Reports

Reports

Analyst Viewpoint

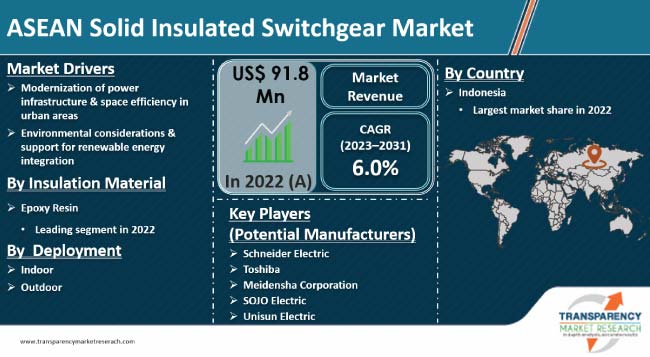

Evolving energy landscape and increase in demand for reliable & efficient power distribution infrastructure are driving ASEAN solid insulated switchgear market. Solid insulated switchgear, with its compact design and enhanced safety features, is gaining traction as a viable alternative to traditional gas-insulated and air-insulated switchgear systems. Urbanization, industrialization, and ongoing shift toward sustainable and smart grid solutions are the other major factors propelling market expansion. Furthermore, environmental considerations and support for renewable energy integration are expected to bolster ASEAN solid insulated switchgear industry size during the forecast period.

Rise in emphasis on grid modernization and integration of renewable energy sources offer lucrative opportunities to market players. Companies are investing in research & development to enhance product offerings, addressing the specific needs of ASEAN market.

The ASEAN region is witnessing a transformative phase in the power sector, significantly influencing the solid insulated switchgear market. The region, comprising countries such as Indonesia, Thailand, Malaysia, Vietnam, and others, has been experiencing rapid industrialization and urbanization, driving substantial demand for reliable and efficient electrical infrastructure.

Solid insulated switchgear, known for its enhanced safety features, compact design, and suitability for challenging environmental conditions, has been increasingly favored in ASEAN. Government initiatives focusing on upgrading power infrastructure, adherence to international safety standards, and growing adoption of renewable energy sources contribute to shaping the current market scenario.

The solid insulated switchgear market in ASEAN is likely to witness robust growth, ascribed to ongoing and anticipated developments in the power sector. Continued expansion of urban areas and industrial zones is expected to propel demand for electricity, necessitating advanced and resilient switchgear solutions.

Environmental consciousness is likely to play a pivotal role in shaping the future market, with a growing preference for eco-friendly and energy-efficient switchgear technologies. Integration of smart grid systems and digital solutions for monitoring and control is anticipated to be a key trend, contributing to the overall efficiency and sustainability of power distribution networks.

However, challenges such as navigating regulatory complexities, responding to economic fluctuations, and addressing geopolitical factors are expected to restrain the solid insulated switchgear market in ASEAN. Industry stakeholders and manufacturers are likely to adopt strategic measures to navigate these challenges and capitalize on emerging opportunities.

Upgrade or modernization of power infrastructure is fueling ASEAN solid insulated switchgear market growth. The need for energy is increasing as countries in the region are experiencing rapid industrialization, urbanization, and economic expansion.

Traditional power infrastructure could struggle to meet these evolving needs, leading to a crucial need for advanced solutions. Among the most important facilitators of this modernizing process is solid insulated switchgear.

Solid insulated switchgear, with its innovative design and advanced features, provides a modern solution for power distribution. Moreover, reliability and durability of solid insulated switchgear contribute to enhanced operational performance, meeting the expectations of utilities and industries seeking a resilient and up-to-date power infrastructure.

The ASEAN region's urbanization is speeding up, which is straining the electrical infrastructure in densely populated areas. Hence, solid insulated switchgear’s small design is projected to propel the solid insulated switchgear market development in the next few years.

Solid insulated switchgear is becoming highly popular in ASEAN due to strong incentives such as regulatory compliance and growing emphasis on environmental sustainability. Sulfur hexafluoride (SF6) and other greenhouse gases with high potential for global warming are frequently used in traditional switchgear technology.

Cleaner, more environment-friendly technologies are becoming common in response to surge in green concerns worldwide and changing regulatory frameworks. Solid insulated switchgear brings down the carbon footprint of power distribution, and eliminates the need for SF6 and other strong greenhouse gases.

This is in line with both regional and global efforts to slow down climate change and protect the environment. The switchgear’s compliance with stringent environmental standards positions it as an attractive option for utilities and industries striving to meet regulatory requirements and demonstrate a commitment to sustainable practices.

Rise of renewable energy sources, such as solar and wind power, is a key driver of the adoption of solid insulated switchgear in ASEAN. Shift toward more environment-friendly and sustainable energy generation demands a power infrastructure that is capable of handling the unique challenges that are associated with employing renewable energy sources.

Using solid-insulated switchgear is an efficient method to incorporate renewable energy sources into the current electrical infrastructure. It is ideally suited to managing the intermittent nature of renewable energy output due to its small size and adaptability.

In terms of insulation material, the epoxy resin segment accounted for the largest ASEAN solid insulated switchgear market share in 2022. This is ascribed to its exceptional properties that align with the evolving needs of modern power distribution systems.

Epoxy resin offers a compelling combination of electrical insulation, mechanical strength, and resistance to environmental factors, making it an ideal choice for solid insulation in switchgear applications. Its excellent dielectric properties contribute to enhanced insulation performance, ensuring the reliability and efficiency of the switchgear.

Moreover, epoxy resin exhibits resistance to moisture, chemicals, and UV radiation, providing durability and longevity to the insulation system. As sustainability becomes a focal point in the power industry, epoxy resin stands out for its eco-friendly characteristics, as it can be formulated with low levels of volatile organic compounds (VOCs), aligning with global environmental regulations and green energy initiatives.

As per solid insulated switchgear market analysis, Indonesia is expected to dominate the industry during the forecast period. As the largest economy in Southeast Asia, Indonesia is experiencing rapid industrialization, urbanization, and increasing need for reliable electricity distribution. Demand for advanced switchgear solutions, such as solid insulated switchgear, is escalating in response to the country’s commitment to modernize its power infrastructure.

Solid insulated switchgear, with its compact design, enhanced safety features, and ability to withstand challenging environmental conditions, aligns with the evolving needs of Indonesia’s power distribution systems.

The country’s focus on improving energy efficiency, reducing transmission losses, and integrating renewable energy sources into the grid amplifies the significance of solid insulated switchgear in meeting these objectives. Furthermore, Indonesia’s ambitious plans for expanding its power generation capacity and grid reliability reinforce the dominance of solid insulated switchgear in the market.

ASEAN solid insulated switchgear market is highly consolidated, with a small number of large-scale vendors controlling majority share. Manufacturers are investing significantly in research and development activities. Leading players are collaborating to accelerate product innovation and expand their business lines in regional and international markets.

Toshiba, Meidensha Corporation, Schneider Electric, Bokong Electric Co. Ltd., SOJO Electric, ENTEC Electric Co. Ltd., LS Electric, Unisun Electric, Zhejiang Volcano Electrical Technology, Herong Electric, Yueqing Luban Technology Co. Ltd., Sandian Electric, Canin Electric, Zhejiang Yinghong, and Henan Fengyuan are the prominent players in the market.

Each of these players has been profiled in the solid insulated switchgear market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 91.8 Mn |

| Forecast (Value) in 2031 | US$ 173.0 Mn |

| Growth Rate (CAGR) | 6.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Mn for Value and Units for Volume |

| Market Analysis | It includes cross-segment analysis at the regional level. Furthermore, the qualitative analysis includes drivers, restraints, market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 91.8 Mn in 2022.

It is projected to grow at a CAGR of 6.0% from 2023 to 2031

Modernization of power infrastructure & space efficiency in urban areas and environmental considerations & support for renewable energy integration.

Epoxy resin was the largest insulation material segment in 2022.

Indonesia was the most lucrative country in 2022

Toshiba, Meidensha Corporation, Schneider Electric, Bokong Electric Co. Ltd., SOJO Electric, ENTEC Electric Co. Ltd., LS Electric, Unisun Electric, Zhejiang Volcano Electrical Technology, Herong Electric, Yueqing Luban Technology Co. Ltd., Sandian Electric, Canin Electric, Zhejiang Yinghong, and Henan Fengyuan.

1. Executive Summary

1.1. ASEAN Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. ASEAN Solid Insulated Switchgear Market Analysis and Forecast, 2022-2031

2.6.1. ASEAN Solid Insulated Switchgear Market Volume (Units)

2.6.2. ASEAN Solid Insulated Switchgear Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealer/Distributors

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain

3.2. Impact on the Demand– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Units)

6. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

6.1. Price Comparison Analysis by Voltage Level

6.2. Price Comparison Analysis by Country

7. ASEAN Solid Insulated Switchgear Market Analysis and Forecast, by Insulation Material, 2022–2031

7.1. Introduction and Definitions

7.2. ASEAN Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

7.2.1. Epoxy Resin

7.2.2. Polyurethane

7.2.3. Silicone Rubber

7.2.4. Others

7.3. ASEAN Solid Insulated Switchgear Market Attractiveness, by Insulation Material

8. ASEAN Solid Insulated Switchgear Market Analysis and Forecast, by Voltage Level, 2022–2031

8.1. Introduction and Definitions

8.2. ASEAN Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

8.2.1. 3 Kv – 10 Kv

8.2.2. 11 Kb – 24 Kv

8.2.3. 25 Kv – 36 Kv

8.3. ASEAN Solid Insulated Switchgear Market Attractiveness, by Voltage Level

9. ASEAN Solid Insulated Switchgear Market Analysis and Forecast, by Deployment, 2022–2031

9.1. Introduction and Definitions

9.2. ASEAN Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

9.2.1. Indoor

9.2.2. Outdoor

9.3. ASEAN Solid Insulated Switchgear Market Attractiveness, by Deployment

10. ASEAN Solid Insulated Switchgear Market Analysis and Forecast, Application, 2022–2031

10.1. Introduction and Definitions

10.2. ASEAN Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.2.1. Substation

10.2.2. Power Distribution System

10.2.3. Power Plant

10.2.4. Industrial Processes

10.2.5. Renewable Energy System

10.2.6. Others

10.3. ASEAN Solid Insulated Switchgear Market Attractiveness, by Application

11. ASEAN Solid Insulated Switchgear Market Analysis and Forecast, by Country, 2022–2031

11.1. Key Findings

11.2. ASEAN Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Country, 2022–2031

11.2.1. Malaysia

11.2.2. Singapore

11.2.3. Indonesia

11.2.4. Thailand

11.2.5. Philippines

11.2.6. Vietnam

11.2.7. Rest of SEA

11.3. ASEAN Solid Insulated Switchgear Market Attractiveness, by Country

11.3.1. Malaysia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

11.3.2. Malaysia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

11.3.3. Malaysia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

11.3.4. Malaysia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, Application, 2022–2031

11.3.5. Singapore Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

11.3.6. Singapore Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

11.3.7. Singapore Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

11.3.8. Singapore Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, Application, 2022–2031

11.3.9. Indonesia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

11.3.10. Indonesia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

11.3.11. Indonesia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

11.3.12. Indonesia Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, Application, 2022–2031

11.3.13. ASEAN Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

11.3.14. Thailand Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

11.3.15. Thailand Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

11.3.16. Thailand Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, Application, 2022–2031

11.3.17. Philippines Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

11.3.18. Philippines Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

11.3.19. Philippines Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

11.3.20. Philippines Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, Application, 2022–2031

11.3.21. Rest of SEA Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

11.3.22. Vietnam Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

11.3.23. Vietnam Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

11.3.24. Vietnam Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, Application, 2022–2031

11.3.25. Rest of SEA Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

11.3.26. Rest of SEA Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

11.3.27. Rest of SEA Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, by Deployment, 2022–2031

11.3.28. Rest of SEA Solid Insulated Switchgear Market Volume (Units) and Value (US$ Mn) Forecast, Application, 2022–2031

11.4. Asia Pacific Solid Insulated Switchgear Market Attractiveness Analysis

12. Competition Landscape

12.1. Market Players - Competition Matrix (by tier and size of companies)

12.2. Market Share Analysis, 2021

12.3. Market Footprint Analysis

12.3.1. By Insulation Material

12.3.2. By Application

12.4. Company Profiles

12.4.1. Toshiba

12.4.1.1. Company Revenue

12.4.1.2. Business Overview

12.4.1.3. Product Segments

12.4.1.4. Geographic Footprint

12.4.1.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.1.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

12.4.2. Meidensha Corporation

12.4.2.1. Company Revenue

12.4.2.2. Business Overview

12.4.2.3. Product Segments

12.4.2.4. Geographic Footprint

12.4.2.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.2.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.3. Schneider Electric

12.4.3.1. Company Revenue

12.4.3.2. Business Overview

12.4.3.3. Product Segments

12.4.3.4. Geographic Footprint

12.4.3.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.3.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.4. Bokong Electric Co. Ltd.

12.4.4.1. Company Revenue

12.4.4.2. Business Overview

12.4.4.3. Product Segments

12.4.4.4. Geographic Footprint

12.4.4.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.4.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.5. SOJO Electric

12.4.5.1. Company Revenue

12.4.5.2. Business Overview

12.4.5.3. Product Segments

12.4.5.4. Geographic Footprint

12.4.5.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.5.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.6. ENTEC Electric Co. Ltd.

12.4.6.1. Company Revenue

12.4.6.2. Business Overview

12.4.6.3. Product Segments

12.4.6.4. Geographic Footprint

12.4.6.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.6.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.7. Henan Fengyuan

12.4.7.1. Company Revenue

12.4.7.2. Business Overview

12.4.7.3. Product Segments

12.4.7.4. Geographic Footprint

12.4.7.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.7.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.8. LS Electric

12.4.8.1. Company Revenue

12.4.8.2. Business Overview

12.4.8.3. Product Segments

12.4.8.4. Geographic Footprint

12.4.8.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.8.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.9. UNISUN ELECTRIC

12.4.9.1. Company Revenue

12.4.9.2. Business Overview

12.4.9.3. Product Segments

12.4.9.4. Geographic Footprint

12.4.9.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.9.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.10. ZHEJIANG VOLCANO ELECTRICAL TECHNOLOGY

12.4.10.1. Company Revenue

12.4.10.2. Business Overview

12.4.10.3. Product Segments

12.4.10.4. Geographic Footprint

12.4.10.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.10.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.11. Herong Electric

12.4.11.1. Company Revenue

12.4.11.2. Business Overview

12.4.11.3. Product Segments

12.4.11.4. Geographic Footprint

12.4.11.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.11.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.12. Yueqing Luban Technology Co. Ltd

12.4.12.1. Company Revenue

12.4.12.2. Business Overview

12.4.12.3. Product Segments

12.4.12.4. Geographic Footprint

12.4.12.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.12.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.13. Sandian Electric

12.4.13.1. Company Revenue

12.4.13.2. Business Overview

12.4.13.3. Product Segments

12.4.13.4. Geographic Footprint

12.4.13.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.13.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.14. Canin Electric

12.4.14.1. Company Revenue

12.4.14.2. Business Overview

12.4.14.3. Product Segments

12.4.14.4. Geographic Footprint

12.4.14.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.14.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

12.4.15. Zhejiang Yinghong

12.4.15.1. Company Revenue

12.4.15.2. Business Overview

12.4.15.3. Product Segments

12.4.15.4. Geographic Footprint

12.4.15.5. Production Type/Plant Details, etc. (*As Applicable)

12.4.15.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Insulation Material, 2022–2031

Table 2: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

Table 3: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Voltage Level, 2022–2031

Table 4: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

Table 5: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Deployment, 2022–2031

Table 6: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Deployment, 2022–2031

Table 7: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Application, 2022–2031

Table 8: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 9: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Country, 2022–2031

Table 10: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 11: Malaysia Solid Insulated Switchgear Market Volume (Units) Forecast, by Insulation Material, 2022–2031

Table 12: Malaysia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Insulation Material 2022–2031

Table 13: Malaysia Solid Insulated Switchgear Market Volume (Units) Forecast, by Voltage Level, 2022–2031

Table 14: Malaysia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

Table 15: Malaysia Solid Insulated Switchgear Market Volume (Units) Forecast, by Deployment, 2022–2031

Table 16: Malaysia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Deployment, 2022–2031

Table 17: Malaysia Solid Insulated Switchgear Market Volume (Units) Forecast, by Application, 2022–2031

Table 18: Malaysia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 19: Singapore Solid Insulated Switchgear Market Volume (Units) Forecast, by Insulation Material, 2022–2031

Table 20: Singapore Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

Table 21: Singapore Solid Insulated Switchgear Market Volume (Units) Forecast, by Voltage Level, 2022–2031

Table 22: Singapore Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

Table 23: Singapore Solid Insulated Switchgear Market Volume (Units) Forecast, by Deployment, 2022–2031

Table 24: Singapore Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Deployment, 2022–2031

Table 25: Singapore Solid Insulated Switchgear Market Volume (Units) Forecast, by Application, 2022–2031

Table 26: Singapore Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 27: Indonesia Solid Insulated Switchgear Market Volume (Units) Forecast, by Insulation Material, 2022–2031

Table 28: Indonesia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

Table 29: Indonesia Solid Insulated Switchgear Market Volume (Units) Forecast, by Voltage Level, 2022–2031

Table 30: Indonesia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

Table 31: Indonesia Solid Insulated Switchgear Market Volume (Units) Forecast, by Deployment, 2022–2031

Table 32: Indonesia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Deployment, 2022–2031

Table 33: Indonesia Solid Insulated Switchgear Market Volume (Units) Forecast, by Application, 2022–2031

Table 34: Indonesia Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 35: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Insulation Material, 2022–2031

Table 36: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

Table 37: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Voltage Level, 2022–2031

Table 38: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

Table 39: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Deployment, 2022–2031

Table 40: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Deployment, 2022–2031

Table 41: ASEAN Solid Insulated Switchgear Market Volume (Units) Forecast, by Application, 2022–2031

Table 42: ASEAN Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 43: Rest of SEA Solid Insulated Switchgear Market Volume (Units) Forecast, by Insulation Material, 2022–2031

Table 44: Rest of SEA Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Insulation Material, 2022–2031

Table 45: Rest of SEA Solid Insulated Switchgear Market Volume (Units) Forecast, by Voltage Level, 2022–2031

Table 46: Rest of SEA Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Voltage Level, 2022–2031

Table 47: Rest of SEA Solid Insulated Switchgear Market Volume (Units) Forecast, by Deployment, 2022–2031

Table 48: Rest of SEA Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Deployment, 2022–2031

Table 49: Rest of SEA Solid Insulated Switchgear Market Volume (Units) Forecast, by Application, 2022–2031

Table 50: Rest of SEA Solid Insulated Switchgear Market Value (US$ Mn) Forecast, by Application 2022–2031

List of Figures

Figure 1: ASEAN Solid Insulated Switchgear Market Volume Share Analysis, by Insulation Material, 2021, 2027, and 2031

Figure 2: ASEAN Solid Insulated Switchgear Market Attractiveness, by Insulation Material

Figure 3: ASEAN Solid Insulated Switchgear Market Volume Share Analysis, by Voltage Level, 2021, 2027, and 2031

Figure 4: ASEAN Solid Insulated Switchgear Market Attractiveness, by Voltage Level

Figure 5: ASEAN Solid Insulated Switchgear Market Volume Share Analysis, by Deployment, 2021, 2027, and 2031

Figure 6: ASEAN Solid Insulated Switchgear Market Attractiveness, by Deployment

Figure 7: ASEAN Solid Insulated Switchgear Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 8: ASEAN Solid Insulated Switchgear Market Attractiveness, by Application

Figure 9: ASEAN Solid Insulated Switchgear Market Volume Share Analysis, by Country, 2021, 2027, and 2031

Figure 10: ASEAN Solid Insulated Switchgear Market Attractiveness, by Country