Reports

Reports

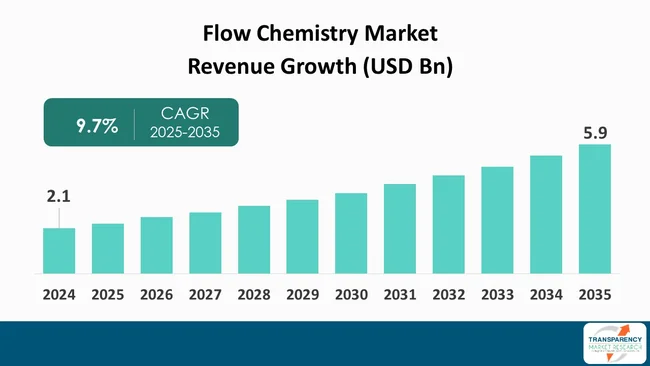

The global flow chemistry market size was valued at US$ 2.1 Billion in 2024 and is projected to reach US$ 5.9 Billion by 2035, expanding at a CAGR of 9.7% from 2025 to 2035. The market growth is driven rising demand for efficient, sustainable & continuous chemical processes, and growth in pharmaceutical and specialty chemical production.

The global flow chemistry market is gradually establishing its role as a key technology contributor that allows manufacturing to be continuous, safer, and more environmentally-friendly, mainly in case of pharmaceuticals, fine, and specialty chemicals.

Several publicly available case studies show that the development cycles are getting faster and the tech transfer from lab to commercial scale becomes easier. This is because microreactor platforms that offer better heat and mass transfer for complex transformations.

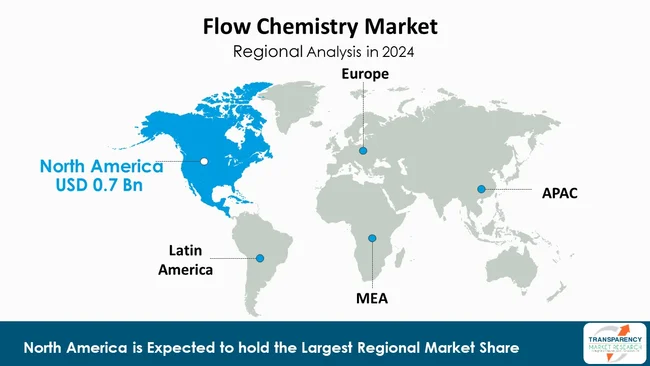

At the regional level, North America and Europe have the advantage of strong regulatory support for continuous manufacturing and ESG‑aligned operations, while Asia Pacific is using flow chemistry to increase its capacity and export competitiveness.

Equipment suppliers and CDMOs are creating a distinction between themselves through integrated automation, PAT, and modular architectures that facilitate scale‑up and provide multi‑product flexibility. Over the medium term, process intensification and green chemistry mandates will keep flow as the main focus of capex decisions.

Flow chemistry or continuous-flow processing is one of the revolutionary manufacturing methods in which chemical reactions are performed in a continuous flow of streams instead of batch reactor. The method lets the operators exercise precise control over the reaction parameters such as pressure, temperature, and residence time, which ultimately results in better product consistency, higher efficiency, and improved safety. Flow chemistry is the most sought-after technique for highly exothermic, fast, or hazardous reactions that are difficult to handle in batch systems.

From a business perspective, flow chemistry is a great enabler of sustainability and cost optimization as it leads to decrease in raw-materials’ consumption, energy use, and waste generation. Besides, it allows for a fast scale-up from the laboratory to commercial production. Thus development cycles become shorter and time-to-market is accelerated. The benefits have made flow chemistry an attractive technology of the future for pharmaceutical, fine chemical, and specialty chemical manufacturers looking for operational agility and regulatory compliance.

As the industries are gradually adopting continuous manufacturing and greener production models, flow chemistry is no longer just a tool for R&D but rather a core production technology. The commercial relevance and long-term growth potential of flow chemistry keep getting stronger with the ongoing innovations in reactor design, automation, and process analytics.

| Attribute | Detail |

|---|---|

| Flow Chemistry Market Drivers |

|

The increasing need for efficiency, sustainability, and operational reliability has been the major reason behind the widespread use of flow chemistry in the global chemical industry. One of the most notable issues of traditional batch processes is their high-energy consumption, inconsistent product quality, and elevated waste generation. On the other hand, continuous flow systems allow for the most accurate control of reaction conditions leading to higher yields and customer quality, which can be repeated, with minimum environmental impact. To illustrate, chemical manufacturers making use of continuous processing can lower their solvent usage by 20-40%, and energy consumption by 15-30%, as compared to conventional batch operations.

Flow chemistry is also a good friend of regulatory and ESG standards as it supports stricter environmental standards’ compliance through its emissions reduction, improved atom economy, and safer handling of hazardous reagents features. In pharmaceutical manufacturing, continuous flow processes have actually increased throughput by 2-5 times while taking up a smaller plant footprint, thus resulting in lower capital and operating costs. Furthermore, margin enhancement and sustainability metrics improvement through direct waste reduction of up to 50% in certain fine chemical reactions is another benefit.

Global pharmaceutical production continues to grow, with API (Active Pharmaceutical Ingredient) output annually rising by approximately 6-8%. Consequently, there is an increasing demand for manufacturing technologies that can deliver high throughput and maintain consistent quality.

Flow chemistry is being actively implemented in the synthesis of APIs and intermediates as it allows achieving from 3 to 10 times higher space-time yields as compared to batch reactors. In this way, producers can reach commercial-scale output with smaller reactor volumes. Also, continuous flow processing has shortened the typical API reaction times, which were from 8 to 24 hours in batch, to 30-120 minutes, thus directly increasing production capacity and scheduling efficiency.

In regulated pharmaceutical manufacturing, flow chemistry facilitates more precise process control resulting in less batch-to-batch variability and thus, yield improvements of 20-40% for multistep reactions. In the case of hazardous transformations like nitration, diazotization, and hydrogenation, the use of continuous flow results in a 70-90% reduction in the in-process inventory, thus decreasing the risk of explosion and exposure, and at the same time, complying with safety regulations.

As for specialty chemicals, continuous flow plants can have 20-35% higher asset utilization and 15-25% lower unit costs due to the steady-state operation and less downtime. These quantifiable performance improvements are the main reasons for the ongoing extensive use of flow chemistry in pharmaceutical and specialty chemical production.

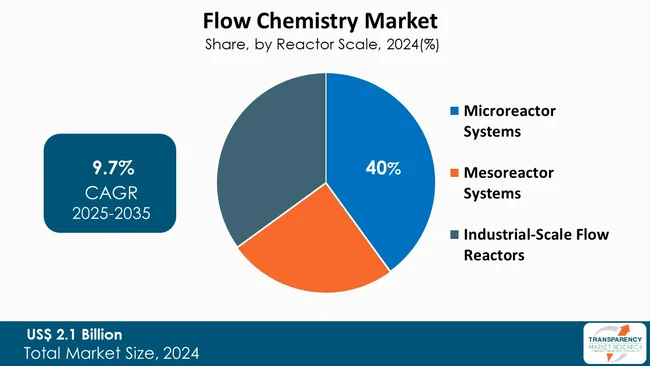

Microreactor systems are the smallest reactor scale most commonly used in the flow chemistry market. This is mainly due to their feature of delivering precise control, high safety, and rapid process development. The working channel of these systems is usually less than one millimeter in size, which results in heat transfer coefficients as high as 1,000-10,000 W/m²·K, which is several times higher than that of conventional batch reactors. For this reason, reaction temperatures can be regulated very closely, leading to fewer side reactions and higher selectivity. For instance, microreactors in pharmaceutical synthesis have yielded 2-5 times higher and shortened reaction times by 60-90% compared to batch processes.

In terms of business, flow systems based on microreactors through numbering-up enable quick scale-up, thus production capacity can be increased without major capital investments. Plant operators have claimed that when microreactors are used instead of small-scale batch reactors, solvent consumption is reduced by 30-50%, and energy usage is lowered by 20-40%. On top of that, less than 70-90% in-process inventory is ensured when hazardous reactions such as nitration or organometallic synthesis are carried out, thus operational safety is enhanced. These measurable benefits are the main reasons why microreactor systems R&D, pilot production, and high-value chemical manufacturing are the most suitable units.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is at the forefront of the global flow chemistry market, mainly due to the early transition to continuous manufacturing and a robust pharmaceutical and specialty chemical production base. The region is responsible for 36% of the global market share, driven by the extensive use of flow reactors in API synthesis, where manufacturers report 3-8× higher space-time yields and 30-50% reductions in cycle time as compared to batch processing. Regulatory support for continuous manufacturing is also a factor that helps the commercial deployment to be faster.

Europe ranks second with an estimated 27% share, credited to strict environmental regulations and a matured fine chemicals sector. European chemical producers implementing flow chemistry have achieved 20-40% less solvent consumption and 15-30% energy use reduction, thereby, meeting sustainability goals and cost-saving initiatives.

The Asia Pacific region is the fastest developing market, with a share of 26%. The growth of pharmaceutical and specialty chemical manufacturing in China, India, and Japan has been the main driver in the region. The adoption of flow chemistry in the region has resulted in 25-35% higher plant utilization and 15-25% lower unit production costs that have helped the rapid capacity expansion and export competitiveness.

ThalesNano Inc. is a top-tier source of flow chemistry systems worldwide. They primarily emphasize continuous hydrogenation, high-pressure reactions, and scalable reactor technologies. Their flow reactors are used, for example, in drug-making and fine chemical manufacturing industries where the users can achieve from 3 to 10 times higher space-time yields along with a greatly enhanced process safety, compared to batch systems. Moreover, the different platforms of ThalesNano are designed to facilitate very fast scale-up from the laboratory level to production, thus the company is present at R&D, pilot, and commercial application levels all over the world.

Syrris Ltd. is a top-tier flow chemistry technology company, recognized for its modular and automated reactor systems that are broadly used in pharmaceutical and specialty chemical R&D. Its flow platforms are capable of effecting the reaction in 60-90% less time while also resulting in 20-40% higher yield due to the exact control of temperature and residence time. In addition, Syrris’ extensive worldwide distribution network and its compatibility with process analytics position the company as a continuous process development and optimization partner that is most trusted.

Vapourtec, AM Technology, Corning, Chemtrix, CEM Corporation, Hel Group, Asynt, Ehrfeld Mikrotechnik, Cambridge Reactor Design, Milestone SRL, Parr Instrument Company, Advion Interchim Scientific, Asymchem are some other major companies in the flow chemistry market. Each of these players has been profiled in the flow chemistry industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 2.1 Billion |

| Market Forecast Value in 2035 | US$ 5.9 Billion |

| Growth Rate (CAGR) | 9.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Billion for Value |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Flow Chemistry market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Reactor Scale

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The flow chemistry market was valued at US$ 2.1 Billion in 2024

The flow chemistry industry is expected to grow at a CAGR of 9.7% from 2025 to 2035

Rising demand for efficient, sustainable & continuous chemical processes, and growth in pharmaceutical and specialty chemical production.

Microreactor systems was the largest reactor scale segment in the flow chemistry market.

North America was the most lucrative region in 2024

Syrris, ThalesNano, Vapourtec, AM Technology, Corning, Chemtrix, CEM Corporation, Hel Group, Asynt, Ehrfeld Mikrotechnick, Cambridge Reactor Design, Milestone SRL, Parr Instrument Company, Advion Interchim Scientific, Asymchem are some of the major companies in the global flow chemistry market.

Table 1 Global Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 2 Global Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type 2020 to 2035

Table 3 Global Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 4 Global Flow Chemistry Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 5 Global Flow Chemistry Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 6 North America Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 7 North America Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type 2020 to 2035

Table 8 North America Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 North America Flow Chemistry Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 10 North America Flow Chemistry Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 11 U.S. Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 12 U.S. Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 13 U.S. Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14 U.S. Flow Chemistry Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 Canada Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 16 Canada Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 17 Canada Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 18 Canada Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 19 Europe Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 20 Europe Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 21 Europe Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22 Europe Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 23 Europe Flow Chemistry Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 24 Germany Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 25 Germany Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 26 Germany Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 Germany Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 28 France Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 29 France Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 30 France Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31 France Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 32 U.K. Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 33 U.K. Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 34 U.K. Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35 U.K. Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 36 Italy Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 37 Italy Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 38 Italy Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39 Italy Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 40 Spain Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 41 Spain Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 42 Spain Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Spain Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 44 Russia & CIS Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 45 Russia & CIS Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 46 Russia & CIS Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47 Russia & CIS Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 48 Rest of Europe Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 49 Rest of Europe Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 50 Rest of Europe Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51 Rest of Europe Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 52 Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 53 Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 54 Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55 Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 56 Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 China Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale 2020 to 2035

Table 58 China Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 59 China Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 60 China Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 61 Japan Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 62 Japan Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 63 Japan Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 64 Japan Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 65 India Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 66 India Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 67 India Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68 India Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 69 ASEAN Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 70 ASEAN Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 71 ASEAN Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72 ASEAN Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 73 Rest of Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 74 Rest of Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 75 Rest of Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 76 Rest of Asia Pacific Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 77 Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 78 Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 79 Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 80 Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 81 Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 82 Brazil Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 83 Brazil Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 84 Brazil Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 Brazil Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 86 Mexico Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 87 Mexico Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 88 Mexico Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 89 Mexico Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 90 Rest of Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 91 Rest of Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 92 Rest of Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Rest of Latin America Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 94 Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 95 Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 96 Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97 Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 98 Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 99 GCC Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 100 GCC Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 101 GCC Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 102 GCC Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 103 South Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 104 South Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 105 South Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 106 South Africa Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 Rest of Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Scale, 2020 to 2035

Table 108 Rest of Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Reactor Type, 2020 to 2035

Table 109 Rest of Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 110 Rest of Middle East & Africa Flow Chemistry Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Flow Chemistry Market Value Share Analysis, by Reactor Scale, 2024, 2028, and 2035

Figure 2 Global Flow Chemistry Market Attractiveness, by Reactor Scale

Figure 3 Global Flow Chemistry Market Value Share Analysis, by Reactor Type, 2024, 2028, and 2035

Figure 4 Global Flow Chemistry Market Attractiveness, by Reactor Type

Figure 5 Global Flow Chemistry Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Flow Chemistry Market Attractiveness, by Application

Figure 7 Global Flow Chemistry Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 Global Flow Chemistry Market Attractiveness, by End-use

Figure 9 Global Flow Chemistry Market Value Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global Flow Chemistry Market Attractiveness, by Region

Figure 11 North America Flow Chemistry Market Value Share Analysis, by Reactor Scale, 2024, 2028, and 2035

Figure 12 North America Flow Chemistry Market Attractiveness, by Reactor Scale

Figure 13 North America Flow Chemistry Market Value Share Analysis, by Reactor Type, 2024, 2028, and 2035

Figure 14 North America Flow Chemistry Market Attractiveness, by Reactor Type

Figure 15 North America Flow Chemistry Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 16 North America Flow Chemistry Market Attractiveness, by Application

Figure 17 North America Flow Chemistry Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 18 North America Flow Chemistry Market Attractiveness, by End-use

Figure 19 North America Flow Chemistry Market Attractiveness, by Country and Sub-region

Figure 20 Europe Flow Chemistry Market Value Share Analysis, by Reactor Scale, 2024, 2028, and 2035

Figure 21 Europe Flow Chemistry Market Attractiveness, by Reactor Scale

Figure 22 Europe Flow Chemistry Market Value Share Analysis, by Reactor Type, 2024, 2028, and 2035

Figure 23 Europe Flow Chemistry Market Attractiveness, by Reactor Type

Figure 24 Europe Flow Chemistry Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 25 Europe Flow Chemistry Market Attractiveness, by Application

Figure 26 Europe Flow Chemistry Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 27 Europe Flow Chemistry Market Attractiveness, by End-use

Figure 28 Europe Flow Chemistry Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 29 Europe Flow Chemistry Market Attractiveness, by Country and Sub-region

Figure 30 Asia Pacific Flow Chemistry Market Value Share Analysis, by Reactor Scale, 2024, 2028, and 2035

Figure 31 Asia Pacific Flow Chemistry Market Attractiveness, by Reactor Scale

Figure 32 Asia Pacific Flow Chemistry Market Value Share Analysis, by Reactor Type, 2024, 2028, and 2035

Figure 33 Asia Pacific Flow Chemistry Market Attractiveness, by Reactor Type

Figure 34 Asia Pacific Flow Chemistry Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 35 Asia Pacific Flow Chemistry Market Attractiveness, by Application

Figure 36 Asia Pacific Flow Chemistry Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 37 Asia Pacific Flow Chemistry Market Attractiveness, by End-use

Figure 38 Asia Pacific Flow Chemistry Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Asia Pacific Flow Chemistry Market Attractiveness, by Country and Sub-region

Figure 40 Latin America Flow Chemistry Market Value Share Analysis, by Reactor Scale, 2024, 2028, and 2035

Figure 41 Latin America Flow Chemistry Market Attractiveness, by Reactor Scale

Figure 42 Latin America Flow Chemistry Market Value Share Analysis, by Reactor Type, 2024, 2028, and 2035

Figure 43 Latin America Flow Chemistry Market Attractiveness, by Reactor Type

Figure 44 Latin America Flow Chemistry Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 45 Latin America Flow Chemistry Market Attractiveness, by Application

Figure 46 Latin America Flow Chemistry Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 47 Latin America Flow Chemistry Market Attractiveness, by End-use

Figure 48 Latin America Flow Chemistry Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 49 Latin America Flow Chemistry Market Attractiveness, by Country and Sub-region

Figure 50 Middle East & Africa Flow Chemistry Market Value Share Analysis, by Reactor Scale, 2024, 2028, and 2035

Figure 51 Middle East & Africa Flow Chemistry Market Attractiveness, by Reactor Scale

Figure 52 Middle East & Africa Flow Chemistry Market Value Share Analysis, by Reactor Type, 2024, 2028, and 2035

Figure 53 Middle East & Africa Flow Chemistry Market Attractiveness, by Reactor Type

Figure 54 Middle East & Africa Flow Chemistry Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 55 Middle East & Africa Flow Chemistry Market Attractiveness, by Application

Figure 56 Middle East & Africa Flow Chemistry Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 57 Middle East & Africa Flow Chemistry Market Attractiveness, by End-use

Figure 58 Middle East & Africa Flow Chemistry Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 59 Middle East & Africa Flow Chemistry Market Attractiveness, by Country and Sub-region