U.S. and China Asthma and COPD Drugs Market: Snapshot

The U.S. and China market for asthma and chronic obstructive pulmonary disease (COPD) drugs is expected to exhibit growth at a steady pace in the next few years. Factors such as a significant rise prevalence of COPD and asthma in these two countries, advancements in diagnostic methods, and rising awareness among patients regarding the available treatment methods are considered key to the overall growth of the market over the period 2016–2024.

The market is expected to exhibit growth at a moderate pace in the first few years of the forecast period, chiefly owing to the patent expiries of leading drugs and the subsequent price erosion. However, the market is expected to witness new drug candidates by 2020, which will help the market tread along a better growth path in the forthcoming years.

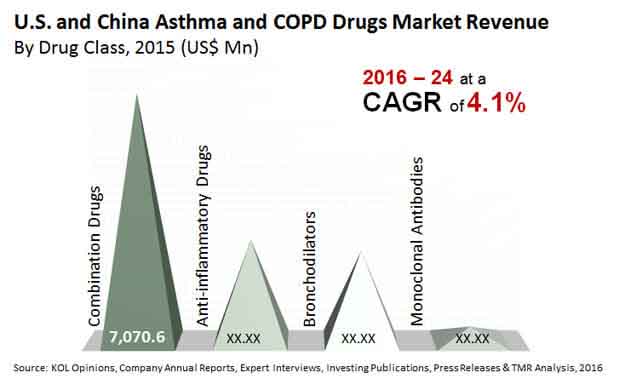

Transparency Market Research estimates that the market will exhibit a 4.1% CAGR from 2016 through 2024, rising to a valuation of US$18.7 bn by 2024 from US$13.0 bn in 2015.

Combination Drugs Sales to Constitute Bulk of Revenue

On the basis of drug classes in the U.S. and China asthma and COPD drugs market, the report examines the future scope of growth for varieties such as bronchodilators, anti-inflammatory drugs, monoclonal antibodies, and combination drugs.

Of these, the segment of combination drugs is presently the leading segment. It accounted for a 54% of the U.S. and China asthma and COPD drugs market in 2015 and is expected to continue to dominate throughout the report’s forecast period. Combination drugs benefit from the recommendations from agencies such as Global Initiative for Chronic Obstructive Lung Disease (GOLD) and Global Initiative for Asthma (GINA), which regard combination drugs as the safer course of managing asthma and COPD.

The segment of monoclonal antibodies is expected to emerge as a prominent drug class for the management of asthma and COPD in the next few years. Emergence of new drug candidates in this segment will bolster its growth potential in the market during the report’s forecast period.

High Costs of Asthma and COPD Drugs and Consumer Awareness make U.S. the Clear Leader

In the U.S. and China market for asthma and COPD drugs, the U.S. market clearly dominates, accounting for a more than 81% of the overall market in 2016. The key factors to have benefitted the U.S. market, despite it being a relatively smaller market in terms of population, include the high costs of asthma and COPD drugs and a high level of attentiveness paid by consumers to healthcare and wellness. The U.S. market also contributes significantly to the overall asthma and COPD drugs market through regular product launches and high investments by leading companies for R&D in the areas of combination therapies and biologics.

Although China presently accounts for a relatively smaller share in the U.S. and China asthma and COPD drugs market, the country is expected to present attractive growth opportunities in the next few years. The China market for asthma and COPD drugs will exhibit an impressive 10% CAGR over the period between 2016 and 2024. The key factors attributable to this projection are the rising number of asthma patients, owing chiefly to rising levels of air pollution, and a vast array of unmet medical needs.

The rising prevalence of COPD in the country is chiefly owing to the high and rising number of smokers. The China market for asthma and COPD drugs also comes across as a more attractive market than the U.S. market owing to a low level of competition and high rate of growth.

Some of the leading vendors presently operating in the U.S. and China asthma and COPD drugs market profiled in the report are Boehringer Ingelheim, GlaxoSmithKline plc, Merck and Co., Inc., Novartis AG, AstraZeneca plc, and F. Hoffmann-La Roche.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: U.S. and China Asthma and COPD Drugs Market

Chapter 4. Market Overview

4.1. Introduction

4.2. Key Industry Developments

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Forces Analysis

Chapter 5. U.S. and China Asthma and COPD Drugs Market Analysis and Forecast, By Drug Class

5.1. Key Findings

5.2. Introduction

5.3. Market Size (US$ Mn) Forecast, by Drug Class

5.3.1. Bronchodilators

5.3.1.1. Short Acting Beta-2 Agonists

5.3.1.2. Long Acting Beta-2 Agonists

5.3.1.3. Anti-cholinergic Agents

5.3.2. Anti-inflammatory Drugs

5.3.2.1. Oral and Inhaled Corticosteroids

5.3.2.2. Anti-leukotrienes

5.3.2.3. Phosphodiesterase Type-4 Inhibitors

5.3.2.4. Others

5.3.3. Monoclonal Antibodies

5.3.4. Combination Drugs

5.4. Market Attractiveness Analysis, by Drug Class, 2015

5.5. Key Trends

Chapter 6. U.S. and China Asthma and COPD Drugs Market Analysis and Forecast, By Indication

6.1. Key Findings

6.2. Introduction

6.3. Market Size (US$ Mn) Forecast, by Indication

6.3.1. Asthma

6.3.2. COPD

6.4. Market Attractiveness Analysis, by Indication, 2015

6.5. Key Trends

Chapter 7. U.S. and China Asthma and COPD Drugs Market Analysis and Forecast, By Region

7.1. Market Scenario

7.2. Introduction

7.3. Market Size (US$ Mn) Forecast, by Region

7.3.1. U.S.

7.3.2. China

7.4. Market Attractiveness Analysis, by Region, 2015

Chapter 8. U.S. Asthma and COPD Drugs Market Analysis and Forecast

8.1. Key Findings

8.2. Introduction

8.3. Market Size (US$ Mn) Forecast, by Drug Class

8.3.1. Bronchodilators

8.3.1.1. Short Acting Beta-2 Agonists

8.3.1.2. Long Acting Beta-2 Agonists

8.3.1.3. Anti-cholinergic Agents

8.3.2. Anti-inflammatory Drugs

8.3.2.1. Oral and Inhaled Corticosteroids

8.3.2.2. Anti-leukotrienes

8.3.2.3. Phosphodiesterase Type-4 Inhibitors

8.3.2.4. Others

8.3.3. Monoclonal Antibodies

8.3.4. Combination Drugs

8.4. Market Size (US$ Mn) Forecast, by Indication

8.4.1. Asthma

8.4.2. COPD

8.4.3. Canada

8.5. Market Attractiveness Analysis, by Drug Class, 2015

8.6. Market Attractiveness Analysis, by Indication, 2015

8.7. Key Trends

Chapter 9. China Asthma and COPD Drugs Market Analysis and Forecast

9.1. Key Findings

9.2. Introduction

9.3. Market Size (US$ Mn) Forecast, by Drug Class

9.3.1. Bronchodilators

9.3.1.1. Short Acting Beta-2 Agonists

9.3.1.2. Long Acting Beta-2 Agonists

9.3.1.3. Anti-cholinergic Agents

9.3.2. Anti-inflammatory Drugs

9.3.2.1. Oral and Inhaled Corticosteroids

9.3.2.2. Anti-leukotrienes

9.3.2.3. Phosphodiesterase Type-4 Inhibitors

9.3.2.4. Others

9.3.3. Monoclonal Antibodies

9.3.4. Combination Drugs

9.4. Market Size (US$ Mn) Forecast, by Indication

9.4.1. Asthma

9.4.2. COPD

9.4.3. Canada

9.5. Market Attractiveness Analysis, by Drug Class, 2015

9.6. Market Attractiveness Analysis, by Indication, 2015

9.7. Key Trends

Chapter 10. Competition Landscape

10.1. Global Asthma and COPD Drugs Market Share Analysis, Key Players, 2015

10.2. Competition Matrix

10.3. Company Profiles

10.3.1. AstraZeneca plc

10.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.1.2. Financial Overview

10.3.1.3. Product Portfolio

10.3.1.4. SWOT Analysis

10.3.1.5. Strategic Overview

10.3.2. Boehringer Ingelheim GmbH

10.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.2.2. Financial Overview

10.3.2.3. Product Portfolio

10.3.2.4. SWOT Analysis

10.3.2.5. Strategic Overview

10.3.3. F Hoffmann-La Roche Ltd.

10.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

10.3.3.2. Financial Overview

10.3.3.3. Product Portfolio

10.3.3.4. SWOT Analysis

10.3.4. GlaxoSmithKline plc

10.3.4.1. Company Overview (HQ, business segments, employee strength)

10.3.4.2. Financial Overview

10.3.4.3. Product Portfolio

10.3.4.4. SWOT Analysis

10.3.4.5. Strategic Overview

10.3.5. Merck & Co., Inc.

10.3.5.1. Company Overview (HQ, business segments, employee strength)

10.3.5.2. Product Portfolio

10.3.5.3. SWOT Analysis

10.3.5.4. Recent Developments

10.3.5.5. Strategic Overview

10.3.6. Novartis AG

10.3.6.1. Company Overview (HQ, business segments, employee strength)

10.3.6.2. Financial Overview

10.3.6.3. Product Portfolio

10.3.6.4. SWOT Analysis

10.3.6.5. Strategic Overview

List of Tables

Table 1: U.S. and China Asthma and COPD Drugs Market Size Analysis and Forecast (US$ Mn), by Drug Class, 2014–2024

Table 2: U.S. and China Asthma and COPD Drugs Market Size Analysis and Forecast (US$ Mn), by Indication, 2014–2024

Table 3: U.S. and China Asthma and COPD Drugs Market Size Analysis and Forecast (US$ Mn), by Region, 2014–2024

Table 4: U.S. Asthma and COPD Drugs Market Size Analysis and Forecast (US$ Mn), by Drug Class, 2014–2024

Table 5: U.S. Asthma and COPD Drugs Market Size Analysis and Forecast (US$ Mn), by Indication Type, 2014–2024

Table 6: China Asthma and COPD Drugs Market Size Analysis and Forecast (US$ Mn), by Drug Class, 2014–2024

Table 7: China Asthma and COPD Drugs Market Size Analysis and Forecast (US$ Mn), by Indication, 2014–2024

List of Figures

Figure 1: U.S. and China Asthma and COPD Drugs Market Size (US$ Mn), 2014–2024

Figure 2: U.S. and China Asthma and COPD Drugs Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 3: U.S. and China Bronchodilators Market Revenue (US$ Mn), 2014–2024

Figure 4: U.S. and China Anti-inflammatory Drugs Market Revenue (US$ Mn), 2014–2024

Figure 5: U.S. and China Monoclonal Antibodies Market Revenue (US$ Mn), 2014–2024

Figure 6: U.S. and China Combination Drugs Market Revenue (US$ Mn), 2014–2024

Figure 7: U.S. and China Asthma and COPD Drugs Attractiveness Analysis, by Drug Class, 2015

Figure 8: U.S. and China Asthma and COPD Drugs Value Share Analysis, by Indication, 2016 and 2024

Figure 9: U.S. and China Asthma Market Revenue (US$ Mn), 2014–2024

Figure 10: U.S. and China COPD Market Revenue (US$ Mn), 2014–2024

Figure 11: U.S. and China Asthma and COPD Drugs Attractiveness Analysis, by Indication, 2015

Figure 12: Global U.S. and China Asthma and COPD Drugs Value Share Analysis, by Region, 2016 and 2024

Figure 13: U.S. and China Asthma and COPD Drugs Attractiveness Analysis, by Region, 2015

Figure 14: U.S. Asthma and COPD Drugs Market Size (US$ Mn), 2014–2024

Figure 15: U.S. Asthma and COPD Drugs Market Y-o-Y Growth Projections, 2015–2024

Figure 16: U.S. Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 17: U.S. Market Value Share Analysis, by Indication, 2016 and 2024

Figure 18: U.S. Asthma and COPD Drugs Market Analysis and Forecast, US$ Mn, by Drug Class, 2014–2024

Figure 19: U.S. Asthma and COPD Drugs Market Analysis and Forecast, US$ Mn, by Indication, 2014–2024

Figure 20: U.S. Asthma and COPD Drugs Market Attractiveness Analysis, by Drug Class, 2015

Figure 21: U.S. Asthma and COPD Drugs Market Attractiveness Analysis, by Indication, 2015

Figure 22: China Asthma and COPD Drugs Market Size (US$ Mn), 2014–2024

Figure 23: China Asthma and COPD Drugs Market Y-o-Y Growth Projections, 2015–2024

Figure 24: China Market Value Share Analysis, by Drug Class, 2016 and 2024

Figure 25: China Market Value Share Analysis, by Indication, 2016 and 2024

Figure 26: China Asthma and COPD Drugs Market Analysis and Forecast, US$ Mn, by Drug Class, 2014–2024

Figure 27: China Asthma and COPD Drugs Market Analysis and Forecast, US$ Mn, by Indication, 2014–2024

Figure 28: China Asthma and COPD Drugs Market Attractiveness Analysis, by Drug Class, 2015

Figure 29: China Asthma and COPD Drugs Market Attractiveness Analysis, by Indication, 2015

Figure 30: Global Asthma and COPD Drugs Market Share Analysis, by Company (2015)