Reports

Reports

Analysts’ Viewpoint

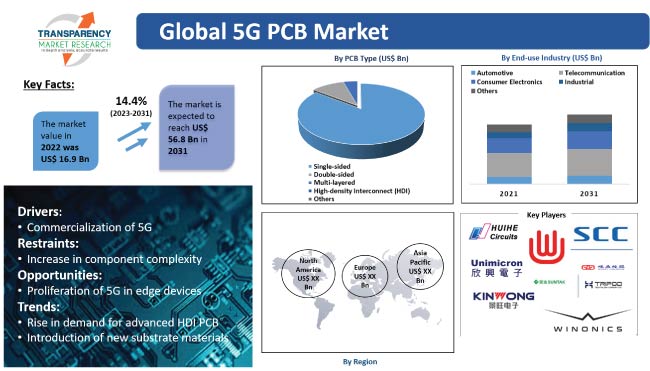

Commercialization of 5G is anticipated to fuel 5G PCB market growth in the next few years. Expansion in end-use industries such as automotive, telecommunication, consumer electronics, and industrial is driving the 5G PCB market share. Rise in demand for communication systems and connected devices such as smartphones and tablets, and advancements in automotive electronics are some of the key factors augmenting 5G PCB market statistics.

Increase in demand for advanced HDI PCBs and introduction of new substrate materials are prominent 5G PCB market trends. Growth in demand for high-speed and low-latency applications is also driving 5G PCB market dynamics. However, increase in component complexities is likely to hamper market development during the forecast period.

Printed circuit board solutions are used for electrical connections between different components. They are also used for digital and analog signal transmission, power supply, and high-frequency data transmission.

5G systems work at higher frequencies than 4G and 3G technologies. Therefore, electronic equipment must support higher digital data rates and frequencies. The next generation of highly advanced printed circuit boards (PCBs) is used in the deployment of 5G technology across critical infrastructure building blocks such as carrier networks, servers, and base stations.

5G uses mmWave and Sub-6 Band frequencies. This creates new requirements and challenges for printed circuit boards. 5G requires much more advanced component integration, such as antennas. This explains the growth in demand for smaller component sizes to better support integration.

Advanced HDI (High-density Interconnect) PCBs with mSAP (modified Semi-Additive Process) technology are becoming increasingly important in the development of 5G technology. These PCBs provide high performance and reliability as well as the ability to handle high frequencies and high-speed data transmission.

mSAP technology allows for finer line and space widths and higher aspect ratios, thus enabling greater density and complexity of the PCB design. This is particularly important for 5G applications, which require more complex and high-speed circuitry.

Advanced HDI PCBs with mSAP technology also have better thermal management, which is important for handling the heat generated by high-speed data transmission. Other benefits of using advanced HDI PCBs with mSAP technology in 5G applications include improved signal integrity, reduced electromagnetic interference (EMI), and better power distribution.

Demand for 5G PCBs is likely to increase in the near future due to the growth in adoption of 5G technology across the globe. 5G end devices require specialized PCBs to support high-frequency, high-bandwidth, and low-latency requirements. PCBs are essential components of electronic devices.

5G technology operates at much higher frequencies than the previous generations of wireless technologies. Therefore, advanced PCB materials and manufacturing techniques are required to handle higher frequency signals and reduce signal loss.

5G antenna array is a key technology used to enable high-speed data transfer and low latency in 5G networks. These antenna arrays use multiple antennas that are arranged in a specific pattern to enable simultaneous communication with multiple devices and increase network capacity.

5G antenna arrays use a technique called beamforming to improve network efficiency and reduce interference. With beamforming, the antenna array can focus its energy in a specific direction to provide stronger and more reliable signals to a specific device or group of devices. This enables more efficient use of the available network resources. It also improves network performance.

5G antenna arrays provide several benefits, including massive MIMO and active antenna systems (AAS), and hybrid beamforming. Massive MIMO (Multiple Input Multiple Output) is a type of 5G antenna array that uses a large number of antennas to enable simultaneous communication with multiple devices. Massive MIMO is used in both base stations and mobile devices to increase network capacity and improve network efficiency.

AAS is another type of 5G antenna array that uses active electronics to adjust the signal in real-time. It is used to improve network efficiency and reduce interference by adjusting the signal to match the specific requirements of each device.

Hybrid beamforming is a technique that combines the advantages of digital beamforming and analog beamforming. Hybrid beamforming is used in 5G networks to improve network efficiency and reduce interference by combining the flexibility of digital beamforming with the efficiency of analog beamforming.

The communications market currently accounts for about one-fifth of the world's production of electronic goods, which includes mobile and fixed devices as well as their infrastructure. Demand for rigid, flexible, and rigid-flexible substrates has been driven by growth in the mobile devices sector.

In the communication sector, PCBs are primarily used in electrical devices for data communication, transmission networks, and wireless networks. Millimeter waves with higher frequencies and broader bandwidths must be used due to the high frequency and speed of the 5G base station. Demand for PCBs has risen significantly as a result of the increase in adoption of 5G base stations and 5G electronic devices.

According to the latest 5G PCB (printed circuit board) market analysis, Asia Pacific is the largest region of the global 5G PCB sector, led by growth in consumer electronics and automotive industries. However, rapid expansion in data center and cloud businesses in North America is fueling market progress in the region.

China, Korea, Taiwan, and the U.S. are the leading countries of the global 5G PCB market. According to the latest 5G PCB market research analysis, the PCB industry is likely to expand in Asia Pacific during the forecast period, owing to the rise in adoption of futuristic technologies, including 5G, HPC, AIoT, and big data, in the region.

Prominent entities operating in the global market are updating their manufacturing technologies, materials, and 5G circuit board design patterns to meet the rising global demand. Thus, presence of a strong raw material supply system and corresponding equipment upgrades are likely to create lucrative 5G PCB market opportunities for companies.

Leading players operating in the market are Panasonic Industry Co., Ltd., Xinfeng Huihe Circuits Co., Ltd., Chin Poon Industrial Co., Ltd., Tripod Technology, Shennan Circuits Co., Ltd., WUS Printed Circuit Co., Ltd., Kinsus, Zhen Ding Technology Holding Limited, Hannstar Board Co., Ltd., Compeq Manufacturing Co., Ltd., NIPPON MEKTRON, LTD., Unimicron, TTM Technologies Inc., Sierra Circuits, Inc., Lexington Europe GmbH, and Winonics.

Key players have been profiled in the 5G PCB market report based on parameters such as company overview, business strategies, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 16.9 Bn |

|

Market Forecast Value in 2031 |

US$ 56.8 Bn |

|

Growth Rate (CAGR) |

14.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 16.9 Bn in 2022.

It is likely to grow at a CAGR of 14.4% by 2031.

It would be worth US$ 56.8 Bn in 2031.

The U.S. held approximately 18.0% share in 2022.

Rise in demand for advanced HDI PCB.

Asia Pacific is a more lucrative region for vendors.

Panasonic Industry Co., Ltd., Xinfeng Huihe Circuits Co., Ltd., Chin Poon Industrial Co., Ltd., Tripod Technology, Shennan Circuits Co., Ltd., WUS Printed Circuit Co., Ltd., Kinsus, Zhen Ding Technology Holding Limited, Hannstar Board Co., Ltd., Compeq Manufacturing Co., Ltd., NIPPON MEKTRON, LTD., Unimicron, TTM Technologies Inc., Sierra Circuits, Inc., Lexington Europe GmbH, and Winonics.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global 5G PCB Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global PCB Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global 5G PCB Market Analysis, by PCB Type

5.1. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By PCB Type, 2017–2031

5.1.1. Single-sided

5.1.2. Double-sided

5.1.3. Multi-layered

5.1.4. High-density Interconnect (HDI)

5.1.5. Others

5.2. Market Attractiveness Analysis, By PCB Type

6. Global 5G PCB Market Analysis, by Substrate

6.1. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

6.1.1. Rigid

6.1.2. Flexible

6.1.3. Rigid-flexible

6.2. Market Attractiveness Analysis, By Substrate

7. Global 5G PCB Market Analysis, by End-use Industry

7.1. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

7.1.1. Automotive

7.1.2. Telecommunication

7.1.3. Consumer Electronics

7.1.4. Industrial

7.1.5. Others

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global 5G PCB Market Analysis and Forecast by Region

8.1. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America 5G PCB Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By PCB Type, 2017–2031

9.3.1. Single-sided

9.3.2. Double-sided

9.3.3. Multi-layered

9.3.4. High-density Interconnect (HDI)

9.3.5. Others

9.4. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

9.4.1. Rigid

9.4.2. Flexible

9.4.3. Rigid-flexible

9.5. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

9.5.1. Automotive

9.5.2. Telecommunication

9.5.3. Consumer Electronics

9.5.4. Industrial

9.5.5. Others

9.6. 5G PCB Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By PCB Type

9.7.2. By Substrate

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe 5G PCB Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By PCB Type, 2017–2031

10.3.1. Single-sided

10.3.2. Double-sided

10.3.3. Multi-layered

10.3.4. High-density Interconnect (HDI)

10.3.5. Others

10.4. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

10.4.1. Rigid

10.4.2. Flexible

10.4.3. Rigid-flexible

10.5. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

10.5.1. Automotive

10.5.2. Telecommunication

10.5.3. Consumer Electronics

10.5.4. Industrial

10.5.5. Others

10.6. 5G PCB Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By PCB Type

10.7.2. By Substrate

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific 5G PCB Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By PCB Type, 2017–2031

11.3.1. Single-sided

11.3.2. Double-sided

11.3.3. Multi-layered

11.3.4. High-density Interconnect (HDI)

11.3.5. Others

11.4. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

11.4.1. Rigid

11.4.2. Flexible

11.4.3. Rigid-flexible

11.5. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.5.1. Automotive

11.5.2. Telecommunication

11.5.3. Consumer Electronics

11.5.4. Industrial

11.5.5. Others

11.6. 5G PCB Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By PCB Type

11.7.2. By Substrate

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa 5G PCB Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By PCB Type, 2017–2031

12.3.1. Single-sided

12.3.2. Double-sided

12.3.3. Multi-layered

12.3.4. High-density Interconnect (HDI)

12.3.5. Others

12.4. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

12.4.1. Rigid

12.4.2. Flexible

12.4.3. Rigid-flexible

12.5. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.5.1. Automotive

12.5.2. Telecommunication

12.5.3. Consumer Electronics

12.5.4. Industrial

12.5.5. Others

12.6. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By PCB Type

12.7.2. By Substrate

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America 5G PCB Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. 5G PCB Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By PCB Type, 2017–2031

13.3.1. Single-sided

13.3.2. Double-sided

13.3.3. Multi-layered

13.3.4. High-density Interconnect (HDI)

13.3.5. Others

13.4. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

13.4.1. Rigid

13.4.2. Flexible

13.4.3. Rigid-flexible

13.5. 5G PCB Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.5.1. Automotive

13.5.2. Telecommunication

13.5.3. Consumer Electronics

13.5.4. Industrial

13.5.5. Others

13.6. 5G PCB Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By PCB Type

13.7.2. By Substrate

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global 5G PCB Market Competition Matrix - a Dashboard View

14.1.1. Global 5G PCB Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Chin Poon Industrial Co., Ltd.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Compeq Manufacturing Co., Ltd.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Hannstar Board Co., Ltd.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Kinsus

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Lexington Europe GmbH

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. NIPPON MEKTRON, LTD.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Panasonic Industry Co., Ltd.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Shennan Circuits Co., Ltd.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Sierra Circuits, Inc.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Tripod Technology

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. TTM Technologies Inc.

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Unimicron

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Winonics

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. WUS Printed Circuit Co., Ltd.,

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

15.15. Xinfeng Huihe Circuits Co., Ltd.

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Key Subsidiaries or Distributors

15.15.5. Strategy and Recent Developments

15.15.6. Key Financials

15.16. Zhen Ding Technology Holding Limited

15.16.1. Overview

15.16.2. Product Portfolio

15.16.3. Sales Footprint

15.16.4. Key Subsidiaries or Distributors

15.16.5. Strategy and Recent Developments

15.16.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By PCB Type

16.1.2. By Substrate

16.1.3. By End-use Industry

16.1.4. By Region/Country/Sub-region

List of Tables

Table 1: Global 5G PCB Market Value (US$ Mn) & Forecast, by PCB Type, 2017‒2031

Table 2: Global 5G PCB Market Volume (Million Units) & Forecast, by PCB Type, 2017‒2031

Table 3: Global 5G PCB Market Value (US$ Mn) & Forecast, by Substrate, 2017‒2031

Table 4: Global 5G PCB Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 5: Global 5G PCB Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 6: Global 5G PCB Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 7: North America 5G PCB Market Value (US$ Mn) & Forecast, by PCB Type, 2017‒2031

Table 8: North America 5G PCB Market Volume (Million Units) & Forecast, by PCB Type, 2017‒2031

Table 9: North America 5G PCB Market Value (US$ Mn) & Forecast, by Substrate, 2017‒2031

Table 10: North America 5G PCB Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 11: North America 5G PCB Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 12: North America 5G PCB Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 13: Europe 5G PCB Market Value (US$ Mn) & Forecast, by PCB Type, 2017‒2031

Table 14: Europe 5G PCB Market Volume (Million Units) & Forecast, by PCB Type, 2017‒2031

Table 15: Europe 5G PCB Market Value (US$ Mn) & Forecast, by Substrate, 2017‒2031

Table 16: Europe 5G PCB Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 17: Europe 5G PCB Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 18: Europe 5G PCB Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 19: Asia Pacific 5G PCB Market Value (US$ Mn) & Forecast, by PCB Type, 2017‒2031

Table 20: Asia Pacific 5G PCB Market Volume (Million Units) & Forecast, by PCB Type, 2017‒2031

Table 21: Asia Pacific 5G PCB Market Value (US$ Mn) & Forecast, by Substrate, 2017‒2031

Table 22: Asia Pacific 5G PCB Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 23: Asia Pacific 5G PCB Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 24: Asia Pacific 5G PCB Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 25: Middle East & Africa 5G PCB Market Value (US$ Mn) & Forecast, by PCB Type, 2017‒2031

Table 26: Middle East & Africa 5G PCB Market Volume (Million Units) & Forecast, by PCB Type, 2017‒2031

Table 27: Middle East & Africa 5G PCB Market Value (US$ Mn) & Forecast, by Substrate, 2017‒2031

Table 28: Middle East & Africa 5G PCB Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 29: Middle East & Africa 5G PCB Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 30: Middle East & Africa 5G PCB Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 31: South America 5G PCB Market Value (US$ Mn) & Forecast, by PCB Type, 2017‒2031

Table 32: South America 5G PCB Market Volume (Million Units) & Forecast, by PCB Type, 2017‒2031

Table 33: South America 5G PCB Market Value (US$ Mn) & Forecast, by Substrate, 2017‒2031

Table 34: South America 5G PCB Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 35: South America 5G PCB Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 36: South America 5G PCB Market Volume (Million Units) & Forecast, by Region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global 5G PCB

Figure 02: Global 5G PCB Price Trend Analysis (Average Price, US$)

Figure 03: Porter Five Forces Analysis - Global 5G PCB

Figure 04: Technology Road Map - Global 5G PCB

Figure 05: Global 5G PCB Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 06: Global 5G PCB Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 07: Global 5G PCB Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 08: Global 5G PCB Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 09: Global 5G PCB Market Projections by PCB Type, and Value (US$ Mn), 2017‒2031

Figure 10: Global 5G PCB Market Share Analysis, by PCB Type, 2021 and 2031

Figure 11: Global 5G PCB Market, Incremental Opportunity, by PCB Type, 2021‒2031

Figure 12: Global 5G PCB Market Projections by Substrate, and Value (US$ Mn), 2017‒2031

Figure 13: Global 5G PCB Market Share Analysis, by Substrate, 2021 and 2031

Figure 14: Global 5G PCB Market, Incremental Opportunity, by Substrate, 2021‒2031

Figure 15: Global 5G PCB Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 16: Global 5G PCB Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 17: Global 5G PCB Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 18: Global 5G PCB Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 19: Global 5G PCB Market Share Analysis, by Region 2021 and 2031

Figure 20: Global 5G PCB Market, Incremental Opportunity, by Region, 2021‒2031

Figure 21: North America 5G PCB Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 22: North America 5G PCB Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 23: North America 5G PCB Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 24: North America 5G PCB Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 25: North America 5G PCB Market Projections by PCB Type, and Value (US$ Mn), 2017‒2031

Figure 26: North America 5G PCB Market Share Analysis, by PCB Type, 2021 and 2031

Figure 27: North America 5G PCB Market, Incremental Opportunity, by PCB Type, 2021‒2031

Figure 28: North America 5G PCB Market Projections by Substrate, and Value (US$ Mn), 2017‒2031

Figure 29: North America 5G PCB Market Share Analysis, by Substrate, 2021 and 2031

Figure 30: North America 5G PCB Market, Incremental Opportunity, by Substrate, 2021‒2031

Figure 31: North America 5G PCB Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 32: North America 5G PCB Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 33: North America 5G PCB Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 34: North America 5G PCB Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 35: North America 5G PCB Market Share Analysis, by Country, 2021 and 2031

Figure 36: North America 5G PCB Market, Incremental Opportunity, by Country, 2021‒2031

Figure 37: Europe 5G PCB Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 38: Europe 5G PCB Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 39: Europe 5G PCB Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 40: Europe 5G PCB Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 41: Europe 5G PCB Market Projections by PCB Type, and Value (US$ Mn), 2017‒2031

Figure 42: Europe 5G PCB Market Share Analysis, by PCB Type, 2021 and 2031

Figure 43: Europe 5G PCB Market, Incremental Opportunity, by PCB Type, 2021‒2031

Figure 44: Europe 5G PCB Market Projections by Substrate, and Value (US$ Mn), 2017‒2031

Figure 45: Europe 5G PCB Market Share Analysis, by Substrate, 2021 and 2031

Figure 46: Europe 5G PCB Market, Incremental Opportunity, by Substrate, 2021‒2031

Figure 47: Europe 5G PCB Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 48: Europe 5G PCB Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 49: Europe 5G PCB Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 50: Europe 5G PCB Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 51: Europe 5G PCB Market Share Analysis, by Country, 2021 and 2031

Figure 52: Europe 5G PCB Market, Incremental Opportunity, by Country, 2021‒2031

Figure 53: Asia Pacific 5G PCB Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 54: Asia Pacific 5G PCB Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific 5G PCB Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 56: Asia Pacific 5G PCB Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 57: Asia Pacific 5G PCB Market Projections by PCB Type, and Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific 5G PCB Market Share Analysis, by PCB Type, 2021 and 2031

Figure 59: Asia Pacific 5G PCB Market, Incremental Opportunity, by PCB Type, 2021‒2031

Figure 60: Asia Pacific 5G PCB Market Projections by Substrate, and Value (US$ Mn), 2017‒2031

Figure 61: Asia Pacific 5G PCB Market Share Analysis, by Substrate, 2021 and 2031

Figure 62: Asia Pacific 5G PCB Market, Incremental Opportunity, by Substrate, 2021‒2031

Figure 63: Asia Pacific 5G PCB Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 64: Asia Pacific 5G PCB Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 65: Asia Pacific 5G PCB Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 66: Asia Pacific 5G PCB Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 67: Asia Pacific 5G PCB Market Share Analysis, by Country, 2021 and 2031

Figure 68: Asia Pacific 5G PCB Market, Incremental Opportunity, by Country, 2021‒2031

Figure 69: Middle East & Africa 5G PCB Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 70: Middle East & Africa 5G PCB Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 71: Middle East & Africa 5G PCB Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 72: Middle East & Africa 5G PCB Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 73: Middle East & Africa 5G PCB Market Projections by PCB Type, and Value (US$ Mn), 2017‒2031

Figure 74: Middle East & Africa 5G PCB Market Share Analysis, by PCB Type, 2021 and 2031

Figure 75: Middle East & Africa 5G PCB Market, Incremental Opportunity, by PCB Type, 2021‒2031

Figure 76: Middle East & Africa 5G PCB Market Projections by Substrate, and Value (US$ Mn), 2017‒2031

Figure 77: Middle East & Africa 5G PCB Market Share Analysis, by Substrate, 2021 and 2031

Figure 78: Middle East & Africa 5G PCB Market, Incremental Opportunity, by Substrate, 2021‒2031

Figure 79: Middle East & Africa 5G PCB Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 80: Middle East & Africa 5G PCB Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 81: Middle East & Africa 5G PCB Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 82: Middle East & Africa 5G PCB Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 83: Middle East & Africa 5G PCB Market Share Analysis, by Country, 2021 and 2031

Figure 84: Middle East & Africa 5G PCB Market, Incremental Opportunity, by Country, 2021‒2031

Figure 85: South America 5G PCB Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 86: South America 5G PCB Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 87: South America 5G PCB Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 88: South America 5G PCB Market Projections by PCB Type, and Value (US$ Mn), 2017‒2031

Figure 89: South America 5G PCB Market Share Analysis, by PCB Type, 2021 and 2031

Figure 90: South America 5G PCB Market, Incremental Opportunity, by PCB Type, 2021‒2031

Figure 91: South America 5G PCB Market Projections by Substrate, and Value (US$ Mn), 2017‒2031

Figure 92: South America 5G PCB Market Share Analysis, by Substrate, 2021 and 2031

Figure 93: South America 5G PCB Market, Incremental Opportunity, by Substrate, 2021‒2031

Figure 94: South America 5G PCB Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 95: South America 5G PCB Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 96: South America 5G PCB Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 97: South America 5G PCB Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 98: South America 5G PCB Market Share Analysis, by Country, 2021 and 2031

Figure 99: South America 5G PCB Market, Incremental Opportunity, by Country, 2021‒2031

Figure 100: Company Share Analysis 2021