Analyst Viewpoint

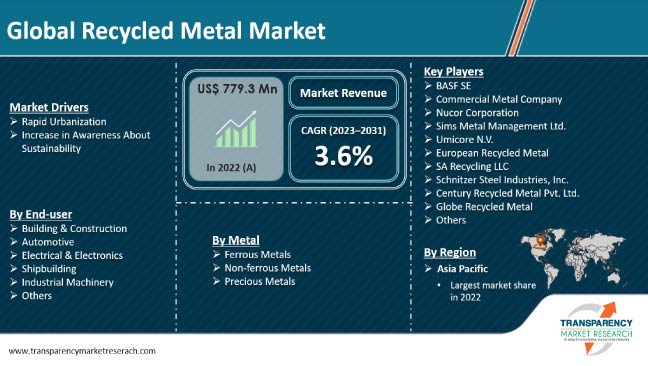

Rapid growth in industrialization and urbanization is fueling the recycled metal market value. Furthermore, infrastructure development across the globe is driving the demand for recycled metal, which in turn is bolstering market progress. Expansion of the construction sector and rise in focus on sustainable construction is augmenting the growth of the industry. Surging environmental concerns due to lack of effective waste management is also fostering development of the market.

Rise in awareness about sustainability in the automotive and construction sector is driving the demand for recycled metal from manufacturers. Stringent government regulations to lower carbon footprints and focus on environmental preservation is encouraging manufacturers to use recycled metal for production. Manufacturers are focusing on forming partnerships to expand their business reach and provide extensive metal recycling services to the market.

Metals, such as steel, brass, copper, iron, and aluminum can be reused again, reducing the amount of produced waste. Metal recycling is the process of taking waste metal, processing it, and creating recycled metal material. This recycled metal can be used to make metal products which can then be upcycled once used or not needed. There are many advantages to recycling metal, including environmental benefits as well as energy savings.

Any nonferrous metal item that has a component of steel or iron is treated as scrap steel. Scrap metal centers sell the scrap to larger super collectors where it is shredded and then melted in furnaces at high temperatures to produce sheets, ingots, or blocks to be sold to manufacturers of metal products. Metal recycling helps reduce pollution, save resources, and reduce waste going to landfills. Mining destroys habitats of humans and other living beings. Metal recycling could prevent destruction of these habitats.

Population growth and increase in infrastructure development is driving the usage of metals in consumer goods, such as electronics and automobile. Metal is one of the crucial components used in infrastructure development in commercial, residential, and industrial sectors. Manufacturers are focusing on recycling metal to control waste production and develop products using upcycled metal. Rapid urbanization in developed as well as developing regions is fostering the recycled metal market demand.

The construction sector is a major consumer of metals. Growth in the construction sector across the globe is bolstering recycled metal market expansion. Surge in investments in development of roads, residential projects, commercial buildings, and other governmental facilities are driving the demand for recycled metals. Construction companies prefer using repurposed metal to reduce the carbon footprint and maintain business sustainability.

Sustainability is a major factor supporting business profitability in various industries, such as automotive, building & construction, electrical & electronics, and industrial machinery. Sustainable construction is on of the significant global market trends adopted by major companies in the industry. Sustainable construction with recycled metal materials reduces waste production and minimizes energy consumption. Increase in awareness about sustainability in construction and automobile sectors is fueling the recycled metal market size.

Implementation of stringent government regulations to lower carbon footprints and environmental preservation is augmenting recycled metal market statistics. Governments across the globe are encouraging businesses to use recycled metals by considering environmental advantages of choosing recycled steel products. For instance, in May 2022, the Government of India signed the Comprehensive Economic Partnership Agreement (CEPA) with the UAE government to increase import of scrap from UAE. This initiative will increase availability of recycled metal for businesses in various sectors.

Recycled metal is used to manufacture several parts in automobiles such as body, chassis, engines, breaks, and wheels. Increase in demand for passenger vehicles globally is driving the demand for recycled metals. Utilization of recycled metal in vehicles ensure sustainability and reduce waste production in the automotive sector. Manufacturers in the automotive sector use recycled metals to reduce production cost and increase business profitability.

According to the regional recycled metal market analysis, Asia Pacific is projected to hold largest market share in the next few years due to economic expansion. Moreover, rapid industrialization and urbanization in the region is fostering the growth of the market. Implementation of government regulations on waste production and management are increasing the usage of recycled metals.

According to the International Trade Administration, Malaysia’s current recycling rate is around 31% and Malaysia’s federal government targets increasing it to 40% by 2050. This initiative is expected to increase production of recycled metal in the region and maintain sustainability.

Key players in the recycled metal market are focusing of implementing various growth strategies, such as partnerships, acquisitions, and launch of new services. Manufacturers are adopting advanced technologies to recycle metals and reduce carbon emission. Business partnerships are likely to allow companies to provide their services across global markets and meet rising demands for recycled metal from several industries.

Some of the leading companies in the recycled metal market are BASF SE, Commercial Metal Company, Nucor Corporation, Sims Metal Management Ltd., Umicore N.V., European Recycled Metal, SA Recycling LLC, Schnitzer Steel Industries, Inc., Century Recycled Metal Pvt. Ltd., Globe Recycled Metal, Kuusakoski Group Oy, OmniSource Corporation, and Aaron Metals.

These companies are listed in the recycled metal market report based on factors such as business strategies, financial overview, product portfolio, company overview, recent developments, and business segments

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 779.3 Mn |

| Market Forecast (Value) in 2031 | US$ 1.1 Bn |

| Growth Rate (CAGR) | 3.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Tons | US$ Mn/Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 779.3 Mn in 2022

It is projected to grow at a CAGR of 3.6% from 2023 to 2031

Rapid urbanization and increase in awareness about sustainability

Asia Pacific is likely to hold a dominant share

BASF SE, Commercial Metal Company, Nucor Corporation, Sims Metal Management Ltd., Umicore N.V., European Recycled Metal, SA Recycling LLC, Schnitzer Steel Industries, Inc., Century Recycled Metal Pvt. Ltd., Globe Recycled Metal, Kuusakoski Group Oy, OmniSource Corporation, and Aaron Metals

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Recycled Metal Market Analysis and Forecast, 2023-2031

2.6.1. Global Recycled Metal Market Volume (Kilo Tons)

2.6.2. Global Recycled Metal Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Recycled Metal

3.2. Impact on Demand for Recycled Metal– Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Metal

6.2. Price Trend Analysis by Region

7. Global Recycled Metal Market Analysis and Forecast, by Metal, 2023–2031

7.1. Introduction and Definitions

7.2. Global Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

7.2.1. Ferrous Metals

7.2.2. Non-ferrous Metals

7.2.2.1. Aluminum

7.2.2.2. Copper

7.2.2.3. Lead

7.2.2.4. Others

7.2.3. Precious Metals

7.3. Global Recycled Metal Market Attractiveness, by Metal

8. Global Recycled Metal Market Analysis and Forecast, by End-user, 2023–2031

8.1. Introduction and Definitions

8.2. Global Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

8.2.1. Building & Construction

8.2.2. Automotive

8.2.3. Electrical & Electronics

8.2.4. Shipbuilding

8.2.5. Industrial Machinery

8.2.6. Others

8.3. Global Recycled Metal Market Attractiveness, by End-user

9. Global Recycled Metal Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Recycled Metal Market Attractiveness, by Region

10. North America Recycled Metal Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

10.3. North America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

10.4. North America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

10.4.1. U.S. Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

10.4.2. U.S. Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

10.4.3. Canada Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

10.4.4. Canada Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

10.5. North America Recycled Metal Market Attractiveness Analysis

11. Europe Recycled Metal Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

11.3. Europe Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

11.4. Europe Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

11.4.2. Germany Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

11.4.3. France Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

11.4.4. France Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

11.4.5. U.K. Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

11.4.6. U.K. Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

11.4.7. Italy Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

11.4.8. Italy Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

11.4.9. Russia & CIS Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

11.4.10. Russia & CIS Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

11.4.11. Rest of Europe Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

11.4.12. Rest of Europe Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

11.5. Europe Recycled Metal Market Attractiveness Analysis

12. Asia Pacific Recycled Metal Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal

12.3. Asia Pacific Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

12.4. Asia Pacific Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

12.4.2. China Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

12.4.3. Japan Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

12.4.4. Japan Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

12.4.5. India Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

12.4.6. India Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

12.4.7. ASEAN Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

12.4.8. ASEAN Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

12.4.9. Rest of Asia Pacific Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

12.4.10. Rest of Asia Pacific Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

12.5. Asia Pacific Recycled Metal Market Attractiveness Analysis

13. Latin America Recycled Metal Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

13.3. Latin America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

13.4. Latin America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

13.4.2. Brazil Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

13.4.3. Mexico Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

13.4.4. Mexico Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

13.4.5. Rest of Latin America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

13.4.6. Rest of Latin America Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

13.5. Latin America Recycled Metal Market Attractiveness Analysis

14. Middle East & Africa Recycled Metal Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

14.3. Middle East & Africa Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

14.4. Middle East & Africa Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

14.4.2. GCC Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

14.4.3. South Africa Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

14.4.4. South Africa Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

14.4.5. Rest of Middle East & Africa Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metal, 2023–2031

14.4.6. Rest of Middle East & Africa Recycled Metal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023–2031

14.5. Middle East & Africa Recycled Metal Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Recycled Metal Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. BASF SE

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Commercial Metal Company

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. Nucor Corporation

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. Sims Metal Management Ltd.

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. Umicore N.V.

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. European Recycled Metal

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. SA Recycling LLC

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. Schnitzer Steel Industries, Inc.

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Century Recycled Metal Pvt. Ltd.

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Globe Recycled Metal

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Kuusakoski Group Oy

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.12. OmniSource Corporation

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.13. Aaron Metals

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 2: Global Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 3: Global Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 4: Global Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 5: Global Recycled Metal Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 6: Global Recycled Metal Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 7: North America Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 8: North America Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 9: North America Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 10: North America Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 11: North America Recycled Metal Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 12: North America Recycled Metal Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 13: U.S. Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 14: U.S. Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 15: U.S. Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 16: U.S. Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 17: Canada Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 18: Canada Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 19: Canada Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 20: Canada Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 21: Europe Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 22: Europe Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 23: Europe Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 24: Europe Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 25: Europe Recycled Metal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 26: Europe Recycled Metal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 27: Germany Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 28: Germany Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 29: Germany Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 30: Germany Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 31: France Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 32: France Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 33: France Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 34: France Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 35: U.K. Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 36: U.K. Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 37: U.K. Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 38: U.K. Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 39: Italy Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 40: Italy Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 41: Italy Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 42: Italy Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 43: Spain Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 44: Spain Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 45: Spain Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 46: Spain Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 47: Russia & CIS Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 48: Russia & CIS Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 49: Russia & CIS Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 50: Russia & CIS Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 51: Rest of Europe Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 52: Rest of Europe Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 53: Rest of Europe Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 54: Rest of Europe Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 55: Asia Pacific Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 56: Asia Pacific Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 57: Asia Pacific Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 58: Asia Pacific Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 59: Asia Pacific Recycled Metal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 60: Asia Pacific Recycled Metal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 61: China Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 62: China Recycled Metal Market Value (US$ Mn) Forecast, by Metal 2023–2031

Table 63: China Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 64: China Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 65: Japan Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 66: Japan Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 67: Japan Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 68: Japan Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 69: India Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 70: India Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 71: India Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 72: India Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 73: ASEAN Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 74: ASEAN Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 75: ASEAN Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 76: ASEAN Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 77: Rest of Asia Pacific Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 78: Rest of Asia Pacific Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 79: Rest of Asia Pacific Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 80: Rest of Asia Pacific Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 81: Latin America Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 82: Latin America Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 83: Latin America Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 84: Latin America Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 85: Latin America Recycled Metal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 86: Latin America Recycled Metal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 87: Brazil Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 88: Brazil Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 89: Brazil Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 90: Brazil Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 91: Mexico Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 92: Mexico Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 93: Mexico Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 94: Mexico Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 95: Rest of Latin America Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 96: Rest of Latin America Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 97: Rest of Latin America Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 98: Rest of Latin America Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 99: Middle East & Africa Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 100: Middle East & Africa Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 101: Middle East & Africa Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 102: Middle East & Africa Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 103: Middle East & Africa Recycled Metal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 104: Middle East & Africa Recycled Metal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 105: GCC Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 106: GCC Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 107: GCC Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 108: GCC Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 109: South Africa Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 110: South Africa Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 111: South Africa Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 112: South Africa Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 113: Rest of Middle East & Africa Recycled Metal Market Volume (Kilo Tons) Forecast, by Metal, 2023–2031

Table 114: Rest of Middle East & Africa Recycled Metal Market Value (US$ Mn) Forecast, by Metal, 2023–2031

Table 115: Rest of Middle East & Africa Recycled Metal Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 116: Rest of Middle East & Africa Recycled Metal Market Value (US$ Mn) Forecast, by End-user, 2023–2031

List of Figures

Figure 1: Global Recycled Metal Market Volume Share Analysis, by Metal, 2022, 2027, and 2031

Figure 2: Global Recycled Metal Market Attractiveness, by Metal

Figure 3: Global Recycled Metal Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 4: Global Recycled Metal Market Attractiveness, by End-user

Figure 5: Global Recycled Metal Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Recycled Metal Market Attractiveness, by Region

Figure 7: North America Recycled Metal Market Volume Share Analysis, by Metal, 2022, 2027, and 2031

Figure 8: North America Recycled Metal Market Attractiveness, by Metal

Figure 9: North America Recycled Metal Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 10: North America Recycled Metal Market Attractiveness, by End-user

Figure 11: North America Recycled Metal Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: North America Recycled Metal Market Attractiveness, by Country

Figure 13: Europe Recycled Metal Market Volume Share Analysis, by Metal, 2022, 2027, and 2031

Figure 14: Europe Recycled Metal Market Attractiveness, by Metal

Figure 15: Europe Recycled Metal Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 16: Europe Recycled Metal Market Attractiveness, by End-user

Figure 17: Europe Recycled Metal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Recycled Metal Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Recycled Metal Market Volume Share Analysis, by Metal, 2022, 2027, and 2031

Figure 20: Asia Pacific Recycled Metal Market Attractiveness, by Metal

Figure 21: Asia Pacific Recycled Metal Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 22: Asia Pacific Recycled Metal Market Attractiveness, by End-user

Figure 23: Asia Pacific Recycled Metal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Recycled Metal Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Recycled Metal Market Volume Share Analysis, by Metal, 2022, 2027, and 2031

Figure 26: Latin America Recycled Metal Market Attractiveness, by Metal

Figure 27: Latin America Recycled Metal Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 28: Latin America Recycled Metal Market Attractiveness, by End-user

Figure 29: Latin America Recycled Metal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Recycled Metal Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Recycled Metal Market Volume Share Analysis, by Metal, 2022, 2027, and 2031

Figure 32: Middle East & Africa Recycled Metal Market Attractiveness, by Metal

Figure 33: Middle East & Africa Recycled Metal Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 34: Middle East & Africa Recycled Metal Market Attractiveness, by End-user

Figure 35: Middle East & Africa Recycled Metal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Recycled Metal Market Attractiveness, by Country and Sub-region