Reports

Reports

Analysts’ Viewpoint

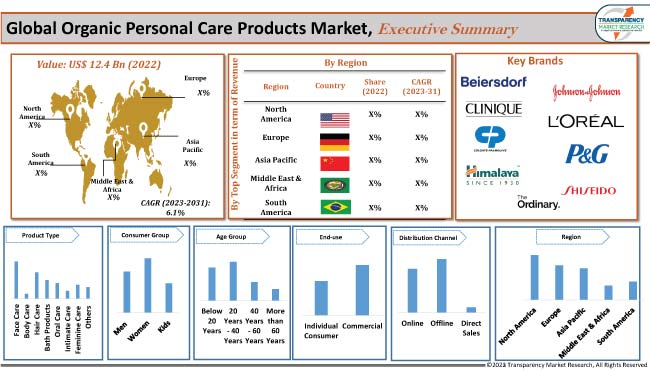

The global organic personal care products market is poised for substantial growth as consumers increasingly prioritize natural and sustainable alternatives. Rise in health consciousness and increase in awareness about harmful chemicals in traditional cosmetics are driving market expansion. Premium organic products, especially skincare and haircare items, are gaining traction due to health-conscious consumers seeking toxin-free options. Furthermore, eco-friendly packaging and cruelty-free practices that align with environmental concerns are the key factors expected to propel the global organic personal care products industry size.

Global shift toward cleaner and greener lifestyles offer lucrative opportunities to market players. Manufacturers are focusing on introducing products with natural ingredients, transparent labeling, and ethical manufacturing practices in order to increase market share and revenue.

Organic personal care products have emerged as popular and sustainable alternatives in the beauty and wellness industry, revolutionizing the way individuals perceive and practice self-care.

Unlike conventional personal care items that often contain harsh chemicals and synthetic ingredients, organic products are crafted from natural, organically grown components, devoid of pesticides, herbicides, and genetically modified organisms (GMOs).

The shift toward organic personal care is driven by growing awareness among consumers about the importance of mindful living, health-conscious choices, and environmental sustainability.

Demand for organic or natural personal care products has increased in the past few years. Consumers are becoming increasingly aware of what they apply to their skin. Organic alternatives offer a holistic approach to skincare, haircare, and overall personal hygiene, ensuring that individuals are not exposed to potentially harmful chemicals. These products are rich in natural ingredients such as plant extracts, essential oils, and botanicals.

The organic personal care movement aligns with the broader global shift toward eco-conscious and ethical consumerism. People are more inclined to support products and companies that prioritize sustainable sourcing, cruelty-free practices, and eco-friendly packaging.

The market for organic personal care products continues to expand, encompassing a wide range of items including organic skincare products, natural haircare solutions, herbal cosmetics, and organic fragrances.

The hospitality industry and wellness centers have also embraced organic personal care products. Luxury hotels, spas, and resorts are incorporating organic toiletries and amenities, recognizing the appeal of natural, chemical-free products to their guests.

Consumer preferences have shifted toward products that promote overall well-being while being environmentally friendly.

Increase in awareness among consumers about the potential risks associated with synthetic chemicals, artificial fragrances, and preservatives commonly found in conventional personal care product is fueling the organic personal care products market growth.

Consumers are now more informed about the adverse effects of these chemicals on their skin, overall health, and the environment. Hence, demand for organic or natural personal care products that offer natural alternatives, free from harmful substances is increasing.

Organic personal care products, also called chemical-free personal care products, are perceived as safer options, as they are made from natural ingredients, free from pesticides, parabens, and sulfates. These products cater to the needs of health-conscious individuals who want to avoid unnecessary exposure to potentially harmful chemicals.

Rise of social media and online platforms has also facilitated the dissemination of information, making consumers more aware about product ingredients and their implications. This increased transparency has empowered consumers to make informed choices, thus driving organic personal care products market revenue.

The global organic personal care products market is driven by growing environmental concerns among consumers. This paradigm shift in consumer behavior is propelled by increase in awareness about environmental issues such as climate change, pollution, and depletion of natural resources.

Hence, environmentally conscious consumers are seeking products that align with their values of sustainability and ecological responsibility, fueling the organic personal care products market demand.

Organic personal care products are often made from natural ingredients cultivated through sustainable agricultural practices. These methods promote soil health, conserve water, and reduce the overall environmental impact. Additionally, the absence of synthetic pesticides and fertilizers in organic farming prevents soil and water contamination, preserving ecosystems and biodiversity.

Consumers are becoming more aware of the packaging waste generated by personal care products. Conventional products often come in non-biodegradable plastic packaging, contributing significantly to the global plastic pollution problem.

The concern for animal welfare also plays a major role in the organic personal care products market development. Several organic and natural beauty brands are cruelty-free, meaning they do not test their products on animals. Ethical consumers, motivated by compassion for animals, are more inclined to support these brands, thereby contributing to the growth of the organic personal care market.

This shift in consumer preferences is driving innovation and sustainability within the industry, shaping a greener future for personal care products.

According to the latest organic personal care products market forecast, North America is expected to account for the largest share from 2023 to 2031. The market in the region is driven by well-established consumer base with high awareness about organic products' benefits. This has led to robust demand for natural and eco-friendly personal care items.

Europe is characterized by stringent regulations promoting organic certifications and sustainable practices, fostering a competitive market.

As per organic personal care products market research, the industry in Asia Pacific is driven by rise in disposable income, changing lifestyles, and growing emphasis on natural ingredients. India, China, and Japan are key markets in the region.

The global market is highly competitive, offering significant opportunities for growth and innovation. Companies are adopting several strategies, including merger & acquisition and product development, in order to increase their organic personal care products market share.

Beiersdorf AG, Clinique Laboratories, LLC, Colgate-Palmolive Company, Himalaya Wellness Company, Johnson & Johnson, L'Oréal S.A., Patanjali Ayurved, Procter & Gamble, Shiseido Company, and The Ordinary are the prominent players in the industry.

Each of these companies has been profiled in the organic personal care products market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 12.4 Bn |

| Forecast (Value) in 2031 | US$ 20.9 Bn |

| Growth Rate (CAGR) | 6.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Values | US$ Bn for Value and Million Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 12.4 Bn in 2022

It is anticipated to expand at a CAGR of 6.1% from 2023 to 2031

It is projected to reach US$ 20.9 Bn by the end of 2031

Increase in consumer awareness & health consciousness and growing environmental concerns.

North America recorded the highest demand in 2022

Beiersdorf AG, Clinique Laboratories, LLC, Colgate-Palmolive Company, Himalaya Wellness Company, Johnson & Johnson, L'Oréal S.A., Patanjali Ayurved, Procter & Gamble, Shiseido Company, and The Ordinary

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Organic Personal Care Products Market Analysis and Forecasts, 2023-2031

2.6.1. Global Organic Personal Care Products Market Volume (Million Units)

2.6.2. Global Organic Personal Care Products Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealer/Distributors

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of Organic Personal Care Products Market

3.2. Impact on the Demand of Organic Personal Care Products Market – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Million Units)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. South America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Unit), 2023-2031

6.1. Price Comparison Analysis by Consumer Group

6.2. Price Comparison Analysis by Region

7. Global Organic Personal Care Products Market Analysis and Forecast, by Product Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

7.2.1. Face Care

7.2.1.1. Moisturizers & Creams

7.2.1.2. Serums & Essence

7.2.1.3. Face Wash & Cleansers

7.2.1.4. Face Mask

7.2.1.5. Face Oil

7.2.1.6. Under-eye Creams

7.2.1.7. Lip Balm

7.2.1.8. Others (toners, face scrubs & exfoliators, etc.)

7.2.2. Body Care

7.2.2.1. Lotions & Creams

7.2.2.2. Body Oil

7.2.2.3. Hand Creams

7.2.2.4. Foot Creams

7.2.2.5. Others (foot masks, neck cream, etc.)

7.2.3. Hair Care

7.2.3.1. Shampoo

7.2.3.2. Conditioner

7.2.3.3. Others (hair mask, hair serum, etc.)

7.2.4. Bath Products

7.2.4.1. Shower Gel

7.2.4.2. Bath Soap

7.2.4.3. Others (bath salt, loofah, etc.)

7.2.5. Oral Care

7.2.5.1. Toothpastes

7.2.5.2. Toothbrushes

7.2.5.3. Others (mouth rinses, interdental cleaning aids, etc.)

7.2.6. Intimate Care

7.2.6.1. Intimate Washes

7.2.6.2. Wipes

7.2.6.3. Whitening Products

7.2.6.4. Others (exfoliates, mists, etc.)

7.2.7. Feminine Care

7.2.7.1. Sanitary Napkins

7.2.7.2. Menstrual Cups

7.2.7.3. Others (tampons, panty liners, etc.)

7.2.8. Others (perfume, deodorant, etc.)

7.3. Global Organic Personal Care Products Market Attractiveness, by Product Type

8. Global Organic Personal Care Products Market Analysis and Forecast, by Consumer Group, 2023-2031

8.1. Introduction and Definitions

8.2. Global Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

8.2.1. Men

8.2.2. Women

8.2.3. Kids

8.3. Global Organic Personal Care Products Market Attractiveness, by Consumer Group

9. Global Organic Personal Care Products Market Analysis and Forecast, by Age Group, 2023-2031

9.1. Introduction and Definitions

9.2. Global Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

9.2.1. Below 20 Years

9.2.2. 20 Years – 40 Years

9.2.3. 40 Years – 60 Years

9.2.4. More than 60 Years

9.3. Global Organic Personal Care Products Market Attractiveness, by Age Group

10. Global Organic Personal Care Products Market Analysis and Forecast, by End-use, 2023-2031

10.1. Introduction and Definitions

10.2. Global Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

10.2.1. Individual

10.2.2. Commercial

10.2.2.1. Hotels & Resorts

10.2.2.2. Spas

10.2.2.3. Beauty Salon

10.2.2.4. Others (hospitals, home stays, etc.)

10.3. Global Organic Personal Care Products Market Attractiveness, by End-use

11. Global Organic Personal Care Products Market Analysis and Forecast, by Distribution Channel, 2023-2031

11.1. Introduction and Definitions

11.2. Global Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

11.2.1. Online

11.2.1.1. E-commerce Websites

11.2.1.2. Company-owned Websites

11.2.2. Offline

11.2.2.1. Supermarkets/Hypermarkets

11.2.2.2. Specialty Stores

11.2.2.3. Drug Stores

11.2.2.4. Beauty Salons

11.2.2.5. Other Retail Stores

11.2.3. Direct Sales

11.3. Global Organic Personal Care Products Market Attractiveness, by Distribution Channel

12. Global Organic Personal Care Products Market Analysis and Forecast, by Region, 2023-2031

12.1. Key Findings

12.2. Global Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Region, 2023-2031

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. South America

12.2.5. Middle East & Africa

12.3. Global Organic Personal Care Products Market Attractiveness, by Region

13. North America Organic Personal Care Products Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. North America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

13.3. North America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

13.4. North America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

13.5. North America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.6. North America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

13.7. North America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

13.8. North America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country, 2023-2031

13.8.1. U.S. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

13.8.2. U.S. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

13.8.3. U.S. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

13.8.4. U.S. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.8.5. U.S. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

13.8.6. Canada Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

13.8.7. Canada Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

13.8.8. Canada Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

13.8.9. Canada Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.8.10. Canada Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

13.9. North America Organic Personal Care Products Market Attractiveness Analysis

14. Europe Organic Personal Care Products Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.3. Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

14.4. Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

14.5. Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.6. Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

14.7. Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.7.1. Germany Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.7.2. Germany Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

14.7.3. Germany Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

14.7.4. Germany Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7.5. Germany Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

14.7.6. France Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.7.7. France Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

14.7.8. France Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

14.7.9. France. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7.10. France Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

14.7.11. U.K. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.7.12. U.K. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

14.7.13. U.K. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

14.7.14. U.K. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7.15. U.K. Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

14.7.16. Italy Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.7.17. Italy Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

14.7.18. Italy Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

14.7.19. Italy Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7.20. Italy Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

14.7.21. Russia & CIS Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.7.22. Russia & CIS Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

14.7.23. Russia & CIS Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

14.7.24. Russia & CIS Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7.25. Russia Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

14.7.26. Rest of Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.7.27. Rest of Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

14.7.28. Rest of Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

14.7.29. Rest of Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7.30. Rest of Europe Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

14.8. Europe Organic Personal Care Products Market Attractiveness Analysis

15. Asia Pacific Organic Personal Care Products Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type

15.3. Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

15.4. Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

15.5. Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.6. Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

15.7. Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

15.7.1. China Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

15.7.2. China Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

15.7.3. China Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

15.7.4. China Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.7.5. China Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

15.7.6. Japan Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

15.7.7. Japan Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

15.7.8. Japan Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

15.7.9. Japan Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.7.10. Japan Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

15.7.11. India Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

15.7.12. India Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

15.7.13. India Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

15.7.14. India Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.7.15. India Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

15.7.16. ASEAN Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

15.7.17. ASEAN Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

15.7.18. ASEAN Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

15.7.19. ASEAN Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.7.20. ASEAN Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

15.7.21. Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

15.7.22. Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

15.7.23. Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

15.7.24. Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.7.25. Rest of Asia Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

15.8. Asia Pacific Organic Personal Care Products Market Attractiveness Analysis

16. South America Organic Personal Care Products Market Analysis and Forecast, 2023-2031

16.1. Key Findings

16.2. South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

16.3. South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

16.4. South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

16.5. South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

16.6. South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

16.7. South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

16.7.1. Brazil Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

16.7.2. Brazil Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

16.7.3. Brazil Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

16.7.4. Brazil Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

16.7.5. Brazil Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

16.7.6. Mexico Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

16.7.7. Mexico Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

16.7.8. Mexico Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

16.7.9. Mexico Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

16.7.10. Mexico Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

16.7.11. Rest of South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

16.7.12. Rest of South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

16.7.13. Rest of South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

16.7.14. Rest of South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

16.7.15. Rest of South America Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

16.8. South America Organic Personal Care Products Market Attractiveness Analysis

17. Middle East & Africa Organic Personal Care Products Market Analysis and Forecast, 2023-2031

17.1. Key Findings

17.2. Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

17.3. Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

17.4. Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

17.5. Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

17.6. Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

17.7. Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

17.7.1. GCC Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

17.7.2. GCC Pure Plant Oil Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

17.7.3. GCC Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

17.7.4. GCC Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

17.7.5. GCC Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

17.7.6. South Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

17.7.7. South Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

17.7.8. South Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

17.7.9. South Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

17.7.10. South Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

17.7.11. Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

17.7.12. Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

17.7.13. Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Age Group, 2023-2031

17.7.14. Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by End-use, 2023-2031

17.7.15. Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) and Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

17.8. Middle East & Africa Organic Personal Care Products Market Attractiveness Analysis

18. Competition Landscape

18.1. Market Players - Competition Matrix (by Tier and Size of Companies)

18.2. Market Share Analysis, 2021

18.3. Market Footprint Analysis

18.3.1. By Product Type

18.3.2. By Age Group

18.4. Company Profiles

18.4.1. Beiersdorf AG

18.4.1.1. Company Revenue

18.4.1.2. Business Overview

18.4.1.3. Product Segments

18.4.1.4. Geographic Footprint

18.4.1.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.1.6. Strategic Partnership, Process Expansion, New Product Innovation etc.

18.4.2. Clinique Laboratories, LLC

18.4.2.1. Company Revenue

18.4.2.2. Business Overview

18.4.2.3. Product Segments

18.4.2.4. Geographic Footprint

18.4.2.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.2.6. Strategic Partnership, Process Expansion, New Product Innovation etc.

18.4.3. Colgate-Palmolive Company

18.4.3.1. Company Revenue

18.4.3.2. Business Overview

18.4.3.3. Product Segments

18.4.3.4. Geographic Footprint

18.4.3.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.3.6. Strategic Partnership, Process Expansion, New Product Innovation etc.

18.4.4. Himalaya Wellness Company

18.4.4.1. Company Revenue

18.4.4.2. Business Overview

18.4.4.3. Product Segments

18.4.4.4. Geographic Footprint

18.4.4.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.4.6. Strategic Partnership, Process Expansion, New Product Innovation etc.

18.4.5. Johnson & Johnson

18.4.5.1. Company Revenue

18.4.5.2. Business Overview

18.4.5.3. Product Segments

18.4.5.4. Geographic Footprint

18.4.5.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.5.6. Strategic Partnership, Process Expansion, New Product Innovation etc.

18.4.6. L'Oréal S.A.

18.4.6.1. Company Revenue

18.4.6.2. Business Overview

18.4.6.3. Product Segments

18.4.6.4. Geographic Footprint

18.4.6.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.6.6. Strategic Partnership, Process Expansion, New Product Innovation etc.

18.4.7. Patanjali Ayurved

18.4.7.1. Company Revenue

18.4.7.2. Business Overview

18.4.7.3. Product Segments

18.4.7.4. Geographic Footprint

18.4.7.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.7.6. Strategic Partnership, Process Expansion, New Product Innovation etc.

18.4.8. Procter & Gamble

18.4.8.1. Company Revenue

18.4.8.2. Business Overview

18.4.8.3. Product Segments

18.4.8.4. Geographic Footprint

18.4.8.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.8.6. Strategic Partnership, Process Expansion, New Product Innovation, etc.

18.4.9. Shiseido Company

18.4.9.1. Company Revenue

18.4.9.2. Business Overview

18.4.9.3. Product Segments

18.4.9.4. Geographic Footprint

18.4.9.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.9.6. Strategic Partnership, Process Expansion, New Product Innovation, etc.

18.4.10. The Ordinary

18.4.10.1. Company Revenue

18.4.10.2. Business Overview

18.4.10.3. Product Segments

18.4.10.4. Geographic Footprint

18.4.10.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.10.6. Strategic Partnership, Process Expansion, New Product Innovation, etc.

19. Primary Research: Key Insights

20. Appendix

List of Tables

Table 1: Global Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 2: Global Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 3: Global Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 4: Global Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 5: Global Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 6: Global Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 7: Global Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 8: Global Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 9: Global Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 10: Global Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 11: Global Organic Personal Care Products Market Volume (Million Units) Forecast, by Region, 2023-2031

Table 12: Global Organic Personal Care Products Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 13: North America Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 14: North America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 15: North America Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 16: North America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 17: North America Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 18: North America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 19: North America Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 20: North America Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 21: North America Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 22: North America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 23: North America Organic Personal Care Products Market Volume (Million Units) Forecast, by Country, 2023-2031

Table 24: North America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 25: U.S. Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 26: U.S. Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 27: U.S. Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 28: U.S. Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 29: U.S. Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 30: U.S. Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 31: U.S. Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 32: U.S. Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 33: U.S. Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 34: U.S. Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 35: Canada Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 36: Canada Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 37: Canada Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 38: Canada Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 39: Canada Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 40: Canada Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 41: Canada Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 42: Canada Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 43: Canada Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 44: Canada Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 45: Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 46: Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 47: Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 48: Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 49: Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 50: Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 51: Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 52: Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 53: Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 54: Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 55: Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Country and Sub-region, 2023-2031

Table 56: Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 57: Germany Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 58: Germany Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 59: Germany Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 60: Germany Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 61: Germany Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 62: Germany Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 63: Germany Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 64: Germany Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 65: Germany Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 66: Germany Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 67: France Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 68: France Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 69: France Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 70: France Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 71: France Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 72: France Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 73: France Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 74: France Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 75: France Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 76: France Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 77: U.K. Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 78: U.K. Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 79: U.K. Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 80: U.K. Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 81: U.K. Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 82: U.K. Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 83: U.K. Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 84: U.K. Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 85: U.K. Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 86: U.K. Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 87: Italy Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 88: Italy Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 89: Italy Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 90: Italy Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 91: Italy Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 92: Italy Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 93: Italy Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 94: Italy Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 95: Italy Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 96: Italy Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 97: Spain Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 98: Spain Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 99: Spain Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 100: Spain Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 101: Spain Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 102: Spain Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 103: Spain Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 104: Spain Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 105: Spain Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 106: Spain Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 107: Russia & CIS Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 108: Russia & CIS Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 109: Russia & CIS Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 110: Russia & CIS Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 111: Russia & CIS Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 112: Russia & CIS Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 113: Russia & CIS Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 114: Russia & CIS Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 115: Russia & CIS Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 116: Russia & CIS Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 117: Rest of Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 118: Rest of Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 119: Rest of Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 120: Rest of Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 121: Rest of Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 122: Rest of Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 123: Rest of Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 124: Rest of Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 125: Rest of Europe Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 126: Rest of Europe Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 127: Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 128: Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 129: Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 130: Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 131: Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 132: Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 133: Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 134: Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 135: Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 136: Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 137: Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Country and Sub-region, 2023-2031

Table 138: Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 139: China Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 140: China Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type 2023-2031

Table 141: China Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 142: China Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 143: China Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 144: China Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 145: China Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 146: China Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 147: China Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 148: China Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 149: Japan Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 150: Japan Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 151: Japan Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 152: Japan Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 153: Japan Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 154: Japan Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 155: Japan Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 156: Japan Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 157: Japan Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 158: Japan Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 159: India Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 160: India Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 161: India Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 162: India Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 163: India Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 164: India Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 165: India Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 166: India Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 167: India Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 168: India Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 169: ASEAN Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 170: ASEAN Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 171: ASEAN Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 172: ASEAN Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 173: ASEAN Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 174: ASEAN Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 175: ASEAN Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 176: ASEAN Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 177: ASEAN Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 178: ASEAN Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 179: Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 180: Rest of Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 181: Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 182: Rest of Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 183: Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 184: Rest of Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 185: Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 186: Rest of Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 187: Rest of Asia Pacific Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 188: Rest of Asia Pacific Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel 2023-2031

Table 189: South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 190: South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 191: South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 192: South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 193: South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 194: South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 195: South America Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 196: South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 197: South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 198: South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel 2023-2031

Table 199: South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Country and Sub-region, 2023-2031

Table 200: South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 201: Brazil Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 202: Brazil Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 203: Brazil Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 204: Brazil Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 205: Brazil Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 206: Brazil Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 207: Brazil Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 208: Brazil Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 209: Brazil Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 210: Brazil Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 211: Mexico Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 212: Mexico Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 213: Mexico Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 214: Mexico Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 215: Mexico Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 216: Mexico Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 217: Mexico Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 218: Mexico Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 219: Mexico Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 220: Mexico Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 221: Rest of South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 222: Rest of South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 223: Rest of South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 224: Rest of South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 225: Rest of South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 226: Rest of South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 227: Rest of South America Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 228: Rest of South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 229: Rest of South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 230: Rest of South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 231: Rest of South America Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 232: Rest of South America Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel 2023-2031

Table 233: Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 234: Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 235: Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 236: Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 237: Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 238: Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 239: Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 240: Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 241: Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 242: Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 243: Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Country and Sub-region, 2023-2031

Table 244: Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 245: GCC Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 246: GCC Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 247: GCC Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 248: GCC Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 249: GCC Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 250: GCC Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 251: GCC Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 252: GCC Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 253: GCC Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 254: GCC Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 255: South Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 256: South Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 257: South Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 258: South Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 259: South Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 260: South Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 261: South Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 262: South Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 263: South Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 264: South Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

Table 265: Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Product Type, 2023-2031

Table 266: Rest of Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 267: Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Consumer Group, 2023-2031

Table 268: Rest of Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Consumer Group, 2023-2031

Table 269: Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Age Group, 2023-2031

Table 270: Rest of Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Age Group, 2023-2031

Table 271: Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by End-use, 2023-2031

Table 272: Rest of Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 273: Rest of Middle East & Africa Organic Personal Care Products Market Volume (Million Units) Forecast, by Distribution Channel, 2023-2031

Table 274: Rest of Middle East & Africa Organic Personal Care Products Market Value (US$ Bn) Forecast, by Distribution Channel, 2023-2031

List of Figures

Figure 1: Global Organic Personal Care Products Market Volume Share Analysis, by Product Type, 2021, 2027, and 2031

Figure 2: Global Organic Personal Care Products Market Attractiveness, by Product Type

Figure 3: Global Organic Personal Care Products Market Volume Share Analysis, by Consumer Group, 2021, 2027, and 2031

Figure 4: Global Organic Personal Care Products Market Attractiveness, by Consumer Group

Figure 5: Global Organic Personal Care Products Market Volume Share Analysis, by Age Group, 2021, 2027, and 2031

Figure 6: Global Organic Personal Care Products Market Attractiveness, by Age Group

Figure 7: Global Organic Personal Care Products Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 8: Global Organic Personal Care Products Market Attractiveness, by End-use

Figure 9: Global Organic Personal Care Products Market Volume Share Analysis, by Distribution Channel, 2021, 2027, and 2031

Figure 10: Global Organic Personal Care Products Market Attractiveness, by Distribution Channel

Figure 11: Global Organic Personal Care Products Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 12: Global Organic Personal Care Products Market Attractiveness, by Region

Figure 13: North America Organic Personal Care Products Market Volume Share Analysis, by Product Type, 2021, 2027, and 2031

Figure 14: North America Organic Personal Care Products Market Attractiveness, by Product Type

Figure 15: North America Organic Personal Care Products Market Volume Share Analysis, by Consumer Group, 2021, 2027, and 2031

Figure 16: North America Organic Personal Care Products Market Attractiveness, by Consumer Group

Figure 17: North America Organic Personal Care Products Market Volume Share Analysis, by Age Group, 2021, 2027, and 2031

Figure 18: North America Organic Personal Care Products Market Attractiveness, by Age Group

Figure 19: North America Organic Personal Care Products Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 20: North America Organic Personal Care Products Market Attractiveness, by End-use

Figure 21: North America Organic Personal Care Products Market Volume Share Analysis, by Distribution Channel, 2021, 2027, and 2031

Figure 22: North America Organic Personal Care Products Market Attractiveness, by Distribution Channel

Figure 23: North America Organic Personal Care Products Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: North America Organic Personal Care Products Market Attractiveness, by Country and Sub-region

Figure 25: Europe Organic Personal Care Products Market Volume Share Analysis, by Product Type, 2021, 2027, and 2031

Figure 26: Europe Organic Personal Care Products Market Attractiveness, by Product Type

Figure 27: Europe Organic Personal Care Products Market Volume Share Analysis, by Consumer Group, 2021, 2027, and 2031

Figure 28: Europe Organic Personal Care Products Market Attractiveness, by Consumer Group

Figure 29: Europe Organic Personal Care Products Market Volume Share Analysis, by Age Group, 2021, 2027, and 2031

Figure 30: Europe Organic Personal Care Products Market Attractiveness, by Age Group

Figure 31: Europe Organic Personal Care Products Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 32: Europe Organic Personal Care Products Market Attractiveness, by End-use

Figure 33: Europe Organic Personal Care Products Market Volume Share Analysis, by Distribution Channel, 2021, 2027, and 2031

Figure 34: Europe Organic Personal Care Products Market Attractiveness, by Distribution Channel

Figure 35: Europe Organic Personal Care Products Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Europe Organic Personal Care Products Market Attractiveness, by Country and Sub-region

Figure 37: Asia Pacific Organic Personal Care Products Market Volume Share Analysis, by Product Type, 2021, 2027, and 2031

Figure 38: Asia Pacific Organic Personal Care Products Market Attractiveness, by Product Type

Figure 39: Asia Pacific Organic Personal Care Products Market Volume Share Analysis, by Consumer Group, 2021, 2027, and 2031

Figure 40: Asia Pacific Organic Personal Care Products Market Attractiveness, by Consumer Group

Figure 41: Asia Pacific Organic Personal Care Products Market Volume Share Analysis, by Age Group, 2021, 2027, and 2031

Figure 42: Asia Pacific Organic Personal Care Products Market Attractiveness, by Age Group

Figure 43: Asia Pacific Organic Personal Care Products Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 44: Asia Pacific Organic Personal Care Products Market Attractiveness, by End-use

Figure 45: Asia Pacific Organic Personal Care Products Market Volume Share Analysis, by Distribution Channel, 2021, 2027, and 2031

Figure 46: Asia Pacific Organic Personal Care Products Market Attractiveness, by Distribution Channel

Figure 47: Asia Pacific Organic Personal Care Products Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 48: Asia Pacific Organic Personal Care Products Market Attractiveness, by Country and Sub-region

Figure 49: South America Organic Personal Care Products Market Volume Share Analysis, by Product Type, 2021, 2027, and 2031

Figure 50: South America Organic Personal Care Products Market Attractiveness, by Product Type

Figure 51: South America Organic Personal Care Products Market Volume Share Analysis, by Consumer Group, 2021, 2027, and 2031

Figure 52: South America Organic Personal Care Products Market Attractiveness, by Consumer Group

Figure 53: South America Organic Personal Care Products Market Volume Share Analysis, by Age Group, 2021, 2027, and 2031

Figure 54: South America Organic Personal Care Products Market Attractiveness, by Age Group

Figure 55: South America Organic Personal Care Products Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 56: South America Organic Personal Care Products Market Attractiveness, by End-use

Figure 57: South America Organic Personal Care Products Market Volume Share Analysis, by Distribution Channel, 2021, 2027, and 2031

Figure 58: South America Organic Personal Care Products Market Attractiveness, by Distribution Channel

Figure 59: South America Organic Personal Care Products Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 60: South America Organic Personal Care Products Market Attractiveness, by Country and Sub-region

Figure 61: Middle East & Africa Organic Personal Care Products Market Volume Share Analysis, by Product Type, 2021, 2027, and 2031

Figure 62: Middle East & Africa Organic Personal Care Products Market Attractiveness, by Product Type

Figure 63: Middle East & Africa Organic Personal Care Products Market Volume Share Analysis, by Consumer Group, 2021, 2027, and 2031

Figure 64: Middle East & Africa Organic Personal Care Products Market Attractiveness, by Consumer Group

Figure 65: Middle East & Africa Organic Personal Care Products Market Volume Share Analysis, by Age Group, 2021, 2027, and 2031

Figure 66: Middle East & Africa Organic Personal Care Products Market Attractiveness, by Age Group

Figure 67: Middle East & Africa Organic Personal Care Products Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 68: Middle East & Africa Organic Personal Care Products Market Attractiveness, by End-use

Figure 69: Middle East & Africa Organic Personal Care Products Market Volume Share Analysis, by Distribution Channel, 2021, 2027, and 2031

Figure 70: Middle East & Africa Organic Personal Care Products Market Attractiveness, by Distribution Channel

Figure 71: Middle East & Africa Organic Personal Care Products Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 72: Middle East & Africa Organic Personal Care Products Market Attractiveness, by Country and Sub-region