Reports

Reports

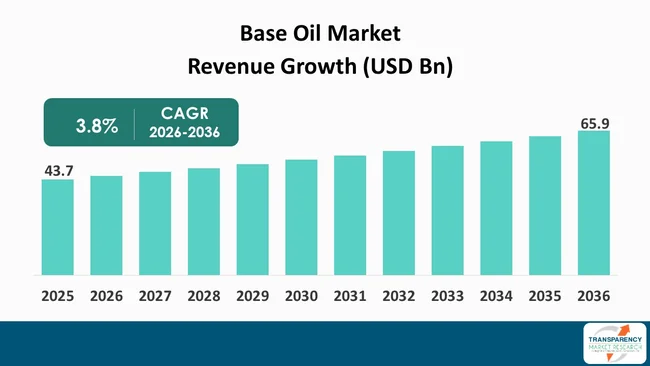

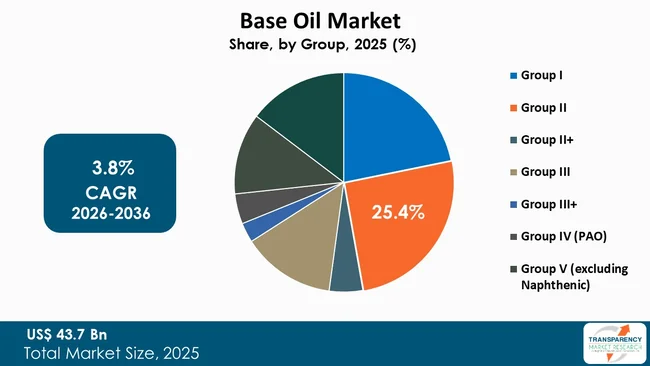

The global base oil market size was valued at US$ 43.7 Billion in 2025 and is projected to reach US$ 65.9 Billion by 2036, expanding at a CAGR of 3.8% from 2026 to 2036. The market is sustained growth in automotive and industrial lubricant consumption.

The base oil market is at the forefront of the lubricants sector, whereby it ensures smooth operation of the diverse machines and vehicle engines across the globe. Rapid industrialization is a major factor driving market revenue. Lubricants are gaining traction in several end-use industries including automotive, industrial machinery, and energy.

The major players operating in the global base oil industry are emphasizing the development of advanced products for expanding their customer base. These novel products satisfy performance requirements and fit with environmental imperatives. The competitive dynamics of the base oil business are getting reshaped by this paradigm shift toward resource-efficient and eco-friendly lubricating solutions.

Base oils are the foundation of lubricant compositions. They play an important role in the performance and lifetime of different industrial and automobile engines. Base oils are generally obtained by refining crude extracts at various temperatures and pressures. These oils are widely classified into numerous classes based on underlying attributes such as temperature and viscosity correlation, with each having distinct uses across diverse sectors. They provide lubrication, heat dissipation, and corrosion prevention.

The global base oil sector is a dynamic section of the petroleum industry, with its products essential in industrial, automotive, and aerospace sectors. The base oil market landscape has witnessed a visible change in the past few years owing to factors like technical breakthroughs, demanding regulatory standards, and shift in the customer tastes toward more ecologically-friendly and sustainable goods. Thus, base oil manufacturers and end-users are looking for new solutions that exceed performance standards and correspond with increase in emphasis on sustainability and resource conservation.

Rise in utilization of lubricants across industries, surge in demand for group II and III base oils, and substantial investments in the thriving automotive sector are contributing to the base oil market growth.

| Attribute | Detail |

|---|---|

| Drivers |

|

Lubricants and their derivatives, especially finished lubricants, are in high demand as industries, particularly in emerging nations, are expanding significantly. This rise in demand is noticeable in sectors such as industrial machinery, automotive, and energy. In-depth base oil market analysis demonstrates a strong association between industrial expansion and lubricant consumption. Expansion of industrial sectors, particularly in emerging countries, is boosting the demand for high-grade oils in the automobile sector.

Declining crude oil sources and rise in focus on environmental safety is augmenting the requirement of environmentally acceptable synthetic hydraulic oils and fluids. These fluids are essential in manufacturing, aviation, construction, and automotive sectors, where they provide a range of services encompassing power transmission, machinery lubrication, wear protection, corrosion prevention, and heat transfer.

Hydraulic fluids transfer potential or kinetic energy, create volume flow between pumps and hydrostatic motors, and reduce the wear of parts that rub against each other. These fluids safeguard the system from corrosion and aid in the removal of heat generated during energy transformation.

Surge in adoption of hydraulic oils in automobile automatic transmissions, brakes, power steering, and industrial machinery such as tractors and other agricultural equipment, forklift trucks, and bulldozers, is driving the base oil market expansion. In terms of production process, materials, and geometry, the automobile sector has grown significantly in the past few years. The sector is working on fulfilling higher mileage and reduced emissions criteria. This, in turn, is augmenting the demand for metalworking fluids in the automotive sector.

The base oil market is receiving strong backing from steadiness in automotive lubricant demand, which is driven by the rising global vehicle population. The rising number of commercial vehicles, passenger cars, and heavy-duty trucks, especially in developing countries, continues to drive the demand for transmission fluids, engine oils, and axle oils. These lubricant types are heavily dependent on base oils as their raw material, thus ensuring a stable base demand.

At the same time, the demand for industrial lubricants also provides strong backing to the base oil market. Sectors like manufacturing, mining, construction, marine, and power plants demand substantial quantities of turbine oils, hydraulic oils, compressor oils, and industrial greases. The rising machine utilization rates, capacity expansions, and periodic maintenance activities continue to drive steady lubricant demand, thus ensuring a corresponding steady base oil demand.

Also, the rising vehicle population and the lack of strict drain interval maintenance in developing countries continue to drive frequent lubricant replacements. This, in turn, drives base oil demand despite the gradual improvement in engine and equipment efficiencies.

| Attribute | Detail |

|---|---|

| Opportunity |

|

| Attribute | Detail |

|---|---|

| Leading Region |

|

Most companies are employing several strategies to increase their base oil market share. They are also investing in R&D activities of new products to expand product portfolio. SK Lubricants, Shell plc, Petronas, ADNOC, S-Oil Corporation, Nynas AB, Chevron Corporation, Repsol, GS Caltex Corporation, and PetroChina Company Limited are key players in the market.

Each of these companies has been profiled in the base oil industry report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. The report also provides detailed insights into the industry's dynamics. It throws light on changing trends, competitive landscapes, and new possibilities, providing stakeholders with useful information for strategic decision-making.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 | US$ 43.7 Bn |

| Market Forecast Value in 2036 | US$ 65.9 Bn |

| Growth Rate (CAGR) | 3.8% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2025 |

| Quantitative Units | US$ Bn for Value and Million Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, base oil market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Group

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The base oil market was valued at US$ 43.7 Bn in 2025

The base oil industry is expected to grow at a CAGR of 3.8% from 2026 to 2036

Rapid industrialization in emerging economies and sustained growth in automotive and industrial lubricant consumption.

Group II was the largest group segment and its value is anticipated to grow at a CAGR of 4.1% during the forecast period

Asia Pacific was the most lucrative region in 2025

SK Lubricants, Shell plc, Petronas, ADNOC, S-Oil Corporation, Nynas AB, Chevron Corporation, Repsol, GS Caltex Corporation, PetroChina Company Limited are the major players in the base oil market

Table 1 Global Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 2 Global Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 3 Global Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 4 Global Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 5 Global Base Oil Market Volume (Million Tons) Forecast, by Region, 2026 to 2036

Table 6 Global Base Oil Market Value (US$ Bn) Forecast, by Region, 2026 to 2036

Table 7 North America Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 8 North America Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 9 North America Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 10 North America Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 11 North America Base Oil Market Volume (Million Tons) Forecast, by Country, 2026 to 2036

Table 12 North America Base Oil Market Value (US$ Bn) Forecast, by Country, 2026 to 2036

Table 13 U.S. Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 14 U.S. Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 15 U.S. Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 16 U.S. Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 17 Canada Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 18 Canada Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 19 Canada Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 20 Canada Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 21 Europe Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 22 Europe Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 23 Europe Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 24 Europe Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 25 Europe Base Oil Market Volume (Million Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 26 Europe Base Oil Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 27 Germany Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 28 Germany Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 29 Germany Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 30 Germany Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 31 U.K. Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 32 U.K. Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 33 U.K. Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 34 U.K. Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 35 France Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 36 France Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 37 France Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 38 France Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 39 Spain Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 40 Spain Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 41 Spain Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 42 Spain Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 43 Italy Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 44 Italy Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 45 Italy Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 46 Italy Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 47 Russia & CIS Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 48 Russia & CIS Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 49 Russia & CIS Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 50 Russia & CIS Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 51 Rest of Europe Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 52 Rest of Europe Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 53 Rest of Europe Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 54 Rest of Europe Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 55 Asia Pacific Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 56 Asia Pacific Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 57 Asia Pacific Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 58 Asia Pacific Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 59 Asia Pacific Base Oil Market Volume (Million Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 60 Asia Pacific Base Oil Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 61 China Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 62 China Base Oil Market Value (US$ Bn) Forecast, by Group 2026 to 2036

Table 63 China Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 64 China Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 65 India Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 66 India Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 67 India Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 68 India Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 69 Japan Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 70 Japan Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 71 Japan Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 72 Japan Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 73 ASEAN Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 74 ASEAN Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 75 ASEAN Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 76 ASEAN Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 77 Rest of Asia Pacific Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 78 Rest of Asia Pacific Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 79 Rest of Asia Pacific Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 80 Rest of Asia Pacific Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 81 Latin America Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 82 Latin America Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 83 Latin America Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 84 Latin America Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 85 Latin America Base Oil Market Volume (Million Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 86 Latin America Base Oil Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 87 Brazil Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 88 Brazil Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 89 Brazil Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 90 Brazil Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 91 Mexico Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 92 Mexico Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 93 Mexico Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 94 Mexico Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 95 Rest of Latin America Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 96 Rest of Latin America Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 97 Rest of Latin America Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 98 Rest of Latin America Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 99 Middle East & Africa Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 100 Middle East & Africa Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 101 Middle East & Africa Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 102 Middle East & Africa Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 103 Middle East & Africa Base Oil Market Volume (Million Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 104 Middle East & Africa Base Oil Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 105 GCC Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 106 GCC Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 107 GCC Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 108 GCC Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 109 South Africa Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 110 South Africa Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 111 South Africa Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 112 South Africa Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 113 Rest of Middle East & Africa Base Oil Market Volume (Million Tons) Forecast, by Group, 2026 to 2036

Table 114 Rest of Middle East & Africa Base Oil Market Value (US$ Bn) Forecast, by Group, 2026 to 2036

Table 115 Rest of Middle East & Africa Base Oil Market Volume (Million Tons) Forecast, by Application, 2026 to 2036

Table 116 Rest of Middle East & Africa Base Oil Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Figure 1 Global Base Oil Market Volume Share Analysis, by Group, 2025, 2029, and 2036

Figure 2 Global Base Oil Market Attractiveness, by Group

Figure 3 Global Base Oil Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 4 Global Base Oil Market Attractiveness, by Application

Figure 5 Global Base Oil Market Volume Share Analysis, by Region, 2025, 2029, and 2036

Figure 6 Global Base Oil Market Attractiveness, by Region

Figure 7 North America Base Oil Market Volume Share Analysis, by Group, 2025, 2029, and 2036

Figure 8 North America Base Oil Market Attractiveness, by Group

Figure 9 North America Base Oil Market Attractiveness, by Group

Figure 10 North America Base Oil Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 11 North America Base Oil Market Attractiveness, by Application

Figure 12 North America Base Oil Market Attractiveness, by Country and Sub-region

Figure 13 Europe Base Oil Market Volume Share Analysis, by Group, 2025, 2029, and 2036

Figure 14 Europe Base Oil Market Attractiveness, by Group

Figure 15 Europe Base Oil Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 16 Europe Base Oil Market Attractiveness, by Application

Figure 17 Europe Base Oil Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 18 Europe Base Oil Market Attractiveness, by Country and Sub-region

Figure 19 Asia Pacific Base Oil Market Volume Share Analysis, by Group, 2025, 2029, and 2036

Figure 20 Asia Pacific Base Oil Market Attractiveness, by Group

Figure 21 Asia Pacific Base Oil Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 22 Asia Pacific Base Oil Market Attractiveness, by Application

Figure 23 Asia Pacific Base Oil Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 24 Asia Pacific Base Oil Market Attractiveness, by Country and Sub-region

Figure 25 Latin America Base Oil Market Volume Share Analysis, by Group, 2025, 2029, and 2036

Figure 26 Latin America Base Oil Market Attractiveness, by Group

Figure 27 Latin America Base Oil Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 28 Latin America Base Oil Market Attractiveness, by Application

Figure 29 Latin America Base Oil Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 30 Latin America Base Oil Market Attractiveness, by Country and Sub-region

Figure 31 Middle East & Africa Base Oil Market Volume Share Analysis, by Group, 2025, 2029, and 2036

Figure 32 Middle East & Africa Base Oil Market Attractiveness, by Group

Figure 33 Middle East & Africa Base Oil Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 34 Middle East & Africa Base Oil Market Attractiveness, by Application

Figure 35 Middle East & Africa Base Oil Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 36 Middle East & Africa Base Oil Market Attractiveness, by Country and Sub-region