Analyst Viewpoint

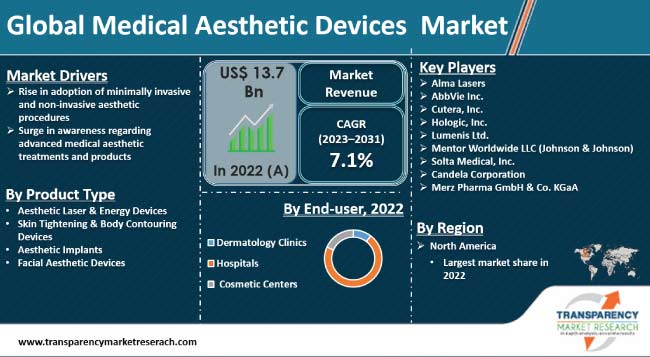

Rise in adoption of minimally invasive and non-invasive aesthetic procedures is fueling the medical aesthetic devices market size. Surge in awareness regarding advanced medical aesthetic treatments and products is also boosting the demand for medical aesthetic devices. Non-invasive and minimally invasive aesthetic procedures are gaining traction among the populace.

Growth in medical tourism is likely to offer lucrative opportunities to vendors in the global medical aesthetics devices industry. Vendors are developing user-friendly devices to expand their customer base. They are also launching next-generation technologies to stay competitive in the market. Manufacturers are partnering with beauty clinics to expand their market presence.

Medical aesthetics are used for the treatment of various skin conditions including skin laxity, excessive fat, cellulite, wrinkles, scars, moles, undesired hair, liver spots, spider veins, and skin discoloration. Medical aesthetic procedures and equipment help enhance a person's physical appearance. These procedures usually consist of plastic surgery, reconstructive surgery, and oral and maxillofacial surgery.

Aesthetic treatments include non-surgical and surgical procedures. These procedures can be used separately or together to improve a person's physical appearance. Medical aesthetic equipment, especially implants, are utilized to correct abnormalities resulting from trauma, accidents, and other congenital illnesses.

Cosmetic laser machines can partially reverse the effects of aging or even remove accident scars. Medical beauty equipment are used for cosmetic and medical purposes such as skin repair, aesthetic enhancement, tissue repair, and pain management.

High cost of treatments, poor reimbursement rates, and possibility of implant malfunctions are projected to limit the medical aesthetic devices market value during the forecast period. Growth in medical tourism sector and rise in number of medical spas are likely to offer lucrative opportunities for industry participants.

Non-invasive and minimally invasive aesthetic procedures are becoming more popular as convenient and low-risk substitutes for traditional surgery. With results that look natural, these procedures—which include chemical peels, microdermabrasion, laser therapy, dermal fillers, and Botox-address a variety of aesthetic issues.

Non-invasive and minimally invasive aesthetic treatments offer rapid recuperation time, making them suitable for quick recovery and easy resumption of daily activities. These treatments are popular among all age groups as they are highly accessible and customizable. Non-invasive and minimally invasive aesthetic treatments reduce scarring. Thus, rise in cases of surgical scars is expected to spur the medical aesthetic devices market growth in the near future.

Consumers are increasingly aware about the availability and benefits of technologically advanced medical aesthetic products and treatments. Several celebrities are endorsing facial cosmetic procedures in public in recent years, which is boosting the awareness of these procedures and normalizing their usage in society.

A significant portion of the male population is adopting various cosmetic procedures due to many factors including the desire to look younger and the growth in acceptance of these treatments. Awareness regarding aesthetic procedures and devices is growing among the male population. This, in turn, is fueling the medical aesthetic devices market progress.

According to the latest medical aesthetic devices market trends, North America held largest share in 2022. R&D of new cosmetic procedures and presence of major medical aesthetic device manufacturers are fueling the market dynamics in the region.

Rise in expenditure on plastic surgeries and increase in number of surgical and non-surgical procedures are also driving the medical aesthetic devices industry statistics in North America. According to the the American Academy of Facial Plastic and Reconstructive Surgery, almost 1.5 million surgical and non-surgical procedures were performed in 2021.

Various medical procedures, such as implantation, body contouring, and liposuction are gaining traction in North America due to rise in prevalence of obesity. Additionally, surge in investment in the healthcare sector and presence of favorable regulations for foreign investments are driving the medical aesthetic devices market landscape in North America.

The global industry is highly fragmented and competitive. Implementation of stringent regulatory approval procedures makes it difficult for new products to enter the market. Vendors are investing in the R&D of new products to expand their product portfolio and increase their medical aesthetic devices market share.

Alma Lasers, AbbVie Inc., Cutera, Inc., Hologic, Inc., Lumenis Ltd., Mentor Worldwide LLC (Johnson & Johnson), Solta Medical, Inc., Candela Corporation, and Merz Pharma GmbH & Co. KGaA are key players operating in this market.

Each of these players has been profiled in the medical aesthetic devices market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 13.7 Bn |

| Market Forecast (Value) in 2031 | US$ 25.1 Bn |

| Growth Rate (CAGR) | 7.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 13.7 Bn in 2022

It is anticipated to grow at a CAGR of 7.1% from 2023 to 2031

Rise in adoption of minimally invasive and non-invasive aesthetic procedures along with surge in awareness regarding advanced medical aesthetic treatments and products

The aesthetic laser & energy devices segment held the largest share in 2022

North America was the most lucrative region in 2022

Alma Lasers, AbbVie Inc., Cutera, Inc., Hologic, Inc., Lumenis Ltd., Mentor Worldwide LLC (Johnson & Johnson), Solta Medical, Inc., Candela Corporation, and Merz Pharma GmbH & Co. KGaA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Aesthetic Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Aesthetic Devices Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Medical Aesthetic Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Aesthetic Laser & Energy Devices

6.3.1.1. Ablatives Skin Resurfacing Devices

6.3.1.2. Non-ablative Skin Resurfacing Devices

6.3.2. Skin Tightening & Body Contouring Devices

6.3.2.1. Liposuction Devices

6.3.2.2. Skin Tightening Devices

6.3.2.3. Cellulite Reduction Devices

6.3.3. Aesthetic Implants

6.3.3.1. Breast Implants

6.3.3.2. Soft Tissue Implants

6.3.3.3. Aesthetic Dental Implants

6.3.3.4. Others

6.3.4. Facial Aesthetic Devices

6.3.4.1. Microdermabrasion Devices

6.3.4.2. Botulinum Toxin

6.3.4.3. Dermal Fillers

6.4. Market Attractiveness Analysis, by Product Type

7. Global Medical Aesthetic Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Facial & Body Contouring

7.3.2. Facial & Skin Rejuvenation

7.3.3. Breast Enhancement

7.3.4. Scar Treatment

7.3.5. Reconstructive Surgery

7.3.6. Tattoo Removal

7.3.7. Hair Removal

7.4. Market Attractiveness Analysis, by Application

8. Global Medical Aesthetic Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Dermatology Clinics

8.3.3. Cosmetic Centers

8.4. Market Attractiveness Analysis, by Application

9. Global Medical Aesthetic Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Medical Aesthetic Devices Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product Type, 2017–2031

10.3.1. Aesthetic Laser & Energy Devices

10.3.1.1. Ablatives Skin Resurfacing Devices

10.3.1.2. Non-ablative Skin Resurfacing Devices

10.3.2. Skin Tightening & Body Contouring Devices

10.3.2.1. Liposuction Devices

10.3.2.2. Skin Tightening Devices

10.3.2.3. Cellulite Reduction Devices

10.3.3. Aesthetic Implants

10.3.3.1. Breast Implants

10.3.3.2. Soft Tissue Implants

10.3.3.3. Aesthetic Dental Implants

10.3.3.4. Others

10.3.4. Facial Aesthetic Devices

10.3.4.1. Microdermabrasion Devices

10.3.4.2. Botulinum Toxin

10.3.4.3. Dermal Fillers

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Facial & Body Contouring

10.4.2. Facial & Skin Rejuvenation

10.4.3. Breast Enhancement

10.4.4. Scar Treatment

10.4.5. Reconstructive Surgery

10.4.6. Tattoo Removal

10.4.7. Hair Removal

10.5. Market Value Forecast, by End-user, 2017–2031

10.5.1. Hospitals

10.5.2. Dermatology Clinics

10.5.3. Cosmetic Centers

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Product Type

10.7.2. By Application

10.7.3. By End-user

10.7.4. By Country

11. Europe Medical Aesthetic Devices Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product Type, 2017–2031

11.3.1. Aesthetic Laser & Energy Devices

11.3.1.1. Ablatives Skin Resurfacing Devices

11.3.1.2. Non-ablative Skin Resurfacing Devices

11.3.2. Skin Tightening & Body Contouring Devices

11.3.2.1. Liposuction Devices

11.3.2.2. Skin Tightening Devices

11.3.2.3. Cellulite Reduction Devices

11.3.3. Aesthetic Implants

11.3.3.1. Breast Implants

11.3.3.2. Soft Tissue Implants

11.3.3.3. Aesthetic Dental Implants

11.3.3.4. Others

11.3.4. Facial Aesthetic Devices

11.3.4.1. Microdermabrasion Devices

11.3.4.2. Botulinum Toxin

11.3.4.3. Dermal Fillers

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Facial & Body Contouring

11.4.2. Facial & Skin Rejuvenation

11.4.3. Breast Enhancement

11.4.4. Scar Treatment

11.4.5. Reconstructive Surgery

11.4.6. Tattoo Removal

11.4.7. Hair Removal

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Dermatology Clinics

11.5.3. Cosmetic Centers

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Application

11.7.3. By End-user

11.7.4. By Country/Sub-region

12. Asia Pacific Medical Aesthetic Devices Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product Type, 2017–2031

12.3.1. Aesthetic Laser & Energy Devices

12.3.1.1. Ablatives Skin Resurfacing Devices

12.3.1.2. Non-ablative Skin Resurfacing Devices

12.3.2. Skin Tightening & Body Contouring Devices

12.3.2.1. Liposuction Devices

12.3.2.2. Skin Tightening Devices

12.3.2.3. Cellulite Reduction Devices

12.3.3. Aesthetic Implants

12.3.3.1. Breast Implants

12.3.3.2. Soft Tissue Implants

12.3.3.3. Aesthetic Dental Implants

12.3.3.4. Others

12.3.4. Facial Aesthetic Devices

12.3.4.1. Microdermabrasion Devices

12.3.4.2. Botulinum Toxin

12.3.4.3. Dermal Fillers

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Facial & Body Contouring

12.4.2. Facial & Skin Rejuvenation

12.4.3. Breast Enhancement

12.4.4. Scar Treatment

12.4.5. Reconstructive Surgery

12.4.6. Tattoo Removal

12.4.7. Hair Removal

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Dermatology Clinics

12.5.3. Cosmetic Centers

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Application

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. Latin America Medical Aesthetic Devices Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product Type, 2017–2031

13.3.1. Aesthetic Laser & Energy Devices

13.3.1.1. Ablatives Skin Resurfacing Devices

13.3.1.2. Non-ablative Skin Resurfacing Devices

13.3.2. Skin Tightening & Body Contouring Devices

13.3.2.1. Liposuction Devices

13.3.2.2. Skin Tightening Devices

13.3.2.3. Cellulite Reduction Devices

13.3.3. Aesthetic Implants

13.3.3.1. Breast Implants

13.3.3.2. Soft Tissue Implants

13.3.3.3. Aesthetic Dental Implants

13.3.3.4. Others

13.3.4. Facial Aesthetic Devices

13.3.4.1. Microdermabrasion Devices

13.3.4.2. Botulinum Toxin

13.3.4.3. Dermal Fillers

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Facial & Body Contouring

13.4.2. Facial & Skin Rejuvenation

13.4.3. Breast Enhancement

13.4.4. Scar Treatment

13.4.5. Reconstructive Surgery

13.4.6. Tattoo Removal

13.4.7. Hair Removal

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Dermatology Clinics

13.5.3. Cosmetic Centers

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Application

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Middle East & Africa Medical Aesthetic Devices Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Product Type, 2017–2031

14.3.1. Aesthetic Laser & Energy Devices

14.3.1.1. Ablatives Skin Resurfacing Devices

14.3.1.2. Non-ablative Skin Resurfacing Devices

14.3.2. Skin Tightening & Body Contouring Devices

14.3.2.1. Liposuction Devices

14.3.2.2. Skin Tightening Devices

14.3.2.3. Cellulite Reduction Devices

14.3.3. Aesthetic Implants

14.3.3.1. Breast Implants

14.3.3.2. Soft Tissue Implants

14.3.3.3. Aesthetic Dental Implants

14.3.3.4. Others

14.3.4. Facial Aesthetic Devices

14.3.4.1. Microdermabrasion Devices

14.3.4.2. Botulinum Toxin

14.3.4.3. Dermal Fillers

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Facial & Body Contouring

14.4.2. Facial & Skin Rejuvenation

14.4.3. Breast Enhancement

14.4.4. Scar Treatment

14.4.5. Reconstructive Surgery

14.4.6. Tattoo Removal

14.4.7. Hair Removal

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Dermatology Clinics

14.5.3. Cosmetic Centers

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Application

14.7.3. By End-user

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Alma Lasers

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. AbbVie Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Cutera, Inc.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Hologic, Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Lumenis Ltd.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Mentor Worldwide LLC (Johnson & Johnson)

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Solta Medical, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Candela Corporation

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Merz Pharma GmbH & Co. KGaA

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

List of Tables

Table 01: Global Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Europe Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Asia Pacific Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Latin America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Middle East & Africa Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Medical Aesthetic Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Medical Aesthetic Devices Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Medical Aesthetic Devices Market Revenue (US$ Mn), by Product Type, 2022

Figure 03: Global Medical Aesthetic Devices Market Value Share, by Product Type, 2022

Figure 04: Global Medical Aesthetic Devices Market Revenue (US$ Mn), by Application, 2022

Figure 05: Global Medical Aesthetic Devices Market Value Share, by Application, 2022

Figure 06: Global Medical Aesthetic Devices Market Revenue (US$ Mn), by End-user, 2022

Figure 07: Global Medical Aesthetic Devices Market Value Share, by End-user, 2022

Figure 08: Global Medical Aesthetic Devices Market Value Share, by Region, 2022

Figure 09: Global Medical Aesthetic Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Medical Aesthetic Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 11: Global Medical Aesthetic Devices Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 12: Global Medical Aesthetic Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 13: Global Medical Aesthetic Devices Market Attractiveness Analysis, by Application, 2023-2031

Figure 14: Global Medical Aesthetic Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 15: Global Medical Aesthetic Devices Market Attractiveness Analysis, by End-user, 2023-2031

Figure 16: Global Medical Aesthetic Devices Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Medical Aesthetic Devices Market Attractiveness Analysis, by Region, 2023-2031

Figure 18: North America Medical Aesthetic Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Medical Aesthetic Devices Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Medical Aesthetic Devices Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Medical Aesthetic Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 22: North America Medical Aesthetic Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 23: North America Medical Aesthetic Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Medical Aesthetic Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 25: North America Medical Aesthetic Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 26: North America Medical Aesthetic Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Europe Medical Aesthetic Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Medical Aesthetic Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Medical Aesthetic Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Medical Aesthetic Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 31: Europe Medical Aesthetic Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Europe Medical Aesthetic Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Medical Aesthetic Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 34: Europe Medical Aesthetic Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 35: Europe Medical Aesthetic Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 36: Asia Pacific Medical Aesthetic Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Medical Aesthetic Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Medical Aesthetic Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Medical Aesthetic Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 40: Asia Pacific Medical Aesthetic Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 41: Asia Pacific Medical Aesthetic Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Asia Pacific Medical Aesthetic Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 43: Asia Pacific Medical Aesthetic Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 44: Asia Pacific Medical Aesthetic Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 45: Latin America Medical Aesthetic Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Medical Aesthetic Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Medical Aesthetic Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Medical Aesthetic Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 49: Latin America Medical Aesthetic Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Latin America Medical Aesthetic Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Latin America Medical Aesthetic Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 52: Latin America Medical Aesthetic Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 53: Latin America Medical Aesthetic Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 54: Middle East & Africa Medical Aesthetic Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Medical Aesthetic Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Medical Aesthetic Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Medical Aesthetic Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 58: Middle East & Africa Medical Aesthetic Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 59: Middle East & Africa Medical Aesthetic Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa Medical Aesthetic Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 61: Middle East & Africa Medical Aesthetic Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 62: Middle East & Africa Medical Aesthetic Devices Market Attractiveness Analysis, by End-user, 2023–2031