Reports

Reports

The U.S. market for bacterial conjunctivitis drugs has been declining sharply over the last few years. Analysts project the trend to continue in the coming years. In 2013, the market’s opportunity was valued at US$473.3 mn, which is likely to reduce to US$439.8 mn by 2024. In the coming years, the market will have to experience a patent cliff as the top U.S. brands of bacterial conjunctivitis drugs, such as AzaSite, Zymaxid, Moxeza, and Vigamox, are set to lose their marketing exclusivity very soon.

The growing genericization of antibacterial drugs has impacted the demand for branded drugs significantly. The generic versions of patented formulations, with almost same efficiency as the latter, are easily available at much lower rates in the market. This has increased the sales volume, albeit at the cost of revenues. Many branded ophthalmic drug manufacturers have incurred huge losses due to the generic cannibalization in this market.

Rising Prevalence of MDROs Creates Serious Challenge for Market’s Growth

Apart from this, the rising prevalence of multi-drug resistant organisms (MDROs), triggered by wide usage of antibiotics, incorrect drug dosage, and inappropriate medications, has created serious challenges for the treatment of infections such as bacterial conjunctivitis. Researchers across the world are working on discovering efficient drugs for these MDROs. However, the non-availability of effective medications in near future is likely to hamper the market’s growth over the coming years.

Although the market is facing a number of restraints at present, it may experience a little relief in future if the product development partnerships (PDPs) models for business are implemented by participants. As various research and development procedures incur a high amount, exerting substantial pressure on pharma companies, strategic alliances with small biotech research organizations will prove to be beneficial for both the parties.

Market Encroachment by Generic Variations to Limit Demand for Topical Fluoroquinolones

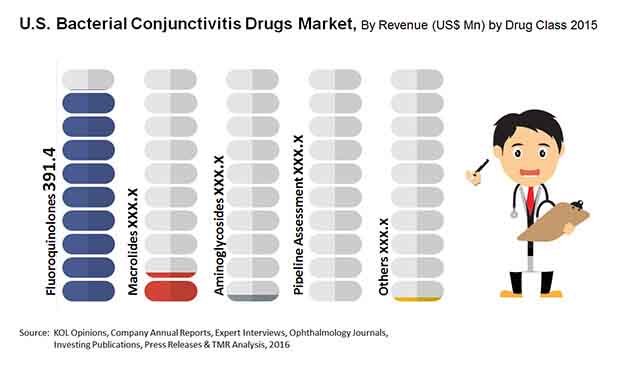

Fluoroquinolones, macrolides, and aminoglycosides are the major classes of drugs used for the treatment of bacterial conjunctivitis. The demand for topical fluoroquinolones is the highest among all classes of bacterial conjunctivitis drugs in the U.S. However, the segment is projected to be hindered severely in the coming years, owing to the forthcoming patent expirations of bestselling drugs of this class, such as Vigamox, Moxeza, and Zymaxid by the end of 2016.

The market’s opportunity will also be hurt significantly over the next few years due to the encroachment by generic variations of these drugs and decline from US$361.9 mn in 2013 to US$286.4 mn by 2024.

Imminent Patent Expiries to Hurt Leading Players Severely

Valeant Pharmaceuticals Int. Inc., Santen Pharmaceutical Co. Ltd., Pfizer Inc., Perrigo Com. Plc., Novartis AG, Merck & Co. Inc., F. Hoffmann-La Roche Ltd., Bayer AG, Akorn Inc., and Actavis Plc. are leading the market for bacterial conjunctivitis drugs in the U.S. The imminent patent expiries is likely to hurt the business of these players significantly in the near future. However, the rising prevalence of bacterial infection in eyes and the increasing susceptibility to infection among individuals of various age groups may provide rewarding opportunities to participants over the next few years.

Players are recommended to focus on developing herbal medicines for the treatment of bacterial conjunctivitis, as the consumer preference is shifting from pharmacological medicines to herbal treatment regimens.

Table of Content

Chapter 1 Preface

1.1 Report Description

1.2 Market Segmentation

1.3 Research Methodology

1.4 Assumptions

Chapter 2 Executive Summary

2.1 Market Snapshot: U.S. Bacterial Conjunctivitis Drugs Market

Chapter 3 U.S. Bacterial Conjunctivitis Drugs Market Overview

3.1 Market Dynamics and Overview

3.2 Incidence Rate of Bacterial Conjunctivitis in the U.S.

3.3 Market Drivers

3.3.1 Rising Incidence of Ophthalmic Bacterial Infection

3.3.2 Susceptibility Among Various Age Groups Ranging from Neonates to Geriatrics

3.4 Market Restraints

3.4.1 Increasing Genericization of Antibacterial Drugs Could Lead to a Crowded and Unprofitable Market

3.4.2 Upcoming Patent Expirations likely to Hinder Market Growth

3.4.3 Burgeoning Multi-Drug Resistant Bacterial Strains Expected To Hinder Market Growth

3.5 Market Opportunities

3.5.1 Implementation of Product Development Partnerships (PDPs) Business Models

3.5.2 Focus on Designing and Producing Combination Drug Products

3.6 Event Impact Assessment: U.S. Bacterial Conjunctivitis Market

3.7 Regulatory Framework

3.8 Patents and Patent Challenges: Overview

3.9 List of API Manufacturers

3.10 Key Discontinued Products: U.S. Bacterial Conjunctivitis Drugs Market

3.10.1 Oxytetracycline/Polymyxin B

3.10.2 Sulfisoxazole Ophthalmic

3.10.3 Phenylephrine/Sulfacetamide Sodium

3.10.4 Chloramphenicol

3.11 Market Attractiveness Analysis: U.S. Bacterial Conjunctivitis Drugs Market, by Drug Type

3.12 Market Share Analysis: U.S. Bacterial Conjunctivitis Drugs Market, by Key Players, 2013 (Value %)

Chapter 4 U.S. Bacterial Conjunctivitis Drugs Market, by Drug Class

4.1 Overview

4.1.1 Recommended Dosages for Treatment of Bacterial Conjunctivitis

4.1.2 U.S. Bacterial Conjunctivitis Drugs Market Revenue, by Drug Class, 2012 – 2024 (USD Million)

4.2 Fluoroquinolones

4.2.1 Fluoroquinolones for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2012 – 2024 (USD Million)

4.2.2 Ciprofloxacin

4.2.2.1 U.S. Ciprofloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.2.3 Ofloxacin

4.2.3.1 U.S. Ofloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.2.4 Levofloxacin

4.2.4.1 U.S. Levofloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.2.5 Moxifloxacin

4.2.5.1 U.S. Moxifloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.2.6 Gatifloxacin

4.2.6.1 U.S. Gatifloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.2.7 Besifloxacin

4.2.7.1 U.S. Besifloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.3 Aminoglycosides

4.3.1 Aminoglycosides for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2012 – 2024 (USD Million)

4.3.2 Tobramycin

4.3.2.1 U.S. Tobramycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.3.3 Gentamycin

4.3.3.1 U.S. Gentamycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.4 Macrolides

4.4.1 Macrolides for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2012 – 2024 (USD Million)

4.4.2 Erythromycin

4.4.2.1 U.S. Erythromycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.4.3 Azithromycin

4.4.3.1 U.S. Azithromycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

4.5 Others (Bacitracin, Doxycycline, Polymyxin, and Fusidic Acid)

4.5.1.1 U.S. Others Market Revenue, by Bacterial Conjunctivitis, 2012 – 2024 (USD Million)

Chapter 5 U.S. Bacterial Conjunctivitis Drugs Market, Pipeline Assessment

5.1 Overview

5.2 Vancomycin Ophthalmic Ointment

5.2.1 U.S. Vancomycin Ophthalmic Ointment for Bacterial Conjunctivitis Market Revenue, 2019 – 2024 (USD Million)

5.3 Early Stage (Phase I and Phase II trials) – Tabular Representation

Chapter 6 Recommendations

Chapter 7 Company Profiles

7.1 Actavis plc (now Allergan plc)

7.1.1 Company Overview

7.1.2 Financial Overview

7.1.3 Product Portfolio

7.1.4 Business Strategies

7.1.5 Recent Developments

7.2 Akorn, Inc.

7.2.1 Company Overview

7.2.2 Financial Overview

7.2.3 Product Portfolio

7.2.4 Business Strategies

7.2.5 Recent Developments

7.3 Bayer AG

7.3.1 Company Overview

7.3.2 Financial Overview

7.3.3 Product Portfolio

7.3.4 Business Strategies

7.3.5 Recent Developments

7.4 F. Hoffmann-La Roche Ltd.

7.4.1 Company Overview

7.4.2 Financial Overview

7.4.3 Product Portfolio

7.4.4 Business Strategies

7.4.5 Recent Developments

7.5 Merck & Co., Inc.

7.5.1 Company Overview

7.5.2 Financial Overview

7.5.3 Product Portfolio

7.5.4 Business Strategies

7.5.5 Recent Developments

7.6 Novartis AG

7.6.1 Company Overview

7.6.2 Financial Overview

7.6.3 Product Portfolio

7.6.4 Business Strategies

7.6.5 Recent Developments

7.7 Perrigo Company plc

7.7.1 Company Overview

7.7.2 Financial Overview

7.7.3 Product Portfolio

7.7.4 Business Strategies

7.7.5 Recent Developments

7.8 Pfizer, Inc.

7.8.1 Company Overview

7.8.2 Financial Overview

7.8.3 Product Portfolio

7.8.4 Business Strategies

7.8.5 Recent Developments

7.9 Santen Pharmaceutical Co., Ltd.

7.9.1 Company Overview

7.9.2 Financial Overview

7.9.3 Product Portfolio

7.9.4 Business Strategies

7.9.5 Recent Developments

7.10 Valeant Pharmaceuticals International, Inc.

7.10.1 Company Overview

7.10.2 Financial Overview

7.10.3 Product Portfolio

7.10.4 Business Strategies

7.10.5 Recent Developments

List of Tables

TABLE 1 Market Snapshot: U.S. Bacterial Conjunctivitis Drugs Market

TABLE 2 Upcoming Patents Expiration of Branded Bacterial Conjunctivitis Drugs and Competing Companies of Generic Products

TABLE 3 List of Ciprofloxacin API Manufacturers

TABLE 4 List of Ofloxacin API Manufacturers

TABLE 5 List of Levofloxacin API Manufacturers

TABLE 6 List of Moxifloxacin API Manufacturers

TABLE 7 List of Gatifloxacin API Manufacturers

TABLE 8 List of Besifloxacin API Manufacturers

TABLE 9 List of Tobramycin API Manufacturers

TABLE 10 List of Gentamycin API Manufacturers

TABLE 11 List of Erythromycin API Manufacturers

TABLE 12 List of Azithromycin API Manufacturers

TABLE 13 List of Bacitracin API Manufacturers

TABLE 14 List of Neomycin API Manufacturers

TABLE 15 List of Fusidic Acid API Manufacturers

TABLE 16 Recommended Dosages for Treatment of Bacterial Conjunctivitis

TABLE 17 U.S. Bacterial Conjunctivitis Drugs Market Revenue, by Drug Class, 2012 – 2018 (USD Million)

TABLE 18 U.S. Bacterial Conjunctivitis Drugs Market Revenue, by Drug Class, 2019 – 2024 (USD Million)

TABLE 19 Fluoroquinolones for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2012 – 2018 (USD Million)

TABLE 20 Fluoroquinolones for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2019 – 2024 (USD Million)

TABLE 21 Aminoglycosides for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2012 – 2018 (USD Million)

TABLE 22 Aminoglycosides for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2019 – 2024 (USD Million)

TABLE 23 Macrolides for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2012 – 2018 (USD Million)

TABLE 24 Macrolides for Bacterial Conjunctivitis Market Revenue, by Drug Class, 2019 – 2024 (USD Million)

TABLE 25 Early Stage (Phase I and Phase II trials) – Tabular Representation

TABLE 26 Actavis plc: Expenses & Revenue, 2011 – 2013 (USD Million)

TABLE 27 Novartis AG: Expenses & Revenue, 2011 – 2013 (USD Million)

List of Figures

FIG. 1 U.S. Bacterial Conjunctivitis Drugs Market Segmentation

FIG. 1 U.S. Bacterial Conjunctivitis Drugs Market, by Drug Class, 2013 (USD Million)

FIG. 2 U.S. Bacterial Conjunctivitis Drugs Market: Drivers, and Restraints

FIG. 3 Market Attractiveness Analysis: U.S. Bacterial Conjunctivitis Drugs Market, by Drug Class

FIG. 4 Market Share Analysis: U.S. Bacterial Conjunctivitis Drugs Market, by Key Players, 2013 (Value %)

FIG. 5 U.S. Ciprofloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 6 U.S. Ofloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 7 U.S. Levofloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 8 U.S. Moxifloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 9 U.S. Gatifloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 10 U.S. Besifloxacin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 11 U.S. Tobramycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 12 U.S. Gentamycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 13 U.S. Erythromycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 14 U.S. Azithromycin for Bacterial Conjunctivitis Market Revenue, 2012 – 2024 (USD Million)

FIG. 15 U.S. Others Market Revenue, by Bacterial Conjunctivitis, 2012 – 2024 (USD Million)

FIG. 16 U.S. Vancomycin Ophthalmic Ointment for Bacterial Conjunctivitis Market Revenue, 2019 – 2024 (USD Million)

FIG. 17 Actavis plc.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 18 Akorn, Inc.: Annual Revenue, 2011 – 2013 (USD million)

FIG. 19 Bayer AG (Bayer HealthCare): Annual Revenue, 2011 – 2013 (USD Million)

FIG. 20 F. Hoffmann-La Roche Ltd.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 21 Annual Revenue: Merck & Co., Inc., 2011 – 2013 (USD Million)

FIG. 22 Novartis AG: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 23 Perrigo Company plc.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 24 Pfizer, Inc.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 25 Santen Pharmaceutical Co., Ltd.: Annual Revenue, 2011 – 2013 (USD million)

FIG. 26 Valeant Pharmaceuticals International, Inc.: Annual Revenue, 2011 – 2013 (USD Million)