Reports

Reports

Analysts’ Viewpoint on Market Scenario

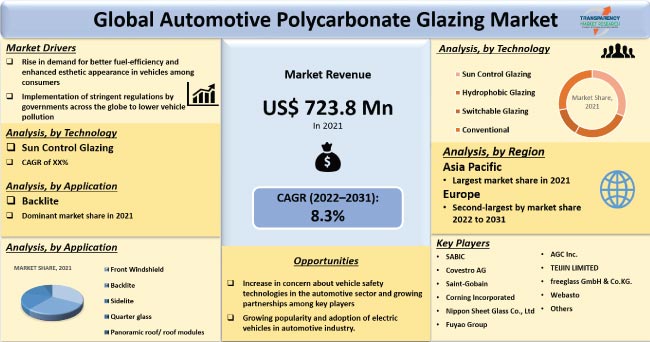

Automotive companies are highly dependent on the plastic industry for the production of lighter and fuel-efficient vehicles. Lightweight materials help facilitate easier braking, reduced collision impact, and superior driving experience in vehicles, which has led to innovations and improvement in the automotive glazing processes in the last few years. Polycarbonate glazing is one such development which can help achieve styling and design features that are just not possible with traditional materials. Major automotive manufacturers are integrating polycarbonate automotive glazing with the primary advantages of lowered weight and associated CO2 emissions reductions along with greater styling freedom and simpler functional integration in vehicles.

Manufacturers are also realizing the safety benefit that automotive polycarbonate glazing offers, which is likely to further help the market progress. Moreover, research & development initiatives can be taken up by market players to upgrade the quality of automotive polycarbonate glazing and help automakers achieve reduced weight, emission requirements, design flexibility and increased fuel-efficiency in their vehicles

Automotive polycarbonate glazing panels offer numerous advantages to automakers to manufacture lightweight, fuel-efficient and stylish vehicles. The use of polycarbonates in automotive glazing provides greater functional integration, parts consolidation, and system cost advantages. It has superb impact resistance, optical clarity, and offers the processing benefits of thermoplastic. The usability of polycarbonate compounds enables glazing designers to explore complex new shapes that go beyond the limitations of glass. New curvatures, 3-D styling, and color capabilities are feasible, allowing OEMs to improve the esthetics and differentiation of their vehicles.

The primary advantages of polycarbonate automotive glazing are lowered weight and associated CO2 emission reductions along with greater styling freedom and simpler functional integration without compromising on performance or safety. Moreover, the utilization of polycarbonate in automotive glazing systems enables the integration of many components into glazing applications, including turn indicators, opening mechanisms for windows, roof pillars, aerodynamic spoilers, and rear lamps, with potential benefits for manufacturing, weight loss, and cost reduction.

The superior thermal properties of polycarbonate sheets over conventional glass to insulate vehicle cabins, results in significantly lower load on the heating, ventilation and air-conditioning system in electric and hybrid vehicles, which in turn likely to drive market expansion. Governments across the globe are enacting stringent regulations to lower vehicle pollution and CO2 emissions, which is anticipated to offer significant growth opportunity for market development.

Currently, vehicle buyers across the globe emphasize more on the esthetic appearance and fuel-efficiency. Use of polycarbonate glazing by automakers is helping them achieve a balance between appearance and performance. Therefore, this trend is a key factor boosting the polycarbonate glazing industry across the globe. Polycarbonate materials offer vehicle designers the freedom to design intricate shapes and integrate them in vehicles, which was earlier not possible while using glass as a material. Presently, colored glazing is possible along with gaps in the window, sharp corners, smooth corner radii, or complex 3D shapes with polycarbonate compounds.

Governments across the globe are enacting stringent regulations to lower vehicle pollution. Countries such as China, India, Brazil, and Mexico are expected to fully adopt the Euro VI equivalent norms. Automakers are compelled to adopt lightweight materials, such as polycarbonate, in order to comply with the emission standard along with greater styling freedom and simpler functional integration. Moreover, EVs are different from a conventional IC engine vehicles at the fundamental level in terms of design, performance, durability, and safety. Governments around the world are supporting the adoption and integration of EVs, which is estimated to offer various opportunities for makers of polycarbonate glazing for electric vehicles.

The sun control glazing technology is expected to witness prominent market demand, due to a surge in demand for fuel-efficient vehicles among consumers. The load on the HVAC unit is reduced significantly by sun control glazing, which in turn mitigates the load on the engine.

Sun control glazing also helps insulate vehicles cabins and provide significantly lower heating for electric and hybrid vehicles, causing less drain on batteries and extending driving range. Moreover, rise in demand for enhanced comfort in vehicle cabins, increase in strictness of emission regulations and the factors mentioned above are anticipated to fuel the automotive polycarbonate glazing market share held by the sun control glazing segment.

Demand for polycarbonate glazing is highest among passenger vehicles, and the passenger vehicles segment is expected to hold a dominant share of the polycarbonate glazing business globally in the next few years. This is due to the high rate of adoption of advanced technology in passenger vehicles and a rise demand for advanced vehicle styling and improved safety systems by vehicle buyers.

The market for automotive polycarbonate glazing in Asia Pacific is projected to grow at a rapid pace, as manufacturers from the region are introducing new materials and technologies to further increase their production capacity.

In terms of share, Europe and North America trail Asia Pacific. Other market trends that are contributing to higher demand for polycarbonates in automotive glazing include strict regulations about emissions and higher spending power of consumers. Moreover, Europe-based automakers are expected to invest significantly in R&D to enhance product quality and design and to cater to the high demand for esthetically appealing luxury cars among consumers in the region.

The global automotive polycarbonate glazing market is fragmented with a large number of service providers controlling the market share and major companies possessing the potential to increase the pace of growth by the way of adoption of newer services. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Some of the key players identified in the automotive polycarbonate glazing market across the globe are SABIC, Covestro AG, Saint-Gobain, Corning Incorporated, Nippon Sheet Glass Co. Ltd, Fuyao Group, AGC Inc., TEIJIN LIMITED, freeglass GmbH & Co.KG., Webasto, Peerless Plastics and Coatings, dott.gallina s.r.l., KRD Sicherheitstechnik GmbH and Flexigard.

Key players have been profiled in the automotive polycarbonate glazing market research report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 723.8 Mn |

|

Market Forecast Value in 2031 |

US$ 1.6 Bn |

|

Growth Rate (CAGR) |

8.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 723.8 Mn in 2021

The market is expected to rise at a CAGR of 8.30% by 2031

The market would be worth US$ 1.6 Bn in 2031

Rise in demand for better fuel-efficiency, enhanced esthetic appearance in vehicles among consumers, and implementation of stringent regulations by governments to lower vehicle pollution

Based on vehicle type, the passenger vehicle segment accounted for majority share of the market

Asia Pacific is anticipated to be the highly lucrative region of the global market

SABIC, Covestro AG, Saint-Gobain, Corning Incorporated, Nippon Sheet Glass Co. Ltd, Fuyao Group, AGC Inc., TEIJIN LIMITED, freeglass GmbH & Co.KG., Webasto, Peerless Plastics and Coatings, dott.gallina s.r.l., KRD Sicherheitstechnik GmbH, and Flexigard

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Automotive Polycarbonate Glazing Market

3.1. Global Automotive Polycarbonate Glazing Market Size, US$ Mn, 2018-2031

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Key Industry Developments

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.5.1. List of Key Manufacturers

4.5.2. List of Customers

4.5.3. Level of Integration

4.6. Regulatory Scenario

4.7. SWOT Analysis

5. Automotive Polycarbonate Glazing Market: Technology Roadmap

6. Polycarbonate (PC) Glazing Revolution in Automotive Industry

6.1. Overview & Advantages

6.2. Global Snapshot

6.3. Global Regulatory standards for PC glazing

7. Automotive Polycarbonate Glazing Market: Future Technology & Trends

7.1. Augmented Reality (AR) Technology

7.2. Interactive Windows & Smart Glass

7.3. Heads up Display

8. Global Automotive Polycarbonate Glazing Market Analysis and Forecasts, By Technology

8.1. Introduction & Definition

8.2. Market Growth & Y-O-Y projection

8.3. Absolute $ Opportunity Analysis

8.4. Basis Point Share (BPS) Analysis

8.5. Automotive Polycarbonate Glazing Market Value (US$ Mn) and Market Size (Million Units) Forecast By Technology, 2017-2031

8.5.1. Sun Control Glazing

8.5.2. Hydrophobic Glazing

8.5.3. Switchable Glazing

8.5.4. Conventional

8.6. Automotive Polycarbonate Glazing Market Attractiveness Analysis By Technology

9. Global Automotive Polycarbonate Glazing Market Analysis and Forecasts, by Application

9.1. Introduction & Definition

9.2. Market Growth & Y-O-Y projection

9.3. Absolute $ Opportunity Analysis

9.4. Basis Point Share (BPS) Analysis

9.5. Automotive Polycarbonate Glazing Market Value (US$ Mn) and Market Size (Million Units) Forecast by Application, 2017-2031

9.5.1. Front Windshield

9.5.2. Backlite

9.5.3. Sidelite

9.5.4. Quarter Glass

9.5.5. Panoramic roof/ roof modules

9.6. Automotive Polycarbonate Glazing Market Attractiveness Analysis By Application

10. Global Automotive Polycarbonate Glazing Market Analysis and Forecasts, by Vehicle Type

10.1. Introduction & Definition

10.2. Market Growth & Y-O-Y projection

10.3. Absolute $ Opportunity Analysis

10.4. Basis Point Share (BPS) Analysis

10.5. Automotive Polycarbonate Glazing Market Value (US$ Mn) and Market Size (Million Units) Forecast by Vehicle Type, 2017-2031

10.5.1. Passenger Vehicle

10.5.2. Commercial Vehicle

10.6. Automotive Polycarbonate Glazing Market Attractiveness Analysis By Vehicle Type

11. Global Automotive Polycarbonate Glazing Market Analysis and Forecasts, by Sales Channel

11.1. Introduction & Definition

11.2. Market Growth & Y-O-Y projection

11.3. Absolute $ Opportunity Analysis

11.4. Basis Point Share (BPS) Analysis

11.5. Automotive Polycarbonate Glazing Market Value (US$ Mn) and Market Size (Million Units) Forecast by Sales Channel, 2017-2031

11.5.1. OEM

11.5.2. Aftermarket

11.6. Automotive Polycarbonate Glazing Market Attractiveness Analysis By Sales Channel

12. Global Automotive Polycarbonate Glazing Market Analysis and Forecasts, by Region

12.1. Market Growth & Y-O-Y projection

12.2. Absolute $ Opportunity Analysis

12.3. Basis Point Share (BPS) Analysis

12.4. Automotive Polycarbonate Glazing Market Value (US$ Mn) and Market Size (Million Units) Forecast by Region, 2017-2031

12.4.1. North America

12.4.2. Latin America

12.4.3. Europe

12.4.4. Asia Pacific

12.4.5. Middle East & Africa

12.5. Automotive Polycarbonate Glazing Market Attractiveness Analysis By Region

13. North America Automotive Polycarbonate Glazing Market Size (Million Units) and Forecast (US$ Mn), 2017-2031

13.1. Key Findings

13.2. North America Market, By Technology

13.2.1. Sun Control Glazing

13.2.2. Hydrophobic Glazing

13.2.3. Switchable Glazing

13.2.4. Conventional

13.3. North America Market, by Application

13.3.1. Front Windshield

13.3.2. Backlite

13.3.3. Sidelite

13.3.4. Quarter Glass

13.3.5. Panoramic roof/ roof modules

13.4. North America Market, by Vehicle Type

13.4.1. Passenger Vehicle

13.4.2. Commercial Vehicle

13.5. North America Market, by Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. North America Market Size & Forecast by Country

13.6.1. U.S.

13.6.2. Canada

13.7. U.S. Market, By Technology

13.7.1. Sun Control Glazing

13.7.2. Hydrophobic Glazing

13.7.3. Switchable Glazing

13.7.4. Conventional

13.8. U.S. Market, by Application

13.8.1. Front Windshield

13.8.2. Backlite

13.8.3. Sidelite

13.8.4. Quarter Glass

13.8.5. Panoramic roof/ roof modules

13.9. U.S. Market, by Vehicle Type

13.9.1. Passenger Vehicle

13.9.2. Commercial Vehicle

13.10. U.S. Market, by Sales Channel

13.10.1. OEM

13.10.2. Aftermarket

13.11. Canada Market, By Technology

13.11.1. Sun Control Glazing

13.11.2. Hydrophobic Glazing

13.11.3. Switchable Glazing

13.11.4. Conventional

13.12. Canada Market, by Application

13.12.1. Front Windshield

13.12.2. Backlite

13.12.3. Sidelite

13.12.4. Quarter Glass

13.12.5. Panoramic roof/ roof modules

13.13. Canada Market, by Vehicle Type

13.13.1. Passenger Vehicle

13.13.2. Commercial Vehicle

13.14. Canada Market, by Sales Channel

13.14.1. OEM

13.14.2. Aftermarket

14. Europe Automotive Polycarbonate Glazing Market Size (Million Units) and Forecast (US$ Mn), 2017-2031

14.1. Key Findings

14.2. Europe Market, By Technology

14.2.1. Sun Control Glazing

14.2.2. Hydrophobic Glazing

14.2.3. Switchable Glazing

14.2.4. Conventional

14.3. Europe Market, by Application

14.3.1. Front Windshield

14.3.2. Backlite

14.3.3. Sidelite

14.3.4. Quarter Glass

14.3.5. Panoramic roof/ roof modules

14.4. Europe Market, by Vehicle Type

14.4.1. Passenger Vehicle

14.4.2. Commercial Vehicle

14.5. Europe Market, by Sales Channel

14.5.1. OEM

14.5.2. Aftermarket

14.6. Europe Market Size & Forecast by Country

14.6.1. Germany

14.6.2. U.K.

14.6.3. France

14.6.4. Italy

14.6.5. Spain

14.6.6. Rest of Europe

14.7. Germany Market, By Technology

14.7.1. Sun Control Glazing

14.7.2. Hydrophobic Glazing

14.7.3. Switchable Glazing

14.7.4. Conventional

14.8. Germany Market, by Application

14.8.1. Front Windshield

14.8.2. Backlite

14.8.3. Sidelite

14.8.4. Quarter Glass

14.8.5. Panoramic roof/ roof modules

14.9. Germany Market, by Vehicle Type

14.9.1. Passenger Vehicle

14.9.2. Commercial Vehicle

14.10. Germany Market, by Sales Channel

14.10.1. OEM

14.10.2. Aftermarket

14.11. U.K. Market, By Technology

14.11.1. Sun Control Glazing

14.11.2. Hydrophobic Glazing

14.11.3. Switchable Glazing

14.11.4. Conventional

14.12. U.K. Market, by Application

14.12.1. Passenger Vehicle

14.12.2. Commercial Vehicle

14.13. U.K. Market, by Vehicle Type

14.13.1. Front Windshield

14.13.2. Backlite

14.13.3. Sidelite

14.13.4. Quarter Glass

14.13.5. Panoramic roof/ roof modules

14.14. U.K. Market, by Sales Channel

14.14.1. OEM

14.14.2. Aftermarket

14.15. France Market, By Technology

14.15.1. Sun Control Glazing

14.15.2. Hydrophobic Glazing

14.15.3. Switchable Glazing

14.15.4. Conventional

14.16. France Market, by Application

14.16.1. Front Windshield

14.16.2. Backlite

14.16.3. Sidelite

14.16.4. Quarter Glass

14.16.5. Panoramic roof/ roof modules

14.17. France Market, by Vehicle Type

14.17.1. Passenger Vehicle

14.17.2. Commercial Vehicle

14.18. France Market, by Sales Channel

14.18.1. OEM

14.18.2. Aftermarket

14.19. Italy Market, By Technology

14.19.1. Sun Control Glazing

14.19.2. Hydrophobic Glazing

14.19.3. Switchable Glazing

14.19.4. Conventional

14.20. Italy Market, by Application

14.20.1. Front Windshield

14.20.2. Backlite

14.20.3. Sidelite

14.20.4. Quarter Glass

14.20.5. Panoramic roof/ roof modules

14.21. Italy Market, by Vehicle Type

14.21.1. Passenger Vehicle

14.21.2. Commercial Vehicle

14.22. Italy Market, by Sales Channel

14.22.1. OEM

14.22.2. Aftermarket

14.23. Spain Market, By Technology

14.23.1. Sun Control Glazing

14.23.2. Hydrophobic Glazing

14.23.3. Switchable Glazing

14.23.4. Conventional

14.24. Spain Market, by Application

14.24.1. Front Windshield

14.24.2. Backlite

14.24.3. Sidelite

14.24.4. Quarter Glass

14.24.5. Panoramic roof/ roof modules

14.25. Spain Market, by Vehicle Type

14.25.1. Passenger Vehicle

14.25.2. Commercial Vehicle

14.26. Spain Market, by Sales Channel

14.26.1. OEM

14.26.2. Aftermarket

14.27. Rest of Europe Market, By Technology

14.27.1. Sun Control Glazing

14.27.2. Hydrophobic Glazing

14.27.3. Switchable Glazing

14.27.4. Conventional

14.28. Rest of Europe Market, by Application

14.28.1. Front Windshield

14.28.2. Backlite

14.28.3. Sidelite

14.28.4. Quarter Glass

14.28.5. Panoramic roof/ roof modules

14.29. Rest of Europe Market, by Vehicle Type

14.29.1. Passenger Vehicle

14.29.2. Commercial Vehicle

14.30. Rest of Europe Market, by Sales Channel

14.30.1. OEM

14.30.2. Aftermarket

15. Asia Pacific Automotive Polycarbonate Glazing Market Size (Million Units) and Forecast (US$ Mn), 2017-2031

15.1. Key Findings

15.2. Asia Pacific Market, By Technology

15.2.1. Sun Control Glazing

15.2.2. Hydrophobic Glazing

15.2.3. Switchable Glazing

15.2.4. Conventional

15.3. Asia Pacific Market, by Application

15.3.1. Front Windshield

15.3.2. Backlite

15.3.3. Sidelite

15.3.4. Quarter Glass

15.3.5. Panoramic roof/ roof modules

15.4. Asia Pacific Market, by Vehicle Type

15.4.1. Passenger Vehicle

15.4.2. Commercial Vehicle

15.5. Asia Pacific Market, by Sales Channel

15.5.1. OEM

15.5.2. Aftermarket

15.6. Asia Pacific Market Size & Forecast by Country

15.6.1. China

15.6.2. India

15.6.3. Japan

15.6.4. ASEAN

15.6.5. Rest of Asia Pacific

15.7. China Market, By Technology

15.7.1. Sun Control Glazing

15.7.2. Hydrophobic Glazing

15.7.3. Switchable Glazing

15.7.4. Conventional

15.8. China Market, by Application

15.8.1. Front Windshield

15.8.2. Backlite

15.8.3. Sidelite

15.8.4. Quarter Glass

15.8.5. Panoramic roof/ roof modules

15.9. China Market, by Vehicle Type

15.9.1. Passenger Vehicle

15.9.2. Commercial Vehicle

15.10. China Market, by Sales Channel

15.10.1. OEM

15.10.2. Aftermarket

15.11. India Market, By Technology

15.11.1. Sun Control Glazing

15.11.2. Hydrophobic Glazing

15.11.3. Switchable Glazing

15.11.4. Conventional

15.12. India Market, by Application

15.12.1. Front Windshield

15.12.2. Backlite

15.12.3. Sidelite

15.12.4. Quarter Glass

15.12.5. Panoramic roof/ roof modules

15.13. India Market, by Vehicle Type

15.13.1. Passenger Vehicle

15.13.2. Commercial Vehicle

15.14. India Market, by Sales Channel

15.14.1. OEM

15.14.2. Aftermarket

15.15. Japan Market, By Technology

15.15.1. Sun Control Glazing

15.15.2. Hydrophobic Glazing

15.15.3. Switchable Glazing

15.15.4. Conventional

15.16. Japan Market, by Application

15.16.1. Front Windshield

15.16.2. Backlite

15.16.3. Sidelite

15.16.4. Quarter Glass

15.16.5. Panoramic roof/ roof modules

15.17. Japan Market, by Vehicle Type

15.17.1. Passenger Vehicle

15.17.2. Commercial Vehicle

15.18. Japan Market, by Sales Channel

15.18.1. OEM

15.18.2. Aftermarket

15.19. ASEAN Market, By Technology

15.19.1. Sun Control Glazing

15.19.2. Hydrophobic Glazing

15.19.3. Switchable Glazing

15.19.4. Conventional

15.20. ASEAN Market, by Application

15.20.1. Front Windshield

15.20.2. Backlite

15.20.3. Sidelite

15.20.4. Quarter Glass

15.20.5. Panoramic roof/ roof modules

15.21. ASEAN Market, by Vehicle Type

15.21.1. Passenger Vehicle

15.21.2. Commercial Vehicle

15.22. ASEAN Market, by Sales Channel

15.22.1. OEM

15.22.2. Aftermarket

15.23. Rest of Asia Pacific Market, By Technology

15.23.1. Sun Control Glazing

15.23.2. Hydrophobic Glazing

15.23.3. Switchable Glazing

15.24. Rest of Asia Pacific Market, by Application

15.24.1. Front Windshield

15.24.2. Backlite

15.24.3. Sidelite

15.24.4. Quarter Glass

15.24.5. Panoramic roof/ roof modules

15.25. Rest of Asia Pacific Market, by Vehicle Type

15.25.1. Passenger Vehicle

15.25.2. Commercial Vehicle

15.26. Rest of Asia Pacific Market, by Sales Channel

15.26.1. OEM

15.26.2. Aftermarket

16. Middle East & Africa Automotive Polycarbonate Glazing Market Size (Million Units) and Forecast (US$ Mn), 2017-2031

16.1. Key Findings

16.2. Middle East & Africa Market, By Technology

16.2.1. Sun Control Glazing

16.2.2. Hydrophobic Glazing

16.2.3. Switchable Glazing

16.2.4. Conventional

16.3. Middle East & Africa Market, by Application

16.3.1. Front Windshield

16.3.2. Backlite

16.3.3. Sidelite

16.3.4. Quarter Glass

16.3.5. Panoramic roof/ roof modules

16.4. Middle East & Africa Market, by Vehicle Type

16.4.1. Passenger Vehicle

16.4.2. Commercial Vehicle

16.5. Middle East & Africa Market, by Sales Channel

16.5.1. OEM

16.5.2. Aftermarket

16.6. Middle East & Africa Market Size & Forecast by Country

16.6.1. GCC

16.6.2. South Africa

16.6.3. Rest of Middle East & Africa

16.7. GCC Market, By Technology

16.7.1. Sun Control Glazing

16.7.2. Hydrophobic Glazing

16.7.3. Switchable Glazing

16.7.4. Conventional

16.8. GCC Market, By Application

16.8.1. Front Windshield

16.8.2. Backlite

16.8.3. Sidelite

16.8.4. Quarter Glass

16.8.5. Panoramic roof/ roof modules

16.9. GCC Market, By Vehicle Type

16.9.1. Passenger Vehicle

16.9.2. Commercial Vehicle

16.10. GCC Market, by Sales Channel

16.10.1. OEM

16.10.2. Aftermarket

16.11. South Africa Market, By Technology

16.11.1. Sun Control Glazing

16.11.2. Hydrophobic Glazing

16.11.3. Switchable Glazing

16.11.4. Conventional

16.12. South Africa Market, by Application

16.12.1. Front Windshield

16.12.2. Backlite

16.12.3. Sidelite

16.12.4. Quarter Glass

16.12.5. Panoramic roof/ roof modules

16.13. South Africa Market, by Vehicle Type

16.13.1. Passenger Vehicle

16.13.2. Commercial Vehicle

16.14. South Africa Market, by Sales Channel

16.14.1. OEM

16.14.2. Aftermarket

16.15. Rest of Middle East & Africa Market, By Technology

16.15.1. Sun Control Glazing

16.15.2. Hydrophobic Glazing

16.15.3. Switchable Glazing

16.15.4. Conventional

16.16. Rest of Middle East & Africa Market, by Application

16.16.1. Front Windshield

16.16.2. Backlite

16.16.3. Sidelite

16.16.4. Quarter Glass

16.16.5. Panoramic roof/ roof modules

16.17. Rest of Middle East & Africa Market, by Vehicle Type

16.17.1. Passenger Vehicle

16.17.2. Commercial Vehicle

16.18. Rest of Middle East & Africa Market, by Sales Channel

16.18.1. OEM

16.18.2. Aftermarket

17. Latin America Automotive Polycarbonate Glazing Market Size (Million Units) and Forecast (US$ Mn), 2017-2031

17.1. Key Findings

17.2. Latin America Market, By Technology

17.2.1. Sun Control Glazing

17.2.2. Hydrophobic Glazing

17.2.3. Switchable Glazing

17.2.4. Conventional

17.3. Latin America Market, by Application

17.3.1. Front Windshield

17.3.2. Backlite

17.3.3. Sidelite

17.3.4. Quarter Glass

17.3.5. Panoramic roof/ roof modules

17.4. Latin America Market, by Vehicle Type

17.4.1. Passenger Vehicle

17.4.2. Commercial Vehicle

17.5. Latin America Market, by Sales Channel

17.5.1. OEM

17.5.2. Aftermarket

17.6. Latin America Market Size & Forecast by Country

17.6.1. Brazil

17.6.2. Mexico

17.6.3. Rest of Latin America

17.7. Brazil Market, By Technology

17.7.1. Sun Control Glazing

17.7.2. Hydrophobic Glazing

17.7.3. Switchable Glazing

17.7.4. Conventional

17.8. Brazil Market, by Application

17.8.1. Front Windshield

17.8.2. Backlite

17.8.3. Sidelite

17.8.4. Quarter Glass

17.8.5. Panoramic roof/ roof modules

17.9. Brazil Market, by Vehicle Type

17.9.1. Passenger Vehicle

17.9.2. Commercial Vehicle

17.10. Brazil Market, by Sales Channel

17.10.1. OEM

17.10.2. Aftermarket

17.11. Mexico Market, By Technology

17.11.1. Sun Control Glazing

17.11.2. Hydrophobic Glazing

17.11.3. Switchable Glazing

17.11.4. Conventional

17.12. Mexico Market, by Application

17.12.1. Front Windshield

17.12.2. Backlite

17.12.3. Sidelite

17.12.4. Quarter Glass

17.12.5. Panoramic roof/ roof modules

17.13. Mexico Market, by Vehicle Type

17.13.1. Passenger Vehicle

17.13.2. Commercial Vehicle

17.14. Mexico Market, by Sales Channel

17.14.1. OEM

17.14.2. Aftermarket

17.15. Rest of Latin America Market, By Technology

17.15.1. Sun Control Glazing

17.15.2. Hydrophobic Glazing

17.15.3. Switchable Glazing

17.15.4. Conventional

17.16. Rest of Latin America Market, by Application

17.16.1. Front Windshield

17.16.2. Backlite

17.16.3. Sidelite

17.16.4. Quarter Glass

17.16.5. Panoramic roof/ roof modules

17.17. Rest of Latin America Market, by Vehicle Type

17.17.1. Passenger Vehicle

17.17.2. Commercial Vehicle

17.18. Rest of Latin America Market, by Sales Channel

17.18.1. OEM

17.18.2. Aftermarket

18. Competition Landscape

18.1. Market Share Analysis By Company (2018)

18.2. Market Player Competition Matrix (By Tier and Size of the Company)

18.3. Company Financials

18.4. Executive Bios/ Business expansion/ Key executive changes

18.5. Manufacturing Footprint

18.6. Key Market Players (Details – Overview, Overall Revenue, Recent Developments, Strategy)

18.6.1. SABIC

18.6.1.1. Overview

18.6.1.2. Overall Revenue

18.6.1.3. Recent Developments

18.6.1.4. Strategy

18.6.2. Covestro AG

18.6.2.1. Overview

18.6.2.2. Overall Revenue

18.6.2.3. Recent Developments

18.6.2.4. Strategy

18.6.3. Saint-Gobain

18.6.3.1. Overview

18.6.3.2. Overall Revenue

18.6.3.3. Recent Developments

18.6.3.4. Strategy

18.6.4. Corning Incorporated

18.6.4.1. Overview

18.6.4.2. Overall Revenue

18.6.4.3. Recent Developments

18.6.4.4. Strategy

18.6.5. Nippon Sheet Glass Co., Ltd.

18.6.5.1. Overview

18.6.5.2. Overall Revenue

18.6.5.3. Recent Developments

18.6.5.4. Strategy

18.6.6. Fuyao Group

18.6.6.1. Overview

18.6.6.2. Overall Revenue

18.6.6.3. Recent Developments

18.6.6.4. Strategy

18.6.7. AGC Inc.

18.6.7.1. Overview

18.6.7.2. Overall Revenue

18.6.7.3. Recent Developments

18.6.7.4. Strategy

18.6.8. TEIJIN LIMITED

18.6.8.1. Overview

18.6.8.2. Overall Revenue

18.6.8.3. Recent Developments

18.6.8.4. Strategy

18.6.9. Freeglass

18.6.9.1. Overview

18.6.9.2. Overall Revenue

18.6.9.3. Recent Developments

18.6.9.4. Strategy

18.6.10. Webasto Thermo & Comfort

18.6.10.1. Overview

18.6.10.2. Overall Revenue

18.6.10.3. Recent Developments

18.6.10.4. Strategy

18.6.11. Peerless Plastics and Coatings

18.6.11.1. Overview

18.6.11.2. Overall Revenue

18.6.11.3. Recent Developments

18.6.11.4. Strategy

18.6.12. Dott.Gallina S.r.l.

18.6.12.1. Overview

18.6.12.2. Overall Revenue

18.6.12.3. Recent Developments

18.6.12.4. Strategy

18.6.13. KRD Sicherheitstechnik GmbH

18.6.13.1. Overview

18.6.13.2. Overall Revenue

18.6.13.3. Recent Developments

18.6.13.4. Strategy

18.6.14. Flexigard

18.6.14.1. Overview

18.6.14.2. Overall Revenue

18.6.14.3. Recent Developments

18.6.14.4. Strategy

List of Tables

Table 1: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Table 2: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 3: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Table 4: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 5: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Table 6: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 7: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Region, 2017-2031

Table 10: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 11: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Table 12: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 13: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Table 14: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 15: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Table 16: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 17: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 19: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 20: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 21: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Table 22: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 23: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Table 24: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 25: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Table 26: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 27: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Table 28: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 29: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Table 32: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 33: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Table 34: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 35: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Table 36: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 37: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 39: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 41: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Table 42: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 43: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Table 44: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 45: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Table 46: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 47: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Table 48: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 49: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 50: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 51: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Table 52: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 53: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Table 54: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 55: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Table 56: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 57: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Table 58: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 59: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Figure 2: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 3: Global Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022-2031

Figure 4: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Figure 5: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 6: Global Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 7: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Figure 8: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 9: Global Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022-2031

Figure 10: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 13: Global Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 16: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Figure 17: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 18: North America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022-2031

Figure 19: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Figure 20: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 21: North America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 22: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Figure 23: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 24: North America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022-2031

Figure 25: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 28: North America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 31: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Figure 32: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 33: Europe Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022-2031

Figure 34: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Figure 35: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 36: Europe Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 37: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Figure 38: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 39: Europe Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022-2031

Figure 40: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Figure 41: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Europe Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 43: Europe Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 46: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Figure 47: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 48: Asia Pacific Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022-2031

Figure 49: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Figure 50: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 51: Asia Pacific Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 52: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Figure 53: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 54: Asia Pacific Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022-2031

Figure 55: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 58: Asia Pacific Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 61: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Figure 62: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 63: Latin America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022-2031

Figure 64: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Figure 65: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 66: Latin America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 67: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Figure 68: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 69: Latin America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022-2031

Figure 70: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Figure 71: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 72: Latin America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 73: Latin America Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Figure 74: Latin America Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 75: Latin America Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 76: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Technology, 2017-2031

Figure 77: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 78: Middle East & Africa Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022-2031

Figure 79: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Application, 2017-2031

Figure 80: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 81: Middle East & Africa Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 82: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Sales Channel, 2017-2031

Figure 83: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 84: Middle East & Africa Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2022-2031

Figure 85: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Vehicle Type, 2017-2031

Figure 86: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 87: Middle East & Africa Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 88: Middle East & Africa Automotive Polycarbonate Glazing Market Volume (Million Tons) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Polycarbonate Glazing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Polycarbonate Glazing Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031