Reports

Reports

Analysts’ Viewpoint

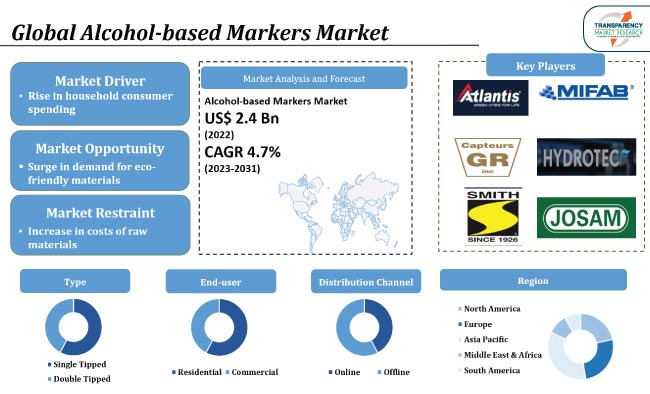

Rise in household consumer spending is a key factor fueling the alcohol-based markers market demand. Moreover, growth in construction and education sectors is creating value-grab alcohol-based markers business opportunities for market participants. These markers can be used for professional purposes by engineers, graphic designers, architects, carpenters, and plumbers.

Alcohol-based markers market manufacturers are focusing on the introduction of innovative and eco-friendly products for their customers. Manufacturers are also following the emerging trends in alcohol-based marker technology to gain revenue benefits. However, increase in prices of raw materials is a prominent factor that is expected to hamper market development in the near future.

Alcohol-based marker is a type of marker that comes with the inclusion of alcohol ink. The product has the ability to rapidly dry due to the quick evaporation of alcohol. Even if a drop of water is accidentally spilled, it won’t directly fade or bleed. Similarly, alcohol markers also produce vibrant color and intensity. This is fueling the global market. Alcohol pens are being increasingly used for recreational as well as professional use by consumers.

Demand for coloring books is rising among children all over the world. Places such as schools, daycare centers, and kids’ recreational centers are major consumers of coloring books, which further fuels the demand for alcohol brush markers.

Moreover, increase in household consumer expenses in several countries around the world is likely to positively impact the growth of the global market in the next few years. This can be ascribed to the growing number of parents willing to increase their expenditure on children’s recreational activities.

Demand for alcohol paint markers is expected to rise in the near future due to the growth in the fashion and furniture industries. Rise in per capita income is also fueling the sale of several design and development tools, equipment, and accessories, including alcohol-based markers.

Moreover, the alcohol-based marker is increasingly gaining traction in the furniture industry. This product assists carpenters in marking the exact spot that they needed to cut and process.

The single tipped type segment is estimated to lead the global market in the next few years. Single tipped alcohol ink markers are gaining popularity across the globe, as these markers hold larger quantities of ink as compared to dual tipped alcohol-based markers. Moreover, rise in availability of these markers across several distribution channels is projected to boost the alcohol-based markers market revenue during the forecast period.

Furthermore, doubled tipped markers are expected to gain traction in the near future due to their capability to hold two different colors in a single marker.

As per the latest alcohol-based markers market forecast, Asia Pacific is likely to account for major share of the global industry during the forecast period. Increase in investment in education sector and rise in economic progression in countries of this region are fueling alcohol-based markers industry growth.

The alcohol-based markers market size in North America is estimated to rise in the near future, owing to the rise in application of these markers in different industries.

The global landscape is highly competitive, with the presence of several prominent players that control majority of the alcohol-based markers market share. According to the latest alcohol-based markers market report, companies are engaged in implementing strategies such as product development, mergers, acquisitions, and partnerships.

Some of the key players operating in the global market are Copic, Prisma Color, Winsor & Newton, Tombow USA, Chartpak, Inc., ShinHan Art Materials Inc., Spectrum Noir, Marvy Uchida, Ohuhu, and TouchFive. These players are following the alcohol-based markers market trends to avail lucrative revenue opportunities.

Key players have been profiled in the alcohol-based marker industry research report based on various parameters such as business strategies, company overview, product portfolio, business segments, latest developments, and financial overview.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 2.4 Bn |

|

Market Forecast Value in 2031 |

US$ 3.6 Bn |

|

Growth Rate (CAGR) |

4.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.4 Bn in 2022

It is estimated to grow at a CAGR of 4.7% during 2023-2031

Rise in household consumer spending and increase in demand for alcohol-based markers in education sector

The single tipped type segment held major share in 2022

Demand is expected to be high in Asia Pacific during the forecast period

Copic, Prisma Color, Winsor & Newton, Tombow USA, Chartpak, Inc., ShinHan Art Materials Inc., Spectrum Noir, Marvy Uchida, Ohuhu, and TouchFive

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework

5.9. Global Alcohol-based Markers Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Alcohol-based Markers Market Analysis and Forecast, by Type

6.1. Global Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

6.1.1. Single Tipped

6.1.2. Double Tipped

6.2. Incremental Opportunity, by Type

7. Global Alcohol-based Markers Market Analysis and Forecast, by End-user

7.1. Global Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by End-user, 2017 - 2031

7.1.1. Residential

7.1.2. Commercial

7.1.2.1. Offices

7.1.2.2. Educational Institutions

7.1.2.3. Hotels

7.1.2.4. Restaurants

7.1.2.5. Others (Community Centers, etc.)

7.2. Incremental Opportunity, by End-user

8. Global Alcohol-based Markers Market Analysis and Forecast, by Distribution Channel

8.1. Global Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

8.1.1. Online

8.1.1.1. E-commerce Stores

8.1.1.2. Company-owned Stores

8.1.2. Offline

8.1.2.1. Supermarkets/Hypermarkets

8.1.2.2. Specialty Stores

8.1.2.3. Independent Retail Stores

8.2. Incremental Opportunity, by Distribution Channel

9. Global Alcohol-based Markers Market Analysis and Forecast, Region

9.1. Global Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Alcohol-based Markers Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Brand Analysis

10.4. Consumer Buying Behavior Analysis

10.4.1. Brand Awareness

10.4.2. Average Spend

10.4.3. Purchasing Factors

10.5. Key Trends Analysis

10.5.1. Demand Side Analysis

10.5.2. Supply Side Analysis

10.6. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

10.6.1. Single Tipped

10.6.2. Double Tipped

10.7. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by End-user, 2017 - 2031

10.7.1. Residential

10.7.2. Commercial

10.7.2.1. Offices

10.7.2.2. Educational Institutions

10.7.2.3. Hotels

10.7.2.4. Restaurants

10.7.2.5. Others (Community Centers, etc.)

10.8. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

10.8.1. Online

10.8.1.1. E-commerce Stores

10.8.1.2. Company-owned Stores

10.8.2. Offline

10.8.2.1. Supermarkets/Hypermarkets

10.8.2.2. Specialty Stores

10.8.2.3. Independent Retail Stores

10.9. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Country, 2017 - 2031

10.9.1. U.S.

10.9.2. Canada

10.9.3. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Alcohol-based Markers Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Brand Analysis

11.4. Consumer Buying Behavior Analysis

11.4.1. Brand Awareness

11.4.2. Average Spend

11.4.3. Purchasing Factors

11.5. Key Trends Analysis

11.5.1. Demand Side Analysis

11.5.2. Supply Side Analysis

11.6. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

11.6.1. Single Tipped

11.6.2. Double Tipped

11.7. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by End-user, 2017 - 2031

11.7.1. Residential

11.7.2. Commercial

11.7.2.1. Offices

11.7.2.2. Educational Institutions

11.7.2.3. Hotels

11.7.2.4. Restaurants

11.7.2.5. Others (Community Centers, etc.)

11.8. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

11.8.1. Online

11.8.1.1. E-commerce Stores

11.8.1.2. Company-owned Stores

11.8.2. Offline

11.8.2.1. Supermarkets/Hypermarkets

11.8.2.2. Specialty Stores

11.8.2.3. Independent Retail Stores

11.9. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Country, 2017 - 2031

11.9.1. U.K.

11.9.2. Germany

11.9.3. France

11.9.4. Rest of Europe

11.10. Incremental Opportunity Analysis

12. Asia Pacific Alcohol-based Markers Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Brand Analysis

12.4. Consumer Buying Behavior Analysis

12.4.1. Brand Awareness

12.4.2. Average Spend

12.4.3. Purchasing Factors

12.5. Key Trends Analysis

12.5.1. Demand Side Analysis

12.5.2. Supply Side Analysis

12.6. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

12.6.1. Single Tipped

12.6.2. Double Tipped

12.7. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by End-user, 2017 - 2031

12.7.1. Residential

12.7.2. Commercial

12.7.2.1. Offices

12.7.2.2. Educational Institutions

12.7.2.3. Hotels

12.7.2.4. Restaurants

12.7.2.5. Others (Community Centers, etc.)

12.8. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

12.8.1. Online

12.8.1.1. E-commerce Stores

12.8.1.2. Company-owned Stores

12.8.2. Offline

12.8.2.1. Supermarkets/Hypermarkets

12.8.2.2. Specialty Stores

12.8.2.3. Independent Retail Stores

12.9. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Country, 2017 - 2031

12.9.1. China

12.9.2. India

12.9.3. Japan

12.9.4. Rest of Asia Pacific

12.10. Incremental Opportunity Analysis

13. Middle East & Africa Alcohol-based Markers Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Brand Analysis

13.4. Consumer Buying Behavior Analysis

13.4.1. Brand Awareness

13.4.2. Average Spend

13.4.3. Purchasing Factors

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

13.6.1. Single Tipped

13.6.2. Double Tipped

13.7. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by End-user, 2017 - 2031

13.7.1. Residential

13.7.2. Commercial

13.7.2.1. Offices

13.7.2.2. Educational Institutions

13.7.2.3. Hotels

13.7.2.4. Restaurants

13.7.2.5. Others (Community Centers, etc.)

13.8. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

13.8.1. Online

13.8.1.1. E-commerce Stores

13.8.1.2. Company-owned Stores

13.8.2. Offline

13.8.2.1. Supermarkets/Hypermarkets

13.8.2.2. Specialty Stores

13.8.2.3. Independent Retail Stores

13.9. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Country, 2017 - 2031

13.9.1. GCC

13.9.2. South Africa

13.9.3. Rest of Middle East & Africa

13.10. Incremental Opportunity Analysis

14. South America Alcohol-based Markers Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Brand Analysis

14.4. Consumer Buying Behavior Analysis

14.4.1. Brand Awareness

14.4.2. Average Spend

14.4.3. Purchasing Factors

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

14.6.1. Single Tipped

14.6.2. Double Tipped

14.7. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by End-user, 2017 - 2031

14.7.1. Residential

14.7.2. Commercial

14.7.2.1. Offices

14.7.2.2. Educational Institutions

14.7.2.3. Hotels

14.7.2.4. Restaurants

14.7.2.5. Others (Community Centers, etc.)

14.8. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

14.8.1. Online

14.8.1.1. E-commerce Stores

14.8.1.2. Company-owned Stores

14.8.2. Offline

14.8.2.1. Supermarkets/Hypermarkets

14.8.2.2. Specialty Stores

14.8.2.3. Independent Retail Stores

14.9. Alcohol-based Markers Market Size (US$ Mn and Thousand Units), by Country, 2017 - 2031

14.9.1. Brazil

14.9.2. Rest of South America

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Share Analysis (%), 2022

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

15.3.1. Copic

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Size Portfolio

15.3.2. Prisma Color

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Size Portfolio

15.3.3. Winsor & Newton

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Size Portfolio

15.3.4. Tombow USA

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Size Portfolio

15.3.5. Chartpak, Inc.

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Size Portfolio

15.3.6. ShinHan Art Materials Inc.

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Size Portfolio

15.3.7. Spectrum Noir

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Size Portfolio

15.3.8. Marvy Uchida

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Size Portfolio

15.3.9. Ohuhu

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Size Portfolio

15.3.10. TouchFive

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Size Portfolio

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Understanding the Buying Process of the Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Table 2: Global Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Table 3: Global Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Table 4: Global Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Table 5: Global Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Table 6: Global Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Table 7: Global Alcohol-based Markers Market, by Region, Thousand Units, 2017-2031

Table 8: Global Alcohol-based Markers Market, by Region, US$ Mn, 2017-2031

Table 9: North America Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Table 10: North America Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Table 11: North America Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Table 12: North America Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Table 13: North America Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Table 14: North America Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Table 15: North America Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Table 16: North America Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Table 17: Europe Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Table 18: Europe Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Table 19: Europe Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Table 20: Europe Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Table 21: Europe Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Table 22: Europe Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Table 23: Europe Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Table 24: Europe Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Table 25: Asia Pacific Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Table 26: Asia Pacific Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Table 27: Asia Pacific Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Table 28: Asia Pacific Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Table 29: Asia Pacific Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Table 30: Asia Pacific Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Table 31: Asia Pacific Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Table 32: Asia Pacific Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Table 33: Middle East & Africa Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Table 34: Middle East & Africa Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Table 35: Middle East & Africa Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Table 36: Middle East & Africa Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Table 37: Middle East & Africa Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Table 38: Middle East & Africa Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Table 39: Middle East & Africa Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Table 40: Middle East & Africa Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Table 41: South America Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Table 42: South America Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Table 43: South America Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Table 44: South America Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Table 45: South America Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Table 46: South America Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Table 47: South America Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Table 48: South America Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Figure 2: Global Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Figure 3: Global Alcohol-based Markers Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 4: Global Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Figure 5: Global Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Figure 6: Global Alcohol-based Markers Market Incremental Opportunity, by End-user, US$ Mn, 2017-2031

Figure 7: Global Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 8: Global Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 9: Global Alcohol-based Markers Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 10: Global Alcohol-based Markers Market, by Region, Thousand Units, 2017-2031

Figure 11: Global Alcohol-based Markers Market, by Region, US$ Mn, 2017-2031

Figure 12: Global Alcohol-based Markers Market Incremental Opportunity, by Region, US$ Mn, 2017-2031

Figure 13: North America Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Figure 14: North America Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Figure 15: North America Alcohol-based Markers Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 16: North America Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Figure 17: North America Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Figure 18: North America Alcohol-based Markers Market Incremental Opportunity, by End-user, US$ Mn, 2017-2031

Figure 19: North America Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 20: North America Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 21: North America Alcohol-based Markers Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 22: North America Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Figure 23: North America Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Figure 24: North America Alcohol-based Markers Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 25: Europe Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Figure 26: Europe Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Figure 27: Europe Alcohol-based Markers Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 28: Europe Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Figure 29: Europe Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Figure 30: Europe Alcohol-based Markers Market Incremental Opportunity, by End-user, US$ Mn, 2017-2031

Figure 31: Europe Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 32: Europe Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 33: Europe Alcohol-based Markers Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 34: Europe Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Figure 35: Europe Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Figure 36: Europe Alcohol-based Markers Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 37: Asia Pacific Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Figure 38: Asia Pacific Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Figure 39: Asia Pacific Alcohol-based Markers Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 40: Asia Pacific Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Figure 41: Asia Pacific Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Figure 42: Asia Pacific Alcohol-based Markers Market Incremental Opportunity, by End-user, US$ Mn, 2017-2031

Figure 43: Asia Pacific Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 44: Asia Pacific Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 45: Asia Pacific Alcohol-based Markers Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 46: Asia Pacific Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Figure 47: Asia Pacific Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Figure 48: Asia Pacific Alcohol-based Markers Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 49: Middle East & Africa Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Figure 50: Middle East & Africa Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Figure 51: Middle East & Africa Alcohol-based Markers Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 52: Middle East & Africa Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Figure 53: Middle East & Africa Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Figure 54: Middle East & Africa Alcohol-based Markers Market Incremental Opportunity, by End-user, US$ Mn, 2017-2031

Figure 55: Middle East & Africa Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Middle East & Africa Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 57: Middle East & Africa Alcohol-based Markers Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 58: Middle East & Africa Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Figure 59: Middle East & Africa Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Figure 60: Middle East & Africa Alcohol-based Markers Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 61: South America Alcohol-based Markers Market, by Type, Thousand Units, 2017-2031

Figure 62: South America Alcohol-based Markers Market, by Type, US$ Mn, 2017-2031

Figure 63: South America Alcohol-based Markers Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 64: South America Alcohol-based Markers Market, by End-user, Thousand Units, 2017-2031

Figure 65: South America Alcohol-based Markers Market, by End-user, US$ Mn, 2017-2031

Figure 66: South America Alcohol-based Markers Market Incremental Opportunity, by End-user, US$ Mn, 2017-2031

Figure 67: South America Alcohol-based Markers Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 68: South America Alcohol-based Markers Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 69: South America Alcohol-based Markers Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 70: South America Alcohol-based Markers Market, by Country, Thousand Units, 2017-2031

Figure 71: South America Alcohol-based Markers Market, by Country, US$ Mn, 2017-2031

Figure 72: South America Alcohol-based Markers Market Incremental Opportunity, by Country, US$ Mn, 2017-2031