Reports

Reports

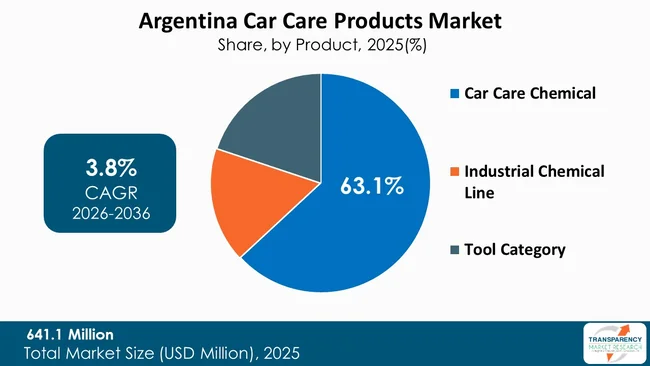

Argentina car care products market size was valued at US$ 641.1 Mn in 2025 and is projected to reach US$ 960.6 Mn by 2036, expanding at a CAGR of 3.8% from 2026 to 2036. The market growth is driven by the rising focus on vehicle appearance and resale value and expansion of professional car wash and detailing services.

Argentina car care products market offers customers a complete product range that includes exterior cleaning solutions, interior care products, surface protection items, aesthetic enhancement tools, and it serves both - individual vehicle owners and professional users who work in car wash centers, detailing studios, fleet operations, and service workshops.

The industry ecosystem combines upstream processes that involve chemical formulation, packaging, and private-label manufacturing with downstream operations that include branding, merchandising, and technical support.

The market structure of the industry shows that car care chemical products represent its main product category that customers use for both - personal and professional purposes as they require these products for their various cleaning, maintenance, and protection needs. The market has shifted from basic cleaning services toward solutions that help maintain surface integrity and visual appearance as car care products have become essential items for vehicle ownership that people need for their daily life.

The market shows a developed usage pattern that results from ongoing consumption throughout the year and operates through a complete supply system and distribution network that exists in Argentina.

The car care products market refers to the organized ecosystem of goods and services dedicated to maintenance, protection, and aesthetic enhancement of passenger and commercial vehicles across Argentina.

The market serves both - individual vehicle owners and professional users such as car wash centers, detailing studios, fleet operators, and automotive service workshops. The market shows a direct relationship between national vehicle parc size and vehicle age distribution that creates continuous demand for products that help maintain vehicle appearance and protect surfaces.

The market operates commercially through various retail channels that include automotive accessory stores, supermarkets, online platforms, and specialized distributors. It provides business-to-business supply to professional service providers. The market structure incorporates upstream chemical formulation packaging and private-label manufacturing activities that operate together with downstream branding and merchandising and after-sales technical support activities that serve professional users.

Argentina car care products industry offers more than basic cleaning services as it provides preventive and protective products that help maintain surface integrity, vehicle resale value, and extend the visual appeal of vehicles throughout their lifespan.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Argentina car care products market experiences growth as people increasingly value vehicle appearance that affects their future resale worth according to the vehicle fleet age distribution. The City of Buenos Aires’ official statistics show that 46.1% of registered vehicles needed more than 10 years of service in the first quarter of 2024 as almost 50% of operational vehicles belonged to an age group that shows signs of wear - paint and interior and surface damage.

Vehicle owners change their perspective about asset ownership when their vehicles remain operational for extended times. The process of vehicle maintenance now requires routine washing, polishing, and interior cleaning, together with protective product application, which helps maintain operational functions, visual appeal, and commercial value.

The resale and secondary market for older vehicles depends mainly on their visible condition as vehicle appearance determines buyer trust and price discussions. Vehicle owners and sellers now spend more money on paint maintenance, leather, plastic treatment products, and surface protection systems that help them decrease the visible signs of aging.

The company establishes its economic value through routine operations that include washing, waxing, and interior detailing activities that help maintain aesthetic appeal while protecting their remaining value. The trend benefits professional car wash centers and detailing services as older vehicles demand greater amounts of maintenance and more frequent service than newer models.

All these factors combined demonstrates that aging vehicles dominate the streets thus creating a permanent demand for car care products which people use to maintain their vehicle appearance and preserve its value for future resale.

The professional car washes and detailing services in Argentina continue to grow as the automotive sector functions as an essential element of the national economy that maintains a big and operational vehicle fleet preferring to use external services for their cleaning and repair needs. Official estimates indicate that in 2024 the automotive industry accounted for around 3% of Argentina's GDP and approximately 9% of industrial production with a significant number of vehicles assembled domestically and integrated into commercial and personal transport networks.

The automotive sector generates economic value through its vehicle production activities while creating jobs in services that support vehicle maintenance and aesthetic preservation work.

The increasing number of vehicles that stay operational during their whole usage period creates time constraints for urban residents who have different daily needs, which make professional car wash and detailing services more desirable than washing their cars at home. Vehicle owners in Buenos Aires and Córdoba, which are high-density cities, face challenges with vehicle maintenance as traffic and pollution and weather conditions fast-track dirt accumulation and damage to vehicle surfaces. Professional outlets use their resources to purchase specialized tools and high-performance items and skilled workers that enable them to achieve superior results and extend customer protection periods beyond what people can accomplish through DIY solutions.

The automotive manufacturing base establishes strong services throughout the ecosystem, which creates additional service growth. Auto dealerships, repair centers, and vehicle service networks frequently incorporate cleaning and detailing services into their offerings. This creates an institutional demand for professional-grade shampoos and polishers and protective coatings. The automotive sector maintains its status as a major employer while driving industrial growth that causes changes in consumer and institutional vehicle care patterns, thereby creating an ongoing demand for car care products throughout Argentina.

Car care chemical products hold 63.1% of market share, which makes them the most popular option in the industry. The market shows this chemical dominance as chemical formulations form the basis of vehicle cleaning and maintenance activities used by both - private individuals and professional services.

The essential products for car maintenance include car care chemicals that consist of shampoos, surface cleaners, waxes, polishes, interior cleaners, tire care solutions, and protective coatings. People use car care chemical products as they need them, which creates an ongoing demand for replacement products.

Manufacturers use chemical products as these products can be easily standardized, branded, and differentiated, which enables them to create multiple specialized solutions that match various surfaces, vehicle types, and different usage scenarios. The combination of these factors enables companies to develop more products, which results in greater total sales than they would achieve through selling tools or equipment.

The recurring contact of vehicles with dust, sunlight, and road contaminants establishes an ongoing demand for cleaning products and protective treatments that use chemical formulas as their main components. The combination of these factors makes car care chemical products the most popular choice among customers who use car care products in the market.

Argentina car care products market are poised to experience strong growth potential through premiumization and product formulation innovations as consumers are moving away from basic cleaning products toward performance-based solutions that provide extra value for vehicle maintenance.

The market has historically depended on functional products as they provide essential washing and surface cleaning capabilities. Vehicle owners now prefer advanced products that help them maintain their vehicle's outward appearance and protect its exterior and keep its interior in good condition. The market requires premium products that deliver visible results that last over the period of time and create distinct benefits as compared to regular products.

Professional car washes and detailing centers establish their product needs as they require chemicals boosting their operational quality while decreasing work duration and providing consistent results delivering higher-value items.

The premiumization process receives support from branding and packaging methods that present products as user-friendly and safe yet delivering professional results, which lead customers to pay extra for car care products that preserve their vehicle assets.

The innovation process creates new products that solve specific problems through specialized solutions including surface restoration, long-term protection, and interior preservation products increasing average customer spending for each vehicle. The car care products market in Argentina will see exciting business changes as companies shift from basic cleaning products toward sophisticated high-margin products that drive better profits while building customer commitment and product differentiation.

3M, ARGENSIL, Dilmax SRL, DISTRIQUIM, Henkel, Molax Argentina, Molysil, Probusol, Química Rodran, Redimer, Sumo Antares SRL, TERNNOVA, Toxic Shine, Walker Argentina, YPF are some of the leading companies operating in Argentina car care products market.

Each of these companies has been profiled in Argentina car care products market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 641.1 Mn |

| Market Forecast Value in 2036 | US$ 960.6 Mn |

| Growth Rate (CAGR 2026 to 2036) | 3.8% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Mn for Value and Thousand Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Product

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

Argentina car care products market was valued at US$ 641.1 Mn in 2025

Argentina car care products industry is projected to reach at US$ 960.6 Mn by the end of 2036

Focus on vehicle appearance & resale value and expansion of professional car wash & detailing services are some of the driving factors for this market

The CAGR is anticipated to be 3.8% from 2026 to 2036

3M, ARGENSIL, Dilmax SRL, DISTRIQUIM, Henkel, Molax Argentina, Molysil, Probusol, Química Rodran, Redimer, Sumo Antares SRL, TERNNOVA, Toxic Shine, Walker Argentina, YPF, and other key players.

Table 01: Argentina Car Care Products Market Value (US$ Mn) Projection, By Product 2021 to 2036

Table 02: Argentina Car Care Products Market Volume (Thousand Units) Projection, By Product 2021 to 2036

Table 03: Argentina Car Care Products Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 04: Argentina Car Care Products Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 01: Argentina Car Care Products Market Value (US$ Mn) Projection, By Product 2021 to 2036

Figure 02: Argentina Car Care Products Market Volume (Thousand Units) Projection, By Product 2021 to 2036

Figure 03: Argentina Car Care Products Market Incremental Opportunities (US$ Mn) Forecast, By Product 2026 to 2036

Figure 04: Argentina Car Care Products Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 05: Argentina Car Care Products Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 06: Argentina Car Care Products Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036