Reports

Reports

Analysts’ Viewpoint on Market Scenario

Rise in complexities in telecommunication networks and surge in adoption of 5G interconnected devices are major factors boosting the 5G test equipment market size. The advent of 5G brings new features, capabilities, and challenges that need to be addressed during the testing phase. Testing and validating various critical parameters is crucial to ensure the success of 5G-enabled mission-critical services.

Vendors in the global 5G test equipment industry are collaborating with major telecommunication companies for the R&D of new products. They are also investing in new cutting-edge test labs to increase their 5G test equipment market share. These labs are likely to enable global telecom infrastructure Original Equipment Manufacturers (OEMs) to test and certify various 5G technologies.

Advent of 5G technology has ushered in a new era of communication possibilities, promising higher speeds, lower latency, and enhanced connectivity. There are various advantages of 5G testing equipment. A diverse array of 5G network testing tools are employed to ensure the seamless integration and optimal performance of 5G networks and devices. Various types of 5G test equipment, ranging from spectrum analyzers to OTA testers, play a pivotal role in validating network infrastructure, certifying devices, and optimizing the overall 5G ecosystem.

5G utilizes massive MIMO technology, involving a large number of antennas at the base station. Testing such complex antenna configurations for beamforming, beam management, and spatial multiplexing requires specialized test equipment and techniques.

5G introduces the concept of network slicing, where the network can be partitioned into multiple virtual networks to cater to different services. Testing these slices for isolation, performance, and security is a significant challenge. 5G promises ultra-low latency and high reliability, which are essential for various applications such as autonomous vehicles and remote surgery. Testing and validating these critical parameters are crucial to ensure the success of 5G-enabled mission-critical services. Consequently, conducting comprehensive testing and troubleshooting for 5G networks becomes imperative to ensure seamless operations. This, in turn, is projected to spur the 5G test equipment market growth in the next few years.

Any wireless technology undergoes thorough validation through rigorous testing before it is introduced to consumers and businesses. The testing simulates real-world radiofrequency conditions. Testing procedures are becoming more intricate due to rise in complexities in wireless technologies, which is contributing to growth of the 5G test equipment industry.

5G technology is significantly more complex compared to its predecessors. Unlike previous generations of wireless technology, 5G introduced several advancements that make it more intricate and sophisticated. These advancements include higher frequency bands, massive MIMO (Multiple-Input, Multiple-Output), beamforming, network slicing, and virtualization. The complexity of 5G brings both exciting opportunities and challenges, requiring extensive testing and validation to ensure its successful deployment and optimal performance in the real world.

According to the latest data from GSMA Intelligence, the number of 5G connections is projected to grow twofold in the next two years. This surge can be ascribed to advancements in technology and the introduction of 5G networks in over 30 countries, exclusively in 2023. 15 of these networks are expected to utilize the 5G Standalone technology.

Increase in number of connected devices is fueling the 5G test equipment market expansion. Rise in adoption of Internet of Things (IoT) and growth in demand for seamless and high-speed connectivity across various industries are also boosting demand for 5G test and measurement solutions.

The proliferation of IoT devices, such as smart appliances, wearables, industrial sensors, and autonomous vehicles, has led to a substantial increase in the number of connected devices. As 5G promises superior data speeds, lower latency, and higher capacity, it becomes the ideal solution to accommodate the massive data exchange required by these devices.

Growth in number of connected devices increases the risk of potential cyber threats. Robust 5G testing is essential to ensure a network's resilience and security against potential vulnerabilities, thereby safeguarding critical data and infrastructure. Maintaining consistent and reliable service is becoming paramount as a multitude of devices are connected to the 5G network. This, in turn, is augmenting the need for thorough testing, thereby driving the 5G test equipment market development. Thorough testing helps identify and address network bottlenecks to ensure a seamless user experience and high-quality service delivery.

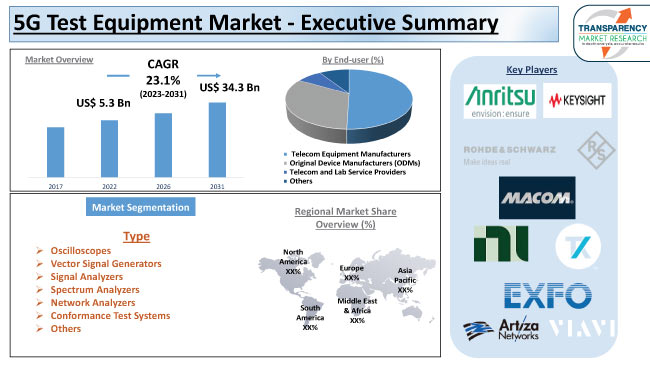

According to the latest 5G test equipment market trends, the telecom equipment manufacturers end-user segment is expected to dominate the industry during the forecast period. Telecommunication equipment testing involves the assessment of the efficiency and dependability of various devices, including phones, routers, switches, and modems, which are utilized for transmitting and receiving voice, data, and video signals.

Telecommunications equipment manufacturers must adhere to stringent compliance standards when developing 5G devices. These standards ensure that the devices meet specific requirements and regulations related to safety, interoperability, and performance. Failure to comply with these standards can result in various consequences, including legal penalties, restricted market access, and damage to the company's reputation.

Many countries around the globe are implementing stringent regulations related to the manufacture and use of telecommunication devices. In 2019, the Department of Telecommunications (DoT) initiated the implementation of MTCTE for various products, including wired telecom equipment, cordless phones, fax machines, Private Automatic Branch Exchange (PABX), and modems, in India. Thus, implementation of such regulations is boosting the demand for 5G test devices from telecom equipment manufacturers.

According to the latest 5G test equipment market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Expansion in the electronics sector and rise in adoption of smartphones are fueling the market dynamics of the region. China, Japan, South Korea, and Taiwan are major markets for 5G field testing equipment due to surge in the production of consumer electronic devices.

Growth in the semiconductors sector is augmenting market statistics in Asia Pacific. China and South Korea are major manufacturers of various semiconductor devices that hold critical roles within the 5G ecosystem. Increase in adoption of IoT and connected devices is fueling demand for 5G networks. Automotive, entertainment, medical, construction, security, and other sectors are employing various 5G-enabled systems, thereby driving the 5G test equipment market progress.

Most 5G test equipment companies are focusing on the testing of novel technologies and components, including MIMO antenna arrays and high-GHz millimeter-wave frequencies.

Anritsu, Keysight Technologies, Rohde & Schwarz, Teradyne Inc., National Instruments Corp., Tektronix Inc. Viavi Solutions Inc. Artiza Networks Inc., EXFO Inc., MACOM, Spirent Communications, and Gl Communications Inc. are major 5G test equipment manufacturers.

Each of these players has been profiled in the 5G test equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 5.3 Bn |

|

Market Forecast Value in 2031 |

US$ 34.3 Bn |

|

Growth Rate (CAGR) |

23.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 5.3 Bn in 2022

It is projected to advance at a CAGR of 23.1% from 2023 to 2031

It is estimated to reach US$ 34.3 Bn by the end of 2031

Rise in complexities in telecommunication networks and surge in adoption of 5G interconnected devices

Asia Pacific is projected to record the highest demand during the forecast period

The U.S. accounted for 32.6% share in 2022

Anritsu, Keysight Technologies, Rohde & Schwarz, Teradyne Inc., National Instruments Corp., Tektronix Inc. Viavi Solutions Inc. Artiza Networks Inc., EXFO Inc., MACOM, Spirent Communications, and Gl Communications Inc.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global 5G Test Equipment Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Telecom Equipment Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global 5G Test Equipment Market Analysis and Forecast, by Type

5.1. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Type, 2017-2031

5.1.1. Oscilloscopes

5.1.2. Vector Signal Generators

5.1.3. Signal Analyzers

5.1.4. Spectrum Analyzers

5.1.5. Network Analyzers

5.1.6. Conformance Test Systems

5.1.7. Others

5.2. Market Attractiveness Analysis, By Type

6. Global 5G Test Equipment Market Analysis and Forecast, by End-user

6.1. 5G Test Equipment Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

6.1.1. Telecom Equipment Manufacturers

6.1.2. Original Device Manufacturers (ODMs)

6.1.3. Telecom and Lab Service Providers

6.1.4. Others

6.2. Market Attractiveness Analysis, By End-user

7. Global 5G Test Equipment Market Analysis and Forecast, by Region

7.1. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Region, 2017-2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, By Region

8. North America 5G Test Equipment Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Type, 2017-2031

8.3.1. Oscilloscopes

8.3.2. Vector Signal Generators

8.3.3. Signal Analyzers

8.3.4. Spectrum Analyzers

8.3.5. Network Analyzers

8.3.6. Conformance Test Systems

8.3.7. Others

8.4. 5G Test Equipment Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

8.4.1. Telecom Equipment Manufacturers

8.4.2. Original Device Manufacturers (ODMs)

8.4.3. Telecom and Lab Service Providers

8.4.4. Others

8.5. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By End-user

8.6.3. By Country/Sub-region

9. Europe 5G Test Equipment Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Type, 2017-2031

9.3.1. Oscilloscopes

9.3.2. Vector Signal Generators

9.3.3. Signal Analyzers

9.3.4. Spectrum Analyzers

9.3.5. Network Analyzers

9.3.6. Conformance Test Systems

9.3.7. Others

9.4. 5G Test Equipment Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

9.4.1. Telecom Equipment Manufacturers

9.4.2. Original Device Manufacturers (ODMs)

9.4.3. Telecom and Lab Service Providers

9.4.4. Others

9.5. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.5.1. U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By End-user

9.6.3. By Country/Sub-region

10. Asia Pacific 5G Test Equipment Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Type, 2017-2031

10.3.1. Oscilloscopes

10.3.2. Vector Signal Generators

10.3.3. Signal Analyzers

10.3.4. Spectrum Analyzers

10.3.5. Network Analyzers

10.3.6. Conformance Test Systems

10.3.7. Others

10.4. 5G Test Equipment Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

10.4.1. Telecom Equipment Manufacturers

10.4.2. Original Device Manufacturers (ODMs)

10.4.3. Telecom and Lab Service Providers

10.4.4. Others

10.5. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. China

10.5.2. Japan

10.5.3. India

10.5.4. South Korea

10.5.5. ASEAN

10.5.6. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Middle East & Africa 5G Test Equipment Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Type, 2017-2031

11.3.1. Oscilloscopes

11.3.2. Vector Signal Generators

11.3.3. Signal Analyzers

11.3.4. Spectrum Analyzers

11.3.5. Network Analyzers

11.3.6. Conformance Test Systems

11.3.7. Others

11.4. 5G Test Equipment Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

11.4.1. Telecom Equipment Manufacturers

11.4.2. Original Device Manufacturers (ODMs)

11.4.3. Telecom and Lab Service Providers

11.4.4. Others

11.5. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of Middle East & Africa

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. South America 5G Test Equipment Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Type, 2017-2031

12.3.1. Oscilloscopes

12.3.2. Vector Signal Generators

12.3.3. Signal Analyzers

12.3.4. Spectrum Analyzers

12.3.5. Network Analyzers

12.3.6. Conformance Test Systems

12.3.7. Others

12.4. 5G Test Equipment Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

12.4.1. Telecom Equipment Manufacturers

12.4.2. Original Device Manufacturers (ODMs)

12.4.3. Telecom and Lab Service Providers

12.4.4. Others

12.5. 5G Test Equipment Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. Brazil

12.5.2. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Competition Assessment

13.1. Global 5G Test Equipment Market Competition Matrix - a Dashboard View

13.1.1. Global 5G Test Equipment Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. Anritsu

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Artiza Networks Inc.

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. EXFO Inc.

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Gl Communications Inc.

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Keysight Technologies

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. MACOM

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. National Instruments Corp.

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. Rohde & Schwarz

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Spirent Communications

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Tektronix Inc.

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. Teradyne Inc.

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. Viavi Solutions Inc.

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

14.13. Other Key Players

14.13.1. Overview

14.13.2. Product Portfolio

14.13.3. Sales Footprint

14.13.4. Key Subsidiaries or Distributors

14.13.5. Strategy and Recent Developments

14.13.6. Key Financials

15. Recommendation

15.1. Opportunity Assessment

15.1.1. By Type

15.1.2. By End-user

15.1.3. By Region/Country/Sub-region

List of Tables

Table 1: Global 5G Test Equipment Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 2: Global 5G Test Equipment Market Volume (Units) & Forecast, by Type, 2017-2031

Table 3: Global 5G Test Equipment Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 4: Global 5G Test Equipment Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 5: Global 5G Test Equipment Market Volume (Units) & Forecast, by Region, 2017-2031

Table 6: North America 5G Test Equipment Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 7: North America 5G Test Equipment Market Volume (Units) & Forecast, by Type, 2017-2031

Table 8: North America 5G Test Equipment Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 9: North America 5G Test Equipment Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 10: North America 5G Test Equipment Market Volume (Units) & Forecast, by Country, 2017-2031

Table 11: Europe 5G Test Equipment Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 12: Europe 5G Test Equipment Market Volume (Units) & Forecast, by Type, 2017-2031

Table 13: Europe 5G Test Equipment Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 14: Europe 5G Test Equipment Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 15: Europe 5G Test Equipment Market Volume (Units) & Forecast, by Country, 2017-2031

Table 16: Asia Pacific 5G Test Equipment Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 17: Asia Pacific 5G Test Equipment Market Volume (Units) & Forecast, by Type, 2017-2031

Table 18: Asia Pacific 5G Test Equipment Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 19: Asia Pacific 5G Test Equipment Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 20: Asia Pacific 5G Test Equipment Market Volume (Units) & Forecast, by Country, 2017-2031

Table 21: Middle East & Africa 5G Test Equipment Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 22: Middle East & Africa 5G Test Equipment Market Volume (Units) & Forecast, by Type, 2017-2031

Table 23: Middle East & Africa 5G Test Equipment Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 24: Middle East & Africa 5G Test Equipment Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 25: Middle East & Africa 5G Test Equipment Market Volume (Units) & Forecast, by Country, 2017-2031

Table 26: South America 5G Test Equipment Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 27: South America 5G Test Equipment Market Volume (Units) & Forecast, by Type, 2017-2031

Table 28: South America 5G Test Equipment Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 29: South America 5G Test Equipment Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 30: South America 5G Test Equipment Market Volume (Units) & Forecast, by Country, 2017-2031

List of Figures

Figure 01: Global 5G Test Equipment Market Analysis & Forecast, Value (US$ Mn), 2017-2031

Figure 02: Global 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 03: Global 5G Test Equipment Market Analysis & Forecast, Volume (Units), 2017-2031

Figure 04: Global 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 05: Global 5G Test Equipment Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 06: Global 5G Test Equipment Market Share Analysis, by Type, 2022 and 2031

Figure 07: Global 5G Test Equipment Market, Incremental Opportunity, by Type, 2022-2031

Figure 08: Global 5G Test Equipment Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 09: Global 5G Test Equipment Market Share Analysis, by End-user, 2022 and 2031

Figure 10: Global 5G Test Equipment Market, Incremental Opportunity, by End-user, 2022-2031

Figure 11: North America 5G Test Equipment Market Analysis & Forecast, Value (US$ Mn), 2017-2031

Figure 12: North America 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 13: North America 5G Test Equipment Market Analysis & Forecast, Volume (Units), 2017-2031

Figure 14: North America 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 15: North America 5G Test Equipment Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 16: North America 5G Test Equipment Market Share Analysis, by Type, 2022 and 2031

Figure 17: North America 5G Test Equipment Market, Incremental Opportunity, by Type, 2022-2031

Figure 18: North America 5G Test Equipment Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 19: North America 5G Test Equipment Market Share Analysis, by End-user, 2022 and 2031

Figure 20: North America 5G Test Equipment Market, Incremental Opportunity, by End-user, 2022-2031

Figure 21: North America 5G Test Equipment Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 22: North America 5G Test Equipment Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 23: North America 5G Test Equipment Market, Incremental Opportunity, by Country and Sub-region, 2022-2031

Figure 24: Europe 5G Test Equipment Market Analysis & Forecast, Value (US$ Mn), 2017-2031

Figure 25: Europe 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 26: Europe 5G Test Equipment Market Analysis & Forecast, Volume (Units), 2017-2031

Figure 27: Europe 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 28: Europe 5G Test Equipment Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 29: Europe 5G Test Equipment Market Share Analysis, by Type, 2022 and 2031

Figure 30: Europe 5G Test Equipment Market, Incremental Opportunity, by Type, 2022-2031

Figure 31: Europe 5G Test Equipment Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 32: Europe 5G Test Equipment Market Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe 5G Test Equipment Market, Incremental Opportunity, by End-user, 2022-2031

Figure 34: Europe 5G Test Equipment Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 35: Europe 5G Test Equipment Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 36: Europe 5G Test Equipment Market, Incremental Opportunity, by Country and Sub-region, 2022-2031

Figure 37: Asia Pacific 5G Test Equipment Market Analysis & Forecast, Value (US$ Mn), 2017-2031

Figure 38: Asia Pacific 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 39: Asia Pacific 5G Test Equipment Market Analysis & Forecast, Volume (Units), 2017-2031

Figure 40: Asia Pacific 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 41: Asia Pacific 5G Test Equipment Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 42: Asia Pacific 5G Test Equipment Market Share Analysis, by Type, 2022 and 2031

Figure 43: Asia Pacific 5G Test Equipment Market, Incremental Opportunity, by Type, 2022-2031

Figure 44: Asia Pacific 5G Test Equipment Market Projections by Wafer Node, Value (US$ Mn), 2017-2031

Figure 45: Asia Pacific 5G Test Equipment Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 46: Asia Pacific 5G Test Equipment Market Share Analysis, by End-user, 2022 and 2031

Figure 47: Asia Pacific 5G Test Equipment Market, Incremental Opportunity, by End-user, 2022-2031

Figure 48: Asia Pacific 5G Test Equipment Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 49: Asia Pacific 5G Test Equipment Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 50: Asia Pacific 5G Test Equipment Market, Incremental Opportunity, by Country and Sub-region, 2022-2031

Figure 51: Middle East & Africa 5G Test Equipment Market Analysis & Forecast, Value (US$ Mn), 2017-2031

Figure 52: Middle East & Africa 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 53: Middle East & Africa 5G Test Equipment Market Analysis & Forecast, Volume (Units), 2017-2031

Figure 54: Middle East & Africa 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 55: Middle East & Africa 5G Test Equipment Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 56: Middle East & Africa 5G Test Equipment Market Share Analysis, by Type, 2022 and 2031

Figure 57: Middle East & Africa 5G Test Equipment Market, Incremental Opportunity, by Type, 2022-2031

Figure 58: Middle East & Africa 5G Test Equipment Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 59: Middle East & Africa 5G Test Equipment Market Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa 5G Test Equipment Market, Incremental Opportunity, by End-user, 2022-2031

Figure 61: Middle East & Africa 5G Test Equipment Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 62: Middle East & Africa 5G Test Equipment Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 63: Middle East & Africa 5G Test Equipment Market, Incremental Opportunity, by Country and Sub-region, 2022-2031

Figure 64: South America 5G Test Equipment Market Analysis & Forecast, Value (US$ Mn), 2017-2031

Figure 65: South America 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 66: South America 5G Test Equipment Market Analysis & Forecast, Volume (Units), 2017-2031

Figure 67: South America 5G Test Equipment Market Analysis & Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 68: South America 5G Test Equipment Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 69: South America 5G Test Equipment Market Share Analysis, by Type, 2022 and 2031

Figure 70: South America 5G Test Equipment Market, Incremental Opportunity, by Type, 2022-2031

Figure 71: South America 5G Test Equipment Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 72: South America 5G Test Equipment Market Share Analysis, by End-user, 2022 and 2031

Figure 73: South America 5G Test Equipment Market, Incremental Opportunity, by End-user, 2022-2031

Figure 74: South America 5G Test Equipment Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 75: South America 5G Test Equipment Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 76: South America 5G Test Equipment Market, Incremental Opportunity, by Country and Sub-region, 2022-2031