Reports

Reports

Analysts’ Viewpoint

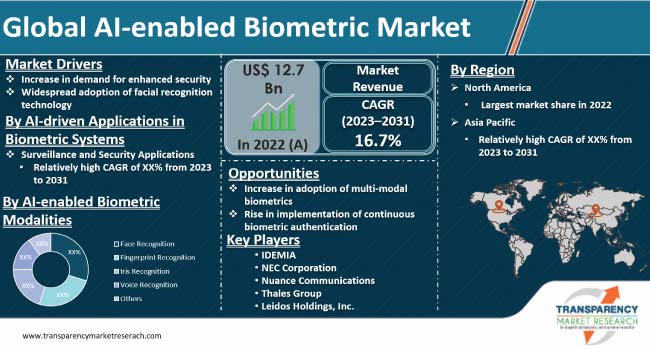

The integration of AI algorithms with biometric systems has significantly improved accuracy, enabling smooth applications in various sectors, such as banking, finance, healthcare, government, and retail. This has significantly enhanced the AI-enabled biometric market share.

Advancements in machine learning and deep learning techniques would further improve accuracy and expand the scope of applications of AI in biometric security systems. Additionally, the integration of AI with other technologies, such as Internet of Things (IoT) and cloud computing, is expected to unlock new possibilities in areas such as smart homes, healthcare, and connected devices, resulting in AI-enabled biometric market expansion.

Key market players are focusing on innovating products and services to cater to the consumer demand. Some players are entering into partnerships to enhance their customer base.

AI-enabled biometric is a term that refers to the use of artificial intelligence (AI) to enhance the accuracy and efficiency of biometric systems. Biometric systems are methods of identifying and verifying individuals based on their physical or behavioral characteristics, such as fingerprints, face, voice, and iris. AI in biometrics can improve the performance of biometric systems by applying advanced techniques, such as deep learning, computer vision, and natural language processing, to process and analyze biometric data.

AI-enabled biometric systems use machine learning algorithms to analyze biometric data and perform tasks, such as enrollment, matching, verification, and identification. These systems can also adapt to changing environmental conditions, detect spoofing attempts, and provide feedback to users.

Demand for AI-enabled biometrics is increasing owing to rise in demand for security and convenience, growth in adoption of smart devices and cloud computing, and surge in need for contactless solutions amid the COVID-19 pandemic. There is an increasing demand for security and privacy in various sectors, such as banking, healthcare, education, and government. Biometric systems can provide a high level of security and privacy by verifying the identity of users and preventing unauthorized access to sensitive data or resources.

Emerging trends in AI-enabled biometric technology facilitated the expansion of biometric modalities beyond traditional methods, such as fingerprints and facial recognition. Emerging modalities, such as voice recognition, iris scanning, and gait analysis are gaining traction due to AI's ability to extract intricate patterns and features.

According to Cost of a Data Breach Report 2021 published by IBM, every one in five data breaching incidents is caused by compromised credentials.

Growth in need for secure identification and access control in various industries is increasing the adoption of AI-enabled biometric solutions. Demand for robust authentication systems that go beyond traditional methods is increasing in industries, such as banking, government, healthcare, and transportation, where sensitive data, assets, and facilities need to be protected.

AI-enabled biometrics is used to secure customer authentication during online banking transactions or while accessing secure banking applications. In government applications, biometric authentication is used for border control, e-passports, and national ID programs to ensure secure identification. AI-enabled biometric solutions for healthcare industry include patient identification and secure access to electronic health records. Transportation sectors employ biometrics for secure access to airports, public transportation systems, or vehicle authentication.

These industries recognize the limitations and vulnerabilities of traditional authentication methods and are turning toward AI-enabled biometric solutions to enhance security, reduce fraud, and ensure the privacy and integrity of sensitive information. Furthermore, advancements in AI-based biometric authentication systems significantly improves the accuracy and reliability of these systems.

AI algorithms analyze vast amount of data, learn patterns, and adapt to variations in biometric traits, thereby enhancing the performance and robustness of biometric authentication systems.

Biometrics solutions are evolving due to the advancements in technologies. Fingerprints were the first biometrics used for identification and verification. Other biometrics, such as iris, face, and DNA, are gaining traction currently.

Multi-modal biometrics provides enhanced recognition, security, and accuracy over unimodal biometrics. The false positivity rate of multi-modal biometrics is very low compared to unimodal biometrics, since multi-modal biometrics uses more than one biometric authentication, such as face recognition, voice recognition, fingerprints, palm vein patterns, and iris patterns, to identify and verify individuals. If one identifier fails to verify one behavioral or physiological feature of a person, it uses another feature for identification.

The adoption of multi-modal biometrics expands the application areas for AI-enabled biometric systems. Industries, such as finance, healthcare, government, transportation, and retail, are increasingly adopting multi-modal biometric solutions to enhance security, streamline processes, and improve user experiences.

The growing demand for AI-enabled biometrics in various sectors presents significant opportunities for providers of AI-based biometric solutions, such as automated facial recognition, automated voice recognition, and automated fingerprint identification system. For instance, Nepal is issuing a national eID in which fingerprint and iris data are both integrated.

Mobile payment solutions currently are implementing multi-modal biometrics for the verification of customers before completing a transaction due to their high accuracy and security level. Law enforcement agencies use multi-modal mobile biometrics devices to verify the identities of people while patrolling.

Increase in adoption of multi-modal biometrics creates ample opportunities for the market by enhancing performance, anti-spoofing capabilities, adaptability, real-time processing, expanding application areas, and leveraging data-driven insights. Demand for AI-enabled biometrics is expected to rise as organizations seek advanced and intelligent biometric solutions, which further drives market progress and innovation.

According to the latest AI-enabled biometric industry research report, North America is anticipated to hold the dominant share of the global industry during the forecast period due to the presence of a large number of key players in the U.S. and increased investments in digital technologies for security and surveillance by governments and law enforcement agencies, among other industries.

AI-enabled biometric industry growth in Asia Pacific is expected to be at the highest CAGR during the forecast period. The region is experiencing rapid economic growth in recent years. This is resulting in growth in digitalization in the IT & telecom sector in India and China, which encourages employees to use their biometrics (face and fingerprints) to prove their presence. This has created a high demand for AI-enabled biometric authentication solutions.

The AI-enabled biometric market research report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

Assa Abloy, Aware Inc., Ayonix pty ltd, Facephi Biometría, S.A., IDEMIA, Leidos Holdings, Inc., M2SYS Technology, NEC Corporation, Nuance Communications, Thales Group, Veridium, and Fujitsu Limited Incorporated are the key AI-enabled biometric providers.

Prominent providers are investing in R&D activities to introduce AI-enabled biometric technologies that can meet the growing AI-enabled biometric market demand. These service providers are tapping into the latest AI-enabled biometric market trends to gain new opportunities and stay ahead of the competitive curve.

Key players have been profiled in the AI-enabled biometric market report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 12.7 Bn |

|

Market Forecast Value in 2031 |

US$ 50.5 Bn |

|

Growth Rate (CAGR) |

16.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2018-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 12.7 Bn in 2022

It is anticipated to reach US$ 50.5 Bn by the end of 2031

The CAGR is estimated to be 16.7% from 2023 to 2031

Increase in demand for enhanced security, and widespread adoption of facial recognition technology

North America accounted for leading share in 2022

Assa Abloy, Aware Inc., Ayonix pty ltd, Facephi Biometría, S.A., IDEMIA, Leidos Holdings, Inc., M2SYS Technology, NEC Corporation, Nuance Communications, Thales Group, Veridium, and Fujitsu Limited

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global AI-enabled Biometric Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on AI-enabled Biometric Market

4.5. Market Opportunity Assessment - by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By AI-enabled Biometric Modalities

4.5.2. By AI-driven Applications in Biometric Systems

4.5.3. By End-use Industry

4.6. Porter’s Five Forces Analysis

4.7. PEST Analysis

4.8. AI Evolution In Biometric Market

4.8.1. Adoption of AI in Biometric Systems

4.8.2. Deep Learning and Biometrics

4.8.3. Multimodal Biometrics and AI Integration

4.8.4. Continuous Authentication and Real-time Verification

4.8.5. Adaptive and Self-learning Biometric Systems

4.8.6. AI-driven Enhancements in Biometric Applications

4.9. Privacy and Ethical Considerations in AI-enabled Biometric

4.9.1. Data Privacy and Security

4.9.2. Ethical Use of Biometric Data

5. Global AI-enabled Biometric Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2018-2031

5.1.1. Historic Growth Trends, 2018-2022

5.1.2. Forecast Trends, 2023-2031

6. Global AI-enabled Biometric Market Analysis, by AI-enabled Biometric Modalities

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. AI-enabled Biometric Market Size (US$ Mn) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

6.3.1. Face Recognition

6.3.2. Fingerprint Recognition

6.3.3. Iris Recognition

6.3.4. Voice Recognition

6.3.5. Others

6.4. AI-enabled Biometric Market Volume (Million Units) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

6.4.1. Face Recognition

6.4.2. Fingerprint Recognition

6.4.3. Iris Recognition

6.4.4. Voice Recognition

6.4.5. Others

7. Global AI-enabled Biometric Market Analysis, by AI-driven Applications in Biometric Systems

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. AI-enabled Biometric Market Size (US$ Mn) Forecast, by AI-driven Applications in Biometric Systems, 2018 - 2031

7.3.1. Mobile Biometrics and Smart Devices

7.3.2. Biometric Access Control Systems

7.3.3. Identity Verification and Authentication

7.3.4. Surveillance and Security Applications

7.3.5. Others

8. Global AI-enabled Biometric Market Analysis, by End-use Industry

8.1. Key Segment Analysis

8.2. AI-enabled Biometric Market Size (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

8.2.1. Healthcare

8.2.2. BFSI

8.2.3. Transportation and logistics

8.2.4. Government and Law Enforcement

8.2.5. Others

9. Global AI-enabled Biometric Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America AI-enabled Biometric Market Analysis and Forecast

10.1. Regional Outlook

10.2. AI-enabled Biometric Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

10.2.1. By AI-enabled Biometric Modalities

10.2.2. By AI-driven Applications in Biometric Systems

10.2.3. By End-use Industry

10.3. AI-enabled Biometric Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe AI-enabled Biometric Market Analysis and Forecast

11.1. Regional Outlook

11.2. AI-enabled Biometric Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

11.2.1. By AI-enabled Biometric Modalities

11.2.2. By AI-driven Applications in Biometric Systems

11.2.3. By End-use Industry

11.3. AI-enabled Biometric Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific AI-enabled Biometric Market Analysis and Forecast

12.1. Regional Outlook

12.2. AI-enabled Biometric Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By AI-enabled Biometric Modalities

12.2.2. By AI-driven Applications in Biometric Systems

12.2.3. By End-use Industry

12.3. AI-enabled Biometric Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa AI-enabled Biometric Market Analysis and Forecast

13.1. Regional Outlook

13.2. AI-enabled Biometric Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By AI-enabled Biometric Modalities

13.2.2. By AI-driven Applications in Biometric Systems

13.2.3. By End-use Industry

13.3. AI-enabled Biometric Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America AI-enabled Biometric Market Analysis and Forecast

14.1. Regional Outlook

14.2. AI-enabled Biometric Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By AI-enabled Biometric Modalities

14.2.2. By AI-driven Applications in Biometric Systems

14.2.3. By End-use Industry

14.3. AI-enabled Biometric Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Competitive Landscape by Tier Structure of Companies

15.3. Scale of Competition, 2022

15.4. Scale of Competition at Regional Level, 2022

15.5. Market Revenue Share Analysis/Ranking , by Leading Players (2022)

15.6. List of Startups

15.7. Competition Evolution

15.8. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. Assa Abloy

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Recent Developments

16.1.6. Impact of COVID-19

16.1.7. TMR View

16.1.8. Competitive Threats and Weakness

16.2. Aware Inc.

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Recent Developments

16.2.6. Impact of COVID-19

16.2.7. TMR View

16.2.8. Competitive Threats and Weakness

16.3. Ayonix pty ltd

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Recent Developments

16.3.6. Impact of COVID-19

16.3.7. TMR View

16.3.8. Competitive Threats and Weakness

16.4. Facephi Biometría, S.A.

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Recent Developments

16.4.6. Impact of COVID-19

16.4.7. TMR View

16.4.8. Competitive Threats and Weakness

16.5. IDEMIA

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Recent Developments

16.5.6. Impact of COVID-19

16.5.7. TMR View

16.5.8. Competitive Threats and Weakness

16.6. Leidos Holdings, Inc.

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Recent Developments

16.6.6. Impact of COVID-19

16.6.7. TMR View

16.6.8. Competitive Threats and Weakness

16.7. M2SYS Technology

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Recent Developments

16.7.6. Impact of COVID-19

16.7.7. TMR View

16.7.8. Competitive Threats and Weakness

16.8. NEC Corporation

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Recent Developments

16.8.6. Impact of COVID-19

16.8.7. TMR View

16.8.8. Competitive Threats and Weakness

16.9. Nuance Communications

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Recent Developments

16.9.6. Impact of COVID-19

16.9.7. TMR View

16.9.8. Competitive Threats and Weakness

16.10. Thales Group

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Recent Developments

16.10.6. Impact of COVID-19

16.10.7. TMR View

16.10.8. Competitive Threats and Weakness

16.11. Veridium

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Recent Developments

16.11.6. Impact of COVID-19

16.11.7. TMR View

16.11.8. Competitive Threats and Weakness

16.12. Fujitsu Limited

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Recent Developments

16.12.6. Impact of COVID-19

16.12.7. TMR View

16.12.8. Competitive Threats and Weakness

16.13. Others

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Recent Developments

16.13.6. Impact of COVID-19

16.13.7. TMR View

16.13.8. Competitive Threats and Weakness

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in AI-enabled Biometric Market

Table 2: North America AI-enabled Biometric Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 3: Europe AI-enabled Biometric Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 4: Asia Pacific AI-enabled Biometric Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 5: Middle East & Africa AI-enabled Biometric Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 6: South America AI-enabled Biometric Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact

Table 8: Forecast Factors: Relevance and Impact

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

Table 11: Global AI-enabled Biometric Market Volume (Million Units) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

Table 12: Global AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-driven Applications in Biometric Systems, 2018 - 2031

Table 13: Global AI-enabled Biometric Market Value (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

Table 14: Global AI-enabled Biometric Market Value (US$ Mn) Forecast, by Region, 2018 - 2031

Table 15: North America AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

Table 16: North America AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-driven Applications in Biometric Systems, 2018 - 2031

Table 17: North America AI-enabled Biometric Market Value (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

Table 18: North America AI-enabled Biometric Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 19: U.S: AI-enabled Biometric Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Europe AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

Table 21: Europe AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-driven Applications in Biometric Systems, 2018 - 2031

Table 22: Europe AI-enabled Biometric Market Value (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

Table 23: Europe AI-enabled Biometric Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 24: Germany AI-enabled Biometric Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Spain AI-enabled Biometric Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Asia Pacific AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

Table 27: Asia Pacific AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-driven Applications in Biometric Systems, 2018 - 2031

Table 28: Asia Pacific AI-enabled Biometric Market Value (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

Table 29: Asia Pacific AI-enabled Biometric Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 30: China AI-enabled Biometric Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: ASEAN AI-enabled Biometric Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Table: Middle East & Africa AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

Table 33: Table: Middle East & Africa AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-driven Applications in Biometric Systems, 2018 - 2031

Table 34: Middle East & Africa AI-enabled Biometric Market Value (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

Table 35: Middle East & Africa AI-enabled Biometric Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 36: Saudi Arabia AI-enabled Biometric Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: South America AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-enabled Biometric Modalities, 2018 - 2031

Table 38: South America AI-enabled Biometric Market Value (US$ Mn) Forecast, by AI-driven Applications in Biometric Systems, 2018 - 2031

Table 39: South America AI-enabled Biometric Market Value (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

Table 40: South America AI-enabled Biometric Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 41: Brazil AI-enabled Biometric Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: Acquisitions, Partnerships, and Launches

Table 43: Acquisitions, Partnerships, and Launches

Table 44: Acquisitions, Partnerships, and Launches

Table 45: Acquisitions, Partnerships, and Launches

List of Figures

Figure 1: Global AI-enabled Biometric Market Size (US$ Mn) Forecast, 2018-2031

Figure 2: Global AI-enabled Biometric Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of AI-enabled Biometric Market

Figure 4: Global AI-enabled Biometric Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global AI-enabled Biometric Market Attractiveness Assessment, by AI-enabled Biometric Modalities

Figure 6: Global AI-enabled Biometric Market Attractiveness Assessment, by AI-driven Applications in Biometric Systems

Figure 7: Global AI-enabled Biometric Market Attractiveness Assessment, by End-use Industry

Figure 8: Global AI-enabled Biometric Market Attractiveness Assessment, by Region

Figure 9: Global AI-enabled Biometric Market Revenue (US$ Mn) Historic Trends, 2018 - 2022

Figure 10: Global AI-enabled Biometric Market Revenue Opportunity (US$ Mn) Historic Trends, 2018 - 2022

Figure 11: Global AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2023

Figure 12: Global AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2031

Figure 13: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Face Recognition, 2023 - 2031

Figure 14: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Fingerprint Recognition, 2023 - 2031

Figure 15: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Iris Recognition, 2023 - 2031

Figure 16: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Voice Recognition, 2023 - 2031

Figure 17: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 18: Global AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2023

Figure 19: Global AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2031

Figure 20: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Mobile Biometrics and Smart Devices, 2023- 2031

Figure 21: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Biometric Access Control Systems, 2023 - 2031

Figure 22: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Identity Verification and Authentication, 2023- 2031

Figure 23: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Surveillance and Security Applications, 2023 - 2031

Figure 24: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023- 2031

Figure 25: Global AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2023

Figure 26: Global AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2031

Figure 27: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 28: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 29: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Transportation and logistics, 2023 - 2031

Figure 30: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Government and Law Enforcement: 2023 - 2031

Figure 31: Global AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 32: Global AI-enabled Biometric Market Opportunity (US$ Mn), by Region

Figure 33: Global AI-enabled Biometric Market Opportunity Share (%), by Region, 2023-2031

Figure 34: Global AI-enabled Biometric Market Size (US$ Mn), by Region, 2023 & 2031

Figure 35: Global AI-enabled Biometric Market Value Share Analysis, by Region, 2023

Figure 36: Global AI-enabled Biometric Market Value Share Analysis, by Region, 2031

Figure 37: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 38: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 39: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 40: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 41: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 42: North America AI-enabled Biometric Market Revenue Opportunity Share, by AI-enabled Biometric Modalities

Figure 43: North America AI-enabled Biometric Market Revenue Opportunity Share, by AI-driven Applications in Biometric Systems

Figure 44: North America AI-enabled Biometric Market Revenue Opportunity Share, by End-use Industry

Figure 45: North America AI-enabled Biometric Market Revenue Opportunity Share, by Country

Figure 46: North America AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2023

Figure 47: North America AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2031

Figure 48: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Face Recognition, 2023 - 2031

Figure 49: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Fingerprint Recognition, 2023 - 2031

Figure 50: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Iris Recognition, 2023 - 2031

Figure 51: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Voice Recognition, 2023 - 2031

Figure 52: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 53: North America AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2023

Figure 54: North America AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2031

Figure 55: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Mobile Biometrics and Smart Devices, 2023- 2031

Figure 56: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Biometric Access Control Systems, 2023 - 2031

Figure 57: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Identity Verification and Authentication, 2023- 2031

Figure 58: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Surveillance and Security Applications, 2023 - 2031

Figure 59: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023- 2031

Figure 60: North America AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2023

Figure 61: North America AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2031

Figure 62: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 63: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 64: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Transportation and logistics, 2023 - 2031

Figure 65: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Government and Law Enforcement: 2023 - 2031

Figure 66: North America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 67: North America AI-enabled Biometric Market Value Share Analysis, by Country, 2023

Figure 68: North America AI-enabled Biometric Market Value Share Analysis, by Country, 2031

Figure 69: U.S: AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 70: Canada AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 71: Mexico AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 72: Europe AI-enabled Biometric Market Revenue Opportunity Share, by AI-enabled Biometric Modalities

Figure 73: Europe AI-enabled Biometric Market Revenue Opportunity Share, by AI-driven Applications in Biometric Systems

Figure 74: Europe AI-enabled Biometric Market Revenue Opportunity Share, by End-use Industry

Figure 75: Europe AI-enabled Biometric Market Revenue Opportunity Share, by Country

Figure 76: Europe AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2023

Figure 77: Europe AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2031

Figure 78: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Face Recognition, 2023 - 2031

Figure 79: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Fingerprint Recognition, 2023 - 2031

Figure 80: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Iris Recognition, 2023 - 2031

Figure 81: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Voice Recognition, 2023 - 2031

Figure 82: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 83: Europe AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2023

Figure 84: Europe AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2031

Figure 85: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Mobile Biometrics and Smart Devices, 2023- 2031

Figure 86: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Biometric Access Control Systems, 2023 - 2031

Figure 87: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Identity Verification and Authentication, 2023- 2031

Figure 88: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Surveillance and Security Applications, 2023 - 2031

Figure 89: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023- 2031

Figure 90: Europe AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2023

Figure 91: Europe AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2031

Figure 92: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 93: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 94: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Transportation and logistics, 2023 - 2031

Figure 95: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Government and Law Enforcement: 2023 - 2031

Figure 96: Europe AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 97: Europe AI-enabled Biometric Market Value Share Analysis, by Country, 2023

Figure 98: Europe AI-enabled Biometric Market Value Share Analysis, by Country, 2031

Figure 99: Germany AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 100: U.K: AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 101: France AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 102: Spain AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 103: Italy AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 104: Asia Pacific AI-enabled Biometric Market Revenue Opportunity Share, by AI-enabled Biometric Modalities

Figure 105: Asia Pacific AI-enabled Biometric Market Revenue Opportunity Share, by AI-driven Applications in Biometric Systems

Figure 106: Asia Pacific AI-enabled Biometric Market Revenue Opportunity Share, by End-use Industry

Figure 107: Asia Pacific AI-enabled Biometric Market Revenue Opportunity Share, by Country

Figure 108: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2023

Figure 109: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2031

Figure 110: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Face Recognition, 2023 - 2031

Figure 111: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Fingerprint Recognition, 2023 - 2031

Figure 112: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Iris Recognition, 2023 - 2031

Figure 113: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Voice Recognition, 2023 - 2031

Figure 114: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 115: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2023

Figure 116: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2031

Figure 117: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Mobile Biometrics and Smart Devices, 2023- 2031

Figure 118: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Biometric Access Control Systems, 2023 - 2031

Figure 119: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Identity Verification and Authentication, 2023- 2031

Figure 120: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Surveillance and Security Applications, 2023 - 2031

Figure 121: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023- 2031

Figure 122: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2023

Figure 123: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2031

Figure 124: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 125: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 126: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Transportation and logistics, 2023 - 2031

Figure 127: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Government and Law Enforcement: 2023 - 2031

Figure 128: Asia Pacific AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 129: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by Country, 2023

Figure 130: Asia Pacific AI-enabled Biometric Market Value Share Analysis, by Country, 2031

Figure 131: China AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 132: India AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 133: Japan AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 134: ASEAN AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 135: Middle East & Africa AI-enabled Biometric Market Revenue Opportunity Share, by AI-enabled Biometric Modalities

Figure 136: Middle East & Africa AI-enabled Biometric Market Revenue Opportunity Share, by AI-driven Applications in Biometric Systems

Figure 137: Middle East & Africa AI-enabled Biometric Market Revenue Opportunity Share, by End-use Industry

Figure 138: Middle East & Africa AI-enabled Biometric Market Revenue Opportunity Share, by Country

Figure 139: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2023

Figure 140: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2031

Figure 141: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Face Recognition, 2023 - 2031

Figure 142: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Fingerprint Recognition, 2023 - 2031

Figure 143: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Iris Recognition, 2023 - 2031

Figure 144: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Voice Recognition, 2023 - 2031

Figure 145: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 146: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2023

Figure 147: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2031

Figure 148: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Mobile Biometrics and Smart Devices, 2023- 2031

Figure 149: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Biometric Access Control Systems, 2023 - 2031

Figure 150: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Identity Verification and Authentication, 2023- 2031

Figure 151: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Surveillance and Security Applications, 2023 - 2031

Figure 152: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023- 2031

Figure 153: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2023

Figure 154: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2031

Figure 155: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 156: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 157: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Transportation and logistics, 2023 - 2031

Figure 158: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Government and Law Enforcement: 2023 - 2031

Figure 159: Middle East & Africa AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 160: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by Country, 2023

Figure 161: Middle East & Africa AI-enabled Biometric Market Value Share Analysis, by Country, 2031

Figure 162: Saudi Arabia AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 163: United Arab Emirates AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 164: South Africa AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 165: South America AI-enabled Biometric Market Revenue Opportunity Share, by AI-enabled Biometric Modalities

Figure 166: South America AI-enabled Biometric Market Revenue Opportunity Share, by AI-driven Applications in Biometric Systems

Figure 167: South America AI-enabled Biometric Market Revenue Opportunity Share, by End-use Industry

Figure 168: South America AI-enabled Biometric Market Revenue Opportunity Share, by Country

Figure 169: South America AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2023

Figure 170: South America AI-enabled Biometric Market Value Share Analysis, by AI-enabled Biometric Modalities, 2031

Figure 171: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Face Recognition, 2023 - 2031

Figure 172: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Fingerprint Recognition, 2023 - 2031

Figure 173: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Iris Recognition, 2023 - 2031

Figure 174: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Voice Recognition, 2023 - 2031

Figure 175: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 176: South America AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2023

Figure 177: South America AI-enabled Biometric Market Value Share Analysis, by AI-driven Applications in Biometric Systems, 2031

Figure 178: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Mobile Biometrics and Smart Devices, 2023- 2031

Figure 179: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Biometric Access Control Systems, 2023 - 2031

Figure 180: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Identity Verification and Authentication, 2023- 2031

Figure 181: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Surveillance and Security Applications, 2023 - 2031

Figure 182: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023- 2031

Figure 183: South America AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2023

Figure 184: South America AI-enabled Biometric Market Value Share Analysis, by End-use Industry, 2031

Figure 185: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 186: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 187: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Transportation and logistics, 2023 - 2031

Figure 188: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Government and Law Enforcement: 2023 - 2031

Figure 189: South America AI-enabled Biometric Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 190: South America AI-enabled Biometric Market Value Share Analysis, by Country, 2023

Figure 191: South America AI-enabled Biometric Market Value Share Analysis, by Country, 2031

Figure 192: Brazil AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 193: Argentina AI-enabled Biometric Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031