Reports

Reports

Analyst Viewpoint

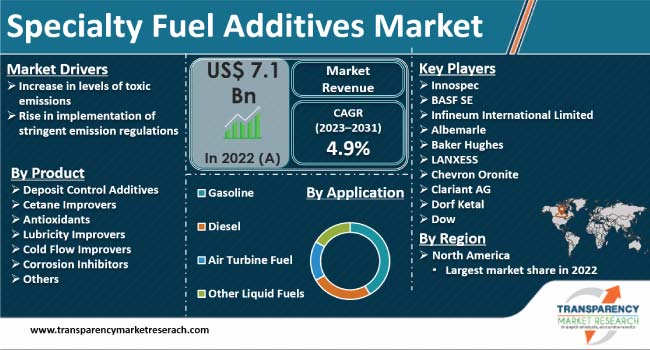

Increase in levels of toxic emissions and rise in implementation of stringent emission regulations are projected to propel the specialty fuel additives market size during the forecast period. Governments in various countries are encouraging the usage of Ultra-low-sulfur diesel (ULSD), wherein the use of specialty additives is crucial.

Multifunctional additives are gaining popularity in diesel, gasoline, and other fuels as they help address multiple issues related to fuel performance, engine efficiency, emissions, and equipment durability. Vendors in the global specialty fuel additives industry are investing in the development of advanced facilities to expand their manufacturing capabilities.

Specialty fuel additives and fuel performance enhancers are used to boost the quality and efficiency of fuels used in Internal Combustion Engine (ICE) vehicles. These additives increase the fuel octane rating. Specialty fuel additives, also known as fuel treatment chemicals, act as corrosion inhibitors or lubricants. Specialty gasoline additives help improve fuel performance. Specialty fuel additives aid in reducing carbon footprint. Thus, rise in focus on carbon emission is projected to spur the specialty fuel additives market growth in the near future.

According to the UN Environment Program’s (UNEP) Pollution Action Note, air pollution is amongst the greatest environmental threats to public health worldwide and accounts for close to 7 million premature fatalities per year. Air pollution is caused due to the rise in levels of toxic emissions in the form of nitrous oxides, sulfur dioxide, and carbon monoxide.

As per the World Health Organization (WHO), ambient air pollution accounts for over 16% of lung cancer fatalities, more than 17% of ischemic heart disease, 25% of Chronic Obstructive Pulmonary Disease (COPD) deaths, and close to 26% of respiratory infection deaths. Toxic gases generated from automobiles and the manufacturing sector are contributing to air pollution. Thus, advanced fuel additives are in high demand around the world to reduce the emission of these toxic gases. These additives help enhance the efficiency of distillates, gasoline, diesel, and other fuels by reducing rates of burns and combustion at high temperatures. They also help remove harmful deposits, which render better power and acceleration to the engine.

Various governments in countries in North America and Europe are emphasizing limiting the average carbon dioxide emissions produced by new passenger cars. In the U.S., Corporate Average Fuel Economy standards are aimed at improving the average fuel efficiency of cars and light trucks sold in the country. In Europe, a similar set of regulations set limits on the average carbon dioxide emissions produced by new passenger cars. Thus, implementation of stringent emission regulations is fueling the specialty fuel additives market value.

Specialty fuel additives are used with biodiesel blends to attain efficient cold-flow performance. Ultra-low-sulfur diesel (ULSD) is gaining traction among end-users. It requires additives in higher concentrations. Multifunctional additives are also gaining popularity in diesel, gasoline, and other fuels. Direct injection of petrol technology is becoming a norm these days. Moreover, R&D in low-temperature homogeneous charge compression ignition (LT-HCCI) combustion is propelling the specialty fuel additives industry progress. LT-HCCI aids in improving thermal efficiency and reducing emissions compared to traditional combustion technologies.

According to the latest specialty fuel additives market forecast, North America is projected to hold largest share from 2023 to 2031. Implementation of stringent emission regulations is fueling the market dynamics of the region. In December 2021, the U.S. Environmental Protection Agency (EPA) issued novel greenhouse gas standards for light trucks and passenger cars; effective for the 2023 vehicle model year.

Rise in adoption of energy-efficient road transport vehicles is driving the specialty fuel additives market statistics in Europe. Surge in usage of environmentally-friendly vehicles is augmenting the demand for specialty fuel additives.in Asia Pacific. Japan, India, and China are major markets for specialty fuel additives in the region. Implementation of stringent emission regulations is propelling the fuel additives market expansion in Japan. The Ministry of the Environment (MOE) in the country adopted the “Law Concerning Special Measures to Reduce the Total Amount of Nitrogen Oxides Emitted from Motor Vehicles in Specified Areas”, called in short “The Motor Vehicle NOx Law, to control the emission of NOx from in-use vehicles.

Key players are investing in the R&D of cost-effective fuel efficiency additives for heavy-duty trucks. They are also developing high-performance specialty fuel additives for diesel engines and streamlining the pre- and post-production processes to boost their production capabilities. Most companies are adopting M&A and partnership strategies to increase their specialty fuel additives market share.

Innospec, BASF SE, Infineum International Limited, Albemarle, Baker Hughes, LANXESS, Chevron Oronite, Clariant AG, Dorf Ketal, Dow, Eurenco, Evonik Industries, The Lubrizol Corporation, Ecolab, Rheochemie GmbH, and TotalEnergies are key companies operating in this market. Each of these companies has been profiled in the specialty fuel additives market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 7.1 Bn |

| Market Forecast Value in 2031 | US$ 10.9 Bn |

| Growth Rate (CAGR) | 4.9% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 7.1 Bn in 2022

It is projected to grow at a CAGR of 4.9% from 2023 to 2031

Increase in levels of toxic emissions and rise in implementation of stringent emission regulations

The gasoline segment held the largest share in 2022

North America is estimated to hold largest share from 2023 to 2031

Innospec, BASF SE, Infineum International Limited, Albemarle, Baker Hughes, LANXESS, Chevron Oronite, Clariant AG, Dorf Ketal, Dow, Eurenco, Evonik Industries, The Lubrizol Corporation, Ecolab, Rheochemie GmbH, and TotalEnergies

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Specialty Fuel Additives Market Analysis and Forecast, 2023-2031

2.6.1. Global Specialty Fuel Additives Market Volume (Kilo Tons)

2.6.2. Global Specialty Fuel Additives Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Specialty Fuel Additives

3.2. Impact on Demand for Specialty Fuel Additives– Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Product

6.2. Price Trend Analysis by Region

7. Global Specialty Fuel Additives Market Analysis and Forecast, by Product, 2023-2031

7.1. Introduction and Definitions

7.2. Global Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

7.2.1. Deposit Control Additives

7.2.2. Cetane Improver

7.2.3. Antioxidants

7.2.4. Lubricity Improvers

7.2.5. Cold Flow Improvers

7.2.6. Corrosion Inhibitors

7.2.7. Others

7.3. Global Specialty Fuel Additives Market Attractiveness, by Product

8. Global Specialty Fuel Additives Market Analysis and Forecast, by Application, 2023-2031

8.1. Introduction and Definitions

8.2. Global Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

8.2.1. Gasoline

8.2.2. Diesel

8.2.3. Air Turbine Fuel

8.2.4. Other Liquid Fuels

8.3. Global Specialty Fuel Additives Market Attractiveness, by Application

9. Global Specialty Fuel Additives Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Specialty Fuel Additives Market Attractiveness, by Region

10. North America Specialty Fuel Additives Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

10.3. North America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.4. North America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

10.4.1. U.S. Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

10.4.2. U.S. Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.4.3. Canada Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

10.4.4. Canada Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.5. North America Specialty Fuel Additives Market Attractiveness Analysis

11. Europe Specialty Fuel Additives Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

11.3. Europe Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4. Europe Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.2. Germany. Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4.3. France Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

11.4.4. France. Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4.5. U.K. Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

11.4.6. U.K. Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4.7. Italy Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

11.4.8. Italy Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4.9. Russia & CIS Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

11.4.10. Russia & CIS Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4.11. Rest of Europe Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

11.4.12. Rest of Europe Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.5. Europe Specialty Fuel Additives Market Attractiveness Analysis

12. Asia Pacific Specialty Fuel Additives Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product

12.3. Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4. Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

12.4.2. China Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4.3. Japan Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

12.4.4. Japan Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4.5. India Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

12.4.6. India Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4.7. ASEAN Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

12.4.8. ASEAN Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4.9. Rest of Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

12.4.10. Rest of Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.5. Asia Pacific Specialty Fuel Additives Market Attractiveness Analysis

13. Latin America Specialty Fuel Additives Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

13.3. Latin America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.4. Latin America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

13.4.2. Brazil Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.4.3. Mexico Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

13.4.4. Mexico Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.4.5. Rest of Latin America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

13.4.6. Rest of Latin America Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.5. Latin America Specialty Fuel Additives Market Attractiveness Analysis

14. Middle East & Africa Specialty Fuel Additives Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.3. Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.4. Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.4.2. GCC Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.4.3. South Africa Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.4.4. South Africa Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.4.5. Rest of Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.4.6. Rest of Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.5. Middle East & Africa Specialty Fuel Additives Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Specialty Fuel Additives Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Innospec

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. BASF SE

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. Infineum International Limited

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. Albemarle

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. Baker Hughes

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. LANXESS

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. Chevron Oronite

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. Clariant AG

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Dorf Ketal

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Dow

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Eurenco

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.12. Evonik Industries

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.13. The Lubrizol Corporation

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.14. Ecolab

15.2.14.1. Company Revenue

15.2.14.2. Business Overview

15.2.14.3. Product Segments

15.2.14.4. Geographic Footprint

15.2.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.15. Rheochemie GmbH

15.2.15.1. Company Revenue

15.2.15.2. Business Overview

15.2.15.3. Product Segments

15.2.15.4. Geographic Footprint

15.2.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.16. TotalEnergies

15.2.16.1. Company Revenue

15.2.16.2. Business Overview

15.2.16.3. Product Segments

15.2.16.4. Geographic Footprint

15.2.16.5. Production Capacity/Plant Details, etc. (*As Applicable)

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 2: Global Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 3: Global Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 4: Global Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 5: Global Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Region, 2023-2031

Table 6: Global Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 7: North America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 8: North America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 9: North America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 10: North America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 11: North America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Country, 2023-2031

Table 12: North America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 13: U.S. Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 14: U.S. Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 15: U.S. Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 16: U.S. Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 17: Canada Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 18: Canada Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 19: Canada Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 20: Canada Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 21: Europe Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 22: Europe Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 23: Europe Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 24: Europe Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 25: Europe Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 26: Europe Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 27: Germany Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 28: Germany Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 29: Germany Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 30: Germany Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 31: France Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 32: France Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 33: France Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 34: France Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 35: U.K. Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 36: U.K. Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 37: U.K. Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 38: U.K. Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 39: Italy Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 40: Italy Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 41: Italy Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 42: Italy Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 43: Spain Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 44: Spain Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 45: Spain Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 46: Spain Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 47: Russia & CIS Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 48: Russia & CIS Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 49: Russia & CIS Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 50: Russia & CIS Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 51: Rest of Europe Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 52: Rest of Europe Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 53: Rest of Europe Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 54: Rest of Europe Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 55: Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 56: Asia Pacific Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 57: Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 58: Asia Pacific Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 59: Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 60: Asia Pacific Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 61: China Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 62: China Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product 2023-2031

Table 63: China Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 64: China Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 65: Japan Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 66: Japan Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 67: Japan Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 68: Japan Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 69: India Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 70: India Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 71: India Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 72: India Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 73: ASEAN Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 74: ASEAN Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 75: ASEAN Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 76: ASEAN Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 77: Rest of Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 78: Rest of Asia Pacific Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 79: Rest of Asia Pacific Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 80: Rest of Asia Pacific Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 81: Latin America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 82: Latin America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 83: Latin America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 84: Latin America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 85: Latin America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Latin America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 87: Brazil Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 88: Brazil Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 89: Brazil Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 90: Brazil Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 91: Mexico Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 92: Mexico Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 93: Mexico Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 94: Mexico Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 95: Rest of Latin America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 96: Rest of Latin America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 97: Rest of Latin America Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 98: Rest of Latin America Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 99: Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 100: Middle East & Africa Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 101: Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 102: Middle East & Africa Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 103: Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 104: Middle East & Africa Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 105: GCC Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 106: GCC Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 107: GCC Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 108: GCC Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 109: South Africa Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 110: South Africa Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 111: South Africa Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 112: South Africa Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 113: Rest of Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Product, 2023-2031

Table 114: Rest of Middle East & Africa Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 115: Rest of Middle East & Africa Specialty Fuel Additives Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 116: Rest of Middle East & Africa Specialty Fuel Additives Market Value (US$ Bn) Forecast, by Application, 2023-2031

List of Figures

Figure 1: Global Specialty Fuel Additives Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 2: Global Specialty Fuel Additives Market Attractiveness, by Product

Figure 3: Global Specialty Fuel Additives Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Global Specialty Fuel Additives Market Attractiveness, by Application

Figure 5: Global Specialty Fuel Additives Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Specialty Fuel Additives Market Attractiveness, by Region

Figure 7: North America Specialty Fuel Additives Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 8: North America Specialty Fuel Additives Market Attractiveness, by Product

Figure 9: North America Specialty Fuel Additives Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 10: North America Specialty Fuel Additives Market Attractiveness, by Application

Figure 11: North America Specialty Fuel Additives Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: North America Specialty Fuel Additives Market Attractiveness, by Country

Figure 13: Europe Specialty Fuel Additives Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 14: Europe Specialty Fuel Additives Market Attractiveness, by Product

Figure 15: Europe Specialty Fuel Additives Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 16: Europe Specialty Fuel Additives Market Attractiveness, by Application

Figure 17: Europe Specialty Fuel Additives Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Specialty Fuel Additives Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Specialty Fuel Additives Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 20: Asia Pacific Specialty Fuel Additives Market Attractiveness, by Product

Figure 21: Asia Pacific Specialty Fuel Additives Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Asia Pacific Specialty Fuel Additives Market Attractiveness, by Application

Figure 23: Asia Pacific Specialty Fuel Additives Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Specialty Fuel Additives Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Specialty Fuel Additives Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 26: Latin America Specialty Fuel Additives Market Attractiveness, by Product

Figure 27: Latin America Specialty Fuel Additives Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Latin America Specialty Fuel Additives Market Attractiveness, by Application

Figure 29: Latin America Specialty Fuel Additives Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Specialty Fuel Additives Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Specialty Fuel Additives Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 32: Middle East & Africa Specialty Fuel Additives Market Attractiveness, by Product

Figure 33: Middle East & Africa Specialty Fuel Additives Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 34: Middle East & Africa Specialty Fuel Additives Market Attractiveness, by Application

Figure 35: Middle East & Africa Specialty Fuel Additives Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Specialty Fuel Additives Market Attractiveness, by Country and Sub-region