Reports

Reports

Analysts’ Viewpoint

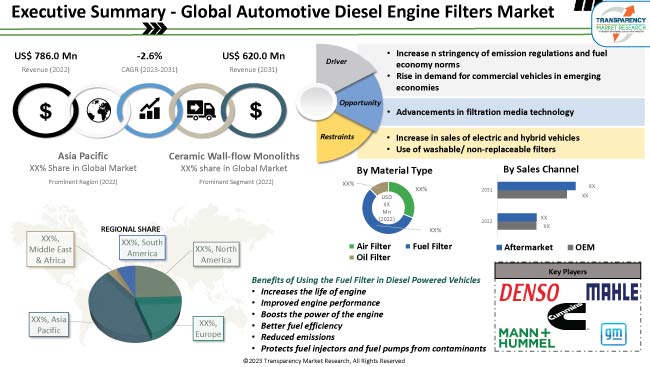

Significant shift in consumer preference toward fuel-efficient diesel engines and the desire to decrease carbon footprint are key factors that are estimated to boost the demand for vehicle diesel engine filters in commercial vehicles in the next few years. However, plans by major automakers across the globe to stop production of diesel engine powered passenger vehicles are anticipated to hamper the automotive diesel engine filters market demand by the end of 2031.

Rise in number of commercial vehicles in emerging nations and improvements in automobile diesel engine filters are anticipated to propel the demand for automotive diesel fuel filter systems for commercial vehicles in the next few years. The introduction of electric vehicles, which do not require filters, could restrain the automotive diesel engine filters market growth. Moreover, falling battery prices, longer-range models, and more charging stations are fueling sales of electric vehicles.

A vehicle's fuel and oil filters are designed to filter the physical elements contained in fluids or gases that enter the vehicle. Automotive diesel engine filters assist in removing contaminants that may enter the engine. They help prolong the life of an engine by effectively trapping dirt and debris that would otherwise damage the pistons and cylinders and other internal engine components. Even a tiny salt particle might cause engine damage, which could require expensive repairs. An engine filter permits adequate airflow into the engine, maintaining the air-fuel ratio.

Increased demand for freight transit via highway has prompted freight operators to expand their fleet of commercial vehicles. Consequently, a rise in demand for commercial vehicles is projected to boost the demand for automobile diesel engine filters. However, a shift in preference toward cleaner fuels and electric vehicles among consumers and automakers is anticipated to negatively impact the automotive diesel engine filters market forecast during the forecast period.

Increasingly stringent air emission rules have been implemented globally as a response to growing concerns about the environment caused by the release of hazardous gases such as CO2. For instance, EU Regulation No. 443/2009 sets a target of 130 grams per kilometer for average CO2 emissions for new passenger cars. Between 2012 and 2015, the goal was phased in progressively. Starting in 2021, a target of 95 grams per kilometer would be used.

Additionally, Bharat Stage VI (BS VI), which mandates the installation of diesel oxidation catalysts (DOC) and diesel particulate filters (DPF) in vehicles in order to meet specified emission objectives, was adopted for passenger automobiles in India in April 2020. Installation of diesel particulate filters and selective catalytic reduction (SCR) technology in diesel passenger cars and light trucks has thus been enforced by regulatory agencies such as the EPA and European Commission in order to minimize emissions.

Companies participating in the market are projected to invest extensively in research & development in order to develop newer, more technologically advanced filters since stiffer laws are likely to guide the automotive industry. Consequently, automakers are required to follow these standards and use of filters in diesel powered passenger vehicles and commercial vehicles is therefore projected to increase during the projection period in order to comply with these regulatory standards.

However, the proposed ban on production of diesel passenger cars by automakers across the globe is expected to restrain the automotive diesel engine filters industry growth by the end of the forecast period.

Rise in demand and utilization of commercial vehicles in the e-commerce and logistics industries has been boosting the production of commercial vehicles worldwide for the last five years. This is driving the need for filters used in the manufacture of commercial vehicles. Rise in global population, changes in people's lifestyles from various parts of the world, and infrastructure advancements are further contributing to this rise in the number of commercial vehicles on road.

The International Organization of Motor Vehicle Manufacturers estimated that more than 23.42 million commercial vehicles would be produced worldwide in 2022. According to the current trends in the automotive industry, diesel engine powered vehicles are being replaced with more efficient gasoline engines or electric powered vehicles. However, not all diesel engine powered vehicles, especially diesel powered light and heavy and commercial vehicles, are likely to go off the road. Additionally, therefore, increase in commercial vehicle production is boosting the application of automotive diesel engine filters.

In terms of material type, the ceramic wall-flow monoliths segment held 56.50% of the automotive diesel engine filters market share in 2022. Ceramic wall-flow monolith filters nearly fully remove carbon particulates, including fine particulates less than 100 nanometers (nm) in diameter, with an efficiency >95% in mass and >99% in number, under a variety of engine operating circumstances.

The most common post-treatment methods for reducing soot particles in diesel vehicle exhaust are ceramic wall-flow monolithic filters. Increasingly stringent laws are driving research in this area, which in turn is projected to boost the segment of the market during the forecast period.

In terms of region, the global automotive diesel engine filters market analysis reveals that easy accessibility of inexpensive labor and raw resources in Asia Pacific can offer significant cost reduction and considerable automotive diesel engine filters market opportunities to manufacturers based in the region. These factors, especially in China, Japan, and India, are anticipated to propel the market dynamics in the region.

Increase in investments by local automakers to boost innovation in technology and rapid expansion of the automotive manufacturing sector in China and India are estimated to further boost the industry in the region.

The market in Europe is likely to be principally influenced by the increasing stringency of emission regulations. Automotive diesel engine maintenance filter technology is likely to witness innovation and advancements in North America in order to feed clean fuel and maintain and complex diesel engines used in commercial vehicles in the region.

The global automotive diesel engine filters market is fragmented among several players who control majority of market share. Key players are creating supply chain networks and adopting latest automotive diesel engine filters market trends, such as collaboration, merger, acquisition, and expansion of product lines, to increase their revenue share. Some of the prominent players in the global industry are ALCO Filters Ltd., Anhui meiruier filter Co., Ltd., Avrand Pishro Co., BorgWarner Inc., Cummins Inc., Continental AG, DENSO Corp., Donaldson Co. Inc., Dongguan Shenglian Filter Manufacturing Co.,Ltd, First Brands Group, General Motors Co., Hengst SE, IHD Industries Pvt. Ltd., Liuzhou Risun Filter Co. Ltd., MAHLE GmbH, MANN HUMMEL International GmbH and Co. KG, Sewon Co. Ltd., Sogefi Spa, and UFI Filters Spa.

The automotive diesel engine filters market report scope includes profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 786.0 Mn |

|

Market Forecast Value in 2031 |

US$ 620.0 Mn |

|

Growth Rate (CAGR) |

-2.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value & (Thousand Units) for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 786.0 Mn in 2022

It has expected to expand at a CAGR of -2.6% by 2031.

The business would be worth US$ 620.0 Mn in 2031

Increase in stringency of regulations governing emissions and fuel economy and rise in production of commercial vehicles globally

The ceramic wall-flow monoliths segment accounted for 56.5% share in 2022

Asia Pacific is a highly lucrative region for automotive diesel engine filters market

Filters Ltd., Anhui meiruier filter Co., Ltd., Avrand Pishro Co., BorgWarner Inc., Cummins Inc., Continental AG, DENSO Corp., Donaldson Co. Inc., Dongguan Shenglian Filter Manufacturing Co.,Ltd, First Brands Group, General Motors Co., Hengst SE, IHD Industries Pvt. Ltd., Liuzhou Risun Filter Co. Ltd., MAHLE GmbH, MANN HUMMEL International GmbH and Co. KG, Sewon Co. Ltd., Sogefi Spa, UFI Filters Spa

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Value Chain Analysis

2.10. Cost Structure Analysis

2.11. Profit Margin Analysis

3. Global Automotive Diesel Engine Filters Market, by Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Type

3.2.1. Air Filter

3.2.2. Fuel Filter

3.2.2.1. Primary

3.2.2.2. Secondary

3.2.3. Oil Filter

4. Global Automotive Diesel Engine Filters Market, by Material Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Material Type

4.2.1. Ceramic Filters

4.2.1.1. Wall-Flow Monoliths

4.2.1.2. Ceramic Fibers

4.2.1.3. Ceramic Foams

4.2.2. Metal Filters

4.2.2.1. Sintered Metal

4.2.2.2. Metal Fiber Filters

4.2.2.3. Other Metal Filters

4.2.3. Pleated Paper Filters

5. Global Automotive Diesel Engine Filters Market, by Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

5.2.1. Three Wheelers

5.2.2. Passenger Cars

5.2.2.1. Hatchback

5.2.2.2. Sedan

5.2.2.3. SUVs

5.2.3. Light Commercial Vehicles

5.2.4. Heavy Duty Trucks

5.2.5. Buses and Coaches

5.2.6. Off-road Vehicles

5.2.6.1. Agriculture Tractors & Equipment

5.2.6.2. Construction & Mining Equipment

5.2.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

6. Global Automotive Diesel Engine Filters Market, by Sales Channel

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Sales Channel

6.2.1. OEM

6.2.2. Aftermarket

7. Global Automotive Diesel Engine Filters Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Automotive Diesel Engine Filters Market

8.1. Market Snapshot

8.2. North America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Type

8.2.1. Air Filter

8.2.2. Fuel Filter

8.2.2.1. Primary

8.2.2.2. Secondary

8.2.3. Oil Filter

8.3. North America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Material Type

8.3.1. Ceramic Filters

8.3.1.1. Wall-Flow Monoliths

8.3.1.2. Ceramic Fibers

8.3.1.3. Ceramic Foams

8.3.2. Metal Filters

8.3.2.1. Sintered Metal

8.3.2.2. Metal Fiber Filters

8.3.2.3. Other Metal Filters

8.3.3. Pleated Paper Filters

8.4. North America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

8.4.1. Three Wheelers

8.4.2. Passenger Cars

8.4.2.1. Hatchback

8.4.2.2. Sedan

8.4.2.3. SUVs

8.4.3. Light Commercial Vehicles

8.4.4. Heavy Duty Trucks

8.4.5. Buses and Coaches

8.4.6. Off-road Vehicles

8.4.6.1. Agriculture Tractors & Equipment

8.4.6.2. Construction & Mining Equipment

8.4.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

8.5. North America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Sales Channel

8.5.1. OEM

8.5.2. Aftermarket

8.6. Key Country Analysis - North America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031

8.6.1. U.S.

8.6.2. Canada

8.6.3. Mexico

9. Europe Automotive Diesel Engine Filters Market

9.1. Market Snapshot

9.2. Europe Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Type

9.2.1. Air Filter

9.2.2. Fuel Filter

9.2.2.1. Primary

9.2.2.2. Secondary

9.2.3. Oil Filter

9.3. Europe Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Material Type

9.3.1. Ceramic Filters

9.3.1.1. Wall-Flow Monoliths

9.3.1.2. Ceramic Fibers

9.3.1.3. Ceramic Foams

9.3.2. Metal Filters

9.3.2.1. Sintered Metal

9.3.2.2. Metal Fiber Filters

9.3.2.3. Other Metal Filters

9.3.3. Pleated Paper Filters

9.4. Europe Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.4.1. Three Wheelers

9.4.2. Passenger Cars

9.4.2.1. Hatchback

9.4.2.2. Sedan

9.4.2.3. SUVs

9.4.3. Light Commercial Vehicles

9.4.4. Heavy Duty Trucks

9.4.5. Buses and Coaches

9.4.6. Off-road Vehicles

9.4.6.1. Agriculture Tractors & Equipment

9.4.6.2. Construction & Mining Equipment

9.4.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

9.5. Europe Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Sales Channel

9.5.1. OEM

9.5.2. Aftermarket

9.6. Key Country Analysis - Europe Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031

9.6.1. Germany

9.6.2. U. K.

9.6.3. France

9.6.4. Italy

9.6.5. Spain

9.6.6. Nordic Countries

9.6.7. Russia & CIS

9.6.8. Rest of Europe

10. Asia Pacific Automotive Diesel Engine Filters Market

10.1. Market Snapshot

10.2. Asia Pacific Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Type

10.2.1. Air Filter

10.2.2. Fuel Filter

10.2.2.1. Primary

10.2.2.2. Secondary

10.2.3. Oil Filter

10.3. Asia Pacific Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Material Type

10.3.1. Ceramic Filters

10.3.1.1. Wall-Flow Monoliths

10.3.1.2. Ceramic Fibers

10.3.1.3. Ceramic Foams

10.3.2. Metal Filters

10.3.2.1. Sintered Metal

10.3.2.2. Metal Fiber Filters

10.3.2.3. Other Metal Filters

10.3.3. Pleated Paper Filters

10.4. Asia Pacific Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.4.1. Three Wheelers

10.4.2. Passenger Cars

10.4.2.1. Hatchback

10.4.2.2. Sedan

10.4.2.3. SUVs

10.4.3. Light Commercial Vehicles

10.4.4. Heavy Duty Trucks

10.4.5. Buses and Coaches

10.4.6. Off-road Vehicles

10.4.6.1. Agriculture Tractors & Equipment

10.4.6.2. Construction & Mining Equipment

10.4.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

10.5. Asia Pacific Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Sales Channel

10.5.1. OEM

10.5.2. Aftermarket

10.6. Key Country Analysis - Asia Pacific Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031

10.6.1. China

10.6.2. India

10.6.3. Japan

10.6.4. ASEAN Countries

10.6.5. South Korea

10.6.6. ANZ

10.6.7. Rest of Asia Pacific

11. Middle East & Africa Automotive Diesel Engine Filters Market

11.1. Market Snapshot

11.2. Middle East & Africa Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Type

11.2.1. Air Filter

11.2.2. Fuel Filter

11.2.2.1. Primary

11.2.2.2. Secondary

11.2.3. Oil Filter

11.3. Middle East & Africa Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Material Type

11.3.1. Ceramic Filters

11.3.1.1. Wall-Flow Monoliths

11.3.1.2. Ceramic Fibers

11.3.1.3. Ceramic Foams

11.3.2. Metal Filters

11.3.2.1. Sintered Metal

11.3.2.2. Metal Fiber Filters

11.3.2.3. Other Metal Filters

11.3.3. Pleated Paper Filters

11.4. Middle East & Africa Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.4.1. Three Wheelers

11.4.2. Passenger Cars

11.4.2.1. Hatchback

11.4.2.2. Sedan

11.4.2.3. SUVs

11.4.3. Light Commercial Vehicles

11.4.4. Heavy Duty Trucks

11.4.5. Buses and Coaches

11.4.6. Off-road Vehicles

11.4.6.1. Agriculture Tractors & Equipment

11.4.6.2. Construction & Mining Equipment

11.4.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

11.5. Middle East & Africa Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.5.1. OEM

11.5.2. Aftermarket

11.6. Key Country Analysis - Middle East & Africa Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031

11.6.1. GCC

11.6.2. South Africa

11.6.3. Turkey

11.6.4. Rest of Middle East & Africa

12. South America Automotive Diesel Engine Filters Market

12.1. Market Snapshot

12.2. South America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Type

12.2.1. Air Filter

12.2.2. Fuel Filter

12.2.2.1. Primary

12.2.2.2. Secondary

12.2.3. Oil Filter

12.3. South America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Material Type

12.3.1. Ceramic Filters

12.3.1.1. Wall-Flow Monoliths

12.3.1.2. Ceramic Fibers

12.3.1.3. Ceramic Foams

12.3.2. Metal Filters

12.3.2.1. Sintered Metal

12.3.2.2. Metal Fiber Filters

12.3.2.3. Other Metal Filters

12.3.3. Pleated Paper Filters

12.4. South America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.4.1. Three Wheelers

12.4.2. Passenger Cars

12.4.2.1. Hatchback

12.4.2.2. Sedan

12.4.2.3. SUVs

12.4.3. Light Commercial Vehicles

12.4.4. Heavy Duty Trucks

12.4.5. Buses and Coaches

12.4.6. Off-road Vehicles

12.4.6.1. Agriculture Tractors & Equipment

12.4.6.2. Construction & Mining Equipment

12.4.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

12.5. South America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Key Country Analysis - South America Automotive Diesel Engine Filters Market Size Analysis & Forecast, 2017-2031

12.6.1. Brazil

12.6.2. Argentina

12.6.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Pricing comparison among key players

13.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14. Company Profile/ Key Players

14.1. ALCO Filters Ltd.

14.1.1. Company Overview

14.1.2. Company Footprints

14.1.3. Production Locations

14.1.4. Product Portfolio

14.1.5. Competitors & Customers

14.1.6. Subsidiaries & Parent Organization

14.1.7. Recent Developments

14.1.8. Financial Analysis

14.1.9. Profitability

14.1.10. Revenue Share

14.2. Anhui meiruier filter Co., Ltd

14.2.1. Company Overview

14.2.2. Company Footprints

14.2.3. Production Locations

14.2.4. Product Portfolio

14.2.5. Competitors & Customers

14.2.6. Subsidiaries & Parent Organization

14.2.7. Recent Developments

14.2.8. Financial Analysis

14.2.9. Profitability

14.2.10. Revenue Share

14.3. Avrand Pishro Co.

14.3.1. Company Overview

14.3.2. Company Footprints

14.3.3. Production Locations

14.3.4. Product Portfolio

14.3.5. Competitors & Customers

14.3.6. Subsidiaries & Parent Organization

14.3.7. Recent Developments

14.3.8. Financial Analysis

14.3.9. Profitability

14.3.10. Revenue Share

14.4. BorgWarner Inc.

14.4.1. Company Overview

14.4.2. Company Footprints

14.4.3. Production Locations

14.4.4. Product Portfolio

14.4.5. Competitors & Customers

14.4.6. Subsidiaries & Parent Organization

14.4.7. Recent Developments

14.4.8. Financial Analysis

14.4.9. Profitability

14.4.10. Revenue Share

14.5. Cummins Inc.

14.5.1. Company Overview

14.5.2. Company Footprints

14.5.3. Production Locations

14.5.4. Product Portfolio

14.5.5. Competitors & Customers

14.5.6. Subsidiaries & Parent Organization

14.5.7. Recent Developments

14.5.8. Financial Analysis

14.5.9. Profitability

14.5.10. Revenue Share

14.6. Continental AG

14.6.1. Company Overview

14.6.2. Company Footprints

14.6.3. Production Locations

14.6.4. Product Portfolio

14.6.5. Competitors & Customers

14.6.6. Subsidiaries & Parent Organization

14.6.7. Recent Developments

14.6.8. Financial Analysis

14.6.9. Profitability

14.6.10. Revenue Share

14.7. DENSO Corp.

14.7.1. Company Overview

14.7.2. Company Footprints

14.7.3. Production Locations

14.7.4. Product Portfolio

14.7.5. Competitors & Customers

14.7.6. Subsidiaries & Parent Organization

14.7.7. Recent Developments

14.7.8. Financial Analysis

14.7.9. Profitability

14.7.10. Revenue Share

14.8. Donaldson Co. Inc.

14.8.1. Company Overview

14.8.2. Company Footprints

14.8.3. Production Locations

14.8.4. Product Portfolio

14.8.5. Competitors & Customers

14.8.6. Subsidiaries & Parent Organization

14.8.7. Recent Developments

14.8.8. Financial Analysis

14.8.9. Profitability

14.8.10. Revenue Share

14.9. Dongguan Shenglian Filter Manufacturing Co. Ltd.

14.9.1. Company Overview

14.9.2. Company Footprints

14.9.3. Production Locations

14.9.4. Product Portfolio

14.9.5. Competitors & Customers

14.9.6. Subsidiaries & Parent Organization

14.9.7. Recent Developments

14.9.8. Financial Analysis

14.9.9. Profitability

14.9.10. Revenue Share

14.10. First Brands Group

14.10.1. Company Overview

14.10.2. Company Footprints

14.10.3. Production Locations

14.10.4. Product Portfolio

14.10.5. Competitors & Customers

14.10.6. Subsidiaries & Parent Organization

14.10.7. Recent Developments

14.10.8. Financial Analysis

14.10.9. Profitability

14.10.10. Revenue Share

14.11. General Motors Co.

14.11.1. Company Overview

14.11.2. Company Footprints

14.11.3. Production Locations

14.11.4. Product Portfolio

14.11.5. Competitors & Customers

14.11.6. Subsidiaries & Parent Organization

14.11.7. Recent Developments

14.11.8. Financial Analysis

14.11.9. Profitability

14.11.10. Revenue Share

14.12. Hengst SE

14.12.1. Company Overview

14.12.2. Company Footprints

14.12.3. Production Locations

14.12.4. Product Portfolio

14.12.5. Competitors & Customers

14.12.6. Subsidiaries & Parent Organization

14.12.7. Recent Developments

14.12.8. Financial Analysis

14.12.9. Profitability

14.12.10. Revenue Share

14.13. IHD Industries Pvt. Ltd.

14.13.1. Company Overview

14.13.2. Company Footprints

14.13.3. Production Locations

14.13.4. Product Portfolio

14.13.5. Competitors & Customers

14.13.6. Subsidiaries & Parent Organization

14.13.7. Recent Developments

14.13.8. Financial Analysis

14.13.9. Profitability

14.13.10. Revenue Share

14.14. Liuzhou Risun Filter Co. Ltd.

14.14.1. Company Overview

14.14.2. Company Footprints

14.14.3. Production Locations

14.14.4. Product Portfolio

14.14.5. Competitors & Customers

14.14.6. Subsidiaries & Parent Organization

14.14.7. Recent Developments

14.14.8. Financial Analysis

14.14.9. Profitability

14.14.10. Revenue Share

14.15. MAHLE GmbH

14.15.1. Company Overview

14.15.2. Company Footprints

14.15.3. Production Locations

14.15.4. Product Portfolio

14.15.5. Competitors & Customers

14.15.6. Subsidiaries & Parent Organization

14.15.7. Recent Developments

14.15.8. Financial Analysis

14.15.9. Profitability

14.15.10. Revenue Share

14.16. MANN HUMMEL International GmbH and Co. KG

14.16.1. Company Overview

14.16.2. Company Footprints

14.16.3. Production Locations

14.16.4. Product Portfolio

14.16.5. Competitors & Customers

14.16.6. Subsidiaries & Parent Organization

14.16.7. Recent Developments

14.16.8. Financial Analysis

14.16.9. Profitability

14.16.10. Revenue Share

14.17. Sewon Co. Ltd.

14.17.1. Company Overview

14.17.2. Company Footprints

14.17.3. Production Locations

14.17.4. Product Portfolio

14.17.5. Competitors & Customers

14.17.6. Subsidiaries & Parent Organization

14.17.7. Recent Developments

14.17.8. Financial Analysis

14.17.9. Profitability

14.17.10. Revenue Share

14.18. Sogefi Spa

14.18.1. Company Overview

14.18.2. Company Footprints

14.18.3. Production Locations

14.18.4. Product Portfolio

14.18.5. Competitors & Customers

14.18.6. Subsidiaries & Parent Organization

14.18.7. Recent Developments

14.18.8. Financial Analysis

14.18.9. Profitability

14.18.10. Revenue Share

14.19. UFI Filters Spa

14.19.1. Company Overview

14.19.2. Company Footprints

14.19.3. Production Locations

14.19.4. Product Portfolio

14.19.5. Competitors & Customers

14.19.6. Subsidiaries & Parent Organization

14.19.7. Recent Developments

14.19.8. Financial Analysis

14.19.9. Profitability

14.19.10. Revenue Share

14.20. Other Key Players

14.20.1. Company Overview

14.20.2. Company Footprints

14.20.3. Production Locations

14.20.4. Product Portfolio

14.20.5. Competitors & Customers

14.20.6. Subsidiaries & Parent Organization

14.20.7. Recent Developments

14.20.8. Financial Analysis

14.20.9. Profitability

14.20.10. Revenue Share

List of Tables

Table 1: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 3: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 4: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 5: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 7: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 9: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 11: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 12: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 13: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 14: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 15: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 16: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 17: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 19: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 21: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 22: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 23: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 24: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 25: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 26: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 27: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 29: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 31: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 32: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 33: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 34: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 35: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 36: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 37: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 38: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 39: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 41: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 42: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 43: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 44: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 45: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 46: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 47: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 48: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 49: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 2: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017-2031

Figure 3: Global Automotive Diesel Engine Filters Market, Incremental Opportunity, by Type, Value (US$ Mn), 2023-2031

Figure 4: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 5: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 6: Global Automotive Diesel Engine Filters Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2023-2031

Figure 7: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Diesel Engine Filters Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 10: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Automotive Diesel Engine Filters Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 13: Global Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Diesel Engine Filters Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 16: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 17: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017-2031

Figure 18: North America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Type, Value (US$ Mn), 2023-2031

Figure 19: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 20: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 21: North America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2023-2031

Figure 22: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 23: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 24: North America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 25: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 28: North America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 31: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 32: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017-2031

Figure 33: Europe Automotive Diesel Engine Filters Market, Incremental Opportunity, by Type, Value (US$ Mn), 2023-2031

Figure 34: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 35: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 36: Europe Automotive Diesel Engine Filters Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2023-2031

Figure 37: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 39: Europe Automotive Diesel Engine Filters Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 40: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Automotive Diesel Engine Filters Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 43: Europe Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Diesel Engine Filters Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 46: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 47: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017-2031

Figure 48: Middle East & Africa Automotive Diesel Engine Filters Market, Incremental Opportunity, by Type, Value (US$ Mn), 2023-2031

Figure 49: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 50: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 51: Middle East & Africa Automotive Diesel Engine Filters Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2023-2031

Figure 52: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 54: Middle East & Africa Automotive Diesel Engine Filters Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 55: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 57: Middle East & Africa Automotive Diesel Engine Filters Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 58: Middle East & Africa Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Automotive Diesel Engine Filters Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 61: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 62: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Type, 2017-2031

Figure 63: South America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Type, Value (US$ Mn), 2023-2031

Figure 64: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 65: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 66: South America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2023-2031

Figure 67: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 69: South America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 70: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 71: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Figure 72: South America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 73: South America Automotive Diesel Engine Filters Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: South America Automotive Diesel Engine Filters Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 75: South America Automotive Diesel Engine Filters Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031