Reports

Reports

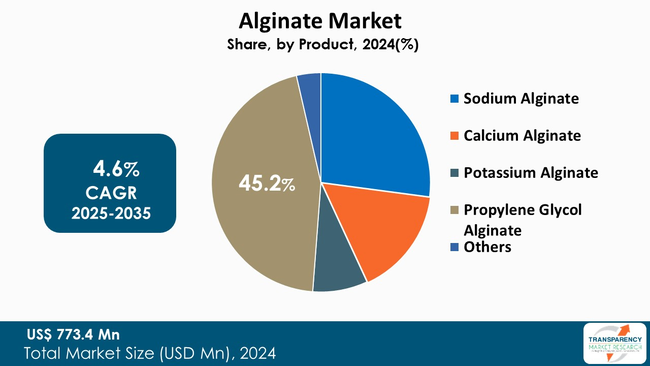

The global Alginate market size was valued at US$ 773.4 million in 2024 and is projected to reach US$ 1268.4 million by 2035, expanding at a CAGR of 4.6% from 2025 to 2035. The market is rising due to increasing demand for clean-label and natural ingredients and expanding applications in pharmaceutical and biomedical sectors.

The alginate market is growing steadily as a result of increased demand for natural and functional biopolymers in the food, pharmaceutical, and biomedical industries. Alginate is derived from brown seaweed by utilizing alkaline extraction, purification, acid precipitation, and drying method. Alginate finds its applications widely in processed foods with excellent properties of thickening, gelling, and film forming as a stabilizer and texture modifier in wound dressings and drug delivery; and probiotic encapsulation. In addition, the new applications of 3D bioprinting and tissue engineering expands its portfolio of uses related to biomedical advanced research.

The key factors for market development would include the ongoing trend of clean label and eco-friendly ingredients, development of seaweed aquaculture to sustain raw material supply for alginate, and increasing research investments to develop drug and pharmaceutical formulations for biomedical applications. The cosmetic and agriculture sectors have also begun adopting the benefits of alginate based solutions due to biocompatibility, biodegradability, and safety. The ability of alginate biopolymers to span over multiple industries allows for diversified, auxiliary revenue sources and help stabilize the growth of the market.

Alginate is a natural polysaccharide derived from brown seaweed. It is known for its thickening, gelling, and stabilizing properties. The process of extraction usually takes place by treating seaweed with alkaline solutions, which would be followed by purification into sodium alginate or the other salts.

Alginate, due to its biocompatibility and versatile properties, is widely used in various different industries. In the food industry, alginate is used as an emulsifier or a stabilizer in items such as sauces, ice-cream, and dressings. Alginate, in pharmaceuticals and healthcare, is used for wound dressings, tissue engineering, and controlled drug delivery. Furthermore, alginate also has applications in textile printing, cosmetics, and water treatment. Its biodegradability and functional versatility have made alginate a robust material for innovations in industries and in biomedical applications.

| Attribute | Detail |

|---|---|

| Drivers |

|

In addition to consumer shifts toward naturally sourced ingredients, regulatory agencies in North America, Europe, and Asia are supporting shift to bio-based and non-genetically engineered ingredients. Regulatory standards continue to promote safer, natural-based formulations, and discourage the replacement of food chemistry with that of additives causing further expansion of alginate as an option.

The increased popularity of a vegan, vegetarian lifestyle is also increasing demand for alginate as a natural, plant-based alternative to gelatin in multiple formulations. Similarly to natural ingredients, this is providing an opportunity for a diverse range of value-added products to be brought to gain market interest and capture the curious, eco-friendly consumer.

The major players in the market are taking measures to vertically integrate, improve extraction technologies, and invest in R&D to improve alginate purity and functions. Most are starting to offer customized grades that have a controlled viscosity and molecular weight for specific applications in food and beverage.

The alginate market has been experiencing strong growth as its use in the pharmaceutical and biomedical areas is increasing. Alginate is attractively incorporated into new products for healthcare as it is a naturally biocompatible, non-immunogenic, and able to form strong gels. Alginate also has useful potential for controlled release in drug-delivery systems, and is often found in oral, transdermal, and injectable drug delivery systems that use precisely dosed therapeutic delivery.

In the pharmaceutical field, alginate is used as a stabilizer, disintegrant, and thickening agent in pharmaceutical formulations including tablets, suspensions and antacids, just to name a few. Alginate increases the stability and bioavailability of drugs by forming protective coatings and encapsulating active ingredient components. The unique ability of alginate to produce modified release profiles through ionic crosslinking make alginate an excellent raw material for developing new strategies for drug delivery.

In addition to improving alginate's applicability in the evolving area of biopharmaceuticals, alginate providers are offering high purity, medical grades or technical-grade alginate that can meet safety specifications and molecular quality requirements. In conjunction with alginate manufacturers, biopharmaceutical companies, and researchers are pushing core innovation in bio-material formulations and therapeutic development. There remains an increased interest for effective interventions for wound management and drug delivery in the context of the globalization of chronic disease and aging populations.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Each of these players has been profiled in the alginate market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 773.4 Mn |

| Market Forecast Value in 2035 | US$ 1268.4 Mn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Alginate market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The alginate market was valued at US$ 773.4 Mn in 2024

The alginate industry is expected to grow at a CAGR of 4.6% from 2025 to 2035

Rising demand for clean-label and natural ingredients and expanding applications in pharmaceutical and biomedical sectors.

Propylene glycol alginate was the largest product segment and its value is anticipated to grow at a CAGR of 4.7% during the forecast period

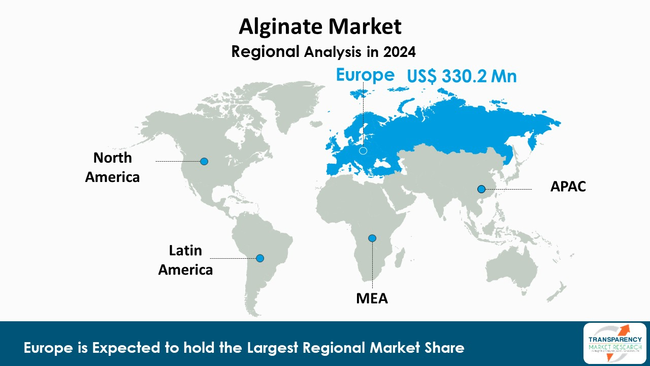

Europe was the most lucrative region in 2024

KIMICA Corporation, Algaia SA, Bright Moon Seaweed Group, Shandong Jiejing Group, FMC Corporation, Marine Biopolymers Ltd, Ceamsa, CP Kelco Corporation, Döhler Group, Ingredients Solutions Inc., Marine Biopolymers Limited, Meron Group Corporation are the major players in the alginate market

Table 1 Global Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 2 Global Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 3 Global Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 4 Global Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 5 Global Alginate Market Volume (Tons) Forecast, by Region, 2025 to 2035

Table 6 Global Alginate Market Value (US$ Mn) Forecast, by Region, 2025 to 2035

Table 7 North America Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 8 North America Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 9 North America Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 10 North America Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 11 North America Alginate Market Volume (Tons) Forecast, by Country, 2025 to 2035

Table 12 North America Alginate Market Value (US$ Mn) Forecast, by Country, 2025 to 2035

Table 13 U.S. Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 14 U.S. Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 15 U.S. Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 16 U.S. Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 17 Canada Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 18 Canada Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 19 Canada Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 20 Canada Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 21 Europe Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 22 Europe Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 23 Europe Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 24 Europe Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 25 Europe Alginate Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 26 Europe Alginate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2025 to 2035

Table 27 Germany Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 28 Germany Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 29 Germany Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 30 Germany Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 31 U.K. Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 32 U.K. Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 33 U.K. Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 34 U.K. Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 35 France Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 36 France Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 37 France Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 38 France Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 39 Spain Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 40 Spain Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 41 Spain Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 42 Spain Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 43 Italy Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 44 Italy Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 45 Italy Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 46 Italy Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 47 Russia & CIS Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 48 Russia & CIS Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 49 Russia & CIS Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 50 Russia & CIS Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 51 Rest of Europe Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 52 Rest of Europe Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 53 Rest of Europe Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 54 Rest of Europe Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 55 Asia Pacific Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 56 Asia Pacific Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 57 Asia Pacific Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 58 Asia Pacific Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 59 Asia Pacific Alginate Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 60 Asia Pacific Alginate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2025 to 2035

Table 61 China Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 62 China Alginate Market Value (US$ Mn) Forecast, by Product 2025 to 2035

Table 63 China Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 64 China Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 65 India Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 66 India Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 67 India Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 68 India Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 69 Japan Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 70 Japan Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 71 Japan Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 72 Japan Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 73 ASEAN Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 74 ASEAN Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 75 ASEAN Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 76 ASEAN Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 77 Rest of Asia Pacific Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 78 Rest of Asia Pacific Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 79 Rest of Asia Pacific Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 80 Rest of Asia Pacific Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 81 Latin America Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 82 Latin America Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 83 Latin America Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 84 Latin America Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 85 Latin America Alginate Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Latin America Alginate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 Brazil Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 88 Brazil Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 89 Brazil Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 90 Brazil Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 91 Mexico Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 92 Mexico Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 93 Mexico Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 94 Mexico Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 95 Rest of Latin America Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 96 Rest of Latin America Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 97 Rest of Latin America Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 98 Rest of Latin America Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 99 Middle East & Africa Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 100 Middle East & Africa Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 101 Middle East & Africa Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 102 Middle East & Africa Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 103 Middle East & Africa Alginate Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 104 Middle East & Africa Alginate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2025 to 2035

Table 105 GCC Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 106 GCC Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 107 GCC Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 108 GCC Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 109 South Africa Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 110 South Africa Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 111 South Africa Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 112 South Africa Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 113 Rest of Middle East & Africa Alginate Market Volume (Tons) Forecast, by Product, 2025 to 2035

Table 114 Rest of Middle East & Africa Alginate Market Value (US$ Mn) Forecast, by Product, 2025 to 2035

Table 115 Rest of Middle East & Africa Alginate Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 116 Rest of Middle East & Africa Alginate Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Figure 1 Global Alginate Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 2 Global Alginate Market Attractiveness, by Product

Figure 3 Global Alginate Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 Global Alginate Market Attractiveness, by Application

Figure 5 Global Alginate Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 6 Global Alginate Market Attractiveness, by Region

Figure 7 North America Alginate Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 8 North America Alginate Market Attractiveness, by Product

Figure 9 North America Alginate Market Attractiveness, by Product

Figure 10 North America Alginate Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 11 North America Alginate Market Attractiveness, by Application

Figure 12 North America Alginate Market Attractiveness, by Country and Sub-region

Figure 13 Europe Alginate Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 14 Europe Alginate Market Attractiveness, by Product

Figure 15 Europe Alginate Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 16 Europe Alginate Market Attractiveness, by Application

Figure 17 Europe Alginate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 18 Europe Alginate Market Attractiveness, by Country and Sub-region

Figure 19 Asia Pacific Alginate Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 20 Asia Pacific Alginate Market Attractiveness, by Product

Figure 21 Asia Pacific Alginate Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 22 Asia Pacific Alginate Market Attractiveness, by Application

Figure 23 Asia Pacific Alginate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24 Asia Pacific Alginate Market Attractiveness, by Country and Sub-region

Figure 25 Latin America Alginate Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 26 Latin America Alginate Market Attractiveness, by Product

Figure 27 Latin America Alginate Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 28 Latin America Alginate Market Attractiveness, by Application

Figure 29 Latin America Alginate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 30 Latin America Alginate Market Attractiveness, by Country and Sub-region

Figure 31 Middle East & Africa Alginate Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 32 Middle East & Africa Alginate Market Attractiveness, by Product

Figure 33 Middle East & Africa Alginate Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 34 Middle East & Africa Alginate Market Attractiveness, by Application

Figure 35 Middle East & Africa Alginate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 36 Middle East & Africa Alginate Market Attractiveness, by Country and Sub-region