Reports

Reports

U.S. Uterine Fibroids Treatment Market: Snapshot

The rising occurrence of uterine fibroids among women is the primary stimulant of the growth of the U.S. market for uterine fibroids treatment. The Society of Interventional Radiology states that around 30% to 40% of women aged 35 and above suffer from uterine fibroids. Moreover, the advent of minimally invasive and effective alternatives to open surgeries is working in favor of the market. The presence of favorable reimbursement policies is also encouraging patients to undergo uterine fibroids treatment. Medicare & Medicaid services – a national social insurance program in the U.S. – covers reimbursement policies and payments for ambulatory surgical centers and hospitals.

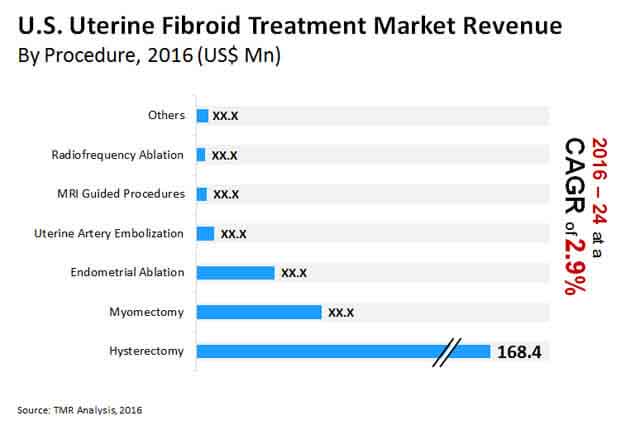

Furthermore, technological advancements and frequent product innovations coupled with an increase in regulatory approvals of novel products are stoking the growth of the market. However, the presence of substitutes such as drug therapy to uterine fibroid treatment procedures is hampering the growth of the market. Moreover, stringent regulations pertaining to treatment devices delay their launch, which in turn adversely affects the growth of the market. With all these factors put together, the U.S. market for uterine fibroid treatment is poised to reach a valuation of US$273.6 mn by the end of 2024 from US$217.6 mn in 2016, rising at a CAGR of 2.9% between 2016 and 2024.

Hysterectomy to Remain Most Preferred Uterine Fibroid Treatment Procedure through 2024

Based on type of procedure, the hysterectomy segment will continue to represent the lion’s share in the U.S. market for uterine fibroids treatment until 2024. The segment can be further classified into laparoscopic hysterectomy, abdominal hysterectomy, robotic hysterectomy, vaginal hysterectomy, and hysteroscopic morcellation. Hysterectomy is the commonly recommended procedure by doctors to women who have large fibroid size and have completed their fertility. According to the American Congress of Obstetricians and Gynecologists, every year nearly 600,000 hysterectomy procedures are performed. However, the segment is expected to register sluggish growth owing to the injury to healthy tissue and risk of having benign neoplasms after a hysterectomy procedure.

The demand for radiofrequency ablation, on the other hand, is likely to increase at a significant pace over the coming years. The increasing demand for minimally invasive procedures is one of the primary factors contributing to the growth of the segment. The fast recovery associated with this procedure coupled with the low complications and risk factor is translating into the greater adoption of this procedure. The segment is estimated to exhibit a CAGR of 7.4% during the forecast period.

Highly Developed Infrastructure Ensures Strong Demand across Hospitals

On the basis of end user, the U.S. uterine fibroids treatment market is divided into hospitals and ambulatory surgical centers. The demand for uterine fibroids treatment is higher in hospitals, owing to the fact that they are highly developed to handle complicated matters and emergencies related to uterine fibroids. Large hospitals are increasingly focusing towards training interventional radiologists and gynecologists for application of radiofrequency ablation and robotic minimally invasive procedure, which is likely to provide a significant boost to the growth of the segment. Owing to these factors, the segment is expected to post a CAGR of 3.1% during the forecast period.

The ambulatory surgical centers segment is anticipated to rise at a sluggish pace during the same period, owing to the high cost of procedures in these centers along with the lack of favorable reimbursement scenario.

Some of the prominent players in the U.S. uterine fibroids market are Richard Wolf Medical Instruments, Blue Endo, Halt Medical Inc., LiNA Medical USA, Cooper Surgical, Merit Medical Systems, Karl Storz, Olympus Corporation, Richard Wolf GmbH, and Boston Scientific Corporation.

Uterine Fibroids Treatment Market to Thrive on Growing Preference for Minimally Invasive Procedures

A uterine fibroid is a form of tumor that develops in the uterus' muscular wall. It affects approximately 20% to 40% of women between the ages of conception and menopause. Globally, the global uterine fibroids treatment market is being driven by the advancement of effective and advanced technologies, increased government interventions across the globe, and increased public awareness. In addition to that, increasing occurrence of uterine fibroids, changes in lifestyle and dietary patterns, as well as the increasing number of women of reproductive age (WRA) around the world are estimated to drive demand in the said market. Furthermore, rising acceptance of uterine fibroid treatment acceptance in developing economies such as India, China, and others are likely to open up new opportunities for the global uterine fibroid treatment market. However, the demand for uterine fibroid treatment is hampered by higher research and development costs.

High Occurrence of Uterine Fibroids in Women Worldwide to Bolster Growth of the Market

The demand is projected to be driven by the high prevalence of uterine fibroids in women around the world, increasing inclination toward minimally invasive treatments, and acceptance of technologically advanced devices. Repeated urination, miscarriage, abdominal pain, and excessive menstrual spotting all could be the symptoms of uterine fibroid. These fibroids are benign tumor of the smooth muscle cells that develop throughout a woman's uterus. Race, hypertension, age, premenopausal state, maternal predisposition, overweight, and diet are both risk factors, despite what actually triggers it is still unclear.

The demand is expected to accelerate due to an increase in patients' preference for non-invasive and minimally invasive fibroids surgeries, which is likely to open up plethora of opportunities for the global uterine fibroid treatment market in the near future. Smaller incisions reduce discomfort after surgery and enable a quick recovery leading to their fast acceptance. Several major players are investing in research and development to launch novel non-invasive and minimal operating instruments. The demand for devices of uterine fibroids treatment is expected to rise as a result of rising demand for such procedures due to their reduced discomfort, effectiveness, low risk of infection, and fast recovery as opposed to open surgeries.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : U.S. Uterine Fibroid Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Industry Evolution / Developments

4.2. Overview

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. U.S. Uterine Fibroid Treatment Market Analysis and Forecasts, 2014–2024

4.5.1. Market Revenue Projections, 2014–2024

4.6. Disease Epidemiology and Treatment

4.7. Porter’s Five Force Analysis

4.8. Market Outlook

5. U.S. Uterine Fibroid Treatment Market Analysis and Forecasts, by Procedure Type, 2016–2024

5.1. Introduction & Definition

5.2. Key Findings/Developments

5.3. Market Value (US$ Mn) Forecast, by Procedure Type, 2016–2024

5.3.1. Endometrial Ablation

5.3.2. MRI Guided Procedures

5.3.3. Hysterectomy

5.3.4. Myomectomy

5.3.5. Uterine Artery Embolization

5.3.6. Radiofrequency Ablation

5.3.7. Others

5.4. Procedure Type Comparison Matrix

5.5. Market Attractiveness, by Procedure Type, 2016–2024

6. U.S. Uterine Fibroid Treatment Market Analysis and Forecasts, by Procedure Type Sub-segment, 2016–2024

6.1. Market Value (US$ Mn) Forecast, by Procedure Type Sub-segment, 2016–2024

6.1.1. MRI Guided Procedures

6.1.1.1. MRI-guided Percutaneous Laser Ablation

6.1.1.2. MRI Guided Transcutaneous Focused Ultrasound

6.1.2. Hysterectomy

6.1.2.1. Abdominal Hysterectomy

6.1.2.2. Vaginal Hysterectomy

6.1.2.3. Laparoscopic Hysterectomy

6.1.2.4. Robotic Hysterectomy

6.1.2.5. Hysteroscopic Morcellation

6.1.3. Myomectomy

6.1.3.1. Open Myomectomy

6.1.3.2. Laparoscopic Myomectomy

6.1.3.3. Robotic Myomectomy

6.2. Market Attractiveness, by Procedure Type Sub-segment, 2016–2024

7. U.S. Uterine Fibroid Treatment Market Analysis and Forecasts, by End-user, 2016–2024

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value (US$ Mn) Forecast, by End-user, 2016–2024

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.4. End-user Comparaison Matrix

7.5. Market Attractiveness, by End-user

8. U.S. Uterine Fibroid Treatment Procedure Volume Analysis and Forecasts – 2010–2015 & 2016–2024

8.1. Endometrial Ablation

8.2. MRI Guided Procedures

8.2.1. MRI-guided Percutaneous Laser Ablation

8.2.2. MRI Guided transcutaneous focused Ultrasound

8.3. Hysterectomy

8.3.1. Abdominal Hysterectomy

8.3.2. Vaginal Hysterectomy

8.3.3. Laparoscopic Hysterectomy

8.3.4. Robotic Hysterectomy

8.3.5. Hysteroscopic Morcellation

8.4. Myomectomy

8.4.1. Open Myomectomy

8.4.2. Laparoscopic Myomectomy

8.4.3. Robotic Myomectomy

8.5. Uterine Artery Embolisation

8.6. Radiofrequency Ablation

8.7. Others

9. Competition Landscape

9.1. Market Player – Competition Matrix (By Tier and Size of companies)

9.2. Market Share Analysis, by Company (2015)

9.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

9.3.1. Blue Endo

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.2. Boston Scientific Corporation

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.3. CooperSurgical, Inc.

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.4. Karl Storz

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.5. Halt Medical, Inc.

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.6. LiNA Medical USA

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.7. Merit Medical Systems

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.8. Olympus Corporation

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

9.3.9. Richard Wolf GmbH

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Business Strategies

List of Tables

Table 01: U.S. Uterine Fibroid Treatment Market Size (US$ Mn) Forecast, by Procedure Type, 2014–2024

Table 02: U.S. Uterine Fibroid Treatment Market Size (US$ Mn) Forecast, by MRI Guided Procedure Type, 2014–2024

Table 03: U.S. Uterine Fibroid Treatment Market Size (US$ Mn) Forecast, by Hysterectomy Procedure Type, 2014–2024

Table 04: U.S. Uterine Fibroid Treatment Market Size (US$ Mn) Forecast, by Myomectomy Procedure Type, 2014–2024

Table 05: U.S. Uterine Fibroid Treatment Market Value (US$ Mn) Forecast, by End-user, 2014–2024

Table 06: U.S. Uterine Fibroid Treatment Market Forecast, by Procedure Type, 2010–2024

List of Figures

Figure 01: US Uterine Fibroid Treatment Market Revenue (US$ Mn) Forecast, 2014–2024

Figure 02: U.S. Endometrial Ablation Market Revenue (US$ Mn), 2014–2024

Figure 03: U.S. MRI Guided Procedures Market Revenue (US$ Mn), 2014–2024

Figure 04: U.S. Hysterectomy Market, Revenue (US$ Mn), 2014–2024

Figure 05: U.S. Myomectomy Market, Revenue (US$ Mn), 2014–2024

Figure 06: U.S. Endometrial Ablation Devices Market, Revenue (US$Mn), 2014–2024

Figure 07: U.S. Radiofrequency Ablation Devices Market, Revenue (US$ Mn), 2014–2024

Figure 08: U.S. Other Procedure Market, Revenue (US$Mn), 2014–2024

Figure 09: U.S. Uterine Fibroid Market Attractiveness Analysis, by Procedure Type, 2016 – 2024

Figure 10: U.S. MRI-guided Percutaneous Laser Ablation Market Revenue (US$ Mn), 2014–2024

Figure 11: U.S. MRI guided Transcutaneous Focused Ultrasound Market Revenue (US$ Mn), 2014–2024

Figure 12: U.S. Abdominal Hysterectomy Market, Revenue (US$ Mn), 2014–2024

Figure 13: U.S. Vaginal Hysterectomy Market, Revenue (US$ Mn), 2014–2024

Figure 14: U.S. Laparoscopic Hysterectomy Market, Revenue (US$ Mn), 2014–2024

Figure 15: U.S. Robotic Hysterectomy Market, Revenue (US$ Mn), 2014–2024

Figure 16: U.S. Hysteroscopic Morcellation Market, Revenue (US$ Mn), 2014–2024

Figure 17: U.S. Open Myomectomy Market, Revenue (US$ Mn), 2014–2024

Figure 18: U.S. Laparoscopic Myomectomy Market, Revenue (US$ Mn), 2014–2024

Figure 19: U.S. Robotic Myomectomy Market, Revenue (US$ Mn), 2014–2024

Figure 20: U.S. Uterine Fibroid Market Attractiveness Analysis, by Procedure Type Sub-segment, 2016 – 2024

Figure 21: U.S. Hospitals Market, Revenue (US$ Mn), 2014–2024

Figure 22: U.S. Ambulatory Surgical Centers Market, Revenue (US$ Mn), 2014–2024

Figure 23: U.S. Uterine Fibroid Market Attractiveness Analysis, by End-user, 2016 – 2024

Figure 24: U.S. Uterine Fibroid Treatment Market Share Analysis, by Company (2015)