Reports

Reports

Analyst Viewpoint

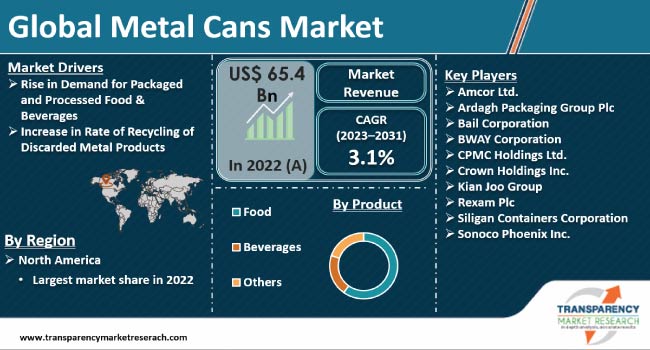

Growing demand for processed food, ready-to-drink beverages, and alcoholic and non-alcoholic beverages, worldwide, owing to changing lifestyle preferences and rising disposable income, is driving the metal cans market growth. The convenience involved in carrying food and beverages in metal cans without compromising on taste and quality is also boosting the use of metal cans in the food & beverage sector.

Increase in awareness about environment protection among consumers and high recycling and recovery rate of metal cans are also projected to boost the metal cans industry growth in the next few years. Furthermore, stringent regulations on the disposal and recycling of metal cans are estimated to offer lucrative metal cans market opportunities for manufacturers to develop eco-friendly cans and improve rate of recycling.

Metal cans are extensively used to package beverages such as energy drinks, soft drinks, beer, owing to longer shelf-life and recyclability. Steel and aluminum are majorly used to manufacture metal cans owing to the high recycling rate of these metals, thereby reducing the carbon footprint in the long run.

Technological advancements and innovation have led to the development of easy to open lids, superior graphical designs, and the availability of self-heating cans. However, volatility in the prices of steel and aluminum are expected to restrain the market expansion. Additionally, rise in demand for packaging materials other than metals, such as plastics and paper, is also anticipated to hamper the metal cans industry development in the next few years.

Metal cans are increasingly being used to package diverse food & beverage products including vegetables, fruits, baby foods, soups, carbonated soft drinks (CSD), liquid dairy products, juices, and alcoholic beverages. The advantages of metal packaging include durability, recyclability, reusability, and superior esthetic appearance. Furthermore, rising demand for beverages and increasing usage of metal cans in their packaging due to several advantages, such as prolonged coolness of the drink and excellent protection from UV rays and bacterial contamination, is expected to positively impact the metal cans market forecast in the next few years.

According to data gathered from TheWorldCounts, global consumption of aluminum cans reached 175.8 Bn in 2022. Furthermore, preferences and perceptions toward packaged food and beverages are changing among millennials and Gen Z. They are increasingly preferring healthy packaged food. These factors are likely to drive the metal cans market demand in the near future.

Metal can be recycled infinitely without compromising on quality. This is estimated to benefit the environment and mitigate disposal in landfills. According to the proposed draft for a Packaging & Packaging Waste Regulation of the EU, the highest recyclability performance grade of 95% is met by aluminum. Therefore, demand for aluminum cans is significantly high, as it is a light weight, non-reactive metal.

Growing demand for deodorants, hairsprays, and pharmaceuticals in aerosol cans is also augmenting the market dynamics. Furthermore, surge in awareness about the adverse effect of single-use plastics and government regulations that ban the use of such plastics that hamper the environment are fueling the metal cans statistics.

North America is a highly mature market and accounts for a prominent share of the global demand for beverages, which includes alcoholic and non-alcoholic drinks. According to the Brewers Association, the beer market in the U.S. was valued at US$ 100.2 Bn in 2021, which included sale of craft beer. Furthermore, the association revealed that the beer market registered a growth of 7.9% in 2022. This highlights the rising demand for metal cans in the U.S.

The major metal cans market share held by North America can be attributed to a dominant packaging industry and highly developed infrastructure. Additionally, a prominent recycling industry is contributing to the market progress in the region.

The global metal cans business is vast, yet highly competitive, with significant participation from both domestic and international players. Leading companies are following the latest metal cans market trends and adopting engaging in mergers & acquisitions, contractual agreements, and collaborations to enhance their presence worldwide. Amcor Ltd., Ardagh Packaging Group Plc, Bail Corporation, BWAY Corporation, CPMC Holdings Ltd., Crown Holdings Inc., Kian Joo Group, Rexam Plc, Siligan Containers Corporation, and Sonoco Phoenix Inc. are a few prominent entities operating in the global market.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 65.4 Bn |

| Market Forecast Value in 2031 | US$ 83.5 Bn |

| Growth Rate (CAGR) | 3.1% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 65.4 Mn in 2022

It is projected to grow at a CAGR of 3.1% from 2023 to 2031

Growing consumption of packaged and processed food & beverages and enhancement in Infrastructure for recycling of discarded metal products

Beverages held the largest share in 2022

Asia Pacific is estimated to dominate in the next few years

Amcor Ltd., Ardagh Packaging Group Plc, Bail Corporation, BWAY Corporation, CPMC Holdings Ltd., Crown Holdings Inc., Kian Joo Group, Rexam Plc, Siligan Containers Corporation, and Sonoco Phoenix Inc.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Metal Cans Market Analysis and Forecast, 2023-2031

2.6.1. Global Metal Cans Market Volume (Million Units)

2.6.2. Global Metal Cans Market Value (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Metal Cans

3.2. Impact on Demand for Metal Cans – Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis, by Product

6.2. Price Trend Analysis by Region

7. Global Metal Cans Market Analysis and Forecast, by Product, 2023–2031

7.1. Introduction and Definitions

7.2. Global Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

7.2.1. Foods

7.2.1.1. Fruits

7.2.1.2. Vegetables

7.2.1.3. Fruits

7.2.1.4. Others

7.2.2. Beverages

7.2.2.1. CSD

7.2.2.2. Alcoholic Beverages

7.2.2.3. New Drinks

7.2.2.4. Fruits and Vegetable Juices

7.2.3. Others

7.3. Global Metal Cans Market Attractiveness, by Product

8. Global Metal Cans Market Analysis and Forecast, by Region, 2023–2031

8.1. Key Findings

8.2. Global Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Metal Cans Market Attractiveness, by Region

9. North America Metal Cans Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. North America Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

9.3. North America Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country, 2023–2031

9.3.1. U.S. Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

9.3.2. Canada Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

9.4. North America Metal Cans Market Attractiveness Analysis

10. Europe Metal Cans Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Europe Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.3. Europe Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

10.3.1. Germany Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Type, 2023–2031

10.3.2. France Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.3.3. U.K. Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.3.4. Italy Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.3.5. Russia & CIS Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.3.6. Rest of Europe Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.4. Europe Metal Cans Market Attractiveness Analysis

11. Asia Pacific Metal Cans Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Asia Pacific Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product

11.3. Asia Pacific Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

11.3.1. China Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.3.2. Japan Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.3.3. India Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.3.4. ASEAN Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.3.5. Rest of Asia Pacific Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.4. Asia Pacific Metal Cans Market Attractiveness Analysis

12. Latin America Metal Cans Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Latin America Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.3. Latin America Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

12.3.1. Brazil Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.3.2. Mexico Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.3.3. Rest of Latin America Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.4. Latin America Metal Cans Market Attractiveness Analysis

13. Middle East & Africa Metal Cans Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Middle East & Africa Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.3. Middle East & Africa Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.3.1. GCC Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.3.2. South Africa Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.3.3. Rest of Middle East & Africa Metal Cans Market Volume (Million Units) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.4. Middle East & Africa Metal Cans Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Metal Cans Market Company Share Analysis, 2022

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Amcor Ltd.

14.2.1.1. Company Revenue

14.2.1.2. Business Overview

14.2.1.3. Product Segments

14.2.1.4. Geographic Footprint

14.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.2. Ardagh Packaging Group Plc

14.2.2.1. Company Revenue

14.2.2.2. Business Overview

14.2.2.3. Product Segments

14.2.2.4. Geographic Footprint

14.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.3. Bail Corporation

14.2.3.1. Company Revenue

14.2.3.2. Business Overview

14.2.3.3. Product Segments

14.2.3.4. Geographic Footprint

14.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.4. BWAY Corporation

14.2.4.1. Company Revenue

14.2.4.2. Business Overview

14.2.4.3. Product Segments

14.2.4.4. Geographic Footprint

14.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.5. CPMC Holdings Ltd.

14.2.5.1. Company Revenue

14.2.5.2. Business Overview

14.2.5.3. Product Segments

14.2.5.4. Geographic Footprint

14.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.6. Crown Holdings Inc.

14.2.6.1. Company Revenue

14.2.6.2. Business Overview

14.2.6.3. Product Segments

14.2.6.4. Geographic Footprint

14.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.7. Kian Joo Group

14.2.7.1. Company Revenue

14.2.7.2. Business Overview

14.2.7.3. Product Segments

14.2.7.4. Geographic Footprint

14.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.8. Rexam Plc

14.2.8.1. Company Revenue

14.2.8.2. Business Overview

14.2.8.3. Product Segments

14.2.8.4. Geographic Footprint

14.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.9. Sonoco Phoenix Inc.

14.2.9.1. Company Revenue

14.2.9.2. Business Overview

14.2.9.3. Product Segments

14.2.9.4. Geographic Footprint

14.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.10. Siligan Containers Corporation

14.2.10.1. Company Revenue

14.2.10.2. Business Overview

14.2.10.3. Product Segments

14.2.10.4. Geographic Footprint

14.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 2: Global Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 3: Global Metal Cans Market Volume (Million Units) Forecast, by Region, 2023–2031

Table 4: Global Metal Cans Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 5: North America Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 6: North America Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 7: North America Metal Cans Market Volume (Million Units) Forecast, by Country, 2023–2031

Table 8: North America Metal Cans Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 9: U.S. Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 10: U.S. Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 11: Canada Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 12: Canada Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 13: Europe Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 14: Europe Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 15: Europe Metal Cans Market Volume (Million Units) Forecast, by Country and Sub-region, 2023–2031

Table 16: Europe Metal Cans Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 17: Germany Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 18: Germany Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 19: France Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 20: France Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 21: U.K. Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 22: U.K. Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 23: Italy Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 24: Italy Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 25: Spain Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 26: Spain Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 27: Russia & CIS Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 28: Russia & CIS Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 29: Rest of Europe Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 30: Rest of Europe Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 31: Asia Pacific Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 32: Asia Pacific Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 33: Asia Pacific Metal Cans Market Volume (Million Units) Forecast, by Country and Sub-region, 2023–2031

Table 34: Asia Pacific Metal Cans Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 35: China Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 36: China Metal Cans Market Value (US$ Bn) Forecast, by Product 2023–2031

Table 37: Japan Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 38: Japan Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 39: India Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 40: India Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 41: ASEAN Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 42: ASEAN Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 43: Rest of Asia Pacific Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 44: Rest of Asia Pacific Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 45: Latin America Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 46: Latin America Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 47: Latin America Metal Cans Market Volume (Million Units) Forecast, by Country and Sub-region, 2023–2031

Table 48: Latin America Metal Cans Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 49: Brazil Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 50: Brazil Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 51: Mexico Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 52: Mexico Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 53: Rest of Latin America Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 54: Rest of Latin America Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 55: Middle East & Africa Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 56: Middle East & Africa Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 57: Middle East & Africa Metal Cans Market Volume (Million Units) Forecast, by Country and Sub-region, 2023–2031

Table 58: Middle East & Africa Metal Cans Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 59: GCC Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 60: GCC Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 61: South Africa Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 62: South Africa Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 63: Rest of Middle East & Africa Metal Cans Market Volume (Million Units) Forecast, by Product, 2023–2031

Table 64: Rest of Middle East & Africa Metal Cans Market Value (US$ Bn) Forecast, by Product, 2023–2031

List of Figures

Figure 1: Global Metal Cans Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 2: Global Metal Cans Market Attractiveness, by Product

Figure 3: Global Metal Cans Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 4: Global Metal Cans Market Attractiveness, by Region

Figure 5: North America Metal Cans Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 6: North America Metal Cans Market Attractiveness, by Product

Figure 7: North America Metal Cans Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 8: North America Metal Cans Market Attractiveness, by Country

Figure 9: Europe Metal Cans Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 10: Europe Metal Cans Market Attractiveness, by Product

Figure 11: Europe Metal Cans Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: Europe Metal Cans Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Metal Cans Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 14: Asia Pacific Metal Cans Market Attractiveness, by Product

Figure 15: Asia Pacific Metal Cans Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: Asia Pacific Metal Cans Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Metal Cans Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 18: Latin America Metal Cans Market Attractiveness, by Product

Figure 19: Latin America Metal Cans Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: Latin America Metal Cans Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Metal Cans Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 22: Middle East & Africa Metal Cans Market Attractiveness, by Product

Figure 23: Middle East & Africa Metal Cans Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Middle East & Africa Metal Cans Market Attractiveness, by Country and Sub-region