Analysts’ Viewpoint on Microgrid Market Scenario

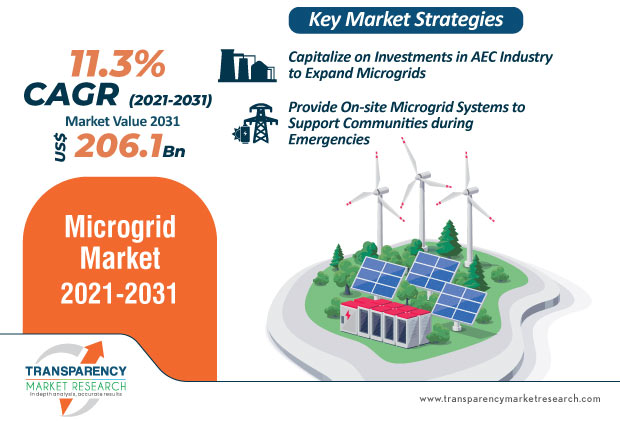

Since microgrids fall under some of the essential services in the global society, companies in the microgrid market are capitalizing on this opportunity to boost power generation capabilities amid the ongoing COVID-19 outbreak. However, in some cases, microgrids are associated with issues of oversupply and undersupply in residential, commercial, and industrial settings. Hence, service providers should make use of system engineers, monitoring systems, and relays to overcome issues in power generation. Moreover, the burgeoning growth of the Industry 4.0 is translating into revenue opportunities for companies in the microgrid market. Growing investments in equipment and machinery of the AEC (Architecture, Engineering, and Construction) industry is supporting the trend of Industry 4.0.

Burgeoning growth in population and rising electricity demand have increased dependence of end users on utility grids to meet their power needs. According to the U.S. Energy Information Administration (EIA), the global energy consumption is expected to increase by around 56% by 2040. Moreover, the demand for energy is rising at a rapid pace, due to increasing industrialization and urbanization, which is not being fully met from main grids. Such gaps are translating into revenue opportunities for companies in the microgrid market to boost their power supply services.

As per the EIA, India and China are witnessing rapid industrial development and they are likely to account for 50% of the world’s total increase in energy usage by 2040. Industrial development in these countries as well as that in the U.S. is driving the global energy sector and contributing toward the expansion of the microgrid market.

Request a sample to get extensive insights into the Microgrid Market

The COVID-19 outbreak has altered the way the global society functions. Nevertheless, service providers in the microgrid market are increasing efforts to tap into revenue opportunities, since electricity is one of the essential needs of people. Companies in the microgrid market are adopting contingency planning to gauge trends of volatile power demands in residential, commercial, and industrial settings. They are boosting local power generation capabilities to support communities, educational campuses, and defense organizations, among others. Service providers in the microgrid market are establishing a balanced relationship with suppliers and ecosystem partners to support mission-critical projects.

To understand how our report can bring difference to your business strategy, Ask for a brochure

One of the major operational challenges faced by microgrids relates to their functioning in an isolated mode. During this functioning, microgrids need to maintain stability with the help of distributed energy resources. Microgrids generally face instability during oversupply as well as undersupply of electricity. The Oversupply of electricity may cause a generator to trip off, resulting in loss of power supply to a microgrid. On the other hand, undersupply of electricity can result in equipment malfunction. Another challenge relates to installation costs incurred when a microgrid is employed to replace a conventional grid. For efficient functioning of microgrids, system engineers, monitoring systems, and relays need to be incorporated by service providers in the microgrid market.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Microgrid Market

One of the major challenges faced by macrogrids is the instability of the grid in the event of severe weather or a natural disaster. This can be easily encountered by using a microgrid. Nevertheless, on-site microgrid systems hold promising potentials to operate during tornadoes, floods, and earthquakes. Moreover, these systems act as substitutes for conventional grids at the time of power outage. Governments are specially developing plans to strategically place microgrids near pharmacies, hospitals, police stations, gas stations, and grocery stores in order to cope with such an emergency situation.

A microgrid can be characterized as a limited matrix that can interface with and disengage from customary utility networks to give better unwavering quality & lattice versatility. A microgrid is an interconnection between conveyed fuel sources and loads inside clear-cut electric limits. It acts a solitary controllable substance. Microgrids can work self-rulingly, due to which, they are profoundly valuable during fundamental framework disappointments and they can help in alleviating chances emerging out of lattice aggravations & disappointments. Since a microgrid can function without much of a stretch associated with and disengage from the fundamental framework, it can work in both network tied and island modes.

Microgrids offer advantages such as matrix modernization and mix of appropriated fuel age sources, including renewables, and reconciliation of a few keen network advances. It additionally helps in serving neighborhood loads from nearby force sources, bringing about a decrease in transmission and appropriation misfortunes & ascend in generally proficiency of the framework.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 63.5 Bn |

|

Market Forecast Value in 2031 |

US$ 206.1 Bn |

|

Growth Rate (CAGR) |

11.3% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Bn for Value & Megawatt (MW) for Volume |

|

Competition Landscape |

Company Profiles section includes overview, product portfolio, key subsidiaries or distributors, strategy & recent developments, and key financials. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Microgrid Market – Segmentation

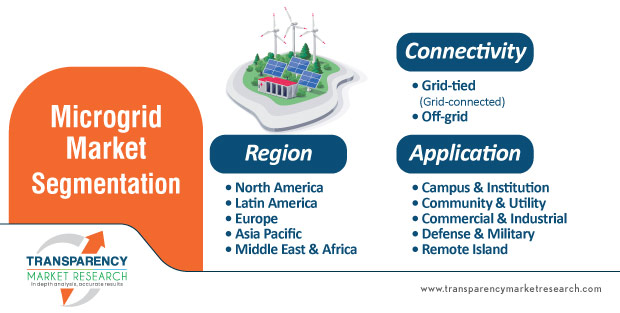

TMR’s research study assesses the global microgrid market in terms of connectivity, application, and region. This report presents extensive market dynamics and trends associated with different segments of the market and how they are influencing growth prospects of the global microgrid market.

| Connectivity |

|

| Application |

|

| Region |

|

Microgrid Market is expected to Reach US$ 206.1 Bn By 2031

Microgrid Market is estimated to rise at a CAGR of 11.3% during forecast period

Advancements in renewable energy technologies is expected to drive the Microgrid Market

Asia Pacific is more attractive for vendors in the Microgrid Market

Key players of Microgrid Market are General Electric, Siemens AG, ABB Group, S&C Electric Company, Engie Group, Schneider Electric SE, Echelon Corporation, Honeywell International Inc and others

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Secondary Sources and Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Market Snapshot

3.2. Top Trends

4. Market Overview

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunity

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of Substitutes

5.2.2. Bargaining Power of Buyers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of New Entrants

5.2.5. Degree of Competition

5.3. Value Chain Analysis

5.4. Regulatory Scenario

6. Global Microgrid Market Analysis and Forecast, by Connectivity, 2020-2031

6.1. Introduction

6.2. Key Findings

6.3. Global Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Connectivity, 2020-2031

6.3.1. Grid-tied (Grid-connected)

6.3.2. Off-grid

6.4. Global Microgrid Market Attractiveness Analysis, by Connectivity

7. Global Microgrid Market Analysis and Forecast, by Application, 2020-2031

7.1. Introduction

7.2. Key Findings

7.3. Global Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Application, 2020-2031

7.3.1. Campus & Institution

7.3.2. Community & Utility

7.3.3. Commercial & Industrial

7.3.4. Defense & Military

7.3.5. Remote Island

7.4. Global Microgrid Market Attractiveness Analysis, by Application

8. Global Microgrid Market Analysis, by Region, 2020-2031

8.1. Global Microgrid Market Value and Growth Scenario, by Region, 2020

8.2. Key Findings

8.3. Global Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Region, 2020-2031

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East & Africa

8.3.5. Latin America

8.4. Global Microgrid Market Attractiveness Analysis, by Region

9. North America Microgrid Market Analysis, 2020-2031

9.1. Key Findings

9.2. North America Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Connectivity

9.2.1. Grid-tied (Grid-connected)

9.2.2. Off-grid

9.3. North America Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Application

9.3.1. Campus & Institution

9.3.2. Community & Utility

9.3.3. Commercial & Industrial

9.3.4. Defense & Military

9.3.5. Remote Island

9.4. U.S. Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

9.4.1. Grid-tied (Grid-connected)

9.4.2. Off-grid

9.5. U.S. Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

9.5.1. Campus & Institution

9.5.2. Community & Utility

9.5.3. Commercial & Industrial

9.5.4. Defense & Military

9.5.5. Remote Island

9.6. Canada Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

9.6.1. Grid-tied (Grid-connected)

9.6.2. Off-grid

9.7. Canada Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

9.7.1. Campus & Institution

9.7.2. Community & Utility

9.7.3. Commercial & Industrial

9.7.4. Defense & Military

9.7.5. Remote Island

9.8. North America Microgrid Market Attractiveness Analysis

9.8.1. By Connectivity

9.8.2. By Application

9.8.3. By Country

10. Europe Microgrid Market Analysis, 2020-2031

10.1. Key Findings

10.2. Europe Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Connectivity

10.2.1. Grid-tied (Grid-connected)

10.2.2. Off-grid

10.3. Europe Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Application

10.3.1. Campus & Institution

10.3.2. Community & Utility

10.3.3. Commercial & Industrial

10.3.4. Defense & Military

10.3.5. Remote Island

10.4. Germany Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

10.4.1. Grid-tied (Grid-connected)

10.4.2. Off-grid

10.5. Germany Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

10.5.1. Campus & Institution

10.5.2. Community & Utility

10.5.3. Commercial & Industrial

10.5.4. Defense & Military

10.5.5. Remote Island

10.6. France Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

10.6.1. Grid-tied (Grid-connected)

10.6.2. Off-grid

10.7. France Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

10.7.1. Campus & Institution

10.7.2. Community & Utility

10.7.3. Commercial & Industrial

10.7.4. Defense & Military

10.7.5. Remote Island

10.8. U.K. Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

10.8.1. Grid-tied (Grid-connected)

10.8.2. Off-grid

10.9. U.K. Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

10.9.1. Campus & Institution

10.9.2. Community & Utility

10.9.3. Commercial & Industrial

10.9.4. Defense & Military

10.9.5. Remote Island

10.10. Denmark Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

10.10.1. Grid-tied (Grid-connected)

10.10.2. Off-grid

10.11. Denmark Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

10.11.1. Campus & Institution

10.11.2. Community & Utility

10.11.3. Commercial & Industrial

10.11.4. Defense & Military

10.11.5. Remote Island

10.12. Russia & CIS Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

10.12.1. Grid-tied (Grid-connected)

10.12.2. Off-grid

10.13. Russia & CIS Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

10.13.1. Campus & Institution

10.13.2. Community & Utility

10.13.3. Commercial & Industrial

10.13.4. Defense & Military

10.13.5. Remote Island

10.14. Rest of Europe Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

10.14.1. Grid-tied (Grid-connected)

10.14.2. Off-grid

10.15. Rest of Europe Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

10.15.1. Campus & Institution

10.15.2. Community & Utility

10.15.3. Commercial & Industrial

10.15.4. Defense & Military

10.15.5. Remote Island

10.16. Europe Microgrid Market Attractiveness Analysis

10.16.1. By Connectivity

10.16.2. By Application

10.16.3. By Country and Sub-region

11. Asia Pacific Microgrid Market Analysis, 2020-2031

11.1. Key Findings

11.2. Asia Pacific Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Connectivity

11.2.1. Grid-tied (Grid-connected)

11.2.2. Off-grid

11.3. Asia Pacific Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Application

11.3.1. Campus & Institution

11.3.2. Community & Utility

11.3.3. Commercial & Industrial

11.3.4. Defense & Military

11.3.5. Remote Island

11.4. China Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

11.4.1. Grid-tied (Grid-connected)

11.4.2. Off-grid

11.5. China Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

11.5.1. Campus & Institution

11.5.2. Community & Utility

11.5.3. Commercial & Industrial

11.5.4. Defense & Military

11.5.5. Remote Island

11.6. India Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

11.6.1. Grid-tied (Grid-connected)

11.6.2. Off-grid

11.7. India Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

11.7.1. Campus & Institution

11.7.2. Community & Utility

11.7.3. Commercial & Industrial

11.7.4. Defense & Military

11.7.5. Remote Island

11.8. Australia Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

11.8.1. Grid-tied (Grid-connected)

11.8.2. Off-grid

11.9. Australia Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

11.9.1. Campus & Institution

11.9.2. Community & Utility

11.9.3. Commercial & Industrial

11.9.4. Defense & Military

11.9.5. Remote Island

11.10. ASEAN Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

11.10.1. Grid-tied (Grid-connected)

11.10.2. Off-grid

11.11. ASEAN Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

11.11.1. Campus & Institution

11.11.2. Community & Utility

11.11.3. Commercial & Industrial

11.11.4. Defense & Military

11.11.5. Remote Island

11.12. Rest of Asia Pacific Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

11.12.1. Grid-tied (Grid-connected)

11.12.2. Off-grid

11.13. Rest of Asia Pacific Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

11.13.1. Campus & Institution

11.13.2. Community & Utility

11.13.3. Commercial & Industrial

11.13.4. Defense & Military

11.13.5. Remote Island

11.14. Asia Pacific Microgrid Market Attractiveness Analysis

11.14.1. By Connectivity

11.14.2. By Application

11.14.3. By Country and Sub-region

12. Middle East & Africa Microgrid Market Analysis, 2020-2031

12.1. Key Findings

12.2. Middle East & Africa Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Connectivity

12.2.1. Grid-tied (Grid-connected)

12.2.2. Off-grid

12.3. Middle East & Africa Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Application

12.3.1. Campus & Institution

12.3.2. Community & Utility

12.3.3. Commercial & Industrial

12.3.4. Defense & Military

12.3.5. Remote Island

12.4. South Africa Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

12.4.1. Grid-tied (Grid-connected)

12.4.2. Off-grid

12.5. South Africa Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

12.5.1. Campus & Institution

12.5.2. Community & Utility

12.5.3. Commercial & Industrial

12.5.4. Defense & Military

12.5.5. Remote Island

12.6. Middle East & Africa Microgrid Market Attractiveness Analysis

12.6.1. By Connectivity

12.6.2. By Application

13. Latin America Microgrid Market Analysis, 2020-2031

13.1. Key Findings

13.2. Latin America Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Connectivity

13.2.1. Grid-tied (Grid-connected)

13.2.2. Off-grid

13.3. Latin America Microgrid Market Volume (MW) & Value (US$ Bn) Share Analysis & Forecast, by Application

13.3.1. Campus & Institution

13.3.2. Community & Utility

13.3.3. Commercial & Industrial

13.3.4. Defense & Military

13.3.5. Remote Island

13.4. Brazil Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Connectivity

13.4.1. Grid-tied (Grid-connected)

13.4.2. Off-grid

13.5. Brazil Microgrid Market Volume (MW) & Value (US$ Bn) Forecast, by Application

13.5.1. Campus & Institution

13.5.2. Community & Utility

13.5.3. Commercial & Industrial

13.5.4. Defense & Military

13.5.5. Remote Island

13.6. Latin America Microgrid Market Attractiveness Analysis

13.6.1. By Connectivity

13.6.2. By Application

14. Competition Landscape

14.1. Global Microgrid Market Share Analysis, by Company (2020)

14.2. Competition Matrix

14.3. Market Footprint Analysis, 2020

14.4. Company Profiles

14.4.1. Siemens AG

14.4.1.1. Company Description

14.4.1.2. Business Overview

14.4.1.3. Financial Overview

14.4.1.4. Strategic Overview

14.4.2. General Electric

14.4.2.1. Company Description

14.4.2.2. Business Overview

14.4.2.3. Financial Overview

14.4.2.4. Strategic Overview

14.4.3. S&C Electric Company

14.4.3.1. Company Description

14.4.3.2. Business Overview

14.4.4. ABB Group

14.4.4.1. Company Description

14.4.4.2. Business Overview

14.4.4.3. Financial Overview

14.4.4.4. Strategic Overview

14.4.5. Schneider Electric SE

14.4.5.1. Company Description

14.4.5.2. Business Overview

14.4.5.3. Financial Overview

14.4.5.4. Strategic Overview

14.4.6. Engie Group

14.4.6.1. Company Description

14.4.6.2. Business Overview

14.4.6.3. Financial Overview

14.4.6.4. Strategic Overview

14.4.7. Honeywell International Inc.

14.4.7.1. Company Description

14.4.7.2. Business Overview

14.4.7.3. Financial Overview

14.4.7.4. Strategic Overview

14.4.8. Echelon Corporation

14.4.8.1. Company Description

14.4.8.2. Business Overview

14.4.8.3. Financial Overview

14.4.8.4. Strategic Overview

14.4.9. Pareto Energy Limited

14.4.9.1. Company Description

14.4.9.2. Business Overview

14.4.10. Toshiba Corporation

14.4.10.1. Company Description

14.4.10.2. Business Overview

14.4.10.3. Financial Overview

14.4.10.4. Strategic Overview

14.4.11. Duke Energy Corporation

14.4.11.1. Company Description

14.4.11.2. Business Overview

14.4.11.3. Financial Overview

14.4.11.4. Strategic Overview

14.4.12. Power Analytics Corporation

14.4.12.1. Company Description

14.4.12.2. Business Overview

15. Primary Research – Key Insights

List of Tables

Table 01: Global Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 02: Global Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 03: Global Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 04: Global Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 05: Global Microgrid Market Volume (MW) Forecast, by Region, 2020-2031

Table 06: Global Microgrid Market Value (US$ Bn) Forecast, by Region, 2020-2031

Table 07: North America Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 08: North America Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 09: North America Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 10: North America Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 11: North America Microgrid Market Volume (MW) Forecast, by Country, 2020-2031

Table 12: North America Microgrid Market Value (US$ Bn) Forecast, by Country, 2020-2031

Table 13: U.S. Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 14: U.S. Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 15: U.S. Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 16: U.S. Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 17: Canada Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 18: Canada Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 19: Canada Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 20: Canada Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 21: Europe Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 22: Europe Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 23: Europe Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 24: Europe Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 25: Europe Microgrid Market Volume (MW) Forecast, by Country and Sub-region, 2020-2031

Table 26: Europe Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 27: Germany Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 28: Germany Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 29: Germany Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 30: Germany Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 31: France Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 32: France Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 33: France Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 34: France Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 35: U.K. Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 36: U.K. Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 37: U.K. Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 38: U.K. Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 39: Denmark Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 40: Denmark Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 41: Denmark Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 42: Denmark Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 43: Russia & CIS Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 44: Russia & CIS Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 45: Russia & CIS Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 46: Russia & CIS Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 47: Rest of Europe Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 48: Rest of Europe Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 49: Rest of Europe Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 50: Rest of Europe Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 51: Asia Pacific Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 52: Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 53: Asia Pacific Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 54: Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 55: Asia Pacific Microgrid Market Volume (MW) Forecast, by Country and Sub-region, 2020-2031

Table 56: Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 57: China Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 58: China Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 59: China Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 60: China Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 61: India Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 62: India Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 63: India Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 64: India Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 65: Australia Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 66: Australia Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 67: Australia Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 68: Australia Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 69: ASEAN Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 70: ASEAN Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 71: ASEAN Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 72: ASEAN Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 73: Rest of Asia Pacific Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 74: Rest of Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 75: Rest of Asia Pacific Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 76: Rest of Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 77: Middle East & Africa Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 78: Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 79: Middle East & Africa Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 80: Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 81: Middle East & Africa Market Volume (MW) Forecast, by Country and Sub-region, 2020-2031

Table 82: Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 83: South Africa Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 84: South Africa Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 85: Latin America Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 86: Latin America Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

Table 87: Latin America Microgrid Market Volume (MW) Forecast, by Application, 2020-2031

Table 88: Latin America Microgrid Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 89: Latin America Market Volume (MW) Forecast, by Country and Sub-region, 2020-2031

Table 90: Latin America Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 91: Brazil Microgrid Market Volume (MW) Forecast, by Connectivity, 2020-2031

Table 92: Brazil Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2020-2031

List of Figures

Figure 01: Global Microgrid Market Value Share Analysis, by Connectivity, 2020-2031

Figure 02: Global Microgrid Market Attractiveness Analysis, by Connectivity, 2020

Figure 03: Global Microgrid Market Value Share Analysis, by Application, 2020-2031

Figure 04: Global Microgrid Market Attractiveness Analysis, by Application, 2020

Figure 05: Global Microgrid Market Value Share Analysis, by Region, 2020-2031

Figure 06: Global Microgrid Market Attractiveness Analysis, by Region, 2020

Figure 07: North America Microgrid Market Value Share Analysis, by Connectivity, 2020-2031

Figure 08: North America Microgrid Market Value Share Analysis, by Application, 2020-2031

Figure 09: North America Microgrid Market Value Share Analysis, by Country, 2020-2031

Figure 10: North America Microgrid Market Attractiveness Analysis, by Country, 2020

Figure 11: North America Microgrid Market Value Share Analysis, by Connectivity, 2020

Figure 12: North America Microgrid Market Attractiveness Analysis, by Application, 2020

Figure 13: Europe Microgrid Market Value Share Analysis, by Connectivity, 2020-2031

Figure 14: Europe Microgrid Market Value Share Analysis, by Application, 2020-2031

Figure 15: Europe Microgrid Market Value Share Analysis, by Country and Sub-region, 2020-2031

Figure 16: Europe Microgrid Market Attractiveness Analysis, by Country and Sub-region, 2020

Figure 17: Europe Microgrid Market Value Share Analysis, by Connectivity, 2020

Figure 18: Europe Microgrid Market Attractiveness Analysis, by Application, 2020

Figure 19: Asia Pacific Microgrid Market Value Share Analysis, by Connectivity, 2020-2031

Figure 20: Asia Pacific Microgrid Market Value Share Analysis, by Application, 2020-2031

Figure 21: Asia Pacific Microgrid Market Value Share Analysis, by Country and Sub-region, 2020-2031

Figure 22: Asia Pacific Microgrid Market Attractiveness Analysis, by Country and Sub-region, 2020

Figure 23: Asia Pacific Microgrid Market Attractiveness Analysis, by Connectivity, 2020

Figure 24: Asia Pacific Microgrid Market Attractiveness Analysis, by Application, 2020

Figure 25: Middle East & Africa Microgrid Market Value Share Analysis, by Connectivity, 2020-2031

Figure 26: Middle East & Africa Microgrid Market Value Share Analysis, by Application, 2020-2031

Figure 27: Middle East & Africa Microgrid Market Value Share Analysis, by Country and Sub-region, 2020-2031

Figure 28: Middle East & Africa Microgrid Market Attractiveness Analysis, by Country and Sub-region, 2020

Figure 29: Middle East & Africa Microgrid Market Attractiveness Analysis, by Connectivity, 2020

Figure 30: Middle East & Africa Microgrid Market Attractiveness Analysis, by Application, 2020

Figure 31: Latin America Microgrid Market Value Share Analysis, by Connectivity, 2020-2031

Figure 32: Latin America Microgrid Market Value Share Analysis, by Application, 2020-2031

Figure 33: Latin America Microgrid Market Value Share Analysis, by Country and Sub-region, 2020-2031

Figure 34: Latin America Microgrid Market Attractiveness Analysis, by Country and Sub-region, 2020

Figure 35: Latin America Microgrid Market Attractiveness Analysis, by Connectivity, 2020

Figure 36: Latin America Microgrid Market Attractiveness Analysis, by Application, 2020

Figure 37: Global Microgrid Market Share Analysis, by Company (2020)