Reports

Reports

Analysts’ Viewpoint on Market Scenario

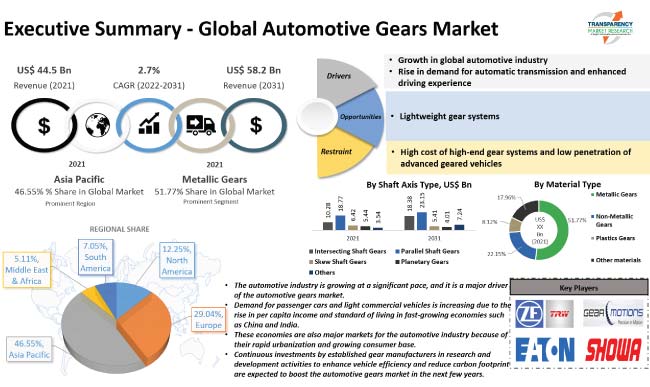

Rise in vehicle production and consumer demand for low-carbon technology is likely to boost the automotive gears industry during the forecast period. Vehicle sales have a direct impact on automotive gears market expansion. Moving to more expensive and energy-efficient systems, such seven-speed and eight-speed automatic gearboxes, is a key factor driving the demand for automotive gears in the automobile industry. However, several variables, such as the rise in demand for electric vehicles, are limiting market progress due to ongoing improvement of pollution laws.

The use of gears is relatively minimal in electric vehicles. The total number of gears has drastically decreased as a result of the lack of gearboxes, differentials, and transmission systems. Additionally, the automotive gears market forecast reveals that expansion of the automotive industry in developing nations, such as Brazil and India, is estimated to drive market demand. However, fully automated transmission vehicles are being produced as a result of technological breakthroughs, such as plastic gears strengthened with carbon fiber, which is likely to restrain the market to some extent.

A gear is a wheel with teeth that mesh with the teeth of another wheel to modify the transmission of rotational motion's speed or direction. A rotating machine's gears have teeth cut on them. The torque, speed, and direction of the power supply can all be changed via geared devices. By causing a change in torque, these systems produce a mechanical advantage through the gear ratio. A gear transmission is made up of two or more meshing gears that operate in a specific order. Gears play a vital role in transmission of power from the engine to the wheels in automobile systems.

The global automotive sector has been growing at a steady pace for the last few years. The economies of countries with more advanced automotive industries, such as those in Western Europe, Japan, and the U.S., are anticipated to expand modestly; however, ongoing expansion into new markets is anticipated to accelerate market growth. Demand for motor vehicles is likely to be boosted by consumers with higher disposable incomes, which in turn is anticipated to boost the auto sector in emerging nations with growing middle classes at a rapid pace. According to the UN, metropolitan areas are home to more than 54% of the world's population, which is boosting employment and individual income levels.

The world's population is expanding, cities are becoming more populated, and standards of living of consumers are rising, which is offering significant opportunities for the global automobile market and consequently for auto gears manufacturers to expand worldwide.

The car gearbox system serves more than just the straightforward function of transmitting engine power to the wheels; it also offers numerous other benefits. Demand for automatic transmissions in automobiles has increased in the last three years, particularly in growing economies such as India and China. Even though 90% or more of cars and trucks in the U.S. have automatic transmissions. Drivers all around the world are increasingly choosing automatic transmissions, which is expected to assist the industry and provide strong sales post the COVID-19 pandemic.

Increased desire for automatic transmission vehicles can be attributed to the several advantages offered by automatic transmission, which include comfortable driving, efficient fuel use, versatile design, and outstanding performance.

According to General Motors Company, demand for automatic transmission systems is expected to increase due to growing environmental concerns and stringent fuel-efficiency norms. This is because fewer automobiles with manual transmissions may be made accessible. Governments all over the world are attempting to increase the sales of fuel-efficient and alternative fuel vehicles through incentives and tax breaks, which is anticipated to increase the demand for automatic transmission in vehicles.

Based on shaft axis type, the automotive gears market segmentation comprises intersecting shaft gears (straight bevel gears, spiral bevel gears), parallel shaft gears (rack & pinion gears, helical gears, spur gears, and herringbone gears), skew shaft gears (hypoid gears, worm gears) planetary gears, and others. The parallel shaft gears segment held 42.23% share of the overall market. The best reliability and lowest MTTR (Mean Time to Repair) are provided by parallel shaft gears, which are also favored for their minimal component count and ease of maintenance. The most typical gear configuration, known as parallel axes, consists of a gear and pinion that mesh. One of the most popular varieties of parallel-shaft gears is the spur gear. Straight teeth that are parallel to the shaft axis are carved into these gears. Spur gears either engage a pair of parallel shafts or a shaft and a rack.

Metallic gears accounted for 51.77% of market demand in 2021. The segment is estimated to maintain its position in the market and expand at a CAGR of more than 2.01% during the forecast period. Steel gears are utilized to make transmissions for cars, because they allow for the smooth transfer of horsepower from one gear to the next. Brass is strong enough to withstand some harsh situations even though it isn't as strong as steel.

The non-metallic gears segment follow the metallic gears segment in terms of market share. It is anticipated to expand at a CAGR of 2.90% during the forecast year. Non-metallic gears are typically employed in high-speed operations where low noise is a top priority. Timing gears and various other forms of gear systems also extensively utilize non-metallic gears.

According to the region-wise automotive gears market forecast, Asia Pacific is expected to be the largest market for automotive gears, globally, with China playing a significant role in expansion of the market in the region. Demand for automotive equipment is expected to rise significantly in the future due to rising car production in nations such as China and India as well as focus of manufacturers on expansion of their production capacity. For instance, some publications have stated that China expects to sell 80 million internal combustion engines every year in the next few years, because IC vehicles still account for the lion's share of the automotive market in the country.

Additionally, the Asia Pacific market is expanding as a result of increase in demand for fuel-efficient automobiles and lightweight automotive components. Consequently, demand for lightweight, extremely robust aluminum and composite gears is anticipated to increase during the forecast period.

The global automotive gears industry is consolidated with a more number of manufacturers controlling market share and major companies possessing the potential to increase the pace of growth by the way of adoption of newer technologies. Key players frequently use mergers and acquisitions and product portfolio expansion as important tactics. Some of the key players identified in the automotive gears market across the globe are Amtek International, B & R Machine and Gear Corporation, Bharat Gears Ltd., Circle Gears & Machine Corporation, Eaton, Gear Motions, Mahindra CIE, RENOLD, SAMGONG GEAR IND. CO., LTD., SHOWA Corporation, Varroc Group, Universal Auto Gears LLP, Univance Corporation, American Axle & Manufacturing, Inc., ZF TRW, Robert Bosch GmbH, and Dynamatic Technologies Ltd.

Key players in the automotive gears market report have been profiled on the basis of company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 44.5 Bn |

|

Market Forecast Value in 2031 |

US$ 58.2 Bn |

|

Growth Rate (CAGR) |

2.7 % |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

Volume (Million Units) & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market is valued at US$ 44.5 Bn in 2021

It is expected to expand at a CAGR of 2.7% by 2031

The automotive gears industry would be worth US$ 58.2 Bn in 2031.

Growth in global automotive industry, rise in demand for automatic transmission and enhanced driving experience in terms of smooth gear shifting & improved acceleration

The metallic gears segment accounted for 51.77% share in 2021

Asia Pacific is a highly lucrative region of the global market

Amtek International, B & R Machine and Gear Corporation, Bharat Gears Ltd., Circle Gears & Machine Corporation, Eaton, Gear Motions, Mahindra CIE, RENOLD, SAMGONG GEAR IND. CO., LTD., SHOWA Corporation, Varroc Group, Universal Auto Gears LLP, Univance Corporation, American Axle & Manufacturing, Inc., ZF TRW, Robert Bosch GmbH, and Dynamatic Technologies Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Volume (Million Units), Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.6.3. Value Chain Analysis

2.6.3.1. List of Key Raw Material Suppliers

2.6.3.2. List of Key Manufacturers

2.6.3.3. List of Customers

2.6.3.4. Level of Integration

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Price Trend Analysis

4. COVID-19 Impact Analysis – Automotive Gears Market

5. Global Automotive Gears Market, by Shaft Axis Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Shaft Axis Type

5.2.1. Intersecting Shaft Gears

5.2.1.1. Straight Bevel Gears

5.2.1.2. Spiral Bevel Gears

5.2.2. Parallel Shaft Gears

5.2.2.1. Rack & Pinion Gears

5.2.2.2. Helical Gears

5.2.2.3. Spur Gears

5.2.2.4. Herringbone Gears

5.2.3. Skew Shaft Gears

5.2.3.1. Hypoid Gears

5.2.3.2. Worm Gears

5.2.4. Planetary Gears

5.2.5. Others

6. Global Automotive Gears Market, by Application

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Application

6.2.1. Transmission System

6.2.2. Differential

6.2.3. Transfer Case

6.2.4. Steering System

6.2.5. Other Automotive Systems

7. Global Automotive Gears Market, by Material Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Material Type

7.2.1. Metallic Gears

7.2.2. Non-Metallic Gears

7.2.3. Plastics Gears

7.2.4. Other materials

8. Global Automotive Gears Market, by Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

8.2.1. Passenger Vehicles

8.2.1.1. Hatchback

8.2.1.2. Sedan

8.2.1.3. Utility Vehicle

8.2.2. Light Commercial Vehicles

8.2.3. Heavy Duty Trucks

8.2.4. Buses & Coaches

9. Global Automotive Gears Market, by Sales Channel

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Sales Channel

9.2.1. OEM

9.2.2. Aftermarket

10. Global Automotive Gears Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Automotive Gears Market

11.1. Market Snapshot

11.2. North America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Shaft Axis Type

11.2.1. Intersecting Shaft Gears

11.2.1.1. Straight Bevel Gears

11.2.1.2. Spiral Bevel Gears

11.2.2. Parallel Shaft Gears

11.2.2.1. Rack & Pinion Gears

11.2.2.2. Helical Gears

11.2.2.3. Spur Gears

11.2.2.4. Herringbone Gears

11.2.3. Skew Shaft Gears

11.2.3.1. Hypoid Gears

11.2.3.2. Worm Gears

11.2.4. Planetary Gears

11.2.5. Others

11.3. North America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Application

11.3.1. Transmission System

11.3.2. Differential

11.3.3. Transfer Case

11.3.4. Steering System

11.3.5. Other Automotive Systems

11.4. North America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Material Type

11.4.1. Metallic Gears

11.4.2. Non-Metallic Gears

11.4.3. Plastics Gears

11.4.4. Other materials

11.5. North America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.5.1. Passenger Vehicles

11.5.1.1. Hatchback

11.5.1.2. Sedan

11.5.1.3. Utility Vehicle

11.5.2. Light Commercial Vehicles

11.5.3. Heavy Duty Trucks

11.5.4. Buses & Coaches

11.6. North America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.6.1. OEM

11.6.2. Aftermarket

11.7. Key Country Analysis – North America Automotive Gears Market Size Analysis & Forecast, 2017-2031

11.7.1. U.S.

11.7.2. Canada

11.7.3. Mexico

12. Europe Automotive Gears Market

12.1. Market Snapshot

12.2. Europe Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Shaft Axis Type

12.2.1. Intersecting Shaft Gears

12.2.1.1. Straight Bevel Gears

12.2.1.2. Spiral Bevel Gears

12.2.2. Parallel Shaft Gears

12.2.2.1. Rack & Pinion Gears

12.2.2.2. Helical Gears

12.2.2.3. Spur Gears

12.2.2.4. Herringbone Gears

12.2.3. Skew Shaft Gears

12.2.3.1. Hypoid Gears

12.2.3.2. Worm Gears

12.2.4. Planetary Gears

12.2.5. Others

12.3. Europe Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Application

12.3.1. Transmission System

12.3.2. Differential

12.3.3. Transfer Case

12.3.4. Steering System

12.3.5. Other Automotive Systems

12.4. Europe Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Material Type

12.4.1. Metallic Gears

12.4.2. Non-Metallic Gears

12.4.3. Plastics Gears

12.4.4. Other materials

12.5. Europe Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.5.1. Passenger Vehicles

12.5.1.1. Hatchback

12.5.1.2. Sedan

12.5.1.3. Utility Vehicle

12.5.2. Light Commercial Vehicles

12.5.3. Heavy Duty Trucks

12.5.4. Buses & Coaches

12.6. Europe Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Key Country Analysis – Europe Automotive Gears Market Size Analysis & Forecast, 2017-2031

12.7.1. Germany

12.7.2. U. K.

12.7.3. France

12.7.4. Italy

12.7.5. Spain

12.7.6. Nordic Countries

12.7.7. Russia & CIS

12.7.8. Rest of Europe

13. Asia Pacific Automotive Gears Market

13.1. Market Snapshot

13.2. North America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Shaft Axis Type

13.2.1. Intersecting Shaft Gears

13.2.1.1. Straight Bevel Gears

13.2.1.2. Spiral Bevel Gears

13.2.2. Parallel Shaft Gears

13.2.2.1. Rack & Pinion Gears

13.2.2.2. Helical Gears

13.2.2.3. Spur Gears

13.2.2.4. Herringbone Gears

13.2.3. Skew Shaft Gears

13.2.3.1. Hypoid Gears

13.2.3.2. Worm Gears

13.2.4. Planetary Gears

13.2.5. Others

13.3. Asia Pacific Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Application

13.3.1. Transmission System

13.3.2. Differential

13.3.3. Transfer Case

13.3.4. Steering System

13.3.5. Other Automotive Systems

13.4. Asia Pacific Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Material Type

13.4.1. Metallic Gears

13.4.2. Non-Metallic Gears

13.4.3. Plastics Gears

13.4.4. Other materials

13.5. Asia Pacific Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.5.1. Passenger Vehicles

13.5.1.1. Hatchback

13.5.1.2. Sedan

13.5.1.3. Utility Vehicle

13.5.2. Light Commercial Vehicles

13.5.3. Heavy Duty Trucks

13.5.4. Buses & Coaches

13.6. Asia Pacific Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis – Asia Pacific Automotive Gears Market Size Analysis & Forecast, 2017-2031

13.7.1. China

13.7.2. India

13.7.3. Japan

13.7.4. ASEAN Countries

13.7.5. South Korea

13.7.6. ANZ

13.7.7. Rest of Asia Pacific

14. Middle East & Africa Automotive Gears Market

14.1. Market Snapshot

14.2. Middle East & Africa Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Shaft Axis Type

14.2.1. Intersecting Shaft Gears

14.2.1.1. Straight Bevel Gears

14.2.1.2. Spiral Bevel Gears

14.2.2. Parallel Shaft Gears

14.2.2.1. Rack & Pinion Gears

14.2.2.2. Helical Gears

14.2.2.3. Spur Gears

14.2.2.4. Herringbone Gears

14.2.3. Skew Shaft Gears

14.2.3.1. Hypoid Gears

14.2.3.2. Worm Gears

14.2.4. Planetary Gears

14.2.5. Others

14.3. Middle East & Africa Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Application

14.3.1. Transmission System

14.3.2. Differential

14.3.3. Transfer Case

14.3.4. Steering System

14.3.5. Other Automotive Systems

14.4. Middle East & Africa Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Material Type

14.4.1. Metallic Gears

14.4.2. Non-Metallic Gears

14.4.3. Plastics Gears

14.4.4. Other materials

14.5. Middle East & Africa Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.5.1. Passenger Vehicles

14.5.1.1. Hatchback

14.5.1.2. Sedan

14.5.1.3. Utility Vehicle

14.5.2. Light Commercial Vehicles

14.5.3. Heavy Duty Trucks

14.5.4. Buses & Coaches

14.6. Middle East & Africa Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis – Middle East & Africa Automotive Gears Market Size Analysis & Forecast, 2017-2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. Turkey

14.7.4. Rest of Middle East & Africa

15. South America Automotive Gears Market

15.1. Market Snapshot

15.2. South America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Shaft Axis Type

15.2.1. Intersecting Shaft Gears

15.2.1.1. Straight Bevel Gears

15.2.1.2. Spiral Bevel Gears

15.2.2. Parallel Shaft Gears

15.2.2.1. Rack & Pinion Gears

15.2.2.2. Helical Gears

15.2.2.3. Spur Gears

15.2.2.4. Herringbone Gears

15.2.3. Skew Shaft Gears

15.2.3.1. Hypoid Gears

15.2.3.2. Worm Gears

15.2.4. Planetary Gears

15.2.5. Others

15.3. South America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Application

15.3.1. Transmission System

15.3.2. Differential

15.3.3. Transfer Case

15.3.4. Steering System

15.3.5. Other Automotive Systems

15.4. South America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Material Type

15.4.1. Metallic Gears

15.4.2. Non-Metallic Gears

15.4.3. Plastics Gears

15.4.4. Other materials

15.5. South America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

15.5.1. Passenger Vehicles

15.5.1.1. Hatchback

15.5.1.2. Sedan

15.5.1.3. Utility Vehicle

15.5.2. Light Commercial Vehicles

15.5.3. Heavy Duty Trucks

15.5.4. Buses & Coaches

15.6. South America Automotive Gears Market Size Analysis & Forecast, 2017-2031, By Sales Channel

15.6.1. OEM

15.6.2. Aftermarket

15.7. Key Country Analysis – South America Automotive Gears Market Size Analysis & Forecast, 2017-2031

15.7.1. Brazil

15.7.2. Argentina

15.7.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2021

16.2. Pricing comparison among key players

16.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/ Key Players

17.1. Amtek International

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. B & R Machine and Gear Corporation

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. Bharat Gears Ltd.

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. Circle Gears & Machine Corporation

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Eaton

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. Gear Motions

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. Kohara Gear Industry Co., Ltd.

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. Mahindra CIE

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. Precipart

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. RENOLD

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. SAMGONG GEAR IND. CO., LTD.

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. SHOWA Corporation

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. Varroc Group

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

17.14. Cone Drive Operations Inc.

17.14.1. Company Overview

17.14.2. Company Footprints

17.14.3. Production Locations

17.14.4. Product Portfolio

17.14.5. Competitors & Customers

17.14.6. Subsidiaries & Parent Organization

17.14.7. Recent Developments

17.14.8. Financial Analysis

17.14.9. Profitability

17.14.10. Revenue Share

17.15. IMS Gear GmbH

17.15.1. Company Overview

17.15.2. Company Footprints

17.15.3. Production Locations

17.15.4. Product Portfolio

17.15.5. Competitors & Customers

17.15.6. Subsidiaries & Parent Organization

17.15.7. Recent Developments

17.15.8. Financial Analysis

17.15.9. Profitability

17.15.10. Revenue Share

17.16. Universal Auto Gears LLP

17.16.1. Company Overview

17.16.2. Company Footprints

17.16.3. Production Locations

17.16.4. Product Portfolio

17.16.5. Competitors & Customers

17.16.6. Subsidiaries & Parent Organization

17.16.7. Recent Developments

17.16.8. Financial Analysis

17.16.9. Profitability

17.16.10. Revenue Share

17.17. Univance Corporation

17.17.1. Company Overview

17.17.2. Company Footprints

17.17.3. Production Locations

17.17.4. Product Portfolio

17.17.5. Competitors & Customers

17.17.6. Subsidiaries & Parent Organization

17.17.7. Recent Developments

17.17.8. Financial Analysis

17.17.9. Profitability

17.17.10. Revenue Share

17.18. American Axle & Manufacturing, Inc.

17.18.1. Company Overview

17.18.2. Company Footprints

17.18.3. Production Locations

17.18.4. Product Portfolio

17.18.5. Competitors & Customers

17.18.6. Subsidiaries & Parent Organization

17.18.7. Recent Developments

17.18.8. Financial Analysis

17.18.9. Profitability

17.18.10. Revenue Share

17.19. ZF TRW

17.19.1. Company Overview

17.19.2. Company Footprints

17.19.3. Production Locations

17.19.4. Product Portfolio

17.19.5. Competitors & Customers

17.19.6. Subsidiaries & Parent Organization

17.19.7. Recent Developments

17.19.8. Financial Analysis

17.19.9. Profitability

17.19.10. Revenue Share

17.20. Robert Bosch GmbH

17.20.1. Company Overview

17.20.2. Company Footprints

17.20.3. Production Locations

17.20.4. Product Portfolio

17.20.5. Competitors & Customers

17.20.6. Subsidiaries & Parent Organization

17.20.7. Recent Developments

17.20.8. Financial Analysis

17.20.9. Profitability

17.20.10. Revenue Share

17.21. Taiwan United Gear Co., Ltd

17.21.1. Company Overview

17.21.2. Company Footprints

17.21.3. Production Locations

17.21.4. Product Portfolio

17.21.5. Competitors & Customers

17.21.6. Subsidiaries & Parent Organization

17.21.7. Recent Developments

17.21.8. Financial Analysis

17.21.9. Profitability

17.21.10. Revenue Share

17.22. Dynamatic Technologies Ltd.

17.22.1. Company Overview

17.22.2. Company Footprints

17.22.3. Production Locations

17.22.4. Product Portfolio

17.22.5. Competitors & Customers

17.22.6. Subsidiaries & Parent Organization

17.22.7. Recent Developments

17.22.8. Financial Analysis

17.22.9. Profitability

17.22.10. Revenue Share

17.23. Franz Morat Group

17.23.1. Company Overview

17.23.2. Company Footprints

17.23.3. Production Locations

17.23.4. Product Portfolio

17.23.5. Competitors & Customers

17.23.6. Subsidiaries & Parent Organization

17.23.7. Recent Developments

17.23.8. Financial Analysis

17.23.9. Profitability

17.23.10. Revenue Share

17.24. Other Key Players

17.24.1. Company Overview

17.24.2. Company Footprints

17.24.3. Production Locations

17.24.4. Product Portfolio

17.24.5. Competitors & Customers

17.24.6. Subsidiaries & Parent Organization

17.24.7. Recent Developments

17.24.8. Financial Analysis

17.24.9. Profitability

17.24.10. Revenue Share

List of Tables

Table 1: Global Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Table 2: Global Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017‒2031

Table 3: Global Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Table 4: Global Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 5: Global Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Table 6: Global Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 7: Global Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 9: Global Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Automotive Gears Market Volume (Million Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Gears Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Table 14: North America Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017‒2031

Table 15: North America Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Table 16: North America Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 17: North America Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Table 18: North America Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 19: North America Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 20: North America Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 21: North America Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 23: North America Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Table 26: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017‒2031

Table 27: Europe Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Table 28: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 29: Europe Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Table 30: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 31: Europe Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 33: Europe Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 35: Europe Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Table 38: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017‒2031

Table 39: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Table 40: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 41: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Table 42: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 43: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Table 50: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017‒2031

Table 51: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Table 52: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 53: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Table 54: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 55: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 57: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 61: South America Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Table 62: South America Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017‒2031

Table 63: South America Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Table 64: South America Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 65: South America Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Table 66: South America Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 67: South America Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 68: South America Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 69: South America Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 71: South America Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Figure 2: Global Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017-2031

Figure 3: Global Automotive Gears Market, Incremental Opportunity, by Shaft Axis Type, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Figure 5: Global Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 6: Global Automotive Gears Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Figure 8: Global Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 9: Global Automotive Gears Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Gears Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Automotive Gears Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 16: Global Automotive Gears Market Volume (Million Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Gears Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Gears Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Figure 20: North America Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017-2031

Figure 21: North America Automotive Gears Market, Incremental Opportunity, by Shaft Axis Type, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Figure 23: North America Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: North America Automotive Gears Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Figure 26: North America Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 27: North America Automotive Gears Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: North America Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: North America Automotive Gears Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Automotive Gears Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 34: North America Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Gears Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Figure 38: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017-2031

Figure 39: Europe Automotive Gears Market, Incremental Opportunity, by Shaft Axis Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Figure 41: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 42: Europe Automotive Gears Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Figure 44: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 45: Europe Automotive Gears Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 46: Europe Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Automotive Gears Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 49: Europe Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Automotive Gears Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 52: Europe Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Gears Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Figure 56: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017-2031

Figure 57: Asia Pacific Automotive Gears Market, Incremental Opportunity, by Shaft Axis Type, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Figure 59: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 60: Asia Pacific Automotive Gears Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Figure 62: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 63: Asia Pacific Automotive Gears Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Gears Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Automotive Gears Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Gears Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Figure 74: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017-2031

Figure 75: Middle East & Africa Automotive Gears Market, Incremental Opportunity, by Shaft Axis Type, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Figure 77: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 78: Middle East & Africa Automotive Gears Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Figure 80: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 81: Middle East & Africa Automotive Gears Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Gears Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Gears Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Gears Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 91: South America Automotive Gears Market Volume (Million Units) Forecast, by Shaft Axis Type, 2017-2031

Figure 92: South America Automotive Gears Market Value (US$ Bn) Forecast, by Shaft Axis Type, 2017-2031

Figure 93: South America Automotive Gears Market, Incremental Opportunity, by Shaft Axis Type, Value (US$ Bn), 2022-2031

Figure 94: South America Automotive Gears Market Volume (Million Units) Forecast, by Application, 2017-2031

Figure 95: South America Automotive Gears Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 96: South America Automotive Gears Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 97: South America Automotive Gears Market Volume (Million Units) Forecast, by Material Type, 2017-2031

Figure 98: South America Automotive Gears Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 99: South America Automotive Gears Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 100: South America Automotive Gears Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 101: South America Automotive Gears Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Automotive Gears Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 103: South America Automotive Gears Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Automotive Gears Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Automotive Gears Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 106: South America Automotive Gears Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Gears Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Gears Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031