Analysts’ Viewpoint on System-on-Chip Market Scenario

System-on-chip (SoC) is used in diverse applications in automotive, consumer electronics, IT & telecommunication, aerospace & defense, healthcare, and power & utility industries due to its ability to incorporate several system components into a single silicon chip. Technology trends such as smart devices, miniaturization of devices, portable medical devices, smart wearable devices, autonomous vehicles, IoT ecosystems, Industry 4.0, and digitization are expected to create long-term revenue opportunities for stakeholders in the SoC market. Rise in demand for faster data communication along with powerful artificial intelligence (AI) capabilities, network of hyper-scale data centers, telecom server farms, and upcoming 5G communication towers is estimated to fuel the system-on-chip market during the forecast period.

Introduction of novel technologies; and innovation in automation, precision, and electronics industry verticals are boosting the development of system-on-chip products, thus creating lucrative opportunities for manufacturers of SoCs. Manufacturers are increasing their R&D activities to innovate in deep learning chips, machine learning chips, and artificial intelligence chips to broaden their revenue streams.

Adoption of system-on-chip is rising across the globe due to its various advantages such as reduced energy wastage and lower cost. On the other hand, semiconductor companies are establishing stable income sources by bolstering the manufacture of power line communication system-on-chip products, flip chips, and chiplets. This is evident as the power line communication technology is being publicized as a low-cost solution for data communication by allowing the transfer of data over existing power lines. Furthermore, manufacturers are diversifying their production of chip on board (CoB) LEDs. CoB LEDs are used as solid-state lighting (SSL) replacements for metal-halide lamps in applications such as high-bay lighting, street lights, and high-output track lights & downlights.

Innovations in mixed signal system-on-chip (MxSoC), organ-on-a-chip, and zigbee system-on-chip are becoming prominent. Lucrative incremental opportunities in smart sensors, low data rate RF devices, and medical monitoring devices are fueling the demand for mixed signal SoC products. Breakthrough innovations in organ-on-a-chip are paving the way for technological advancements in the field of disease modeling and drug testing. On the other hand, rise in demand for low-data rate, low-power applications, and open standard wireless technology is augmenting the demand for zigbee system-on-chip to be embedded in electronic devices.

Request a sample to get extensive insights into the System-on-Chip Market

Developments in SoC technology have led to differences in CPUs that run high-end applications such as Adobe Premiere Pro, Illustrator, Photoshop, and Autodesk Maya, which earlier required dedicated graphics cards, large amount of RAM, and powerful cooling systems. Most traditional computers had separate components strategically placed on a motherboard such as the RAM, storage, and network components. These components independently process the data and then send it back to the CPU. This whole process consumes time to generate output.

SoC has only one single chip that runs all the functions at the same time and caters to the customer’s requirement of fast speed devices with long battery life such as laptops, smartphones, and tablets. This is expected to boost the market in the near future.

ADAS-based system-on-chip (SoC) is a highly optimized and scalable family of devices that is designed to cater to the requirements of leading Advanced Driver Assistance Systems (ADAS). This SoC has numerous channels that are used as dedicated hardware. It offers a wide range of features such as conversion of data input from cameras to panoramic stereoscopic video that is obliquely viewed and provides clear HD video. This enables image recognition such as pedestrians on roads, collision avoidance, object detection, and surround monitoring systems. This is expected to propel the demand for SoC in the automotive & transportation industry.

Request a custom report on System-on-Chip Market

In terms of region, the global system-on-chip market has been divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific is expected to hold prominent share of the global system-on-chip market during the forecast period due to the increase in demand for SoCs in consumer electronics and IT & telecommunication industries. System-on-chips are widely used in electronic devices such as smartphones, tablets, laptops, consumer appliances, and smart wearables such as fitness bands, smartwatches, headsets, and Bluetooth in the region. Furthermore, rise in digitization, increase in penetration of Internet of Things (IoT), advanced analytics & server performance, and running investment in advanced workstations and servers using 5G technologies are augmenting the market. Innovation in portable electronic devices such as e-readers, smartphones, tablets, and flash drives is also a key factor boosting the system-on-chip market in Asia Pacific.

The system-on-chip market in North America and Europe is expected to advance at a significant rate during the forecast period due to the rise in demand for the integration of CPU, graphics, and memory interfaces in a wide range of industries such as automotive, consumer electronics, and aerospace & defense. Expansion of the market in North America and Europe is anticipated to be driven by leading countries such as the U.S., Canada, Italy, Spain, Germany, and France.

The system-on-chip market in Middle East & Africa and South America is anticipated to grow at a steady pace during the forecast period due to the impact of several conflicts in Syria and Yemen in the Middle East. Low economic diversification and need to improve education systems & infrastructure are being witnessed in the SoC market in Middle East & Africa. Complex political & governance scenarios and persistently high barriers to the economic & social wellbeing of important sections of the society are restraining the market. Nevertheless, companies should work closely with governments to improve the socio-economic factors of the SoC market in Middle East & Africa.

The market for the system-on-chip is consolidated, with just a few players catering to the global demand. Key players operating in the global system-on-chip market include Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductor, Renesas Electronics Corporation, STMicroelectronics, Texas Instruments Incorporated, On Semiconductor, Maxim Integrated, and Toshiba Corporation.

Prominent providers of system-on-chip offer an extensive range of system-on-chip products for various applications. Key developments in the global system-on-chip market have been highlighted below:

Each of these players has been profiled in the system-on-chip market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

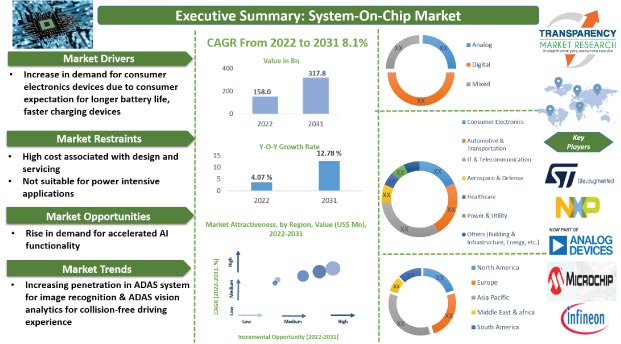

Market Size Value in 2021 |

US$ 151.8 Bn |

|

Market Forecast Value in 2031 |

US$ 317.8 Bn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market size of system-on-chip stood at US$ 151.8 Bn in 2021.

The system-on-chip is expected to grow at a CAGR of 8.1% from 2022 to 2031.

The system-on-chip market is likely to reach 317 Bn in 2031.

Increasing demand for high performance and low cost portable electronic devices and wearable devices such as smartphones, laptops, smart watch, headsets, etc.

Asia Pacific is more lucrative region of the system-on-chip market.

Prominent players in the system-on-chip market are Intel Corporation, MediaTek Inc., Microchip Technology Inc., NXP Semiconductors N.V., Qualcomm Incorporated, Samsung Electronics Ltd, STMicroelectronics N.V., and Toshiba Corporation.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global System-On-Chip Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Electronic System & Devices Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Global System-On-Chip Market Analysis, by Type

5.1. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Analog

5.1.2. Digital

5.1.3. Mixed

5.2. Market Attractiveness Analysis, by Type

6. Global System-On-Chip Market Analysis, by Application

6.1. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Home Appliances

6.1.2. Portable Electronic Devices

6.1.3. ADAS System

6.1.4. Medical Devices

6.1.5. RF Devices

6.1.6. Power-electronic devices

6.1.7. Wired & Wireless Communication Devices

6.1.8. Wearable Devices

6.1.9. Others

6.2. Market Attractiveness Analysis, by Application

7. Global System-On-Chip Market Analysis, by End-use Industry

7.1. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

7.1.1. Consumer Electronics

7.1.2. Automotive & Transportation

7.1.3. IT & Telecommunication

7.1.4. Aerospace & Defense

7.1.5. Healthcare

7.1.6. Power & Utility

7.1.7. Others

7.2. Market Attractiveness Analysis, by End-use Industry

8. Global System-On-Chip Market Analysis and Forecast, by Region

8.1. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America System-On-Chip Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

9.3.1. Analog

9.3.2. Digital

9.3.3. Mixed

9.4. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

9.4.1. Home Appliances

9.4.2. Portable Electronic Devices

9.4.3. ADAS System

9.4.4. Medical Devices

9.4.5. RF Devices

9.4.6. Power-electronic devices

9.4.7. Wired & Wireless Communication Devices

9.4.8. Wearable Devices

9.4.9. Others

9.5. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

9.5.1. Consumer Electronics

9.5.2. Automotive & Transportation

9.5.3. IT & Telecommunication

9.5.4. Aerospace & Defense

9.5.5. Healthcare

9.5.6. Power & Utility

9.5.7. Others

9.6. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country & Sub-region

10. Europe System-On-Chip Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.3.1. Analog

10.3.2. Digital

10.3.3. Mixed

10.4. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

10.4.1. Home Appliances

10.4.2. Portable Electronic Devices

10.4.3. ADAS System

10.4.4. Medical Devices

10.4.5. RF Devices

10.4.6. Power-electronic devices

10.4.7. Wired & Wireless Communication Devices

10.4.8. Wearable Devices

10.4.9. Others

10.5. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

10.5.1. Consumer Electronics

10.5.2. Automotive & Transportation

10.5.3. IT & Telecommunication

10.5.4. Aerospace & Defense

10.5.5. Healthcare

10.5.6. Power & Utility

10.5.7. Others

10.6. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country & Sub-region

11. Asia Pacific System-On-Chip Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.3.1. Analog

11.3.2. Digital

11.3.3. Mixed

11.4. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

11.4.1. Home Appliances

11.4.2. Portable Electronic Devices

11.4.3. ADAS System

11.4.4. Medical Devices

11.4.5. RF Devices

11.4.6. Power-electronic devices

11.4.7. Wired & Wireless Communication Devices

11.4.8. Wearable Devices

11.4.9. Others

11.5. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.5.1. Consumer Electronics

11.5.2. Automotive & Transportation

11.5.3. IT & Telecommunication

11.5.4. Aerospace & Defense

11.5.5. Healthcare

11.5.6. Power & Utility

11.5.7. Others

11.6. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country & Sub-region

12. Middle East and Africa System-On-Chip Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.3.1. Analog

12.3.2. Digital

12.3.3. Mixed

12.4. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

12.4.1. Home Appliances

12.4.2. Portable Electronic Devices

12.4.3. ADAS System

12.4.4. Medical Devices

12.4.5. RF Devices

12.4.6. Power-electronic devices

12.4.7. Wired & Wireless Communication Devices

12.4.8. Wearable Devices

12.4.9. Others

12.5. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.5.1. Consumer Electronics

12.5.2. Automotive & Transportation

12.5.3. IT & Telecommunication

12.5.4. Aerospace & Defense

12.5.5. Healthcare

12.5.6. Power & Utility

12.5.7. Others

12.6. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country & Sub-region

13. South America System-On-Chip Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

13.3.1. Analog

13.3.2. Digital

13.3.3. Mixed

13.4. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by Application, 2017–2031

13.4.1. Home Appliances

13.4.2. Portable Electronic Devices

13.4.3. ADAS System

13.4.4. Medical Devices

13.4.5. RF Devices

13.4.6. Power-electronic devices

13.4.7. Wired & Wireless Communication Devices

13.4.8. Wearable Devices

13.4.9. Others

13.5. System-On-Chip Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

13.5.1. Consumer Electronics

13.5.2. Automotive & Transportation

13.5.3. IT & Telecommunication

13.5.4. Aerospace & Defense

13.5.5. Healthcare

13.5.6. Power & Utility

13.5.7. Others

13.6. System-On-Chip Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country & Sub-region

14. Competition Assessment

14.1. Global System-On-Chip Market Competition Matrix - a Dashboard View

14.1.1. Global System-On-Chip Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Broadcom Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Intel Corporation

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. MediaTek Inc

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Microchip Technology Inc.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. NXP Semiconductors N.V.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Qualcomm Incorporated

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Samsung Electronics Ltd

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. STMicroelectronics N.V.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Toshiba Corporation

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Country & Sub-region

List of Tables

Table 01: Global System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 02: Global System-On-Chip Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 03: Global System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 04: Global System-On-Chip Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 05: Global System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 06: Global System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Table 07: Global System-On-Chip Market Size & Forecast, by Region, Volume (Million Units), 2017‒2031

Table 08: North America System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 09: North America System-On-Chip Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 10: North America System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 11: North America System-On-Chip Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 12: North America System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 13: North America System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 14: North America System-On-Chip Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 14: Europe System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 15: Europe System-On-Chip Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 16: Europe System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 17: Europe System-On-Chip Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 18: Europe System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 19: Europe System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 20: Europe System-On-Chip Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 21: Asia Pacific System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 22: Asia Pacific System-On-Chip Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 23: Asia Pacific System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 24: Asia Pacific System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 25: Asia Pacific System-On-Chip Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 26: Middle East & Africa System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 27: Middle East & Africa System-On-Chip Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 28: Middle East & Africa System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 29: Middle East & Africa System-On-Chip Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 30: Middle East & Africa System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 31: Middle East & Africa System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 32: Middle East & Africa System-On-Chip Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 33: South America System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 34: South America System-On-Chip Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 35: South America System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Table 36: South America System-On-Chip Market Size & Forecast, by Application, Volume (US$ Mn), 2017‒2031

Table 37: South America System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 38: South America System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 39: South America System-On-Chip Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

List of Figures

Figure 01: Global System-On-Chip Price Trend Analysis (Average Price, US$)

Figure 02: Global System-On-Chip Market, Value (US$ Bn), 2017‒2031

Figure 03: Global System-On-Chip Market, Value (US$ Bn), 2017‒2031

Figure 04: Global System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 05: Global System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 06: Global System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 07: Global System-On-Chip Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 08: Global System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 09: Global System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 10: Global System-On-Chip Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 11: Global System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2022‒2031

Figure 12: Global System-On-Chip Market Attractiveness, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 13: Global System-On-Chip Market Attractiveness, by End-use industry, Value (US$ Bn), 2022‒2031

Figure14: Global System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 15: Global System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 16: Global System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 17: Global System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 18: North America System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 19: North America System-On-Chip Market, Value (US$ Bn), 2017‒2031

Figure 20: North America System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 21: North America System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 22: North America System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 23: North America System-On-Chip Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 24: North America System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 25: North America System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 26: North America System-On-Chip Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 27: North America System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2022‒2031

Figure 28: North America System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Figure 29: North America System-On-Chip Market Attractiveness, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 30: North America System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 31: North America System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 32: North America System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 33: North America System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 34: Europe System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 35: Europe System-On-Chip Market, Value (US$ Bn), 2017‒2031

Figure 36: Europe System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 37: Europe System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 38: Europe System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 39: Europe System-On-Chip Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 40: Europe System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 41: Europe System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 42: Europe System-On-Chip Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 43: Europe System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2022‒2031

Figure 44: Europe System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Figure 45: Europe System-On-Chip Market Attractiveness, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 46: Europe System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 47: Europe System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 48: Europe System-On-Chip Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 49: Europe System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 50: Europe System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 51: Europe System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 52: Asia Pacific System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 53: Asia Pacific System-On-Chip Market, Value (US$ Bn), 2017‒2031

Figure 54: Asia Pacific System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 55: Asia Pacific System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 56: Asia Pacific System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 57: Asia Pacific System-On-Chip Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 58: Asia Pacific System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 59: Asia Pacific System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 60: Asia Pacific System-On-Chip Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 61: Asia Pacific System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2022‒2031

Figure 62: Asia Pacific System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 63: Asia Pacific System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 64: Asia Pacific System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 65: Asia Pacific System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 66: Asia Pacific System-On-Chip Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 67: Asia Pacific System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 66: Middle East & Africa System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 67: Middle East & Africa System-On-Chip Market, Value (US$ Bn), 2017‒2031

Figure 68: Middle East & Africa System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 69: Middle East & Africa System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 70: Middle East & Africa System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 71: Middle East & Africa System-On-Chip Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 72: Middle East & Africa System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 73: Middle East & Africa System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 74: Middle East & Africa System-On-Chip Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 75: Middle East & Africa System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2022‒2031

Figure 76: Middle East & Africa System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 77: Middle East & Africa System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 78: Middle East & Africa System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031

Figure 79: Middle East & Africa System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 80: Middle East & Africa System-On-Chip Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 81: Middle East & Africa System-On-Chip Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 82: South America System-On-Chip Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 83: South America System-On-Chip Market, Value (US$ Bn), 2017‒2031

Figure 84: South America System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 85: South America System-On-Chip Market, Volume (Million Units), 2017‒2031

Figure 86: South America System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 87: South America System-On-Chip Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 88: South America System-On-Chip Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 89: South America System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 90: South America System-On-Chip Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 91: South America System-On-Chip Market Size & Forecast, by Application, Value (US$ Bn), 2022‒2031

Figure 92: South America System-On-Chip Market Size & Forecast, by End-use industry, Value (US$ Bn), 2022‒2031