A solid, reliable and attractive rooftop is essential to any house. It protects the house from extreme weather conditions and enhances the house's control bid. With increasing spending power, consumers are using underlayment in their homes, which improves cushion, insulation, and sound absorption. The underlayment usage should help in propelling the overall roofing underlying materials market.

The global roofing underlying market is on the verge of a huge transformation with the developing economies emerging as key consumers.. The growth in the construction industry, as well as a consistent rise in fresh construction projects in developing regions, are anticipated to play a crucial role in the overall growth of the global roofing underlying materials market.

The growth in the roofing underlying materials market is anticipated to expand at a steady compound annual growth rate (CAGR) of 5.5 percent during the same period 2016-2024. In 2015, the roofing underlying materials market worldwide had a valuation of US $ 27.99 Bn. The valuation is estimated to rise to US $ 45.16 Bn at the end of the forecast period in 2024.

Roofing materials comprise different types of natural materials such as thatches and slates. Roofing materials also include commercially used products such as plastic sheeting, bituminous, and tiles.

Tiles are one of the crucial product segments in the roofing industry worldwide. Tile roofing decreases the demand for air conditioning and causes reduced energy use. In the coming years, these factors are expected to help improve the demand for tiles. Rising demand for roofing underlying materials in the commercial sector is anticipated to be primarily driven by the frequent need for maintenance and replacement activities.

The non-residential sector is at present the largest contributor to the global roofing underlying materials market and held an overall market share of 44 percent in the worldwide market in 2015. But it is estimated that this segment will witness a fall in growth and could also experience a reduction in the overall market share during the forecast period.

It is also projected that the revenue contribution of the residential sector to the market worldwide will grow at a CAGR of 6 percent over the forecast period. The volume-wise requirement in the residential sector for roofing underlying materials is expected to grow at a CAGR of 4.6 percent between 2016 and 2024.

The most cost-effective underlayment is done by using felt material, which when mixed with asphalt becomes water-proof.. Felt underlayment can vary in costs, depending on the immersion levels of asphalt. Since asphalt is the most expensive component in this process, the higher the quality of asphalt, the more solid and costlier the product would be.

Felt underlayment comprises fiberglass support, which improves the quality and solidity of the product. The different type of fiberglass are yarn, mats, fabric, and strands. With the increasing adoption of this particular type of underlayment worldwide, the global roofing underlying materials market would grow significantly in future.

An improved underlayment alternative than felt is made from an asphalt material, which is treated with rubber. Asphalt can be combined with bitumen, which provides elastic properties to the material. This form of asphalt is used in large boards which are reinforced together into one single film. This asphalt version is versatile and adaptable and can occupy spaces in nails, adapt according to surface weaknesses, and join breaks in the substrate surfaces.

The increased adoption of this product could fuel the growth of the global roofing underlying materials market in future.

However, asphalt does have its own set of drawbacks which are difficult to procure and is not easily available. Despite them, however, there is a growing demand for asphalt around the world, particularly in developing economies such as India, China, and Brazil as all of them are experiencing an upsurge in construction activities.

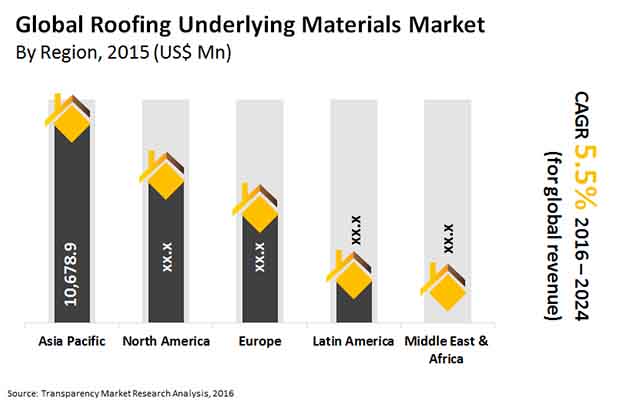

In 2015, Asia Pacific emerged as the most dominant region in the global roofing underlying materials market. This was primarily due to the rapidly developing construction industry and the ever-rising number of house owners in the urban parts of the region. The total revenue generated by Asia Pacific in 2015 in the overall roofing underlying materials market was US $ 10678.9 Mn.

In comparison with the rest of the world, the roofing underlying materials market in Asia Pacific is estimated to grow at the fastest rate, with a projected CAGR of 4.8 percent over the forecast period from 2016-2024.

The developing economies like Indonesia and Malaysia over the years have witnessed rapid urbanization, which has been further propelled by a rise in the standard of living in these countries. The demand for residential buildings is also increasing, led by population growth in these regions. The growing construction activities in these countries is estimated to be the primary contributor to the growth and development of the roofing underlying materials market in future.

China is anticipated to dominate the regional market in Asia Pacific over the entire forecast period and is expected to hold approximately 58 percent of the entire market share in the region by the fall of 2024.

Some of the other regional markets such as Latin America and Middle East and Africa are anticipated to show a positive growth rate in future.

Some of the important players in the roofing underlying materials market include Firestone Building Group Services S.A., DuPont, GAF Materials Corporation, Atlas Roofing Corporation, Carlisle, and IKO Industries Ltd.

Roofing Underlying Materials Market is expected to reach US$45.16 bn by 2024

Roofing Underlying Materials Market is estimated to rise at a CAGR of 5.50% during forecast period

Rising demand for roofing underlying materials in the commercial sector is expected to drive the Roofing Underlying Materials Market

Asia Pacific is more attractive for vendors in the Roofing Underlying Materials Market

Key players of Roofing Underlying Materials Market are Firestone Building Group Services S.A., DuPont, GAF Materials Corporation, Atlas Roofing Corporation, Carlisle, and IKO Industries Ltd

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Report Scope

1.4. Assumptions

1.5. Research Methodology

2. Executive Summary

2.1. Global Roofing Underlying Materials Market, (Million square meter) (US$ Mn), 2015–2024

2.2. Global Roofing Underlying Materials Market: Snapshot

3. Roofing Underlying Materials Market – Industry Analysis

3.1. Introduction

3.2. Value Chain Analysis

3.3. Market Drivers

3.3.1. Growing Construction industry

3.3.2. Rapid Urbanization of Developing Economies

3.4. Restraints

3.4.1. Increase in production cost

3.5. Opportunity

3.5.1. New Product Development in Roofing Underlying Materials

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining Power of Suppliers

3.6.2. Bargaining Power of Buyers

3.6.3. Threat of New Entrants

3.6.4. Threat of Substitutes

3.6.5. Degree of Competition

3.7. Global Roofing Underlying Materials Market Attractiveness, by Region/Country, 2015

3.8. Global Roofing Underlying Materials Market Attractiveness, by Application, 2015

3.9. Company Market Share, 2015

4. Price Trend Analysis

4.1. Global Average Roofing Price Trend, 2015–2024 (US$/square meter)

5. Global Roofing Underlying Materials Market – Product Segment Analysis

5.1. Global Roofing Underlying Materials Market: Product Segment Overview

5.2. Global Roofing Underlying Materials Market for Asphalt-saturated Felt (Million square meter) (US$ Mn), 2015–2024

5.3. Global Roofing Underlying Materials Market for Rubberized Asphalt (Million square meter) (US$ Mn), 2015–2024

5.4. Global Roofing Underlying Materials Market for Non-bitumen Synthetic (Million square meter) (US$ Mn), 2015–2024

6. Global Roofing Underlying Materials Market – Application Analysis

6.1. Global Roofing Underlying Materials Market: Application Overview

6.2. Global Roofing Underlying Materials Market for Residential (Million square meter) (US$ Mn), 2015–2024

6.3. Global Roofing Underlying Materials Market for Commercial (Million square meter) (US$ Mn), 2015–2024

6.4. Global Roofing Underlying Materials Market for Non-Residential (Million square meter) (US$ Mn), 2015–2024

7. Global Roofing Underlying Materials Market - Regional Analysis

7.1. Global Roofing Underlying Materials Market: Regional Overview

7.2. North America Roofing Underlying Materials Market, 2015 and 2024

7.2.1. North America Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.2.2. North America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.2.3. North America Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.2.4. North America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.2.5. U.S Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.2.6. U.S Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.2.7. U.S Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.2.8. U.S Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.2.9. Rest of North America Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.2.10. Rest of North America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.2.11. Rest of North America Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.2.12. Rest of North America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.3. Europe Roofing Underlying Materials Market, 2015 and 2024

7.3.1. Europe Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.3.2. Europe Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.3.3. Europe Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.3.4. Europe Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.3.5. France Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.3.6. France Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.3.7. France Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.3.8. France Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.3.9. U.K. Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.3.10. U.K. Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.3.11. U.K. Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.3.12. U.K. Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.3.13. Spain Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.3.14. Spain Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.3.15. Spain Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.3.16. Spain Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.3.17. Germany Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.3.18. Germany Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.3.19. Germany Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.3.20. Germany Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.3.21. Italy Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.3.22. Italy Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.3.23. Italy Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.3.24. Italy Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.3.25. Rest of Europe Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.3.26. Rest of Europe Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.3.27. Rest of Europe Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.3.28. Rest of Europe Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.4. Asia Pacific Roofing Underlying Materials Market, 2015 and 2024

7.4.1. Asia Pacific Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.4.2. Asia Pacific Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.4.3. Asia Pacific Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.4.4. Asia Pacific Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.4.5. China Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.4.6. China Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.4.7. China Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.4.8. China Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.4.9. Japan Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.4.10. Japan Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.4.11. Japan Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.4.12. Japan Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.4.13. ASEAN Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.4.14. ASEAN Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.4.15. ASEAN Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.4.16. ASEAN Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.4.17. Rest of Asia Pacific Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.4.18. Rest of Asia Pacific Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.4.19. Rest of Asia Pacific Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.4.20. Rest of Asia Pacific Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.5. Latin America Roofing Underlying Materials Market, 2015 and 2024

7.5.1. Latin America Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.5.2. Latin America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.5.3. Latin America Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.5.4. Latin America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.5.5. Brazil Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.5.6. Brazil Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.5.7. Brazil Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.5.8. Brazil Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.5.9. Rest of Latin America Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.5.10. Rest of Latin America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.5.11. Rest of Latin America Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.5.12. Rest of Latin America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.6. Middle East & Africa Roofing Underlying Materials Market, 2015 and 2024

7.6.1. Middle East & Africa Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.6.2. Middle East & Africa Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.6.3. Middle East & Africa Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.6.4. Middle East & Africa Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.6.5. GCC Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.6.6. GCC Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.6.7. GCC Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.6.8. GCC Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.6.9. South Africa Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.6.10. South Africa Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.6.11. South Africa Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.6.12. South Africa Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

7.6.13. Rest of Middle East & Africa Roofing Underlying Materials Market Volume, by Product Segment (Million square meter), 2015–2024

7.6.14. Rest of Middle East & Africa Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

7.6.15. Rest of Middle East & Africa Roofing Underlying Materials Market Volume, by Application Segment (Million square meter), 2015–2024

7.6.16. Rest of Middle East & Africa Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

8. Company Profiles

8.1. Atlas Roofing Corporation

8.1.1 Company Overview

8.1.2 Business Overview

8.1.3 Business Strategy

8.2. Duro-Last Roofing, Inc.

8.2.1 Company Overview

8.2.2 Business Overview

8.2.3 Business Strategy

8.3. CertainTeed Corporation

8.3.1 Company Overview

8.3.2 Business Overview

8.3.3 Business Strategy

8.4. Braas Monier Building Group Services S.A

8.4.1 Company Overview

8.4.2 Business Overview

8.4.3 Recent Developments

8.4.4 Business Strategy

8.4.5 Financial Details

8.5. GAF

8.5.1 Company Overview

8.5.2 Business Overview

8.5.3 Recent Developments

8.5.4 Business Strategy

8.6. IKO Industries Ltd.

8.6.1 Company Overview

8.6.2 Business Overview

8.6.3 Business Strategy

8.7. DuPont

8.7.1 Company Overview

8.7.2 Business Overview

8.7.3 Business Strategy

8.7.4 Financial Details

8.8. Owens Corning

8.8.1 Company Overview

8.8.2 Business Overview

8.8.3 Business Strategy

8.8.4 Financial Details

8.9. Firestone Building Products Company

8.9.1 Company Overview

8.9.2 Business Overview

8.9.3 Business Strategy

8.10. TAMKO Building Products, Inc.

8.10.1 Company Overview

8.10.2 Business Overview

8.10.3 Business Strategy

8.11. Carlisle

8.11.1 Company Overview

8.12.2 Business Overview

8.13.3 Business Strategy

8.14.4 Financial Details

9. Primary Research – Key Findings

List of Tables

Table 1. Global Roofing Underlying Materials Market: Snapshot

Table 2. North America Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 3. North America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 4. North America Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 5. North America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 6. U.S Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 7. U.S Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 8. U.S Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 9. U.S Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 10. Rest of North America Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 11. Rest of North America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 12. Rest of North America Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 13. Rest of North America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 14. Europe Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 15. Europe Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 16. Europe Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 17. Europe Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 18. France Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 19. France Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 20. France Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 21. France Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 22. U.K. Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 23. U.K. Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 24. U.K. Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 25. U.K. Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 26. Spain Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 27. Spain Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 28. Spain Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 29. Spain Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 30. Germany Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 31. Germany Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 32. Germany Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 33. Germany Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 34. Italy Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 35. Italy Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 36. Italy Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 37. Italy Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 38. Rest of Europe Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 39. Rest of Europe Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 40. Rest of Europe Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 41. Rest of Europe Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 42. Asia Pacific Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 43. Asia Pacific Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 44. Asia Pacific Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 45. Asia Pacific Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 46. China Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 47. China Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 48. China Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 49. China Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 50. Japan Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 51. Japan Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 52. Japan Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 53. Japan Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 54. ASEAN Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 55. ASEAN Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 56. ASEAN Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 57. ASEAN Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 58. Rest of Asia Pacific Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 59. Rest of Asia Pacific Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 60. Rest of Asia Pacific Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 61. Rest of Asia Pacific Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 62. Latin America Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 63. Latin America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 64. Latin America Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 65. Latin America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 66. Brazil Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 67. Brazil Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 68. Brazil Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 69. Brazil Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 70. Rest of Latin America Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 71. Rest of Latin America Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 72. Rest of Latin America Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 73. Rest of Latin America Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 74. Middle East & Africa Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 75. Middle East & Africa Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 76. Middle East & Africa Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 77. Middle East & Africa Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 78. GCC Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 79. GCC Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 80. GCC Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 81. GCC Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 82. South Africa Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 83. South Africa Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 84. South Africa Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 85. South Africa Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

Table 86. Rest of Middle East & Africa Roofing Underlying Materials Market Volume, by Product Segment (Million Square Meter), 2015–2024

Table 87. Rest of Middle East & Africa Roofing Underlying Materials Market Revenue, by Product Segment (US$ Mn), 2015–2024

Table 88. Rest of Middle East & Africa Roofing Underlying Materials Market Volume, by Application Segment (Million Square Meter), 2015–2024

Table 89. Rest of Middle East & Africa Roofing Underlying Materials Market Revenue, by Application Segment (US$ Mn), 2015–2024

List of Figures

Figure 1. Roofing Underlying Materials Market Segmentation: By Product, Application, and Region

Figure 2. Global Roofing Underlying Materials Market (Million Square Meter) (US$ Mn), 2015–2024

Figure 3. Roofing Underlying Materials Market: Value Chain Analysis

Figure 4. Roofing Underlying Materials Market: Market Dynamics

Figure 5. Global Construction Industry, 2015–2024

Figure 6. Global Urban Population, 2015–2024

Figure 7. Production Cost of Roofing Underlying Materials

Figure 8. Porter’s Five Forces Analysis

Figure 9. Global Roofing Underlying Materials Market Attractiveness, by Region/Country, 2015

Figure 10. Global Roofing Underlying Materials Market Attractiveness, by Application, 2015

Figure 11. Global Roofing Underlying Materials Market Share, by Company, 2015

Figure 12. Global Average Price Trend (US$/Square Meter), 2015–2024

Figure 13. Global Roofing Underlying Materials Market: Product Segment Overview

Figure 14. Global Roofing Underlying Materials Market for Asphalt-saturated Felt (Million Square Meter) (US$ Mn), 2015–2024

Figure 15. Global Roofing Underlying Materials Market for Rubberized Asphalt (Million Square Meter) (US$ Mn), 2015–2024

Figure 16. Global Roofing Underlying Materials Market for Non-bitumen Synthetic (Million Square Meter) (US$ Mn), 2015–2024

Figure 17. Global Roofing Underlying Materials Market: Application Overview

Figure 18. Global Roofing Underlying Materials Market for Residential (Million Square Meter) (US$ Mn), 2015–2024

Figure 19. Global Roofing Underlying Materials Market for Commercial (Million Square Meter) (US$ Mn), 2015–2024

Figure 20. Global Roofing Underlying Materials Market for Non-residential (Million Square Meter) (US$ Mn), 2015–2024

Figure 21. Global Roofing Underlying Materials Market: Regional Overview

Figure 22. North America Roofing Underlying Materials Market, 2015 and 2024

Figure 23. Europe Roofing Underlying Materials Market, 2015 and 2024

Figure 24. Asia Pacific Roofing Underlying Materials Market, 2015 and 2024

Figure 25. Latin America Roofing Underlying Materials Market, 2015 and 2024

Figure 26. Middle East & Africa Roofing Underlying Materials Market, 2015 and 2024