Reports

Reports

Analysts’ Viewpoint on Market Scenario

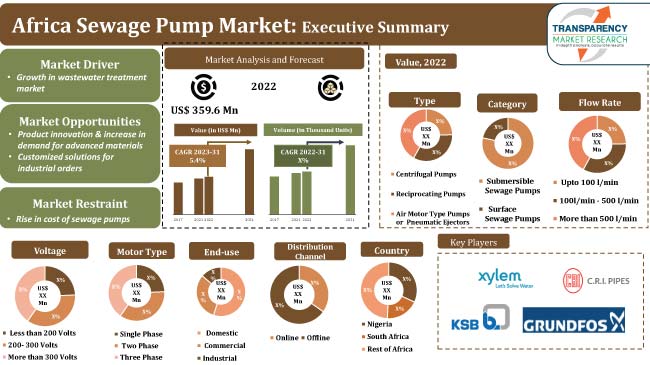

Growth in population, rapid urbanization, and expansion of the construction sector are expected to propel the Africa sewage pump market size in the near future. The rise in awareness among the general population and government organizations about the importance of proper sanitation and its impact on public health has led to increased focus on sanitation drives in the continent. This is likely to drive the demand for sewage pumps to maintain proper hygiene and prevent the spread of diseases, thereby augmenting market expansion in the next few years.

Sewage pump technology has advanced, making it more efficient, durable, and automated, increasing their appeal for installation and use. Further, the advanced pump design, and monitoring technology is expected to boost Africa sewage pump market demand.

A sewage pump or wastewater pump is used to transfer sewage liquids and solids from one place to another. In residential, industrial, as well as industrial applications, sewage includes soft solids up to 2″ in diameter that is pumped from a sewage basin to a sewer system or a septic tank.

A sewage pump is installed at the lowest point of the sewage basin. Since the sewer pump or sanitary pump is submerged most of the time, it is also referred to as a submersible sewage pump.

A sewage pump can be automatic, manual, or dual mode, and is available in different types and categories such as submersible pump, surface pump, centrifugal pump, and reciprocating pump. Industrial sewage pump market analysis and forecast is influenced by the technological advancement in sewage pumps and overall wastewater technologies.

Large number of people are relocating from rural to urban areas in Africa, and the continent is undergoing rapid urbanization, driving the need for efficient sanitation and sewage management systems, consequently boosting the demand for sewage pumps. Many African nations are investing in the development of their infrastructure, which includes building sewage treatment facilities, wastewater management systems, and sewerage networks. Sewage pumps are necessary for these projects to efficiently transport and handle sewage. All these factors are fueling market development in Africa.

The widespread use of sewage pumps in the oil and gas industry in recent decades is further expected to create lucrative Africa sewage pump business opportunities during the forecast period.

Governments, organizations, and individuals are becoming more and more conscious of the significance of good sanitation and how it affects public health. The surge in demand for sewage pumps is attributed to the importance of maintaining hygiene and stopping the spread of diseases. African governments are framing laws and rules into effect to advance environmental sustainability and upgrade sanitary infrastructure. These programs encourage the use of sewage pumps in order to meet the requirements established by governments.

The Africa sewage pump market segmentation in terms of category includes submersible sewage pumps and surface sewage pumps. The submersible sewage pumps segment dominates the market based on share. Submersible sewage pumps used inside sewage are the most widely used in various industrial as well as municipality treatment plants.

Submersible sewage pumps are more popular in the pumps market due to their ability to extract the water from underground. These pumps work with high efficiency when it comes to extraction of water. Submersible pumps account for highest Africa sewage pump market share.

According to the latest Africa sewage pump market forecast, Egypt is expected to lead the landscape during the forecast period both in terms of value and volume. Furthermore, the market in Nigeria and South Africa is projected to expand at a notable CAGR, during the forecast period.

Africa's population is expanding quickly, putting pressure on the region's sewage infrastructure. Sewage pumps are increasingly needed as the population grows, in order to provide effective sewage disposal and avoid environmental degradation.

The landscape is fragmented due to the presence of several local and international companies as well as the intense competition among prominent players. Manufacturers continuously launch new products and updated models to maximize plant uptime. To stay competitive and fulfill the needs of customers, leading players in the sewage pump industry are including more modern design features, flexibility, ease of installation, and transportation options in order to enhance their Africa sewage pump market revenue.

C.R.I. Pumps Private Limited, Dab Pumps Spa, EBARA CORPORATION, Elsumo, Gorman-Rupp Pumps, Grundfos Holding A/S, KSB SE & Co. KGaA, Robot Pumps, WILO SE, and Xylem are some of the prominent sewage pump market manufacturers. These manufacturers are following the latest Africa sewage pump market trends to avail lucrative revenue opportunities.

Each of these players has been profiled in the Africa sewage pump market report based on parameters such as product portfolio, recent developments, financial overview, business segments, company overview, and business strategies.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 359.6 Mn |

|

Market Forecast Value in 2031 |

US$ 575.0 Mn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Country Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Africa Sewage Pump Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Africa Sewage Pump Market Analysis and Forecast, By Type

6.1. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

6.1.1. Centrifugal pumps

6.1.2. Reciprocating pumps

6.1.2.1. Ram type

6.1.2.2. Propeller type

6.1.3. Air Motor Type Pumps or Pneumatic Ejectors

6.2. Incremental Opportunity, By Type

7. Africa Sewage Pump Market Analysis and Forecast, By Category

7.1. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Category, 2017 - 2031

7.1.1. Submersible Sewage Pumps

7.1.2. Surface Sewage Pumps

7.2. Incremental Opportunity, By Category

8. Africa Sewage Pump Market Analysis and Forecast, By Flow Rate

8.1. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Flow Rate, 2017 - 2031

8.1.1. Upto 100 l/min

8.1.2. 100l/min - 500 l/min

8.1.3. More than 500 l/min

8.2. Incremental Opportunity, By Flow Rate

9. Africa Sewage Pump Market Analysis and Forecast, By Voltage

9.1. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Voltage, 2017 - 2031

9.1.1. Less than 200 Volts

9.1.2. 200- 300 Volts

9.1.3. More than 300 Volts

9.2. Incremental Opportunity, By Voltage

10. Africa Sewage Pump Market Analysis and Forecast, By Motor Type

10.1. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Motor Type, 2017 - 2031

10.1.1. Single Phase

10.1.2. Two Phase

10.1.3. Three Phase

10.2. Incremental Opportunity, By Motor Type

11. Africa Sewage Pump Market Analysis and Forecast, By End-use

11.1. Sewage Pump Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

11.1.1. Domestic

11.1.2. Commercial

11.1.3. Industrial

12. Africa Sewage Pump Market Analysis and Forecast, By Distribution Channel

12.1. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Distribution Channel, 2017 - 2031

12.1.1. Online

12.1.1.1. Company Owned Website

12.1.1.2. Other e-commerce websites

12.1.2. Offline

12.1.2.1. Direct

12.1.2.2. Indirect

12.2. Incremental Opportunity, By Distribution Channel

13. Africa Sewage Pump Market Analysis and Forecast, By Country/Sub-region

13.1. Sewage Pump Market Size (US$ Mn and Thousand Units), By Country/Sub-region, 2017 - 2031

13.1.1. Nigeria

13.1.2. South Africa

13.1.3. Algeria

13.1.4. Egypt

13.1.5. Kenya

13.1.6. Rest of Africa

13.2. Incremental Opportunity, By Country

14. Nigeria Sewage Pump Market Analysis and Forecast

14.1. Country Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

14.5.1. Centrifugal pumps

14.5.2. Reciprocating pumps

14.5.2.1. Ram type

14.5.2.2. Propeller type

14.5.3. Air Motor Type Pumps or Pneumatic Ejectors

14.6. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Category, 2017 - 2031

14.6.1. Submersible Sewage Pumps

14.6.2. Surface Sewage Pumps

14.7. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Flow Rate, 2017 - 2031

14.7.1. Upto 100 l/min

14.7.2. 100l/min - 500 l/min

14.7.3. More than 500 l/min

14.8. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Voltage, 2017 - 2031

14.8.1. Less than 200 Volts

14.8.2. 200- 300 Volts

14.8.3. More than 300 Volts

14.9. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Motor Type, 2017 - 2031

14.9.1. Single Phase

14.9.2. Two Phase

14.9.3. Three Phase

14.10. Sewage Pump Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

14.10.1. Domestic

14.10.2. Commercial

14.10.3. Industrial

14.11. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Distribution Channel, 2017 - 2031

14.11.1. Online

14.11.1.1. Company Owned Website

14.11.1.2. Other e-commerce websites

14.11.2. Offline

14.11.2.1. Direct

14.11.2.2. Indirect

14.12. Incremental Opportunity Analysis

15. South Africa Sewage Pump Market Analysis and Forecast

15.1. Country Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

15.5.1. Centrifugal pumps

15.5.2. Reciprocating pumps

15.5.2.1. Ram type

15.5.2.2. Propeller type

15.5.3. Air Motor Type Pumps or Pneumatic Ejectors

15.6. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Category, 2017 - 2031

15.6.1. Submersible Sewage Pumps

15.6.2. Surface Sewage Pumps

15.7. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Flow Rate, 2017 - 2031

15.7.1. Upto 100 l/min

15.7.2. 100l/min - 500 l/min

15.7.3. More than 500 l/min

15.8. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Voltage, 2017 - 2031

15.8.1. Less than 200 Volts

15.8.2. 200- 300 Volts

15.8.3. More than 300 Volts

15.9. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Motor Type, 2017 - 2031

15.9.1. Single Phase

15.9.2. Two Phase

15.9.3. Three Phase

15.10. Sewage Pump Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

15.10.1. Domestic

15.10.2. Commercial

15.10.3. Industrial

15.11. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Distribution Channel, 2017 - 2031

15.11.1. Online

15.11.1.1. Company Owned Website

15.11.1.2. Other e-commerce websites

15.11.2. Offline

15.11.2.1. Direct

15.11.2.2. Indirect

15.12. Incremental Opportunity Analysis

16. Egypt Sewage Pump Market Analysis and Forecast

16.1. Country Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

16.5.1. Centrifugal pumps

16.5.2. Reciprocating pumps

16.5.2.1. Ram type

16.5.2.2. Propeller type

16.5.3. Air Motor Type Pumps or Pneumatic Ejectors

16.6. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Category, 2017 - 2031

16.6.1. Submersible Sewage Pumps

16.6.2. Surface Sewage Pumps

16.7. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Flow Rate, 2017 - 2031

16.7.1. Upto 100 l/min

16.7.2. 100l/min - 500 l/min

16.7.3. More than 500 l/min

16.8. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Voltage, 2017 - 2031

16.8.1. Less than 200 Volts

16.8.2. 200- 300 Volts

16.8.3. More than 300 Volts

16.9. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Motor Type, 2017 - 2031

16.9.1. Single Phase

16.9.2. Two Phase

16.9.3. Three Phase

16.10. Sewage Pump Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

16.10.1. Domestic

16.10.2. Commercial

16.10.3. Industrial

16.11. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Distribution Channel, 2017 - 2031

16.11.1. Online

16.11.1.1. Company Owned Website

16.11.1.2. Other e-commerce websites

16.11.2. Offline

16.11.2.1. Direct

16.11.2.2. Indirect

16.12. Incremental Opportunity Analysis

17. Algeria Sewage Pump Market Analysis and Forecast

17.1. Country Snapshot

17.2. Key Supplier Analysis

17.3. Key Trends Analysis

17.3.1. Demand Side Analysis

17.3.2. Supply Side Analysis

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

17.5.1. Centrifugal pumps

17.5.2. Reciprocating pumps

17.5.2.1. Ram type

17.5.2.2. Propeller type

17.5.3. Air Motor Type Pumps or Pneumatic Ejectors

17.6. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Category, 2017 - 2031

17.6.1. Submersible Sewage Pumps

17.6.2. Surface Sewage Pumps

17.7. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Flow Rate, 2017 - 2031

17.7.1. Upto 100 l/min

17.7.2. 100l/min - 500 l/min

17.7.3. More than 500 l/min

17.8. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Voltage, 2017 - 2031

17.8.1. Less than 200 Volts

17.8.2. 200- 300 Volts

17.8.3. More than 300 Volts

17.9. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Motor Type, 2017 - 2031

17.9.1. Single Phase

17.9.2. Two Phase

17.9.3. Three Phase

17.10. Sewage Pump Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

17.10.1. Domestic

17.10.2. Commercial

17.10.3. Industrial

17.11. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Distribution Channel, 2017 - 2031

17.11.1. Online

17.11.1.1. Company Owned Website

17.11.1.2. Other e-commerce websites

17.11.2. Offline

17.11.2.1. Direct

17.11.2.2. Indirect

17.12. Incremental Opportunity Analysis

18. Kenya Sewage Pump Market Analysis and Forecast

18.1. Country Snapshot

18.2. Key Supplier Analysis

18.3. Key Trends Analysis

18.3.1. Demand Side Analysis

18.3.2. Supply Side Analysis

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Price (US$)

18.5. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

18.5.1. Centrifugal pumps

18.5.2. Reciprocating pumps

18.5.2.1. Ram type

18.5.2.2. Propeller type

18.5.3. Air Motor Type Pumps or Pneumatic Ejectors

18.6. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Category, 2017 - 2031

18.6.1. Submersible Sewage Pumps

18.6.2. Surface Sewage Pumps

18.7. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Flow Rate, 2017 - 2031

18.7.1. Upto 100 l/min

18.7.2. 100l/min - 500 l/min

18.7.3. More than 500 l/min

18.8. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Voltage, 2017 - 2031

18.8.1. Less than 200 Volts

18.8.2. 200- 300 Volts

18.8.3. More than 300 Volts

18.9. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Motor Type, 2017 - 2031

18.9.1. Single Phase

18.9.2. Two Phase

18.9.3. Three Phase

18.10. Sewage Pump Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

18.10.1. Domestic

18.10.2. Commercial

18.10.3. Industrial

18.11. Sewage Pump Market Size (US$ Mn and Thousand Units ), By Distribution Channel, 2017 - 2031

18.11.1. Online

18.11.1.1. Company Owned Website

18.11.1.2. Other e-commerce websites

18.11.2. Offline

18.11.2.1. Direct

18.11.2.2. Indirect

18.12. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player - Competition Dashboard

19.2. Market Share Analysis (%), 2022

19.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

19.3.1. C.R.I. Pumps Private Limited

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Revenue

19.3.1.4. Strategy & Business Overview

19.3.1.5. Go-To-Market Strategy

19.3.2. Dab Pumps Spa

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Revenue

19.3.2.4. Strategy & Business Overview

19.3.2.5. Go-To-Market Strategy

19.3.3. EBARA CORPORATION

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Revenue

19.3.3.4. Strategy & Business Overview

19.3.3.5. Go-To-Market Strategy

19.3.4. Elsumo

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Revenue

19.3.4.4. Strategy & Business Overview

19.3.4.5. Go-To-Market Strategy

19.3.5. Gorman-Rupp Pumps

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Revenue

19.3.5.4. Strategy & Business Overview

19.3.5.5. Go-To-Market Strategy

19.3.6. Grundfos Holding A/S

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Revenue

19.3.6.4. Strategy & Business Overview

19.3.6.5. Go-To-Market Strategy

19.3.7. KSB SE & Co. KGaA

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Revenue

19.3.7.4. Strategy & Business Overview

19.3.7.5. Go-To-Market Strategy

19.3.8. Robot Pumps

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Revenue

19.3.8.4. Strategy & Business Overview

19.3.8.5. Go-To-Market Strategy

19.3.9. WILO SE

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Revenue

19.3.9.4. Strategy & Business Overview

19.3.9.5. Go-To-Market Strategy

19.3.10. Xylem

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Revenue

19.3.10.4. Strategy & Business Overview

19.3.10.5. Go-To-Market Strategy

19.3.11. Other Key Players

19.3.11.1. Company Overview

19.3.11.2. Sales Area/Geographical Presence

19.3.11.3. Revenue

19.3.11.4. Strategy & Business Overview

19.3.11.5. Go-To-Market Strategy

20. Go To Market Strategy

20.1. Identification of Potential Market Spaces

20.2. Understanding the Buying Process of Customers

List of Tables

Table 1: Africa Sewage Pump Market, by Type, Thousand Units 2017-2031

Table 2: Africa Sewage Pump Market, by Type, US$ Mn 2017-2031

Table 4: Africa Sewage Pump Market, by Category, Thousand Units 2017-2031

Table 5: Africa Sewage Pump Market, by Category, US$ Mn 2017-2031

Table 7: Africa Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Table 8: Africa Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Table 10: Africa Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Table 11: Africa Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Table 13: Africa Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Table 14: Africa Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Table 16: Africa Sewage Pump Market, by End-User, Thousand Units 2017-2031

Table 17: Africa Sewage Pump Market, by End-User, US$ Mn 2017-2031

Table 19: Africa Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Table 20: Africa Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

Table 22: Africa Sewage Pump Market, by Country, Thousand Units 2017-2031

Table 23: Africa Sewage Pump Market, by Country, US$ Mn 2017-2031

Table 24: Nigeria Sewage Pump Market, by Type, Thousand Units 2017-2031

Table 25: Nigeria Sewage Pump Market, by Type, US$ Mn 2017-2031

Table 26: Nigeria Sewage Pump Market, by Category, Thousand Units 2017-2031

Table 27: Nigeria Sewage Pump Market, by Category, US$ Mn 2017-2031

Table 28: Nigeria Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Table 29: Nigeria Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Table 30: Nigeria Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Table 31: Nigeria Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Table 32: Nigeria Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Table 33: Nigeria Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Table 34: Nigeria Sewage Pump Market, by End-User, Thousand Units 2017-2031

Table 35: Nigeria Sewage Pump Market, by End-User, US$ Mn 2017-2031

Table 36: Nigeria Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Table 37: Nigeria Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

Table 38: South Africa Sewage Pump Market, by Type, Thousand Units 2017-2031

Table 39: South Africa Sewage Pump Market, by Type, US$ Mn 2017-2031

Table 40: South Africa Sewage Pump Market, by Category, Thousand Units 2017-2031

Table 41: South Africa Sewage Pump Market, by Category, US$ Mn 2017-2031

Table 42: South Africa Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Table 43: South Africa Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Table 44: South Africa Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Table 45: South Africa Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Table 46: South Africa Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Table 47: South Africa Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Table 48: South Africa Sewage Pump Market, by End-User, Thousand Units 2017-2031

Table 49: South Africa Sewage Pump Market, by End-User, US$ Mn 2017-2031

Table 50: South Africa Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Table 51: South Africa Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

Table 52: Rest of Africa Sewage Pump Market, by Type, Thousand Units 2017-2031

Table 53: Rest of Africa Sewage Pump Market, by Type, US$ Mn 2017-2031

Table 54: Rest of Africa Sewage Pump Market, by Category, Thousand Units 2017-2031

Table 55: Rest of Africa Sewage Pump Market, by Category, US$ Mn 2017-2031

Table 56: Rest of Africa Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Table 57: Rest of Africa Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Table 58: Rest of Africa Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Table 59: Rest of Africa Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Table 60: Rest of Africa Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Table 61: Rest of Africa Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Table 62: Rest of Africa Sewage Pump Market, by End-User, Thousand Units 2017-2031

Table 63: Rest of Africa Sewage Pump Market, by End-User, US$ Mn 2017-2031

Table 64: Rest of Africa Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Table 65: Rest of Africa Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

List of Figures

Figure 1: Africa Sewage Pump Market, by Type, Thousand Units 2017-2031

Figure 2: Africa Sewage Pump Market, by Type, US$ Mn 2017-2031

Figure 3: Africa Sewage Pump Market, by Type, Incremental Opportunity2017-2031

Figure 4: Africa Sewage Pump Market, by Category, Thousand Units 2017-2031

Figure 5: Africa Sewage Pump Market, by Category, US$ Mn 2017-2031

Figure 6: Africa Sewage Pump Market, by Category, Incremental Opportunity2017-2031

Figure 7: Africa Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Figure 8: Africa Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Figure 9: Africa Sewage Pump Market, by Flow Rate, Incremental Opportunity2017-2031

Figure 10: Africa Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Figure 11: Africa Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Figure 12: Africa Sewage Pump Market, by Voltage, Incremental Opportunity2017-2031

Figure 13: Africa Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Figure 14: Africa Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Figure 15: Africa Sewage Pump Market, by Motor Type, Incremental Opportunity 2017-2031

Figure 16: Africa Sewage Pump Market, by End-User, Thousand Units 2017-2031

Figure 17: Africa Sewage Pump Market, by End-User, US$ Mn 2017-2031

Figure 18: Africa Sewage Pump Market, by End-User, Incremental Opportunity2017-2031

Figure 19: Africa Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Figure 20: Africa Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

Figure 21: Africa Sewage Pump Market, by Distribution Channel, Incremental Opportunity2017-2031

Figure 22: Africa Sewage Pump Market, by Country, Thousand Units 2017-2031

Figure 23: Africa Sewage Pump Market, by Country, US$ Mn 2017-2031

Figure 24: Africa Sewage Pump Market, by Country, Incremental Opportunity2017-2031

Figure 25: Nigeria Sewage Pump Market, by Product type, Thousand Units 2017-2031

Figure 26: Nigeria Sewage Pump Market, by Product type, US$ Mn 2017-2031

Figure 27: Nigeria Sewage Pump Market, by Product type, Incremental Opportunity2017-2031

Figure 28: Nigeria Sewage Pump Market, by Category, Thousand Units 2017-2031

Figure 29: Nigeria Sewage Pump Market, by Category, US$ Mn 2017-2031

Figure 30: Nigeria Sewage Pump Market, by Category, Incremental Opportunity2017-2031

Figure 31: Nigeria Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Figure 32: Nigeria Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Figure 33: Nigeria Sewage Pump Market, by Flow Rate, Incremental Opportunity2017-2031

Figure 34: Nigeria Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Figure 35: Nigeria Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Figure 36: Nigeria Sewage Pump Market, by Voltage, Incremental Opportunity2017-2031

Figure 37: Nigeria Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Figure 38: Nigeria Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Figure 39: Nigeria Sewage Pump Market, by Motor Type, Incremental Opportunity 2017-2031

Figure 40: Nigeria Sewage Pump Market, by End-User, Thousand Units 2017-2031

Figure 41: Nigeria Sewage Pump Market, by End-User, US$ Mn 2017-2031

Figure 42: Nigeria Sewage Pump Market, by End-User, Incremental Opportunity2017-2031

Figure 43: Nigeria Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Figure 44: Nigeria Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

Figure 45: Nigeria Sewage Pump Market, by Distribution Channel, Incremental Opportunity2017-2031

Figure 46: South Africa Sewage Pump Market, by Product type, Thousand Units 2017-2031

Figure 47: South Africa Sewage Pump Market, by Product type, US$ Mn 2017-2031

Figure 48: South Africa Sewage Pump Market, by Product type, Incremental Opportunity2017-2031

Figure 49: South Africa Sewage Pump Market, by Category, Thousand Units 2017-2031

Figure 50: South Africa Sewage Pump Market, by Category, US$ Mn 2017-2031

Figure 51: South Africa Sewage Pump Market, by Category, Incremental Opportunity2017-2031

Figure 52: South Africa Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Figure 53: South Africa Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Figure 54: South Africa Sewage Pump Market, by Flow Rate, Incremental Opportunity2017-2031

Figure 55: South Africa Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Figure 56: South Africa Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Figure 57: South Africa Sewage Pump Market, by Voltage, Incremental Opportunity2017-2031

Figure 58: South Africa Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Figure 59: South Africa Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Figure 60: South Africa Sewage Pump Market, by Motor Type, Incremental Opportunity 2017-2031

Figure 61: South Africa Sewage Pump Market, by End-User, Thousand Units 2017-2031

Figure 62: South Africa Sewage Pump Market, by End-User, US$ Mn 2017-2031

Figure 63: South Africa Sewage Pump Market, by End-User, Incremental Opportunity2017-2031

Figure 64: South Africa Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Figure 65: South Africa Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

Figure 66: South Africa Sewage Pump Market, by Distribution Channel, Incremental Opportunity2017-2031

Figure 67: Rest of Africa Sewage Pump Market, by Product type, Thousand Units 2017-2031

Figure 68: Rest of Africa Sewage Pump Market, by Product type, US$ Mn 2017-2031

Figure 69: Rest of Africa Sewage Pump Market, by Product type, Incremental Opportunity2017-2031

Figure 70: Rest of Africa Sewage Pump Market, by Category, Thousand Units 2017-2031

Figure 71: Rest of Africa Sewage Pump Market, by Category, US$ Mn 2017-2031

Figure 72: Rest of Africa Sewage Pump Market, by Category, Incremental Opportunity2017-2031

Figure 73: Rest of Africa Sewage Pump Market, by Flow Rate, Thousand Units 2017-2031

Figure 74: Rest of Africa Sewage Pump Market, by Flow Rate, US$ Mn 2017-2031

Figure 75: Rest of Africa Sewage Pump Market, by Flow Rate, Incremental Opportunity2017-2031

Figure 76: Rest of Africa Sewage Pump Market, by Voltage, Thousand Units 2017-2031

Figure 77: Rest of Africa Sewage Pump Market, by Voltage, US$ Mn 2017-2031

Figure 78: Rest of Africa Sewage Pump Market, by Voltage, Incremental Opportunity2017-2031

Figure 79: Rest of Africa Sewage Pump Market, by Motor Type, Thousand Units 2017-2031

Figure 80: Rest of Africa Sewage Pump Market, by Motor Type, US$ Mn 2017-2031

Figure 81: Rest of Africa Sewage Pump Market, by Motor Type, Incremental Opportunity 2017-2031

Figure 82: Rest of Africa Sewage Pump Market, by End-User, Thousand Units 2017-2031

Figure 83: Rest of Africa Sewage Pump Market, by End-User, US$ Mn 2017-2031

Figure 84: Rest of Africa Sewage Pump Market, by End-User, Incremental Opportunity2017-2031

Figure 85: Rest of Africa Sewage Pump Market, by Distribution Channel, Thousand Units 2017-2031

Figure 86: Rest of Africa Sewage Pump Market, by Distribution Channel, US$ Mn 2017-2031

Figure 87: Rest of Africa Sewage Pump Market, by Distribution Channel, Incremental Opportunity 2017-2031