Reports

Reports

Growing Need for Crop Protection to Boost Agricultural Disinfectant Market

The global agricultural disinfectant market is likely to observe growth due to the rising importance of the product in modern day agricultural sector. Agricultural disinfectants find extensive use in the protection of livestock and crop. These products are found in many different forms such as gel, granule, powder, and liquid. Agricultural disinfectants are used in either livestock farms or agricultural farms. In a bid to safeguard livestock and crops from various harmful diseases, proper disinfection or sterilization of microorganisms is needed.

Rising Demand for Hygienic Livestock Products to Spur Demand in the Market

The global agricultural disinfectant market is estimated to witness substantial development across all regions in the world. The augmented demand for meat and various meat products in India and China is forecasted to propel growth of the global agricultural disinfectant market in the years to come.

Furthermore, increased research and developments for improvement of in the quality of disinfectants in Asia Pacific is expected to encourage expansion of the global agricultural disinfectant market. In addition, growth of the global agricultural disinfectant market is likely to be influenced by the following factors

In addition, green house vegetable production together with development of vertical farming is estimated to drive the global agricultural disinfectant market. Furthermore, rising number of diseases amongst the livestock is likely to be another growth-inducing factor for the market.

The health of livestock is gaining significance across the globe due to increased demand for hygienic meat and meat products. In a bid to ensure availability of hygienic and proper meat and meat products, it is necessary to apply disinfectant on surface, yards, and in drinking water. Frequent removal of manure, routine cleanliness and application of disinfectant properly are expected to work in favor of the global agricultural disinfectant market in the years to come.

Agricultural Disinfectant Market: Snapshot

The global market for agricultural disinfectants has been expanding at a steady pace across most regions, driven primarily by the rising demand for meat products in India and China. The rapid growth of the agricultural disinfectant market is also attributed to the increase in research and development activities in order to improve the quality as well as efficacy of disinfectants.

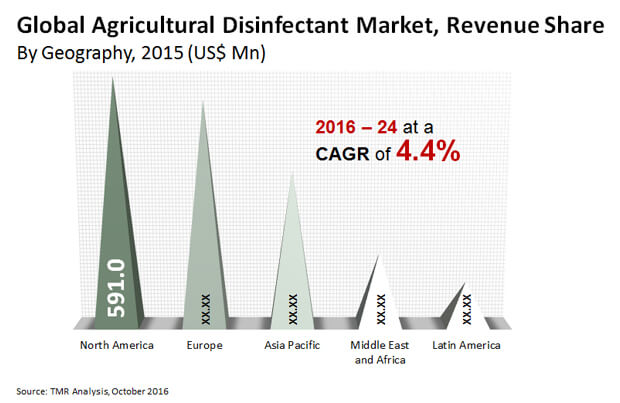

There has been a growing emphasis on minimizing operating expenditure, improving performance, ensure crop protection, and adhering to regulatory standards. The development of greenhouse vegetable production and vertical farming are also considered to be key drivers in the global agricultural disinfectants market. The market is expected to grow from a value of US$1.7 bn in 2015 to US$2.5 bn by 2024, at a CAGR of 4.4% therein.

Livestock Farms Surpass Agricultural Farms in terms of Demand

By form, the agricultural disinfectant market has been divided into liquid, powder, and others, such as gels and granules. The liquid agricultural disinfectants segment captured the leading share in 2015 due to their easy availability, low cost, and soluble nature. Liquid agricultural disinfectants are used in agricultural farms to ensure better crop productivity and in the drinking water of the livestock.

Based on application, agricultural disinfectants are used on land, in the water, and in the air. The application of these disinfectants is most common on land, followed by the water sanitizing and aerial segments.

On the basis of end use, agricultural disinfectants are used in agricultural and livestock farms. Livestock farms surpass agricultural farms in terms of demand owing to the rising demand for meat products and the need to ensure the safety of the livestock. Farmers are especially concerned about newborn livestock as they are increasingly vulnerable to diseases.

Growing Importance of Crop and Livestock Protection Key Driving Factor in Europe

By geography, the agricultural disinfectant market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominated the market in 2015, accounting for more than 33.0% of the global agricultural disinfectant market that year. The region has been displaying strong growth owing to the increase in livestock and a rising demand for quality meat products, which in turn, results in the growing demand for agricultural disinfectants in livestock farms.

The agricultural disinfectant market in Europe held the second largest share in 2015 and is expected to grow consistently during the forecast period. France boasts of a large number of agricultural fields and hence captures the dominant share in the region. The growing focus in Germany about the importance of crop and livestock protection is likely to boost the agricultural disinfectant market in the country.

Asia Pacific is expected to witness impressive growth during the forecast period, attributed mainly to the rising opportunities presented by developing countries. Continuous research and development and the increasing demand for meat products in countries such as India and China is expected to boost the market for agricultural disinfectants by 2024.

The vendor landscape of the market is immensely consolidated owing to the presence of several domestic and international manufacturers. This makes the market rather competitive. The leading players in the agricultural disinfectant market include Zoetis (U.S.), The Chemours Company (U.S.), Nufarm (Melbourne), The Dow Chemical Company (U.S.), The Stepan Company (U.S.), The Thymox Technology (Canada), Neogen Corporation (U.S.), Fink Tec GmbH (Germany), QuatChem Limited (U.K.), and Entaco N.V. (Belgium).

Chapter 1 Preface

1.1 Research Scope

1.2 Market Segmentation

1.3 Research Objectives

1.4 Key Questions Answered

Chapter 2 Assumptions and Research Methodology

2.1 Research Assumptions

2.2 Acronyms used

2.3 Research Methodology

Chapter 3 Executive Summary

3.1 Global Agricultural Disinfectant Market Snapshot

Chapter 4 Global Agricultural Disinfectant Market, 2016-2024-Industry Analysis

4.1 Key Trend Analysis

4.2 Drivers and Restraints Snapshot Analysis

4.3 Market Drivers

4.4 Market Restraints

4.5 Market Opportunities

4.6 Agricultural Disinfectant Market: Market Share Analysis, by Company, 2015 (%)

Chapter 5 Global Agricultural Disinfectant Market Analysis, By Form 2016 – 2024 (USD Million)

5.1 Introduction

5.2 Global Agricultural Disinfectant Market Value Share Analysis, by Form

5.3 Global Agricultural Disinfectant Market Revenue and Forecast, By Form

5.3.1 Liquid

5.3.2 Powder

5.3.3 Others

Chapter 6 Global Agricultural Disinfectant Market Analysis, By Application 2016 – 2024 (USD Million)

6.1 Introduction

6.2 Global Agricultural Disinfectant Market Value Share Analysis, by Application

6.3 Global Agricultural Disinfectant Market Revenue and Forecast, By Application

6.3.1 Land

6.3.2 Water Sanitizing

6.3.3 Aerial

Chapter 7 Global Agricultural Disinfectant Market Analysis, By End Use 2016 – 2024 (USD Million)

7.1 Introduction

7.2 Global Agricultural Disinfectant Market Value Share Analysis, by End Use

7.3 Global Agricultural Disinfectant Market Revenue and Forecast, By End Use

7.3.1 Agricultural Farms

7.3.2 Livestock Farms

Chapter 8 Global Agricultural Disinfectant Market Analysis, By Region 2016 – 2024 (USD Million)

8.1 Geographical Scenario

8.2 Agricultural Disinfectant Market Value Share Analysis, by Region

8.3 Agricultural Disinfectant Market Revenue and Forecast, by Region

Chapter 9 North America Agricultural Disinfectant Market Analysis, 2016 – 2024 (USD Million)

9.1 North America Agricultural Disinfectant Market Value Share Analysis, by Form

9.2 North America Agricultural Disinfectant Market Revenue and Forecast, by Form

9.3 North America Agricultural Disinfectant Market Value Share Analysis, by Application

9.4 North America Agricultural Disinfectant Market Revenue and Forecast, by Application

9.5 North America Agricultural Disinfectant Market Value Share Analysis, by End Use Type

9.6 North America Agricultural Disinfectant Market Revenue and Forecast, by End Use Type

9.7 North America Agricultural Disinfectant Market Value Share Analysis, by Country Type

9.8 North America Agricultural Disinfectant Market Revenue and Forecast, by Country Type

9.8.1 U.S. Agricultural Disinfectant Market Analysis,

9.8.2 Rest of North America Agricultural Disinfectant Market Analysis

Chapter 10 Europe Agricultural Disinfectant Market Analysis, 2016 – 2024 (USD Million)

10.1 Europe Agricultural Disinfectant Market Value Share Analysis, by Form

10.2 Europe Agricultural Disinfectant Market Revenue and Forecast, by Form

10.3 Europe Agricultural Disinfectant Market Value Share Analysis, by Application

10.4 Europe Agricultural Disinfectant Market Revenue and Forecast, by Application

10.5 Europe Agricultural Disinfectant Market Value Share Analysis, by End Use Type

10.6 Europe Agricultural Disinfectant Market Revenue and Forecast, by End Use Type

10.7 Europe Agricultural Disinfectant Market Value Share Analysis, by Country Type

10.8 Europe Agricultural Disinfectant Market Revenue and Forecast, by Country Type

10.8.1 Germany Agricultural Disinfectant Market Analysis,

10.8.2 U.K. Agricultural Disinfectant Market Analysis

10.8.3 France Agricultural Disinfectant Market Analysis,

10.8.4 Italy Agricultural Disinfectant Market Analysis

10.8.4 Rest of Europe Agricultural Disinfectant Market Analysis

Chapter 11 Asia Pacific Agricultural Disinfectant Market Analysis, 2016 – 2024 (USD Million)

11.1 Asia Pacific Agricultural Disinfectant Market Value Share Analysis, by Form

11.2 Asia Pacific Agricultural Disinfectant Market Revenue and Forecast, by Form

11.3 Asia Pacific Agricultural Disinfectant Market Value Share Analysis, by Application

11.4 Asia Pacific Agricultural Disinfectant Market Revenue and Forecast, by Application

11.5 Asia Pacific Agricultural Disinfectant Market Value Share Analysis, by End Use Type

11.6 Asia Pacific Agricultural Disinfectant Market Revenue and Forecast, by End Use Type

11.7 Asia Pacific Agricultural Disinfectant Market Value Share Analysis, by Country Type

11.8 Asia Pacific Agricultural Disinfectant Market Revenue and Forecast, by Country Type

11.8.1 China Agricultural Disinfectant Market Analysis,

11.8.2 India Agricultural Disinfectant Market Analysis

11.8.3 Japan Agricultural Disinfectant Market Analysis,

11.8.4 Rest of Asia Pacific Agricultural Disinfectant Market Analysis

Chapter 12 Latin America Agricultural Disinfectant Market Analysis, 2016 – 2024 (USD Million)

12.1 Latin America Agricultural Disinfectant Market Value Share Analysis, by Form

12.2 Latin America Agricultural Disinfectant Market Revenue and Forecast, by Form

12.3 Latin America Agricultural Disinfectant Market Value Share Analysis, by Application

12.4 Latin America Agricultural Disinfectant Market Revenue and Forecast, by Application

12.5 Latin America Agricultural Disinfectant Market Value Share Analysis, by End Use Type

12.6 Latin America Agricultural Disinfectant Market Revenue and Forecast, by End Use Type

12.7 Latin America Agricultural Disinfectant Market Value Share Analysis, by Country Type

12.8 Latin America Agricultural Disinfectant Market Revenue and Forecast, by Country Type

12.8.1 Saudi Arabia Agricultural Disinfectant Market Analysis,

12.8.2 UAE Agricultural Disinfectant Market Analysis

12.8.3 South Africa Agricultural Disinfectant Market Analysis,

12.8.4 Rest of Middle East and Africa Agricultural Disinfectant Market Analysis

Chapter 13 Middle East and Africa (MEA) Agricultural Disinfectant Market Analysis, 2016 – 2024(USD Million)

13.1 Middle East and Africa Agricultural Disinfectant Market Value Share Analysis, by Form

13.2 Middle East and Africa Agricultural Disinfectant Market Revenue and Forecast, by Form

13.3 Middle East and Africa Agricultural Disinfectant Market Value Share Analysis, by Application

13.4 Middle East and Africa Agricultural Disinfectant Market Revenue and Forecast, by Application

13.5 Middle East and Africa Agricultural Disinfectant Market Value Share Analysis, by End Use Type

13.6 Middle East and Africa Agricultural Disinfectant Market Revenue and Forecast, by End Use Type

13.7 Middle East and Africa Agricultural Disinfectant Market Value Share Analysis, by Country Type

13.8 Middle East and Africa Agricultural Disinfectant Market Revenue and Forecast, by Country Type

13.8.1 Brazil Agricultural Disinfectant Market Analysis,

13.8.2 Rest of Latin America Agricultural Disinfectant Market Analysis

Chapter 14 Company Profiles

14.1 Zoetis

14.1.1 Company Details (HQ, Foundation Year, Employee Strength)

14.1.2 Market Presence, By Segment and Geography

14.1.3 Key Developments

14.1.4 Strategy and Historical Roadmap

14.1.5 Revenue and Operating Profit

14.2 The Chemours Company

14.2.1 Company Details (HQ, Foundation Year, Employee Strength)

14.2.2 Market Presence, By Segment and Geography

14.2.3 Key Developments

14.2.4 Strategy and Historical Roadmap

14.2.5 Revenue and Operating Profit

14.3 Nufarm

14.3.1 Company Details (HQ, Foundation Year, Employee Strength)

14.3.2 Market Presence, By Segment and Geography

14.3.3 Key Developments

14.3.4 Strategy and Historical Roadmap

14.3.5 Revenue and Operating Profit

14.4 Thymox Technology

14.4.1 Company Details (HQ, Foundation Year, Employee Strength)

14.4.2 Market Presence, By Segment and Geography

14.4.3 Key Developments

14.4.4 Strategy and Historical Roadmap

14.4.5 Revenue and Operating Profit

14.5 The Dow Chemical Company.

14.5.1 Company Details (HQ, Foundation Year, Employee Strength)

14.5.2 Market Presence, By Segment and Geography

14.5.3 Key Developments

14.5.4 Strategy and Historical Roadmap

14.5.5 Revenue and Operating Profit

14.6 Neogen Corporation

14.6.1 Company Details (HQ, Foundation Year, Employee Strength)

14.6.2 Market Presence, By Segment and Geography

14.6.3 Key Developments

14.6.4 Strategy and Historical Roadmap

14.6.5 Revenue and Operating Profit

14.7 Stepan Companyl

14.7.1 Company Details (HQ, Foundation Year, Employee Strength)

14.7.2 Market Presence, By Segment and Geography

14.7.3 Key Developments

14.7.4 Strategy and Historical Roadmap

14.7.5 Revenue and Operating Profit

14.8 Fink Tech GmbH

14.8.1 Company Details (HQ, Foundation Year, Employee Strength)

14.8.2 Market Presence, By Segment and Geography

14.8.3 Key Developments

14.8.4 Strategy and Historical Roadmap

14.8.5 Revenue and Operating Profit

14.9 Quat Chem Limited

14.9.1 Company Details (HQ, Foundation Year, Employee Strength)

14.9.2 Market Presence, By Segment and Geography

14.9.3 Key Developments

14.9.4 Strategy and Historical Roadmap

14.9.5 Revenue and Operating Profit

14.10 Entaco NV.

14.10.1 Company Details (HQ, Foundation Year, Employee Strength)

14.10.2 Market Presence, By Segment and Geography

14.10.3 Key Developments

14.10.4 Strategy and Historical Roadmap

14.10.5 Revenue and Operating Profit

List of Tables

TABLE 1 Global Agricultural Disinfectant Market Revenue (US$ Mn) and Forecast, By Form, 2016–2024

TABLE 2 Global Agricultural Disinfectant Market Revenue (US$ Mn) and Forecast, By Application, 2015–2024

TABLE 3 Global Agricultural Disinfectant Market Revenue (US$ Mn) and Forecast, By End-Use, 2015–2024

List of Figures

FIG. 1 Global Agricultural Disinfectant Market Share Analysis By Company (2015)t

FIG. 2 Global Agricultural Disinfectant Market Value Share Analysis By Form, 2015 and 2024

FIG. 3 Global Liquid Disinfectant Market Revenue (US$ Mn), 2016 – 2024

FIG. 4 Global Powder Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 5 Global Others Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 6 Global Agricultural Disinfectant Market Value Share Analysis By Application, 2015 and 2024)

FIG. 7 Global Land Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 8 Global Water Sanitizing Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 9 Global Aerial Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 10 Global Agricultural Disinfectant Market Value Share Analysis By End-Use Type, 2015 and 2024

FIG. 11 Global Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 12 Global Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 13 Global Agricultural Disinfectant Market Value Share Analysis, by Region, 2016 and 2024

FIG. 14 North America Agricultural Disinfectant Market Value Share Analysis By Form, 2015 and 2024

FIG. 15 North America Agricultural Disinfectant Market Value Share Analysis By Product Type, 2015 and 2024

FIG. 16 North America Agricultural Disinfectant Market Value Share Analysis By End Use, 2015 and 2024

FIG. 17 North America Market Value Share Analysis By Country, 2015 and 2024

FIG. 18 U.S. Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 19 Rest of North America Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 20 Europe Agricultural Disinfectant Market Value Share Analysis By Form, 2015 and 2024

FIG. 21 Europe Agricultural Disinfectant Market Value Share Analysis By Product Type, 2015 and 2024

FIG. 22 Europe Agricultural Disinfectant Market Value Share Analysis By End Use, 2015 and 2024

FIG. 23 Europe Market Value Share Analysis By Country, 2015 and 2024

FIG. 24 U.K. Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 25 Germany Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 26 France Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 27 Italy Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 28 Rest of Europe Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 29 Asia Pacific Agricultural Disinfectant Market Value Share Analysis By Form, 2015 and 2024

FIG. 30 Asia Pacific Agricultural Disinfectant Market Value Share Analysis By Product Type, 2015 and 2024

FIG. 31 Asia Pacific Agricultural Disinfectant Market Value Share Analysis By End Use, 2015 and 2024

FIG. 32 Asia Pacific Market Value Share Analysis By Country, 2015 and 2024

FIG. 33 China Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 34 India Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 35 Japan Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 36 Rest of Asia Pacific Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 37 MEA Agricultural Disinfectant Market Value Share Analysis By Form, 2015 and 2024

FIG. 38 MEA Agricultural Disinfectant Market Value Share Analysis By Product Type, 2015 and 2024

FIG. 39 MEA Agricultural Disinfectant Market Value Share Analysis By End Use, 2015 and 2024

FIG. 40 MEA Market Value Share Analysis By Country, 2015 and 2024

FIG. 41 U.A.E. Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 42 South Africa Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 43 Rest of MEA Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024

FIG. 44 Latin America Agricultural Disinfectant Market Value Share Analysis By Form, 2015 and 2024

FIG. 45 Latin America Agricultural Disinfectant Market Value Share Analysis By Product Type, 2015 and 2024

FIG. 46 Latin America Agricultural Disinfectant Market Value Share Analysis By End Use, 2015 and 2024

FIG. 47 Latin America Market Value Share Analysis By Country, 2015 and 2024

FIG. 48 Brazil Agricultural Disinfectant Market Revenue (US$ Mn), 2015 – 2024