Reports

Reports

Analysts’ Viewpoint

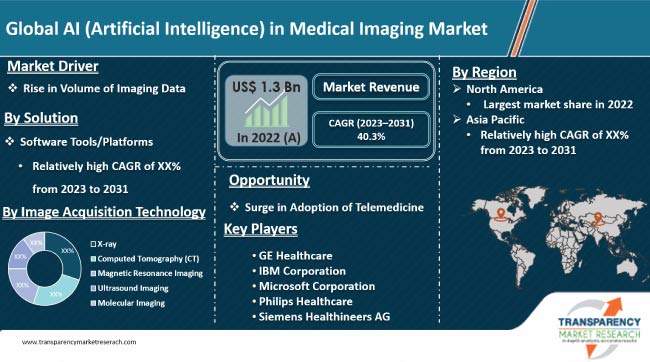

Introduction of the artificial intelligence (AI) technology is revolutionizing the medical imaging industry. AI is now being used increasingly in digital imaging technologies, and for early and accurate diagnosis of various diseases. The market for AI in medical imaging is expected to grow significantly during the next few years, driven by the expansion in the healthcare industry, rise in availability of data, and need for more accurate and efficient diagnosis. Increase in demand for artificial intelligence in medical imaging diagnostics, such as artificial intelligence CT scans, MRIs, X-rays, and ultrasounds, is a key market trend.

The market is expected to benefit immensely from the rise in demand for telemedicine - AI technologies help healthcare providers remotely diagnose and treat patients. Growth in adoption of AI-based predictive analytics, and AI-based personalized medicine is also likely to fuel market progress.

Artificial intelligence (AI) is the imitation of human intelligence progressions by machines, mainly computer systems. Artificial intelligence has extensive applications in the healthcare sector; healthcare artificial intelligence solutions assist healthcare providers in several aspects of patient care and administrative processes.

The incorporation of artificial intelligence (AI) in healthcare and computer-aided diagnostics brought about a change in the mode of diagnostics. AI diagnostic imaging assists physicians in the image capturing procedure and provides support to diagnose these images for interpretation and individualized treatment for every patient.

Medical imaging refers to the use of various imaging modalities such as X-rays, CT scans, MRI scans, and ultrasound to produce images of the internal structures of the body. Healthcare professionals use these images for various purposes, such as diagnosis, treatment planning, and monitoring disease progression. For example, medical image analysis AI algorithms can be used to detect and track changes in brain tissue that are characteristic of neurological disorders such as Alzheimer's disease.

However, medical imaging generates a large amount of data that needs to be analyzed and interpreted to extract meaningful information. This is a time-consuming and labor-intensive process, especially for complex images such as MRI scans, and leads to in delays in diagnosis and treatment. The images may contain a large number of slices and requires careful inspection by a radiologist to detect abnormalities and make an accurate diagnosis.

AI algorithms analyze medical images much faster and more accurately than humans. These algorithms use advanced techniques such as deep learning to analyze and interpret images. They quickly detect abnormalities and classify them according to their severity, making it easier for radiologists to identify and diagnose diseases. Additionally, AI algorithms work continuously, without making mistakes, which leads to more consistent and reliable results. Medical professionals identify the most effective treatment options for patients with the use of AI, which leads to better outcomes and fewer complications.

According to Diagnostic Imaging Dataset Annual Statistical Release 2021/22, NHS England (National Health Service), performed 21.8 million X-rays in the year 2022/21, which is 30% more than from the previous year. In addition, ultrasound, CT scans, and MRI scans increased by 23%, 21%, and 28% respectively compared with 2020/21.

The rise in volume of imaging data has increased the use of AI in medical imaging by helping to analyze and interpret images more efficiently and accurately. The use of artificial intelligence in medical imaging applications is expected to continue to grow in the next few years, as more advanced algorithms are developed and more healthcare organizations adopt these technologies.

Telemedicine is rapidly becoming one of the critical tools in the healthcare industry, providing patients with access to medical care from the comfort of their homes. Healthcare professionals are finding new ways to use technology to diagnose, treat, and prevent medical conditions.

The growth in need to improve access to healthcare services is accelerating the adoption of telemedicine solutions. Patients who live in remote or underserved areas may not have access to healthcare services that are available in more urban areas. Telemedicine can help to bridge this gap by enabling patients to access healthcare services remotely.

The COVID-19 pandemic accelerated the adoption of telemedicine. Telemedicine enabled patients to receive medical care without the need to visit a healthcare facility while adhering to social distancing measures. It has become an important tool for providing healthcare services while minimizing the risk of transmission of the virus.

The ability to remotely provide patients with access to medical imaging services is a significant advantage of telemedicine. This results in an upsurge in demand for medical imaging services, necessitating more efficient and precise analysis of medical images. AI algorithms can be used to analyze medical images much faster and more accurately, saving time and reducing errors. With the surge in demand for medical imaging services, the use of AI algorithms can help to improve the efficiency of healthcare delivery, enabling healthcare professionals to see more patients in a shorter amount of time. These factors are leading to significant AI (artificial intelligence) in medical imaging market opportunities.

The surge in telemedicine is driving AI in medical imaging market demand, enabling healthcare professionals to provide faster and more accurate diagnosis and treatment recommendations. As telemedicine continues to grow in popularity, the use of AI algorithms in medical imaging is likely to become increasingly important, improving patient outcomes, reducing the cost of healthcare delivery, and positively impacting market development.

According to the latest AI (artificial intelligence) in medical imaging market forecast, North America is anticipated to hold largest share of the global industry during the forecast period. The region dominated the market in 2022 as per artificial intelligence in medical imaging market analysis. North American healthcare providers are often early adopters of new technologies, including AI-powered medical imaging tools. A highly developed healthcare system with strong emphasis on innovation and technology is boosting AI (artificial intelligence) in medical imaging market growth in the region.

The AI in medical imaging business growth in Asia Pacific is expected to record the fastest CAGR during the forecast period. Asia Pacific has a high prevalence of chronic diseases, such as diabetes and cancer, which require advanced imaging technologies for diagnosis and treatment. AI in medical imaging provides more accurate and faster diagnoses of these diseases, which is driving the adoption of these technologies in the region and fueling market expansion.

The research report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

Autodesk, Inc., Ada Health GmbH, Arterys, Bay Labs, Inc., Babylon, BenevolentAI, Butterfly Network, Inc., EchoNous, Inc., Enlitic, Inc., Gauss Surgical, GE Healthcare, IBM Corporation, Lunit Inc., Microsoft, NVIDIA Corporation, Philips Healthcare, OrCam, Qure.ai, Siemens Healthineers AG, and Zebra Medical Vision are key companies in the AI (artificial intelligence) in medical imaging industry.

AI medical imaging companies are continuously investing in R&D activities to introduce advanced AI (artificial intelligence) in medical imaging solutions that can meet the growing demand for medical image recognition AI.

Key players have been profiled in the AI (artificial intelligence) in medical imaging market research report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

US$ 26.8 Bn |

|

Growth Rate (CAGR) |

40.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.3 Bn in 2022.

It is anticipated to reach US$ 26.8 Bn by the end of 2031.

The CAGR is estimated to be 40.3% from 2023 to 2031.

Rising volume of imaging data.

North America accounted for the leading share in 2022.

Autodesk, Inc., Ada Health GmbH, Arterys, Bay Labs, Inc., Babylon, BenevolentAI, Butterfly Network, Inc., EchoNous, Inc., Enlitic, Inc., Gauss Surgical, GE Healthcare, IBM Corporation, Lunit Inc., Microsoft, NVIDIA Corporation, Philips Healthcare, OrCam, Qure.ai, Siemens Healthineers AG, and Zebra Medical Vision.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global AI (Artificial Intelligence) in Medical Imaging Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on AI (Artificial Intelligence) in Medical Imaging Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis of Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Solution

4.5.2. By AI Technology

4.5.3. By Image Acquisition Technology

4.5.4. By Clinical Application

4.5.5. By End-user

5. Global AI (Artificial Intelligence) in Medical Imaging Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global AI (Artificial Intelligence) in Medical Imaging Market Analysis, by Solution

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Solution, 2018 - 2031

6.3.1. Software Tools/Platforms

6.3.2. Services

6.3.2.1. Integration

6.3.2.2. Deployment

7. Global AI (Artificial Intelligence) in Medical Imaging Market Analysis, by AI Technology

7.1. Key Segment Analysis

7.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by AI Technology, 2018 - 2031

7.2.1. Deep Learning

7.2.2. Computer Vision

7.2.3. Others

8. Global AI (Artificial Intelligence) in Medical Imaging Market Analysis and Forecasts, by Image Acquisition Technology

8.1. Key Segment Analysis

8.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Image Acquisition Technology, 2018 - 2031

8.2.1. X-ray

8.2.2. Computed Tomography (CT)

8.2.3. Magnetic Resonance Imaging

8.2.4. Ultrasound Imaging

8.2.5. Molecular Imaging

9. Global AI (Artificial Intelligence) in Medical Imaging Market Analysis and Forecasts, by Clinical Application

9.1. Key Segment Analysis

9.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Clinical Application, 2018 - 2031

9.2.1. Cardiovascular

9.2.2. Neurology

9.2.3. Lung (Respiratory System)

9.2.4. Breast (Mammography)

9.2.5. Oncology

9.2.6. Pathology

9.2.7. Liver (GI)

9.2.8. Oral Diagnostics

9.2.9. Rest of the Body

10. Global AI (Artificial Intelligence) in Medical Imaging Market Analysis and Forecasts, by End-user

10.1. Overview and Definitions

10.2. Key Segment Analysis

10.3. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by End-user, 2018 - 2031

10.3.1. Hospitals

10.3.2. R&D Centers

10.3.3. Laboratories & Diagnostic Centers

11. Global AI (Artificial Intelligence) in Medical Imaging Market Analysis and Forecasts, by Region

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America AI (Artificial Intelligence) in Medical Imaging Market Analysis and Forecast

12.1. Regional Outlook

12.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By Solution

12.2.2. By AI Technology

12.2.3. By Image Acquisition Technology

12.2.4. By Clinical Application

12.2.5. By End-user

12.3. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

12.3.1. U.S.

12.3.2. Canada

12.3.3. Mexico

13. Europe AI (Artificial Intelligence) in Medical Imaging Market Analysis and Forecast

13.1. Regional Outlook

13.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By Solution

13.2.2. By AI Technology

13.2.3. By Image Acquisition Technology

13.2.4. By Clinical Application

13.2.5. By End-user

13.3. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Germany

13.3.2. UK

13.3.3. France

13.3.4. Italy

13.3.5. Spain

13.3.6. Rest of Europe

14. Asia Pacific AI in Medical Imaging Market Analysis and Forecast

14.1. Regional Outlook

14.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By Solution

14.2.2. By AI Technology

14.2.3. By Image Acquisition Technology

14.2.4. By Clinical Application

14.2.5. By End-user

14.3. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Rest of Asia Pacific

15. Middle East & Africa AI in Medical Imaging Market Analysis and Forecast

15.1. Regional Outlook

15.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

15.2.1. By Solution

15.2.2. By AI Technology

15.2.3. By Image Acquisition Technology

15.2.4. By Clinical Application

15.2.5. By End-user

15.3. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

15.3.1. Saudi Arabia

15.3.2. United Arab Emirates

15.3.3. South Africa

15.3.4. Rest of Middle East & Africa

16. South America AI in Medical Imaging Market Analysis and Forecast

16.1. Regional Outlook

16.2. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

16.2.1. By Solution

16.2.2. By AI Technology

16.2.3. By Image Acquisition Technology

16.2.4. By Clinical Application

16.2.5. By End-user

16.3. AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

16.3.1. Brazil

16.3.2. Argentina

16.3.3. Rest of South America

17. Competition Landscape

17.1. Market Competition Matrix, by Leading Players

17.2. Market Revenue Share Analysis (%), by Leading Players (2022)

17.3. Competitive Scenario

17.3.1. List of Emerging, Prominent, and Leading Players

17.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

18. Company Profiles

18.1. Autodesk, Inc.

18.1.1. Business Overview

18.1.2. Company Revenue

18.1.3. Product Portfolio

18.1.4. Geographic Footprint

18.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.2. Ada Health GmbH

18.2.1. Business Overview

18.2.2. Company Revenue

18.2.3. Product Portfolio

18.2.4. Geographic Footprint

18.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.3. Arterys

18.3.1. Business Overview

18.3.2. Company Revenue

18.3.3. Product Portfolio

18.3.4. Geographic Footprint

18.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.4. Bay Labs, Inc.

18.4.1. Business Overview

18.4.2. Company Revenue

18.4.3. Product Portfolio

18.4.4. Geographic Footprint

18.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.5. Babylon

18.5.1. Business Overview

18.5.2. Company Revenue

18.5.3. Product Portfolio

18.5.4. Geographic Footprint

18.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.6. BenevolentAI

18.6.1. Business Overview

18.6.2. Company Revenue

18.6.3. Product Portfolio

18.6.4. Geographic Footprint

18.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.7. Butterfly Network, Inc.

18.7.1. Business Overview

18.7.2. Company Revenue

18.7.3. Product Portfolio

18.7.4. Geographic Footprint

18.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.8. EchoNous, Inc.

18.8.1. Business Overview

18.8.2. Company Revenue

18.8.3. Product Portfolio

18.8.4. Geographic Footprint

18.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.9. Enlitic, Inc.

18.9.1. Business Overview

18.9.2. Company Revenue

18.9.3. Product Portfolio

18.9.4. Geographic Footprint

18.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.10. Gauss Surgical

18.10.1. Business Overview

18.10.2. Company Revenue

18.10.3. Product Portfolio

18.10.4. Geographic Footprint

18.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.11. GE Healthcare

18.11.1. Business Overview

18.11.2. Company Revenue

18.11.3. Product Portfolio

18.11.4. Geographic Footprint

18.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.12. IBM Corporation

18.12.1. Business Overview

18.12.2. Company Revenue

18.12.3. Product Portfolio

18.12.4. Geographic Footprint

18.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.13. Lunit Inc.

18.13.1. Business Overview

18.13.2. Company Revenue

18.13.3. Product Portfolio

18.13.4. Geographic Footprint

18.13.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.14. Microsoft

18.14.1. Business Overview

18.14.2. Company Revenue

18.14.3. Product Portfolio

18.14.4. Geographic Footprint

18.14.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.15. NVIDIA Corporation

18.15.1. Business Overview

18.15.2. Company Revenue

18.15.3. Product Portfolio

18.15.4. Geographic Footprint

18.15.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.16. Philips Healthcare

18.16.1. Business Overview

18.16.2. Company Revenue

18.16.3. Product Portfolio

18.16.4. Geographic Footprint

18.16.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.17. OrCam

18.17.1. Business Overview

18.17.2. Company Revenue

18.17.3. Product Portfolio

18.17.4. Geographic Footprint

18.17.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.18. Qure.ai

18.18.1. Business Overview

18.18.2. Company Revenue

18.18.3. Product Portfolio

18.18.4. Geographic Footprint

18.18.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.19. Siemens Healthineers AG

18.19.1. Business Overview

18.19.2. Company Revenue

18.19.3. Product Portfolio

18.19.4. Geographic Footprint

18.19.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.20. Zebra Medical Vision

18.20.1. Business Overview

18.20.2. Company Revenue

18.20.3. Product Portfolio

18.20.4. Geographic Footprint

18.20.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

18.21. Others

18.21.1. Business Overview

18.21.2. Company Revenue

18.21.3. Product Portfolio

18.21.4. Geographic Footprint

18.21.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

19. Key Takeaways

List of Tables

Table 1: Acronyms Used in AI (Artificial Intelligence) in Medical Imaging Market

Table 2: North America AI (Artificial Intelligence) in Medical Imaging Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 3: Europe AI (Artificial Intelligence) in Medical Imaging Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 4: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 5: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 6: South America AI (Artificial Intelligence) in Medical Imaging Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Solution, 2018 – 2031

Table 11: Global AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by AI Technology, 2018 – 2031

Table 12: Global AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Image Acquisition Technology, 2018 – 2031

Table 13: Global AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Clinical Application, 2018 – 2031

Table 14: Global AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 15: Global AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Region, 2018 - 2031

Table 16: North America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Solution, 2018 – 2031

Table 17: North America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by AI Technology, 2018 – 2031

Table 18: North America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Image Acquisition Technology, 2018 – 2031

Table 19: North America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Clinical Application, 2018 – 2031

Table 20: North America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 21: North America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 22: U.S. AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Canada AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: Mexico AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Europe AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Solution, 2018 – 2031

Table 26: Europe AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by AI Technology, 2018 – 2031

Table 27: Europe AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Image Acquisition Technology, 2018 – 2031

Table 28: Europe AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Clinical Application, 2018 – 2031

Table 29: Europe AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 30: Europe AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 31: Germany AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: U.K. AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: France AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Italy AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: Spain AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Solution, 2018 – 2031

Table 37: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by AI Technology, 2018 – 2031

Table 38: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Image Acquisition Technology, 2018 – 2031

Table 39: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Clinical Application, 2018 – 2031

Table 40: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 41: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 42: China AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: India AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: Japan AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: ASEAN AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 46: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Solution, 2018 – 2031

Table 47: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by AI Technology, 2018 – 2031

Table 48: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Image Acquisition Technology, 2018 – 2031

Table 49: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Clinical Application, 2018 – 2031

Table 50: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 51: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 52: Saudi Arabia AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 53: United Arab Emirates AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 54: South Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 55: South America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Solution, 2018 – 2031

Table 56: South America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by AI Technology, 2018 – 2031

Table 57: South America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Image Acquisition Technology, 2018 – 2031

Table 58: South America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Clinical Application, 2018 – 2031

Table 59: South America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 60: South America AI (Artificial Intelligence) in Medical Imaging Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 61: Brazil AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 62: Argentina AI (Artificial Intelligence) in Medical Imaging Market Revenue CAGR Breakdown (%), by Growth Term

Table 63: Mergers & Acquisitions, Partnerships (1/2)

Table 64: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn) Forecast, 2018–2031

Figure 2: Global AI (Artificial Intelligence) in Medical Imaging Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of AI (Artificial Intelligence) in Medical Imaging Market

Figure 4: Global AI (Artificial Intelligence) in Medical Imaging Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global AI (Artificial Intelligence) in Medical Imaging Market Attractiveness Assessment, by Solution

Figure 6: Global AI (Artificial Intelligence) in Medical Imaging Market Attractiveness Assessment, by AI Technology

Figure 7: Global AI (Artificial Intelligence) in Medical Imaging Market Attractiveness Assessment, by Image Acquisition Technology

Figure 8: Global AI (Artificial Intelligence) in Medical Imaging Market Attractiveness Assessment, by Clinical Application

Figure 9: Global AI (Artificial Intelligence) in Medical Imaging Market Attractiveness Assessment, by End-user

Figure 10: Global AI (Artificial Intelligence) in Medical Imaging Market Attractiveness Assessment, by Region

Figure 11: Global AI (Artificial Intelligence) in Medical Imaging Market Revenue (US$ Mn) Historic Trends, 2017 – 2022

Figure 12: Global AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity (US$ Mn) Historic Trends, 2017 – 2022

Figure 13: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2023

Figure 14: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2031

Figure 15: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Software Tools/Platforms, 2023 – 2031

Figure 16: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Services, 2023 – 2031

Figure 17: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2023

Figure 18: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2031

Figure 19: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Deep Learning, 2023 – 2031

Figure 20: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computer Vision, 2023 – 2031

Figure 21: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Others, 2023 – 2031

Figure 22: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2023

Figure 23: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2031

Figure 24: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by X-ray, 2023 – 2031

Figure 25: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computed Tomography (CT), 2023 – 2031

Figure 26: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Magnetic Resonance Imaging, 2023 – 2031

Figure 27: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Ultrasound Imaging, 2023 – 2031

Figure 28: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Molecular Imaging, 2023 – 2031

Figure 29: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2023

Figure 30: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2031

Figure 31: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Cardiovascular, 2023 – 2031

Figure 32: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Neurology, 2023 – 2031

Figure 33: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Lung (Respiratory System), 2023 – 2031

Figure 34: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Breast (Mammography), 2023 – 2031

Figure 35: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oncology, 2023 – 2031

Figure 36: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Pathology, 2023 – 2031

Figure 37: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Liver (GI), 2023 – 2031

Figure 38: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oral Diagnostics, 2023 – 2031

Figure 39: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Rest of the Body, 2023 – 2031

Figure 40: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2023

Figure 41: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2031

Figure 42: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Hospitals, 2023 – 2031

Figure 43: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by R&D Centers, 2023 – 2031

Figure 44: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Laboratories & Diagnostic Centers, 2023 – 2031

Figure 45: Global AI (Artificial Intelligence) in Medical Imaging Market Opportunity (US$ Mn), by Region

Figure 46: Global AI (Artificial Intelligence) in Medical Imaging Market Opportunity Share (%), by Region, 2023–2031

Figure 47: Global AI (Artificial Intelligence) in Medical Imaging Market Size (US$ Mn), by Region, 2023 & 2031

Figure 48: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Region, 2023

Figure 49: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Region, 2031

Figure 50: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), 2023 – 2031

Figure 51: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), 2023 – 2031

Figure 52: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), 2023 – 2031

Figure 53: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), 2023 – 2031

Figure 54: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), 2023 – 2031

Figure 55: North America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Solution

Figure 56: North America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by AI Technology

Figure 57: North America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Image Acquisition Technology

Figure 58: North America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Clinical Application

Figure 59: North America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by End-user

Figure 60: North America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Country

Figure 61: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2023

Figure 62: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2031

Figure 63: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Software Tools/Platforms, 2023 – 2031

Figure 64: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Services, 2023 – 2031

Figure 65: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2023

Figure 66: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2031

Figure 67: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Deep Learning, 2023 – 2031

Figure 68: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computer Vision, 2023 – 2031

Figure 69: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Others, 2023 – 2031

Figure 70: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2023

Figure 71: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2031

Figure 72: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by X-ray, 2023 – 2031

Figure 73: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computed Tomography (CT), 2023 – 2031

Figure 74: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Magnetic Resonance Imaging, 2023 – 2031

Figure 75: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Ultrasound Imaging, 2023 – 2031

Figure 76: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Molecular Imaging, 2023 – 2031

Figure 77: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2023

Figure 78: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2031

Figure 79: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Cardiovascular, 2023 – 2031

Figure 80: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Neurology, 2023 – 2031

Figure 81: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Lung (Respiratory System), 2023 – 2031

Figure 82: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Breast (Mammography), 2023 – 2031

Figure 83: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oncology, 2023 – 2031

Figure 84: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Pathology, 2023 – 2031

Figure 85: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Liver (GI), 2023 – 2031

Figure 86: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oral Diagnostics, 2023 – 2031

Figure 87: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Rest of the Body, 2023 – 2031

Figure 88: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2023

Figure 89: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2031

Figure 90: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Hospitals, 2023 – 2031

Figure 91: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by R&D Centers, 2023 – 2031

Figure 92: North America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Laboratories & Diagnostic Centers, 2023 – 2031

Figure 93: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2023

Figure 94: North America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2031

Figure 95: U.S. AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 96: Canada AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 97: Mexico AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 98: Europe AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Solution

Figure 99: Europe AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by AI Technology

Figure 100: Europe AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Image Acquisition Technology

Figure 101: Europe AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Clinical Application

Figure 102: Europe AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by End-user

Figure 103: Europe AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Country

Figure 104: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2023

Figure 105: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2031

Figure 106: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Software Tools/Platforms, 2023 – 2031

Figure 107: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Services, 2023 – 2031

Figure 108: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2023

Figure 109: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2031

Figure 110: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Deep Learning, 2023 – 2031

Figure 111: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computer Vision, 2023 – 2031

Figure 112: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Others, 2023 – 2031

Figure 113: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2023

Figure 114: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2031

Figure 115: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by X-ray, 2023 – 2031

Figure 116: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computed Tomography (CT), 2023 – 2031

Figure 117: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Magnetic Resonance Imaging, 2023 – 2031

Figure 118: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Ultrasound Imaging, 2023 – 2031

Figure 119: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Molecular Imaging, 2023 – 2031

Figure 120: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2023

Figure 121: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2031

Figure 122: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Cardiovascular, 2023 – 2031

Figure 123: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Neurology, 2023 – 2031

Figure 124: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Lung (Respiratory System), 2023 – 2031

Figure 125: Global AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Breast (Mammography), 2023 – 2031

Figure 126: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oncology, 2023 – 2031

Figure 127: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Pathology, 2023 – 2031

Figure 128: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Liver (GI), 2023 – 2031

Figure 129: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oral Diagnostics, 2023 – 2031

Figure 130: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Rest of the Body, 2023 – 2031

Figure 131: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2023

Figure 132: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2031

Figure 133: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Hospitals, 2023 – 2031

Figure 134: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by R&D Centers, 2023 – 2031

Figure 135: Europe AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Laboratories & Diagnostic Centers, 2023 – 2031

Figure 136: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2023

Figure 137: Europe AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2031

Figure 138: Germany AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 139: U.K. AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 140: France AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 141: Italy AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 142: Spain AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 143: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Solution

Figure 144: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by AI Technology

Figure 145: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Image Acquisition Technology

Figure 146: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Clinical Application

Figure 147: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by End-user

Figure 148: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Country

Figure 149: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2023

Figure 150: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2031

Figure 151: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Software Tools/Platforms, 2023 – 2031

Figure 152: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Services, 2023 – 2031

Figure 153: Global AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2023

Figure 154: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2031

Figure 155: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Deep Learning, 2023 – 2031

Figure 156: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computer Vision, 2023 – 2031

Figure 157: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Others, 2023 – 2031

Figure 158: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2023

Figure 159: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2031

Figure 160: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by X-ray, 2023 – 2031

Figure 161: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computed Tomography (CT), 2023 – 2031

Figure 162: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Magnetic Resonance Imaging, 2023 – 2031

Figure 163: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Ultrasound Imaging, 2023 – 2031

Figure 164: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Molecular Imaging, 2023 – 2031

Figure 165: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2023

Figure 166: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2031

Figure 167: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Cardiovascular, 2023 – 2031

Figure 168: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Neurology, 2023 – 2031

Figure 169: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Lung (Respiratory System), 2023 – 2031

Figure 170: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Breast (Mammography), 2023 – 2031

Figure 171: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oncology, 2023 – 2031

Figure 172: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Pathology, 2023 – 2031

Figure 173: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Liver (GI), 2023 – 2031

Figure 174: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oral Diagnostics, 2023 – 2031

Figure 175: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Rest of the Body, 2023 – 2031

Figure 176: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2023

Figure 177: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2031

Figure 178: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Hospitals, 2023 – 2031

Figure 179: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by R&D Centers, 2023 – 2031

Figure 180: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Laboratories & Diagnostic Centers, 2023 – 2031

Figure 181: Asia Pacific AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Country

Figure 182: China AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 183: India AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 184: Japan AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 185: ASEAN AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 186: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Solution

Figure 187: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by AI Technology

Figure 188: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Image Acquisition Technology

Figure 189: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Clinical Application

Figure 190: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by End-user

Figure 191: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Country

Figure 192: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2023

Figure 193: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2031

Figure 194: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Software Tools/Platforms, 2023 – 2031

Figure 195: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Services, 2023 – 2031

Figure 196: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2023

Figure 197: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2031

Figure 198: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Deep Learning, 2023 – 2031

Figure 199: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computer Vision, 2023 – 2031

Figure 200: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Others, 2023 – 2031

Figure 201: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2023

Figure 202: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2031

Figure 203: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by X-ray, 2023 – 2031

Figure 204: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computed Tomography (CT), 2023 – 2031

Figure 205: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Magnetic Resonance Imaging, 2023 – 2031

Figure 206: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Ultrasound Imaging, 2023 – 2031

Figure 207: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Molecular Imaging, 2023 – 2031

Figure 208: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2023

Figure 209: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2031

Figure 210: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Cardiovascular, 2023 – 2031

Figure 211: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Neurology, 2023 – 2031

Figure 212: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Lung (Respiratory System), 2023 – 2031

Figure 213: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Breast (Mammography), 2023 – 2031

Figure 214: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oncology, 2023 – 2031

Figure 215: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Pathology, 2023 – 2031

Figure 216: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Liver (GI), 2023 – 2031

Figure 217: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oral Diagnostics, 2023 – 2031

Figure 218: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Rest of the Body, 2023 – 2031

Figure 219: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2023

Figure 220: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2031

Figure 221: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Hospitals, 2023 – 2031

Figure 222: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by R&D Centers, 2023 – 2031

Figure 223: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Laboratories & Diagnostic Centers, 2023 – 2031

Figure 224: Middle East & Africa East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2023

Figure 225: Middle East & Africa AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2031

Figure 226: Saudi Arabia AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 227: United Arab Emirates AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 228: South Africa AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 229: South America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Solution

Figure 230: South America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by AI Technology

Figure 231: South America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Image Acquisition Technology

Figure 232: South America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Clinical Application

Figure 233: South America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by End-user

Figure 234: South America AI (Artificial Intelligence) in Medical Imaging Market Revenue Opportunity Share, by Country

Figure 235: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2023

Figure 236: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Solution, 2031

Figure 237: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Software Tools/Platforms, 2023 – 2031

Figure 238: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Services, 2023 – 2031

Figure 239: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2023

Figure 240: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by AI Technology, 2031

Figure 241: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Deep Learning, 2023 – 2031

Figure 242: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computer Vision, 2023 – 2031

Figure 243: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Others, 2023 – 2031

Figure 244: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2023

Figure 245: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Image Acquisition Technology, 2031

Figure 246: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by X-ray, 2023 – 2031

Figure 247: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Computed Tomography (CT), 2023 – 2031

Figure 248: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Magnetic Resonance Imaging, 2023 – 2031

Figure 249: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Ultrasound Imaging, 2023 – 2031

Figure 250: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Molecular Imaging, 2023 – 2031

Figure 251: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2023

Figure 252: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Clinical Application, 2031

Figure 253: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Cardiovascular, 2023 – 2031

Figure 254: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Neurology, 2023 – 2031

Figure 255: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Lung (Respiratory System), 2023 – 2031

Figure 256: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Breast (Mammography), 2023 – 2031

Figure 257: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oncology, 2023 – 2031

Figure 258: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Pathology, 2023 – 2031

Figure 259: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Liver (GI), 2023 – 2031

Figure 260: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Oral Diagnostics, 2023 – 2031

Figure 261: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Rest of the Body, 2023 – 2031

Figure 262: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2023

Figure 263: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by End-user, 2031

Figure 264: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Hospitals, 2023 – 2031

Figure 265: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by R&D Centers, 2023 – 2031

Figure 266: South America AI (Artificial Intelligence) in Medical Imaging Market Absolute Opportunity (US$ Mn), by Laboratories & Diagnostic Centers, 2023 – 2031

Figure 267: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2023

Figure 268: South America AI (Artificial Intelligence) in Medical Imaging Market Value Share Analysis, by Country, 2031

Figure 269: Brazil AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031

Figure 270: Argentina AI (Artificial Intelligence) in Medical Imaging Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 – 2031