Reports

Reports

Analysts’ Viewpoint

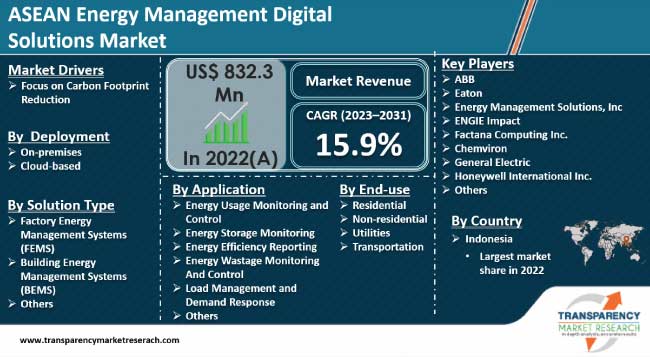

Rapid economic growth in many countries in ASEAN is driving the industrial demand for electricity. Integration of Factory Energy Management Systems (FEMS) and Building Energy Management Systems (BEMS) for safe and effective transmission of power is one of the major ASEAN energy management digital solutions market trends.

Digital transformation is anticipated to have a major impact on the advancement of energy source creation and acceptance, improving efficiency, dependability, and accessibility. Increase in emphasis on energy security and the focus on reducing carbon footprints are predicted to foster sustainability measures and integration of renewable energy sources in digital energy management solutions. Companies in the ASEAN energy management digital solutions industry have adopted a range of strategies to maintain and expand their market presence.

Energy management digital solutions refer to a wide range of technologies and systems designed to monitor, analyze, and control energy consumption and distribution. These solutions aim to improve efficiency, reduce costs, and minimize environmental impact. They encompass various components, such as Energy Management Systems (EMS), Factory Energy Management Systems (FEMS), and Building Energy Management Systems (BEMS).

Energy management digital solutions gather and examine data from a variety of energy sources, including utility bills, meteorological data, and sensor measurements to maximize energy use and system performance. Sophisticated algorithms and machine learning approaches are applied to predict energy demand, find inefficiencies, and optimize energy use.

To centralize data and regulate energy use, energy management solutions can be combined with already-in-place infrastructure, such as building management systems. These systems frequently include data analytics and visualization tools to assist users in making defensible decisions based on information about energy consumption,.

While some systems can carry out automated modifications to underlying building systems for optimization, others can automatically identify and diagnose defects at the equipment or system level.

Carbon emission reduction is among the top priorities of corporate environmental management programs. Wastage of energy can be reduced through the implementation of energy management systems. Several factors such as the rise in significance of social responsibility and climate change are driving the demand for energy management systems.

In the residential segment, the usage of energy-efficient, energy-star-rated products is expected to reduce carbon emissions. Furthermore, governments in Asia are providing incentives to encourage businesses and individuals to reduce their carbon footprint. This can include tax credits, subsidies, and regulatory measures aimed at promoting sustainable practices. Thus, EMS platforms provide users with complete monitoring of aggregate energy consumption and carbon emission rates. This plays a critical role in minimizing carbon emissions and further drives the ASEAN energy management digital solutions market demand.

Industrialization and rapid urbanization over the last few years in ASEAN has fueled the demand for energy. Electrical systems are continuously operating at high capacities. An energy management system can determine the appropriate system response to a variety of changes and disturbances by using electrical and physical parameters, loading and generation levels, network topology, and control logic. Additionally, energy management software can determine the source of potential problems and advise on corrective actions to avoid interruptions.

Governments of several countries in ASEAN are investing in projects to enhance power management system efficiency. Investment in energy efficiency is projected to increase significantly, to reach global sustainability goals and reduce the overall cost of energy supply measures.

Numerous energy companies have been increasingly relying on the automation process for the last couple of years, for better monitoring, and to increase profitability. Furthermore, Internet of Things (IoT) platforms connect production facilities and distribution networks from different locations. This enables remote monitoring and increasing efficiency through predictive maintenance and is expected to drive the ASEAN energy management system services market share. Strong government policies on energy efficiency and various government regulations have been implemented to adopt safe and cost-effective sources of energy, which in turn is likely to boost market development.

Global electricity demand surged in 2022 and is expected to rise further during the forecast period. The steep increase in demand outstripped the ability of sources of electricity supply to keep pace in some major markets. This has generated the need for new power systems as well as upgrade of existing aging systems. Long-term plans for a more sustainable and safe future have been laid by governments throughout Southeast Asia.

Automation systems include SCADA, distributed control systems, manufacturing execution systems, safety instrumented systems, and industrial asset management. Demand for an integrated system with multiple functionalities is also increasing simultaneously. Some regions in Asia are exploring cross-border energy connectivity to balance supply and demand. This involves the development of interconnected power grids to facilitate efficient energy sharing among neighboring countries. New installations and system upgrades are vital to support the energy needs of growing industries.

Electricity demand is expected to continue to rise across the region during the forecast period. This rise in demand for electricity is expected to bolster the ASEAN energy management digital solutions industry.

According to the latest ASEAN energy management digital solutions market forecast, in terms of revenue, Indonesia dominated in 2022, accounting for a sizable share, which is predicted to rise by 2031. From 2023 to 2031, the Indonesian market is expected to grow at a significant compound annual growth rate (CAGR), signifying its incremental potential.

Following closely is the market in Thailand, which had the second largest share in 2022 and is expected to expand rapidly throughout the forecast period. Growth in demand for energy-efficient solutions and presence of major manufacturers is augmenting the energy management digital solutions market share of the country.

Furthermore, the Vietnam market for energy management digital solutions is anticipated to experience significant growth due to the surge in demand for renewable energy sources and implementation of stringent regulations to reduce carbon emissions.

According to recent ASEAN energy management digital solutions market analysis, the landscape is robust, with several lucrative opportunities for growth and innovation. These dynamics present profitable opportunities for market expansion.

ABB, Eaton, Energy Management Solutions, Inc., ENGIE Impact, Factana Computing Inc., Chemviron, General Electric, Honeywell International Inc., Huawei Digital Power Technologies Co., Ltd, Itron Inc., Johnson Controls, and Rockwell Automation are some of the prominent players in the ASEAN energy management digital solutions market.

Each of these companies has been profiled in the energy management digital solutions market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 832.3 Mn |

| Market Forecast (Value) in 2031 | US$ 3.1 Bn |

| Growth Rate (CAGR) | 15.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Tons | US$ Mn/Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 832.3 Mn in 2022

The CAGR is projected to be 15.9% from 2023 to 2031

Focus on carbon footprint reduction

Factory Energy Management Systems (FEMS) held largest share under the solution type segment in 2022

Indonesia was the most lucrative country in 2022

ABB, Eaton, Energy Management Solutions, Inc., ENGIE Impact, Factana Computing Inc., Chemviron, General Electric, Honeywell International Inc., Huawei Digital Power Technologies Co., Ltd, Itron Inc., Johnson Controls, and Rockwell Automation

1. Executive Summary

1.1. ASEAN Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. ASEAN Energy Management Digital Solutions Market Analysis and Forecasts, 2023-2031

2.6.1. ASEAN Energy Management Digital Solutions Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Solution Type Suppliers

2.9.2. List of Manufacturers/ Service Providers

2.9.3. List of Potential Customers

2.10. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Energy Management Digital Solutions

3.2. Impact on Demand for Energy Management Digital Solutions – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. ASEAN Energy Management Digital Solutions Market Analysis and Forecast, by Deployment, 2023–2031

5.1. Introduction and Definitions

5.2. ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

5.2.1. On-Premises

5.2.2. Cloud-Based

5.3. ASEAN Energy Management Digital Solutions Market Attractiveness, by Deployment

6. ASEAN Energy Management Digital Solutions Market Analysis and Forecast, by Solution Type, 2023–2031

6.1. Introduction and Definitions

6.2. ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

6.2.1. Factory Energy Management Systems (FEMS)

6.2.2. Building Energy Management Systems (BEMS)

6.2.3. Others

6.3. ASEAN Energy Management Digital Solutions Market Attractiveness, by Solution Type

7. ASEAN Energy Management Digital Solutions Market Analysis and Forecast, Component, 2023–2031

7.1. Introduction and Definitions

7.2. ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

7.2.1. Hardware

7.2.1.1. Computer Server

7.2.1.2. Controller

7.2.1.3. Sensors

7.2.1.4. Communication Network

7.2.1.5. Others

7.2.2. Software

7.2.2.1. Supervisory Control and Data Acquisition (SCADA)

7.2.2.2. Advanced Distribution Management Solution (ADMS)

7.2.2.3. Outage Management System (OMS)

7.2.2.4. Generation Management System (GMS)

7.2.2.5. Others

7.3. ASEAN Energy Management Digital Solutions Market Attractiveness, by Component

8. ASEAN Energy Management Digital Solutions Market Analysis and Forecast, Application, 2023–2031

8.1. Introduction and Definitions

8.2. ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

8.2.1. Energy Usage Monitoring and Control

8.2.2. Energy Storage Monitoring

8.2.3. Energy Efficiency Reporting

8.2.4. Energy Wastage Monitoring And Control

8.2.5. Load Management and Demand Response

8.2.6. Others

8.3. ASEAN Energy Management Digital Solutions Market Attractiveness, by Application

9. ASEAN Energy Management Digital Solutions Market Analysis and Forecast, End-use, 2023–2031

9.1. Introduction and Definitions

9.2. ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use, 2023–2031

9.2.1. Residential

9.2.2. Non-Residential

9.2.3. Utilities

9.2.4. Transportation

9.3. ASEAN Energy Management Digital Solutions Market Attractiveness, by End-use

10. ASEAN Energy Management Digital Solutions Market Analysis and Forecast, by Country, 2023–2031

10.1. Key Findings

10.2. ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Country, 2023–2031

10.2.1. Vietnam

10.2.2. Singapore

10.2.3. Indonesia

10.2.4. Malaysia

10.2.5. Philippines

10.2.6. Thailand

10.3. ASEAN Energy Management Digital Solutions Market Attractiveness, by Country

11. ASEAN Energy Management Digital Solutions Market Analysis and Forecast, 2023–2031

11.1. Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

11.2. Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

11.3. Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

11.4. Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.5. Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use, 2023–2031

11.6. Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

11.7. Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

11.8. Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

11.9. Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.10. Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, End-use, 2023–2031

11.11. Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

11.12. Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

11.13. Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

11.14. Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.15. Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, End-use, 2023–2031

11.16. Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

11.17. Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

11.18. Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

11.19. Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.20. Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use, 2023–2031

11.21. Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

11.22. Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

11.23. Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

11.24. Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.25. Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, End-use, 2023–2031

11.26. Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

11.27. Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

11.28. Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

11.29. Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.30. Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, End-use, 2023–2031

12. Competition Landscape

12.1. Market Players - Competition Matrix (by Tier and Size of Companies)

12.2. Market Share Analysis, 2022

12.3. Market Footprint Analysis

12.3.1. By Deployment

12.4. Company Profiles

12.4.1. ABB

12.4.1.1. Company Revenue

12.4.1.2. Business Overview

12.4.1.3. Product Segments

12.4.1.4. Geographic Footprint

12.4.1.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.1.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.2. Eaton

12.4.2.1. Company Revenue

12.4.2.2. Business Overview

12.4.2.3. Product Segments

12.4.2.4. Geographic Footprint

12.4.2.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.2.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.3. Energy Management Solutions, Inc.

12.4.3.1. Company Revenue

12.4.3.2. Business Overview

12.4.3.3. Product Segments

12.4.3.4. Geographic Footprint

12.4.3.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.3.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.4. ENGIE Impact

12.4.4.1. Company Revenue

12.4.4.2. Business Overview

12.4.4.3. Product Segments

12.4.4.4. Geographic Footprint

12.4.4.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.4.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.5. Factana Computing Inc.

12.4.5.1. Company Revenue

12.4.5.2. Business Overview

12.4.5.3. Product Segments

12.4.5.4. Geographic Footprint

12.4.5.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.5.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.6. Chemviron

12.4.6.1. Company Revenue

12.4.6.2. Business Overview

12.4.6.3. Product Segments

12.4.6.4. Geographic Footprint

12.4.6.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.6.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.7. General Electric

12.4.7.1. Company Revenue

12.4.7.2. Business Overview

12.4.7.3. Product Segments

12.4.7.4. Geographic Footprint

12.4.7.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.7.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.8. Honeywell International Inc.

12.4.8.1. Company Revenue

12.4.8.2. Business Overview

12.4.8.3. Product Segments

12.4.8.4. Geographic Footprint

12.4.8.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.8.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.9. Itron Inc.

12.4.9.1. Company Revenue

12.4.9.2. Business Overview

12.4.9.3. Product Segments

12.4.9.4. Geographic Footprint

12.4.9.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.9.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.10. Huawei Digital Power Technologies Co., Ltd.

12.4.10.1. Company Revenue

12.4.10.2. Business Overview

12.4.10.3. Product Segments

12.4.10.4. Geographic Footprint

12.4.10.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.10.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.11.Johnson Controls

12.4.11.1. Company Revenue

12.4.11.2. Business Overview

12.4.11.3. Product Segments

12.4.11.4. Geographic Footprint

12.4.11.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.11.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

12.4.12. Rockwell Automation

12.4.12.1. Company Revenue

12.4.12.2. Business Overview

12.4.12.3. Product Segments

12.4.12.4. Geographic Footprint

12.4.12.5. Production Process/Plant Details, etc. (*As Applicable)

12.4.12.6. Strategic Partnership, Solution Type Expansion, New Product Innovation etc.

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

Table 2: ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

Table 3: ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component 2023–2031

Table 4: ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 5: ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 6: ASEAN Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 7: Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

Table 8: Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

Table 9: Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component 2023–2031

Table 10: Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: Vietnam Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 12: Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

Table 13: Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

Table 14: Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 15: Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 16: Singapore Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 17: Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

Table 18: Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

Table 19: Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 20: Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 21: Indonesia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use 2023–2031

Table 22: Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

Table 23: Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

Table 24: Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 25: Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 26: Malaysia Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 27: Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

Table 28: Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

Table 29: Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 30: Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 31: Philippines Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use 2023–2031

Table 32: Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Deployment, 2023–2031

Table 33: Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Solution Type, 2023–2031

Table 34: Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 35: Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 36: Thailand Energy Management Digital Solutions Market Value (US$ Mn) Forecast, by End-use 2023–2031

List of Figures

Figure 1: ASEAN Energy Management Digital Solutions Market Value Share Analysis, by Deployment, 2022, 2027, and 2031

Figure 2: ASEAN Energy Management Digital Solutions Market Attractiveness, by Deployment

Figure 3: ASEAN Energy Management Digital Solutions Market Value Share Analysis, by Solution Type, 2022, 2027, and 2031

Figure 4: ASEAN Energy Management Digital Solutions Market Attractiveness, by Solution Type

Figure 5: ASEAN Energy Management Digital Solutions Market Value Share Analysis, by Component, 2022, 2027, and 2031

Figure 6: ASEAN Energy Management Digital Solutions Market Attractiveness, by Component

Figure 7: ASEAN Energy Management Digital Solutions Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 8: ASEAN Energy Management Digital Solutions Market Attractiveness, by Application

Figure 9: ASEAN Energy Management Digital Solutions Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: ASEAN Energy Management Digital Solutions Market Attractiveness, by End-use

Figure 11: ASEAN Energy Management Digital Solutions Market Value Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: ASEAN Energy Management Digital Solutions Market Attractiveness, by Country