Reports

Reports

North America Electrical Fuses Market: Key Trends

The North America electrical fuses market is likely to witness the advent of more compact and slimmer electronics with leading players vying to cater to ever-changing consumer preferences. The development of the latest technologies and innovation have thus emerged as the most defining trends in the market. The electrical fuses market in North America is primarily driven by the rising demand for electricity and efficient power delivery systems. Besides this, diverse applications of electrical fuses across various industries will also fuel demand from the market.

Growth in the North America electrical fuses has been robust, primarily because the region boasts rapid technological advancements, economic growth, and a sizeable increase in population. Moreover, the construction industry in North America has reported considerable growth in the last few years in response to the increasing spending on housing infrastructure. This is subsequently boosting sales opportunities for electrical fuses manufacturers in the region

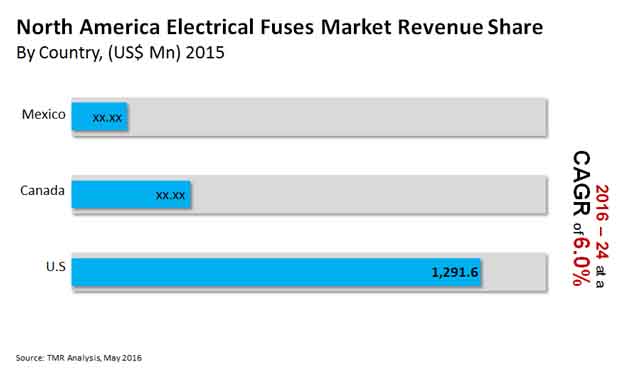

Bolsted by these factors, the market for electrical fuses in North America is expected to have a CAGR of 6.0% between 2016 and 2024, forecasts Transparency Market Research (TMR). As per TMR, the North America electrical fuses market stood at US$1.84 bn in 2015 and is expected to reach US$3.09 bn by the end of 2024.

Expansion of Automotive and Construction Sectors in the U.S. Boosts Application of Electrical Fuses

The U.S., Canada, and Mexico make the most lucrative markets for electrical fuses in North America. Among these nations, the U.S. held the largest share in the market in 2015. The rising demand for electrical fuses from the automotive and construction sectors of the country has catapulted it to the forefront of the North America electrical fuses market. In the same year, Canada emerged as the second-largest market for electrical fuses in North America, trailed by Mexico. The electrical fuses market in the U.S. is poised to reach US$2,152.0 mn by 2024 from a valuation of US$1,291.6 mn in 2015. The market is therefore poised to exhibit a CAGR of 5.9% from 2016 to 2024.

Additionally, in countries such as Mexico and the U.S., the production of vehicles has substantially increased, which has positively influenced the application of electrical fuses in the automotive sector.

Construction Industry to Emerge as Leading Application Segment for Electrical Fuses in North America

As a result of urbanization and industrial development, demand for electricity and reliable power delivery systems has been persistently increasing in North America. This has in turn given the sales of electrical fuses across the automotive and construction sectors a fillip. Electrical fuses are used across these industries to ensure safety during electricity transmission and distribution across these segments.

The construction segment led the North America electrical fuses market in 2015 in terms of revenue. In that year, the segment accounted for a dominant share of 40.3% in the market. By volume as well, the segment led the North America electrical fuses market in 2015, with a share of 45.4%.

Furthermore, the advent of electrical vehicles also provides considerable opportunities for the market’s growth in North America. The increasing willingness among consumers to spend on hybrid and electrical vehicles is likely to bolster the applications of electrical fuses in EVs and hybrid vehicles.

Some of the leading companies in North America electrical fuses market include General Electric,ABB Ltd, Eaton Corporation, S&C Electric Company, Schneider Electric SA, G&W Electric Company, Mitsubishi Electric, Siemens AG, Bel Fuse Inc., Mersen S.A and Littelfuse, Inc., among others.

North America Electrical Fuses Market to Gain from Increasing Demand for Consumer Electronics

Electricity being a part and parcel of the human civilization is solely dependent on electrical fuse. An electrical wire is a low softening point copper or other metal wire that breaks because of warmth brought about by overvoltage or high burden to dodge short out or inability to the gadget. North America observes an extensively popularity for power. The district being the harbinger in a few mechanical headways, gives rewarding freedoms to electrical fuses producers to profit by. Besides, the fast monetary development and the expanding populace in North America will likewise forecast well for the market's future. Other than this, administrations in this district are additionally zeroing in on updating introduced limits in power framework to fulfill the flooding need for power to suffice to the increasing popularity and adoption of consumer electronics. Since electronic gadgets are helpless against disappointment because of force vacillations, strategy creators in North America have commanded the utilization of value electrical fuses. Fuelled by these elements, the deals of electrical fuses is required to stay hearty in North America.

The accelerating rate of urbanization and modern turn of events, interest for power and solid force conveyance frameworks has been perseveringly expanding in North America. This has thus given the deals of electrical fuses across the car and development areas a fillip. Electrical fuses are utilized across these businesses to guarantee wellbeing during power transmission and dispersion across these sections. Since electrical fuses shield electronic segments from overheating, their application in electrical and half breed vehicles will increment impressively. Serious techniques received by driving business sector players will likewise push deals of electrical fuses upward in North America.

The U.S. at present shows the most worthwhile chances for makers and providers of electrical fuses in the locale. Great approaches will additionally advance the deals of electrical fuses in this country. The U.S. driven the North America electrical fuses market in that past, trailed by Canada and Mexico.

Chapter 1 Preface

1.1 Report description

1.2 Research Scope

1.3 Market Segmentation

1.4 Research methodology

Chapter 2 Executive Summary

Chapter 3 North America Electrical Fuses Market Overview

3.1 Introduction

3.2 Nature of Electrical Fuses Market

3.3 Market Dynamics

3.3.1 Market Drivers

3.3.1.1 Rise in demand for electricity and reliable power delivery

3.3.1.2 Growth of construction and automotive sector

3.3.2 Market Restraints

3.3.2.1 Advent of counterfeit switchgear and its components

3.3.2.2 Impact of price-based competition

3.3.3 Market Opportunities

3.3.3.1 Increasing demand for solar energy and electric vehicles

3.4 Competitive Strategies Adopted by Major Players

3.5 Porter’s Five Forces Analysis

3.5.1 Bargaining power of suppliers

3.5.2 Bargaining power of buyers

3.5.3 Threat from substitutes

3.5.4 Threat of new entrants

3.5.5 Competitive rivalry

3.6 Value Chain Analysis

3.7 Market Attractiveness Analysis

3.8 Market Positioning of key Players, 2015

Chapter 4 North America Electrical Fuses Market Analysis, 2015 – 2024 (USD Million and Units Million)

4.1 Key Trend Analysis

4.2 North America Electrical Fuses Market Analysis, By Voltage Level of Installations, 2015 – 2024 (USD Million and Units Million)

4.2.1 Overview

4.2.2 Low Voltage Fuses

4.2.3 North America Low Voltage Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

4.2.3.1 Plug-in fuses

4.2.4 North America Plug-in Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

4.2.4.1 Cartridge fuses

4.2.5 North America Cartridge Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

4.2.6 High Voltage Fuses

4.2.7 North America High Voltage Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

4.3 North America Electrical Fuses Market Analysis, By Application, 2015 –2024 (USD Million and Units Million)

4.3.1 Overview

4.3.2 Construction

4.3.2.1 North America Construction Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

4.3.3 Automotive

4.3.3.1 North America Automotive Sector Market size and forecast, 2015 - 2024 (USD Million and Units Million)

4.3.4 Industrial

4.3.4.1 North America Industrial Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

4.3.5 Consumer electronics

4.3.5.1 North America Consumer Electronics Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

4.3.6 Power generation

4.3.6.1 North America Power Generation Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

4.3.7 Others

4.3.7.1 North America Other Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

4.4 North America Electrical Fuses Market Analysis, By Country, 2015 –2024 (USD Million and Units Million)

4.4.1 Overview

4.4.2 The U.S.

4.4.2.1 U.S. Electrical Fuses Market revenue and volume forecast, 2015 – 2024 (USD Million and Units Million)

4.4.3 Canada

4.4.3.1 Canada Electrical Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

4.4.4 Mexico

4.4.4.1 Mexico Electrical Fuses Market revenue and volume forecast, 2015 – 2024 (USD Million and Units Million)

Chapter 5 Company Profiles

5.1 ABB Ltd.

5.1.1 Company Details (HQ, Foundation Year, Employee Strength)

5.1.2 Market Presence, By Segment and Geography

5.1.3 Key Developments

5.1.4 Strategy and Historical Roadmap

5.1.5 Revenue and Operating Profits

5.2 S&C Electric Company

5.2.1 Company Details (HQ, Foundation Year, Employee Strength)

5.2.2 Market Presence, By Segment and Geography

5.2.3 Key Developments

5.2.4 Strategy and Historical Roadmap

5.2.5 Revenue and Operating Profits

5.3 Eaton Corporation

5.3.1 Company Details (HQ, Foundation Year, Employee Strength)

5.3.2 Market Presence, By Segment and Geography

5.3.3 Key Developments

5.3.4 Strategy and Historical Roadmap

5.3.5 Revenue and Operating Profits

5.4 G&W Electric Company

5.4.1 Company Details (HQ, Foundation Year, Employee Strength)

5.4.2 Market Presence, By Segment and Geography

5.4.3 Key Developments

5.4.4 Strategy and Historical Roadmap

5.4.5 Revenue and Operating Profits

5.5 General Electric

5.5.1 Company Details (HQ, Foundation Year, Employee Strength)

5.5.2 Market Presence, By Segment and Geography

5.5.3 Key Developments

5.5.4 Strategy and Historical Roadmap

5.5.5 Revenue and Operating Profits

5.6 Siemens AG

5.6.1 Company Details (HQ, Foundation Year, Employee Strength)

5.6.2 Market Presence, By Segment and Geography

5.6.3 Key Developments

5.6.4 Strategy and Historical Roadmap

5.6.5 Revenue and Operating Profits

5.7 Schneider Electric SE

5.7.1 Company Details (HQ, Foundation Year, Employee Strength)

5.7.2 Market Presence, By Segment and Geography

5.7.3 Key Developments

5.7.4 Strategy and Historical Roadmap

5.7.5 Revenue and Operating Profits

5.8 Toshiba Corporation

5.8.1 Company Details (HQ, Foundation Year, Employee Strength)

5.8.2 Market Presence, By Segment and Geography

5.8.3 Key Developments

5.8.4 Strategy and Historical Roadmap

5.8.5 Revenue and Operating Profits

5.9 Mitsubishi Electric Corporation

5.9.1 Company Details (HQ, Foundation Year, Employee Strength)

5.9.2 Market Presence, By Segment and Geography

5.9.3 Key Developments

5.9.4 Strategy and Historical Roadmap

5.9.5 Revenue and Operating Profits

5.10 Bel Fuse Inc.

5.10.1 Company Details (HQ, Foundation Year, Employee Strength)

5.10.2 Market Presence, By Segment and Geography

5.10.3 Key Developments

5.10.4 Strategy and Historical Roadmap

5.10.5 Revenue and Operating Profits

5.11 Mersen S.A.

5.11.1 Company Details (HQ, Foundation Year, Employee Strength)

5.11.2 Market Presence, By Segment and Geography

5.11.3 Key Developments

5.11.4 Strategy and Historical Roadmap

5.11.5 Revenue and Operating Profits

5.12 Littelfuse, Inc

5.12.1 Company Details (HQ, Foundation Year, Employee Strength)

5.12.2 Market Presence, By Segment and Geography

5.12.3 Key Developments

5.12.4 Strategy and Historical Roadmap

5.12.5 Revenue and Operating Profits

List of Tables

TABLE 1 North America electrical fuses market snapshot (Revenue)

TABLE 2 North America electrical fuses market snapshot (Volume)

List of Figures

FIG. 1 Market segmentation: North America electrical fuses market

FIG. 2 Production Statistics of Vehicles, 2013 – 2015 (Units)

FIG. 3 Porter’s five forces analysis for electrical fuses market

FIG. 4 Market Attractiveness Analysis, by Industry Application Type, 2015

FIG. 5 Market Share of Key Vendors in Electrical Fuses Market, 2015 (Value %)

FIG. 6 North America Low Voltage Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

FIG. 7 North America Plug-in Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

FIG. 8 North America Cartridge Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

FIG. 9 North America High Voltage Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

FIG. 10 North America electrical fuses market revenue share (%), by applications, 2015 and 2024

FIG. 11 Electrical fuses market volume share (%), by applications, 2015 – 2024 (%)

FIG. 12 North America Construction Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

FIG. 13 North America Automotive Sector Market size and forecast, 2015 - 2024 (USD Million and Units Million)

FIG. 14 North America Industrial Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

FIG. 15 North America Consumer Electronics Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

FIG. 16 North America Power Generation Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

FIG. 17 North America Other Sector Market Size and Forecast, 2015 - 2024 (USD Million and Units Million)

FIG. 18 North America electrical fuses market size, by country, 2015 vs 2024 ( Revenue %)

FIG. 19 U.S. Electrical Fuses Market revenue and volume forecast, 2015 – 2024 (USD Million and Units Million)

FIG. 20 Canada Electrical Fuses Market Revenue and Volume Forecast, 2015 – 2024 (USD Million and Units Million)

FIG. 21 Mexico Electrical Fuses Market revenue and volume forecast, 2015 – 2024 (USD Million and Units Million)