Reports

Reports

Analysts’ Viewpoint on Market Scenario

Increasing burden on urban infrastructure has compelled the government to implement smart ways to develop public infrastructure. Energy, water, waste, and transportation are the major areas of focus, as the management of these utilities fulfills the necessities of people. Innovation in smart city solutions has increased owing to advancements in artificial intelligence, Internet of things, big data, cloud technologies, and connected sensors networks. Therefore, several key players have developed unique solutions in order to grab business growth opportunities, which in turn has made the market more competitive.

The smart city technologies industry in India is huge and highly fragmented, with the presence of numerous players from various industries. Increased penetration of technology and rise in disposable income in India are anticipated to boost the standard of living of people in the country and consequently, aid the smart city market growth in India.

The term ‘smart city’ originally referred to programs that use digital and ICT-based innovation to boost the effectiveness of urban services and create new business opportunities. According to the United Nations, 'smart city makes use of opportunities from digitalization, clean energy, and technologies as well as innovative transport technologies, thus providing options for inhabitants to make more environment-friendly choices, boost sustainable economic growth, and enable cities to improve their service delivery’. Smart infrastructure refers to the use of technology and data to create more efficient and effective systems in order to manage transportation, energy, water, waste, and other key areas of infrastructure.

Every city has distinct qualities in terms of its size, environment, financial resources, and several other features. These differences influence the ability of cities to manage smart technologies and attract smart city investment. The various distinctions in the physical characteristics of a city also impacts the level of applicability of particular digital technologies.

The Government of India has been encouraging institutional and organizational changes, facilitating steady investment, and establishing a consortium for combining various businesses. Rise in focus on smart city is also responsible for a specific development―the formation of a new genre of public-private partnerships. Furthermore, finance and funding methods for infrastructure development as well as governance frameworks are significantly fueling the smart city market scope.

Investment is likely to be the biggest driver of growth, driven primarily by government capital spending, while the private sector may take some time to catch up to the pace of investment. One of the key global smart city market trends is the increased emphasis on smart infrastructure by governments worldwide. This is because technology helps better manage infrastructure systems, thereby enabling governments to reduce waste, optimize resource use, and streamline operations. This, in turn, can lead to significant cost savings over time, as well as increased productivity and economic growth.

Governments can create more efficient, sustainable, and resilient infrastructure systems by leveraging the power of technology and data. These systems can help improve quality of life and support economic growth for years to come.

India is one of the most populous countries in the world. Since 1950, the number of Indians living in cities has grown nearly eightfold, from 62 million to 482 million, while the overall urbanization rate has doubled from 17.3% to 35%. Urban areas in India are expected to accommodate 40% of India's population and contribute to around 75% of India's GDP by the year 2030.

Population growth is expected to continue until just before 2050, and an ongoing evolution away from the agriculture sector and towards manufacturing and services would coincide with this growth, pulling a larger share of the population into cities.

The smart city attracts more talented people, who are drawn to the safer, happier environment. This rise in population leads to increased GDP and overall economic growth. These trends are accompanied by an unprecedented increase in demand for water, land, building materials, food, pollution control measures and waste management.

Cities are therefore under constant pressure to provide better quality services, promote local economic competitiveness, improve services delivery, increase efficiency and reduce costs, increase effectiveness and productivity and address congestion and environmental issues. Such pressures are motivating cities to turn to smart solutions and experiment with various smart infrastructure applications.

Smart solutions need considerable investment to cater to the needs of urbanization and address urban issues such as transportation and traffic management, smart parking and smart transportation solutions, water supply, safety and surveillance, power distribution and lighting, e-governance, and waste management.

Energy and transportation solutions require greater investment than other solutions owing to the increasing burden on available infrastructure. Consequently, adopting smart solutions optimizes resources and makes the urban space more livable.

Development of smart cities relies heavily on smart energy chains, which are a sustainable response to the rising need for energy. This energy driven transaction model is a digital solution that is likely to boost the India smart city market forecast in the upcoming years.

The smart city market involves the use of technology to create more efficient and sustainable urban environments. There are several players and competitors in this market, including:

In terms of competition, there are several areas where key players in the smart city market compete, including technology, cost, implementation, customer service, and innovation.

The India smart city market report contains profiles of key players who have been analyzed based on parameters such as company overview, financial overview, product portfolio, business segments, business strategies, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 6.5 Bn |

|

Market Forecast Value in 2031 |

US$ 47.8 Bn |

|

Growth Rate (CAGR) |

25.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Country Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

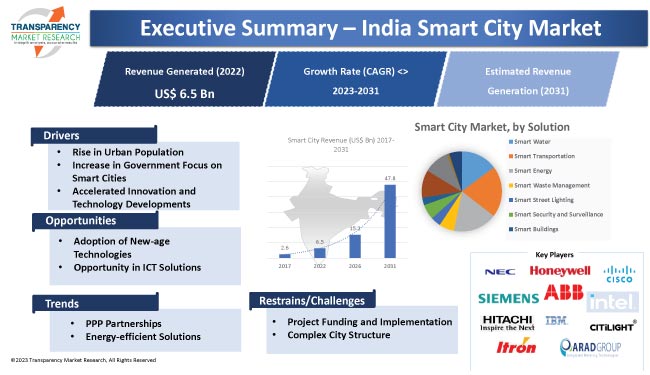

The India market stood at US$ 6.5 Bn in 2022.

The market estimated to expand at a CAGR of 25.2% during the forecast period.

The India market is expected to reach US$ 47.8 Bn by 2031.

NEC Corporation, Bharat Electronics Ltd (BEL), Cisco Systems, Inc., EFKON India Pvt., Hitachi, Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., IBM, Intel Corporation, Larsen & Toubro Limited, Microsoft, Schneider Electric, Siemens, TCS, and Thales.

Public private partnership and increasing government initiatives.

Increase in government focus on smart cities and rise in urban population.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. India Smart City Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Smart City Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Funding and Governing Bodies Assessment

5. India Smart City Market Analysis, by Component

5.1. India Smart City Market Size (US$ Mn) Analysis & Forecast, by Component, 2017–2031

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. Market Attractiveness Analysis, by Component

6. India Smart City Market Analysis, by Solution

6.1. India Smart City Market Size (US$ Mn) Analysis & Forecast, by Solution, 2017–2031

6.1.1. Smart Water

6.1.2. Advanced Metering Infrastructure (AMI)

6.1.2.1. Flood monitoring

6.1.2.2. Water Quality Monitoring

6.1.2.3. Smart water grids

6.1.2.4. Others

6.1.3. Smart Transportation

6.1.4. Traffic Management

6.1.4.1. Parking Management

6.1.4.2. Smart Public Transport Solutions

6.1.4.3. Automated Number Plate Recognition (ANPR)

6.1.4.4. Others

6.1.5. Smart Energy

6.1.5.1. Smart Energy Metering Infrastructure

6.1.5.2. Smart Grid

6.1.6. Waste Management

6.1.6.1. Smart Bin Sensors

6.1.6.2. Smart Waste Management Platform

6.1.6.3. Intelligent Routing and Tracking

6.1.7. Smart Street Lighting

6.1.7.1. Retrofit

6.1.7.2. Green Field

6.1.7.3. New installation

6.1.8. Security and Surveillance

6.1.8.1. Cameras

6.1.8.2. Video Analytics

6.1.8.3. Gun Shoot Detection

6.1.9. Integrated Command and Control Center

6.1.10. Smart Healthcare

6.1.11. Smart Buildings

6.1.12. E- Governance

6.1.13. Others

6.2. Market Attractiveness Analysis, by Solution

7. India Smart City Market Analysis, by Connectivity

7.1. India Smart City Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Connectivity, 2017–2031

7.1.1. Wired

7.1.2. Wireless

7.2. Market Attractiveness Analysis, by Connectivity

8. Competition Assessment

8.1. India Smart City Market Competition Matrix - a Dashboard View

8.1.1. India Smart City Market Company Share Analysis, by Value (2022)

8.1.2. Technological Differentiator

9. Company Profiles (Global Manufacturers/Suppliers)

9.1. ABB

9.1.1. Overview

9.1.2. Product Portfolio

9.1.3. Sales Footprint

9.1.4. Key Subsidiaries or Distributors

9.1.5. Strategy and Recent Developments

9.1.6. Key Financials

9.2. AT&T

9.2.1. Overview

9.2.2. Product Portfolio

9.2.3. Sales Footprint

9.2.4. Key Subsidiaries or Distributors

9.2.5. Strategy and Recent Developments

9.2.6. Key Financials

9.3. Bharat Electronics Ltd (BEL)

9.3.1. Overview

9.3.2. Product Portfolio

9.3.3. Sales Footprint

9.3.4. Key Subsidiaries or Distributors

9.3.5. Strategy and Recent Developments

9.3.6. Key Financials

9.4. Cisco Systems, Inc.

9.4.1. Overview

9.4.2. Product Portfolio

9.4.3. Sales Footprint

9.4.4. Key Subsidiaries or Distributors

9.4.5. Strategy and Recent Developments

9.4.6. Key Financials

9.5. EFKON India Pvt.

9.5.1. Overview

9.5.2. Product Portfolio

9.5.3. Sales Footprint

9.5.4. Key Subsidiaries or Distributors

9.5.5. Strategy and Recent Developments

9.5.6. Key Financials

9.6. Hitachi, Ltd.

9.6.1. Overview

9.6.2. Product Portfolio

9.6.3. Sales Footprint

9.6.4. Key Subsidiaries or Distributors

9.6.5. Strategy and Recent Developments

9.6.6. Key Financials

9.7. Honeywell International Inc.

9.7.1. Overview

9.7.2. Product Portfolio

9.7.3. Sales Footprint

9.7.4. Key Subsidiaries or Distributors

9.7.5. Strategy and Recent Developments

9.7.6. Key Financials

9.8. Huawei Technologies Co., Ltd.

9.8.1. Overview

9.8.2. Product Portfolio

9.8.3. Sales Footprint

9.8.4. Key Subsidiaries or Distributors

9.8.5. Strategy and Recent Developments

9.8.6. Key Financials

9.9. IBM

9.9.1. Overview

9.9.2. Product Portfolio

9.9.3. Sales Footprint

9.9.4. Key Subsidiaries or Distributors

9.9.5. Strategy and Recent Developments

9.9.6. Key Financials

9.10. Intel Corporation

9.10.1. Overview

9.10.2. Product Portfolio

9.10.3. Sales Footprint

9.10.4. Key Subsidiaries or Distributors

9.10.5. Strategy and Recent Developments

9.10.6. Key Financials

9.11. Larsen & Toubro Limited

9.11.1. Overview

9.11.2. Product Portfolio

9.11.3. Sales Footprint

9.11.4. Key Subsidiaries or Distributors

9.11.5. Strategy and Recent Developments

9.11.6. Key Financials

9.12. Microsoft

9.12.1. Overview

9.12.2. Product Portfolio

9.12.3. Sales Footprint

9.12.4. Key Subsidiaries or Distributors

9.12.5. Strategy and Recent Developments

9.12.6. Key Financials

9.13. Schneider Electric

9.13.1. Overview

9.13.2. Product Portfolio

9.13.3. Sales Footprint

9.13.4. Key Subsidiaries or Distributors

9.13.5. Strategy and Recent Developments

9.13.6. Key Financials

9.14. Siemens

9.14.1. Overview

9.14.2. Product Portfolio

9.14.3. Sales Footprint

9.14.4. Key Subsidiaries or Distributors

9.14.5. Strategy and Recent Developments

9.14.6. Key Financials

9.15. TCS

9.15.1. Overview

9.15.2. Product Portfolio

9.15.3. Sales Footprint

9.15.4. Key Subsidiaries or Distributors

9.15.5. Strategy and Recent Developments

9.15.6. Key Financials

9.16. Thales

9.16.1. Overview

9.16.2. Product Portfolio

9.16.3. Sales Footprint

9.16.4. Key Subsidiaries or Distributors

9.16.5. Strategy and Recent Developments

9.16.6. Key Financials

10. Recommendation

10.1. Opportunity Assessment

10.1.1. By Component

10.1.2. By Solution

10.1.3. By Connectivity

List of Tables

Table 1: India Smart City Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 2: India Smart City Market Value (US$ Mn) Forecast, by Solution, 2017‒2031

Table 3: India Smart City Market Value (US$ Mn) Forecast, by Connectivity, 2017‒2031

List of Figures

Figure 01: Major Source of Funding

Figure 02: India Smart City Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 03: India Smart City Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 04: India Smart City Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 05: India Smart City Market Share Analysis, by Component, 2023 and 2031

Figure 06: India Smart City Market, Incremental Opportunity, by Component, 2023‒2031

Figure 07: India Smart City Market Projections by Solution, and Value (US$ Mn), 2017‒2031

Figure 08: India Smart City Market Share Analysis, by Solution, 2023 and 2031

Figure 09: India Smart City Market, Incremental Opportunity, by Solution, 2023‒2031

Figure 10: India Smart City Market Projections by Connectivity, and Value (US$ Mn), 2017‒2031

Figure 11: India Smart City Market Share Analysis, by Connectivity, 2023 and 2031

Figure 12: India Smart City Market, Incremental Opportunity, by Connectivity, 2023‒2031

Figure 13: Company Share Analysis 2022