Reports

Reports

Analysts’ Viewpoint on Global Market Scenario

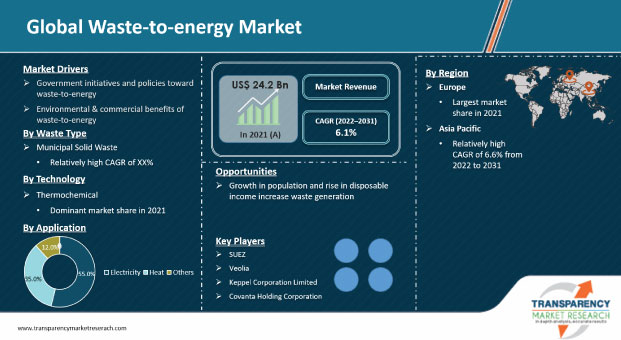

Significant increase in power consumption due to rapid urbanization & industrialization and growth in emphasis on generating energy from renewable sources are anticipated to be key factors driving the waste to energy market. Waste-to-energy (WTE) is a process of generating energy from waste and reducing the dependence on fossil fuels, such as coal, for energy generation. Countries across the globe are investing in renewable energy sources to reduce reliance on fossil fuels. Favorable incentives and schemes have been introduced across all regions to promote effective waste collection and processing, thereby creating significant opportunities for the waste-to-energy industry. Companies operating in the market should penetrate more in developing economies in order to diversify their sources of income.

Waste-to-energy process refers to a technique that converts municipal solid waste, which is generated from industrial, commercial, and domestic sectors, into energy. Various technologies are deployed to process the waste generated from different sectors to produce fuel cells, steam, and electricity. The course of action in every technology is comparatively different and the end product is used in industries, commercial units, and domestic dwellings.

The global market is significantly driven by the potential advantages of waste-to-energy along with an increase in the number of government policies toward developing waste-to-energy during the forecast period. Demand for energy is increasing along with the prices of oil and gas. Various initiatives are being taken by governments to reuse & recycle waste and convert it into energy. Innovative waste-to-energy plants are being developed for proper waste management in developing countries.

The rise in investment in renewable energy, government initiatives, and policies, and an increase in focus on reducing global dependence on coal and other fossil fuels by various governments are some of the factors expected to drive the market for waste-to-energy. Several new waste-to-energy projects are being established across the globe. Policies such as feed-in-tariffs, tax credits, and capital subsidies have been provided for waste-to-energy in countries such as China, India, the U.S., and countries in the EU. The Government of India recognizes waste-to-energy as a renewable technology and supports it through various subsidies and incentives.

The Ministry of New and Renewable Energy (MNRE) is actively promoting technology options available for energy recovery from urban and industrial wastes. MNRE is also promoting research on waste-to-energy by providing financial support for R&D projects on a cost-sharing basis by following its R&D Policy. The landfill directive aims to minimize landfilling within the EU to prevent and reduce the negative effects of waste landfills on the environment and human health. These supportive regulations and policies from governments are propelling the market.

Most of the generated waste finds its way into land and water bodies without being properly treated, thus causing water pollution. This waste emits greenhouse gases such as carbon dioxide and methane; and increases air pollution. According to the World Bank estimates, the world’s waste generation is projected to nearly double in volume by 2025 and reach 6 million tons of waste per day. Several countries are opting for alternate sources of energy due to restricted landfilling, growing environmental issues, and volatility in fuel prices. Waste-to-energy is a process of generating energy by treating waste. WTE not only solves environmental issues related to waste by reducing the volume but also decreases the emission of greenhouse gases.

Organic waste from urban and rural areas degrades. It is a resource for generating energy. Issues caused by solid and liquid wastes can be considerably reduced through the adoption of environment-friendly waste-to-energy technologies that enable the processing and treatment of waste before its disposal. These measures reduce the quantity of waste, generate a substantial quantity of energy, and decrease the environmental pollution. Waste-to-energy generates clean, reliable energy from a renewable fuel source, thus reducing the dependence on fossil fuels that increase GHG emissions. Thus, various social and economic benefits of waste-to-energy are anticipated to drive the market during the forecast period.

In terms of waste type, the global waste-to-energy industry has been segregated into municipal solid waste, agriculture, and others. The municipal solid waste segment held the major share of 65.5% of the global market in 2021. It is estimated to dominate the market during the forecast period. The generation of municipal solid waste is rising due to rapid industrialization. Municipal solid waste can be extensively used for energy generation across the globe.

The agriculture segment accounted for a 21.67% share of the market in 2021. It is estimated to expand at a steady pace during the forecast period. The e-waste segment held a relatively minor share of 12.7% of the market in 2021; however, its share is increasing consistently due to the increase in the usage of electric products.

Based on technology, the global waste to energy market has been bifurcated into thermochemical and biochemical. The thermochemical segment dominated the global waste-to-energy market with a 71.8% share in 2021. The rise in adoption and popularity of thermochemical waste-to-energy generation processes such as combustion or incineration, gasification, and pyrolysis is driving the future market for waste-to-energy. Demand for waste-to-energy technology is increasing, as several government bodies are taking initiatives to increase the adoption of thermochemical waste-to-energy technology.

In terms of application, the global market has been classified into electricity, heat, and others. The electricity segment accounted for a significant share of around 54.94% of the global market in 2021. The rise in infrastructure development activities is boosting the demand for electricity across the globe. Hence, the electricity segment is expected to dominate the market during the forecast period. The heat segment is also expected to grow at a steady pace during the forecast period.

Europe accounted for a prominent share of 39.48% of the global market in 2021. This trend is projected to continue during the forecast period. In Europe, the electricity segment accounted for a 43.3% share of the market, while the thermochemical segment held a 58.65% share in 2021. In terms of waste type, the municipal solid waste segment constituted a 70.6% share of the market in Europe in 2021.

Asia Pacific is also a key market for waste-to-energy. The region held a 30.59% share of the global market in 2021. North America held a 20.8% share of the global market in 2021. Latin America is a larger market for waste-to-energy than Middle East & Africa. The waste to energy market in Latin America is estimated to grow during the forecast period due to the increase in waste generation in the region.

The global market is consolidated, with a small number of large-scale vendors controlling a majority of the share. Most organizations are investing significantly in comprehensive research and development activities. Key players operating in the waste to energy market are SUEZ, Veolia, Keppel Corporation Limited, Covanta Holding Corporation, Constructions industrielles de la Méditerranée (CNIM), China Everbright International Limited, Babcock & Wilcox Enterprises, Inc., STEAG GmbH, Future Biogas Limited, and Gazasia Ltd.

Each of these players has been profiled in the waste to energy market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 24.2 Bn |

|

Market Forecast Value in 2031 |

US$ 43.1 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market stood at US$ 24.2 Bn in 2021.

The waste-to-energy business is expected to grow at a CAGR of 6.1% from 2022 to 2031.

Growth in industrialization and urbanization is a key factor driving the waste-to-energy market.

The municipal solid waste segment accounted for 65.5% share of the waste-to-energy market in 2021.

Europe is more attractive for vendors in the waste to energy market.

SUEZ, Veolia, Keppel Corporation Limited, Covanta Holding Corporation, Constructions industrielles de la Méditerranée (CNIM), China Everbright International Limited, Babcock & Wilcox Enterprises, Inc., STEAG GmbH, Future Biogas Limited, and Gazasia Ltd.

1. Executive Summary

1.1. Waste-to-energy Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Key Manufacturers

2.6.2. List of Suppliers/ Distributors

2.6.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2020

5. Price Trend Analysis

6. Global Waste-to-energy Market Analysis and Forecast, by Waste Type, 2020–2031

6.1. Introduction and Definitions

6.2. Global Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

6.2.1. Municipal Solid Waste (MSW)

6.2.2. Agricultural Waste

6.2.3. Others

6.3. Global Waste-to-energy Market Attractiveness, by Waste Type

7. Global Waste-to-energy Market Analysis and Forecast, by Technology, 2020–2031

7.1. Introduction and Definitions

7.2. Global Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

7.2.1. Thermochemical

7.2.1.1. Incineration

7.2.1.2. Others

7.2.2. Biochemical

7.2.2.1. Anaerobic Digestion

7.2.2.2. Others

7.3. Global Waste-to-energy Market Attractiveness, by Technology

8. Global Waste-to-energy Market Analysis and Forecast, by Application, 2020–2031

8.1. Introduction and Definitions

8.2. Global Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

8.2.1. Heat

8.2.2. Electricity

8.2.3. Others

8.3. Global Waste-to-energy Market Attractiveness, by Application

9. Global Waste-to-energy Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Waste-to-energy Market Attractiveness, by Region

10. North America Waste-to-energy Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

10.3. North America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

10.4. North America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

10.5. North America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country, 2020–2031

10.5.1. U.S. Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

10.5.2. U.S. Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

10.5.3. U.S. Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

10.5.4. Canada Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

10.5.5. Canada Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

10.5.6. Canada Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

10.6. North America Waste-to-energy Market Attractiveness Analysis

11. Europe Waste-to-energy Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

11.3. Europe Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

11.4. Europe Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5. Europe Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

11.5.1. Germany Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

11.5.2. Germany Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.3. Germany Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.4. France Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

11.5.5. France Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.6. France Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.7. U.K. Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

11.5.8. U.K. Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.9. U.K. Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.10. Italy Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

11.5.11. Italy. Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.12. Italy Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.13. Russia & CIS Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

11.5.14. Russia & CIS Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.15. Russia & CIS Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.16. Rest of Europe Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

11.5.17. Rest of Europe Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.18. Rest of Europe Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.6. Europe Waste-to-energy Market Attractiveness Analysis

12. Asia Pacific Waste-to-energy Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type

12.3. Asia Pacific Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

12.4. Asia Pacific Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5. Asia Pacific Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

12.5.1. China Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

12.5.2. China Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.3. China Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.4. Japan Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

12.5.5. Japan Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.6. Japan Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.7. India Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

12.5.8. India Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.9. India Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.10. ASEAN Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

12.5.11. ASEAN Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.12. ASEAN Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.13. Rest of Asia Pacific Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

12.5.14. Rest of Asia Pacific Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.15. Rest of Asia Pacific Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.6. Asia Pacific Waste-to-energy Market Attractiveness Analysis

13. Latin America Waste-to-energy Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

13.3. Latin America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

13.4. Latin America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.5. Latin America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

13.5.1. Brazil Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

13.5.2. Brazil Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

13.5.3. Brazil Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.5.4. Mexico Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

13.5.5. Mexico Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

13.5.6. Mexico Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.5.7. Rest of Latin America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

13.5.8. Rest of Latin America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

13.5.9. Rest of Latin America Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.6. Latin America Waste-to-energy Market Attractiveness Analysis

14. Middle East & Africa Waste-to-energy Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

14.3. Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

14.4. Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.5. Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

14.5.1. GCC Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

14.5.2. GCC Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

14.5.3. GCC Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.5.4. South Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

14.5.5. South Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

14.5.6. South Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.5.7. Rest of Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Waste Type, 2020–2031

14.5.8. Rest of Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Technology, 2020–2031

14.5.9. Rest of Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.6. Middle East & Africa Waste-to-energy Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Waste-to-energy Company Market Share Analysis, 2020

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Veolia

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. Cleanaway Waste-to-energy Limited

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. Daiseki Co.Ltd

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. Waste Connections Inc.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. Clean Harbors

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. Suez

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. Umicore

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. ERI

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. Stericycle

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.10. Enviro-Hub group

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

15.2.11. WM Intellectual Property Holdings L.L.C

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.11.3. Financial Overview

15.2.11.4. Strategic Overview

15.2.12. Augean Plc

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.12.3. Financial Overview

15.2.12.4. Strategic Overview

15.2.13. Reclay Group

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.13.3. Financial Overview

15.2.13.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 2: Global Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 3: Global Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 4: Global Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 5: Global Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 6: Global Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 7: Global Waste-to-energy Market Volume (Thousand Tons) Forecast, by Region, 2020–2031

Table 8: Global Waste-to-energy Market Value (US$ Bn) Forecast, by Region, 2020–2031

Table 9: North America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 10: North America Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 11: North America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 12: North America Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 13: North America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 14: North America Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 15: North America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Country, 2020–2031

Table 16: North America Waste-to-energy Market Value (US$ Bn) Forecast, by Country, 2020–2031

Table 17: U.S. Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 18: U.S. Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 19: U.S. Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 20: U.S. Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 21: U.S. Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 22: U.S. Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 23: Canada Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 24: Canada Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 25: Canada Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 26: Canada Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 27: Canada Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 28: Canada Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 29: Europe Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 30: Europe Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 31: Europe Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 32: Europe Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 33: Europe Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 34: Europe Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 35: Europe Waste-to-energy Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Waste-to-energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 38: Germany Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 39: Germany Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 40: Germany Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 41: Germany Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 42: Germany Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 43: France Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 44: France Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 45: France Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 46: France Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 47: France Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 48: France Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 49: U.K. Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 50: U.K. Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 51: U.K. Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 52: U.K. Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 53: U.K. Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 54: U.K. Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 55: Italy Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 56: Italy Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 57: Italy Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 58: Italy Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 59: Italy Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 60: Italy Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 61: Spain Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 62: Spain Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 63: Spain Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 64: Spain Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 65: Spain Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 66: Spain Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 67: Russia & CIS Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 68: Russia & CIS Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 69: Russia & CIS Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 70: Russia & CIS Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 71: Russia & CIS Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 72: Russia & CIS Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 73: Rest of Europe Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 74: Rest of Europe Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 75: Rest of Europe Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 76: Rest of Europe Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 77: Rest of Europe Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 78: Rest of Europe Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 79: Asia Pacific Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 80: Asia Pacific Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 81: Asia Pacific Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 82: Asia Pacific Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 83: Asia Pacific Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 84: Asia Pacific Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 85: Asia Pacific Waste-to-energy Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Asia Pacific Waste-to-energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 87: China Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 88: China Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type 2020–2031

Table 89: China Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 90: China Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 91: China Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 92: China Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 93: Japan Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 94: Japan Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 95: Japan Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 96: Japan Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 97: Japan Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 98: Japan Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 99: India Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 100: India Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 101: India Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 102: India Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 103: India Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 104: India Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 105: India Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 106: India Waste-to-energy Market Value (US$ Bn) Forecast, by Application 2020–2031

Table 107: ASEAN Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 108: ASEAN Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 109: ASEAN Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 110: ASEAN Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 111: ASEAN Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 112: ASEAN Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 113: Rest of Asia Pacific Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 114: Rest of Asia Pacific Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 115: Rest of Asia Pacific Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 116: Rest of Asia Pacific Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 117: Rest of Asia Pacific Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 118: Rest of Asia Pacific Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 119: Latin America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 120: Latin America Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 121: Latin America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 122: Latin America Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 123: Latin America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 124: Latin America Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 125: Latin America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 126: Latin America Waste-to-energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 127: Brazil Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 128: Brazil Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 129: Brazil Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 130: Brazil Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 131: Brazil Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 132: Brazil Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 133: Mexico Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 134: Mexico Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 135: Mexico Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 136: Mexico Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 137: Mexico Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 138: Mexico Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 139: Rest of Latin America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 140: Rest of Latin America Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 141: Rest of Latin America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 142: Rest of Latin America Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 143: Rest of Latin America Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 144: Rest of Latin America Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 145: Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 146: Middle East & Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 147: Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 148: Middle East & Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 149: Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 150: Middle East & Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 151: Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 152: Middle East & Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 153: GCC Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 154: GCC Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 155: GCC Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 156: GCC Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 157: GCC Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 158: GCC Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 159: South Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 160: South Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 161: South Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 162: South Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 163: South Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 164: South Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 165: Rest of Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Waste Type, 2020–2031

Table 166: Rest of Middle East & Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Waste Type, 2020–2031

Table 167: Rest of Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Technology, 2020–2031

Table 168: Rest of Middle East & Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 169: Rest of Middle East & Africa Waste-to-energy Market Volume (Thousand Tons) Forecast, by Application, 2020–2031

Table 170: Rest of Middle East & Africa Waste-to-energy Market Value (US$ Bn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Waste-to-energy Market Volume Share Analysis, by Waste Type, 2020, 2025, and 2031

Figure 2: Global Waste-to-energy Market Attractiveness, by Waste Type

Figure 3: Global Waste-to-energy Market Volume Share Analysis, by Technology, 2020, 2025, and 2031

Figure 4: Global Waste-to-energy Market Attractiveness, by Technology

Figure 5: Global Waste-to-energy Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 6: Global Waste-to-energy Market Attractiveness, by Application

Figure 7: Global Waste-to-energy Market Volume Share Analysis, by Region, 2020, 2025, and 2031

Figure 8: Global Waste-to-energy Market Attractiveness, by Region

Figure 9: North America Waste-to-energy Market Volume Share Analysis, by Waste Type, 2020, 2025, and 2031

Figure 10: North America Waste-to-energy Market Attractiveness, by Waste Type

Figure 11: North America Waste-to-energy Market Attractiveness, by Waste Type

Figure 12: North America Waste-to-energy Market Volume Share Analysis, by Technology, 2020, 2025, and 2031

Figure 13: North America Waste-to-energy Market Attractiveness, by Technology

Figure 14: North America Waste-to-energy Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 15: North America Waste-to-energy Market Attractiveness, by Application

Figure 16: North America Waste-to-energy Market Attractiveness, by Country

Figure 17: Europe Waste-to-energy Market Volume Share Analysis, by Waste Type, 2020, 2025, and 2031

Figure 18: Europe Waste-to-energy Market Attractiveness, by Waste Type

Figure 19: Europe Waste-to-energy Market Volume Share Analysis, by Technology, 2020, 2025, and 2031

Figure 20: Europe Waste-to-energy Market Attractiveness, by Technology

Figure 21: Europe Waste-to-energy Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 22: Europe Waste-to-energy Market Attractiveness, by Application

Figure 23: Europe Waste-to-energy Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 24: Europe Waste-to-energy Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Waste-to-energy Market Volume Share Analysis, by Waste Type, 2020, 2025, and 2031

Figure 26: Asia Pacific Waste-to-energy Market Attractiveness, by Waste Type

Figure 27: Asia Pacific Waste-to-energy Market Volume Share Analysis, by Technology, 2020, 2025, and 2031

Figure 28: Asia Pacific Waste-to-energy Market Attractiveness, by Technology

Figure 29: Asia Pacific Waste-to-energy Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 30: Asia Pacific Waste-to-energy Market Attractiveness, by Application

Figure 31: Asia Pacific Waste-to-energy Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 32: Asia Pacific Waste-to-energy Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Waste-to-energy Market Volume Share Analysis, by Waste Type, 2020, 2025, and 2031

Figure 34: Latin America Waste-to-energy Market Attractiveness, by Waste Type

Figure 35: Latin America Waste-to-energy Market Volume Share Analysis, by Technology, 2020, 2025, and 2031

Figure 36: Latin America Waste-to-energy Market Attractiveness, by Technology

Figure 37: Latin America Waste-to-energy Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 38: Latin America Waste-to-energy Market Attractiveness, by Application

Figure 39: Latin America Waste-to-energy Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 40: Latin America Waste-to-energy Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Waste-to-energy Market Volume Share Analysis, by Waste Type, 2020, 2025, and 2031

Figure 42: Middle East & Africa Waste-to-energy Market Attractiveness, by Waste Type

Figure 43: Middle East & Africa Waste-to-energy Market Volume Share Analysis, by Technology, 2020, 2025, and 2031

Figure 44: Middle East & Africa Waste-to-energy Market Attractiveness, by Technology

Figure 45: Middle East & Africa Waste-to-energy Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 46: Middle East & Africa Waste-to-energy Market Attractiveness, by Application

Figure 47: Middle East & Africa Waste-to-energy Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 48: Middle East & Africa Waste-to-energy Market Attractiveness, by Country and Sub-region