Reports

Reports

Analysts’ Viewpoint

Rapid growth of e-commerce and the rise of on-demand delivery services have increased the demand for efficient and reliable transportation. Companies operating in these sectors often require large fleets to fulfill customer orders and meet delivery deadlines, which is driving the automotive fleet market growth. Rapid advancements in technology, such as autonomous driving, electrification, and connectivity, are revolutionizing the automotive industry and have a significant impact on the fleet management sector.

Fleet operators often provide vehicles to ride-sharing drivers, either through leasing or rental agreements. These technological advancements present business opportunities in the automotive fleet market for fleet operators to adopt innovative solutions, optimize operations, and gain a competitive edge. Adhering to transportation regulations and safety standards is crucial for fleet operators. In-house fleet management offers companies more control over ensuring compliance with regulations, reducing the risk of penalties, and maintaining a good reputation in the market.

The automotive fleet refers to a collection of vehicles owned or leased by an organization, typically used for business purposes. Fleet management involves the administration and coordination of these vehicles to ensure optimal utilization, operational efficiency, and cost-effectiveness. Automotive fleet management encompasses various activities, including vehicle acquisition, maintenance, fuel management, driver monitoring, route planning, and compliance with regulatory requirements.

Fleet management is essential for businesses that rely heavily on transportation, such as logistics companies, delivery services, public transportation providers, and corporate organizations with large employee fleets. It enables these entities to effectively manage their vehicle assets, reduce operating costs, improve productivity, and ensure compliance with safety and environmental regulations.

The need for efficient transportation solutions coupled with increasing global trade and commerce has a significantly positive impact on the automotive fleet industry.

Governments and regulatory bodies are implementing more stringent regulations concerning vehicle emissions, safety standards, and driver qualifications. Compliance with these regulations is a complex task for businesses operating large vehicle fleets. Automotive fleet management providers assist businesses in meeting these requirements by ensuring vehicles are properly maintained, drivers are trained, and necessary documentation is in place. Demand for regulatory compliance support is driving the automotive fleet market value.

Increase in environmental concerns is augmenting the focus on sustainability in transportation. Several businesses are looking to reduce their carbon footprint and adopt greener practices, including the use of electric vehicles and alternative fuel options in their fleets. The automotive fleet market is playing a crucial role in supporting this transition by providing expertise and solutions for managing and optimizing sustainable fleets.

Fuel costs are a significant expense for fleet operators. Reducing fuel consumption is crucial for both financial and environmental reasons. Fleet managers employ various strategies to achieve fuel efficiency, such as route optimization, driver training programs, adopting fuel-efficient vehicles, and implementing technologies such as telematics systems that monitor fuel usage and driver behavior.

Fleet managers effectively managing vehicle schedules, routes, and assignments to minimize idle time and maximize productivity. Moreover, regular inspections, preventive maintenance schedules, and telematics data analysis can help identify and address maintenance needs promptly, optimizing fleet performance and minimizing expenses. Consequently, these factors play a vital role in driving the automotive fleet market statistics

Increase in population and urbanization is fueling the need for efficient and reliable transportation solutions. This increased demand is witnessed in various sectors such as ride-sharing, car rental, last-mile delivery services, and corporate transportation. Expansion of e-commerce has fueled the demand for last-mile delivery services. Companies such as Amazon, UPS, and FedEx rely on fleets of vehicles to transport goods from distribution centers to customers' doorsteps. Boom in online shopping is boosting the need for efficient and timely delivery services, which in turn is estimated to positively impact the automotive fleet market forecast.

Several businesses and organizations require transportation services for their employees and clients. This includes shuttle services, corporate car rentals, and transportation for events or conferences. Fleet management services offer businesses a convenient and cost-effective solution for managing their transportation needs.

In-house fleet management provides companies with greater flexibility and control over their transportation operations. They can tailor their fleet size, vehicle types, and schedules according to their specific business needs, resulting in improved efficiency and responsiveness to customer demands.

Increasing emphasis on sustainability and environmental responsibility is driving companies to adopt greener transportation solutions. In-house fleet management allows organizations to implement eco-friendly initiatives such as incorporating electric vehicles (EVs) into their fleets, reducing emissions, and promoting sustainable practices.

In-house fleet management also allows companies to provide a customized and branded experience to their customers. which can lead to enhanced customer loyalty and increased market share.

Asia Pacific is expected to account for a notable automotive fleet market share during the forecast period. Strong economic growth, resulting in increased business activities and the need for efficient transportation solutions have been witnessed in the region for the last few years. Growing economies, such as China, India, and a few in Southeast Asia, have witnessed a rise in industrialization, urbanization, and trade, which has led to higher demand for automotive fleets.

Additionally, ongoing infrastructure development projects, including the construction of roads, highways, and logistics hubs, further contributes to the growth of the automotive fleet market share held by the region.

Companies in Asia Pacific are increasingly recognizing the benefits of fleet management, which can lead to improved operational efficiency, cost savings, enhanced safety, and compliance with regulations. Consequently, they are more likely to invest in their automotive fleets, thereby driving the market.

The global automotive fleet industry is highly competitive, with several key players operating in the market. Moreover, key players are following the latest automotive fleet market trends to gain a competitive edge and capture a larger share of the market. Some of key manufacturers operating in the global market include APL Logistics Ltd., Holman Inc., Cox Enterprises, Inc., DHL International GmbH, Element, Enterprise Fleet Management, FedEx Corporation, Halliburton, J.B. Hunt Transport, Inc., Knight-Swift Transportation Holdings Inc., LeasePlan, McLANE COMPANY, INC., Schlumberger Limited, Schneider, Swift Transportation, United Parcel Service of America, Inc., VRL Logistics Ltd., Wheels, and XPO Logistics.

Key players have been profiled in the automotive fleet market report based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Volume in 2022 |

42,980 New Fleet |

|

Market Forecast Volume in 2031 |

59,089 New Fleet |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

Volume in New Fleet |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

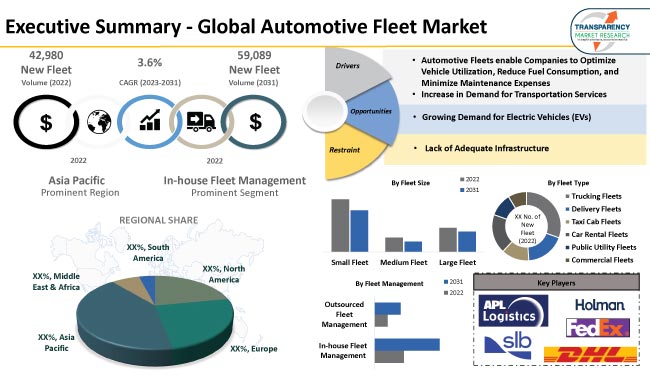

The global market stood at 42,980 new fleet in 2022

It is expected to expand at a CAGR of 3.60% by 2031

The business is estimated to reach 59,089 new fleet in 2031

Automotive fleet enables companies to optimize vehicle utilization, reduce fuel consumption, and minimize maintenance expenses and increase in demand for transportation services

In terms of fleet management, the in-house fleet management segment accounted for majority share in 2022

Asia Pacific is anticipated to be highly lucrative for automotive fleet

The prominent players operating in the automotive fleet market are: APL Logistics Ltd., Holman Inc., Cox Enterprises, Inc., DHL International GmbH, Element, Enterprise Fleet Management, FedEx Corporation, Halliburton, J.B. Hunt Transport, Inc., Knight-Swift Transportation Holdings Inc., LeasePlan, McLANE COMPANY, INC., Schlumberger Limited, Schneider, Swift Transportation, United Parcel Service of America, Inc., VRL Logistics Ltd., Wheels, and XPO Logistics.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Number of New Fleet, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Automotive Fleet Market, by Fleet Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Type

3.2.1. Trucking Fleets

3.2.2. Delivery Fleets

3.2.3. Taxi Cab Fleets

3.2.4. Car Rental Fleets

3.2.5. Public Utility Fleets

3.2.6. Commercial Fleets

4. Global Automotive Fleet Market, by Fleet Size

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Size

4.2.1. Small Fleet (Less than 50 Vehicles)

4.2.2. Medium Fleet (50 - 100 Vehicles)

4.2.3. Large Fleet (More than 100 Vehicles)

5. Global Automotive Fleet Market, by Industry Vertical

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Industry Vertical

5.2.1. Logistics and Transportation

5.2.2. Construction and Infrastructure

5.2.3. Utilities and Energy

5.2.4. Government and Public Services

5.2.5. Corporate

5.2.6. Emergency Services

5.2.7. Others

6. Global Automotive Fleet Market, by Service Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Service Type

6.2.1. Leasing or Renting Services

6.2.2. Goods Transportation Vehicles

6.2.3. Passenger Transportation Vehicles

6.2.4. On Demand Services

6.2.5. Goods Transportation Vehicles

6.2.6. Passenger Transportation Vehicles

7. Global Automotive Fleet Market, by Fleet Management

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Management

7.2.1. In-house Fleet Management

7.2.2. Outsourced Fleet Management

8. Global Automotive Fleet Market, by Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

8.2.1. Passenger Vehicle

8.2.2. Commercial Vehicle

8.2.2.1. Trailers/Trucks

8.2.2.2. Tankers

8.2.2.3. Refrigerated Trucks

8.2.2.4. Buses/Shuttle

8.2.2.5. Others

9. Global Automotive Fleet Market, by Ownership

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Ownership

9.2.1. Private Fleet

9.2.2. Leased Fleet

9.2.3. Rental Fleet

9.2.4. Shared Fleet

10. Global Automotive Fleet Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Fleet Market Size & Forecast, 2017-2031, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Automotive Fleet Market

11.1. Market Snapshot

11.2. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Type

11.2.1. Trucking Fleets

11.2.2. Delivery Fleets

11.2.3. Taxi Cab Fleets

11.2.4. Car Rental Fleets

11.2.5. Public Utility Fleets

11.2.6. Commercial Fleets

11.3. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Size

11.3.1. Small Fleet (Less than 50 Vehicles)

11.3.2. Medium Fleet (50 - 100 Vehicles)

11.3.3. Large Fleet (More than 100 Vehicles)

11.4. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Industry Vertical

11.4.1. Logistics and Transportation

11.4.2. Construction and Infrastructure

11.4.3. Utilities and Energy

11.4.4. Government and Public Services

11.4.5. Corporate

11.4.6. Emergency Services

11.4.7. Others

11.5. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Service Type

11.5.1. Leasing or Renting Services

11.5.2. Goods Transportation Vehicles

11.5.3. Passenger Transportation Vehicles

11.5.4. On Demand Services

11.5.5. Goods Transportation Vehicles

11.5.6. Passenger Transportation Vehicles

11.6. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Management

11.6.1. In-house Fleet Management

11.6.2. Outsourced Fleet Management

11.7. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

11.7.1. Passenger Vehicle

11.7.2. Commercial Vehicle

11.7.2.1. Trailers/Trucks

11.7.2.2. Tankers

11.7.2.3. Refrigerated Trucks

11.7.2.4. Buses/Shuttle

11.7.2.5. Others

11.8. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Ownership

11.8.1. Private Fleet

11.8.2. Leased Fleet

11.8.3. Rental Fleet

11.8.4. Shared Fleet

11.9. North America Automotive Fleet Market Size & Forecast, 2017-2031, by Country

11.9.1. The U. S.

11.9.2. Canada

11.9.3. Mexico

12. Europe Automotive Fleet Market

12.1. Market Snapshot

12.2. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Type

12.2.1. Trucking Fleets

12.2.2. Delivery Fleets

12.2.3. Taxi Cab Fleets

12.2.4. Car Rental Fleets

12.2.5. Public Utility Fleets

12.2.6. Commercial Fleets

12.3. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Size

12.3.1. Small Fleet (Less than 50 Vehicles)

12.3.2. Medium Fleet (50 - 100 Vehicles)

12.3.3. Large Fleet (More than 100 Vehicles)

12.4. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Industry Vertical

12.4.1. Logistics and Transportation

12.4.2. Construction and Infrastructure

12.4.3. Utilities and Energy

12.4.4. Government and Public Services

12.4.5. Corporate

12.4.6. Emergency Services

12.4.7. Others

12.5. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Service Type

12.5.1. Leasing or Renting Services

12.5.2. Goods Transportation Vehicles

12.5.3. Passenger Transportation Vehicles

12.5.4. On Demand Services

12.5.5. Goods Transportation Vehicles

12.5.6. Passenger Transportation Vehicles

12.6. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Management

12.6.1. In-house Fleet Management

12.6.2. Outsourced Fleet Management

12.7. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

12.7.1. Passenger Vehicle

12.7.2. Commercial Vehicle

12.7.2.1. Trailers/Trucks

12.7.2.2. Tankers

12.7.2.3. Refrigerated Trucks

12.7.2.4. Buses/Shuttle

12.7.2.5. Others

12.8. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Ownership

12.8.1. Private Fleet

12.8.2. Leased Fleet

12.8.3. Rental Fleet

12.8.4. Shared Fleet

12.9. Europe Automotive Fleet Market Size & Forecast, 2017-2031, by Country

12.9.1. Germany

12.9.2. U. K.

12.9.3. France

12.9.4. Italy

12.9.5. Spain

12.9.6. Nordic Countries

12.9.7. Russia & CIS

12.9.8. Rest of Europe

13. Asia Pacific Automotive Fleet Market

13.1. Market Snapshot

13.2. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Type

13.2.1. Trucking Fleets

13.2.2. Delivery Fleets

13.2.3. Taxi Cab Fleets

13.2.4. Car Rental Fleets

13.2.5. Public Utility Fleets

13.2.6. Commercial Fleets

13.3. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Size

13.3.1. Small Fleet (Less than 50 Vehicles)

13.3.2. Medium Fleet (50 - 100 Vehicles)

13.3.3. Large Fleet (More than 100 Vehicles)

13.4. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Industry Vertical

13.4.1. Logistics and Transportation

13.4.2. Construction and Infrastructure

13.4.3. Utilities and Energy

13.4.4. Government and Public Services

13.4.5. Corporate

13.4.6. Emergency Services

13.4.7. Others

13.5. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Service Type

13.5.1. Leasing or Renting Services

13.5.2. Goods Transportation Vehicles

13.5.3. Passenger Transportation Vehicles

13.5.4. On Demand Services

13.5.5. Goods Transportation Vehicles

13.5.6. Passenger Transportation Vehicles

13.6. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Management

13.6.1. In-house Fleet Management

13.6.2. Outsourced Fleet Management

13.7. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

13.7.1. Passenger Vehicle

13.7.2. Commercial Vehicle

13.7.2.1. Trailers/Trucks

13.7.2.2. Tankers

13.7.2.3. Refrigerated Trucks

13.7.2.4. Buses/Shuttle

13.7.2.5. Others

13.8. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Ownership

13.8.1. Private Fleet

13.8.2. Leased Fleet

13.8.3. Rental Fleet

13.8.4. Shared Fleet

13.9. Asia Pacific Automotive Fleet Market Size & Forecast, 2017-2031, by Country

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. ASEAN Countries

13.9.5. South Korea

13.9.6. ANZ

13.9.7. Rest of Asia Pacific

14. Middle East & Africa Automotive Fleet Market

14.1. Market Snapshot

14.2. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Type

14.2.1. Trucking Fleets

14.2.2. Delivery Fleets

14.2.3. Taxi Cab Fleets

14.2.4. Car Rental Fleets

14.2.5. Public Utility Fleets

14.2.6. Commercial Fleets

14.3. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Size

14.3.1. Small Fleet (Less than 50 Vehicles)

14.3.2. Medium Fleet (50 - 100 Vehicles)

14.3.3. Large Fleet (More than 100 Vehicles)

14.4. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Industry Vertical

14.4.1. Logistics and Transportation

14.4.2. Construction and Infrastructure

14.4.3. Utilities and Energy

14.4.4. Government and Public Services

14.4.5. Corporate

14.4.6. Emergency Services

14.4.7. Others

14.5. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Service Type

14.5.1. Leasing or Renting Services

14.5.2. Goods Transportation Vehicles

14.5.3. Passenger Transportation Vehicles

14.5.4. On Demand Services

14.5.5. Goods Transportation Vehicles

14.5.6. Passenger Transportation Vehicles

14.6. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Management

14.6.1. In-house Fleet Management

14.6.2. Outsourced Fleet Management

14.7. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

14.7.1. Passenger Vehicle

14.7.2. Commercial Vehicle

14.7.2.1. Trailers/Trucks

14.7.2.2. Tankers

14.7.2.3. Refrigerated Trucks

14.7.2.4. Buses/Shuttle

14.7.2.5. Others

14.8. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Ownership

14.8.1. Private Fleet

14.8.2. Leased Fleet

14.8.3. Rental Fleet

14.8.4. Shared Fleet

14.9. Middle East & Africa Automotive Fleet Market Size & Forecast, 2017-2031, by Country

14.9.1. GCC

14.9.2. South Africa

14.9.3. Turkey

14.9.4. Rest of Middle East & Africa

15. South America Automotive Fleet Market

15.1. Market Snapshot

15.2. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Type

15.2.1. Trucking Fleets

15.2.2. Delivery Fleets

15.2.3. Taxi Cab Fleets

15.2.4. Car Rental Fleets

15.2.5. Public Utility Fleets

15.2.6. Commercial Fleets

15.3. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Size

15.3.1. Small Fleet (Less than 50 Vehicles)

15.3.2. Medium Fleet (50 - 100 Vehicles)

15.3.3. Large Fleet (More than 100 Vehicles)

15.4. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Industry Vertical

15.4.1. Logistics and Transportation

15.4.2. Construction and Infrastructure

15.4.3. Utilities and Energy

15.4.4. Government and Public Services

15.4.5. Corporate

15.4.6. Emergency Services

15.4.7. Others

15.5. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Service Type

15.5.1. Leasing or Renting Services

15.5.2. Goods Transportation Vehicles

15.5.3. Passenger Transportation Vehicles

15.5.4. On Demand Services

15.5.5. Goods Transportation Vehicles

15.5.6. Passenger Transportation Vehicles

15.6. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Fleet Management

15.6.1. In-house Fleet Management

15.6.2. Outsourced Fleet Management

15.7. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Vehicle Type

15.7.1. Passenger Vehicle

15.7.2. Commercial Vehicle

15.7.2.1. Trailers/Trucks

15.7.2.2. Tankers

15.7.2.3. Refrigerated Trucks

15.7.2.4. Buses/Shuttle

15.7.2.5. Others

15.8. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Ownership

15.8.1. Private Fleet

15.8.2. Leased Fleet

15.8.3. Rental Fleet

15.8.4. Shared Fleet

15.9. South America Automotive Fleet Market Size & Forecast, 2017-2031, by Country

15.9.1. Brazil

15.9.2. Argentina

15.9.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2022

16.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/ Key Players

17.1. APL Logistics Ltd.

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. ARI

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. Cox Enterprises, Inc.

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. DHL International GmbH

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Element

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. Enterprise Fleet Management

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. FedEx Corporation

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. Halliburton

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. J.B. Hunt Transport, Inc.

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. Knight-Swift Transportation Holdings Inc.

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. LeasePlan

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. McLANE COMPANY, INC.

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. Schlumberger Limited

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

17.14. Schneider

17.14.1. Company Overview

17.14.2. Company Footprints

17.14.3. Production Locations

17.14.4. Product Portfolio

17.14.5. Competitors & Customers

17.14.6. Subsidiaries & Parent Organization

17.14.7. Recent Developments

17.14.8. Financial Analysis

17.14.9. Profitability

17.14.10. Revenue Share

17.15. Swift Transportation

17.15.1. Company Overview

17.15.2. Company Footprints

17.15.3. Production Locations

17.15.4. Product Portfolio

17.15.5. Competitors & Customers

17.15.6. Subsidiaries & Parent Organization

17.15.7. Recent Developments

17.15.8. Financial Analysis

17.15.9. Profitability

17.15.10. Revenue Share

17.16. United Parcel Service of America, Inc.

17.16.1. Company Overview

17.16.2. Company Footprints

17.16.3. Production Locations

17.16.4. Product Portfolio

17.16.5. Competitors & Customers

17.16.6. Subsidiaries & Parent Organization

17.16.7. Recent Developments

17.16.8. Financial Analysis

17.16.9. Profitability

17.16.10. Revenue Share

17.17. VRL Logistics Ltd.

17.17.1. Company Overview

17.17.2. Company Footprints

17.17.3. Production Locations

17.17.4. Product Portfolio

17.17.5. Competitors & Customers

17.17.6. Subsidiaries & Parent Organization

17.17.7. Recent Developments

17.17.8. Financial Analysis

17.17.9. Profitability

17.17.10. Revenue Share

17.18. Wheels

17.18.1. Company Overview

17.18.2. Company Footprints

17.18.3. Production Locations

17.18.4. Product Portfolio

17.18.5. Competitors & Customers

17.18.6. Subsidiaries & Parent Organization

17.18.7. Recent Developments

17.18.8. Financial Analysis

17.18.9. Profitability

17.18.10. Revenue Share

17.19. XPO Logistics

17.19.1. Company Overview

17.19.2. Company Footprints

17.19.3. Production Locations

17.19.4. Product Portfolio

17.19.5. Competitors & Customers

17.19.6. Subsidiaries & Parent Organization

17.19.7. Recent Developments

17.19.8. Financial Analysis

17.19.9. Profitability

17.19.10. Revenue Share

17.20. Other Key Players

17.20.1. Company Overview

17.20.2. Company Footprints

17.20.3. Production Locations

17.20.4. Product Portfolio

17.20.5. Competitors & Customers

17.20.6. Subsidiaries & Parent Organization

17.20.7. Recent Developments

17.20.8. Financial Analysis

17.20.9. Profitability

17.20.10. Revenue Share

List of Tables

Table 1: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Table 2: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Table 3: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Table 4: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Table 5: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Table 6: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Table 7: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Table 8: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Region, 2017-2031

Table 9: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Table 10: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Table 11: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Table 12: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Table 13: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Table 14: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Table 15: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Table 16: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Table 17: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Table 18: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Table 19: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Table 20: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Table 21: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Table 22: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Table 23: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Table 24: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Table 25: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Table 26: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Table 27: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Table 28: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Table 29: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Table 30: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Table 31: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Table 32: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Table 33: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Table 34: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Table 35: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Table 36: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Table 37: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Table 38: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Table 39: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Table 40: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Table 41: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Table 42: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Table 43: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Table 44: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Table 45: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Table 46: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Table 47: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Table 48: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Figure 2: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Figure 3: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Figure 4: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Figure 5: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Figure 6: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Figure 7: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Figure 8: Global Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Region, 2017-2031

Figure 9: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Figure 10: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Figure 11: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Figure 12: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Figure 13: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Figure 14: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Figure 15: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Figure 16: North America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Figure 17: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Figure 18: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Figure 19: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Figure 20: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Figure 21: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Figure 22: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Figure 23: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Figure 24: Europe Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Figure 25: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Figure 26: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Figure 27: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Figure 28: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Figure 29: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Figure 30: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Figure 31: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Figure 32: Asia Pacific Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Figure 33: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Figure 34: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Figure 35: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Figure 36: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Figure 37: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Figure 38: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Figure 39: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Figure 40: Middle East & Africa Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031

Figure 41: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Type, 2017-2031

Figure 42: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Size, 2017-2031

Figure 43: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Industry Vertical, 2017-2031

Figure 44: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Service Type, 2017-2031

Figure 45: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Fleet Management, 2017-2031

Figure 46: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Vehicle Type, 2017-2031

Figure 47: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Ownership, 2017-2031

Figure 48: South America Automotive Fleet Market Volume (Number of New Fleet) Forecast, by Country, 2017-2031