Reports

Reports

Analysts’ Viewpoint

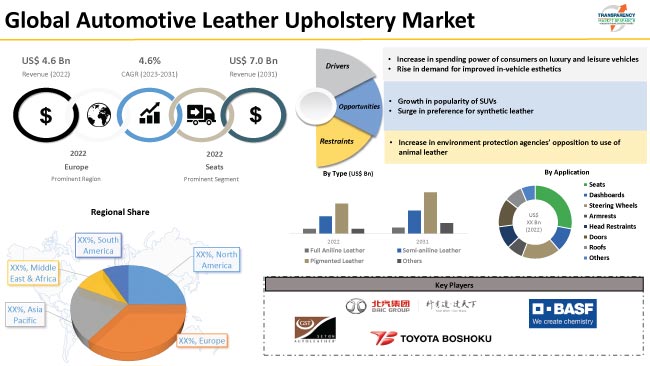

Increase in spending power of consumers on luxury and leisure vehicles and rise in demand for improved in-vehicle esthetics are significant factors fueling the automotive leather upholstery market growth. Moreover, rise in sale of passenger vehicles across the globe is contributing to the automotive leather upholstery market development. Leather can be used to design various interior components of the vehicle, primarily to enhance its esthetic value. Expansion of aftermarket sales channels is also boosting the market value.

Some of the leading players in the automotive leather market are increasing their investments in research and development (R&D) activities to facilitate the provision of a variety of leather produced in various colors and materials for diverse uses. Companies operating in the global market are focusing on product innovation with the help of partnerships and collaborations.

Design and comfort of the cabin space are important factors to consider when choosing a new car. Full aniline leather and semi-aniline leather are the major types of upholstery leather. These types are gaining popularity in the automotive upholstery due to their cost-effectiveness, excellent features, and easy-to-maintain characteristics.

Automotive leather offers more stain- and abrasion-resistance as compared to other materials; consequently, keeping the vehicle clean and reducing maintenance charges during the vehicle lifespan. Leather is frequently used in automobiles due to rise in demand for lightweight, high-quality, and durable leather interiors, particularly for seats, which enhances not only the esthetic appeal of the car but also provides comfort for the driver and passengers.

As per the latest automotive leather upholstery market research analysis, automotive leather offers various advantages over its alternatives, such as fabrics. Automotive leather is easier to clean than its alternatives. Its characteristics do not alter during cooling, heating, and ventilation in a vehicle. Additionally, leather increases the overall esthetic of the interiors, which adds significantly to the resale value of the automobile. All these factors are likely to propel the global market during the forecast period.

Rise in preference for personal mobility is likely to drive the demand for passenger cars in the near future. Consumers are inclined toward personal mobility rather than the public mode of transportation. Consumers are preferring to own vehicles due to significant increase in their income levels. According to automobile industry experts, the demand for passenger vehicles is rising consistently across the globe, especially after the peak of the COVID-19 pandemic. This is fueling the automotive leather upholstery market development.

Availability of a wide variety of interior leather designs along with rise in expenditure of consumers on automotive accessories is fueling the automotive leather upholstery business growth. Rise in adoption of bio-based leathers is anticipated to augment the global automotive interior leather market in the near future. Furthermore, shift in consumer preference toward artificial leather is also driving market progress. Rapid urbanization and rise in disposable income levels of individuals are key factors propelling the sale of luxury vehicles with enhanced features, comfortable interiors, premium upholstery, and better safety arrangements.

Furthermore, rise in awareness about the benefits offered by upholsteries among car owners is anticipated to create growth opportunities for market players. Leather upholsteries are durable, customizable, and easy to maintain, hence these can be widely adopted in automobiles. Moreover, various innovations and technological advancements in the automotive industry are significantly driving the demand for automotive leather upholstery.

The seats application segment held major automobile leather upholstery market share in 2022. It is projected to dominate the global market during the forecast period. Leather is a popular material to be used for vehicle interior components such as seats. Leather is being increasingly used for automobile seats due to its durability, softness, ability to reduce cabin noise levels, damp vibrations, and enhance the esthetic appearance of the vehicle.

Additionally, demand for leather for automobile interiors is projected to be driven by rise in sale of premium vehicles during the forecast period. Key players in the market are engaged in research & development activities to enhance the interior of the vehicle using leather seats.

According to the latest automotive leather upholstery market forecast analysis, Europe is likely to dominate the global market during the forecast period. This region is a major exporter of automotive components. Economic slowdown due to BREXIT is likely to hamper market development in the region in the near future. Major vendors of automotive upholstery have their production sites located in the region. Companies in Europe are at the forefront of development of advanced techniques to manufacture various types of synthetic materials for automotive industry applications. Therefore, the automotive leather upholstery market size in Europe in anticipated to increase during the forecast period.

Strong presence of luxurious vehicle manufacturers in North America is contributing to the automotive leather upholstery industry growth. Automotive leather upholstery market demand in North America is increasing due to rise in popularity of passenger vehicles among consumers in the region. Increase in demand for luxury vehicles in the region has boosted the sale of attractive leather upholstery in vehicles across North America.

China is home to the world’s largest automakers and automotive part suppliers. The aftermarket industry in China is renowned for making vehicle components at low costs and exporting them across the globe. Lucrative presence of key automakers such as BYD, Volkswagen, Geely, SIAC, BAIC, Toyota, and Daimler, and increase in disposable income of consumers in the region are fueling market expansion.

Major automotive players across the globe are collaborating with automotive suppliers to provide comfort and luxury features in their vehicles. They are following the automotive leather upholstery market trends to gain revenue streams. Implementation of various strategies by market players such as partnerships, mergers, acquisitions, and development in product portfolios are positively impacting the automotive leather upholstery market future analysis.

Some of the key manufacturers identified in the automotive leather upholstery market across the globe are Alea Leather Specialist (Sunguard Group), BASF SE, Beijing Automotive Group, Berhad, Chang'an Automobile Group, Classic Soft Trim, Dk Leather Corporation, FAW Group Corporation, GST Autoleather Inc., Katzkin Leather, Kuraray Co. Ltd., Lear Corporation, Toyota Boshoku Corporation, and Wollsdorf Leder Schmidt & Co. GmbH.

Key players have been profiled in the automotive leather upholstery market report based on parameters such as company overview, recent developments, product portfolio, business strategies, financial overview, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 4.6 Bn |

|

Market Forecast Value in 2031 |

US$ 7.0 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 4.6 Bn in 2022.

It is expected to grow at a CAGR of 4.6% by 2031.

It would be worth US$ 7.0 Bn in 2031.

Increase in spending power of consumers on luxury and leisure vehicles and rise in demand for improved in-vehicle esthetics.

Based on type, the seats segment accounted for largest share in 2022.

Europe is anticipated to be the highly lucrative market for vendors.

Alea Leather Specialist (Sunguard Group), BASF SE, Beijing Automotive Group, Berhad, Chang'an Automobile Group, Classic Soft Trim, Dk Leather Corporation, FAW Group Corporation, GST Autoleather Inc., Katzkin Leather, Kuraray Co. Ltd., Lear Corporation, Toyota Boshoku Corporation, and Wollsdorf Leder Schmidt & Co. GmbH.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboards Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Automotive Leather Upholstery Market

4. Global Automotive Leather Upholstery Market, by Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Type

4.2.1. Full Aniline Leather

4.2.2. Semi-aniline Leather

4.2.2.1. Pull-up Leather

4.2.2.2. Hand Rubbed or Hand Antiqued Leather

4.2.2.3. Others

4.2.3. Pigmented Leather

4.2.4. Others

5. Global Automotive Leather Upholstery Market, by Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Application

5.2.1. Seats

5.2.2. Dashboards

5.2.3. Steering Wheel

5.2.4. Armrests

5.2.5. Head Restraints

5.2.6. Doors

5.2.7. Roofs

5.2.8. Others

6. Global Automotive Leather Upholstery Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Vehicle Type

6.2.1. Passenger Cars

6.2.2. Hatchbacks

6.2.3. Sedans

6.2.4. Utility Vehicles

6.2.5. Light Commercial Vehicles

6.2.6. Heavy Duty Trucks

6.2.7. Buses and Coaches

7. Global Automotive Leather Upholstery Market, by Sales Channel

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Sales Channel

7.2.1. OEM

7.2.2. Aftermarket

8. Global Automotive Leather Upholstery Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Leather Upholstery Market

9.1. Market Snapshot

9.2. North America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Type

9.2.1. Full Aniline Leather

9.2.2. Semi-aniline Leather

9.2.2.1. Pull-up Leather

9.2.2.2. Hand Rubbed or Hand Antiqued Leather

9.2.2.3. Others

9.2.3. Pigmented Leather

9.2.4. Others

9.3. North America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Application

9.3.1. Seats

9.3.2. Dashboards

9.3.3. Steering Wheel

9.3.4. Armrests

9.3.5. Head Restraints

9.3.6. Doors

9.3.7. Roofs

9.3.8. Others

9.4. North America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Vehicle Type

9.4.1. Passenger Cars

9.4.1.1. Hatchbacks

9.4.1.2. Sedans

9.4.1.3. Utility Vehicles

9.4.2. Light Commercial Vehicles

9.4.3. Heavy Duty Trucks

9.4.4. Buses and Coaches

9.5. North America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Sales Channel

9.5.1. OEM

9.5.2. Aftermarket

9.6. North America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Country

9.6.1. The U. S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Automotive Leather Upholstery Market

10.1. Market Snapshot

10.2. Europe Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Type

10.2.1. Full Aniline Leather

10.2.2. Semi-aniline Leather

10.2.2.1. Pull-up Leather

10.2.2.2. Hand Rubbed or Hand Antiqued Leather

10.2.2.3. Others

10.2.3. Pigmented Leather

10.2.4. Others

10.3. Europe Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Application

10.3.1. Seats

10.3.2. Dashboards

10.3.3. Steering Wheel

10.3.4. Armrests

10.3.5. Head Restraints

10.3.6. Doors

10.3.7. Roofs

10.3.8. Others

10.4. Europe Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Vehicle Type

10.4.1. Passenger Cars

10.4.1.1. Hatchbacks

10.4.1.2. Sedans

10.4.1.3. Utility Vehicles

10.4.2. Light Commercial Vehicles

10.4.3. Heavy Duty Trucks

10.4.4. Buses and Coaches

10.5. Europe Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Sales Channel

10.5.1. OEM

10.5.2. Aftermarket

10.6. Europe Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Country

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Automotive Leather Upholstery Market

11.1. Market Snapshot

11.2. Asia Pacific Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Type

11.2.1. Full Aniline Leather

11.2.2. Semi-aniline Leather

11.2.2.1. Pull-up Leather

11.2.2.2. Hand Rubbed or Hand Antiqued Leather

11.2.2.3. Others

11.2.3. Pigmented Leather

11.2.4. Others

11.3. Asia Pacific Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Application

11.3.1. Seats

11.3.2. Dashboards

11.3.3. Steering Wheel

11.3.4. Armrests

11.3.5. Head Restraints

11.3.6. Doors

11.3.7. Roofs

11.3.8. Others

11.4. Asia Pacific Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Vehicle Type

11.4.1. Passenger Cars

11.4.1.1. Hatchbacks

11.4.1.2. Sedans

11.4.1.3. Utility Vehicles

11.4.2. Light Commercial Vehicles

11.4.3. Heavy Duty Trucks

11.4.4. Buses and Coaches

11.5. Asia Pacific Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Sales Channel

11.5.1. OEM

11.5.2. Aftermarket

11.6. Asia Pacific Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Country

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Leather Upholstery Market

12.1. Market Snapshot

12.2. Middle East & Africa Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Type

12.2.1. Full Aniline Leather

12.2.2. Semi-aniline Leather

12.2.2.1. Pull-up Leather

12.2.2.2. Hand Rubbed or Hand Antiqued Leather

12.2.2.3. Others

12.2.3. Pigmented Leather

12.2.4. Others

12.3. Middle East & Africa Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Application

12.3.1. Seats

12.3.2. Dashboards

12.3.3. Steering Wheel

12.3.4. Armrests

12.3.5. Head Restraints

12.3.6. Doors

12.3.7. Roofs

12.3.8. Others

12.4. Middle East & Africa Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Vehicle Type

12.4.1. Passenger Cars

12.4.1.1. Hatchbacks

12.4.1.2. Sedans

12.4.1.3. Utility Vehicles

12.4.2. Light Commercial Vehicles

12.4.3. Heavy Duty Trucks

12.4.4. Buses and Coaches

12.5. Middle East & Africa Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Middle East & Africa Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Country

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Automotive Leather Upholstery Market

13.1. Market Snapshot

13.2. South America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Type

13.2.1. Full Aniline Leather

13.2.2. Semi-aniline Leather

13.2.2.1. Pull-up Leather

13.2.2.2. Hand Rubbed or Hand Antiqued Leather

13.2.2.3. Others

13.2.3. Pigmented Leather

13.2.4. Others

13.3. South America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Application

13.3.1. Seats

13.3.2. Dashboards

13.3.3. Steering Wheel

13.3.4. Armrests

13.3.5. Head Restraints

13.3.6. Doors

13.3.7. Roofs

13.3.8. Others

13.4. South America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Vehicle Type

13.4.1. Passenger Cars

13.4.1.1. Hatchbacks

13.4.1.2. Sedans

13.4.1.3. Utility Vehicles

13.4.2. Light Commercial Vehicles

13.4.3. Heavy Duty Trucks

13.4.4. Buses and Coaches

13.5. South America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. South America Automotive Leather Upholstery Market Size & Forecast, 2017-2031, by Country

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. Alea Leather Specialist (Sunguard Group)

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. BASF SE

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Beijing Automotive Group

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Berhad

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Chang'an Automobile Group

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Classic Soft Trim

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Dk Leather Corporation

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. FAW Group Corporation

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. GST Autoleather Inc.

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Katzkin Leather

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. Kuraray Co. Ltd.

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Lear Corporation

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Toyota Boshoku Corporation

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Wollsdorf Leder Schmidt & Co. GmbH

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. Other Key Players

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

List of Tables

Table 1: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 2: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 3: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 4: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 5: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 6: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 7: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 8: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 10: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 11: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 12: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 13: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 14: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 15: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 16: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 17: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 18: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 20: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 22: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 23: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 24: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 25: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 26: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 27: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 28: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 29: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 30: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 2: Global Automotive Leather Upholstery Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 3: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 4: Global Automotive Leather Upholstery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 5: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Automotive Leather Upholstery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 8: Global Automotive Leather Upholstery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 9: Global Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 10: Global Automotive Leather Upholstery Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 11: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 12: North America Automotive Leather Upholstery Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 13: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 14: North America Automotive Leather Upholstery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 15: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 16: North America Automotive Leather Upholstery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 17: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 18: North America Automotive Leather Upholstery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 20: North America Automotive Leather Upholstery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 21: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 22: Europe Automotive Leather Upholstery Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 23: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: Europe Automotive Leather Upholstery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 25: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 26: Europe Automotive Leather Upholstery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 27: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 28: Europe Automotive Leather Upholstery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 29: Europe Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: Europe Automotive Leather Upholstery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 32: Asia Pacific Automotive Leather Upholstery Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 33: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 34: Asia Pacific Automotive Leather Upholstery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 35: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 36: Asia Pacific Automotive Leather Upholstery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 38: Asia Pacific Automotive Leather Upholstery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: Asia Pacific Automotive Leather Upholstery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 41: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 42: Middle East & Africa Automotive Leather Upholstery Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 43: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 44: Middle East & Africa Automotive Leather Upholstery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 45: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 46: Middle East & Africa Automotive Leather Upholstery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 47: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 48: Middle East & Africa Automotive Leather Upholstery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 50: Middle East & Africa Automotive Leather Upholstery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 51: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 52: South America Automotive Leather Upholstery Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 53: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: South America Automotive Leather Upholstery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 55: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 56: South America Automotive Leather Upholstery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 57: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 58: South America Automotive Leather Upholstery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 59: South America Automotive Leather Upholstery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: South America Automotive Leather Upholstery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031