Reports

Reports

Animal feed amino acids have emerged as an essential component of livestock nutrition. The global livestock production has improved at a significant rate in the past few years, owing to a range of factors. Some of the major factors that have directly or indirectly impacted livestock production in recent years include exponential growth of the human population, rise in disposable income, improvements in production efficiency, and environmental sustainability, among others. In addition, animal nutritionists around the world have been increasingly leaning toward the use of animal feed amino acids to fulfill the growing demand for livestock products and improve feed efficiency at lower costs.

The demand for animal feed amino acids has consistently increased in the past few years and the trend is set to continue during the forecast period (2019-2027). Most livestock do not have the ability to synthesize amino acids and thus, animal feed amino acids have gained tremendous popularity in the past few years. Research and development activities have revealed that lysine (Lys) and Methionine (Met)– the first and second limiting amino acids, are increasingly being used in lactating dairy cows to enhance production efficiency and decrease metabolic disorders incidences.

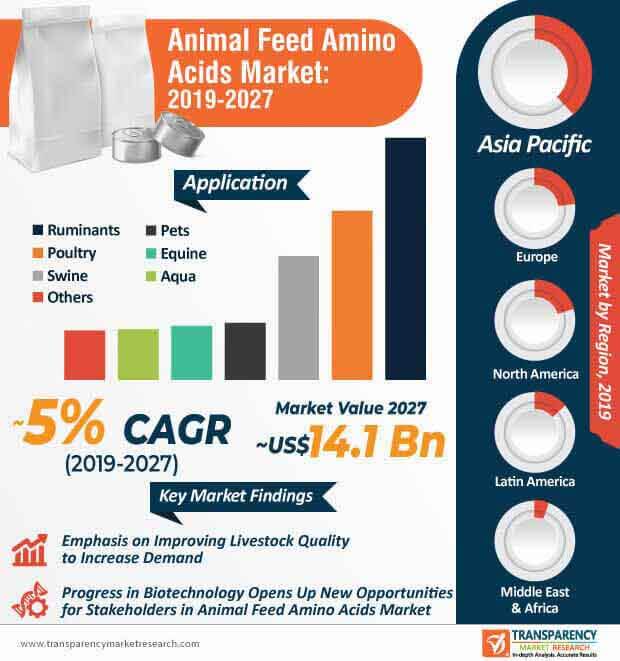

Moreover, significant advancements over the past few years have enabled animal nutritionists to assess the internal activities of the rumen. Stakeholders in the animal feed amino acids market are expected to combine animal feed amino acids and microbial protein to minimize diet costs and improve livestock production. Thus, the global animal feed amino acids market is expected to reach ~US$ 14.1 Bn by the end of 2027 and grow at a steady pace during the assessment period.

Research Activities Explore New Livestock Improvement Techniques

Amidst rapid growth of human population worldwide, there have been significant developments in animal productivity in recent years. Researchers are focusing on improving animal productivity and quantity by leveraging new technologies and techniques to feed livestock, streamline production systems, etc. Conventional techniques, such as breeding, genetics, livestock disease management, livestock nutrition, are extensively used to improve livestock. However, according to a research, due to the exponential rise in demand for livestock, conventional techniques deployed to improve livestock production are no longer sustainable.

Thus, due to these drawbacks of conventional livestock production techniques, new techniques that leverage biotechnology have emerged as one of the most reliable and efficient techniques to enhance productivity. The use of animal feed amino acids and biotechnology have opened up new opportunities for stakeholders in the animal feed amino acids market to improve productivity in a sustainable way. Livestock, including cows, pigs, sheep, hens, and fish require an array of nutrients in their diet such as minerals, vitamins, and amino acids. Some of the most essential amino acids required for improved growth, lactation, reproduction, and maintenance include isoleucine, leucine, lysine, and methionine. Lys and Met have emerged as commonly used animal feed amino acids, and both these product segment are likely to be hold key share of the global animal feed amino acids market during the forecast period.

On the other hand, the demand for threonine and other animal feed amino acids such as tryptophan is also expected to grow at a steady pace in the animal feed amino acids market during the forecast period. The smooth development of the rumen largely relies on animal feed amino acids due to which, the demand for animal feed amino acids is expected to move in an upward trajectory in the coming years. According to the research carried out by Transparency Market Research, the ascending demand for animal feed amino acids for ruminants, swine, and poultry will play a key role in the development of the global animal feed amino acids market in the coming years. Moreover, amidst the mounting pressure to minimize carbon footprint and address environmental concerns, animal feed amino acids are set to play a critical role in improving the quality of livestock diet, and improve sustainability. In addition, as animal feed amino acids have also offered immense promise in terms of reducing the cost of lactation feed, the demand for the same will witness steady growth during the assessment period, thus driving the animal feed amino acids market.

Analysts’ Viewpoint

The global animal feed amino acids market is expected to grow at a steady CAGR of ~5% during the forecast period. As animal feed amino acids can reduce the cost of lactation feed, reduce metabolic disorder incidences, and enhance dairy herd fertility, the demand will grow in the upcoming years. Furthermore, the growing application of animal feed amino acids in aquatic feeds offers stakeholders a lucrative window of opportunity to enhance their position in the animal feed amino acids market. Research and development activities will play an important role in improving the quality of livestock productivity wherein animal feed amino acids will play an essential role.

Rise in Demand for Methionine Animal Feed Amino Acids in Poultry and Swine Applications

Demand for Animal Feed Amino Acids to Increase in Ruminants and Poultry Applications

Key Regional Highlights

Animal Feed Amino Acids Market: Competition Landscape

1. Executive Summary: Global Animal Feed Amino Acids Market

1.1. Global Animal Feed Amino Acids Market Volume (Kilo Tons) Forecast, 2018–2027

1.2. Global Animal Feed Amino Acids Market Value (US$ Mn) Forecast, by Region, 2018–2027

1.3. Key Trends

2. Market Overview

2.1. Animal Feed Amino Acids: Product Definition

2.2. Animal Feed Amino Acids: Application Definition

2.3. Market Trend

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Key Opportunities

2.5. Porters Five Forces Analysis

2.6. Value Chain Analysis

2.7. Regulatory Landscape

2.8. List of Feed Grade Amino Acid Manufacturers

2.9. List of Potential Customers

2.10. SWOT Analysis

3. Supply-Demand Scenario, 2018

4. Import and Export Analysis, 2015–2018

5. Price Trend Analysis

5.1. Price Trend Analysis (US$ Per Ton), 2018-2027, by Product

5.2. Price Trend Analysis (US$ Per Ton), 2018-2027, by Region

6. Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2018–2027

6.1. Key Facts and Figures – Product

6.2. Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.2.1. Tryptophan

6.2.2. Lysine

6.2.3. Methionine

6.2.4. Threonine

6.2.5. Others

6.3. Key Facts and Figures – Application

6.4. Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.4.1. Ruminants

6.4.1.1. Cattle

6.4.1.2. Sheep

6.4.1.3. Others

6.4.2. Poultry

6.4.3. Swine

6.4.4. Pets

6.4.5. Equine

6.4.6. Aqua

6.4.7. Others

7. Global Animal Feed Amino Acids Market Analysis, by Region, 2018–2027

7.1. Key Findings

7.2. Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Global Animal Feed Amino Acids Market Attractiveness Analysis, by Region

8. North America Animal Feed Amino Acids Market Analysis

8.1. Key Findings

8.2. North America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

8.2.1. Tryptophan

8.2.2. Lysine

8.2.3. Methionine

8.2.4. Threonine

8.2.5. Others

8.3. North America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.3.1. Ruminants

8.3.1.1. Cattle

8.3.1.2. Sheep

8.3.1.3. Others

8.3.2. Poultry

8.3.3. Swine

8.3.4. Pets

8.3.5. Equine

8.3.6. Aqua

8.3.7. Others

8.4. North America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2018–2027

8.5. U.S. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

8.5.1. Tryptophan

8.5.2. Lysine

8.5.3. Methionine

8.5.4. Threonine

8.5.5. Others

8.6. U.S. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.6.1. Ruminants

8.6.1.1. Cattle

8.6.1.2. Sheep

8.6.1.3. Others

8.6.2. Poultry

8.6.3. Swine

8.6.4. Pets

8.6.5. Equine

8.6.6. Aqua

8.6.7. Others

8.7. Canada Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

8.7.1. Tryptophan

8.7.2. Lysine

8.7.3. Methionine

8.7.4. Threonine

8.7.5. Others

8.8. Canada Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.8.1. Ruminants

8.8.1.1. Cattle

8.8.1.2. Sheep

8.8.1.3. Others

8.8.2. Poultry

8.8.3. Swine

8.8.4. Pets

8.8.5. Equine

8.8.6. Aqua

8.8.7. Others

8.9. North America Animal Feed Amino Acids Market Attractiveness Analysis

9. Europe Animal Feed Amino Acids Market Analysis

9.1. Key Findings

9.2. Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.2.1. Tryptophan

9.2.2. Lysine

9.2.3. Methionine

9.2.4. Threonine

9.2.5. Others

9.3. Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.3.1. Ruminants

9.3.1.1. Cattle

9.3.1.2. Sheep

9.3.1.3. Others

9.3.2. Poultry

9.3.3. Swine

9.3.4. Pets

9.3.5. Equine

9.3.6. Aqua

9.3.7. Others

9.4. Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

9.5. Germany Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.5.1. Tryptophan

9.5.2. Lysine

9.5.3. Methionine

9.5.4. Threonine

9.5.5. Others

9.6. Germany Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.6.1. Ruminants

9.6.1.1. Cattle

9.6.1.2. Sheep

9.6.1.3. Others

9.6.2. Poultry

9.6.3. Swine

9.6.4. Pets

9.6.5. Equine

9.6.6. Aqua

9.6.7. Others

9.7. France Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.7.1. Tryptophan

9.7.2. Lysine

9.7.3. Methionine

9.7.4. Threonine

9.7.5. Others

9.8. France Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.8.1. Ruminants

9.8.1.1. Cattle

9.8.1.2. Sheep

9.8.1.3. Others

9.8.2. Poultry

9.8.3. Swine

9.8.4. Pets

9.8.5. Equine

9.8.6. Aqua

9.8.7. Others

9.9. U.K. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.9.1. Tryptophan

9.9.2. Lysine

9.9.3. Methionine

9.9.4. Threonine

9.9.5. Others

9.10. U.K. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.10.1. Ruminants

9.10.1.1. Cattle

9.10.1.2. Sheep

9.10.1.3. Others

9.10.2. Poultry

9.10.3. Swine

9.10.4. Pets

9.10.5. Equine

9.10.6. Aqua

9.10.7. Others

9.11. Spain Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.11.1. Tryptophan

9.11.2. Lysine

9.11.3. Methionine

9.11.4. Threonine

9.11.5. Others

9.12. Spain Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.12.1. Ruminants

9.12.1.1. Cattle

9.12.1.2. Sheep

9.12.1.3. Others

9.12.2. Poultry

9.12.3. Swine

9.12.4. Pets

9.12.5. Equine

9.12.6. Aqua

9.12.7. Others

9.13. Italy Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.13.1. Tryptophan

9.13.2. Lysine

9.13.3. Methionine

9.13.4. Threonine

9.13.5. Others

9.14. Italy Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.14.1. Ruminants

9.14.1.1. Cattle

9.14.1.2. Sheep

9.14.1.3. Others

9.14.2. Poultry

9.14.3. Swine

9.14.4. Pets

9.14.5. Equine

9.14.6. Aqua

9.14.7. Others

9.15. Russia & CIS Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.15.1. Tryptophan

9.15.2. Lysine

9.15.3. Methionine

9.15.4. Threonine

9.15.5. Others

9.16. Russia & CIS Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.16.1. Ruminants

9.16.1.1. Cattle

9.16.1.2. Sheep

9.16.1.3. Others

9.16.2. Poultry

9.16.3. Swine

9.16.4. Pets

9.16.5. Equine

9.16.6. Aqua

9.16.7. Others

9.17. Rest of Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

9.17.1. Tryptophan

9.17.2. Lysine

9.17.3. Methionine

9.17.4. Threonine

9.17.5. Others

9.18. Rest of Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.18.1. Ruminants

9.18.1.1. Cattle

9.18.1.2. Sheep

9.18.1.3. Others

9.18.2. Poultry

9.18.3. Swine

9.18.4. Pets

9.18.5. Equine

9.18.6. Aqua

9.18.7. Others

9.19. Europe Animal Feed Amino Acids Market Attractiveness Analysis

10. Asia Pacific Animal Feed Amino Acids Market Analysis

10.1. Key Findings

10.2. Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

10.2.1. Tryptophan

10.2.2. Lysine

10.2.3. Methionine

10.2.4. Threonine

10.2.5. Others

10.3. Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.3.1. Ruminants

10.3.1.1. Cattle

10.3.1.2. Sheep

10.3.1.3. Others

10.3.2. Poultry

10.3.3. Swine

10.3.4. Pets

10.3.5. Equine

10.3.6. Aqua

10.3.7. Others

10.4. Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

10.5. China Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

10.5.1. Tryptophan

10.5.2. Lysine

10.5.3. Methionine

10.5.4. Threonine

10.5.5. Others

10.6. China Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.6.1. Ruminants

10.6.1.1. Cattle

10.6.1.2. Sheep

10.6.1.3. Others

10.6.2. Poultry

10.6.3. Swine

10.6.4. Pets

10.6.5. Equine

10.6.6. Aqua

10.6.7. Others

10.7. India Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

10.7.1. Tryptophan

10.7.2. Lysine

10.7.3. Methionine

10.7.4. Threonine

10.7.5. Others

10.8. India Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.8.1. Ruminants

10.8.1.1. Cattle

10.8.1.2. Sheep

10.8.1.3. Others

10.8.2. Poultry

10.8.3. Swine

10.8.4. Pets

10.8.5. Equine

10.8.6. Aqua

10.8.7. Others

10.9. Japan Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

10.9.1. Tryptophan

10.9.2. Lysine

10.9.3. Methionine

10.9.4. Threonine

10.9.5. Others

10.10. Japan Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.10.1. Ruminants

10.10.1.1. Cattle

10.10.1.2. Sheep

10.10.1.3. Others

10.10.2. Poultry

10.10.3. Swine

10.10.4. Pets

10.10.5. Equine

10.10.6. Aqua

10.10.7. Others

10.11. ASEAN Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

10.11.1. Tryptophan

10.11.2. Lysine

10.11.3. Methionine

10.11.4. Threonine

10.11.5. Others

10.12. ASEAN Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.12.1. Ruminants

10.12.1.1. Cattle

10.12.1.2. Sheep

10.12.1.3. Others

10.12.2. Poultry

10.12.3. Swine

10.12.4. Pets

10.12.5. Equine

10.12.6. Aqua

10.12.7. Others

10.13. Rest of Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

10.13.1. Tryptophan

10.13.2. Lysine

10.13.3. Methionine

10.13.4. Threonine

10.13.5. Others

10.14. Rest of Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.14.1. Ruminants

10.14.1.1. Cattle

10.14.1.2. Sheep

10.14.1.3. Others

10.14.2. Poultry

10.14.3. Swine

10.14.4. Pets

10.14.5. Equine

10.14.6. Aqua

10.14.7. Others

10.15. Asia Pacific Animal Feed Amino Acids Market Attractiveness Analysis

11. Latin America Animal Feed Amino Acids Market Analysis

11.1. Key Findings

11.2. Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

11.2.1. Tryptophan

11.2.2. Lysine

11.2.3. Methionine

11.2.4. Threonine

11.2.5. Others

11.3. Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.3.1. Ruminants

11.3.1.1. Cattle

11.3.1.2. Sheep

11.3.1.3. Others

11.3.2. Poultry

11.3.3. Swine

11.3.4. Pets

11.3.5. Equine

11.3.6. Aqua

11.3.7. Others

11.4. Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

11.5. Brazil Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

11.5.1. Tryptophan

11.5.2. Lysine

11.5.3. Methionine

11.5.4. Threonine

11.5.5. Others

11.6. Brazil Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.6.1. Ruminants

11.6.1.1. Cattle

11.6.1.2. Sheep

11.6.1.3. Others

11.6.2. Poultry

11.6.3. Swine

11.6.4. Pets

11.6.5. Equine

11.6.6. Aqua

11.6.7. Others

11.7. Mexico Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

11.7.1. Tryptophan

11.7.2. Lysine

11.7.3. Methionine

11.7.4. Threonine

11.7.5. Others

11.8. Mexico Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.8.1. Ruminants

11.8.1.1. Cattle

11.8.1.2. Sheep

11.8.1.3. Others

11.8.2. Poultry

11.8.3. Swine

11.8.4. Pets

11.8.5. Equine

11.8.6. Aqua

11.8.7. Others

11.9. Rest of Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

11.9.1. Tryptophan

11.9.2. Lysine

11.9.3. Methionine

11.9.4. Threonine

11.9.5. Others

11.10. Rest of Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.10.1. Ruminants

11.10.1.1. Cattle

11.10.1.2. Sheep

11.10.1.3. Others

11.10.2. Poultry

11.10.3. Swine

11.10.4. Pets

11.10.5. Equine

11.10.6. Aqua

11.10.7. Others

11.11. Latin America Animal Feed Amino Acids Market Attractiveness Analysis

12. Middle East & Africa Animal Feed Amino Acids Market Analysis

12.1. Key Findings

12.2. Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

12.2.1. Tryptophan

12.2.2. Lysine

12.2.3. Methionine

12.2.4. Threonine

12.2.5. Others

12.3. Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.3.1. Ruminants

12.3.1.1. Cattle

12.3.1.2. Sheep

12.3.1.3. Others

12.3.2. Poultry

12.3.3. Swine

12.3.4. Pets

12.3.5. Equine

12.3.6. Aqua

12.3.7. Others

12.4. Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

12.5. GCC Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

12.5.1. Tryptophan

12.5.2. Lysine

12.5.3. Methionine

12.5.4. Threonine

12.5.5. Others

12.6. GCC Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.6.1. Ruminants

12.6.1.1. Cattle

12.6.1.2. Sheep

12.6.1.3. Others

12.6.2. Poultry

12.6.3. Swine

12.6.4. Pets

12.6.5. Equine

12.6.6. Aqua

12.6.7. Others

12.7. South Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

12.7.1. Tryptophan

12.7.2. Lysine

12.7.3. Methionine

12.7.4. Threonine

12.7.5. Others

12.8. South Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.8.1. Ruminants

12.8.1.1. Cattle

12.8.1.2. Sheep

12.8.1.3. Others

12.8.2. Poultry

12.8.3. Swine

12.8.4. Pets

12.8.5. Equine

12.8.6. Aqua

12.8.7. Others

12.9. Rest of Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

12.9.1. Tryptophan

12.9.2. Lysine

12.9.3. Methionine

12.9.4. Threonine

12.9.5. Others

12.10. Rest of Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.10.1. Ruminants

12.10.1.1. Cattle

12.10.1.2. Sheep

12.10.1.3. Others

12.10.2. Poultry

12.10.3. Swine

12.10.4. Pets

12.10.5. Equine

12.10.6. Aqua

12.10.7. Others

12.11. Middle East & Africa Animal Feed Amino Acids Market Attractiveness Analysis

13. Competition Landscape

13.1. Animal Feed Amino Acids Market Share Analysis, by Company, 2018

13.2. Competition Matrix

13.3. Animal Feed Amino Acids Market Share Analysis, by Company

13.3.1. Product Mapping

13.4. Company Profiles

13.4.1. Archer Daniels Midland Company

13.4.1.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.1.2. Business Overview

13.4.1.3. Product/Services, Key End-use Industries

13.4.1.4. Financial Overview

13.4.1.5. Strategic Initiatives

13.4.2. Evonik Industries AG

13.4.2.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.2.2. Business Overview

13.4.2.3. Product/Services, Key End-use Industries

13.4.2.4. Financial Overview

13.4.2.5. Strategic Initiatives

13.4.3. Kemin Industries

13.4.3.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.3.2. Business Overview

13.4.3.3. Product/Services, Key End-use Industries

13.4.3.4. Strategic Initiatives

13.4.4. Sumitomo Chemical Co. Ltd.

13.4.4.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.4.2. Business Overview

13.4.4.3. Product/Services, Key End-use Industries

13.4.4.4. Financial Overview

13.4.5. Novus International, Inc.

13.4.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.5.2. Business Overview

13.4.5.3. Product/Services, Key End-use Industries

13.4.6. Cargill

13.4.6.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.6.2. Business Overview

13.4.6.3. Product/Services, Key End-use Industries

13.4.6.4. Financial Overview

13.4.7. Adisseo

13.4.7.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.7.2. Business Overview

13.4.7.3. Product/Services, Key End-use Industries

13.4.7.4. Financial Overview

13.4.8. MeiHua Holdings Group Co., Ltd.

13.4.8.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.8.2. Business Overview

13.4.8.3. Product/Services, Key End-use Industries

13.4.9. Koudijs Mkorma

13.4.9.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.9.2. Business Overview

13.4.9.3. Product/Services, Key End-use Industries

13.4.10. Global Bio-chem Technology Group Company Limited

13.4.10.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.10.2. Business Overview

13.4.10.3. Product/Services, Key End-use Industries

13.4.10.4. Financial Overview

13.4.11. Shijiazhuang Donghua Jinlong Chemical Co. Ltd.

13.4.11.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.11.2. Business Overview

13.4.11.3. Product/Services, Key End-use Industries

13.4.12. Ajinomoto Group

13.4.12.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

13.4.12.2. Business Overview

13.4.12.3. Product/Services, Key End-use Industries

13.4.12.4. Financial Overview

14. Primary Research - Key Insights

15. Appendix

15.1. Research Methodology and Assumptions

List of Tables

Table 01: Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 02: Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 03: Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

Table 04: North America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 05: North America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 06: North America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2018–2027

Table 07: U.S. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 08: U.S. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 09: Canada Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 10: Canada Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 11: Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 12: Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 13: Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 14: Germany Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 15: Germany Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 16: France Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 17: France Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 18: U.K. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 19: U.K. Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 20: Italy Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 21: Italy Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 22: Spain Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 23: Spain Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 24: Russia & CIS Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 25: Russia & CIS Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 26: Rest of Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 27: Rest of Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 28: Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 29: Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 30: Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 31: China Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 32: China Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 33: India Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 34: India Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 35: Japan Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 36: Japan Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 37: ASEAN Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 38: ASEAN Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 39: Rest of Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 40: Rest of Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 41: Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 42: Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 43: Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 44: Brazil Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 45: Brazil Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 46: Mexico Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 47: Mexico Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 48: Rest of Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 49: Rest of Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 50: Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 51: Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 52: Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 53: GCC Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 54: GCC Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 55: South Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 56: South Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 57: Rest of Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 58: Rest of Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 01: Global Animal Feed Amino Acids Market Share Analysis, by Product

Figure 02: Global Animal Feed Amino Acids Market Attractiveness Analysis, by Product

Figure 03: Global Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn), 2018–2027

Figure 04: Global Animal Feed Amino Acids Market Share Analysis, by Application

Figure 05: Global Animal Feed Amino Acids Market Attractiveness Analysis, by Application

Figure 06: Global Animal Feed Amino Acids Market Share Analysis, by Region

Figure 07: Global Animal Feed Amino Acids Market Attractiveness Analysis, by Region

Figure 08: North America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn), 2018–2027

Figure 09: North America Animal Feed Amino Acids Market Value Share Analysis, by Country

Figure 10: North America Animal Feed Amino Acids Market Attractiveness Analysis, by Country

Figure 11: North America Animal Feed Amino Acids Market Share Analysis, by Product

Figure 12: North America Animal Feed Amino Acids Market Attractiveness Analysis, by Product

Figure 13: North America Animal Feed Amino Acids Market Share Analysis, by Application

Figure 14: North America Animal Feed Amino Acids Market Attractiveness Analysis, by Application

Figure 15: Europe Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn), 2018–2027

Figure 16: Europe Animal Feed Amino Acids Market Share Analysis, by Country and Sub-region

Figure 17: Europe Animal Feed Amino Acids Market Attractiveness Analysis, by Country and Sub-region

Figure 18: Europe Animal Feed Amino Acids Market Share Analysis, by Product

Figure 19: Europe Animal Feed Amino Acids Market Attractiveness Analysis, by Product

Figure 20: Europe Animal Feed Amino Acids Market Share Analysis, by Application

Figure 21: Europe Animal Feed Amino Acids Market Attractiveness Analysis, by Application

Figure 22: Asia Pacific Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn), 2018–2027

Figure 23: Asia Pacific Animal Feed Amino Acids Market Value Share Analysis, by Country and Sub-region

Figure 24: Asia Pacific Animal Feed Amino Acids Market Attractiveness Analysis, by Country and Sub-region

Figure 25: Asia Pacific Animal Feed Amino Acids Market Share Analysis, by Product

Figure 26: Asia Pacific Animal Feed Amino Acids Market Attractiveness Analysis, by Product

Figure 27: Asia Pacific Animal Feed Amino Acids Market Share Analysis, by Application

Figure 28: Asia Pacific Animal Feed Amino Acids Market Attractiveness Analysis, by Application

Figure 29: Latin America Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn), 2018–2027

Figure 30: Latin America Animal Feed Amino Acids Market Share Analysis, by Country and Sub-region

Figure 31: Latin America Animal Feed Amino Acids Market Attractiveness Analysis, by Country and Sub-region

Figure 32: Latin America Animal Feed Amino Acids Market Share Analysis, by Product

Figure 33: Latin America Animal Feed Amino Acids Market Attractiveness Analysis, by Product

Figure 34: Latin America Animal Feed Amino Acids Market Share Analysis, by Application

Figure 35: Latin America Animal Feed Amino Acids Market Attractiveness Analysis, by Application

Figure 36: Middle East & Africa Animal Feed Amino Acids Market Volume (Kilo Tons) and Value (US$ Mn), 2018–2027

Figure 37: Middle East & Africa Animal Feed Amino Acids Market Share Analysis, by Country and Sub-region

Figure 38: Middle East & Africa Animal Feed Amino Acids Market Attractiveness Analysis, by Country and Sub-region

Figure 39: Middle East & Africa Animal Feed Amino Acids Market Share Analysis, by Product

Figure 40: Middle East & Africa Animal Feed Amino Acids Market Attractiveness Analysis, by Product

Figure 41: Middle East & Africa Animal Feed Amino Acids Market Share Analysis, by Application

Figure 42: Middle East & Africa Animal Feed Amino Acids Market Attractiveness Analysis, by Application

Figure 43: Company Market Share Analysis, 2018