Analysts’ Viewpoint

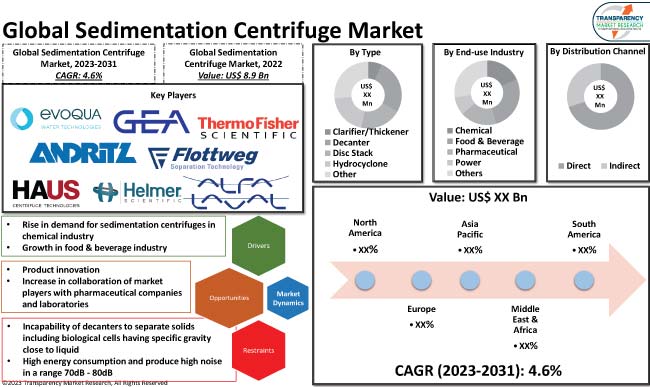

Rise in demand for sedimentation centrifuges in the chemical industry and growth in food & beverage industry are key factors driving the global market. A centrifuge is widely utilized in liquid filtration and the separation of solid components in fluids. Increase in collaboration of market players with pharmaceutical companies and laboratories is also contributing to the market dynamics.

Manufacturers in the global market are developing innovative products based on recent improvements, in which high-speed rotation forces are utilized to isolate solids from liquid in a rotating cylindrical bowl. This is expected to generate value-grab sedimentation centrifuge market opportunities for them in the near future. However, high energy consumption is likely to hamper sedimentation centrifuge market demand during the forecast period.

The centrifugal sedimentation method is used to determine the particle size from the speed of particles moving by centrifugal force. When a centrifugal force is applied to particles, larger particles settle faster while smaller particles settle slower.

Sedimentation centrifuges are of various types based on their working standards. Decanters, conical plates, solid bowls, pendulums, and tubular centrifuges are some of the common types.

In a single, nonstop cycle, a decanter centrifuge separates solids from a couple of fluid stages. A cone-like plate centrifuge is a kind of centrifuge that has a series of conical discs that gives an equal setup of centrifugation spaces. The primary function of a tubular centrifuge is the continuous separation of liquids or very fine particles from liquids.

Numerous industrial processes rely heavily on centrifuge separators that separate solids from liquids. Several industries including chemical, food & beverage, pharmaceutical, and power have been using centrifugal liquid sedimentation for a long time.

The chemical industry makes extensive use of sedimentation centrifuges for drug production and analysis. Expansion of the chemical industry across the globe is anticipated to propel the sedimentation centrifuge industry growth during the forecast period.

China is the world's largest chemical producer, and it accounted 43.0% of global chemical sales in 2021. The chemical business in Europe and North America is also expanding rapidly, creating potential opportunities for market players.

The food & beverage industry employs sedimentation and centrifugation equipment to get rid of excess water from juice, milk products, and other liquids. Likewise, it assists in isolating strong particles such as residues or soil present in fluids. Growth in the food & beverage industry, specifically in North America and Europe, is estimated to fuel the demand for sedimentation centrifuges in the next few years.

Positive monetary strategies, attractive financial incentives, and expansion of the food processing sector make India’s food ecosystem an enormous investment opportunity. The Government of India is making significant investments in the food processing sector. The PMKSY program received an allocation of INR 4600 crores till March 2026. Rise in food production in India and China is contributing to the sedimentation centrifuge market development.

As per the sedimentation centrifuge market report, Asia Pacific is projected to hold major share of the global industry in the near future.

Moreover, growth in the pharmaceutical industry and rise in number of R&D projects in countries including China, India, and Southeast Asia are key factors fueling the sedimentation centrifuge market growth in the region.

The sedimentation centrifuge market size in Europe is likely to increase at a steady pace in the near future. This is primarily because of the rise in demand for centrifuges in various end-use industries in Southern Europe.

The global industry is highly stagnant and competitive, with the presence of various global and regional players that control majority of the sedimentation centrifuge market share. Product development is a major marketing strategy for companies.

Alfa Laval AB, Andritz AG, Evoqua Water Technologies LLC, Flottweg SE, GEA Group AG, HAUS Centrifuge Technologies, Helmer Scientific, Labnet International, Rousselet Robatel, and Thermo Fisher Scientific are the prominent companies in sedimentation centrifuge market. These companies are focusing on sedimentation centrifuge market trends to gain revenue opportunities.

Key players have been profiled in the sedimentation centrifuge industry research report based on parameters including company overview, business segments, financial overview, latest developments, business strategies, and product portfolio.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 8.9 Bn |

|

Market Forecast Value in 2031 |

US$ 14.2 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 8.9 Bn in 2022

The CAGR is anticipated to be 4.6% from 2023 to 2031

Rise in demand for centrifugal sedimentation in chemical industry and growth in food & beverage industry

The clarifier/thickener type segment accounted for significant share in 2022

Demand for sedimentation centrifuges is likely to be high in Asia Pacific

Alfa Laval AB, Andritz AG, Evoqua Water Technologies LLC, Flottweg SE, GEA Group AG, HAUS Centrifuge Technologies, Helmer Scientific, Labnet International, Rousselet Robatel, and Thermo Fisher Scientific

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Raw Material Analysis

5.8. Technological Overview Analysis

5.9. Global Sedimentation Centrifuge Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Sedimentation Centrifuge Market Analysis and Forecast, by Type

6.1. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

6.1.1. Clarifier/Thickener

6.1.2. Decanter

6.1.3. Disc Stack

6.1.4. Hydrocyclone

6.1.5. Other

6.2. Incremental Opportunity, by Type

7. Global Sedimentation Centrifuge Market Analysis and Forecast, by End-use Industry

7.1. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

7.1.1. Chemical

7.1.2. Food & Beverage

7.1.3. Pharmaceutical

7.1.4. Power

7.1.5. Others

7.2. Incremental Opportunity, by End-use Industry

8. Global Sedimentation Centrifuge Market Analysis and Forecast, by Distribution Channel

8.1. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

8.1.1. Direct

8.1.2. Indirect

8.2. Incremental Opportunity, by Distribution Channel

9. Global Sedimentation Centrifuge Market Analysis and Forecast, by Region

9.1. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East and Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Sedimentation Centrifuge Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price (US$)

10.4. Brand Analysis

10.5. Consumer Buying Behavior Analysis

10.6. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

10.6.1. Clarifier/Thickener

10.6.2. Decanter

10.6.3. Disc Stack

10.6.4. Hydrocyclone

10.6.5. Other

10.7. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

10.7.1. Chemical

10.7.2. Food & Beverage

10.7.3. Pharmaceutical

10.7.4. Power

10.7.5. Others

10.8. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

10.8.1. Direct

10.8.2. Indirect

10.9. Sedimentation Centrifuge Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

10.9.1. U.S.

10.9.2. Canada

10.9.3. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Sedimentation Centrifuge Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

11.6.1. Clarifier/Thickener

11.6.2. Decanter

11.6.3. Disc Stack

11.6.4. Hydrocyclone

11.6.5. Other

11.7. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

11.7.1. Chemical

11.7.2. Food & Beverage

11.7.3. Pharmaceutical

11.7.4. Power

11.7.5. Others

11.8. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

11.9. Sedimentation Centrifuge Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

11.9.1. UK

11.9.2. Germany

11.9.3. France

11.9.4. Rest of Europe

11.10. Incremental Opportunity Analysis

12. Asia Pacific Sedimentation Centrifuge Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

12.6.1. Clarifier/Thickener

12.6.2. Decanter

12.6.3. Disc Stack

12.6.4. Hydrocyclone

12.6.5. Other

12.7. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

12.7.1. Chemical

12.7.2. Food & Beverage

12.7.3. Pharmaceutical

12.7.4. Power

12.7.5. Others

12.8. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Sedimentation Centrifuge Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

12.9.1. China

12.9.2. India

12.9.3. Japan

12.9.4. Rest of Asia Pacific

12.10. Incremental Opportunity Analysis

13. Middle East & Africa Sedimentation Centrifuge Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

13.6.1. Clarifier/Thickener

13.6.2. Decanter

13.6.3. Disc Stack

13.6.4. Hydrocyclone

13.6.5. Other

13.7. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

13.7.1. Chemical

13.7.2. Food & Beverage

13.7.3. Pharmaceutical

13.7.4. Power

13.7.5. Others

13.8. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

13.8.1. Direct

13.8.2. Indirect

13.9. Sedimentation Centrifuge Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

13.9.1. GCC

13.9.2. South Africa

13.9.3. Rest of Middle East & Africa

13.10. Incremental Opportunity Analysis

14. South America Sedimentation Centrifuge Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

14.6.1. Clarifier/Thickener

14.6.2. Decanter

14.6.3. Disc Stack

14.6.4. Hydrocyclone

14.6.5. Other

14.7. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

14.7.1. Chemical

14.7.2. Food & Beverage

14.7.3. Pharmaceutical

14.7.4. Power

14.7.5. Others

14.8. Sedimentation Centrifuge Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Sedimentation Centrifuge Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

14.9.1. Brazil

14.9.2. Rest of South America

14.10. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Revenue Share Analysis (%), (2022)

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Alfa Laval AB

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. Andritz AG

15.3.3. Evoqua Water Technologies LLC

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. Flottweg SE

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. GEA Group AG

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. HAUS Centrifuge Technologies

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Helmer Scientific

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. Labnet International

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. Rousselet Robatel

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. Thermo Fisher Scientific

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. By Type

16.1.2. By End-use Industry

16.1.3. By Distribution Channel

16.1.4. By Region

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 4: Global Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 5: Global Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 6: Global Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 7: Global Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Table 8: Global Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Table 9: North America Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Table 10: North America Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Table 11: North America Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 12: North America Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 13: North America Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 14: North America Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 15: North America Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Table 16: North America Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Table 17: Europe Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Table 18: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Table 19: Europe Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 20: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 21: Europe Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 22: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: Europe Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Table 24: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Table 25: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Table 26: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Table 27: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 28: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 29: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 30: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 31: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Table 32: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Table 33: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Table 34: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Table 35: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 36: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 37: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Table 40: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Table 41: South America Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Table 42: South America Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Table 43: South America Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 44: South America Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 45: South America Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 46: South America Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: South America Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Table 48: South America Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 5: Global Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 6: Global Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 7: Global Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 8: Global Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 9: Global Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 10: Global Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Figure 11: Global Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Figure 12: Global Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 13: North America Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Figure 14: North America Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Figure 15: North America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 16: North America Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 17: North America Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 18: North America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by End Use Industry, 2023-2031

Figure 19: North America Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 20: North America Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 21: North America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 22: North America Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Figure 23: North America Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Figure 24: North America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 25: Europe Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Figure 26: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Figure 27: Europe Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 28: Europe Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 29: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 30: Europe Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 31: Europe Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 32: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: Europe Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 34: Europe Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Figure 35: Europe Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Figure 36: Europe Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Figure 38: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Figure 39: Asia Pacific Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 40: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 41: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 42: Asia Pacific Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by End Use Industry, 2023-2031

Figure 43: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 44: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 45: Asia Pacific Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 46: Asia Pacific Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Figure 47: Asia Pacific Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Figure 48: Asia Pacific Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 49: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Figure 50: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Figure 51: Middle East & Africa Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 52: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 53: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Middle East & Africa Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by End Use Industry, 2023-2031

Figure 55: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Middle East & Africa Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Middle East & Africa Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Middle East & Africa Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Middle East & Africa Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: South America Sedimentation Centrifuge Market Value (US$ Bn), by Type, 2017-2031

Figure 62: South America Sedimentation Centrifuge Market Volume (Thousand Units), by Type 2017-2031

Figure 63: South America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: South America Sedimentation Centrifuge Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 65: South America Sedimentation Centrifuge Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 66: South America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by End Use Industry, 2023-2031

Figure 67: South America Sedimentation Centrifuge Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 68: South America Sedimentation Centrifuge Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: South America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 70: South America Sedimentation Centrifuge Market Value (US$ Bn), by Region, 2017-2031

Figure 71: South America Sedimentation Centrifuge Market Volume (Thousand Units), by Region 2017-2031

Figure 72: South America Sedimentation Centrifuge Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031