Reports

Reports

Methyl isobutyl ketone (MIBK) is one of the excellent solvents for resins used in various surface coatings. It is also widely used in rubber chemicals for the production of tires, followed by surfactants, and insecticides. MIBK is used as a solvent in industries that produce rubber products, paints, machineries, and chemicals. Rising demand for solvents and rubber processing chemicals, chiefly owing to the flourishing growth of the global automotive industry, is expected to fuel to the overall global demand for methyl isobutyl ketone market in the next few years.

However, concerns regarding the harsh impact of the material on the environment and human health are leading to an increased aversion for synthetic, petroleum-based MIBK across a vast number of industries. Analysts estimate that synthetic MIBK will gradually be replaced by bio-based MIBK across major applications in the next few years. This factor can emerge as one of the most lucrative growth opportunities for companies in the market in the near future, allowing significant traction to businesses and providing sustainable growth opportunities.

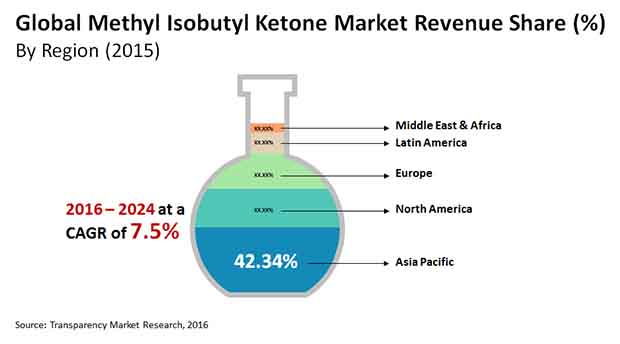

Transparency Market Research estimates that the global methyl isobutyl ketone market, which valued at US$827.4 mn in 2015, will exhibit a CAGR of 7.5% between 2016 and 2024 and reach US$1,572.3 mn by 2024.

MIBK’s Use as Solvent to Remain Market’s Most Promising Application Segment

MIBK is known to be one of the best solvents for resins used in the production of surface coatings. Moreover, MIBK is also used as a solvent for more than 40 applications across a number of industries. As a result, the use of MIBK as a solvent is one of the most lucrative application segments of the global methyl isobutyl ketone market, accounting for over 54% of the overall market in 2015. The segment is expected to retain its dominant stance over the forecast period as well, exhibiting a promising 7.7% CAGR in terms of value over the period between 2016 and 2024.

However, the segment is expected to lose prominence to the rubber chemicals segment in terms of rate of growth over the said period, chiefly owing to the rising demand for rubber across a number of industries and applications. The segment of rubber chemicals is expected to expand at an 8.4% CAGR in terms of value from 2016 through 2024. Owing to this, the share of the segment in the global methyl isobutyl ketone market is expected to rise from nearly 15% in 2015 to 16.3% by 2024.

In terms of geography, Asia Pacific presently leads the global methyl isobutyl ketone market. It is followed by North America and Europe. Increasing consumption of MIBK in automotive and crop-protection industries in China, India, and ASEAN countries is expected to drive the demand for MIBK-based applications in Asia Pacific during the forecast period. China is the leading consumer of MIBK in Asia Pacific, especially in the antiozonants application. Production and demand of MIBK is expected to continue to rise in Asia Pacific during forecast period as well, granting the region a commanding position in the global market in the near future. In terms of revenue contribution to the global market, Asia Pacific accounted for a dominant share of more than 42% in 2015.

North America chiefly consists of developed countries and mature markets. Therefore, the methyl isobutyl ketone market in the region is expected to expand at a moderate pace during the forecast period. Countries in Middle East and Africa are estimated to provide lucrative opportunities for the methyl isobutyl ketone market owing to the rise in commercial infrastructure development activities.

The global methyl isobutyl ketone market features a largely consolidated competitive landscape, with the top five companies cumulatively accounting for a lion’s share in the market’s overall valuation. Some of the key companies in the market are The Dow Chemical Company, Royal Dutch Shell Plc, Kumho P&B, Lee Chang Yung Chemical, Celanese Corporation, Eastman Chemical Company, Mitsubishi Chemical Holdings Corporation, and Mitsui Chemicals, Inc.

High Demand from the Paints and Coatings Industry to Bolster Growth of the Methyl Isobutyl Ketone Market

The booming global automotive industry is likely to drive up the demand for surface coatings chemicals and solvents in rubber manufacturing, which is estimated to bolster expansion of the global methyl isobutyl ketone market in the years to come. Likewise, augmented construction spending has expanded the utilization of methyl isobutyl ketone in paints and coatings as solvents and extraction solvents. Furthermore, the rising demand for the product in the maritime and pharmaceutical sectors is likely to result in a positive effect on the global methyl isobutyl ketone market in the years to come. In addition to that, the chemical is extensively utilized in the making of insecticides, which are frequently used in the commercial agriculture sector. This is driving agriculture-driven economies like India to invest heavily in optimizing their agricultural production by concentrating on fertilizers and insecticides. This factor is likely to exert positive influence on global methyl isobutyl ketone market in the forthcoming years.

Demand for MIK to Ride on the Back of Growing Concern for the Environment

Since methyl isobutyl ketone is organic in nature, it is extensively used in the manufacture of agrochemicals and cosmetics, leading to its widespread use. In addition, the chemical is one of the most effective solvents for varnishes, paints, resin gums, and other similar materials. It's widely used as a denaturant in ethanol formulations and in the form of an extractive agent in de-waxing and rubber de-oiling. In addition to that, synthetic methyl isobutyl ketone exposure could possibly cause a negative effect on the environment, resulting in a rising demand for bio-based methyl isobutyl ketone, which is less expensive to produce than other petroleum-based methods.

Furthermore, when petroleum-based methyl isobutyl ketone is exposed to sunlight, it forms volatile peroxides, which may be toxic even if spilled during transportation, shipping, and handling. As a result, using bio-based methyl isobutyl ketone would be a cost-effective and environmentally friendly solution for a wide range of industries, fueling growth of the global methyl isobutyl ketone market in the coming years. Because of its high toxicity, many regulatory bodies around the world have imposed strict restrictions and recommendations on the production of methyl isobutyl ketone. However, because of its toxic effects on the ecosystem and human wellbeing, bio-based methyl isobutyl ketone is being used more often.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Size, Global Methyl Isobutyl Ketone Market (US$ Mn)

3.2. Key Trends

3.3. Regional Overview, 2015 & Top 3 Product Share, 2015-2024

4. Market Overview

4.1. Product Overview

4.2. Market Indicators

4.3. Key Industry Developments

4.4. Market Dynamics Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Key Opportunities

4.5. Methyl Isobutyl Ketone (MIBK)Pricing - Actuals and Projections, 2015-2024 (US$/kilo tons)

4.6. Methyl Isobutyl Ketone (MIBK)Market - Global Supply Demand Scenario

4.7. Porter’s Analysis Porter’s Analysis

4.7.1. Threat of Substitutes

4.7.2. Bargaining Power of Buyers

4.7.3. Bargaining Power of Suppliers

4.7.4. Threat of New Entrants

4.7.5. Degree of Competition

4.8. Market Outlook

5. Global Methyl Isobutyl Ketone (MIBK)Market Analysis By Application, 2015-2024

5.1. Key Findings

5.2. Introduction

5.3. Global Methyl Isobutyl Ketone (MIBK) Market Value Share Analysis, by Application, 2015-2024

5.4. Methyl Isobutyl Ketone (MIBK) Market Forecast, by Application, 2015-2024

5.5. Methyl Isobutyl Ketone (MIBK) Market Analysis, by Application, 2015-2024

5.6. Methyl Isobutyl Ketone (MIBK) Market Attractiveness Analysis, by Application, 2015-2024

6. Global Methyl Isobutyl Ketone (MIBK)Market Analysis By End-User, 2015-2024

6.1. Key Findings

6.2. Introduction

6.3. Global MIBK Market Value Share Analysis, by End-User, 2015-2024

6.4. Methyl Isobutyl Ketone (MIBK) Market Analysis, by End-User, 2015-2024

6.5. Methyl Isobutyl Ketone (MIBK) Market Attractiveness Analysis, by End-User, 2015-2024

7. Global Methyl Isobutyl Ketone (MIBK)Market Analysis and Forecasts, By Region

7.1. Global Methyl Isobutyl Ketone (MIBK)Market Scenario, by Region, 2015-2024

7.2. Global MIBK Market Value Share Analysis, by Region, 2015-2024

7.3. MIBK Market Forecast, by Region, 2015-2024

7.4. Methyl Isobutyl Ketone (MIBK) Market Attractiveness Analysis, by Region, 2015-2024

8. North America Methyl Isobutyl Ketone (MIBK) Market Analysis

8.1. Key Findings

8.2. Market Trends- Policies & Regulations

8.3. North America MIBK Market Overview

8.4. North America Market Value Share Analysis, by Application, 2015-2024

8.5. North America Market Forecast, by Application, 2015-2024

8.6. North America Market Value Share Analysis, by End-user, 2015-2024

8.7. North America Market Forecast, by End-user, 2015-2024

8.8. North America Market Value Share Analysis, by Country, 2015-2024

8.9. North America Market Forecast, by Country, 2015-2024

8.10. Market Attractiveness Analysis

8.10.1. By Country

8.10.2. By Application

8.10.3. By End use

8.11. Market Trends

9. Europe Methyl Isobutyl Ketone (MIBK) Market Analysis

9.1. Key Findings

9.2. Europe MIBK Market Overview

9.3. Europe Market Value Share Analysis, by Application, 2015-2024

9.4. Europe Market Forecast, by Application, 2015-2024

9.5. Europe Market Value Share Analysis, by End-user, 2015-2024

9.6. Europe Market Forecast, by End-user, 2015-2024

9.7. Europe Market Value Share Analysis, by Country, 2015-2024

9.8. 9.10. Europe Market Forecast, by Country, 2015-2024

9.9. 9.11. Europe Market Attractiveness Analysis

9.9.1. 9.11.1. By Country

9.9.2. 9.11.2. By Application

9.9.3. 9.11.3. By End use

9.10. 9.12. Market Trends

10. Asia Pacific Methyl Isobutyl Ketone (MIBK)Market Analysis

10.1. Key Findings

10.2. Asia Pacific MIBK Market Overview

10.3. Asia Pacific Market Value Share Analysis, by Application, 2015-2024

10.4. Asia Pacific Market Forecast, by Application, 2015-2024

10.5. Asia Pacific Market Value Share Analysis, by End-user, 2015-2024

10.6. Asia Pacific Market Forecast, by End-user, 2015-2024

10.7. Asia Pacific Market Value Share Analysis, by Country, 2015-2024

10.8. Asia Pacific Market Forecast, by Country, 2015-2024

10.9. Market Attractiveness Analysis

10.9.1. By Country

10.9.2. By Application

10.9.3. By End use

10.10. Market Trends

11. Latin America Methyl Isobutyl Ketone (MIBK) Market Analysis

11.1. Key Findings

11.2. Latin America MIBK Market Overview

11.3. Latin America Market Value Share Analysis, by Application, 2015-2024

11.4. Latin America Market Forecast, by Application, 2015-2024

11.5. Latin America Market Value Share Analysis, by End-user, 2015-2024

11.6. Latin America Market Forecast, by End-user, 2015-2024

11.7. Latin America Market Value Share Analysis, by Country, 2015-2024

11.8. Latin America Market Forecast, by Country, 2015-2024

11.9. Market Attractiveness Analysis

11.9.1. By Country

11.9.2. By Application

11.9.3. By End use

11.10. Market Trends

12. Middle East & Africa (MEA) Methyl Isobutyl Ketone (MIBK) Market Analysis

12.1. Key Findings

12.2. Middle East & Africa MIBK Market Overview

12.3. Middle East & Africa MIBK Market Value Share Analysis, by Application, 2015-2024

12.4. Middle East & Africa MIBK Market Forecast, by Application, 2015-2024

12.5. Middle East & Africa MIBK Market Value Share Analysis, by End-user, 2015-2024

12.6. Middle East & Africa MIBK Market Forecast, by End-user, 2015-2024

12.7. Middle East & Africa MIBK Market Value Share Analysis, by Country, 2015-2024

12.8. Market Attractiveness Analysis

12.8.1. 12.5.1. By Country

12.8.2. 12.5.2. By Application

12.8.3. 12.5.3. By End use

12.9. Market Trends

13. Competition Landscape

13.1. Competition Matrix

13.2. Methyl Isobutyl Ketone (MIBK)Market Share Analysis, by Company (2015)

13.3. Company Profiles

13.3.1. Eastman Chemical Company

13.3.1.1. Company Description

13.3.1.2. Business Overview

13.3.1.3. Financial Details

13.3.1.4. SWOT

13.3.1.5. Strategic Overview

13.3.2. Mitsui Chemicals, Inc.

13.3.2.1. Company Description

13.3.2.2. Business Overview

13.3.2.3. Financial Details

13.3.2.4. SWOT

13.3.2.5. Strategic Overview

13.3.3. Mitsubishi Chemical Holdings Corporation

13.3.3.1. Company Description

13.3.3.2. Business Overview

13.3.3.3. Financial Details

13.3.3.4. SWOT

13.3.3.5. Strategic Overview

13.3.4. Celanese Corporation

13.3.4.1. Company Description

13.3.4.2. Business Overview

13.3.4.3. Financial Details

13.3.4.4. SWOT

13.3.4.5. Strategic Overview

13.3.5. Royal Dutch Shell Plc. (Shell)

13.3.5.1. Company Description

13.3.5.2. Business Overview

13.3.5.3. Financial Details

13.3.5.4. SWOT

13.3.5.5. Strategic Overview

13.3.6. The Dow Chemicals Company

13.3.6.1. Company Description

13.3.6.2. Business Overview

13.3.6.3. Financial Details

13.3.6.4. SWOT

13.3.6.5. Strategic Overview

13.3.7. KUMHO P&B CHEMICALS., INC.

13.3.7.1. Company Description

13.3.7.2. Business Overview

13.3.7.3. Financial Details

13.3.7.4. SWOT

13.3.7.5. Strategic Overview

13.3.8. Sasol Ltd.

13.3.8.1. Company Description

13.3.8.2. Business Overview

13.3.8.3. Financial Details

13.3.8.4. SWOT

13.3.8.5. Strategic Overview

13.3.9. Monument Chemical

13.3.9.1. Company Description

13.3.9.2. Business Overview

13.3.10. Carboclor S.A.

13.3.10.1. Company Description

13.3.10.2. Business Overview

13.3.11. LCY Chemical Corporation

13.3.11.1. Company Description

13.3.11.2. Business Overview

13.3.11.3. Financial Details

13.3.11.4. SWOT

13.3.11.5. Strategic Overview

14. Key Take aways

List of Tables

Table 1: Global MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015-2024

Table 2: MIBK Market, Application Comparison Matrix

Table 3: Global MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by End-user, 2015-2024

Table 4: Global MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Region, 2015-2024

Table 5: North America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015-2024

Table 6: North America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by End-user, 2015-2024

Table 7: North America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015-2024

Table 8: Europe MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015-2024

Table 9: Europe MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by End-user, 2015-2024

Table 10: Europe MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015-2024

Table 11: Asia Pacific MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015-2024

Table 12: Asia Pacific MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by End-user, 2015-2024

Table 13: Asia Pacific MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015-2024

Table 14: Latin America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015-2024

Table 15: Latin America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by End-user, 2015-2024

Table 16: Latin America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015-2024

Table 17: Middle East & Africa MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015-2024

Table 18: Middle East & Africa MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by End-user, 2015-2024

Table 19: Middle East & Africa MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015-2024

List of Figures

Figure 1: Global MIBK Market Size, by Market Value (US$ Mn) and Market Value Share

Figure 2: Regional Overview, 2015

Figure 3: Top 3 Application Share, 2015-2024

Figure 4: Global MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, 2015-2024

Figure 5: Global MIBK Prices (US$ Mn/Kilo Ton)

Figure 6: Global MIBK Market Value Share Analysis, by Application, 2015 and 2024

Figure 7: By Application (Solvents), 2015-2024 (Tons) (US$ Mn)

Figure 8: By Application (Rubber Chemicals), 2015-2024 (Tons) (US$ Mn)

Figure 9: By Application (Insecticides), 2015-2024 (Tons) (US$ Mn)

Figure 10: By Application (Surfactants), 2015-2024 (Tons) (US$ Mn)

Figure 11: By Application (Others), 2015-2024 (Tons) (US$ Mn)

Figure 12: Methyl Isobutyl Ketone (MIBK) Market Attractiveness Analysis, by Application, 2015

Figure 13: Global MIBK Market Value Share Analysis, by End-user, 2015 and 2024

Figure 14: By End-user, 2015-2024 (Tons) (US$ Mn)

Figure 15: By End-user, 2015-2024 (Tons) (US$ Mn)

Figure 16: By End-user, 2015-2024 (Tons) (US$ Mn)

Figure 17: By End-user, 2015-2024 (Tons) (US$ Mn)

Figure 18: By End-user, 2015-2024 (Tons) (US$ Mn)

Figure 19: Methyl Isobutyl Ketone (MIBK) Market Attractiveness Analysis, by End-user, 2015

Figure 20: Global MIBK Market Value Share Analysis, by Region, 2015 and 2024

Figure 21: Methyl Isobutyl Ketone (MIBK) Market Attractiveness Analysis, by Region, 2015

Figure 22: North America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, 2015-2024

Figure 23: North America MIBK Market Size and Volume Y-o-Y Growth Projection, 2015-2024

Figure 24: North America Market Attractiveness Analysis, by Country

Figure 25: North America Market Value Share Analysis, by Application, 2015 and 2024

Figure 26: North America Market Value Share Analysis, by End-user, 2015 and 2024

Figure 27: North America Market Value Share Analysis, by Country, 2015 and 2024

Figure 29: By End-user

Figure 28: By Application

Figure 30: Europe MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, 2015-2024

Figure 31: Europe MIBK Market Size and Volume Y-o-Y Growth Projection, 2015-2024

Figure 32: Europe Market Attractiveness Analysis, by Country

Figure 33: Europe Market Value Share Analysis, by Application, 2016 and 2024

Figure 34: Europe Market Value Share Analysis, by End-user, 2016 and 2024

Figure 35: Europe Market Value Share Analysis, by Country, 2015 and 2024

Figure 36: By End-user

Figure 37: By Application

Figure 38: Asia Pacific MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, 2015-2024

Figure 39: Asia Pacific MIBK Market Size and Volume Y-o-Y Growth Projection, 2015-2024

Figure 40: Asia Pacific Market Attractiveness Analysis, by Country

Figure 41: Asia Pacific Market Value Share Analysis, by Application, 2015 and 2024

Figure 42: Asia Pacific Market Value Share Analysis, by End-user, 2015 and 2024

Figure 43: Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

Figure 44: By End-user

Figure 45: By Application

Figure 46: Latin America MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, 2015-2024

Figure 47: Latin America MIBK Market Size and Volume Y-o-Y Growth Projection, 2015-2024

Figure 48: Latin America Market Attractiveness Analysis, by Country

Figure 49: Latin America Market Value Share Analysis, by Application, 2015 and 2024

Figure 50: Latin America Market Value Share Analysis, by End-user, 2015 and 2024

Figure 51: Latin America Market Value Share Analysis, by Country, 2015 and 2024

Figure 52: By End-user

Figure 53: By Application

Figure 54: MEA MIBK Market Size (US$ Mn) and Volume (Tons) Forecast, 2015-2024

Figure 55: MEA MIBK Market Size and Volume, Y-o-Y Growth Projections, 2015-2024

Figure 56: MEA MIBK Market Attractiveness Analysis, by Country

Figure 57: Middle East & Africa MIBK Market Value Share Analysis, by Application, 2015 and 2024

Figure 58: Middle East & Africa MIBK Market Value Share Analysis, by End-user, 2016 and 2024

Figure 59: Middle East & Africa MIBK Market Value Share Analysis, by Country, 2016 and 2024

Figure 60: By Application

Figure 61: By End-user

Figure 62: Global Methyl Isobutyl Ketone (MIBK) Market Share Analysis, by Company (2015)