Reports

Reports

Africa lead-acid battery market is anticipated to witness steadiness, with many structural and demand-side factors driving it’s use. Lead-acid batteries continue to be a critical energy storage option throughout the continent. Their continued affordability, durability, and potential for recycling has sustained interest in this product segment.

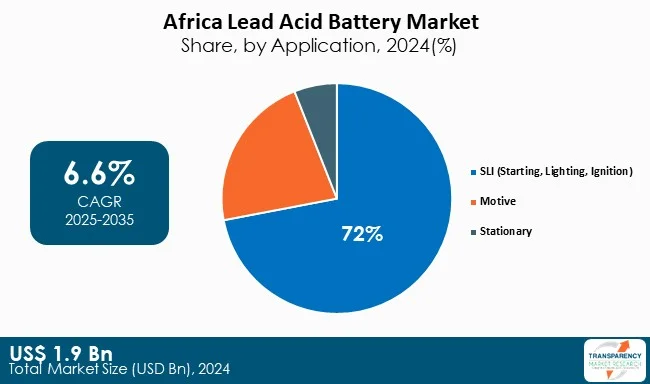

Lead-acid batteries are utilized in numerous applications principally stemming from automotive starter use, but more prominently as backup power supplies in telecommunications towers, uninterruptable power supplies (UPS), and growth in off-grid solar, in mini-grids where electricity is unreliable.

Growth is being influenced by increase in vehicle ownership, rapid urbanization, and adoption of renewable energy alternatives. The major players like Exide, EnerSys, and many local manufacturers in South Africa are gaining strength and market presence through partnerships and regional assembly, for which recycling sources of low-cost battery feedstock is lessening environmental impacts and operation costs.

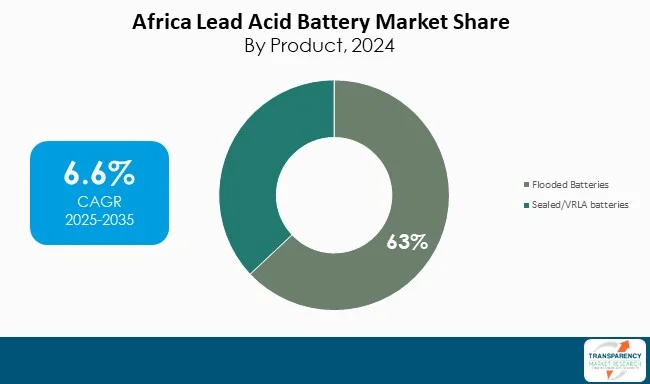

In addition, development of sealed valve-regulated lead-acid (VRLA) batteries mitigates user maintenance, which will spur uptake in telecommunications, solar, and back-up for homes.

Africa lead-acid battery market accounts for a critical part of the energy and power storage market in the region. With low cost, longevity and versatility across a wide range of applications, lead-acid batteries are extraordinary devices. Lead-acid batteries are electrochemical storage devices, which means they consume and produce electricity through chemical reactions. In the case of lead-acid batteries, electricity is produced and stored in lead plates and sulfuric acid.

Lead-acid batteries are primarily used for automotive starter batteries, for backup power on telecom towers and data centers, and as energy storage in solar off-grid and mini-grid systems that are an important energy source in a region with unreliable access to electricity.

| Attribute | Detail |

|---|---|

| Drivers |

|

The expansion of reliable access to energy across Africa, especially in areas of limited or non-existent grid access, is one of the strongest drivers of growth in Africa lead-acid battery market. As per IEA, over 600 million people in Sub-Saharan Africa have no access to electricity. This gap provides enormous opportunities for decentralized power solutions such as diesel generators, mini-grids, solar home systems, and telecom towers. Lead-acid batteries are the dominant storage technology due to their lower costs, established technology, resilience in harsh climate conditions, and capacity to provide consistent storage.

Mobile operators, especially in rural markets, rely heavily on lead-acid batteries for backup power to provide uninterrupted mobile services to customers, where governments and NGOs support solar electrification projects relying on lead-acid storage installed in rural households.

With a parallel global shift toward renewable energy, and international development agencies and private investors financing off-grid and hybrid renewable projects, the stock of lead-acid batteries continues to be underpinned with renewed demand.

Africa is anticipated to have one of the fastest real-time urban population growth numbers around the world, thus driving the demand for personal vehicles, taxis, and logistics fleets higher and consequently increasing the demand for batteries.

Beyond personal transport vehicles, growth in public transport fleets and commercial delivery vehicles continues offering more opportunities. The logistics segment, further enhanced by the e-Commerce boom and reliance on dependable battery technology for trucks, motorcycles, and ancillary equipment such as forklifts, thrives on the reliability of battery solutions.

Automotive lead-acid batteries are also characterized by short replacement cycles, typically 2-3 years in a demanding environment, thus creating ongoing demand and steady return to the aftermarket. There are also a number of larger organizations that are taking advantage of this opportunity, enhancing their distribution channels, by providing local assembly in areas like South Africa and committing to a recycling program to help ensure a more stable and cost-effective supply. The large inventory of imported used vehicles in Africa, which has high battery replacement rates, offers a further conduit of sustained demand.

The low-cost characteristics of flooded batteries make them viable in Africa's price-conscious markets, including rural populations and small enterprises.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Nigeria's growth is increasingly driven by population explosion, thereby increasing vehicle ownership and rising adoption of off-grid solar energy particularly in rural regions.

| Attribute | Detail |

|---|---|

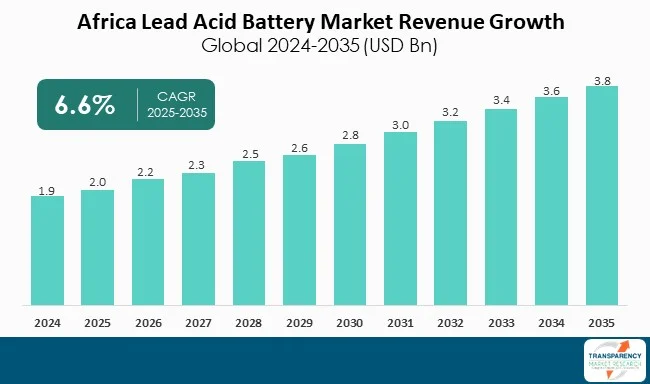

| Market Size Value in 2024 | US$ 1.9 Bn |

| Market Forecast Value in 2035 | US$ 3.8 Bn |

| Growth Rate (CAGR) | 6.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Mn Units for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Africa Lead-Acid Battery market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Product Type

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The Africa lead-acid battery market was valued at US$ 1.9 Bn in 2024

The Africa lead-acid battery market is expected to grow at a CAGR of 6.6% from 2025 to 2035

Rising energy needs and off-grid renewable deployment and expanding automotive sector and growing vehicle ownership

Flooded lead-acid batteries held the largest share within the product type segment and is anticipated to grow at an estimated CAGR of 6.2% during the forecast period

South Africa was the most lucrative country in 2024

Robert Bosch GmbH, Johnson Controls International PLC, Exide Industries Limited, Enersys, Panasonic, Hawker Powersource, FIRST NATIONAL BATTERY are the major players in the Africa lead-acid battery market

Table 1 Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Product Type, 2020 to 2035

Table 2 Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 3 Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Type, 2020 to 2035

Table 4 Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 5 Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Technology 2020 to 2035

Table 6 Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 7 Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Application, 2020 to 2035

Table 8 Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Market Type, 2020 to 2035

Table 10 Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Market Type, 2020 to 2035

Table 11 Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Country, 2020 to 2035

Table 12 Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13 South Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Product Type, 2020 to 2035

Table 14 South Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 15 South Africa Lead Acid Battery Market Volume (Million Units) Forecast, by Type, 2020 to 2035

Table 16 South Africa Lead Acid Battery Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 17 South Africa Lead Acid Battery Market Volume (Million Units) Forecast, by Technology 2020 to 2035

Table 18 South Africa Lead Acid Battery Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 19 South Africa Lead Acid Battery Market Volume (Million Units) Forecast, by Application, 2020 to 2035

Table 20 South Africa Lead Acid Battery Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 South Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Market Type, 2020 to 2035

Table 22 South Africa Lead Acid Battery Market Value (US$ Bn) Forecast, by Market Type, 2020 to 2035

Table 23 Egypt Lead Acid Battery Market Volume (Million Units) Forecast, by Product Type, 2020 to 2035

Table 24 Egypt Lead Acid Battery Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 25 Egypt Lead Acid Battery Market Volume (Million Units) Forecast, by Type, 2020 to 2035

Table 26 Egypt Lead Acid Battery Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 27 Egypt Lead Acid Battery Market Volume (Million Units) Forecast, by Technology, 2020 to 2035

Table 28 Egypt Lead Acid Battery Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 29 Egypt Lead Acid Battery Market Volume (Million Units) Forecast, by Application, 2020 to 2035

Table 30 Egypt Lead Acid Battery Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31 Egypt Lead Acid Battery Market Volume (Million Units) Forecast, by Market Type, 2020 to 2035

Table 32 Egypt Lead Acid Battery Market Value (US$ Bn) Forecast, by Market Type 2020 to 2035

Table 33 Nigeria Lead Acid Battery Market Volume (Million Units) Forecast, by Product Type, 2020 to 2035

Table 34 Nigeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 35 Nigeria Lead Acid Battery Market Volume (Million Units) Forecast, by Type, 2020 to 2035

Table 36 Nigeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 37 Nigeria Lead Acid Battery Market Volume (Million Units) Forecast, by Technology, 2020 to 2035

Table 38 Nigeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 39 Nigeria Lead Acid Battery Market Volume (Million Units) Forecast, by Application, 2020 to 2035

Table 40 Nigeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 41 Nigeria Lead Acid Battery Market Volume (Million Units) Forecast, by Market Type, 2020 to 2035

Table 42 Nigeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Market Type 2020 to 2035

Table 43 Algeria Lead Acid Battery Market Volume (Million Units) Forecast, by Product Type, 2020 to 2035

Table 44 Algeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 45 Algeria Lead Acid Battery Market Volume (Million Units) Forecast, by Type, 2020 to 2035

Table 46 Algeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 47 Algeria Lead Acid Battery Market Volume (Million Units) Forecast, by Technology, 2020 to 2035

Table 48 Algeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 49 Algeria Lead Acid Battery Market Volume (Million Units) Forecast, by Application, 2020 to 2035

Table 50 Algeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51 Algeria Lead Acid Battery Market Volume (Million Units) Forecast, by Market Type, 2020 to 2035

Table 52 Algeria Lead Acid Battery Market Value (US$ Bn) Forecast, by Market Type 2020 to 2035

Table 53 Morocco Lead Acid Battery Market Volume (Million Units) Forecast, by Product Type, 2020 to 2035

Table 54 Morocco Lead Acid Battery Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 55 Morocco Lead Acid Battery Market Volume (Million Units) Forecast, by Type, 2020 to 2035

Table 56 Morocco Lead Acid Battery Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 57 Morocco Lead Acid Battery Market Volume (Million Units) Forecast, by Technology, 2020 to 2035

Table 58 Morocco Lead Acid Battery Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 59 Morocco Lead Acid Battery Market Volume (Million Units) Forecast, by Application, 2020 to 2035

Table 60 Morocco Lead Acid Battery Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 Morocco Lead Acid Battery Market Volume (Million Units) Forecast, by Market Type, 2020 to 2035

Table 62 Morocco Lead Acid Battery Market Value (US$ Bn) Forecast, by Market Type 2020 to 2035

Table 63 Rest of Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Product Type, 2020 to 2035

Table 64 Rest of Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 65 Rest of Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Type, 2020 to 2035

Table 66 Rest of Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 67 Rest of Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Technology, 2020 to 2035

Table 68 Rest of Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 69 Rest of Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Application, 2020 to 2035

Table 70 Rest of Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 71 Rest of Africa Lead-Acid Battery Market Volume (Million Units) Forecast, by Market Type, 2020 to 2035

Table 72 Rest of Africa Lead-Acid Battery Market Value (US$ Bn) Forecast, by Market Type 2020 to 2035

Figure 1 Africa Lead-Acid Battery Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 2 Africa Lead-Acid Battery Market Attractiveness, by Product Type

Figure 3 Africa Lead-Acid Battery Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 4 Africa Lead-Acid Battery Market Attractiveness, by Type

Figure 5 Africa Lead-Acid Battery Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 6 Africa Lead-Acid Battery Market Attractiveness, by Technology

Figure 7 Africa Lead-Acid Battery Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 8 Africa Lead-Acid Battery Market Attractiveness, by Application

Figure 9 Africa Lead-Acid Battery Market Volume Share Analysis, by Market Type, 2024, 2028, and 2035

Figure 10 Africa Lead-Acid Battery Market Attractiveness, by Market Type

Figure 11 Africa Lead-Acid Battery Market Volume Share Analysis, by Country, 2024, 2028, and 2035

Figure 12 Africa Lead-Acid Battery Market Attractiveness, by Country