Reports

Reports

The U.S. market for pharmaceutical plastic bottles derives much of its growth by addressing the growing sustainability concerns by increasing the recycling rate of plastics and lowering the environmental impact in the pharmaceutical industry. The advancements in the technology has emerged as the key growth driver of this market. Apart from this, the rising application of plastic bottles in solid and liquid oral medications is also adding to the market’s growth significantly.

In addition to this, the growing popularity of plastic bottle, owing to the convenience, safety, and security they offer, is likely to fuel the demand for pharmaceutical plastic bottles in the U.S., leading to a phenomenal rise in this market over the next few years. However, the eco-friendly substitutes for PE and PET, such as glass, metal, and sugarcane, which is also a renewable material, may limit this demand to some extent and hamper the growth of the U.S. pharmaceutical plastics bottles market in the years to come.

The U.S. market for pharmaceutical plastics bottles presented an opportunity worth US$6.74 bn in 2016. Analysts expect it to progress at a CAGR of 4.10% between 2016 and 2024 and reach a value of US$9.28 bn by the end of 2024.

Packer bottles, liquid bottles, dropper bottles, and various other types of bottles, such as Boston round bottle and bullet are the key products available in the U.S. pharmaceutical plastic bottles market. The packer bottles segment is leading the overall market with a share of nearly 50% and is expected to retain its dominance over the next few years due to the rising demand for customized pharmaceutical plastic packer bottles. Liquid bottles, however, is likely to witness a huge leap in demand in the near future, thanks to the retention of drugs content.

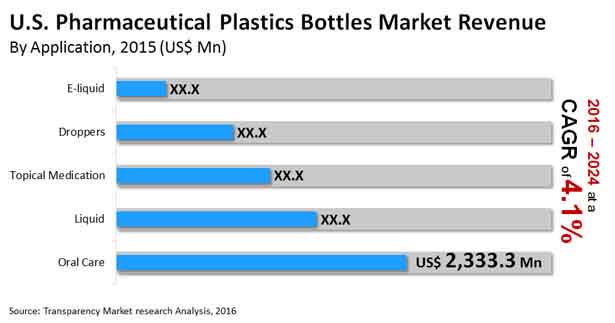

E-liquid, liquid, oral care, droppers, and topical medication are the prime application areas of pharmaceutical plastic bottles in the U.S. These bottles are likely to find a higher usage in oral care and topical medications than other application areas over the next few years.

Pharmaceutical companies, chemical companies, pharmaceutical packaging companies, healthcare centers, and compounding pharmacies are the main end users of pharmaceutical plastic bottles in the U.S. Among these, the demand from pharmaceutical companies is much higher than other end users. Analysts expect this scenario to remain so, thanks to the expansion of healthcare industry and the rising uptake of plastic material for packaging. The healthcare centers are also projected to experience an increase in the demand for pharmaceutical plastic bottles in the near future.

The U.S. market for pharmaceutical plastics bottles exhibits a highly fragmented and a competitive landscape. At the forefront of this market are Gerresheimer AG, AptarGroup Inc., Berry Plastics Group Inc., Amcor Ltd., Alpha Packaging, COMAR LLC, Drug Plastics, O. Berk Co. LLC, Pretium Packaging Corp., and Tim Plastics Inc.

U.S. Pharmaceutical Plastic Bottles Market - Snapshot

A wide range of pharmaceutical products for medication dispensing utilize containers, closures, and PET bottles as the plastic packaging. Rise in use of plastics in eye droppers, nasal sprays, nebulisers, applicators, droppers, and ointment jars is one of the key drivers for demand for pharmaceutical plastic bottles world over. The U.S. pharmaceutical plastic bottles market is making remarkable strides on the back of rising sales of prescription medicines and a thriving prescription retail sector in North America. Proliferating use of pharmaceutical plastics bottles for ophthalmic application is a key driver for the expansion of the U.S. pharmaceutical plastic bottles market. The need for packaging that help maintain the integrity of pharmaceutical formulations has kept manufacturers look for innovative solutions. The U.S. pharmaceutical plastic bottles market has also seen lucrative avenues from widespread popularity of packer bottles. Rise in use of oral care and topical formulations, including off-label medicines, has spurred the prospective demand in the market. Expansion of oral care demand in parts of the U.S. has also spurred the sales of pharmaceutical plastic bottles. However, the growing popularity of renewable packaging materials in various end-use industries has constrained the revenue potential in recent years.

Packaging companies are leaning on meeting tailored needs of leading pharmaceutical brands. Focus on this trend as a key strategy has become prominent over the years in the U.S. pharmaceutical plastic bottles market. The COVID-19 pandemic caused a massive disruptions in the value chain of packaging sector and hence the demand dynamic of end-use industries. While, some disruptions led to new revenue streams, some severely constrained the demand for some product categories in U.S. pharmaceutical plastic bottles market. Further, the stay-near or at-home restrictions in recent months of 2020 when the pandemic struck resulted in supply chain bottlenecks, hindering the availability of packaging solutions for pharmaceutical manufacturers. On the other hand, packaging sector and pharma business have been collaborating to adopt new business models to boost their prospects in post-pandemic world.

1. Executive Summary: U.S. Pharmaceutical Plastics Bottles Market

2. Assumptions and Acronyms

3. Research Methodology

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.2. Market Overview

5. Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunities

5.4. Key Trends

5.5. Industry Trends and Recent Developments

5.5.1. Composition Level Trends and Market Developments (Features, Neck Finish, Shape, Properties etc.)

5.5.2. Technology Level Trends and Market Developments

5.5.3. Business Level Trends and Market Developments

5.6. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, 2016 – 2024

5.6.1. Market Revenue and Volume Projections

5.7. U.S. Pharmaceutical Plastics Bottles Market - U.S. Supply Demand Scenario

5.8. Supply Chain Analysis

5.8.1. List of key market participants (suppliers/distributors/manufacturers/vendors)

5.9. Market Outlook

6. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, By Bottle Type

6.1. Market Snapshot

6.1.1. Market Share and BPS Analysis, By Bottle Type

6.1.2. Y-o-Y Growth Projections, By Bottle Type

6.1.3. Market Attractiveness Analysis, By Bottle Type

6.2. Market Size (US$ Mn), Volume (Mn Units) Forecast, By Bottle Type

6.2.1. Packer Bottles

6.2.2. Dropper Bottles

6.2.2.1. Eye Droppers

6.2.2.2. Ear Droppers

6.2.2.3. Nose Droppers

6.2.3. Liquid Bottles

6.2.4. Others (Boston Round Bottle, Bullet)

7. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, By Application

7.1. Market Snapshot

7.1.1. Market Share and BPS Analysis, By Application

7.1.2. Y-o-Y Growth Projections, By Application

7.1.3. Market Attractiveness Analysis, By Application

7.2. Market Size (US$ Mn) and Volume (Mn Units) Forecast, By Application

7.2.1. E Liquid

7.2.2. Liquid

7.2.3. Droppers

7.2.4. Oral care

7.2.5. Topical Medication

8. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, By Material Type

8.1. Market Snapshot

8.1.1. Market Share and BPS Analysis, By Material Type

8.1.2. Y-o-Y Growth Projections, By Material Type

8.1.3. Market Attractiveness Analysis, By Material Type

8.2. Market Size (US$ Mn) and Volume (Mn Units) Forecast, By Material Type

8.2.1. High-density polyethylene (HDPE)

8.2.2. Low-density polyethylene (LDPE)

8.2.3. Polyethylene terephthalate (PET)

8.2.4. Polypropylene (PP)

8.2.5. Polyvinyl chloride (PVC)

9. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, By Color Type

9.1. Market Snapshot

9.1.1. Market Share and BPS Analysis, By Color Type

9.1.2. Y-o-Y Growth Projections, By Color Type

9.1.3. Market Attractiveness Analysis, By Color Type

9.2. Market Size (US$ Mn) and Volume (Mn Units) Forecast, By Color Type

9.2.1. Clear/Transparent Bottles

9.2.2. Amber Bottles

9.2.3. Milky White

9.2.4. Others

10. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, By Size/Capacity

10.1. Market Snapshot

10.1.1. Market Share and BPS Analysis, By Size/Capacity

10.1.2. Y-o-Y Growth Projections, By Size/Capacity

10.1.3. Market Attractiveness Analysis, By Size/Capacity

10.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Size/Capacity

10.2.1. Less than 10 ml

10.2.2. 10 – 30 ml

10.2.3. 31 – 50 ml

10.2.4. 51 – 100 ml

10.2.5. 100 ml & Above

11. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, By Closure Type

11.1. Market Snapshot

11.1.1. Market Share and BPS Analysis, By Closure Type

11.1.2. Y-o-Y Growth Projections, By Closure Type

11.1.3. Market Attractiveness Analysis, By Closure Type

11.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Closure Type

11.2.1. Screw Cap

11.2.2. Crown Cap

11.2.3. Friction Fit

11.2.4. Others (Flat Top, Hole Caps, Metal Caps)

12. U.S. Pharmaceutical Plastics Bottles Market Analysis and Forecast, By End User

12.1. Market Snapshot

12.1.1. Market Share and BPS Analysis, By End User

12.1.2. Y-o-Y Growth Projections, By End User

12.1.3. Market Attractiveness Analysis, By End User

12.2. Market Size (US$ Mn) and Volume (Units) Forecast, By End User

12.2.1. Pharmaceutical Companies

12.2.2. Compounding Pharmacies

12.2.3. Chemical Companies

12.2.4. Healthcare Centers

12.2.5. Pharmaceutical Packaging Companies

13. Competition Landscape

13.1. Market Player – Competition Dashboard & Company Market Share Analysis

13.2. Company Profiles

13.2.1. Gerresheimer AG

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.2. AptarGroup, Inc

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.3. Berry Plastics Group, Inc.

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.4. Amcor Limited

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.5. Alpha Packaging

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.6. COMAR, LLC

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.7. Drug Plastics

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.8. O.Berk Company, LLC

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.9. Pretium Packaging Corporation

Overview

Financials

Recent Developments

SWOT

Strategy

13.2.10. Tim Plastics, Inc.

Overview

Financials

Recent Developments

SWOT

Strategy

List of Tables

Table 01: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) Analysis and Forecast by Bottle Type 2015–2024

Table 02: U.S. Pharmaceutical Plastics Bottles Market Volume (Mn Units) Analysis and Forecast by Bottle Type 2015–2024

Table 03: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) & Volume (Mn Units) Analysis and Forecast by Application 2015–2024

Table 04: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) Analysis and Forecast by Material Type 2015–2024

Table 05: U.S. Pharmaceutical Plastics Bottles Market Volume (Mn Units) Analysis and Forecast by Material Type 2015–2024

Table 06: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) & Volume (Mn Units) Analysis and Forecast by Color Type 2015–2024

Table 07: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) Analysis and Forecast by Size/Capacity 2015–2024

Table 08: U.S. Pharmaceutical Plastics Bottles Market Volume (Mn Units) Analysis and Forecast by Size/Capacity 2015–2024

Table 09: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) & Volume (Mn Units) Analysis and Forecast by Closure Type 2015–2024

Table 10: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) Analysis and Forecast by End User 2015–2024

Table 11: U.S. Pharmaceutical Plastics Bottles Market Volume (Mn Units) Analysis and Forecast by End User 2015–2024

List of Figures

Figure 01: U.S. Pharmaceutical Plastics Bottles Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 02: U.S. Pharmaceutical Plastics Bottles Market Absolute $ Opportunity, 2016-2024

Figure 03: U.S. Pharmaceutical Plastics Bottles Market Value Share & BPS Analysis, by Bottle Type, 2016 & 2024

Figure 04: U.S. Pharmaceutical Plastics Bottles Market, Y-o-Y Growth Comparison, by Bottle Type, 2015–2024

Figure 05: U.S. Pharmaceutical Plastics Bottles Market Attractiveness Analysis By Bottle Type, 2016–2024

Figure 06: U.S. Packer Bottles Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 07: U.S. Dropper Bottles Market Value (US$ Mn) & Volume (Mn Units) Forecast 2015–2024

Figure 08: U.S. Liquid Bottles Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 09: U.S. Others Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 10: U.S. Pharmaceutical Plastics Bottles Market Value Share & BPS Analysis, by Application, 2016 & 2024

Figure 11: U.S. Pharmaceutical Plastics Bottles Market, Y-o-Y Growth Comparison, by Application, 2015–2024

Figure 12: U.S. Pharmaceutical Plastics Bottles Market Attractiveness Analysis By Application, 2016–2024

Figure 13: U.S. E-liquid Market Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 14: U.S. Liquid Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 15: U.S. Droppers Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 16: U.S. Oral Care Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 17: U.S. Topical Medication Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 18: U.S. Pharmaceutical Plastics Bottles Market Value Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 19: U.S. Pharmaceutical Plastics Bottles Market, Y-o-Y Growth Comparison, by Material Type, 2015–2024

Figure 20: U.S. Pharmaceutical Plastics Bottles Market Attractiveness Analysis By Material Type, 2016–2024

Figure 21: U.S. HDPE Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 22: U.S. LDPE Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 23: U.S. PET Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 24: U.S. PP Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 25: U.S. PVC Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 26: U.S. Pharmaceutical Plastics Bottles Market Value Share & BPS Analysis, by Color Type, 2016 & 2024

Figure 27: U.S. Pharmaceutical Plastics Bottles Market, Y-o-Y Growth Comparison, by Color Type, 2015–2024

Figure 28: U.S. Pharmaceutical Plastics Bottles Market Attractiveness Analysis By Color Type, 2016–2024

Figure 29: U.S. Clear/Transparent Bottles Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 30: U.S. Milky White Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 31: U.S. Amber Bottles Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 32: U.S. Others Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 33: U.S. Pharmaceutical Plastics Bottles Market Value Share & BPS Analysis, by Size/Capacity, 2016 & 2024

Figure 34: U.S. Pharmaceutical Plastics Bottles Market, Y-o-Y Growth Comparison, by Size/Capacity, 2015–2024

Figure 35: U.S. Pharmaceutical Plastics Bottles Market Attractiveness Analysis By Size/Capacity, 2016–2024

Figure 36: U.S. Less than 10 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 37: U.S. 10-30 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 38: U.S. 31-50 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 39: U.S. 51-100 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 40: U.S. 100 ml & Above, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 41: U.S. Pharmaceutical Plastics Bottles Market Value Share & BPS Analysis, by Closure Type, 2016 & 2024

Figure 42: U.S. Pharmaceutical Plastics Bottles Market, Y-o-Y Growth Comparison, by Closure Type, 2015–2024

Figure 43: U.S. Pharmaceutical Plastics Bottles Market Attractiveness Analysis By Closure Type, 2016–2024

Figure 44: U.S. Screw Cap Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 45: U.S. Crown Cap Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 46: U.S. Screw Cap Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 47: U.S. Others Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 48: U.S. Pharmaceutical Plastics Bottles Market Value Share & BPS Analysis, by End User, 2016 & 2024

Figure 49: U.S. Pharmaceutical Plastics Bottles Market, Y-o-Y Growth Comparison, by End User, 2015–2024

Figure 50: U.S. Pharmaceutical Plastics Bottles Market Attractiveness Analysis By End User, 2016–2024

Figure 51: U.S. Less than 10 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 52: U.S. 10-30 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 53: U.S. 31-50 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 54: U.S. 51-100 ml, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024

Figure 55: U.S. 100 ml & Above, Size/Capacity Market Value (US$ Mn) & Volume (Mn Units) Forecast, 2015–2024