A continuously expanding healthcare industry, rising numbers of diagnostic tests, and flourishing medical devices and pharmaceutical industries have significantly contributed towards the exponentially rising medical waste volumes in the U.S. The U.S. medical waste is highly regulated by strict emission, disposal, and recycling norms. It has witnessed excellent expansion in the past few years, and technological developments, emergence of advanced and innovative disposal techniques, and sustained efforts by government and non-government bodies aimed at ensuring public safety from hazardous medical waste at a sustained pace.

The Drug Enforcement Administration (DEA) has collected over 2,100 tons of prescription medicines as of September 2010 across the country, reports show. Apart from being one of the largest producers of medical waste across the globe, the U.S. also has one of the most efficient medical waste management markets of the globe. Government bodies, several NGOs, and community-based organizations are constantly guiding healthcare facilities about devising proper ways of effective recycling and disposal of medical wastes in the country.

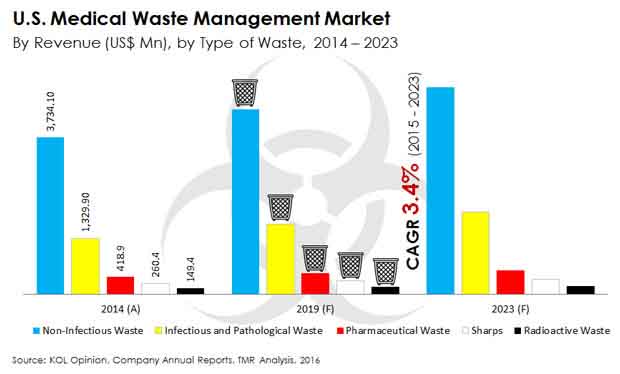

Non-infectious Waste Takes Lion’s Share in Market

A large portion of the overall medical waste generated in the U.S. is of the non-infectious variety. In 2014, non-infectious waste accounted for a dominant share of around 63% in the U.S. waste management market. In the same year, infectious waste accounted for the second-largest, 22.6%, share of the market, TMR says.

The rising number of diagnostic tests in the country is the prime reason behind the generation of vast volumes of infectious wastes from pathological labs in the country. Rising geriatric population and the relatively larger possibility of this demographic contracting serious illnesses provides a big boost to the demand for medical services and diagnostic tests, which are major contributors to the rising volumes of medical wastes.

Non-incineration Waste Disposal Practices are Now Preferred in the U.S.

Incineration of medical wastes has traditionally been the dominant medical waste management method in the U.S. However, incineration leads to the emission of several harmful gases such as carbon monoxide, sulfur dioxide, and dioxins, which contribute to global warming. The Environment Protection Agency (EPA) has made air emission limits more stringent in the country, compelling waste management companies to switch cleaner ways of handling medical waste.

This has led to the increased adoption of non-incineration technologies such as steam autoclave treatment, non-ionization radiation treatment, a variety of chemical treatments in the past few years. Non-incineration technologies are also gaining increased popularity owing to their less capital intensive nature and the possibility of turning waste into resource efficient materials using these techniques.

Large Companies Face Stiff Competition from Small-sized Local Vendors

The U.S. market for medical waste management features the presence of a large number of small-sized local vendors and only a few large companies. In 2014, small-sized companies in the market accounted for a massive share of 53.1% in the market, while Stericycle, the most prominent large-scale company in the market held a share of 23.2%.

Mergers with and acquisitions of smaller companies are thus the most beneficial growth opportunities for new entrants and existing vendors in the market. Acquisition of smaller companies allows large-sized vendors in enhancing their operational efficiencies and expanding their service capabilities and consumer base in the U.S. medical waste management market.

Table of Content

1. Preface

1.1 Report Description

1.2 Market Segmentation

1.3 Assumptions

2. Executive Summary

2.1 U.S. Medical Waste Management Market: Market Snapshot

2.2 U.S. Medical Waste Management Market Revenue, by Type of Waste, (US$ Mn), 2014

2.3 U.S. Medical Waste Management Market Share, by Type of Waste

2.4 U.S. Medical Waste Management Market Share, by Service

2.5 U.S. Pharmaceutical Waste Management Market, by Substance Generator, (US$ Mn), 2014

3. U.S. Medical Waste Management Market– Market Overview

3.1 Introduction

3.2 Regulations: U.S. Medical Waste Management Market

3.3 Best Management Practices: U.S. Medical Waste Management Market

3.4 Value Chain Analysis: U.S. Medical Waste Management Market

3.5 Market Dynamics

3.5.1 Driver1 - Positive government initiatives to manage pharmaceutical or medical waste

3.5.2 Driver 2 - Active participation of non-government organizations (NGOs) in medical waste management

3.5.3 Driver 3 - Aging population is expected to boost market growth

3.5.4 Driver 4 - Technological advancements

3.5.5 Driver 5 - Growing health care and pharmaceutical industries

3.5.6 Restraint 1 - High initial capital investment

3.5.7 Restraint 2 - Intense competition from local players

3.5.8 Opportunity 1- Focus on small quantity waste generators

3.6 Porter’s Five Forces Analysis: U.S. Medical Waste Management Market

3.7 Market Share Analysis: U.S. Medical Waste Management Market (Value %)

4 Market Segmentation – Medical Waste Management: by Type of Waste

4.1 Introduction

4.2 U.S. Sharps Waste Market Revenue, (US$ Mn), 2013–2023

4.3 U.S. Infectious and Pathological Waste Market Revenue, (US$ Mn), 2013–2023

4.4 U.S. Non-infectious Waste Market Revenue, (US$ Mn), 2013–2023

4.5 U.S. Radioactive Waste Market Revenue, (US$ Mn), 2013–2023

4.6 U.S. Pharmaceutical Waste Market Revenue, (US$ Mn), 2013–2023

5 Market Segmentation – By Geography

5.1 Introduction

5.2 U.S. Collection, Transportation, and Storage Market Revenue, (US$ Mn), 2013–2023

5.3 U.S. Waste Treatment Market Revenue, (US$ Mn), 2013–2023

5.4 U.S. Disposable Method Market Revenue, (US$ Mn), 2013–2023

6 Market Segmentation - Pharmaceutical Waste Management Market: by Category

6.1 U.S. Pharmaceutical Waste Management Market Revenue, by Category, (US$ Mn), 2013–2023

6.2 U.S. Pharmaceutical Waste Management Market Volume, by Category, (Tons), 2013–2023

6.3 Controlled Pharmaceutical Waste Market Revenue, (US$ Mn), 2013–2023

6.4 Controlled Pharmaceutical Waste Market Volume, (Tons), 2013–2023

6.5 Uncontrolled Pharmaceutical Waste Market Revenue, (US$ Mn), 2013–2023

6.6 Uncontrolled Pharmaceutical Waste Market Volume, (Tons), 2013–2023

7 Market Segmentation - Pharmaceutical Waste Management: by Types

7.1 U.S. Pharmaceutical Waste Management Market, by Types, (US$ Mn), 2013–2023

7.2 Hazardous Pharmaceutical Waste Management Market Revenue, (US$ Mn), 2013–2023

7.3 Non-hazardous Pharmaceutical Waste Management Market Revenue, (US$ Mn), 2013–2023

8 Market Segmentation - Pharmaceutical Waste Management: by Substance Generator

8.1 U.S. Pharmaceutical Waste Management Market, by Substance Generator, (US$ Mn), 2013–2023

8.2 Hospitals Waste Management Market Revenue, (US$ Mn), 2013–2023

8.3 Physician Offices Waste Management Market Revenue, (US$ Mn), 2013–2023

8.4 Clinical Laboratories Waste Management Market Revenue, (US$ Mn), 2013–2023

8.5 Manufacturer Waste Management Market Revenue, (US$ Mn), 2013–2023

8.6 Reverse Distributors Waste Management Market Revenue, (US$ Mn), 2013–2023

9 Recommendations

9.1 Recommendation 1 - Broadening of service offerings

9.2 Recommendation 2 – Increase the adoption of non-incinerated waste management technologies

9.3 Recommendation 3 – Acquisition of companies with complementary strengths

9.4 Recommendation 4 – Focus on strengthening network of processing and transportation locations

10 Company Profiles

10.1 Clean Harbors, Inc.

10.2 Republic Services Inc.

10.3 Sharps Compliance, Inc.

10.4 Stericycle Inc.

10.5 Suez Environmental Services

10.6 U.S. Ecology Inc.

10.7 Veolia Environmental Services

10.8 Waste Management Inc.

List of Tables

TABLE 1 U.S. Medical Waste Management Market: Market Snapshot

TABLE 2 U.S. Medical Waste Management Market: Market Snapshot

TABLE 3 U.S. Medical Waste Management Market, by Type of Waste, (US$ Mn), 2013–2023

TABLE 4 U.S. Medical Waste Management Market, by Services, (US$ Mn), 2013–2023

TABLE 5 U.S. Pharmaceutical Waste Management Market Revenue, by Category, (US$ Mn), 2013–2023

TABLE 6 U.S. Pharmaceutical Waste Management Market Volume, by Category, (Tons), 2013–2023

TABLE 7 U.S. Pharmaceutical Waste Management Market, by Types, (US$ Mn), 2013–2023

TABLE 8 U.S. Pharmaceutical Waste Management Market, by Substance Generator, (US$ Mn), 2013–2023

List of Figures

FIG. 1 Executive Summary: U.S. Medical Waste Management Market, by Type of Waste, 2014 & 2023 (Value %)

FIG. 2 Executive Summary: U.S. Medical Waste Management Market, by Services, 2014 & 2023 (Value %)

FIG. 3 U.S. Pharmaceutical Waste Management Market Share, by Substance Generator, 2014 & 2023 (Value %)

FIG. 4 Market Share Analysis: U.S. Medical Waste Management Market (Value %)

FIG. 5 U.S. Sharps Waste Market Revenue, (US$ Mn), 2013–2023

FIG. 6 U.S. Infectious and Pathological Waste Market Revenue, (US$ Mn), 2013–2023

FIG. 7 U.S. Non-infectious Waste Market Revenue, (US$ Mn), 2013–2023

FIG. 8 U.S. Radioactive Waste Market Revenue, (US$ Mn), 2013–2023

FIG. 9 U.S. Pharmaceutical Waste Market Revenue, (US$ Mn), 2013–2023

FIG. 10 U.S. Collection, Transportation, and Storage Market Revenue, (US$ Mn), 2013–2023

FIG. 11 U.S. Waste Treatment Market Revenue, (US$ Mn), 2013–2023

FIG. 12 U.S. Disposable Method Market Revenue, (US$ Mn), 2013–2023

FIG. 13 U.S. Controlled Pharmaceutical Waste Market Revenue, (US$ Mn), 2013–2023

FIG. 14 U.S. Controlled Pharmaceutical Waste Market Volume, (Tons), 2013–2023

FIG. 15 U.S. Uncontrolled Pharmaceutical Waste Market Revenue, (US$ Mn), 2013–2023

FIG. 16 U.S. Uncontrolled Pharmaceutical Waste Market Volume, (Tons), 2013–2023

FIG. 17 U.S. Hazardous Pharmaceutical Waste Management Market Revenue, (US$ Mn), 2013–2023

FIG. 18 U.S. Non-hazardous Pharmaceutical Waste Management Market Revenue, (US$ Mn), 2013–2023

FIG. 19 U.S. Hospitals Waste Management Market Revenue, (US$ Mn), 2013–2023

FIG. 20 U.S. Physician Offices Waste Management Market Revenue, (US$ Mn), 2013–2023

FIG. 21 U.S. Clinical Laboratories Waste Management Market Revenue, (US$ Mn), 2013–2023

FIG. 22 U.S. Manufacturer Waste Management Market Revenue, (US$ Mn), 2013–2023

FIG. 23 U.S. Reverse Distributors Waste Management Market Revenue, (US$ Mn), 2013–2023