Reports

Reports

The animal model industry is anticipated to witness steadiness throughout the forecast period. This could be attributed to the increasing demand for advanced scientific research in drug discovery and the usage of preclinical trials. A growing number of investments in research and development activities as well as government initiatives to support biomedical research are likely to propel the market beyond the horizon. Further, it is estimated that the Asia-Pacific region will become a potential market with the highest rate of turnover, mainly due to the rapid development of healthcare infrastructure and favorable regulatory policies. This market is also complemented by innovations in genetic manipulation and the creation of more forecastable animal models.

Moreover, there are some ethical concerns, strict rules and regulations, and increasing use of alternative methods such as organs-on-chip and computer simulation for testing that may hamper the development. Partnerships amongst academic institutions, drug companies, and biotech organizations will extend the opportunities for future, thus guaranteeing the continuing presence of market in the changing landscape of the biomedical vertical.

The animal model helps researchers to understand disease mechanisms, evaluate drug effectiveness, and measure the safety of the new treatments prior to human application. Animal models have been relied for the development of drugs, biotechnological innovation, and advancements of academic research over the past few decades due to their potential to simulate human physiological and pathological conditions.

The demand for better treatments is the main driver of the market, along with rising incidences of chronic and infectious diseases and the expanding funds for research and development activities. Some other factors that favor the growth of the global biomedical market include the progress in genetic engineering and the fabrication of transgenic and humanized animal models that have a major impact on the precision of the preclinical studies.

For instance, in April of 2025, the FDA declared a plan that aimed to lower the necessity of animal testing in preclinical safety studies with a major focus on monoclonal antibody treatments. The concept is to facilitate the adoption of New Approach Methodologies (NAMs) such as computer modeling, organ-on-a-chip, and sophisticated in vitro assays.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing occurrences of chronic and complicated diseases such as cancer, cardiovascular disorders, and nervous system are the major catalysts to animal model market. The National Cancer Institute's Oncology Models Forum (OMF) is dealing with cancer disease modeling. Additionally, as the major health problems worldwide are getting bigger, pharma and biopharma companies are increasingly relying on animal models. These organizations use such models to drastically shorten the drug discovery process, personalize treatment plans in a more efficient manner, and amplify clinical trial outcomes. The ongoing trend is almost unequivocally underlining the significance of animal models in overcoming the vast divide between the healthcare revolution and the plethora of unmet medical needs.

Moreover, the demand for individually tailored medication and specific treatment has made usage of specially designed animal models even more necessary. Progress in gene editing and creation of human-like models is likely to extend their use for conquering complicated diseases. According to the 2004 report of the World Health Organization (WHO), the global mortality from CVD is 17 million people per year, accounting for 29% of all-cause mortality. Therefore, CVD remains the leading cause of death worldwide. Another serious disease is called neoplasm (or tumor), which is an abnormal growth of tissues. Thus, animal models are still widely used to study complex diseases, including CVD, neoplastic diseases, nervous system diseases, multiple sclerosis, etc.

Innovations in genetic engineering, most notably the CRISPR-Cas9 technology open the door for scientists to produce genetically modified, gene knockout, and gene humanized animals whose genetic diseases and physiological processes have closer resemblance with those of humans.

For instance, the U.S. Food and Drug Administration has released GFI #187A & GFI #187B that describe the risk-based regulatory framework for intentionally genomic changes in animals. This oversight relates to the modifications of the genome that can be passed on to the offspring of the edited organism by using such tools as genome editing, recombinant DNA.

Consequently, the extent to which preclinical research can be predictive and useful has been considerably raised, giving a strong backing to the finding of new drugs and customized treatments. Moreover, the increasing efficiency and lower costs of modern gene-editing instruments are the main factors for the increasing adoption by the pharmaceutical, biotech, and academic research departments. Further developments in this field are anticipated to lead to greater instances of disease modeling, thus creating opportunities for the treatment of diseases through precision medicine.

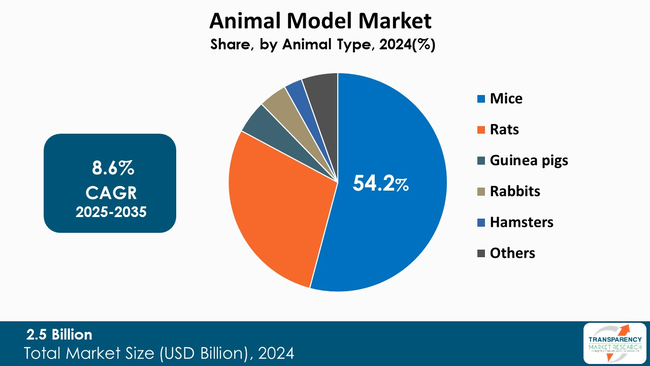

In the global animal model market, mice are the leading segment with 54.2% of market share compared to the other animal types. Mice find their application in the fields of cancer, immune system, brain, and hereditary diseases, and are used to give precise explanations of disease mechanisms and treatment reactions. Additionally, the extensive availability of validated data and standardized procedures are the main factors that place mice at the top as the most commonly used animal model. Their cost-effectiveness relative to larger species is also a major factor that has led to their wide use in academic and commercial research. For instance, in December 2021, World Health Organization (WHO) launched the SARS-CoV-2 Omicron variant assays and animal models study tracker, even as the highly mutant variant is spreading fast across the globe. WHO is already conducting research studies on variants of the SARS-CoV2 virus.

| Attribute | Detail |

|---|---|

| Leading Region |

|

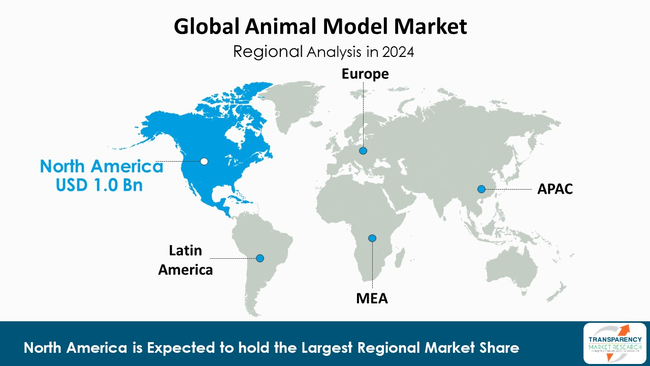

The animal model market worldwide is led by North America with 38.5% market share, which is mainly due to the region's advanced healthcare system, the extensive presence of the major pharmaceutical and biotech companies, and the large financial resources allocated to R&D.

The region receives a substantial financial support from different government agencies such as the National Institutes of Health (NIH) and the Food and Drug Administration (FDA), which allocate money for innovative research and the development of new treatments. Besides, the growing adoption of high-grade technologies, accessibility of qualified researchers, as well as the presence of many academic and research institutions, are the factors that significantly contribute to the advanced position of the U.S. and Canada in the global biotechnology field. For instance, NIH issued a Notice of Funding Opportunity PAR-25-273 to solicit groundbreaking research to develop, characterize, and maintain the animal models and associated technologies such as New Approach Methodologies (NAMs) to facilitate animal research as a more reliable bridge to human clinical applications.

Charles River Laboratories, The Jackson Laboratory, genOway, Taconic Biosciences, Inc., Harbour BioMed, Janvier Labs, Crown Bioscience, Inotiv, Biocytogen Boston Corp, Cyagen, BioSpherix, LLC, SelectScience, ingenious targeting laboratory, Ozgene Pty Ltd., Creative Animodel are some of the leading manufacturers operating in the global animal model market.

Each of these companies has been profiled in the animal model market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.5 Bn |

| Forecast Value in 2035 | More than US$ 6.2 Bn |

| CAGR | 8.6 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Animal Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global animal model market was valued at US$ 2.5 Bn in 2024

The global animal model industry is projected to reach more than US$ 6.2 Bn by the end of 2035

Prevalence of chronic and complex diseases & advancements in genetic engineering are some of the factors driving the expansion of animal model market.

The CAGR is anticipated to be 8.6% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Charles River Laboratories, The Jackson Laboratory, genOway, Taconic Biosciences, Inc., Harbour BioMed, Janvier Labs, Crown Bioscience, Inotiv, Biocytogen Boston Corp, Cyagen, BioSpherix, LLC, SelectScience, ingenious targeting laboratory, Ozgene Pty Ltd., Creative Animodel, and other prominent players.

Table 01: Global Animal Model Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 02: Global Animal Model Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Animal Model Market Value (US$ Bn) Forecast, By End-use, 2020 to 2035

Table 04: Global Animal Model Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Animal Model Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America Animal Model Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 07: North America Animal Model Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 08: North America Animal Model Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 09: Europe Animal Model Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 10: Europe Animal Model Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 11: Europe Animal Model Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 12: Europe Animal Model Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 13: Asia Pacific Animal Model Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Asia Pacific Animal Model Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 15: Asia Pacific Animal Model Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 16: Asia Pacific Animal Model Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 17: Latin America Animal Model Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 18: Latin America Animal Model Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 19: Latin America Animal Model Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Latin America Animal Model Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 21: Middle East and Africa Animal Model Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Middle East and Africa Animal Model Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 23: Middle East and Africa Animal Model Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 24: Middle East and Africa Animal Model Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 01: Global Animal Model Market Value Share Analysis, by Animal Type, 2024 and 2035

Figure 02: Global Animal Model Market Attractiveness Analysis, by Animal Type, 2025 to 2035

Figure 03: Global Animal Model Market Revenue (US$ Bn), by Mice, 2020 to 2035

Figure 04: Global Animal Model Market Revenue (US$ Bn), by Rat, 2020 to 2035

Figure 05: Global Animal Model Market Revenue (US$ Bn), by Guinea Pigs, 2020 to 2035

Figure 06: Global Animal Model Market Revenue (US$ Bn), by Rabbits, 2020 to 2035

Figure 07: Global Animal Model Market Revenue (US$ Bn), by Hamsters, 2020 to 2035

Figure 08: Global Animal Model Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 09: Global Animal Model Market Value Share Analysis, by Application, 2024 and 2035

Figure 10: Global Animal Model Market Attractiveness Analysis, by Application, 2024 and 2035

Figure 11: Global Animal Model Market Revenue (US$ Bn), by Drug Discovery and Development, 2020 to 2035

Figure 12: Global Animal Model Market Revenue (US$ Bn), by Basic Research, 2020 to 2035

Figure 13: Global Animal Model Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Animal Model Market Value Share Analysis, by End-use, 2024 and 2035

Figure 15: Global Animal Model Market Attractiveness Analysis, by End-use, 2024 and 2035

Figure 16: Global Animal Model Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology Companies, 2025 to 2035

Figure 17: Global Animal Model Market Revenue (US$ Bn), by Academic Research Institute, 2020 to 2035

Figure 18: Global Animal Model Market Revenue (US$ Bn), by Contract Research Organization, 2020 to 2035

Figure 19: Global Animal Model Market Value Share Analysis, By Region, 2024 and 2035

Figure 20: Global Animal Model Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 21: North America Animal Model Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 22: North America Animal Model Market Value Share Analysis, by Country, 2024 and 2035

Figure 23: North America Animal Model Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 24: North America Animal Model Market Value Share Analysis, by Animal Type, 2024 and 2035

Figure 25: North America Animal Model Market Attractiveness Analysis, by Animal Type, 2025 to 2035

Figure 26: North America Animal Model Market Value Share Analysis, by Application, 2024 and 2035

Figure 27: North America Animal Model Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 28: North America Animal Model Market Value Share Analysis, by End-use, 2024 and 2035

Figure 29: North America Animal Model Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 30: Europe Animal Model Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 31: Europe Animal Model Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 32: Europe Animal Model Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 33: Europe Animal Model Market Value Share Analysis, by Animal Type, 2024 and 2035

Figure 34: Europe Animal Model Market Attractiveness Analysis, by Animal Type, 2025 to 2035

Figure 35: Europe Animal Model Market Value Share Analysis, By Application, 2024 and 2035

Figure 36: Europe Animal Model Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 37: Europe Animal Model Market Value Share Analysis, by End-use, 2024 and 2035

Figure 38: Europe Animal Model Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 39: Asia Pacific Animal Model Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Asia Pacific Animal Model Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Asia Pacific Animal Model Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 42: Asia Pacific Animal Model Market Value Share Analysis, by Animal Type, 2024 and 2035

Figure 43: Asia Pacific Animal Model Market Attractiveness Analysis, by Animal Type, 2025 to 2035

Figure 44: Asia Pacific Animal Model Market Value Share Analysis, By Application, 2024 and 2035

Figure 45: Asia Pacific Animal Model Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 46: Asia Pacific Animal Model Market Value Share Analysis, by End-use, 2024 and 2035

Figure 47: Asia Pacific Animal Model Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 48: Latin America Animal Model Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Latin America Animal Model Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 50: Latin America Animal Model Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 51: Latin America Animal Model Market Value Share Analysis, by Animal Type, 2024 and 2035

Figure 52: Latin America Animal Model Market Attractiveness Analysis, by Animal Type, 2025 to 2035

Figure 53: Latin America Animal Model Market Value Share Analysis, By Application, 2024 and 2035

Figure 54: Latin America Animal Model Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 55: Latin America Animal Model Market Value Share Analysis, by End-use, 2024 and 2035

Figure 56: Latin America Animal Model Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 57: Middle East & Africa Animal Model Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Middle East & Africa Animal Model Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Middle East & Africa Animal Model Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 60: Middle East and Africa Animal Model Market Value Share Analysis, by Animal Type, 2024 and 2035

Figure 61: Middle East and Africa Animal Model Market Attractiveness Analysis, by Animal Type, 2025 to 2035

Figure 62: Middle East and Africa Animal Model Market Value Share Analysis, by Application, 2024 and 2035

Figure 63: Middle East and Africa Animal Model Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Middle East and Africa Animal Model Market Value Share Analysis, by End-use, 2024 and 2035

Figure 65: Middle East and Africa Animal Model Market Attractiveness Analysis, by End-use, 2025 to 2035