Reports

Reports

Analyst Viewpoint

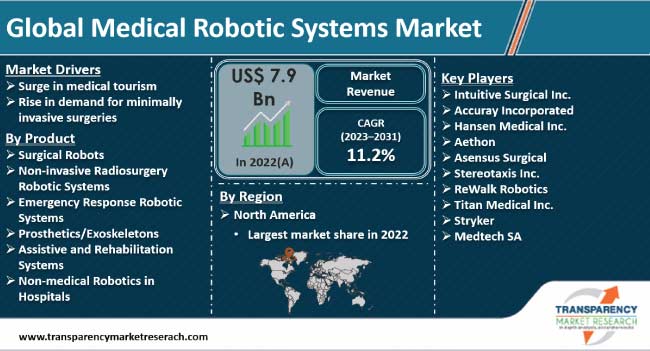

Surge in medical tourism across the globe, especially in Asia Pacific, to seek advanced cosmetic and non-cosmetic treatments is fueling the medical robotic systems market size. Technological advancements in surgical robotic systems allow surgeons to conduct surgeries in a short period of time. AI-driven robotic systems help obtain accurate and real-time patient data, which simplifies the work of healthcare professionals. Thus, incorporation of advanced technologies in robotic systems is fueling market progress. Increase in demand for minimally invasive surgeries is also bolstering market dynamics.

In line with the latest medical robotic systems market trends, manufacturers are investing in research and development activities to provide advanced robotic systems to patients. Rise in prevalence of chronic diseases among the global population is also creating lucrative growth opportunities for medical robotic system manufacturers.

Medical robotic systems allow surgeons to handle surgical instruments or catheters during minimally invasive surgeries. Robotic systems are widely used in medicine and healthcare fields to automate complicated processes and partially reduce human intervention.

Medical robotic systems are designed to ease minimally invasive surgeries and orthopedic surgeries. Advantages of these systems include faster recovery, minimal scarring, shorter hospitalization, reduced blood loss, smaller incisions, and reduced pain and discomfort.

Healthcare organizations are installing medical robotic systems to increase surgical accuracy and ensure a faster recovery rate. Time taken to perform orthopedic surgeries is less due to seamless process conducted by autonomous medical robotics.

Surgical robots, hospital service robots, and rehabilitation robots are extensively employed in healthcare facilities. Surgical robots allow surgeons to perform complex surgeries with more precision. Hospital service robots are designed to reduce the workload of the healthcare staff by completing logistical tasks and generating reports. Rehabilitation robots enable physicians to conduct required therapies and improve recoveries from neurological impairments.

Medical tourism is the practice of traveling outside the country in order to seek better healthcare services. High cost of treatments and healthcare services is leading to a rise in medical tourism, especially from developed countries to developing countries.

Increase in demand for cosmetic tourism across the globe is driving the medical robotic systems market growth. Cosmetic surgeries such as rhinoplasty, abdominoplasty, eyelid surgery, liposuction, and breast augmentation require robotic assistance to conduct these procedures accurately.

Telemedicine robots for remote patient monitoring play an important role in ensuring that patients seek appropriate treatment and assistance during complex oncology procedures. Artificial Intelligence (AI) is employed in medical robotic systems to track and maintain patient data during prolonged treatments or rehabilitation processes.

Advancement in technologies in the healthcare sector has resulted in an increase in AI-guided robotic assistance in rehabilitation programs. AI-guided systems allow healthcare professionals to understand patient history and track their progress during the treatment/rehabilitation process.

Minimally invasive surgeries are often less risky, as they are less scarring and entail lesser blood loss. Patients prefer minimally invasive surgery over open surgery due to the lower risk of complications and reduced hospitalization period.

Laparoscopy is one of the most common minimally invasive surgeries. Robotics in laparoscopic surgery for weight loss are widely implemented to conduct imaging tests such as MRI scans, ultrasounds, and X-rays. Thus, increase in demand for minimally invasive surgeries in cosmetology and weight loss procedures is boosting the medical robotic systems market statistics.

Manufacturers are investing significantly in research and development activities to introduce highly efficient healthcare robotics. Incorporation of HD cameras to obtain a clear 360-degree view during surgeries allows surgeons to examine and conduct surgeries with precision. These technological advancements are primarily required in neurological surgeries. Thus, rise in demand for robotic systems in neurological applications is encouraging companies to expand their product portfolio.

Robot-assisted surgeries allow surgeons to perform complex surgeries with more precision and accuracy. Increase in purchasing power of healthcare organizations is driving the medical robotic systems market demand.

Minimally invasive robotics technology is widely employed in urology, gynecology, and general surgery. Surgical robots conduct complex as well as minimally invasive surgeries with accuracy. These robots restrict infections caused during the surgeries, thus ensuring patient safety and faster recovery. Growth in robotic surgeries in hospitals is bolstering market expansion across the globe.

According to medical robotic systems industry forecast, North America is likely to hold the leading position in the global landscape during the forecast period. Presence of advanced healthcare infrastructure and availability of better reimbursement policies are driving the medical robotic systems market share of the region.

Growth in geriatric population is also expected to fuel the demand for robotic surgeries in North America.

Leading players in the market are focusing on strategic business plans such as collaborations and new product launches to increase efficiency and accuracy of complex surgeries. They are investing significantly in innovative robotic medical devices to ensure faster and reliable surgical procedures.

Some of the leading companies in the industry are Intuitive Surgical Inc., Accuray Incorporated, Hansen Medical Inc., Aethon, Asensus Surgical, Stereotaxis Inc., ReWalk Robotics, Titan Medical Inc., Stryker, and Medtech SA. Automation in medicines has enabled these companies to streamline workflow and make processes more cost-effective and efficient.

Leading players have been profiled in the medical robotic systems market research report based on factors such as financial overview, company overview, product portfolio, business strategies, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 7.9 Bn |

| Market Forecast (Value) in 2031 | US$ 21.3 Bn |

| Growth Rate (CAGR) | 11.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 7.9 Bn in 2022

It is projected to register a CAGR of 11.2% from 2023 to 2031

Surge in medical tourism and rise in demand for minimally invasive surgeries

North America was the most lucrative region in 2022

Intuitive Surgical Inc., Accuray Incorporated, Hansen Medical Inc., Aethon, Asensus Surgical, Stereotaxis Inc., ReWalk Robotics, Titan Medical Inc., Stryker, and Medtech SA

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Robotic Systems Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Robotic Systems Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. List of Surgical Robotic Systems for Minimally Invasive Surgeries

5.3. Disease Prevalence & Incidence Rate Globally with Key Countries

5.4. COVID-19 Pandemic Impact on Industry

6. Medical Robotic Systems Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2023-2031

6.3.1. Surgical Robots

6.3.1.1. Orthopedic Robotic Systems

6.3.1.2. Neurosurgery Robotic Systems

6.3.1.3. General Laparoscopy Robotic Systems

6.3.1.4. Steerable Robotic Catheters

6.3.2. Non-invasive Radiosurgery Robotic Systems

6.3.3. Emergency Response Robotic Systems

6.3.4. Prosthetics/Exoskeletons

6.3.5. Assistive and Rehabilitation Systems

6.3.6. Non-medical Robotics in Hospitals

6.3.6.1. Telemedicine Robots

6.3.6.2. Cart Transportation Robots

6.3.6.3. Robotic Hospital Pharmacies

6.4. Market Attractiveness, by Product

7. Global Medical Robotic Systems Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Market Value Forecast, by Region, 2023-2031

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness, by Region

8. North America Medical Robotic Systems Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast, by Product, 2023-2031

8.2.1. Surgical Robots

8.2.1.1. Orthopedic Robotic Systems

8.2.1.2. Neurosurgery Robotic Systems

8.2.1.3. General Laparoscopy Robotic Systems

8.2.1.4. Steerable Robotic Catheters

8.2.2. Non-invasive Radiosurgery Robotic Systems

8.2.3. Emergency Response Robotic Systems

8.2.4. Prosthetics/Exoskeletons

8.2.5. Assistive and Rehabilitation Systems

8.2.6. Non-medical Robotics in Hospitals

8.2.6.1. Telemedicine Robots

8.2.6.2. Cart Transportation Robots

8.2.6.3. Robotic Hospital Pharmacies

8.2.7. Market Attractiveness, by Product

8.3. Market Value Forecast, by Country, 2023-2031

8.3.1. U.S.

8.3.2. Canada

8.4. Market Attractiveness Analysis

8.4.1. By Product

8.4.2. By Country

9. Europe Medical Robotic Systems Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2023-2031

9.2.1. Surgical Robots

9.2.1.1. Orthopedic Robotic Systems

9.2.1.2. Neurosurgery Robotic Systems

9.2.1.3. General Laparoscopy Robotic Systems

9.2.1.4. Steerable Robotic Catheters

9.2.2. Non-invasive Radiosurgery Robotic Systems

9.2.3. Emergency Response Robotic Systems

9.2.4. Prosthetics/Exoskeletons

9.2.5. Assistive and Rehabilitation Systems

9.2.6. Non-medical Robotics in Hospitals

9.2.6.1. Telemedicine Robots

9.2.6.2. Cart Transportation Robots

9.2.6.3. Robotic Hospital Pharmacies

9.2.7. Market Attractiveness, by Product

9.3. Market Value Forecast, by Country/Sub-region, 2023-2031

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Product

9.4.2. By Country/Sub-region

10. Asia Pacific Medical Robotic Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2023-2031

10.2.1. Surgical Robots

10.2.1.1. Orthopedic Robotic Systems

10.2.1.2. Neurosurgery Robotic Systems

10.2.1.3. General Laparoscopy Robotic Systems

10.2.1.4. Steerable Robotic Catheters

10.2.2. Non-invasive Radiosurgery Robotic Systems

10.2.3. Emergency Response Robotic Systems

10.2.4. Prosthetics/Exoskeletons

10.2.5. Assistive and Rehabilitation Systems

10.2.6. Non-medical Robotics in Hospitals

10.2.6.1. Telemedicine Robots

10.2.6.2. Cart Transportation Robots

10.2.6.3. Robotic Hospital Pharmacies

10.2.7. Market Attractiveness, by Product

10.3. Market Value Forecast, by Country/Sub-region, 2023-2031

10.3.1. China

10.3.2. Japan

10.3.3. India

10.3.4. Australia & New Zealand

10.3.5. Rest of Asia Pacific

10.4. Market Attractiveness Analysis

10.4.1. By Product

10.4.2. By Country/Sub-region

11. Latin America Medical Robotic Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2023-2031

11.2.1. Surgical Robots

11.2.1.1. Orthopedic Robotic Systems

11.2.1.2. Neurosurgery Robotic Systems

11.2.1.3. General Laparoscopy Robotic Systems

11.2.1.4. Steerable Robotic Catheters

11.2.2. Non-invasive Radiosurgery Robotic Systems

11.2.3. Emergency Response Robotic Systems

11.2.4. Prosthetics/Exoskeletons

11.2.5. Assistive and Rehabilitation Systems

11.2.6. Non-medical Robotics in Hospitals

11.2.6.1. Telemedicine Robots

11.2.6.2. Cart Transportation Robots

11.2.6.3. Robotic Hospital Pharmacies

11.2.7. Market Attractiveness, by Product

11.3. Market Value Forecast, by Country/Sub-region, 2023-2031

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Rest of Latin America

11.4. Market Attractiveness Analysis

11.4.1. By Product

11.4.2. By Country/Sub-region

12. Middle East & Africa Medical Robotic Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2023-2031

12.2.1. Surgical Robots

12.2.1.1. Orthopedic Robotic Systems

12.2.1.2. Neurosurgery Robotic Systems

12.2.1.3. General Laparoscopy Robotic Systems

12.2.1.4. Steerable Robotic Catheters

12.2.2. Non-invasive Radiosurgery Robotic Systems

12.2.3. Emergency Response Robotic Systems

12.2.4. Prosthetics/Exoskeletons

12.2.5. Assistive and Rehabilitation Systems

12.2.6. Non-medical Robotics in Hospitals

12.2.6.1. Telemedicine Robots

12.2.6.2. Cart Transportation Robots

12.2.6.3. Robotic Hospital Pharmacies

12.2.7. Market Attractiveness, by Product

12.3. Market Value Forecast, by Country/Sub-region, 2023-2031

12.3.1. GCC Countries

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

12.4. Market Attractiveness Analysis

12.4.1. By Product

12.4.2. By Country/Sub-region

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of Companies)

13.2. Market Share Analysis, by Company (2022)

13.3. Company Profiles

13.3.1. Intuitive Surgical Inc.

13.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.1.2. Product Portfolio

13.3.1.3. Financial Overview

13.3.1.4. SWOT Analysis

13.3.1.5. Strategic Overview

13.3.2. Accuray Incorporated

13.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.2.2. Product Portfolio

13.3.2.3. Financial Overview

13.3.2.4. SWOT Analysis

13.3.2.5. Strategic Overview

13.3.3. Hansen Medical Inc.

13.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.3.2. Product Portfolio

13.3.3.3. Financial Overview

13.3.3.4. SWOT Analysis

13.3.3.5. Strategic Overview

13.3.4. Aethon

13.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.4.2. Product Portfolio

13.3.4.3. Financial Overview

13.3.4.4. SWOT Analysis

13.3.4.5. Strategic Overview

13.3.5. Asensus Surgical

13.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.5.2. Product Portfolio

13.3.5.3. Financial Overview

13.3.5.4. SWOT Analysis

13.3.5.5. Strategic Overview

13.3.6. Stereotaxis Inc.

13.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.6.2. Product Portfolio

13.3.6.3. Financial Overview

13.3.6.4. SWOT Analysis

13.3.6.5. Strategic Overview

13.3.7. ReWalk Robotics

13.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.7.2. Product Portfolio

13.3.7.3. Financial Overview

13.3.7.4. SWOT Analysis

13.3.7.5. Strategic Overview

13.3.8. Titan Medical Inc.

13.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.8.2. Product Portfolio

13.3.8.3. Financial Overview

13.3.8.4. SWOT Analysis

13.3.8.5. Strategic Overview

13.3.9. Stryker

13.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.9.2. Product Portfolio

13.3.9.3. Financial Overview

13.3.9.4. SWOT Analysis

13.3.9.5. Strategic Overview

13.3.10. Medtech SA

13.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

13.3.10.2. Product Portfolio

13.3.10.3. Financial Overview

13.3.10.4. SWOT Analysis

13.3.10.5. Strategic Overview

List of Tables

Table 1: Global Medical Robotic Systems Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 2: Global Medical Robotic Systems Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 3: North America Medical Robotic Systems Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 4: North America Medical Robotic Systems Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 5: Europe Medical Robotic Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 6: Europe Medical Robotic Systems Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 7: Asia Pacific Medical Robotic Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 8: Asia Pacific Medical Robotic Systems Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 9: Latin America Medical Robotic Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 10: Latin America Medical Robotic Systems Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 11: Middle East & Africa Medical Robotic Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 12: Middle East & Africa Medical Robotic Systems Market Value (US$ Mn) Forecast, by Product, 2023-2031

List of Figures

Figure 1: Global Medical Robotic Systems Market Value (US$ Mn) Forecast, 2023-2031

Figure 2: Global Medical Robotic Systems Market Value Share, by Product, 2022

Figure 3: Global Medical Robotic Systems Market Value Share Analysis, by Product, 2022 and 2031

Figure 4: Global Medical Robotic Systems Market Attractiveness Analysis, by Product, 2023-2031

Figure 5: Global Medical Robotic Systems Market Value Share Analysis, by Region, 2022 and 2031

Figure 6: Global Medical Robotic Systems Market Attractiveness Analysis, by Region, 2023-2031

Figure 7: North America Medical Robotic Systems Market Value (US$ Mn) Forecast, 2023-2031

Figure 8: North America Medical Robotic Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 9: North America Medical Robotic Systems Market Attractiveness Analysis, by Country, 2023-2031

Figure 10: North America Medical Robotic Systems Market Value Share Analysis, by Product, 2022 and 2031

Figure 11: North America Medical Robotic Systems Market Attractiveness Analysis, by Product, 2023-2031

Figure 12: Europe Medical Robotic Systems Market Value (US$ Mn) Forecast, 2023-2031

Figure 13: Europe Medical Robotic Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 14: Europe Medical Robotic Systems Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 15: Europe Medical Robotic Systems Market Value Share Analysis, by Product, 2022 and 2031

Figure 16: Asia Pacific Medical Robotic Systems Market Value (US$ Mn) Forecast, 2023-2031

Figure 17: Asia Pacific Medical Robotic Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 18: Asia Pacific Medical Robotic Systems Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 19: Asia Pacific Medical Robotic Systems Market Value Share Analysis, by Product, 2022 and 2031

Figure 20: Asia Pacific America Medical Robotic Systems Market Attractiveness Analysis, by Product, 2023-2031

Figure 21: Latin America Medical Robotic Systems Market Value (US$ Mn) Forecast, 2023-2031

Figure 22: Latin America Medical Robotic Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 23: Latin America Medical Robotic Systems Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 24: Latin America Medical Robotic Systems Market Value Share Analysis, by Product, 2022 and 2031

Figure 25: Latin America Medical Robotic Systems Market Attractiveness Analysis, by Product, 2023-2031

Figure 26: Middle East & Africa Medical Robotic Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 27: Middle East & Africa Medical Robotic Systems Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 28: Middle East & Africa America Medical Robotic Systems Market Value Share Analysis, by Product, 2023-2031

Figure 29: Middle East & Africa America Medical Robotic Systems Market Attractiveness Analysis, by Product, 2023-2031

Figure 30: Global Medical Robotic Systems Market Share Analysis, by Company (2022)