Reports

Reports

Analyst Viewpoint

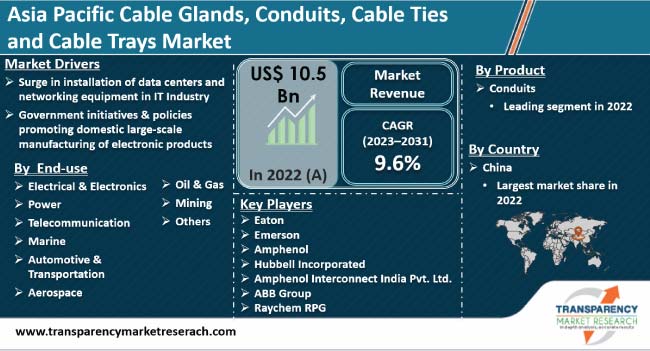

Rise in demand for robust and efficient cable management solutions across industries and surge in infrastructure development are driving Asia Pacific cable clamps, conduits, cable ties, and cable trays market. Cable clamps and conduits ensure organized and secure cable routing, minimizing the risk of damage and enhancing overall safety. Surge in installation of data centers and networking equipment in the IT Industry is another major factor propelling market expansion. Furthermore, government initiatives & policies promoting domestic large-scale manufacturing of electronic products are expected to fuel to Asia Pacific cable clamps, conduits, cable ties, and cable trays market size during the forecast period.

Development of smart and environmentally-friendly cable management solutions offers lucrative opportunities to market players. Companies are focusing on collaborations to drive innovation and enhance reliability of cable management solutions across transportation, industrial, and robotics applications.

Asia Pacific’s electronics sector has experienced robust growth in the past few years. Each electronic manufacturing plan has been carefully devised to incentivize the electronics manufacturing industry in order to facilitate large-scale manufacturing, development of a supply chain ecosystem, and building of new manufacturing clusters in the country.

Growth of large-scale electronics manufacturing in India, China, Japan, and South Korea is expected to propel demand, innovation, and development of cable management systems. As the electronics manufacturing sector expands, the need for efficient and organized cable management becomes crucial to ensure reliable operation of electronic devices, systems, and infrastructure.

Electronics manufacturing spans various sectors, including consumer electronics, automotive, industrial automation, and telecommunications. Each sector's unique requirements for cable management systems could lead to the development of specialized solutions. As electronic products become more compact and complex, integrating cable management considerations into product design becomes essential.

Reliable data centers and networking systems are important owing to increase in remote work and digital connectivity. Rise in usage of smartphones, online services, e-commerce, and digital transactions has increased data consumption. Moreover, businesses are adopting cloud-based solutions, which is driving the number of data centers. This, in turn, is increasing the need for effective cable management to support the infrastructure.

As digital landscape continues to evolve, expansion of data centers and networking equipment is set to play a pivotal role in driving demand for efficient, scalable, and reliable cable management systems to support the region’s growing data needs and digital transformation efforts.

Businesses are digitizing their operations, which has led to increased data storage, processing, and communication requirements. India and China have one of the world's largest and fastest-growing internet user bases. This surge in online activity, from e-commerce to social media, requires the support of data centers and networking equipment for seamless connectivity.

Development of smart cities and growth of the Internet of Things (IoT) require robust networking infrastructure and data centers to support the interconnected systems and devices. Furthermore, implementation of 5G technology demands improved networking infrastructure, including data centers, to handle the increased data speeds and network requirements.

As data usage, digital services, and cloud computing continue to grow, data centers and networking infrastructure are being scaled up to meet the increasing demands for connectivity, processing power, and storage. This has created various challenges related to cable organization, protection, and overall system efficiency, all of which are addressed by cable management systems.

Industries in Asia Pacific are undergoing digital transformation, which necessitates robust networking infrastructure and data center capabilities. Proper cable management ensures that these networks function seamlessly and reliably.

Modern electronic devices are becoming increasingly complex due to inclusion of numerous components and subsystems. Proper cable management is essential to prevent cable clutter, tangling, and interference, which can adversely affect device performance and reliability.

In high-volume manufacturing, efficient assembly processes are crucial. Well-designed cable management solutions streamline the assembly process by ensuring cables are easily routed, secured, and connected, reducing production time and minimizing errors.

Proper cable management enhances the overall quality and durability of electronics products. It reduces the risk of cable damage, short circuits, and other issues that could lead to product failure, recalls, or safety hazards.

Government initiatives such as "Make in India" encourage domestic electronics manufacturing. This leads to increased production volumes, which in turn drives demand for cable management systems to support the manufacturing processes.

Growth of large-scale electronics manufacturing in India is creating a substantial demand for cable management systems to ensure efficient production processes, high-quality products, compliance with regulations, and reliable performance of electronic devices and systems.

In terms of product, the conduits segment accounted for the largest Asia Pacific cable glands, cable ties, and cable trays market share in 2022. This is ascribed to their indispensable role in ensuring organized and protected routing of cables.

Conduits provide a crucial protective casing for electrical wires, shielding them from environmental factors, physical damage, and interference. The versatility of conduits, available in various materials such as metal, plastic, and fiber, allows for customization based on specific industry needs.

Rapid urbanization and infrastructure development projects in Asia Pacific contribute significantly to the surge in demand for conduits, particularly in construction, manufacturing, and energy sectors.

The flexibility and adaptability of conduits make them an essential component in diverse applications, ranging from commercial buildings to industrial facilities, driving their dominant Asia Pacific cable glands, conduits, cable ties, and cable trays market share.

Dominance of the conduits segment is further underscored by their compliance with safety and regulatory standards, ensuring the integrity of electrical systems. As industries increasingly prioritize safety and reliability in cable management, conduits emerge as a preferred solution to safeguard wiring and minimize the risk of electrical hazards. The burgeoning demand for conduits reflects not only their protective function, but also their role in facilitating maintenance and upgrades, thereby solidifying their position in the cable management ecosystem across the Asia Pacific.

Based on material, the plastic segment dominated Asia Pacific cable glands, cable ties, and cable trays market in 2022. This can be ascribed to advantages of plastic, including cost-effectiveness, lightweight nature, and exceptional versatility.

Industrial and infrastructural development is growing rapidly in Asia Pacific. Hence, demand for cable management solutions that are not only efficient, but also economically viable has fueled widespread adoption of plastic materials.

Plastics, such as polyvinyl chloride (PVC) and polyethylene, offer resilience against corrosion, ease of installation, and durability, making them a preferred choice across a spectrum of applications.

Adaptability of plastic to various environmental conditions and resistance to chemicals also contribute to the dominance of the segment. Flexibility in design and molding capabilities enables manufacturers to create intricate and customized cable management solutions to meet specific industry needs.

As industries in Asia Pacific continue to prioritize cost-effective and reliable cable management systems, the plastic segment is expected to dominate the cable glands, conduits, cable ties, and cable trays market, driven by optimal balance of performance, affordability, and adaptability of plastic components to the diverse requirements of cable management across sectors.

As per cable glands, conduits, cable ties, and cable trays market research, Asia Pacific exhibits dynamic variations across countries, reflecting diverse industrial landscapes, and infrastructure development stages.

China, as a manufacturing and industrial powerhouse, accounted for the largest share of the market in the region in 2022. The country’s rapid urbanization and infrastructure expansion contribute significantly to the demand for cable management solutions. With a focus on smart cities and technological advancements, China is a robust market for cable glands, conduits, ties, and trays.

India’s growing construction and industrial sectors are driving the cable glands, conduits, cable ties, and cable trays market growth in Asia Pacific. The market in the country is driven by initiatives such as “Make in India” and urbanization projects. The need for reliable and efficient cable management solutions is quite evident, making cable glands, conduits, ties, and trays pivotal in the country’s electrical infrastructure development.

The market for cable management solutions in Asia Pacific varies across countries, reflecting a combination of industrialization levels, infrastructure needs, and technological advancements. Each country’s unique dynamics contribute to the overall growth and diversification of the cable glands, conduits, cable ties, and cable trays market in the region.

Asia Pacific cable glands, conduits, cable ties, and cable trays market is highly fragmented, with presence of large number of players in the market. Manufacturers are investing significantly in comprehensive research & development activities. Companies are collaborating strategically to accelerate innovation and expand their business lines in the region.

Eaton, Emerson, Hubbell Incorporated, Amphenol Interconnect India Pvt. Ltd., CMP Products, ABB Group, Raychem RPG, Aurum Alloys, Allied Power Solutions, Essentra (India) Private Limited, PARTEX MARKING SYSTEMS, and Metalmech Engineering are the prominent players in the Asia Pacific cable glands, conduits, cable ties, and cable trays market.

Each of these players has been profiled in the cable glands, conduits, cable ties, and cable trays market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 10.5 Bn |

| Forecast (Value) in 2031 | US$ 24.1 Bn |

| Growth Rate (CAGR) | 9.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2021 |

| Quantitative Tons | US$ Bn for Value & Mn Units for Volume |

| Market Analysis | It includes cross-segment analysis at country level. Furthermore, the qualitative analysis includes drivers, restraints, market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 10.5 Bn in 2022

It is projected to advance at a CAGR of 9.6% from 2023 to 2031

Surge in installation of data centers and networking equipment in IT Industry and government initiatives & policies promoting domestic large-scale manufacturing of electronic products.

Conduits was the largest product segment in 2022.

China was the most lucrative country in 2022.

Eaton, Emerson, Hubbell Incorporated, Amphenol Interconnect India Pvt. Ltd., CMP Products, ABB Group, Raychem RPG, Aurum Alloys, Allied Power Solutions, Essentra (India) Private Limited, PARTEX MARKING SYSTEMS, and Metalmech Engineering

1. Executive Summary

1.1. Asia Pacific Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Analysis and Forecast, 2023-2033

2.6.1. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units)

2.6.2. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.11.1. Cost Structure Analysis

3. Economic Recovery Post COVID-19 Impact

3.1. Impact on the Supply Chain of the Cable Glands, Conduits, Cable Ties, and Cable Trays

3.2. Impact on the Demand of Cable Glands, Conduits, Cable Ties, and Cable Trays– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis (Mn Units), 2022

5.1. Asia Pacific

6. Price Trend Analysis and Forecast (US$/Unit), 2023-2033

6.1. Price Comparison Analysis by Product

7. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Analysis and Forecast, by Product, 2023–2033

7.1. Introduction and Definitions

7.2. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

7.2.1. Cable Glands

7.2.1.1. Waterproof

7.2.1.2. Explosion Proof

7.2.1.3. Electromagnetic Compatibility

7.2.1.4. Armored

7.2.1.5. Spiral Flexible

7.2.1.6. Breathable

7.2.1.7. Others

7.2.2. Conduits

7.2.2.1. Metal Electrical Conduits

7.2.2.2. Non-metal Electrical Conduits

7.2.3. Cable Ties

7.2.3.1. Plastic Cable Ties

7.2.3.1.1. Standard Cable Ties

7.2.3.1.2. Releasable Cable Ties

7.2.3.1.3. Mounting Cable Ties

7.2.3.2. Heavy-duty Cable Ties

7.2.3.3. Stainless Steel Cable Ties

7.2.3.4. Others

7.2.4. Cable Trays

7.2.4.1. Ladder

7.2.4.2. Perforated Cable

7.2.4.3. Solid Background

7.2.4.4. Basket

7.2.4.5. Channel

7.2.4.6. Others

7.3. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Attractiveness, by Product

8. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Analysis and Forecast, by Material, 2023–2033

8.1. Introduction and Definitions

8.2. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

8.2.1. Stainless Steel

8.2.2. Brass

8.2.3. Aluminum

8.2.4. Plastic

8.2.4.1. Polyvinyl Chloride (PVC)

8.2.4.2. Polyamide (Nylon)

8.2.4.3. Others

8.2.5. Rubber

8.2.6. Others

8.3. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Attractiveness, by Material

9. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Analysis and Forecast, by End-use, 2023–2033

9.1. Introduction and Definitions

9.2. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

9.2.1. Electrical & Electronics

9.2.2. Power

9.2.3. Telecommunication

9.2.4. Marine

9.2.5. Automotive & Transportation

9.2.6. Aerospace

9.2.7. Oil & Gas

9.2.8. Mining

9.2.9. Others

9.3. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Attractiveness, by End-use

10. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Analysis and Forecast, by Country 2023–2033

10.1. Key Findings

10.2. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Country, 2023-2033

10.2.1. China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

10.2.2. China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

10.2.3. China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

10.2.4. Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

10.2.5. Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

10.2.6. Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

10.2.7. India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

10.2.8. India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

10.2.9. India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

10.2.10. ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

10.2.11. ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

10.2.12. ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

10.2.13. Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

10.2.14. Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

10.2.15. Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

10.3. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Attractiveness Analysis

11. Competition Landscape

11.1. Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Company Market Share Analysis, 2022

11.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.2.1. Amphenol Interconnect India Pvt. Ltd.

11.2.1.1. Company Revenue

11.2.1.2. Business Overview

11.2.1.3. Product Segments

11.2.1.4. Geographic Footprint

11.2.1.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.1.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.2. BARTEC

11.2.2.1. Company Revenue

11.2.2.2. Business Overview

11.2.2.3. Product Segments

11.2.2.4. Geographic Footprint

11.2.2.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.2.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.3. CMP Products

11.2.3.1. Company Revenue

11.2.3.2. Business Overview

11.2.3.3. Product Segments

11.2.3.4. Geographic Footprint

11.2.3.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.3.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.4. Eaton

11.2.4.1. Company Revenue

11.2.4.2. Business Overview

11.2.4.3. Product Segments

11.2.4.4. Geographic Footprint

11.2.4.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.4.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.5. ABB Group

11.2.5.1. Company Revenue

11.2.5.2. Business Overview

11.2.5.3. Product Segments

11.2.5.4. Geographic Footprint

11.2.5.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.5.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.6. Emerson

11.2.6.1. Company Revenue

11.2.6.2. Business Overview

11.2.6.3. Product Segments

11.2.6.4. Geographic Footprint

11.2.6.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.6.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.7. Hubbell Incorporated

11.2.7.1. Company Revenue

11.2.7.2. Business Overview

11.2.7.3. Product Segments

11.2.7.4. Geographic Footprint

11.2.7.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.7.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.8. Raychem RPG

11.2.8.1. Company Revenue

11.2.8.2. Business Overview

11.2.8.3. Product Segments

11.2.8.4. Geographic Footprint

11.2.8.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.8.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.9. Aurum Alloys

11.2.9.1. Company Revenue

11.2.9.2. Business Overview

11.2.9.3. Product Segments

11.2.9.4. Geographic Footprint

11.2.9.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.9.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.10. Allied Power Solutions

11.2.10.1. Company Revenue

11.2.10.2. Business Overview

11.2.10.3. Product Segments

11.2.10.4. Geographic Footprint

11.2.10.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.10.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.11. Essentra (India) Private Limited

11.2.11.1. Company Revenue

11.2.11.2. Business Overview

11.2.11.3. Product Segments

11.2.11.4. Geographic Footprint

11.2.11.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.11.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.12. PARTEX MARKING SYSTEMS

11.2.12.1. Company Revenue

11.2.12.2. Business Overview

11.2.12.3. Product Segments

11.2.12.4. Geographic Footprint

11.2.12.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.12.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.13. Metalmech Engineering

11.2.13.1. Company Revenue

11.2.13.2. Business Overview

11.2.13.3. Product Segments

11.2.13.4. Geographic Footprint

11.2.13.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.13.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.14. JIGO

11.2.14.1. Company Revenue

11.2.14.2. Business Overview

11.2.14.3. Product Segments

11.2.14.4. Geographic Footprint

11.2.14.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.14.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.15. Jacob

11.2.15.1. Company Revenue

11.2.15.2. Business Overview

11.2.15.3. Product Segments

11.2.15.4. Geographic Footprint

11.2.15.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.15.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.16. VSM Plast

11.2.16.1. Company Revenue

11.2.16.2. Business Overview

11.2.16.3. Product Segments

11.2.16.4. Geographic Footprint

11.2.16.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.16.6. Strategic Partnership, Form Expansion, New Product Innovation etc

11.2.17. Trinity Touch

11.2.17.1. Company Revenue

11.2.17.2. Business Overview

11.2.17.3. Product Segments

11.2.17.4. Geographic Footprint

11.2.17.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.17.6. Strategic Partnership, Form Expansion, New Product Innovation etc

11.2.18. Hummel

11.2.18.1. Company Revenue

11.2.18.2. Business Overview

11.2.18.3. Product Segments

11.2.18.4. Geographic Footprint

11.2.18.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.18.6. Strategic Partnership, Form Expansion, New Product Innovation, etc.

11.2.19. NKT

11.2.19.1. Company Revenue

11.2.19.2. Business Overview

11.2.19.3. Product Segments

11.2.19.4. Geographic Footprint

11.2.19.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.19.6. Strategic Partnership, Form Expansion, New Product Innovation etc

11.2.20. Supaflex

11.2.20.1. Company Revenue

11.2.20.2. Business Overview

11.2.20.3. Product Segments

11.2.20.4. Geographic Footprint

11.2.20.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.20.6. Strategic Partnership, Form Expansion, New Product Innovation etc

11.2.21. Controlwell

11.2.21.1. Company Revenue

11.2.21.2. Business Overview

11.2.21.3. Product Segments

11.2.21.4. Geographic Footprint

11.2.21.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.21.6. Strategic Partnership, Form Expansion, New Product Innovation etc

11.2.22. Indo Electricals

11.2.22.1. Company Revenue

11.2.22.2. Business Overview

11.2.22.3. Product Segments

11.2.22.4. Geographic Footprint

11.2.22.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.22.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

11.2.23. Cabex India

11.2.23.1. Company Revenue

11.2.23.2. Business Overview

11.2.23.3. Product Segments

11.2.23.4. Geographic Footprint

11.2.23.5. Production Form/Plant Details, etc. (*As Applicable)

11.2.23.6. Strategic Partnership, Form Expansion, New Product Innovation, etc.

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Product, 2023–2033

Table 2: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

Table 3: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Material, 2023–2033

Table 4: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

Table 5: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by End-use, 2023–2033

Table 6: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

Table 7: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Country, 2023–2033

Table 8: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Country, 2023–2033

Table 9: China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Product, 2023–2033

Table 10: China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product 2023–2033

Table 11: China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Material, 2023–2033

Table 12: China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

Table 13: China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by End-use, 2023–2033

Table 14: China Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

Table 15: Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Product, 2023–2033

Table 16: Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

Table 17: Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Material, 2023–2033

Table 18: Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

Table 19: Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by End-use, 2023–2033

Table 20: Japan Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

Table 21: India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Product, 2023–2033

Table 22: India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

Table 23: India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Material, 2023–2033

Table 24: India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

Table 25: India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by End-use, 2023–2033

Table 26: India Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

Table 27: ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Product, 2023–2033

Table 28: ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

Table 29: ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Material, 2023–2033

Table 30: ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

Table 31: ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by End-use, 2023–2033

Table 32: ASEAN Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

Table 33: Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Product, 2023–2033

Table 34: Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Product, 2023–2033

Table 35: Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by Material, 2023–2033

Table 36: Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by Material, 2023–2033

Table 37: Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Forecast, by End-use, 2023–2033

Table 38: Rest of Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume (Mn Units) and Value (US$ Mn) Forecast, by End-use, 2023–2033

List of Figures

Figure 1: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume Share Analysis, by Product, 2022, 2025, and 2033

Figure 2: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Attractiveness, by Product

Figure 3: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume Share Analysis, by Material, 2022, 2025, and 2033

Figure 4: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Attractiveness, by Material

Figure 5: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume Share Analysis, by End-use, 2022, 2025, and 2033

Figure 6: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Attractiveness, by End-use

Figure 7: Asia Pacific Cable Glands, Conduits, Cable Ties, and Cable Trays Market Volume Share Analysis, by Country, 2022, 2025, and 2033