product Portfolio

15.4.2.5. Competitors & Customers

15.4.2.6. Subsidiaries & Parent Organization

15.4.2.7. Recent Developments

15.4.2.8. Financial Analysis

15.4.2.9. Profitability

15.4.2.10. Revenue Share

15.4.2.11. Executive Bios

15.4.3. Hyundai Mobis Co. Ltd.

15.4.3.1. Company Overview

15.4.3.2. Company Footprints

15.4.3.3. Production Locations

15.4.3.4. Product Portfolio

15.4.3.5. Competitors & Customers

15.4.3.6. Subsidiaries & Parent Organization

15.4.3.7. Recent Developments

15.4.3.8. Financial Analysis

15.4.3.9. Profitability

15.4.3.10. Revenue Share

15.4.3.11. Executive Bios

15.4.4. ZF Friedrichshafen AG

15.4.4.1. Company Overview

15.4.4.2. Company Footprints

15.4.4.3. Production Locations

15.4.4.4. Product Portfolio

15.4.4.5. Competitors & Customers

15.4.4.6. Subsidiaries & Parent Organization

15.4.4.7. Recent Developments

15.4.4.8. Financial Analysis

15.4.4.9. Profitability

15.4.4.10. Revenue Share

15.4.4.11. Executive Bios

15.4.5. Hitachi Astemo, Ltd

15.4.5.1. Company Overview

15.4.5.2. Company Footprints

15.4.5.3. Production Locations

15.4.5.4. Product Portfolio

15.4.5.5. Competitors & Customers

15.4.5.6. Subsidiaries & Parent Organization

15.4.5.7. Recent Developments

15.4.5.8. Financial Analysis

15.4.5.9. Profitability

15.4.5.10. Revenue Share

15.4.5.11. Executive Bios

List of Tables

Table 1: Global Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 3: Global Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Region, 2017-2031

Table 4: Global Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 5: North America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 6: North America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 7: North America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Table 8: North America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 9: South America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 10: South America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 11: South America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Table 12: South America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 14: Europe Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 15: Europe Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Table 16: Europe Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 17: Asia Pacific Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 18: Asia Pacific Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: Asia Pacific Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Table 20: Asia Pacific Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 22: Middle East & Africa Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 23: Middle East & Africa Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: Middle East & Africa Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 3: Global Automotive Rear Axle Steering System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Region, 2017-2031

Figure 5: Global Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 6: Global Automotive Rear Axle Steering System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 7: North America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: North America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: North America Automotive Rear Axle Steering System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 10: North America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 11: North America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 12: North America Automotive Rear Axle Steering System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 13: South America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 14: South America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 15: South America Automotive Rear Axle Steering System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 16: South America Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 17: South America Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 18: South America Automotive Rear Axle Steering System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 19: Europe Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: Europe Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 21: Europe Automotive Rear Axle Steering System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 22: Europe Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 23: Europe Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: Europe Automotive Rear Axle Steering System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 25: Asia Pacific Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: Asia Pacific Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 27: Asia Pacific Automotive Rear Axle Steering System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 28: Asia Pacific Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 29: Asia Pacific Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: Asia Pacific Automotive Rear Axle Steering System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 31: Middle East & Africa Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 32: Middle East & Africa Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 33: Middle East & Africa Automotive Rear Axle Steering System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 34: Middle East & Africa Automotive Rear Axle Steering System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: Middle East & Africa Automotive Rear Axle Steering System Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Middle East & Africa Automotive Rear Axle Steering System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031