Reports

Reports

Analysts’ Viewpoint on Market Scenario

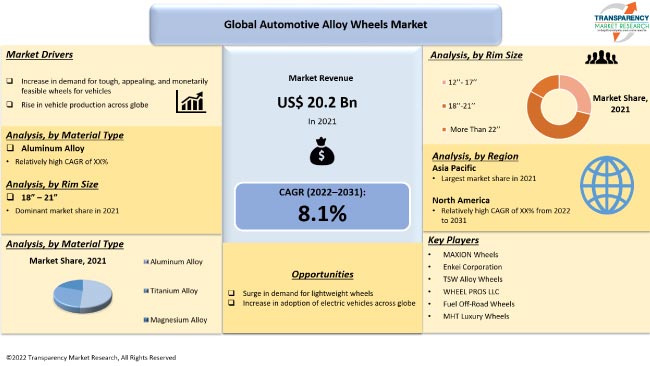

Increase in demand for lightweight vehicles from consumers across the globe is anticipated to increase the market value for automotive alloy wheels during the forecast period. Reduction of weight becomes a crucial requirement, as the amount of carbon dioxide emitted is proportionate to the size of the automobile and the amount of gasoline consumed. This has prompted several automakers to produce lightweight, cost-efficient, safe, and more environment-friendly vehicles.

Rapid urbanization, economic growth, and emergence of electric vehicles are key factors that are expected to accelerate market demand for automotive alloy wheels in the next few years. Alloy wheels are increasingly being preferred by consumers over factory-installed wheels due to their appealing appearance. Customization of vehicles is a current trend, which is likely to drive automotive alloy wheels business opportunities in the near future. However, high cost of wheels made of magnesium and aluminum alloys is expected to hamper market development during the forecast period.

Automotive wheels made from an alloy of aluminum or magnesium are known as alloy wheels. Metals and other elements are mixed to produce alloy wheels. Compared to pure metals, which are softer and more ductile, they often offer better strength. Aluminum alloy wheels are a popular choice for passenger cars due to their superior heat conductivity, anti-corrosive qualities, and weight advantage over steel wheels. Several manufacturers brand their products by molding their emblems into the rim. Market demand for automotive alloy wheels is expected to increase during the forecast period, owing to rise in spending power of customers and increase in the demand for lightweight vehicles across the globe.

Manufacturers are focusing on the manufacture of lightweight and fuel-efficient vehicles. Therefore, adoption of alloy wheels is crucial for automakers and suppliers around the globe. Steel wheels are heavier than alloy wheels, and their production is complex. Therefore, automakers are increasingly fitting alloy wheels to reduce weight and enhance fuel efficiency of their vehicles. Consequently, consumers are more likely to opt for vehicles with lightweight alloy wheels in the near future.

Vehicle production is rising at a rapid pace across the globe. Increase in demand for lightweight alloy wheels and rims in developing countries such as India, China, Brazil, and Mexico is projected to augment the automotive alloy wheels market size in the next few years. Furthermore, rise in implementation of emission standards in these nations is also expected to boost the demand for alloy wheels.

Popularity of electric cars is increasing across the globe. An electric vehicle must be lightweight to optimize the battery range. Electric cars are fitted with alloy wheels, as they help reduce the overall weight of the vehicle. Therefore, increase in electric car sales is likely to further boost the market demand for automotive alloy wheels in the near future.

Rise in disposable income of consumers and recovery of the world economy are major factors driving the demand for smart car alloy mag wheels. Wheel manufacturers are focusing on producing esthetically pleasing wheels due to rise in demand from consumers. Use of alloys enables the manufacture or fabrication of sophisticated designs and complex shapes. Rise in competition among automakers to produce tough and attractive wheels for vehicles is likely to fuel market development in the near future.

Alloy wheels have changed from being just a technical component to a stylish accent that enhances the vehicle's brand. The automotive alloy wheels industry is anticipated to grow during the forecast period due to the rise in market demand for automotive alloy wheels among young consumers.

In terms of material type, market segmentation comprises aluminum alloy, titanium alloy, and magnesium alloy. The aluminum alloy segment held 55.2% share in 2021. It is likely to dominate the global market during the forecast period.

Aluminum and nickel are combined to make aluminum alloy wheels. Most wheels currently are made of cast aluminum alloy, which means that molten aluminum is poured into a mold to make wheels. These wheels are more attractive than steel wheels. They are light in weight and strong. Additionally, aluminum is a highly adaptable material that offers several benefits. It is flexible and possesses high corrosion resistance, as well as strong electrical and thermal conductivity. Therefore, aluminum alloy wheels are expected to witness high demand globally during the forecast period.

Based on rim size, the automotive alloy wheels market has been segmented into 12”- 17”, 18”- 21”, and more than 22”. According to the automotive alloy wheels market forecast report, the 18”-21” segment is expected to account for 54.2% share and grow at a CAGR of more than 8.3% by the end of the forecast period.

The top 30 selling vehicles worldwide are dominated by SUVs and pickup trucks. These vehicles have larger rims than sedans and hatchbacks. Most SUVs and pickup trucks start out with 18" rims and increase to 21" in size. 18"- 21" inch wheels are more prevalent in the U.S. market; however, 17" and 18"-inch wheels are standard in top-selling passenger cars in Europe. Therefore, demand for 18"- 21" rime-sized wheels is increasing across the globe. Additionally, ongoing premiumization trend in India is likely to offer significant business opportunities for automotive alloy wheels manufacturers in the near future.

The automotive alloy wheel market size in Asia Pacific is estimated to grow at a rapid pace in the near future due to the expansion of the automotive sector and rise in living standards, particularly in nations such as Japan, China, and India. Moreover, market expansion in the region is anticipated to be aided by the lucrative presence of two-wheeler manufacturers in the region.

North America is anticipated to hold significant market share during the forecast period due to the increase in popularity of alloy wheels in the region. High spending incomes of consumers in the U.S. and Canada is another factor anticipated to boost market progress during the projection period.

The automotive alloy wheel market in Europe is anticipated to expand considerably in the next few years, owing to the presence of prominent automakers in the region. The alloy wheel industry in Middle East & Africa is estimated to grow at a moderate pace in the near future.

The global market is consolidated, with a large number of manufacturers controlling the market share. Major companies have started adopting new technologies to increase the market value for automotive alloy wheels. Important strategies adopted by leading players include mergers, acquisitions, and expansion of product portfolios. Automotive alloy wheels market forecast report highlights major drives, market opportunities, leading regions, etc.

MAXION Wheels, BORBET GmbH, Enkei Corporation, MHT Luxury Wheels, RONAL GROUP, Stamford Sport Wheels, Superior Industries International, Inc., TSW Alloy Wheels, Fuel Off-Road Wheels, CITIC Dicastal Wheel Manufacturing Co, WHEELPROS LLC, and Alcoa Wheels are some of the prominent players operating in the market.

Key players profiled in the automotive alloy wheels business report are based on parameters such as product portfolio, company overview, financial overview, business segments, business strategies, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 20.2 Bn |

|

Market Forecast Value in 2031 |

US$ 44.2 Bn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Automotive Alloy Wheels Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 20.2 Bn in 2021.

It is expected to advance at a CAGR of 8.1% by 2031.

It is likely to be valued at US$ 44.2 Bn by 2031.

Increase in demand for tough, appealing, and cost-effective wheels for vehicles and rise in vehicle production across the globe.

The aluminum alloy segment accounted for 55.2% share in 2021.

Asia Pacific is a highly lucrative region in the market.

MAXION Wheels, BORBET GmbH, Enkei Corporation, MHT Luxury Wheels, RONAL GROUP, Stamford Sport Wheels, Superior Industries International, Inc., TSW Alloy Wheels, Fuel Off-Road Wheels, CITIC Dicastal Wheel Manufacturing Co, WHEELPROS LLC, and Alcoa Wheels.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Volume (Thousand Units) and Value (US$ Bn), 2017-2031

1.2. Competitive Dashboard Analysis

1.3. Who Supplies Whom

1.3.1. List of Raw Material Supplier à Automotive Alloy Wheels Manufacturer à Vehicle Manufacturer (OEM)

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.6.3. Value Chain Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Cost Structure Analysis

2.10. Profit Margin Analysis

3. COVID-19 Impact Analysis – Automotive Alloy Wheels

4. Global Automotive Alloy Wheels Market, By Vehicle Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

4.2.1. Two Wheeler

4.2.2. Passenger Vehicle

4.2.2.1. Hatchback

4.2.2.2. Sedan

4.2.2.3. Utility Vehicle

4.2.3. Light Commercial Vehicle

4.2.4. Truck

4.2.5. Bus & Coach

5. Global Automotive Alloy Wheels Market, By Finishing Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Finishing Type

5.2.1. Powder Coated/Painted Lacquered

5.2.2. Diamond Cut

5.2.3. Spilt Wheel

5.2.4. Chrome Wheel

5.2.5. Anodized

5.2.6. Others

6. Global Automotive Alloy Wheels Market, By Rim Size

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Rim Size

6.2.1. 12’’- 17’’

6.2.2. 18’’-21’’

6.2.3. More Than 22’’

7. Global Automotive Alloy Wheels Market, By Material Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Material Type

7.2.1. Aluminum Alloy

7.2.2. Titanium Alloy

7.2.3. Magnesium Alloy

8. Global Automotive Alloy Wheels Market, By Sales Channel

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Sales Channel

8.2.1. OEM

8.2.2. Aftermarket

9. Global Automotive Alloy Wheels Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Alloy Wheels Market

10.1. Market Snapshot

10.2. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.2.1. Two Wheeler

10.2.2. Passenger Vehicle

10.2.2.1. Hatchback

10.2.2.2. Sedan

10.2.2.3. Utility Vehicle

10.2.3. Light Commercial Vehicle

10.2.4. Truck

10.2.5. Bus & Coach

10.3. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Finishing Type

10.3.1. Powder Coated/Painted Lacquered

10.3.2. Diamond Cut

10.3.3. Spilt Wheel

10.3.4. Chrome Wheel

10.3.5. Anodized

10.3.6. Others

10.4. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Rim Size

10.4.1. 12’’- 17’’

10.4.2. 18’’-21’’

10.4.3. More Than 22’’

10.5. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Material Type

10.5.1. Aluminum Alloy

10.5.2. Titanium Alloy

10.5.3. Magnesium Alloy

10.6. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Sales Channel

10.6.1. OEM

10.6.2. Aftermarket

10.7. Key Country Analysis – North America Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Automotive Alloy Wheels Market

11.1. Market Snapshot

11.2. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.2.1. Two Wheeler

11.2.2. Passenger Vehicle

11.2.2.1. Hatchback

11.2.2.2. Sedan

11.2.2.3. Utility Vehicle

11.2.3. Light Commercial Vehicle

11.2.4. Truck

11.2.5. Bus & Coach

11.3. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Finishing Type

11.3.1. Powder Coated/Painted Lacquered

11.3.2. Diamond Cut

11.3.3. Spilt Wheel

11.3.4. Chrome Wheel

11.3.5. Anodized

11.3.6. Others

11.4. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Rim Size

11.4.1. 12’’- 17’’

11.4.2. 18’’-21’’

11.4.3. More Than 22’’

11.5. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Material Type

11.5.1. Aluminum Alloy

11.5.2. Titanium Alloy

11.5.3. Magnesium Alloy

11.6. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.6.1. OEM

11.6.2. Aftermarket

11.7. Key Country Analysis – Europe Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Automotive Alloy Wheels Market

12.1. Market Snapshot

12.2. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.2.1. Two Wheeler

12.2.2. Passenger Vehicle

12.2.2.1. Hatchback

12.2.2.2. Sedan

12.2.2.3. Utility Vehicle

12.2.3. Light Commercial Vehicle

12.2.4. Truck

12.2.5. Bus & Coach

12.3. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Finishing Type

12.3.1. Powder Coated/Painted Lacquered

12.3.2. Diamond Cut

12.3.3. Spilt Wheel

12.3.4. Chrome Wheel

12.3.5. Anodized

12.3.6. Others

12.4. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Rim Size

12.4.1. 12’’- 17’’

12.4.2. 18’’-21’’

12.4.3. More Than 22’’

12.5. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Material Type

12.5.1. Aluminum Alloy

12.5.2. Titanium Alloy

12.5.3. Magnesium Alloy

12.6. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Key Country Analysis – Asia Pacific Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Alloy Wheels Market

13.1. Market Snapshot

13.2. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.2.1. Two Wheeler

13.2.2. Passenger Vehicle

13.2.2.1. Hatchback

13.2.2.2. Sedan

13.2.2.3. Utility Vehicle

13.2.3. Light Commercial Vehicle

13.2.4. Truck

13.2.5. Bus & Coach

13.3. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Finishing Type

13.3.1. Powder Coated/Painted Lacquered

13.3.2. Diamond Cut

13.3.3. Spilt Wheel

13.3.4. Chrome Wheel

13.3.5. Anodized

13.3.6. Others

13.4. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Rim Size

13.4.1. 12’’- 17’’

13.4.2. 18’’-21’’

13.4.3. More Than 22’’

13.5. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Material Type

13.5.1. Aluminum Alloy

13.5.2. Titanium Alloy

13.5.3. Magnesium Alloy

13.6. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis – Middle East & Africa Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Automotive Alloy Wheels Market

14.1. Market Snapshot

14.2. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.2.1. Two Wheeler

14.2.2. Passenger Vehicle

14.2.2.1. Hatchback

14.2.2.2. Sedan

14.2.2.3. Utility Vehicle

14.2.3. Light Commercial Vehicle

14.2.4. Truck

14.2.5. Bus & Coach

14.3. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Finishing Type

14.3.1. Powder Coated/Painted Lacquered

14.3.2. Diamond Cut

14.3.3. Spilt Wheel

14.3.4. Chrome Wheel

14.3.5. Anodized

14.3.6. Others

14.4. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Rim Size

14.4.1. 12’’- 17’’

14.4.2. 18’’-21’’

14.4.3. More Than 22’’

14.5. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Material Type

14.5.1. Aluminum Alloy

14.5.2. Titanium Alloy

14.5.3. Magnesium Alloy

14.6. Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031, By Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis – South America Automotive Alloy Wheels Market Size Analysis & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2021

15.2. Pricing comparison among key players

15.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1.1. Alcoa Wheels

16.1.1.1. Company Overview

16.1.1.2. Company Footprints

16.1.1.3. Production Locations

16.1.1.4. Product Portfolio

16.1.1.5. Competitors & Customers

16.1.1.6. Subsidiaries & Parent Organization

16.1.1.7. Recent Developments

16.1.1.8. Financial Analysis

16.1.1.9. Profitability

16.1.1.10. Revenue Share

16.1.2. ARCONIC

16.1.2.1. Company Overview

16.1.2.2. Company Footprints

16.1.2.3. Production Locations

16.1.2.4. Product Portfolio

16.1.2.5. Competitors & Customers

16.1.2.6. Subsidiaries & Parent Organization

16.1.2.7. Recent Developments

16.1.2.8. Financial Analysis

16.1.2.9. Profitability

16.1.2.10. Revenue Share

16.1.3. BBS GmbH

16.1.3.1. Company Overview

16.1.3.2. Company Footprints

16.1.3.3. Production Locations

16.1.3.4. Product Portfolio

16.1.3.5. Competitors & Customers

16.1.3.6. Subsidiaries & Parent Organization

16.1.3.7. Recent Developments

16.1.3.8. Financial Analysis

16.1.3.9. Profitability

16.1.3.10. Revenue Share

16.1.4. BORBET GmbH

16.1.4.1. Company Overview

16.1.4.2. Company Footprints

16.1.4.3. Production Locations

16.1.4.4. Product Portfolio

16.1.4.5. Competitors & Customers

16.1.4.6. Subsidiaries & Parent Organization

16.1.4.7. Recent Developments

16.1.4.8. Financial Analysis

16.1.4.9. Profitability

16.1.4.10. Revenue Share

16.1.5. CITIC Dicastal Wheel Manufacturing Co

16.1.5.1. Company Overview

16.1.5.2. Company Footprints

16.1.5.3. Production Locations

16.1.5.4. Product Portfolio

16.1.5.5. Competitors & Customers

16.1.5.6. Subsidiaries & Parent Organization

16.1.5.7. Recent Developments

16.1.5.8. Financial Analysis

16.1.5.9. Profitability

16.1.5.10. Revenue Share

16.1.6. Enkei Corporation

16.1.6.1. Company Overview

16.1.6.2. Company Footprints

16.1.6.3. Production Locations

16.1.6.4. Product Portfolio

16.1.6.5. Competitors & Customers

16.1.6.6. Subsidiaries & Parent Organization

16.1.6.7. Recent Developments

16.1.6.8. Financial Analysis

16.1.6.9. Profitability

16.1.6.10. Revenue Share

16.1.7. Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd.

16.1.7.1. Company Overview

16.1.7.2. Company Footprints

16.1.7.3. Production Locations

16.1.7.4. Product Portfolio

16.1.7.5. Competitors & Customers

16.1.7.6. Subsidiaries & Parent Organization

16.1.7.7. Recent Developments

16.1.7.8. Financial Analysis

16.1.7.9. Profitability

16.1.7.10. Revenue Share

16.1.8. Fuel Off-Road Wheels

16.1.8.1. Company Overview

16.1.8.2. Company Footprints

16.1.8.3. Production Locations

16.1.8.4. Product Portfolio

16.1.8.5. Competitors & Customers

16.1.8.6. Subsidiaries & Parent Organization

16.1.8.7. Recent Developments

16.1.8.8. Financial Analysis

16.1.8.9. Profitability

16.1.8.10. Revenue Share

16.1.9. Japan Wheels

16.1.9.1. Company Overview

16.1.9.2. Company Footprints

16.1.9.3. Production Locations

16.1.9.4. Product Portfolio

16.1.9.5. Competitors & Customers

16.1.9.6. Subsidiaries & Parent Organization

16.1.9.7. Recent Developments

16.1.9.8. Financial Analysis

16.1.9.9. Profitability

16.1.9.10. Revenue Share

16.1.10. Kawashima Group Co., Ltd.

16.1.10.1. Company Overview

16.1.10.2. Company Footprints

16.1.10.3. Production Locations

16.1.10.4. Product Portfolio

16.1.10.5. Competitors & Customers

16.1.10.6. Subsidiaries & Parent Organization

16.1.10.7. Recent Developments

16.1.10.8. Financial Analysis

16.1.10.9. Profitability

16.1.10.10. Revenue Share

16.1.11. Kosei Aluminum Co., Ltd.

16.1.11.1. Company Overview

16.1.11.2. Company Footprints

16.1.11.3. Production Locations

16.1.11.4. Product Portfolio

16.1.11.5. Competitors & Customers

16.1.11.6. Subsidiaries & Parent Organization

16.1.11.7. Recent Developments

16.1.11.8. Financial Analysis

16.1.11.9. Profitability

16.1.11.10. Revenue Share

16.1.12. MAXION Wheels

16.1.12.1. Company Overview

16.1.12.2. Company Footprints

16.1.12.3. Production Locations

16.1.12.4. Product Portfolio

16.1.12.5. Competitors & Customers

16.1.12.6. Subsidiaries & Parent Organization

16.1.12.7. Recent Developments

16.1.12.8. Financial Analysis

16.1.12.9. Profitability

16.1.12.10. Revenue Share

16.1.13. MHT Luxury Wheels

16.1.13.1. Company Overview

16.1.13.2. Company Footprints

16.1.13.3. Production Locations

16.1.13.4. Product Portfolio

16.1.13.5. Competitors & Customers

16.1.13.6. Subsidiaries & Parent Organization

16.1.13.7. Recent Developments

16.1.13.8. Financial Analysis

16.1.13.9. Profitability

16.1.13.10. Revenue Share

16.1.14. NAPREJAPAN

16.1.14.1. Company Overview

16.1.14.2. Company Footprints

16.1.14.3. Production Locations

16.1.14.4. Product Portfolio

16.1.14.5. Competitors & Customers

16.1.14.6. Subsidiaries & Parent Organization

16.1.14.7. Recent Developments

16.1.14.8. Financial Analysis

16.1.14.9. Profitability

16.1.14.10. Revenue Share

16.1.15. RAYS Co., Ltd.

16.1.15.1. Company Overview

16.1.15.2. Company Footprints

16.1.15.3. Production Locations

16.1.15.4. Product Portfolio

16.1.15.5. Competitors & Customers

16.1.15.6. Subsidiaries & Parent Organization

16.1.15.7. Recent Developments

16.1.15.8. Financial Analysis

16.1.15.9. Profitability

16.1.15.10. Revenue Share

16.1.16. RONAL GROUP

16.1.16.1. Company Overview

16.1.16.2. Company Footprints

16.1.16.3. Production Locations

16.1.16.4. Product Portfolio

16.1.16.5. Competitors & Customers

16.1.16.6. Subsidiaries & Parent Organization

16.1.16.7. Recent Developments

16.1.16.8. Financial Analysis

16.1.16.9. Profitability

16.1.16.10. Revenue Share

16.1.17. Stamford Sport Wheels

16.1.17.1. Company Overview

16.1.17.2. Company Footprints

16.1.17.3. Production Locations

16.1.17.4. Product Portfolio

16.1.17.5. Competitors & Customers

16.1.17.6. Subsidiaries & Parent Organization

16.1.17.7. Recent Developments

16.1.17.8. Financial Analysis

16.1.17.9. Profitability

16.1.17.10. Revenue Share

16.1.18. Status Wheels

16.1.18.1. Company Overview

16.1.18.2. Company Footprints

16.1.18.3. Production Locations

16.1.18.4. Product Portfolio

16.1.18.5. Competitors & Customers

16.1.18.6. Subsidiaries & Parent Organization

16.1.18.7. Recent Developments

16.1.18.8. Financial Analysis

16.1.18.9. Profitability

16.1.18.10. Revenue Share

16.1.19. Superior Industries International, Inc.

16.1.19.1. Company Overview

16.1.19.2. Company Footprints

16.1.19.3. Production Locations

16.1.19.4. Product Portfolio

16.1.19.5. Competitors & Customers

16.1.19.6. Subsidiaries & Parent Organization

16.1.19.7. Recent Developments

16.1.19.8. Financial Analysis

16.1.19.9. Profitability

16.1.19.10. Revenue Share

16.1.20. Tan-ei-sya

16.1.20.1. Company Overview

16.1.20.2. Company Footprints

16.1.20.3. Production Locations

16.1.20.4. Product Portfolio

16.1.20.5. Competitors & Customers

16.1.20.6. Subsidiaries & Parent Organization

16.1.20.7. Recent Developments

16.1.20.8. Financial Analysis

16.1.20.9. Profitability

16.1.20.10. Revenue Share

16.1.21. TOPY INDUSTRIES LIMITED

16.1.21.1. Company Overview

16.1.21.2. Company Footprints

16.1.21.3. Production Locations

16.1.21.4. Product Portfolio

16.1.21.5. Competitors & Customers

16.1.21.6. Subsidiaries & Parent Organization

16.1.21.7. Recent Developments

16.1.21.8. Financial Analysis

16.1.21.9. Profitability

16.1.21.10. Revenue Share

16.1.22. TSW Alloy Wheels

16.1.22.1. Company Overview

16.1.22.2. Company Footprints

16.1.22.3. Production Locations

16.1.22.4. Product Portfolio

16.1.22.5. Competitors & Customers

16.1.22.6. Subsidiaries & Parent Organization

16.1.22.7. Recent Developments

16.1.22.8. Financial Analysis

16.1.22.9. Profitability

16.1.22.10. Revenue Share

16.1.23. Washi Beam

16.1.23.1. Company Overview

16.1.23.2. Company Footprints

16.1.23.3. Production Locations

16.1.23.4. Product Portfolio

16.1.23.5. Competitors & Customers

16.1.23.6. Subsidiaries & Parent Organization

16.1.23.7. Recent Developments

16.1.23.8. Financial Analysis

16.1.23.9. Profitability

16.1.23.10. Revenue Share

16.1.24. WHEELPROS LLC

16.1.24.1. Company Overview

16.1.24.2. Company Footprints

16.1.24.3. Production Locations

16.1.24.4. Product Portfolio

16.1.24.5. Competitors & Customers

16.1.24.6. Subsidiaries & Parent Organization

16.1.24.7. Recent Developments

16.1.24.8. Financial Analysis

16.1.24.9. Profitability

16.1.24.10. Revenue Share

List of Tables

Table 1: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 3: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Table 4: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017‒2031

Table 5: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 6: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 7: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 8: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 9: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 14: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 15: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Table 16: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017‒2031

Table 17: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 18: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 19: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 20: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 21: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 23: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 26: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 27: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Table 28: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017‒2031

Table 29: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 30: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 31: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 32: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 33: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 35: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 39: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Table 40: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017‒2031

Table 41: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 42: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 43: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 44: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 45: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 50: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 51: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Table 52: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017‒2031

Table 53: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 54: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 55: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 56: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 57: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 61: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 62: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 63: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Table 64: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017‒2031

Table 65: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 66: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 67: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Table 68: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017‒2031

Table 69: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 71: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 3: Global Automotive Alloy Wheels Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Figure 5: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017-2031

Figure 6: Global Automotive Alloy Wheels Market, Incremental Opportunity, by Finishing Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 8: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 9: Global Automotive Alloy Wheels Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 11: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 12: Global Automotive Alloy Wheels Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Automotive Alloy Wheels Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 16: Global Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Alloy Wheels Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 21: North America Automotive Alloy Wheels Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Figure 23: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017-2031

Figure 24: North America Automotive Alloy Wheels Market, Incremental Opportunity, by Finishing Type, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 26: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 27: North America Automotive Alloy Wheels Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 29: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 30: North America Automotive Alloy Wheels Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Automotive Alloy Wheels Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 34: North America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Alloy Wheels Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: Europe Automotive Alloy Wheels Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Figure 41: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017-2031

Figure 42: Europe Automotive Alloy Wheels Market, Incremental Opportunity, by Finishing Type, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 44: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 45: Europe Automotive Alloy Wheels Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 46: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 47: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 48: Europe Automotive Alloy Wheels Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 49: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Automotive Alloy Wheels Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 52: Europe Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Alloy Wheels Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific Automotive Alloy Wheels Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Figure 59: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017-2031

Figure 60: Asia Pacific Automotive Alloy Wheels Market, Incremental Opportunity, by Finishing Type, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 62: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 63: Asia Pacific Automotive Alloy Wheels Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 65: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 66: Asia Pacific Automotive Alloy Wheels Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Automotive Alloy Wheels Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Alloy Wheels Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 74: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 75: Middle East & Africa Automotive Alloy Wheels Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Figure 77: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017-2031

Figure 78: Middle East & Africa Automotive Alloy Wheels Market, Incremental Opportunity, by Finishing Type, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 80: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 81: Middle East & Africa Automotive Alloy Wheels Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 83: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 84: Middle East & Africa Automotive Alloy Wheels Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Alloy Wheels Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Alloy Wheels Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 91: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 92: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 93: South America Automotive Alloy Wheels Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 94: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Finishing Type, 2017-2031

Figure 95: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Finishing Type, 2017-2031

Figure 96: South America Automotive Alloy Wheels Market, Incremental Opportunity, by Finishing Type, Value (US$ Bn), 2022-2031

Figure 97: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 98: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 99: South America Automotive Alloy Wheels Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 100: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Material Type, 2017-2031

Figure 101: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 102: South America Automotive Alloy Wheels Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 103: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Automotive Alloy Wheels Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 106: South America Automotive Alloy Wheels Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Alloy Wheels Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Alloy Wheels Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031