Reports

Reports

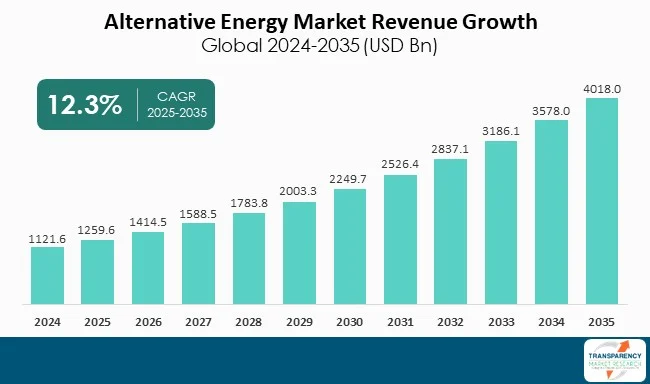

The global alternative energy market is poised for strong growth based upon escalating decarbonization targets, increasing demand for energy, and the declining costs of underlying technologies. Key market drivers include government incentives, favorable regulatory policies, and corporate sustainability commitments. The growth of solar, wind, hydro, biomass, geothermal, and hydrogen technologies are more appealing as the global energy markets accelerate towards alternatives fuels.

Alternative energy processes, such as solar photovoltaic conversion, wind turbine electricity generation, and electrolysis to produce green hydrogen, which are deployed into utility scale power plants (private sector), industrial applications, and more localized, distributed energy systems achieving dual purposes of energy security and meeting sustainable environmental values in a transitioning energy mix are expanding on a significant note.

Some of the larger players include Vestas, Siemens Gamesa, First Solar, Enel Green Power and Iberdrola, which are all investing into capacity expansion and building knowledge to support technology advances in storage systems, grid integration, and partnership development to achieve faster deployment. The anticipated progress of this growth is further supported by advances in battery storage, smart grid structure, and hydrogen infrastructure.

The alternative energy market consists of technologies and solutions that provide power from renewable or non-traditional sources. For example, solar, wind, hydro, biomass, geothermal, and hydrogen are either non-fossil sources of energy or renewable feedstock. These forms of energy reduce carbon emissions and are a part of sustainable energy supply.

Solar panels convert sunlight to electricity using photovoltaic cells, wind turbines convert the kinetic energy to electricity, hydroelectric green electricity systems depend on flowing water to generate electricity from turbines, biomass and organic materials are fuels to produce heat, electricity and biofuels, while green hydrogen is renewables-based electricity through electrolysis produced from water and it provides a clean fuel for transportation and industry.

These uses and applications are implemented in utility scale power plants, residential and commercial energy systems, as well as industrial operational systems; thereby providing scalable, cleaner solutions as a replacement for traditional forms of energy.

| Attribute | Detail |

|---|---|

| Drivers |

|

Government policies, regulatory frameworks, and financial incentives are amongst the most important drivers to the alternative energy markets. Globally governments are committing to aggressive renewable energy targets, carbon neutrality goals, and emissions reductions. All of these actions include, but are not limited to, subsidies, tax credits, feed-in tariffs, renewable energy certificates, and low-interest lending for clean energy projects. For example, countries in North America and Europe have significant tax rebates for solar and wind projects while India and China are making extensive investments in renewable infrastructure through favorable policy support and financing.

These regulatory approaches help in lessening the initial capital burden on developers, reducing project risk, and improving return on capital, thereby making renewable energy projects feasible. Regulatory frameworks often require a systematic phase out of fossil fuel usage and incentivize clean energy solutions to be grid connected, which further enhances market acceptance.

By providing a predictable and supportive regulatory environment, governments provide confidence to investors and larger corporations to invest long-term capital in renewable energy projects. The collective effect of these incentives and measures drives technological adoption, thereby supporting widespread deployment of renewable solutions.

Technological advances and decreasing production costs are large drivers for the growth of the alternative energy sector. In the past ten years, enhancements in photovoltaic systems, wind turbine technology, smart grid technology, and energy storage solutions have greatly enhanced the reliability, efficiency, and scalability of these solutions. The production and installation costs for solar panels have dropped over 70%, whereas the productivity and efficiency of wind turbine systems have also located substantial advances with larger rotors, improved aerodynamics and predictive maintenance algorithms.

At the same time, energy storage options, including lithium-ion and new solid-state batteries to mitigate intermittency, allow reliable and constant power to be generated from variable renewable sources. Innovations regarding the synthesis of green hydrogen and subsequent bioenergy conversion, and telecommunication technologies that ensure seamless electricity grid connectivity, expand the applications for alternative energy in industrial, commercial, and residential sectors.

Technological advancements that offer better performance, but are cost competitive, increase the attractiveness of renewable energy, and not just so for large scale utility-scale projects but also for small businesses and consumers, indicative of sustainable market growth.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 1121.6 Bn |

| Market Forecast Value in 2035 | US$ 4018.0 Bn |

| Growth Rate (CAGR) | 12.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and GW for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Alternative Energy market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The alternative energy market was valued at US$ 1121.6 Bn in 2024

The alternative energy industry is expected to grow at a CAGR of 12.3% from 2025 to 2035

Regulatory support, technological advancements and cost reductions

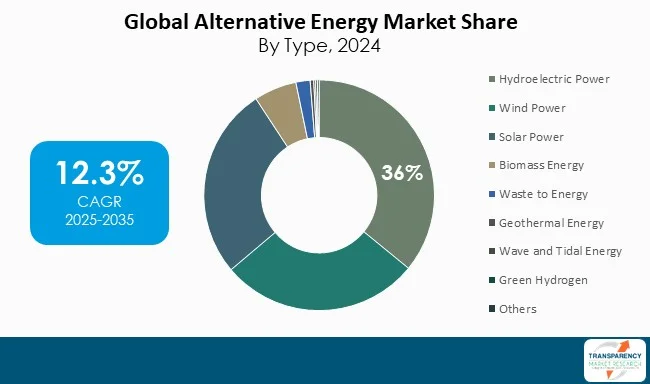

Hydroelectric Power held the largest share respectively within the type segment and was anticipated to grow at an estimated CAGR of 11.2% during the forecast period

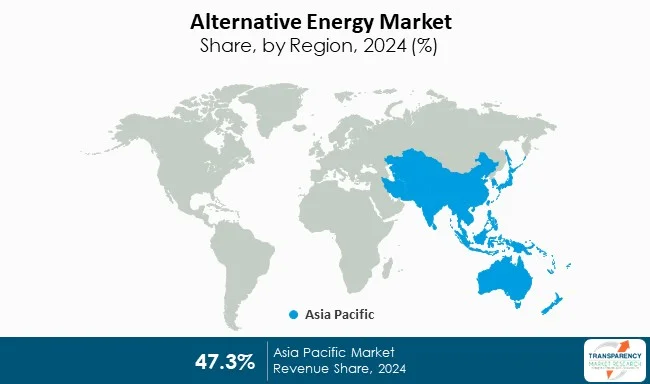

Asia Pacific was the most lucrative region in 2024

Engie, Enel Green Power, GE Renewable Energy, Iberdola S.A., Nel ASA, Orstead A/S, and RWE AG are the major players in the Alternative Energy market

Table 1 Global Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 2 Global Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 3 Global Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 4 Global Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 5 Global Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 6 Global Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 7 Global Alternative Energy Market Volume (GW) Forecast, by Region, 2025 to 2035

Table 8 Global Alternative Energy Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 10 North America Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 11 North America Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 12 North America Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 13 North America Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 14 North America Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 15 North America Alternative Energy Market Volume (GW) Forecast, by Country, 2025 to 2035

Table 16 North America Alternative Energy Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 18 U.S. Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 19 U.S. Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 20 U.S. Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 21 U.S. Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 22 U.S. Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 23 Canada Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 24 Canada Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 25 Canada Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 26 Canada Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 27 Canada Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 28 Canada Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 29 Europe Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 30 Europe Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 31 Europe Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 32 Europe Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 33 Europe Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 34 Europe Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 35 Europe Alternative Energy Market Volume (GW) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Alternative Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 38 Germany Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 39 Germany Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 40 Germany Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 41 Germany Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 42 Germany Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 43 France Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 44 France Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 45 France Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 46 France Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 47 France Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 48 France Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 49 U.K. Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 50 U.K. Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 51 U.K. Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 52 U.K. Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 53 U.K. Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 54 U.K. Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 55 Italy Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 56 Italy Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 57 Italy Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 58 Italy Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 59 Italy Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 60 Italy Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 61 Spain Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 62 Spain Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 63 Spain Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 64 Spain Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 65 Spain Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 66 Spain Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 67 Russia & CIS Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 68 Russia & CIS Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 69 Russia & CIS Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 70 Russia & CIS Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 71 Russia & CIS Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 72 Russia & CIS Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 73 Rest of Europe Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 74 Rest of Europe Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 75 Rest of Europe Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 76 Rest of Europe Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 77 Rest of Europe Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 78 Rest of Europe Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 79 Asia Pacific Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 80 Asia Pacific Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 81 Asia Pacific Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 82 Asia Pacific Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 83 Asia Pacific Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 84 Asia Pacific Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 85 Asia Pacific Alternative Energy Market Volume (GW) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Alternative Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 88 China Alternative Energy Market Value (US$ Bn) Forecast, by Type 2025 to 2035

Table 89 China Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 90 China Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 91 China Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 92 China Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 93 Japan Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 94 Japan Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 95 Japan Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 96 Japan Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 97 Japan Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 98 Japan Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 99 India Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 100 India Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 101 India Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 102 India Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 103 India Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 104 India Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 105 India Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 106 India Alternative Energy Market Value (US$ Bn) Forecast, by End-user 2025 to 2035

Table 107 ASEAN Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 108 ASEAN Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 109 ASEAN Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 110 ASEAN Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 111 ASEAN Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 112 ASEAN Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 113 Rest of Asia Pacific Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 114 Rest of Asia Pacific Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 115 Rest of Asia Pacific Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 116 Rest of Asia Pacific Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 117 Rest of Asia Pacific Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 118 Rest of Asia Pacific Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 119 Latin America Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 120 Latin America Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 121 Latin America Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 122 Latin America Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 123 Latin America Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 124 Latin America Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 125 Latin America Alternative Energy Market Volume (GW) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Alternative Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 128 Brazil Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 129 Brazil Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 130 Brazil Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 131 Brazil Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 132 Brazil Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 133 Mexico Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 134 Mexico Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 135 Mexico Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 136 Mexico Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 137 Mexico Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 138 Mexico Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 139 Rest of Latin America Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 140 Rest of Latin America Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 141 Rest of Latin America Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 142 Rest of Latin America Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 143 Rest of Latin America Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 144 Rest of Latin America Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 145 Middle East & Africa Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 146 Middle East & Africa Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 147 Middle East & Africa Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 148 Middle East & Africa Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 149 Middle East & Africa Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 150 Middle East & Africa Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 151 Middle East & Africa Alternative Energy Market Volume (GW) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Alternative Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 154 GCC Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 155 GCC Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 156 GCC Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 157 GCC Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 158 GCC Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 159 South Africa Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 160 South Africa Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 161 South Africa Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 162 South Africa Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 163 South Africa Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 164 South Africa Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Table 165 Rest of Middle East & Africa Alternative Energy Market Volume (GW) Forecast, by Type, 2025 to 2035

Table 166 Rest of Middle East & Africa Alternative Energy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 167 Rest of Middle East & Africa Alternative Energy Market Volume (GW) Forecast, by Connectivity, 2025 to 2035

Table 168 Rest of Middle East & Africa Alternative Energy Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 169 Rest of Middle East & Africa Alternative Energy Market Volume (GW) Forecast, by End-user, 2025 to 2035

Table 170 Rest of Middle East & Africa Alternative Energy Market Value (US$ Bn) Forecast, by End-user, 2025 to 2035

Figure 1 Global Alternative Energy Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global Alternative Energy Market Attractiveness, by Type

Figure 3 Global Alternative Energy Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 4 Global Alternative Energy Market Attractiveness, by Connectivity

Figure 5 Global Alternative Energy Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 6 Global Alternative Energy Market Attractiveness, by End-user

Figure 7 Global Alternative Energy Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Alternative Energy Market Attractiveness, by Region

Figure 9 North America Alternative Energy Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 10 North America Alternative Energy Market Attractiveness, by Type

Figure 11 North America Alternative Energy Market Attractiveness, by Type

Figure 12 North America Alternative Energy Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 13 North America Alternative Energy Market Attractiveness, by Connectivity

Figure 14 North America Alternative Energy Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 15 North America Alternative Energy Market Attractiveness, by End-user

Figure 16 North America Alternative Energy Market Attractiveness, by Country and Sub-region

Figure 17 Europe Alternative Energy Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 18 Europe Alternative Energy Market Attractiveness, by Type

Figure 19 Europe Alternative Energy Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 20 Europe Alternative Energy Market Attractiveness, by Connectivity

Figure 21 Europe Alternative Energy Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 22 Europe Alternative Energy Market Attractiveness, by End-user

Figure 23 Europe Alternative Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24 Europe Alternative Energy Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Alternative Energy Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 26 Asia Pacific Alternative Energy Market Attractiveness, by Type

Figure 27 Asia Pacific Alternative Energy Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 28 Asia Pacific Alternative Energy Market Attractiveness, by Connectivity

Figure 29 Asia Pacific Alternative Energy Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 30 Asia Pacific Alternative Energy Market Attractiveness, by End-user

Figure 31 Asia Pacific Alternative Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 32 Asia Pacific Alternative Energy Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Alternative Energy Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 34 Latin America Alternative Energy Market Attractiveness, by Type

Figure 35 Latin America Alternative Energy Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 36 Latin America Alternative Energy Market Attractiveness, by Connectivity

Figure 37 Latin America Alternative Energy Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 38 Latin America Alternative Energy Market Attractiveness, by End-user

Figure 39 Latin America Alternative Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Latin America Alternative Energy Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Alternative Energy Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 42 Middle East & Africa Alternative Energy Market Attractiveness, by Type

Figure 43 Middle East & Africa Alternative Energy Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 44 Middle East & Africa Alternative Energy Market Attractiveness, by Connectivity

Figure 45 Middle East & Africa Alternative Energy Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 46 Middle East & Africa Alternative Energy Market Attractiveness, by End-user

Figure 47 Middle East & Africa Alternative Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Middle East & Africa Alternative Energy Market Attractiveness, by Country and Sub-region