Reports

Reports

Genomics and proteomics reagents, research kits, and analytical instruments market is witnessing breakneck growth, fueled by a synergy of technological innovation, mounting investment in research, and a reinforced emphasis on personalized medicine. Fueled by plummeting costs of sequencing technologies and their efficiency, genomics reagent and research kit markets have grown manifold, supporting genetic research as well as diagnostic improvement.

Since the identification of protein function and interactions would complement genomics, proteomics development is also picking up pace with advancements in mass spectrometry and bioinformatics tools. Furthermore, the increasing case load of chronic and hereditary diseases has fueled the transition to precision medicine that requires advanced analysis tools for proper diagnosis and tracking of treatment.

Increased implementation of machine learning and artificial intelligence into protocols for research further increases data analysis capability, contributing to efficiency and accuracy in research genomics and proteomics. This dynamic environment is further strengthened by the increasing ratio of clinical trials and research collaborations between industrial and academic players, offering an environment that is innovative.

Ongoing trends in the genomics and proteomics reagents, research kits, and analytical instruments market include technology development and personalized medicine. One of the most notable trends is the use of next-generation sequencing (NGS) increasingly, which has significantly reduced the cost and time taken by genomic analysis. This has generated the need for high-throughput research kits and reagents.

Furthermore, more emphasis has been laid on the integration of artificial intelligence and machine learning with data analysis processes that have enhanced the ability to effectively analyze complex biological data. One can also appreciate how proteomics have progressed based on improved mass spectrometry techniques and protein analysis methods for a broader scope of research potential.

Firms are investing in R&D for next-generation sequencing and mass spectrometry technology. Biotech firms are facilitating academic partnerships that are fueling innovation in new reagents and analysis instruments. These endeavors combined contribute to the accessibility and usability of genomic and proteomic investigations becoming a reality, leading to more targeted therapeutic interventions in medicine.

Genomics and proteomics reagents, research kits, and analyzing instruments are the essential molecular biology and biotechnology equipment that enable scientists to investigate the complex interactions of gene and protein in living systems.

Genomics is the investigation of an organism's complete set of DNA, genes, and proteomics is the investigation of the structure, function, and protein-protein interaction encoded by such genes. Reagents and kits are research materials with a mixture of compounds, i.e., enzymes, nucleotides, and antibodies, which are intended to aid particular experimental processes, i.e., protein assays, polymerase chain reaction (PCR), and DNA sequencing. Analytical instruments, e.g., sequencers, mass spectrometers, and microarray platforms, offer the technology to analyze and interpret the genetic and proteomic information.

These technologies have wide-ranging applications in every branch of industry. Genomics and proteomics are core operations in the diagnosis of medicine, including genetic disease detection, providing individualized treatment regimens, and drug formulation for targeted therapy of disease like cancer. Genomic sequencing, for instance, identifies mutations that are used in screening targeted therapy drugs while proteomic profiling identifies markers of disease progression and drug response.

Furthermore, in the field of drug discovery, genomics and proteomics are pivotal in finding new drug targets as well as in elucidating the mechanism of action of medicinal compounds. As both these disciplines are in their growth phase, the confluence of high-throughput technologies and bioinformatics is further extending the scope of genomics and proteomics research to enable interrogation of complex biology issues and better health outcomes on a global level.

| Attribute | Detail |

|---|---|

| Genomics and Proteomics Reagents, Research Kits and Analytical Instruments Market Drivers |

|

Sequencing and mass spectrometry technologies are core drivers of the genomics and proteomics reagents, research kits, and analytical instruments market. NGS technologies have been transforming genomic research by lowering the cost of DNA sequencing and process time significantly.

The technologies permit researchers to conduct large-scale genomic analysis so they can conduct analyses that take a long time to conduct, which was not possible earlier. Single-cell and whole-genome sequencing technologies permit more insight into cellular heterogeneity and genetic diversity required to be applied in personalized medicine.

At the same time, mass spectrometry has become the tool to transform proteomics with outstanding sensitivity and high-precision analysis of proteins. Techniques such as liquid chromatography coupled with mass spectrometry (LC-MS) enable one to separate and quantify several hundred proteins of intricate biological specimens to enable information regarding protein expression, post-translational modifications, and interactions.

Further, the incorporation of automation of high-throughput potential to sequencing and mass spectrometry protocols has further boosted research activity. Sample handling and analysis by automated equipment improve reproducibility and allow more samples to be processed, thereby generating more consistent data.

Additionally, bioinformatics programs being integrated with mass spectrometry and sequencing is expanding the range of data interpretation and analysis. Machine learning and innovative algorithms are facilitating researchers to glean useful information from noisy data, leading to advancements in genomic and proteomic research.

The largest motivating force of the genomics and proteomics reagents, research kits, and analytical instruments market is the growth in demand for precision or personalized medicine. Precision or personalized medicine tailors the medical care to meet the individual differences, needs, and preferences of people, primarily based on genetics, environment, and lifestyle. It is an alternative to the standard "one-size-fits-all" care, with possible more effective and targeted therapies.

With the movement of medicine toward personalized medicine, the demand for genomic and proteomic profiling has grown exponentially. With genomic sequencing, doctors can diagnose some of the mutations and variations that make a patient susceptible to disease or drug responsiveness. For instance, in cancer, genomically guided tumor profiling can assist in the identification of mutations to guide targeted therapy with improved patient outcomes and reduced toxicity. Therefore, quality reagents and kits used for analysis and sequencing need to be sought more as they are important for correct identification of the genetic markers.

Similarly, proteomics enables personalized medicine as it can determine protein expression patterns and post-translational modifications that have an impact on disease processes. Being able to analyze markers in patient samples can result in earlier and more specific treatment protocols. This has important consequences in the management of chronic diseases since having the knowledge of the proteomic profile is able to personalize interventions that are more suited to the individual patient.

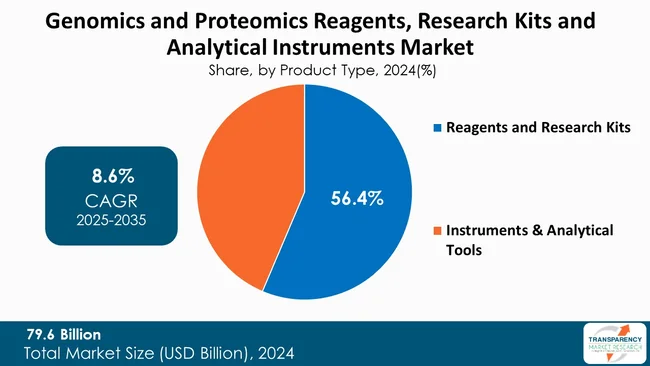

The reagents and research kits segment of the genomics and proteomics reagents, research kits, and analytical instruments market commands a huge market share by virtue of several reasons. To begin with, the kits are indispensable tools for a host of applications ranging from DNA sequencing and PCR to protein assays and therefore the basis for research and clinical diagnostics.

The kits are versatile, and the researchers are able to carry out several experiments using one kit, and therefore providing greater efficiency and cost advantages.

Second, growth in the application of next-generation sequencing (NGS) and mass spectrometry technology places pressure on quality reagents that promise exact and reproducible results. As scientists desire to streamline their workflows, pre-formulated ready-to-use kits make life easy, enabling easier achievement of reproducible and faster results.

| Attribute | Detail |

|---|---|

| Leading Region |

|

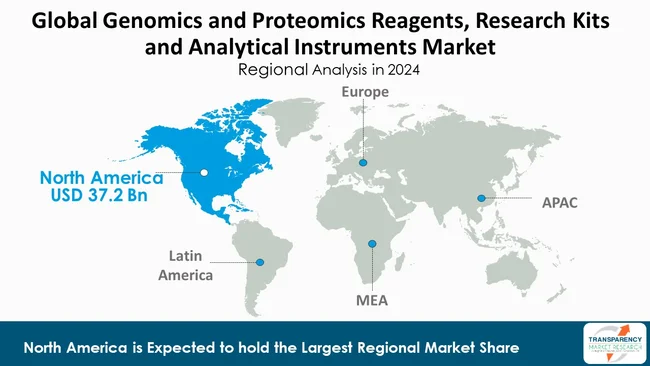

North America led with highest market share in 2024, according to the recent genomics and proteomics reagents, research kits and analytical instruments market report. To begin with, the area hosts leading biotech and pharma companies with enormous R&D investments.

Additionally, government funding programs, such as the ones from National Institutes of Health (NIH) and the Precision Medicine Initiative, enable genomic science and health innovation. These initiatives elevate access to resources and infrastructure available for advanced research.

Also, North America has a good framework of research institutions and academic centers that are involved in conducting genomics and proteomics research, which further fuels the demand for research kit and reagents. The regulatory mechanisms in place also allow new products to be commercialized efficiently, thereby innovations in the market are on schedule.

Competition among genomics and proteomics reagents, research kits, and analytical instruments players is developing focused reagents and kits that enable the use of the applications of personalized medicine, through which health practitioners can tailor treatments to the unique genetic makeup and biomarkers of individuals. The players are also venturing into the emerging markets in an attempt to access new bases of customers and take advantage of increased demand for research on genomic and proteomic applications in such markets.

Thermo Fisher Scientific Inc., Beckman Coulter, Inc. (Danaher Corporation), Bio-Rad Laboratories, Inc., Merck KGaA, Agilent Technologies, Inc., Becton, Dickinson and Company, Bruker, Illumina, Inc., New England Biolabs, BGI Genomics, 10x Genomics, Twist Bioscience, Revvity, Vazyme International LLC, Complete Genomics Incorporated, and Paragon Genomics, Inc. are some of the leading players operating in the global genomics and proteomics reagents, research kits and analytical instruments market.

Each of these players has been profiled in the genomics and proteomics reagents, research kits and analytical instruments industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

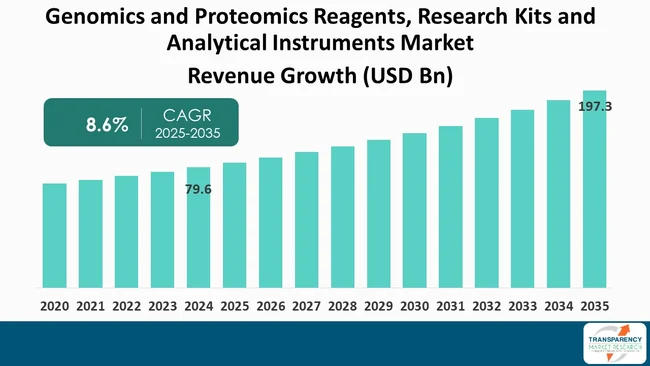

| Size in 2024 | US$ 79.6 Bn |

| Forecast Value in 2035 | US$ 197.3 Bn |

| CAGR | 8.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Genomics And Proteomics Reagents, Research Kits and Analytical Instruments Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global genomics and proteomics reagents, research kits and analytical instruments market was valued at US$ 79.6 Bn in 2024

The global genomics and proteomics reagents, research kits and analytical instruments industry is projected to cross US$ 197.3 Bn by the end of 2035

Technological innovations in sequencing and mass spectrometry, rising demand for personalized medicine and growing prevalence of chronic diseases are some of the factors driving the expansion of genomics and proteomics reagents, research kits and analytical instruments market.

The CAGR is anticipated to be 8.6% from 2025 to 2035

Thermo Fisher Scientific Inc., Beckman Coulter, Inc. (Danaher Corporation), Bio-Rad Laboratories, Inc., Merck KGaA, Agilent Technologies, Inc., Becton, Dickinson and Company, Bruker, Illumina, Inc., New England Biolabs, BGI Genomics, 10x Genomics, Twist Bioscience, Revvity, Vazyme International LLC, Complete Genomics Incorporated, and Paragon Genomics, Inc.

Table 01: Global Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Market Value (US$ Bn) Forecast, By Reagents and Research Kits, 2020 to 2035

Table 03: Global Market Value (US$ Bn) Forecast, By Protein Separation Kits, 2020 to 2035

Table 04: Global Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 06: Global Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 10: North America Market Value (US$ Bn) Forecast, By Reagents and Research Kits, 2020 to 2035

Table 11: North America Market Value (US$ Bn) Forecast, By Protein separation Kits, 2020 to 2035

Table 12: North America Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 13: North America Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 14: North America Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 16: Europe Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 17: Europe Market Value (US$ Bn) Forecast, By Reagents and Research Kits, 2020 to 2035

Table 18: Europe Market Value (US$ Bn) Forecast, By Protein separation Kits, 2020 to 2035

Table 19: Europe Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Europe Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 21: Europe Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 23: Asia Pacific Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 24: Asia Pacific Market Value (US$ Bn) Forecast, By Reagents and Research Kits, 2020 to 2035

Table 25: Asia Pacific Market Value (US$ Bn) Forecast, By Protein separation Kits, 2020 to 2035

Table 26: Asia Pacific Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 27: Asia Pacific Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 28: Asia Pacific Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 30: Latin America Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 31: Latin America Market Value (US$ Bn) Forecast, By Reagents and Research Kits, 2020 to 2035

Table 32: Latin America Market Value (US$ Bn) Forecast, By Protein separation Kits, 2020 to 2035

Table 33: Latin America Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 34: Latin America Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 35: Latin America Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Middle East & Africa Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 37: Middle East & Africa Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 38: Middle East & Africa Market Value (US$ Bn) Forecast, By Reagents and Research Kits, 2020 to 2035

Table 39: Middle East & Africa Market Value (US$ Bn) Forecast, By Protein separation Kits, 2020 to 2035

Table 40: Middle East & Africa Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 41: Middle East & Africa Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 42: Middle East & Africa Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Market Revenue (US$ Bn), by Reagents and Research Kits, 2020 to 2035

Figure 04: Global Market Revenue (US$ Bn), by Instruments & Analytical Tools, 2020 to 2035

Figure 05: Global Market Value Share Analysis, By Application, 2024 and 2035

Figure 06: Global Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 07: Global Market Revenue (US$ Bn), by Genomics, 2020 to 2035

Figure 08: Global Market Revenue (US$ Bn), by Chemoinformatics & Drug Design, 2020 to 2035

Figure 09: Global Market Revenue (US$ Bn), by Proteomics, 2020 to 2035

Figure 10: Global Market Revenue (US$ Bn), by Transcriptomics, 2020 to 2035

Figure 11: Global Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 12: Global Market Value Share Analysis, By End-user, 2024 and 2035

Figure 13: Global Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 14: Global Market Revenue (US$ Bn), by Diagnostic Laboratories, 2020 to 2035

Figure 15: Global Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 16: Global Market Revenue (US$ Bn), by Academic and Research Institutions, 2020 to 2035

Figure 17: Global Market Value Share Analysis, By Region, 2024 and 2035

Figure 18: Global Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 19: North America Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 20: North America Market Value Share Analysis, by Country, 2024 and 2035

Figure 21: North America Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 22: North America Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 23: North America Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 24: North America Market Value Share Analysis, By Application, 2024 and 2035

Figure 25: North America Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 26: North America Market Value Share Analysis, By End-user, 2024 and 2035

Figure 27: North America Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 28: Europe Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: Europe Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 30: Europe Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 31: Europe Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 32: Europe Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 33: Europe Market Value Share Analysis, By Application, 2024 and 2035

Figure 34: Europe Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 35: Europe Market Value Share Analysis, By End-user, 2024 and 2035

Figure 36: Europe Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 37: Asia Pacific Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: Asia Pacific Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 39: Asia Pacific Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 40: Asia Pacific Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 41: Asia Pacific Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 42: Asia Pacific Market Value Share Analysis, By Application, 2024 and 2035

Figure 43: Asia Pacific Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 44: Asia Pacific Market Value Share Analysis, By End-user, 2024 and 2035

Figure 45: Asia Pacific Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 46: Latin America Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Latin America Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 48: Latin America Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 49: Latin America Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 50: Latin America Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 51: Latin America Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Latin America Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Latin America Market Value Share Analysis, By End-user, 2024 and 2035

Figure 54: Latin America Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 55: Middle East & Africa Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Middle East & Africa Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 57: Middle East & Africa Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 58: Middle East & Africa Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 59: Middle East & Africa Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 60: Middle East & Africa Market Value Share Analysis, By Application, 2024 and 2035

Figure 61: Middle East & Africa Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 62: Middle East & Africa Market Value Share Analysis, By End-user, 2024 and 2035

Figure 63: Middle East & Africa Market Attractiveness Analysis, By End-user, 2025 to 2035