Reports

Reports

Folding cartons are gathering steam as a flexible packaging option among several end-use industries. The food & beverages industry has been at the forefront of uptake of folding cartons. The widespread demand has been propelling the prospects of the ASEAN folding cartons market.

Advancements in manufacturing and conversion technologies and techniques have enabled manufacturers in the ASEAN folding cartons market to come out with new designs. Advances in inline production technologies has led players to cater to the requirements of various end-use industries. Revenues in the ASEAN market are being driven by growing demand for various colors, sizes, and dimension of folding cartons in the pharmaceuticals, healthcare products household & laundry, and toys & games.

The incorporation of cutting-edge printing machinery has also extended the horizon for new branding options with the help of folding cartons. The demand for cost-effective and top-notch quality boxes to meet the requirements of brands is generating massive revenue prospects of the ASEAN folding cartons market.

Over the years, businesses in the packaging sector are keen on strengthening their supply chain to boost the reliability of products. Furthermore, new strategies pertaining to operational management has helped them packaging companies meet stringent requirements of end-use industries. The relentless focus on customer satisfaction has set the tone for innovations in the ASEAN folding cartons market.

Strides being made in the secondary packaging in relation to technologies used in manufacturing them are boosting the prospects of the ASEAN folding cartons market. New techniques pertaining to gluing and folding have been promoting the commercialization avenue of products over the pas few decades. A number of biodegradable materials have recently attracted customers and packaging companies alike. Another area which is adding value to products in the market are the freedom for manufacturers to impart various visual effects. The growing trend of customization of products is one of the key trends opening new avenues in the ASEAN folding cartons market.

The ASEAN folding cartons market has gained significant impetus from the robust growth of small- and medium-sized enterprises (SMEs) and various other industries in ASEAN countries over the last couple of years. Since there is a free trade agreement between the ASEAN countries, most of the small and large scale industries need packaging materials in large volume, consequently boosting the demand for folding cartons.

The preference for folding cartons is anticipated to increase further, thanks to the cost benefits, these cartons provide during transportation and handling of products. The rising demand for packaged and takeaway food products is also projected to influence the market for folding carton in ASEAN countries. However, the availability of flexible plastic packaging materials and rigid boxes at comparatively low prices may limit the uptake of folding cartons to some extent over the forthcoming years, reflecting negatively on this market.

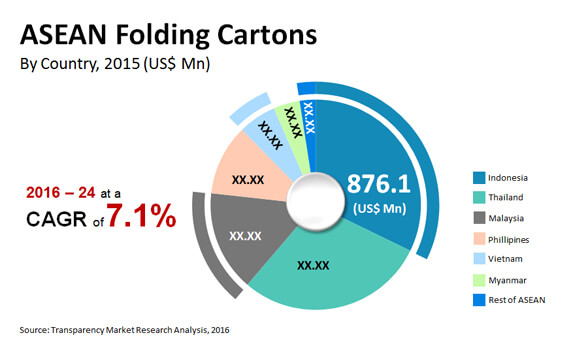

The opportunity in the ASEAN folding cartons market was worth US$2.8 bn in 2016. Rising at a CAGR of 7.10% between 2016 and 2024, the market is estimated to reach a value of US$4.9 bn by the end of 2024.

The industrial food and beverages, homecare products, personal care, pharma and healthcare, and tobacco sectors are the key end users of the folding cartons in the ASEAN market. Among these, the food and beverages industry has emerged as the leading end user of folding cartons and is expected to remain dominant over the next few years, rising at a CAGR of 6.80%. In the food and beverage sector, these cartons find a robust usage in the packaging of fresh food products.

Among other end users, the pharma and healthcare and the personal care industries are anticipated to witness a healthy rise in the adoption of folding cartons in the near future. The increasing middle-class population in ASEAN countries and the rising awareness pertaining to the beneficial properties of these cartons are likely to boost their uptake in these industries over the years to come.

Solid bleached sulfate (SBS), coated unbleached kraft (CUK), uncoated kraft boxboard (UKB), and coated recycled board (CRB) are the three main types of materials, which folded cartons are produced of. Among these, the demand for SBS-based folding cartons is significantly higher as compared to others. Analysts expect this segment to witness continued demand over the forthcoming years. However, in terms of revenue, UKB-based folding cartons are likely to fare better than others in the near future.

Indonesia, among all the ASEAN countries, has surfaced as the key contributor to the ASEAN folding cartons market. Analysts estimate this domestic market to continue its leading streak over the next few years, expanding at a CAGR of 7.20% between 2016 and 2024. In Indonesia, the food and beverage sector has been reporting a strong demand for folding cartons and is likely to continue doing so in the near future. Thailand and Malaysia are also anticipated to provide promising opportunities to market players over the coming years.

The ASEAN market for folding cartons is a highly competitive in nature. Some of the key players in this market are Amcor Ltd., AR Packaging Group AB, Huhtamaki Group, Mayr-Melnhof Karton Gesellschaft M.b.h., International Paper, DS Smith Plc, and Rengo Co. Ltd.

ASEAN Folding Cartons Market to Thrive on Rebounding of E-commerce Activities in Post-Covid Era

Folding cartons are extensively used in the packaging of lightweight products. Over the years, a variety of designs have come, expanding the functional and branding options for end-use industries in the folding cartons market, including in ASEAN member states. The key differentiating part is the high visibility that folding cartons offer to its customers. The ASEAN folding cartons market is witnessing new avenues on the back of the remarkable strides made in the retail sector in various Asian nations and a thriving international trade in Asia Pacific over the last few years. Rise in use in wholesale retail packaging has bolstered the uptake of folding cartons in ASEAN. Also, packaging companies in the ASEAN folding cartons market have tapped into the rising opportunity by offering cost-effective options, since many markets may be cost-sensitive, it is pragmatic to pay conscious attention to pricing strategies for attracting brands in the key end-use industries. Growing traction of custom-made box boards has nudged players to adopt advanced manufacturing techniques in the ASEAN folding cartons market. The focus of companies in end-use industries has led them to increasingly leverage folding cartons for differentiating their products to end-users.

Growing concerns of the sustainability in the overall packaging sector, paperboard packaging materials have gained popularity in the ASEAN folding cartons market. Folding characteristics and printing options are key concerns. In the months of 2020, in the backdrop of Covid-19 creating macro- and micro-economic upheavals, governments of ASEAN member states have also come out with regional response system, to boost decline in economic activities across industries. One of the worst fallout of the outbreak of Covid-19 was the massive decline in domestic consumption, which also severely impacted the demand for folding cartons. Players in the ASEAN folding cartons market in collaboration with policy makers have been adopting strategies and business models to overcome the disruption in supply chain and put the economies of the path of growth in post-Covid-era. This will open interesting avenues for packaging manufacturers all over the world.

The Folding Cartons Market is studied from 2016 - 2024.

The market was valued at US$2.8 bn in 2016 and is likely to reach US$4.9 bn by the end of 2024.

The ASEAN folding cartons market, as stated in the report, is expanding at a very healthy CAGR of 7.10% within a forecast period from 2016 to 2024.

The global Folding Cartons Market is segmented on basis of application, imaging modality and key regions.

The ASEAN market for folding cartons is a highly competitive in nature. Some of the key players in this market are Amcor Ltd., AR Packaging Group AB, Huhtamaki Group, Mayr-Melnhof Karton Gesellschaft M.b.h., International Paper, DS Smith Plc, and Rengo Co. Ltd.

1. Executive Summary

2. Research Methodology

3. Assumptions and Acronyms Used

4. Market Introduction

4.1. Taxonomy

4.2. Value Chain

5. Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunities

5.4. Trends

6. ASEAN Folding Cartons Market Overview

6.1. Value (US$ Mn) and Volume (‘000’ Tons)

6.2. Absolute $ Opportunity

7. ASEAN Folding Cartons Market Analysis, by Country

7.1. Introduction

7.2. Market Snapshot of Folding cartons market by country

7.2.1. Market share and Basis Points (BPS) Analysis By Country

7.2.2. Y-o-Y Growth Projections By Country

7.3. Market Attractiveness Analysis, By Country

8. Thailand Folding Cartons Market Analysis and Forecast

8.1. Introduction & Market snapshot

8.2. Market Size (US$ Mn) and Volume (‘000’ Tons) by end use

8.2.1. Absolute $ opportunity by Food & Beverages sub segment

8.2.1.1. Frozen and Chilled food products

8.2.1.2. Fresh Food products

8.2.1.3. Bakery & Confectionary

8.2.1.4. Ready to eat food products

8.2.1.5. Beverages

8.2.1.6. Others

8.3. Absolute $ Opportunity, by Material Type

8.3.1. Solid Bleached Sulfate (SBS)

8.3.2. Coated Unbleached Kraft (CUK)

8.3.3. Coated Recycled Board (CRB)

8.3.4. Uncoated Kraft Boxboard (UKB)

8.4. Absolute $ Opportunity, by order type

8.4.1. Standard

8.4.2. Customized

9. Myanmar Folding Cartons Market Analysis and Forecast

9.1. Introduction & Market snapshot

9.2. Market Size (US$ Mn) and Volume (‘000’ Tons) by end use

9.2.1. Absolute $ opportunity by Food & Beverages sub segment

9.2.1.1. Frozen and Chilled food products

9.2.1.2. Fresh Food products

9.2.1.3. Bakery & Confectionary

9.2.1.4. Ready to eat food products

9.2.1.5. Beverages

9.2.1.6. Others

9.3. Absolute $ Opportunity, by Material Type

9.3.1. Solid Bleached Sulfate (SBS)

9.3.2. Coated Unbleached Kraft (CUK)

9.3.3. Coated Recycled Board (CRB)

9.3.4. Uncoated Kraft Boxboard (UKB)

9.4. Absolute $ Opportunity, by order type

9.4.1. Standard

9.4.2. Customized

10. Indonesia Folding Cartons Market Analysis and Forecast

10.1. Introduction & Market snapshot

10.2. Market Size (US$ Mn) and Volume (‘000’ Tons) by end use

10.2.1. Absolute $ opportunity by Food & Beverages sub segment

10.2.1.1. Frozen and Chilled food products

10.2.1.2. Fresh Food products

10.2.1.3. Bakery & Confectionary

10.2.1.4. Ready to eat food products

10.2.1.5. Beverages

10.2.1.6. Others

10.3. Absolute $ Opportunity, by Material Type

10.3.1. Solid Bleached Sulfate (SBS)

10.3.2. Coated Unbleached Kraft (CUK)

10.3.3. Coated Recycled Board (CRB)

10.3.4. Uncoated Kraft Boxboard (UKB)

10.4. Absolute $ Opportunity, by order type

10.4.1. Standard

10.4.2. Customized

11. Malaysia Folding Cartons Market Analysis and Forecast

11.1. Introduction & Market snapshot

11.2. Market Size (US$ Mn) and Volume (‘000’ Tons) by end use

11.2.1. Absolute $ opportunity by Food & Beverages sub segment

11.2.1.1. Frozen and Chilled food products

11.2.1.2. Fresh Food products

11.2.1.3. Bakery & Confectionary

11.2.1.4. Ready to eat food products

11.2.1.5. Beverages

11.2.1.6. Others

11.3. Absolute $ Opportunity, by Material Type

11.3.1. Solid Bleached Sulfate (SBS)

11.3.2. Coated Unbleached Kraft (CUK)

11.3.3. Coated Recycled Board (CRB)

11.3.4. Uncoated Kraft Boxboard (UKB)

11.4. Absolute $ Opportunity, by order type

11.4.1. Standard

11.4.2. Customized

12. Vietnam Folding Cartons Market Analysis and Forecast

12.1. Introduction & Market snapshot

12.2. Market Size (US$ Mn) and Volume (‘000’ Tons) by end use

12.2.1. Absolute $ opportunity by Food & Beverages sub segment

12.2.1.1. Frozen and Chilled food products

12.2.1.2. Fresh Food products

12.2.1.3. Bakery & Confectionary

12.2.1.4. Ready to eat food products

12.2.1.5. Beverages

12.2.1.6. Others

12.3. Absolute $ Opportunity, by Material Type

12.3.1. Solid Bleached Sulfate (SBS)

12.3.2. Coated Unbleached Kraft (CUK)

12.3.3. Coated Recycled Board (CRB)

12.3.4. Uncoated Kraft Boxboard (UKB)

12.4. Absolute $ Opportunity, by order type

12.4.1. Standard

12.4.2. Customized

13. Philippines Folding Cartons Market Analysis and Forecast

13.1. Introduction & Market snapshot

13.2. Market Size (US$ Mn) and Volume (‘000’ Tons) by end use

13.2.1. Absolute $ opportunity by Food & Beverages sub segment

13.2.1.1. Frozen and Chilled food products

13.2.1.2. Fresh Food products

13.2.1.3. Bakery & Confectionary

13.2.1.4. Ready to eat food products

13.2.1.5. Beverages

13.2.1.6. Others

13.3. Absolute $ Opportunity, by Material Type

13.3.1. Solid Bleached Sulfate (SBS)

13.3.2. Coated Unbleached Kraft (CUK)

13.3.3. Coated Recycled Board (CRB)

13.3.4. Uncoated Kraft Boxboard (UKB)

13.4. Absolute $ Opportunity, by order type

13.4.1. Standard

13.4.2. Customized

14. Rest of ASEAN Folding Cartons Market Analysis and Forecast

14.1. Introduction & Market snapshot

14.2. Market Size (US$ Mn) and Volume (‘000’ Tons) by end use

14.2.1. Absolute $ opportunity by Food & Beverages sub segment

14.2.1.1. Frozen and Chilled food products

14.2.1.2. Fresh Food products

14.2.1.3. Bakery & Confectionary

14.2.1.4. Ready to eat food products

14.2.1.5. Beverages

14.2.1.6. Others

14.3. Absolute $ Opportunity, by Material Type

14.3.1. Solid Bleached Sulfate (SBS)

14.3.2. Coated Unbleached Kraft (CUK)

14.3.3. Coated Recycled Board (CRB)

14.3.4. Uncoated Kraft Boxboard (UKB)

14.4. Absolute $ Opportunity, by order type

14.4.1. Standard

14.4.2. Customized

15. Competitive Landscape

15.1. Competition Dashboard

15.2. Company Profiles

15.2.1. Amcor Limited

15.2.2. AR Packaging Group AB

15.2.3. HUHTAMAKI GROUP

15.2.4. Mayr-Melnhof Karton Gesellschaft M.b.h.

15.2.5. International Paper

15.2.6. DS Smith PLC

15.2.7. Rengo Co., Ltd.

List of Tables

Table 01: ASEAN Folding Cartons Market Size (US$ Mn) and Volume (‘000’ Tons) by Region, 2015–2024

Table 02: Thailand Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by End Use Type, 2015–2024

Table 03: Thailand Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Food & Beverages Sub segment Type, 2015–2024

Table 04: Thailand Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Material Type, 2015–2024

Table 05: Thailand Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Order Type, 2015–2024

Table 06: Myanmar Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by End Use Type, 2015–2024

Table 07: Myanmar Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Food & Beverages Sub segment Type, 2015–2024

Table 08: Myanmar Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Material Type, 2015–2024

Table 09: Myanmar Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Order Type, 2015–2024

Table 10: Indonesia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by End Use Type, 2015–2024

Table 11: Indonesia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Food & Beverages Sub segment Type, 2015–2024

Table 12: Indonesia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Material Type, 2015–2024

Table 13: Indonesia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Order Type, 2015–2024

Table 14: Malaysia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by End Use Type, 2015–2024

Table 15: Malaysia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Food & Beverages Sub segment Type, 2015–2024

Table 16: Malaysia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Material Type, 2015–2024

Table 17: Malaysia Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Order Type, 2015–2024

Table 18: Vietnam Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by End Use Type, 2015–2024

Table 19: Vietnam Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Food & Beverages Sub segment Type, 2015–2024

Table 20: Vietnam Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Material Type, 2015–2024

Table 21: Vietnam Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Order Type, 2015–2024

Table 22: Philippines Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by End Use Type, 2015–2024

Table 23: Philippines Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Food & Beverages Sub segment Type, 2015–2024

Table 24: Philippines Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Material Type, 2015–2024

Table 25: Philippines Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Order Type, 2015–2024

Table 26: Rest of ASEAN Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by End Use Type, 2015–2024

Table 27: Rest of ASEAN Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Food & Beverages Sub segment Type, 2015–2024

Table 28: Rest of ASEAN Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Material Type, 2015–2024

Table 29: Rest of ASEAN Folding Cartons Market Size (US$ Mn) and Volume (‘000 Tons) by Order Type, 2015–2024

List of Figures

Figure 01: ASEAN Folding Cartons Market Value (US$ Mn) and Volume (‘000’ Tons), 2015–2024

Figure 02: ASEAN Folding Cartons Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 03: ASEAN Folding Cartons Market Share & BPS Analysis by Region, 2016 & 2024

Figure 04: ASEAN Folding Cartons Market Revenue Y-o-Y Growth by Region, 2016–2024

Figure 05: ASEAN Folding Cartons Market Attractiveness by Region, 2016–2024

Figure 06: Thailand Folding Cartons Market Value (US$ Mn) by End Use Segment, 2014–2024

Figure 07: Thailand Folding Cartons Market Volume (‘000’ Tons) by End Use Segment, 2014–2024

Figure 08: Thailand Folding Cartons Market Absolute $ Opportunity by Frozen and Chilled food products segment, 2016–2024

Figure 09: Thailand Folding Cartons Market Absolute $ Opportunity by Fresh food products segment, 2016–2024

Figure 10: Thailand Folding Cartons Market Absolute $ Opportunity by Bakery & confectionary segment, 2016–2024

Figure 11: Thailand Folding Cartons Market Absolute $ Opportunity by Ready to eat food products segment, 2016–2024

Figure 12: Thailand Folding Cartons Market Absolute $ Opportunity by Beverages segment, 2016–2024

Figure 13: Thailand Folding Cartons Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 14: Thailand Folding Cartons Market Absolute $ Opportunity by Solid Bleached Sulfate segment, 2016–2024

Figure 15: Thailand Folding Cartons Market Absolute $ Opportunity by Coated Unbleached Kraft segment, 2016–2024

Figure 16: Thailand Folding Cartons Market Absolute $ Opportunity by Coated Recycled Board segment, 2016–2024

Figure 17: Thailand Folding Cartons Market Absolute $ Opportunity by Uncoated Kraft Boxboard segment, 2016–2024

Figure 18: Thailand Folding Cartons Market Absolute $ Opportunity by Standard Order Type segment, 2016–2024

Figure 19: Thailand Folding Cartons Market Absolute $ Opportunity by Customized order type segment, 2016–2024

Figure 20: Myanmar Folding Cartons Market Value (US$ Mn) by End Use Segment, 2014–2024

Figure 21: Myanmar Folding Cartons Market Volume (‘000’ Tons) by End Use Segment, 2014–2024

Figure 22: Myanmar Folding Cartons Market Absolute $ Opportunity by Frozen and Chilled food products segment, 2016–2024

Figure 23: Myanmar Folding Cartons Market Absolute $ Opportunity by Fresh food products segment, 2016–2024

Figure 24: Myanmar Folding Cartons Market Absolute $ Opportunity by Bakery & confectionary segment, 2016–2024

Figure 25: Myanmar Folding Cartons Market Absolute $ Opportunity by Ready to eat food products segment, 2016–2024

Figure 26: Myanmar Folding Cartons Market Absolute $ Opportunity by Beverages segment, 2016–2024

Figure 27: Myanmar Folding Cartons Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 28: Myanmar Folding Cartons Market Absolute $ Opportunity by Solid Bleached Sulfate segment, 2016–2024

Figure 29: Myanmar Folding Cartons Market Absolute $ Opportunity by Coated Unbleached Kraft segment, 2016–2024

Figure 30: Myanmar Folding Cartons Market Absolute $ Opportunity by Coated Recycled Board segment, 2016–2024

Figure 31: Myanmar Folding Cartons Market Absolute $ Opportunity by Uncoated Kraft Boxboard segment, 2016–2024

Figure 32: Myanmar Folding Cartons Market Absolute $ Opportunity by Standard Order Type segment, 2016–2024

Figure 33: Myanmar Folding Cartons Market Absolute $ Opportunity by Customized order type segment, 2016–2024

Figure 34: Indonesia Folding Cartons Market Value (US$ Mn) by End Use Segment, 2014–2024

Figure 35: Indonesia Folding Cartons Market Volume (‘000’ Tons) by End Use Segment, 2014–2024

Figure 36: Indonesia Folding Cartons Market Absolute $ Opportunity by Frozen and Chilled food products segment, 2016–2024

Figure 37: Indonesia Folding Cartons Market Absolute $ Opportunity by Fresh food products segment, 2016–2024

Figure 38: Indonesia Folding Cartons Market Absolute $ Opportunity by Bakery & confectionary segment, 2016–2024

Figure 39: Indonesia Folding Cartons Market Absolute $ Opportunity by Ready to eat food products segment, 2016–2024

Figure 40: Indonesia Folding Cartons Market Absolute $ Opportunity by Beverages segment, 2016–2024

Figure 41: Indonesia Folding Cartons Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 42: Indonesia Folding Cartons Market Absolute $ Opportunity by Solid Bleached Sulfate segment, 2016–2024

Figure 43: Indonesia Folding Cartons Market Absolute $ Opportunity by Coated Unbleached Kraft segment, 2016–2024

Figure 44: Indonesia Folding Cartons Market Absolute $ Opportunity by Coated Recycled Board segment, 2016–2024

Figure 45: Indonesia Folding Cartons Market Absolute $ Opportunity by Uncoated Kraft Boxboard segment, 2016–2024

Figure 46: Indonesia Folding Cartons Market Absolute $ Opportunity by Standard Order Type segment, 2016–2024

Figure 47: Indonesia Folding Cartons Market Absolute $ Opportunity by Customized order type segment, 2016–2024

Figure 48: Malaysia Folding Cartons Market Value (US$ Mn) by End Use Segment, 2014–2024

Figure 49: Malaysia Folding Cartons Market Volume (‘000’ Tons) by End Use Segment, 2014–2024

Figure 50: Malaysia Folding Cartons Market Absolute $ Opportunity by Frozen and Chilled food products segment, 2016–2024

Figure 51: Malaysia Folding Cartons Market Absolute $ Opportunity by Fresh food products segment, 2016–2024

Figure 52: Malaysia Folding Cartons Market Absolute $ Opportunity by Bakery & confectionary segment, 2016–2024

Figure 53: Malaysia Folding Cartons Market Absolute $ Opportunity by Ready to eat food products segment, 2016–2024

Figure 54: Malaysia Folding Cartons Market Absolute $ Opportunity by Beverages segment, 2016–2024

Figure 55: Malaysia Folding Cartons Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 56: Malaysia Folding Cartons Market Absolute $ Opportunity by Solid Bleached Sulfate segment, 2016–2024

Figure 57: Malaysia Folding Cartons Market Absolute $ Opportunity by Coated Unbleached Kraft segment, 2016–2024

Figure 58: Malaysia Folding Cartons Market Absolute $ Opportunity by Coated Recycled Board segment, 2016–2024

Figure 59: Malaysia Folding Cartons Market Absolute $ Opportunity by Uncoated Kraft Boxboard segment, 2016–2024

Figure 60: Malaysia Folding Cartons Market Absolute $ Opportunity by Standard Order Type segment, 2016–2024

Figure 61: Malaysia Folding Cartons Market Absolute $ Opportunity by Customized order type segment, 2016–2024

Figure 62: Vietnam Folding Cartons Market Value (US$ Mn) by End Use Segment, 2014–2024

Figure 63: Vietnam Folding Cartons Market Volume (‘000’ Tons) by End Use Segment, 2014–2024

Figure 64: Vietnam Folding Cartons Market Absolute $ Opportunity by Frozen and Chilled food products segment, 2016–2024

Figure 65: Vietnam Folding Cartons Market Absolute $ Opportunity by Fresh food products segment, 2016–2024

Figure 66: Vietnam Folding Cartons Market Absolute $ Opportunity by Bakery & confectionary segment, 2016–2024

Figure 67: Vietnam Folding Cartons Market Absolute $ Opportunity by Ready to eat food products segment, 2016–2024

Figure 68: Vietnam Folding Cartons Market Absolute $ Opportunity by Beverages segment, 2016–2024

Figure 69: Vietnam Folding Cartons Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 70: Vietnam Folding Cartons Market Absolute $ Opportunity by Solid Bleached Sulfate segment, 2016–2024

Figure 71: Vietnam Folding Cartons Market Absolute $ Opportunity by Coated Unbleached Kraft segment, 2016–2024

Figure 72: Vietnam Folding Cartons Market Absolute $ Opportunity by Coated Recycled Board segment, 2016–2024

Figure 73: Vietnam Folding Cartons Market Absolute $ Opportunity by Uncoated Kraft Boxboard segment, 2016–2024

Figure 74: Vietnam Folding Cartons Market Absolute $ Opportunity by Standard Order Type segment, 2016–2024

Figure 75: Vietnam Folding Cartons Market Absolute $ Opportunity by Customized order type segment, 2016–2024

Figure 76: Philippines Folding Cartons Market Value (US$ Mn) by End Use Segment, 2014–2024

Figure 77: Philippines Folding Cartons Market Volume (‘000’ Tons) by End Use Segment, 2014–2024

Figure 78: Philippines Folding Cartons Market Absolute $ Opportunity by Frozen and Chilled food products segment, 2016–2024

Figure 79: Philippines Folding Cartons Market Absolute $ Opportunity by Fresh food products segment, 2016–2024

Figure 80: Philippines Folding Cartons Market Absolute $ Opportunity by Bakery & confectionary segment, 2016–2024

Figure 81: Philippines Folding Cartons Market Absolute $ Opportunity by Ready to eat food products segment, 2016–2024

Figure 82: Philippines Folding Cartons Market Absolute $ Opportunity by Beverages segment, 2016–2024

Figure 83: Philippines Folding Cartons Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 84: Philippines Folding Cartons Market Absolute $ Opportunity by Solid Bleached Sulfate segment, 2016–2024

Figure 85: Philippines Folding Cartons Market Absolute $ Opportunity by Coated Unbleached Kraft segment, 2016–2024

Figure 86: Philippines Folding Cartons Market Absolute $ Opportunity by Coated Recycled Board segment, 2016–2024

Figure 87: Philippines Folding Cartons Market Absolute $ Opportunity by Uncoated Kraft Boxboard segment, 2016–2024

Figure 88: Philippines Folding Cartons Market Absolute $ Opportunity by Standard Order Type segment, 2016–2024

Figure 89: Philippines Folding Cartons Market Absolute $ Opportunity by Customized order type segment, 2016–2024

Figure 90: Rest of ASEAN Folding Cartons Market Value (US$ Mn) by End Use Segment, 2014–2024

Figure 91: Rest of ASEAN Folding Cartons Market Volume (‘000’ Tons) by End Use Segment, 2014–2024

Figure 92: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Frozen and Chilled food products segment, 2016–2024

Figure 93: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Fresh food products segment, 2016–2024

Figure 94: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Bakery & confectionary segment, 2016–2024

Figure 95: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Ready to eat food products segment, 2016–2024

Figure 96: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Beverages segment, 2016–2024

Figure 97: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 98: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Solid Bleached Sulfate segment, 2016–2024

Figure 99: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Coated Unbleached Kraft segment, 2016–2024

Figure 100: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Coated Recycled Board segment, 2016–2024

Figure 101: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Uncoated Kraft Boxboard segment, 2016–2024

Figure 102: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Standard Order Type segment, 2016–2024

Figure 103: Rest of ASEAN Folding Cartons Market Absolute $ Opportunity by Customized order type segment, 2016–2024