Prebiotics, often overshadowed by the massive popularity garnered by probiotics, are finally getting their due – our new research finds demand for prebiotic ingredients has grown at nearly 6% annually since 2015, propelling global sales to the US$ 4.5 billion mark in 2018. As the global dietary supplements industry fights a ‘perception battle’, prebiotics are emerging as a bright spot. However, it is also pertinent to note that prebiotics still command a market value that pales in comparison to their popular counterparts, the probiotics; this continues to be a challenge for prebiotic ingredients suppliers.

The surge in demand for prebiotic ingredients—although a recent phenomenon—is paradoxical. Over the years, many dietary supplements have faced a legitimacy crisis, as lack of scientific literature on their actual health benefits hasn’t been really forthcoming. However, armed with humungous marketing budgets, the dietary supplements industry has prodded along. And, the status-quo hasn’t entirely changed; instead, it has witnessed an evolution which has created space for ‘less-marketing, more-science’ based products—a playing ground more level and conducive for prebiotic ingredients manufacturers.

While consumer awareness and inquisitiveness about the scientific literature has helped prebiotic ingredients suppliers, the trust factor consumers once placed in probiotics is now being challenged. Scientific research, most notably from University of Copenhagen, has ruled that there is “lack of evidence” surrounding the actual health benefits of probiotics. The prebiotics industry has used these findings to ‘educate’ consumers on the benefits of using a combination of probiotics and prebiotics instead.

As these perception battles support the momentum in the prebiotic ingredients market, gains have also been driven by a range of macro-economic factors, ranging from growing urbanization, increasing disposable income, and resurgency in retail sales. The impact of these broader factors has been especially palpable in the emerging countries of Asia Pacific.

The functional food and dietary supplement industry remained concentrated in North America and Europe for a long time. However, in the last decade or so, a new demographic of consumers in Asia Pacific has induced a scramble among the world’s biggest food and beverage brands. Currently, dietary supplements is a multi-million dollar business in Asia Pacific, and probiotics are easily available in hypermarkets and retail stores.

The plethora of opportunities emerging in Asia Pacific are not lost on prebiotic ingredients industry. However, to succeed in the highly lucrative and fiercely-competitive markets of Asia Pacific, a holistic strategy to capture market share from probiotic industry is required. In a region as cost-sensitive as Asia Pacific, all consumer awareness initiatives and marketing strategies can boomerang if product pricing is out of sync with consumer expectations.

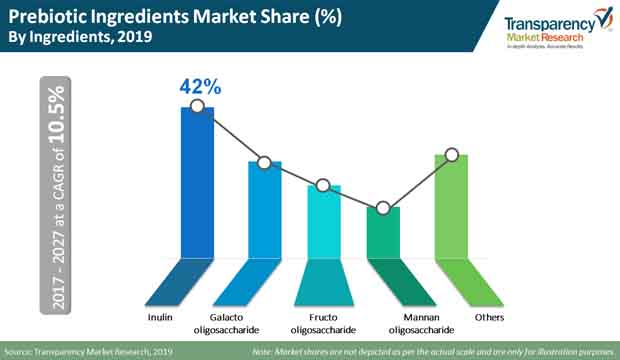

Asia Pacific also offers unique advantages in terms of sourcing prebiotic ingredients. Many countries in the region are agrarian, and the various prebiotic ingredients, including fructo-oligosaccharide, mannan-oligosaccharide, galacto-oligosaccharide, and inulin are easily available to prebiotic manufacturers. As is the case globally, inulin remains the ingredient of choice for prebiotic companies in Asia Pacific. Galacto-oligosaccharides and fructo-oligosaccharides follow suit, with mannan-oligosaccharides being the least preferred of all prebiotic ingredients.

The prebiotic ingredients market shows varied a level of competitive landscape. On a global level, a handful of multinational companies account for a sizeable market share. However, regionally, and also on a country-wide level, smaller players hold sway. Prebiotic companies have to comply with a number of regulations, especially those outlining the marketing and advertising of the products. Guidelines on labelling are also present, which puts pressure on prebiotic ingredients suppliers to be transparent in how they source their products. The degree of competition is high in the prebiotics market, and considering the undercurrents impacting probiotics and dairy supplements, it is highly likely that the landscape will become more competitive during the course of the forecast period.

The companies profiled in this study on prebiotic ingredients market include Koninklijke FrieslandCampina N.V., Roquette Frères S.A., Kerry Group plc, Ingredion Incorporated, Cargill, Incorporated, Yakult Honsha Co.,Ltd., Cosucra Groupe Warcoing SA, BENEO GmbH, Fonterra Co-operative Group Limited, Sensus America, Inc., and Jarrow Formulas, Inc.

Prebiotic Ingredients Market to Gain Momentum Owing to Rising Demand from Food and Beverage Industry

The growing demand for healthy beverage items worldwide is expected to promote the growth of the global prebiotic ingredient market. In the coming years, numerous dietary enhancements have confronted an authenticity emergency, as absence of logical writing on their genuine medical advantages hasn't been truly impending. In any case, equipped with humungous showcasing spending plans, the dietary enhancements industry has nudged along. Furthermore, business as usual hasn't completely changed; all things being equal, it has seen an advancement which has made space for 'less-promoting, more-science' based items—a playing ground more level and favorable for prebiotic fixings makers.

The global prebiotic ingredients market is classified on the basis of source, ingredients, end use, and region. In terms of source, the market is grouped into roots, cereals, vegetables, and others. Geographically, the market is dominated by North America, with Europe in close competition. Furthermore, the market in Asia Pacific will witness notable growth in the coming years owing to the increasing adoption of probiotics from supermarkets and hypermarkets.

There is developing interest in Indian shoppers for stomach related wellbeing fixings, especially prebiotics, in food items. India's probiotics market is to a great extent zeroed in on creature feed, and probiotic items for human utilization are as yet a specialty area. Mindfulness exercises by organizations, for example, Yakult keeps on driving buyer mindfulness about probiotic items that will thusly keep on filling market development. Besides, developing dairy utilization in China is driving interest for esteem added dairy items. China's reliance on imported dairy decreases its ability to build up its own cycles, and subsequently will in general repeat innovations created in Japan. China has an enormous inulin source. Licensed innovation security for these items should be thought of, with numerous imitator items known to exist. The medical advantages of prebiotics and probiotics in China is as of now problematic, thus the deals are commonly determined by viva voce.

|

Region |

|

|

Source Type |

|

|

Ingredient Type |

|

|

End Use |

|

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Wheel of Fortune

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market View Point

3.1. Macro-Economic Factors

3.2. Opportunity Analysis

3.3. Pricing Analysis

3.4. Porters Five Force Analysis

4. Global Market Analysis 2012–2016 and Forecast 2017–2027

4.1. Market Volume Projections

4.2. Market Size

4.3. Value Chain

4.4. Common Foodstuff and Their Prebiotic Fiber Content

5. Global Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast, By Source 2017–2027

5.1. Introduction

5.2. Historical Market Size (US$ Mn) and Volume Units Analysis By Source (2012-2016)

5.2.1. Vegetables

5.2.2. Cereals

5.2.3. Roots

5.2.4. Others

5.3. Market Size (US$ Mn) and Volume Units Forecast By Source (2017-2027)

5.3.1. Vegetables

5.3.2. Cereals

5.3.3. Roots

5.3.4. Others

6. Global Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast, By Ingredients 2017–2027

6.1. Introduction

6.2. Historical Market Size (US$ Mn) and Volume Units Analysis By Ingredients (2012-2016)

6.2.1. Fructo-oligosaccharide

6.2.2. Mannan-oligosaccharide

6.2.3. Galacto-oligosaccharide

6.2.4. Inulin

6.2.5. Others

6.3. Market Size (US$ Mn) and Volume Units Forecast By Ingredients (2017-2027)

6.3.1. Fructo-oligosaccharide

6.3.2. Mannan-oligosaccharide

6.3.3. Galacto-oligosaccharide

6.3.4. Inulin

6.3.5. Others

7. Global Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast, By End Use 2017–2027

7.1. Introduction

7.2. Historical Market Size (US$ Mn) and Volume Units Analysis By End Use (2012-2016)

7.2.1. Clinical Nutrition

7.2.2. Dietary Supplement

7.2.3. Functional Food & Beverage

7.2.4. Dairy Products

7.2.5. Infant Formula

7.2.6. Breakfast Cereal & Cereal Bars

7.2.7. Meat Products

7.2.8. Animal Nutrition

7.2.9. Pet Food

7.3. Market Size (US$ Mn) and Volume Units Forecast By End Use (2017-2027)

7.3.1. Clinical Nutrition

7.3.2. Dietary Supplement

7.3.3. Functional Food & Beverage

7.3.4. Dairy Products

7.3.5. Infant Formula

7.3.6. Breakfast Cereal & Cereal Bars

7.3.7. Meat Products

7.3.8. Animal Nutrition

7.3.9. Pet Food

8. Global Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast By Region 2017–2027

8.1. Introduction / Key Findings

8.2. Market Size (US$ Mn) and Volume (MT) Forecast By Region

8.2.1. North America

8.2.2. Western Europe

8.2.3. Eastern Europe

8.2.4. Latin America

8.2.5. Asia Pacific Excluding Japan

8.2.6. Japan

8.2.7. Middle East and Africa

9. North America Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast 2017–2027

9.1. Introduction

9.2. Regional Market Dynamics

9.2.1. Drivers

9.2.2. Restraints

9.2.3. Trends

9.3. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Country (2012-2016)

9.3.1. U.S.

9.3.2. Canada

9.4. Market Size (US$ Mn) and Volume (MT) Forecast By Country (2017-2027)

9.4.1. U.S.

9.4.2. Canada

9.5. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Source (2012-2016)

9.5.1. Vegetables

9.5.2. Cereals

9.5.3. Roots

9.5.4. Others

9.6. Market Size (US$ Mn) and Volume (MT) Forecast By Source (2017-2027)

9.6.1. Vegetables

9.6.2. Cereals

9.6.3. Roots

9.6.4. Others

9.7. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Ingredients (2012-2016)

9.7.1. Fructo-oligosaccharide

9.7.2. Mannan-oligosaccharide

9.7.3. Galacto-oligosaccharide

9.7.4. Inulin

9.7.5. Others

9.8. Market Size (US$ Mn) and Volume (MT) Forecast By Ingredients (2017-2027)

9.8.1. Fructo-oligosaccharide

9.8.2. Mannan-oligosaccharide

9.8.3. Galacto-oligosaccharide

9.8.4. Inulin

9.8.5. Others

9.9. Historical Market Size (US$ Mn) and Volume (MT) Analysis By End Use (2012-2016)

9.9.1. Clinical Nutrition

9.9.2. Dietary Supplement

9.9.3. Functional Food & Beverage

9.9.4. Dairy Products

9.9.5. Infant Formula

9.9.6. Breakfast Cereal & Cereal Bars

9.9.7. Meat Products

9.9.8. Animal Nutrition

9.9.9. Pet Food

9.10. Market Size (US$ Mn) and Volume (MT) Forecast By End Use (2017-2027)

9.10.1. Clinical Nutrition

9.10.2. Dietary Supplement

9.10.3. Functional Food & Beverage

9.10.4. Dairy Products

9.10.5. Infant Formula

9.10.6. Breakfast Cereal & Cereal Bars

9.10.7. Meat Products

9.10.8. Animal Nutrition

9.10.9. Pet Food

9.11. Market Attractiveness Analysis

9.11.1. By Country

9.11.2. By Source

9.11.3. By Ingredients

9.11.4. By End Use

10. Western Europe Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast 2017–2027

10.1. Introduction

10.2. Regional Market Dynamics

10.2.1. Drivers

10.2.2. Restraints

10.2.3. Trends

10.3. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Country (2012-2016)

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Spain

10.3.5. Italy

10.3.6. Rest of Western Europe

10.4. Market Size (US$ Mn) and Volume (MT) Forecast By Country (2017-2027)

10.4.1. Germany

10.4.2. France

10.4.3. U.K.

10.4.4. Spain

10.4.5. Italy

10.4.6. Netherland

10.4.7. Rest of Western Europe

10.5. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Source (2012-2016)

10.5.1. Vegetables

10.5.2. Cereals

10.5.3. Roots

10.5.4. Others

10.6. Market Size (US$ Mn) and Volume (MT) Forecast By Source (2017-2027)

10.6.1. Vegetables

10.6.2. Cereals

10.6.3. Roots

10.6.4. Others

10.7. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Ingredients (2012-2016)

10.7.1. Fructo-oligosaccharide

10.7.2. Mannan-oligosaccharide

10.7.3. Galacto-oligosaccharide

10.7.4. Inulin

10.7.5. Others

10.8. Market Size (US$ Mn) and Volume (MT) Forecast By Ingredients (2017-2027)

10.8.1. Fructo-oligosaccharide

10.8.2. Mannan-oligosaccharide

10.8.3. Galacto-oligosaccharide

10.8.4. Inulin

10.8.5. Others

10.9. Historical Market Size (US$ Mn) and Volume (MT) Analysis By End Use (2012-2016)

10.9.1. Clinical Nutrition

10.9.2. Dietary Supplement

10.9.3. Functional Food & Beverage

10.9.4. Dairy Products

10.9.5. Infant Formula

10.9.6. Breakfast Cereal & Cereal Bars

10.9.7. Meat Products

10.9.8. Animal Nutrition

10.9.9. Pet Food

10.10. Market Size (US$ Mn) and Volume (MT) Forecast By End Use (2017-2027)

10.10.1. Clinical Nutrition

10.10.2. Dietary Supplement

10.10.3. Functional Food & Beverage

10.10.4. Dairy Products

10.10.5. Infant Formula

10.10.6. Breakfast Cereal & Cereal Bars

10.10.7. Meat Products

10.10.8. Animal Nutrition

10.10.9. Pet Food

10.11. Market Attractiveness Analysis

10.11.1. By Country

10.11.2. By Source

10.11.3. By Ingredients

10.11.4. By End Use

11. Eastern Europe Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast 2017–2027

11.1. Introduction

11.2. Regional Market Dynamics

11.2.1. Drivers

11.2.2. Restraints

11.2.3. Trends

11.3. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Country 2012-2016

11.3.1. Russia

11.3.2. Poland

11.3.3. Rest of Eastern Europe

11.4. Market Size (US$ Mn) and Volume (MT) Forecast By Country 2017-2027

11.4.1. Russia

11.4.2. Poland

11.4.3. Rest of Eastern Europe

11.5. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Source (2012-2016)

11.5.1. Vegetables

11.5.2. Cereals

11.5.3. Roots

11.5.4. Others

11.6. Market Size (US$ Mn) and Volume (MT) Forecast By Source (2017-2027)

11.6.1. Vegetables

11.6.2. Cereals

11.6.3. Roots

11.6.4. Others

11.7. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Ingredients (2012-2016)

11.7.1. Fructo-oligosaccharide

11.7.2. Mannan-oligosaccharide

11.7.3. Galacto-oligosaccharide

11.7.4. Inulin

11.7.5. Others

11.8. Market Size (US$ Mn) and Volume (MT) Forecast By Ingredients (2017-2027)

11.8.1. Fructo-oligosaccharide

11.8.2. Mannan-oligosaccharide

11.8.3. Galacto-oligosaccharide

11.8.4. Inulin

11.8.5. Others

11.9. Historical Market Size (US$ Mn) and Volume (MT) Analysis By End Use (2012-2016)

11.9.1. Clinical Nutrition

11.9.2. Dietary Supplement

11.9.3. Functional Food & Beverage

11.9.4. Dairy Products

11.9.5. Infant Formula

11.9.6. Breakfast Cereal & Cereal Bars

11.9.7. Meat Products

11.9.8. Animal Nutrition

11.9.9. Pet Food

11.10. Market Size (US$ Mn) and Volume (MT) Forecast By End Use (2017-2027)

11.10.1. Clinical Nutrition

11.10.2. Dietary Supplement

11.10.3. Functional Food & Beverage

11.10.4. Dairy Products

11.10.5. Infant Formula

11.10.6. Breakfast Cereal & Cereal Bars

11.10.7. Meat Products

11.10.8. Animal Nutrition

11.10.9. Pet Food

11.11. Market Attractiveness Analysis

11.11.1. By Country

11.11.2. By Source

11.11.3. By Ingredients

11.11.4. By End Use

12. Latin America Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast 2017–2027

12.1. Introduction

12.2. Regional Market Dynamics

12.2.1. Drivers

12.2.2. Restraints

12.2.3. Trends

12.3. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Country (2012-2016)

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Rest of Latin America

12.4. Market Size (US$ Mn) and Volume (MT) Forecast By Country (2017-2027)

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Source (2012-2016)

12.5.1. Vegetables

12.5.2. Cereals

12.5.3. Roots

12.5.4. Others

12.6. Market Size (US$ Mn) and Volume (MT) Forecast By Source (2017-2027)

12.6.1. Vegetables

12.6.2. Cereals

12.6.3. Roots

12.6.4. Others

12.7. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Ingredients (2012-2016)

12.7.1. Fructo-oligosaccharide

12.7.2. Mannan-oligosaccharide

12.7.3. Galacto-oligosaccharide

12.7.4. Inulin

12.7.5. Others

12.8. Market Size (US$ Mn) and Volume (MT) Forecast By Ingredients (2017-2027)

12.8.1. Fructo-oligosaccharide

12.8.2. Mannan-oligosaccharide

12.8.3. Galacto-oligosaccharide

12.8.4. Inulin

12.8.5. Others

12.9. Historical Market Size (US$ Mn) and Volume (MT) Analysis By End Use (2012-2016)

12.9.1. Clinical Nutrition

12.9.2. Dietary Supplement

12.9.3. Functional Food & Beverage

12.9.4. Dairy Products

12.9.5. Infant Formula

12.9.6. Breakfast Cereal & Cereal Bars

12.9.7. Meat Products

12.9.8. Animal Nutrition

12.9.9. Pet Food

12.10. Market Size (US$ Mn) and Volume (MT) Forecast By End Use (2017-2027)

12.10.1. Clinical Nutrition

12.10.2. Dietary Supplement

12.10.3. Functional Food & Beverage

12.10.4. Dairy Products

12.10.5. Infant Formula

12.10.6. Breakfast Cereal & Cereal Bars

12.10.7. Meat Products

12.10.8. Animal Nutrition

12.10.9. Pet Food

12.11. Market Attractiveness Analysis

12.11.1. By Country

12.11.2. By Source

12.11.3. By Ingredients

12.11.4. By End Use

13. Asia Pacific Excluding Japan (APEJ) Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast 2017–2027

13.1. Introduction

13.2. Regional Market Dynamics

13.2.1. Drivers

13.2.2. Restraints

13.2.3. Trends

13.3. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Country (2012-2016)

13.3.1. China

13.3.2. India

13.3.3. Australia and New Zealand

13.3.4. ASEAN

13.3.5. Rest of APEJ

13.4. Market Size (US$ Mn) and Volume (MT) Forecast By Country (2017-2027)

13.4.1. China

13.4.2. India

13.4.3. Australia and New Zealand

13.4.4. ASEAN

13.4.5. Rest of APEJ

13.5. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Source (2012-2016)

13.5.1. Vegetables

13.5.2. Cereals

13.5.3. Roots

13.5.4. Others

13.6. Market Size (US$ Mn) and Volume (MT) Forecast By Source (2017-2027)

13.6.1. Vegetables

13.6.2. Cereals

13.6.3. Roots

13.6.4. Others

13.7. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Ingredients (2012-2016)

13.7.1. Fructo-oligosaccharide

13.7.2. Mannan-oligosaccharide

13.7.3. Galacto-oligosaccharide

13.7.4. Inulin

13.7.5. Others

13.8. Market Size (US$ Mn) and Volume (MT) Forecast By Ingredients (2017-2027)

13.8.1. Fructo-oligosaccharide

13.8.2. Mannan-oligosaccharide

13.8.3. Galacto-oligosaccharide

13.8.4. Inulin

13.8.5. Others

13.9. Historical Market Size (US$ Mn) and Volume (MT) Analysis By End Use (2012-2016)

13.9.1. Clinical Nutrition

13.9.2. Dietary Supplement

13.9.3. Functional Food & Beverage

13.9.4. Dairy Products

13.9.5. Infant Formula

13.9.6. Breakfast Cereal & Cereal Bars

13.9.7. Meat Products

13.9.8. Animal Nutrition

13.9.9. Pet Food

13.10. Market Size (US$ Mn) and Volume (MT) Forecast By End Use (2017-2027)

13.10.1. Clinical Nutrition

13.10.2. Dietary Supplement

13.10.3. Functional Food & Beverage

13.10.4. Dairy Products

13.10.5. Infant Formula

13.10.6. Breakfast Cereal & Cereal Bars

13.10.7. Meat Products

13.10.8. Animal Nutrition

13.10.9. Pet Food

13.11. Market Attractiveness Analysis

13.11.1. By Country

13.11.2. By Source

13.11.3. By Ingredients

13.11.4. By End Use

14. Japan Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast 2017–2027

14.1. Introduction

14.2. Regional Market Dynamics

14.2.1. Drivers

14.2.2. Restraints

14.2.3. Trends

14.3. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Source (2012-2016)

14.3.1. Vegetables

14.3.2. Cereals

14.3.3. Roots

14.3.4. Others

14.4. Market Size (US$ Mn) and Volume (MT) Forecast By Source (2017-2027)

14.4.1. Vegetables

14.4.2. Cereals

14.4.3. Roots

14.4.4. Others

14.5. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Ingredients (2012-2016)

14.5.1. Fructo-oligosaccharide

14.5.2. Mannan-oligosaccharide

14.5.3. Galacto-oligosaccharide

14.5.4. Inulin

14.5.5. Others

14.6. Market Size (US$ Mn) and Volume (MT) Forecast By Ingredients (2017-2027)

14.6.1. Fructo-oligosaccharide

14.6.2. Mannan-oligosaccharide

14.6.3. Galacto-oligosaccharide

14.6.4. Inulin

14.6.5. Others

14.7. Historical Market Size (US$ Mn) and Volume (MT) Analysis By End Use (2012-2016)

14.7.1. Clinical Nutrition

14.7.2. Dietary Supplement

14.7.3. Functional Food & Beverage

14.7.4. Dairy Products

14.7.5. Infant Formula

14.7.6. Breakfast Cereal & Cereal Bars

14.7.7. Meat Products

14.7.8. Animal Nutrition

14.7.9. Pet Food

14.8. Market Size (US$ Mn) and Volume (MT) Forecast By End Use (2017-2027)

14.8.1. Clinical Nutrition

14.8.2. Dietary Supplement

14.8.3. Functional Food & Beverage

14.8.4. Dairy Products

14.8.5. Infant Formula

14.8.6. Breakfast Cereal & Cereal Bars

14.8.7. Meat Products

14.8.8. Animal Nutrition

14.8.9. Pet Food

14.9. Market Attractiveness Analysis

14.9.1. By Country

14.9.2. By Source

14.9.3. By Ingredients

14.9.4. By End Use

15. Middle East and Africa Prebiotic Ingredients Products Market Analysis 2012–2016 and Forecast 2017–2027

15.1. Introduction

15.2. Regional Market Dynamics

15.2.1. Drivers

15.2.2. Restraints

15.2.3. Trends

15.3. Historical Market Size (US$ Mn) and Volume (MT) Forecast By Country (2012 -2016)

15.3.1. GCC Countries

15.3.2. North Africa

15.3.3. South Africa

15.3.4. Rest of Middle East and Africa

15.4. Market Size (US$ Mn) and Volume (MT) Forecast By Country (2017 -2027)

15.4.1. GCC Countries

15.4.2. North Africa

15.4.3. South Africa

15.4.4. Rest of Middle East and Africa

15.5. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Source (2012-2016)

15.5.1. Vegetables

15.5.2. Cereals

15.5.3. Roots

15.5.4. Others

15.6. Market Size (US$ Mn) and Volume (MT) Forecast By Source (2017-2027)

15.6.1. Vegetables

15.6.2. Cereals

15.6.3. Roots

15.6.4. Others

15.7. Historical Market Size (US$ Mn) and Volume (MT) Analysis By Ingredients (2012-2016)

15.7.1. Fructo-oligosaccharide

15.7.2. Mannan-oligosaccharide

15.7.3. Galacto-oligosaccharide

15.7.4. Inulin

15.7.5. Others

15.8. Market Size (US$ Mn) and Volume (MT) Forecast By Ingredients (2017-2027)

15.8.1. Fructo-oligosaccharide

15.8.2. Mannan-oligosaccharide

15.8.3. Galacto-oligosaccharide

15.8.4. Inulin

15.8.5. Others

15.9. Historical Market Size (US$ Mn) and Volume (MT) Analysis By End Use (2012-2016)

15.9.1. Clinical Nutrition

15.9.2. Dietary Supplement

15.9.3. Functional Food & Beverage

15.9.4. Dairy Products

15.9.5. Infant Formula

15.9.6. Breakfast Cereal & Cereal Bars

15.9.7. Meat Products

15.9.8. Animal Nutrition

15.9.9. Pet Food

15.10. Market Size (US$ Mn) and Volume (MT) Forecast By End Use (2017-2027)

15.10.1. Clinical Nutrition

15.10.2. Dietary Supplement

15.10.3. Functional Food & Beverage

15.10.4. Dairy Products

15.10.5. Infant Formula

15.10.6. Breakfast Cereal & Cereal Bars

15.10.7. Meat Products

15.10.8. Animal Nutrition

15.10.9. Pet Food

15.11. Market Attractiveness Analysis

15.11.1. By Country

15.11.2. By Source

15.11.3. By Ingredients

15.11.4. By End Use

16. Forecast Factors: Relevance and Impact

17. Forecast Assumptions

18. Competition Landscape

18.1. Market Structure

18.2. Competition Dashboard

18.3. Company Profiles (Details – Overview, Financials, Strategy, Recent

Developments)

18.3.1. Koninklijke FrieslandCampina N.V.

18.3.2. Roquette Frères S.A.

18.3.3. Kerry Group plc

18.3.4. Ingredion Incorporated

18.3.5. Cargill, Incorporated

18.3.6. Yakult Honsha Co.,Ltd.

18.3.7. Cosucra Groupe Warcoing SA

18.3.8. BENEO GmbH

18.3.9. Fonterra Co-operative Group Limited

18.3.10. Sensus America, Inc.

18.3.11. Jarrow Formulas, Inc.

19. Research Methodology

List of Table

Table 01: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 02: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 03: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027s

Table 04: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Application, 2012–2027

Table 05: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Region, 2012–2027

Table 06: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Region, 2012–2027

Table 07: North America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Country, 2012–2027

Table 08: North America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 09: North America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 10: North America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 11: North America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 12: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Country, 2012–2027

Table 13: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Country, 2012–2027

Table 14: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 15: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 16: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 17: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 18: Eastern Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Country, 2012–2027

Table 19: Eastern Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 20: Eastern Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 21: Eastern Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 22: Eastern Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 23: Latin America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Country, 2012–2027

Table 24: Latin America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 25: Latin America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 26: Latin America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 27: Latin America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 28: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Country, 2012–2027

Table 29: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 30: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 31: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 32: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 33: Japan Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 34: Japan Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 35: Japan Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 36: Japan Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 37: MEA Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Country, 2012–2027

Table 38: MEA Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Source, 2012–2027

Table 39: MEA Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By Ingredients, 2012–2027

Table 40: MEA Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

Table 41: MEA Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, By End Use, 2012–2027

List of Figures

Figure 01: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 02: Global Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 03: Global Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 04: Global Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 05: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Vegetable Segment, 2012 to 2016–2027

Figure 06: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Cereals Segment, 2012 to 2016–2027

Figure 07: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Roots Segment, 2012 to 2016–2027

Figure 08: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Others Segment, 2012 to 2016–2027

Figure 09: Global Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 10: Global Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 11: Global Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 12: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Fructo-oligosaccharide, 2012 to 2016–2027

Figure 13: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Mannan-oligosaccharide, 2012 to 2016–2027

Figure 14: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Spice Flavours Segment, 2012 to 2016–2027

Figure 15: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Nut Flavours Segment, 2012 to 2016–2027

Figure 16: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Others Segment, 2012 to 2016–2027

Figure 17: Global Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 18: Global Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 19: Global Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 20: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Clinical Nutrition, 2012 to 2016–2027

Figure 21: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Dietary Supplements, 2012 to 2016–2027

Figure 22: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Functional Foods & Beverages, 2012 to 2016–2027

Figure 23: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Dairy Products, 2012 to 2016–2027

Figure 24: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Infant Formula, 2012 to 2016–2027

Figure 25: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Breakfast Cereal & Cereal Bars, 2012 to 2016–2027

Figure 26: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Meat Products, 2012 to 2016–2027

Figure 27: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Animal Nutrition, 2012 to 2016–2027

Figure 28: Global Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), By Animal Nutrition, 2012 to 2016–2027

Figure 29: Global Prebiotic Ingredients Market Attractiveness, By Application, 2017–2027

Figure 30 : Global Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Region –2017 & 2027

Figure 31: Global Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Region, 2017–2027

Figure 32: Global Prebiotic Ingredients Market Attractiveness, By Region, 2017–2027

Figure 33: North America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 34: North America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 35: U.S. Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 36: Canada Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 37: North America Prebiotic Ingredients Market Attractiveness, By Country, 2017–2027

Figure 38: North America Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 39: North America Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 40: North America Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 41: North America Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 42: North America Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 43: North America Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 44: North America Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 45: North America Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 46: North America Prebiotic Ingredients Market Attractiveness, By Application, 2017–2027

Figure 47: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 48: Western Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 49: Germany Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 50: France Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 51: U.K. Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 52: Spain Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 53: Italy Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 54: BENELUX Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 55: NORDIC Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 56: Rest of Western Europe Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 57: Western Europe Prebiotic Ingredients Market Attractiveness, By Country, 2017–2027

Figure 58: Western Europe Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 59: Western Europe Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 60: Western Europe Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 61: Western Europe Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 62: Western Europe Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 63: Western Europe Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 64: Western Europe Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 65: Western Europe Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 66: Western Europe Prebiotic Ingredients Market Attractiveness, By Application, 2017–2027

Figure 67: Eastern Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 68: Eastern Europe Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 69: Russia Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 70: Poland Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 71: Rest of Eastern Europe Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 72: Eastern Europe Prebiotic Ingredients Market Attractiveness, By Country, 2017–2027

Figure 73: Eastern Europe Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 74: Eastern Europe Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 75: Eastern Europe Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 76: Eastern Europe Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 77: Eastern Europe Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 78: Eastern Europe Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 79: Eastern Europe Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 80: Eastern Europe Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 81: Eastern Europe Prebiotic Ingredients Market Attractiveness, By Application, 2017–2027

Figure 82: Latin America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 83: Latin America Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 84: Brazil Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 85: Mexico Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 86: Argentina Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 87: Rest of Latin America Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 88: Latin America Prebiotic Ingredients Market Attractiveness, By Country, 2017–2027

Figure 89: Latin America Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 90: Latin America Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 91: Latin America Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 92: Latin America Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 93: Latin America Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 94: Latin America Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 95: Latin America Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 96: Latin America Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 97: Latin America Prebiotic Ingredients Market Attractiveness, By Application, 2017–2027

Figure 98: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 99: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 100: China Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 101: India Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 102: Australia & New Zealand Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 103: ASEAN Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 104: Rest of APEJ Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 105: APEJ Prebiotic Ingredients Market Attractiveness, By Country, 2017–2027

Figure 106: APEJ Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 107: APEJ Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 108: APEJ Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 109: APEJ Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 110: APEJ Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 111: APEJ Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 112: APEJ Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 113: APEJ Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 114: APEJ Prebiotic Ingredients Market Attractiveness, By End Use, 2017–2027

Figure 115: Japan Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 116: Japan Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 117: Japan Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 118: Japan Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 119: Japan Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 120: Japan Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 121: Japan Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 122: Japan Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 123: Japan Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 124: Japan Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 125: Japan Prebiotic Ingredients Market Attractiveness, By End Use, 2017–2027

Figure 126: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT), 2012–2016

Figure 127: APEJ Prebiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2017–2027

Figure 128: GCC Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 129: North Africa Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 130: South Africa Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 131: Rest of MEA Prebiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2012 to 2016–2027

Figure 132: MEA Prebiotic Ingredients Market Attractiveness, By Country, 2017–2027

Figure 133: MEA Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Source, 2012, 2017 & 2027

Figure 134: MEA Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Source , 2012–2027

Figure 135: MEA Prebiotic Ingredients Market Attractiveness, By Source, 2017–2027

Figure 136: MEA Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By Ingredients – 2012, 2017 & 2027

Figure 137: MEA Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By Ingredients, 2012–2027

Figure 138: MEA Prebiotic Ingredients Market Attractiveness, By Ingredients, 2017–2027

Figure 139: MEA Prebiotic Ingredients Market Value Share (%) and BPS Analysis, By End Use – 2012, 2017 & 2027

Figure 140: MEA Prebiotic Ingredients Market Y-o-Y Growth (%) Projections, By End Use, 2012–2027

Figure 141: MEA Prebiotic Ingredients Market Attractiveness, By End Use, 2017–2027